How is Land Tax Calculated in QLD? A Step-by-Step Guide

- 2 hours ago

- 11 min read

Land tax in Queensland is an annual state tax levied on the total value of freehold land you own, excluding your primary home. The critical date for assessment is midnight on 30 June each year. Whoever owns the land at that moment is liable for the tax for the following financial year.

For property investors, businesses, and trustees, understanding your land tax obligations is essential for compliance and financial planning. Failing to correctly calculate or pay this tax can lead to significant penalties and interest charges from the Queensland Revenue Office (QRO). This guide provides a clear, step-by-step process for navigating the land tax QLD rules.

What Is Land Tax and Why It Matters in Queensland

Land tax is a yearly tax charged by the state on the unimproved value of your land holdings. This means the value of buildings, such as your house or sheds, is not included in the calculation. The tax is based purely on the land's value as determined by the Queensland Valuer-General.

This tax is a major source of revenue for the Queensland Government, helping to fund essential public services like schools, hospitals, and roads. For anyone holding investment properties, commercial sites, or land through a trust, understanding your obligations is non-negotiable. The Queensland Revenue Office, which administers this tax, strictly enforces compliance.

Key Compliance Risks, Penalties, and Regulatory Relevance

Managing land tax involves more than just paying the annual bill. Several common compliance risks can lead to unexpected penalties and reassessments.

Failure to Register: You have a legal obligation to notify the Queensland Revenue Office when the total taxable value of your land exceeds the relevant threshold. Waiting for them to contact you is not a compliant strategy and can result in penalties.

Incorrect Aggregation: Land tax is calculated on the total combined value of all your non-exempt land in Queensland. Forgetting to declare a parcel of land can lead to a significant reassessment, penalties, and interest charges.

Misunderstanding Exemptions: While your principal place of residence is generally exempt, the rules are strict. Using your home for significant business purposes or owning it through certain trust structures can jeopardise your eligibility.

Incorrect Ownership Details: The tax liability falls on the legal owner recorded at 30 June. It’s vital to ensure your ownership details are current and correct with Titles Queensland. Non-compliance can result in penalty tax of up to 75% of the outstanding liability.

According to the Queensland Budget analysis for 2023-24, land tax is projected to generate $13.9 billion over the four years to 2028-29. This growth highlights the state's increasing reliance on property-based taxes, making compliance more critical than ever. You can find more detail in the latest REIQ budget analysis.

Who Pays Land Tax in Queensland?

The fundamental rule for Queensland land tax is simple: the owner of the land at midnight on 30 June is liable for the tax. However, the amount you pay—or whether you pay at all—depends on the ownership structure. The Queensland Revenue Office applies different rules for individuals, companies, trusts, and absentee owners.

Individuals and Joint Owners

For most individuals, Queensland provides a tax-free threshold of $600,000 on the total taxable value of their land. If the combined unimproved value of all your non-exempt properties is below this amount, you will not pay land tax.

When you own property jointly (as joint tenants or tenants in common), you are assessed together. The ATO assesses the total value of the land, and the same $600,000 threshold applies to the group. If the total value exceeds the limit, a single assessment notice is issued, and all owners are jointly and severally liable for the payment.

Companies and Trustees

Companies and trusts face stricter rules, with a lower tax-free threshold of $350,000. This means they become liable for land tax at a much lower value than individuals.

This lower threshold reflects that properties held in these structures are typically for investment or business purposes. It's a common mistake to assume that creating a new company or trust for each property isolates them for land tax purposes. Queensland's legislation includes grouping provisions, which allow the QRO to aggregate land holdings controlled by the same person or group, or trusts with common beneficiaries.

The Absentee Surcharge

Individuals who do not ordinarily reside in Australia are subject to an absentee land tax surcharge. This applies to foreign individuals, foreign companies, and trustees of foreign trusts.

An "absentee" is generally someone who was not physically present in Australia on 30 June or did not spend at least six months in Australia during the preceding financial year.

Who is an Absentee? A landowner who is not an Australian citizen or permanent resident and does not meet the residency criteria.

Surcharge Rate: A 2% surcharge is applied to the total taxable value of their land.

Lower Threshold: Absentees are also subject to the lower $350,000 tax-free threshold.

This surcharge ensures foreign investors who benefit from Queensland's infrastructure and property market contribute to state revenue.

Understanding Queensland Land Tax Rates and Thresholds

Queensland's land tax system is progressive, similar to income tax. The more your land is worth in total, the higher the rate you pay on the value above certain thresholds. Your ownership structure—individual, company, trust, or absentee—determines the specific tax-free threshold and rates that apply.

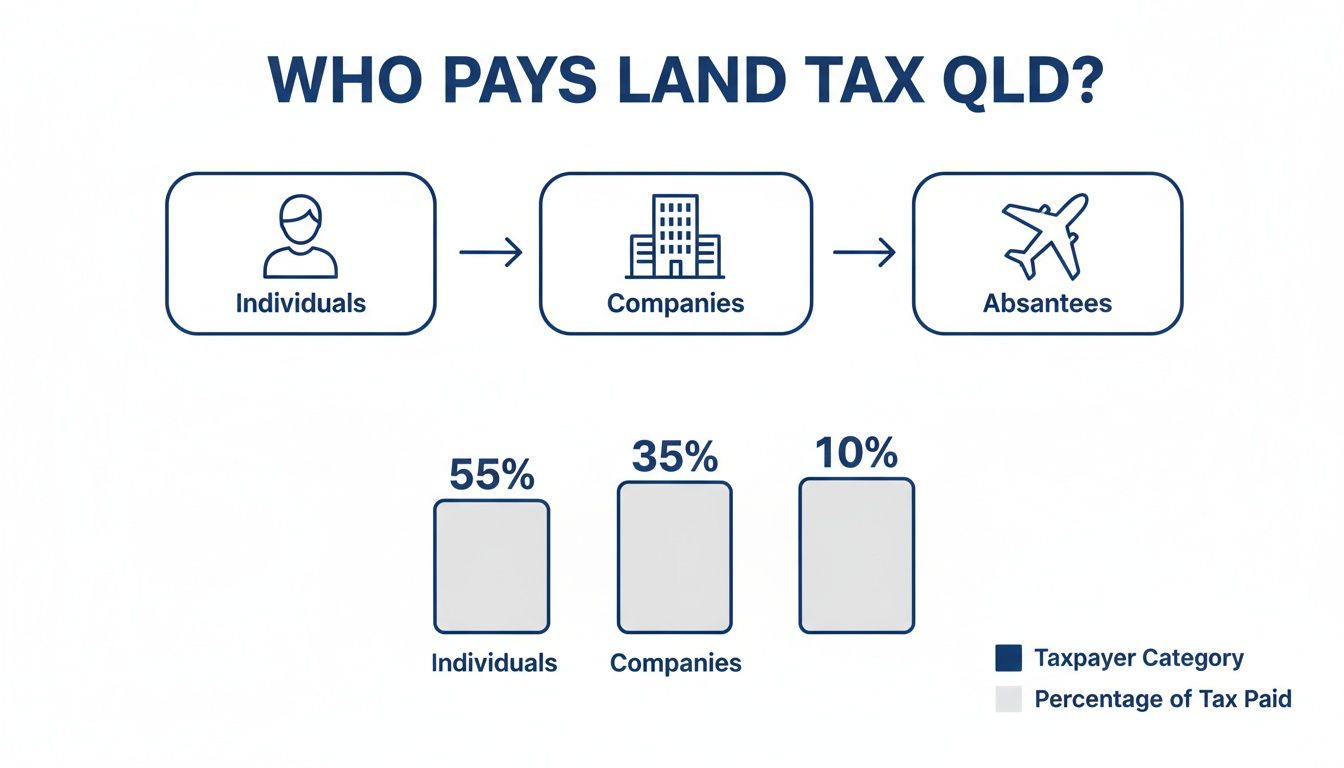

The infographic below provides a snapshot of who pays land tax in Queensland.

As shown, the ownership structure is the most significant factor affecting your land tax liability.

Rates for Individuals

For individual investors, the rules are more generous.

Tax-Free Threshold: If the total taxable value of your land is under $600,000, you pay no land tax.

Progressive Rates: Once the value exceeds $600,000, a marginal tax rate applies to the amount over the threshold.

For example, for land valued between $600,000 and $999,999, the tax is $500 plus 1 cent for each dollar over the threshold. The rates increase with the land value, reaching 2.25 cents for each dollar for portfolios valued at $10,000,000 or more.

Rates for Companies, Trustees, and Absentees

The rules for companies, trustees, and absentee owners are much stricter, reflecting their commercial focus.

The tax-free threshold for these entities is only $350,000. Consequently, they start paying land tax much sooner than individuals. Additionally, absentee owners are subject to a 2% surcharge.

For this group, the tax begins at $1,450 plus 1.75 cents for each dollar on land valued between $350,000 and $2,249,999. The rates climb to a maximum of 2.75 cents for each dollar on land worth $10,000,000 or more. For more information on how different tax systems function, refer to our guide on Australian tax rates for 2025.

Here is a table summarising the current rates:

Queensland Land Tax Rates and Thresholds

Owner Type | Taxable Value Range | Tax Rate |

|---|---|---|

Individual | Below $600,000 | Nil |

$600,000 to $999,999 | $500 + 1.0c for each $1 over $600,000 | |

$1,000,000 to $2,999,999 | $4,500 + 1.65c for each $1 over $1,000,000 | |

$3,000,000 to $4,999,999 | $37,500 + 1.25c for each $1 over $3,000,000 | |

$5,000,000 to $9,999,999 | $62,500 + 1.75c for each $1 over $5,000,000 | |

$10,000,000 and over | $150,000 + 2.25c for each $1 over $10,000,000 | |

Company, Trustee, or Absentee | Below $350,000 | Nil |

$350,000 to $2,249,999 | $1,450 + 1.75c for each $1 over $350,000 | |

$2,250,000 to $4,999,999 | $34,700 + 2.25c for each $1 over $2,250,000 | |

$5,000,000 to $9,999,999 | $96,575 + 2.0c for each $1 over $5,000,000 | |

$10,000,000 and over | $196,575 + 2.75c for each $1 over $10,000,000 | |

Absentee (additional) | All taxable land | 2.0% surcharge |

This summary illustrates how significantly liability can vary based on ownership structure. The current $600,000 tax-free threshold for individuals was established in 2008 and has not been adjusted for property price inflation, leading to "bracket creep" where more owners are drawn into the tax system. You can review previous land tax rates from the Queensland Revenue Office for historical context.

How to Calculate Your Land Tax Liability

Calculating your land tax in Queensland follows a logical, step-by-step process. The calculation is based on the taxable value of your land, which is the unimproved value determined annually by the Queensland Valuer-General, excluding any buildings or structures.

Step 1: Determine Your Total Taxable Value

First, sum the taxable value of all non-exempt land you own in Queensland as of midnight on 30 June. This includes all investment properties, commercial sites, and vacant land. Your principal place of residence is typically excluded from this calculation.

Step 2: Apply the Correct Threshold and Rate

Once you have your total taxable value, apply the appropriate tax-free threshold and marginal rates based on your ownership structure (individual, company, trustee, or absentee). Tax is only payable on the value that exceeds the relevant threshold.

It is crucial to use the correct rate schedule. An individual has a $600,000 tax-free threshold, whereas a company or trust has a $350,000 threshold. Using the wrong schedule will result in an incorrect calculation.

The Queensland Government provides an official land tax estimator for a quick calculation.

Practical Examples of Land Tax QLD Calculations

Here are some practical scenarios for different owner types.

Example 1: Individual Investor (SME)

Owner: Sarah, a Queensland resident and sole trader.

Land Holdings: One investment property with a taxable value of $750,000.

Threshold: $600,000 (for individuals).

Calculation:

Value over threshold: $750,000 - $600,000 = $150,000.

Tax rate: $500 + 1.0 cent for each $1 over $600,000.

Liability: $500 + ($150,000 x $0.01) = $500 + $1,500 = $2,000.

Example 2: Corporate Holdings (Corporation)

Owner: A proprietary limited company.

Land Holdings: A commercial property with a taxable value of $900,000.

Threshold: $350,000 (for companies).

Calculation:

Value over threshold: $900,000 - $350,000 = $550,000.

Tax rate: $1,450 + 1.75 cents for each $1 over $350,000.

Liability: $1,450 + ($550,000 x $0.0175) = $1,450 + $9,625 = $11,075.

Example 3: Absentee Investor (Individual)

Owner: Ben, who lives overseas (non-resident).

Land Holdings: One vacant lot with a taxable value of $400,000.

Threshold: $350,000 (for absentees).

Calculation:

Value over threshold: $400,000 - $350,000 = $50,000.

Base tax rate: $1,450 + 1.75 cents for each $1 over $350,000.

Base liability: $1,450 + ($50,000 x $0.0175) = $1,450 + $875 = $2,325.

Absentee Surcharge: 2% of the total taxable value ($400,000 x 0.02) = $8,000.

Total Liability: $2,325 + $8,000 = $10,325.

These examples demonstrate how ownership structure and residency status significantly impact the final tax bill. Accurate record-keeping of property values and ownership details is essential.

Navigating Land Tax Exemptions and Concessions

Several exemptions can reduce or eliminate your land tax liability in Queensland. Understanding these is key to effective property portfolio management. The most significant is the Principal Place of Residence (PPR) exemption, which ensures you do not pay land tax on your family home.

The Principal Place of Residence Exemption

The PPR exemption allows you to claim a full exemption on the land your home is on, provided it is your main residence.

To qualify, the property must be owned by an individual (not a company or trust) and occupied as your primary home. You can only claim one PPR exemption at a time. A partial exemption may apply if you rent out part of your property or use it for business purposes. This exemption's rules are similar to those for capital gains tax, as detailed in our guide on the Capital Gains Tax exemption for your main residence.

Other Key Land Tax Exemptions

Other important exemptions cater to specific land uses and ownership structures.

Primary Production: Land used primarily for a commercial primary production business, such as farming or grazing, may be exempt.

Charities and Not-for-Profits: Land owned and used by certain charitable, religious, or non-profit organisations for their designated purposes is generally exempt.

Moveable Dwellings Parks: Land used as a caravan or manufactured home park may also qualify for an exemption if it meets specific conditions.

Land Tax QLD Exemption Checklist

Use this checklist to assess your eligibility for key exemptions.

Exemption Type | Key Eligibility Criteria | Applicable to You? (Yes/No) |

|---|---|---|

Principal Place of Residence | Do you own the land as an individual and occupy the home as your main residence? | |

Primary Production | Is the land primarily used for a commercial agricultural business? | |

Charitable Institution | Is the land owned by a registered charity and used for its charitable purposes? | |

Temporary Absence | Were you temporarily absent from your PPR for work, illness, or renovations? |

This checklist is a useful starting point for identifying potential savings.

Key Deadlines and Penalties for Non-Compliance

The land tax cycle is based on a single date: midnight on 30 June. The owner at this time is liable for land tax for the entire following financial year. The Queensland Revenue Office (QRO) issues assessment notices between August and October, specifying your taxable land value, the tax calculation, and the payment due date.

The Cost of Non-Compliance

Failing to meet your land tax obligations can lead to significant financial penalties. The QRO enforces compliance through:

Unpaid Tax Interest (UTI): Interest accrues on any outstanding balance immediately after the due date.

Penalty Tax: For more serious breaches, such as failing to notify the QRO that you have exceeded the tax-free threshold, a penalty of up to 75% of the tax owed may be applied.

These penalties can substantially increase your liability. For more information on how the tax office handles late payments, see our guide on the penalties for a late tax return.

It is essential to keep your contact details updated with the QRO. An assessment notice sent to an old address does not absolve you of liability for late payment penalties.

Queensland’s property tax revenue has increased by an estimated 133% over the last decade. This is largely due to rising property values and a static tax-free threshold, which has drawn more landowners into the tax system.

FAQ Section

Do I pay land tax on my family home in QLD?

No, in most cases, your primary home, known as your principal place of residence (PPR), is exempt from land tax in Queensland. This exemption applies if you are an individual owner and use the property as your main home. However, partial or full ineligibility can occur if the property is used for significant business purposes or owned by certain companies or trusts. The official rules are available from the Queensland Revenue Office.

What happens if I own land jointly with someone else?

When you own land with others, the Queensland Revenue Office (QRO) assesses the tax based on the total taxable value of the entire property. The standard $600,000 tax-free threshold for individuals applies to the property's total value, not each owner's share. If the value exceeds this, a single assessment is issued, and all owners are jointly and severally liable for the full amount.

How is the taxable value of my land determined?

The taxable value is the ‘site valuation’ determined annually by the Queensland Valuer-General. This represents the value of the vacant land alone, without any buildings, landscaping, or other improvements. These valuations are also used by local councils to calculate rates. You have the right to object to your valuation if you believe it is incorrect.

What is an absentee owner for land tax purposes?

An ‘absentee’ is a landowner who does not ordinarily reside in Australia. This includes foreign individuals, overseas-registered companies, or trusts controlled from outside Australia. Absentees are subject to an additional 2% land tax surcharge on the total taxable value of their land, on top of the standard rates. They also have a lower tax-free threshold of $350,000, the same as companies and trusts.

Summary

Assessment Date: Land tax QLD is calculated based on land owned at midnight on 30 June each year.

Taxable Value: The tax is based on the unimproved value of the land, not the total property market value.

Thresholds: Individuals have a $600,000 tax-free threshold. Companies, trusts, and absentees have a $350,000 threshold.

Exemptions: Your principal place of residence is generally exempt, along with land used for primary production or by charities.

Penalties: Non-compliance can result in unpaid tax interest and penalty tax of up to 75% of the tax liability.

Absentees: Foreign owners pay a 2% surcharge on top of standard rates.

Call to Action

Queensland's land tax laws are complex, and your obligations can vary significantly depending on your ownership structure and residency status. To ensure you meet your compliance requirements and effectively manage your tax liabilities, it is advisable to seek professional advice.

Contact Section

Baron Tax and Accounting Website: https://www.baronaccounting.com Email: info@baronaccounting.com Phone: +61 1300 087 213

Comments