Maximize Your CGT Exemption Main Residence

- Jul 3, 2025

- 16 min read

Selling your family home is a huge life event, but it doesn’t have to come with a scary tax bill. In Australia, the CGT exemption for your main residence is easily the most valuable tax break you can get as a property owner. In many cases, it allows you to pay exactly zero Capital Gains Tax (CGT) on the profit you make from the sale. It’s a powerful rule designed to protect everyday homeowners.

Your Home's Shield Against Capital Gains Tax

Think of the main residence exemption as a financial shield for your home. It's the Australian government’s single biggest tax concession for property owners, acknowledging that your home is much more than just an asset—it’s where your life happens. When you sell a property that qualifies, you can often exclude the entire capital gain from your taxable income.

Why This Exemption Is a Big Deal

It's hard to overstate how much this exemption matters. Treasury estimates for the 2023-24 financial year suggest the government will forgo around $47.5 billion in tax revenue because of it. That number shows just how many Australians rely on this rule, making it a cornerstone of how we build personal wealth.

This is so important because property values, especially over the long term, can shoot up. Without this exemption, selling your home could trigger a massive tax liability, making it much harder to downsize, upgrade, or move for a new job.

The core idea is simple: You shouldn't be penalised for selling the home you've lived in and built your life around. The Australian Taxation Office (ATO) put this rule in place to ensure the family home remains a protected asset.

Eligibility at a Glance

So, how do you know if you qualify? The full exemption usually hinges on a few core conditions. You must have actually lived in the property, the land it sits on must be two hectares or less, and you can't have used it to earn an income (like renting out a room).

Of course, life is rarely that neat and tidy. Plenty of situations can lead to a partial exemption or, in some cases, none at all. Let's break down some common scenarios.

Main Residence Exemption Eligibility at a Glance

Here’s a quick table to help you see where you might stand. It's a great starting point for understanding how different situations affect your eligibility.

Scenario | Full Exemption Likely? | Partial Exemption Likely? | Key Consideration |

|---|---|---|---|

Lived in home for the entire ownership period | Yes | No | You must treat it as your main residence and not use it to produce income. |

Rented out a room while living there | No | Yes | The portion of the home used to generate income is typically subject to CGT. |

Moved out and rented the entire property | No | Yes | The 'six-year rule' may apply, but CGT is calculated for the rental period. |

Property is on more than 2 hectares of land | No | Yes | Only the home and land up to two hectares are exempt; the rest is assessable. |

Used the home for business (e.g., home office) | No | Yes | The area used for business and the duration of use will determine the taxable portion. |

You are a foreign resident for tax purposes | No | No | Foreign residents generally cannot claim the main residence exemption. |

This table provides a snapshot, but individual circumstances can be complex. Always consider getting professional advice tailored to your specific situation.

Once you’ve sorted the tax side of things, the physical move is next. A good ultimate moving checklist can make that part a whole lot less stressful.

Meeting the Conditions for a Full CGT Exemption Main Residence.

To secure a full CGT exemption on your main residence, the Australian Taxation Office (ATO) needs to see more than just your name on the title deed. They want to be sure the property was genuinely your home, not just another asset in your investment portfolio. This means proving it was your true main residence for the entire time you owned it.

Think of it as your life's headquarters. It's the address you come back to after a holiday, where your important mail arrives, and where your personal belongings have a permanent spot. These are the practical, real-world signs the ATO looks for to confirm a property’s home status.

The Litmus Test: What Makes a Property Your Home?

So, what does it actually take to "establish" a property as your main residence? It’s not about one single rule, but a combination of factors that paint a clear picture of where you live.

The ATO will look at whether you and your family have:

Moved your personal belongings into the house.

Redirected your mail to the property's address.

Updated your address on the Commonwealth electoral roll.

Connected utilities like electricity and gas in your name.

Used the property's address for crucial documents like your driver's licence.

Essentially, you need to show that your day-to-day life is centred around the property. Simply owning it and dropping in for the odd weekend won't cut it if you want the full tax exemption.

Beyond Your Four Walls: The Two-Hectare Rule

The good news is the exemption doesn't just cover the house itself. It also extends to the land it sits on, but there’s an important limit. The "two-hectare rule" means the main residence exemption applies to a maximum of two hectares (roughly five acres) of land, including the land your home is physically on.

If your property is bigger than two hectares, you can’t claim a full exemption on the entire block. You’ll have to treat the excess land as a separate asset, and any capital gain tied to that extra portion will be subject to CGT when you sell.

Key Insight: You get to choose which two hectares are covered by the exemption. It makes sense to choose the part that includes your actual house, as the dwelling must be part of the exempt area.

A Real-World Example: The Miller Family's Journey

Let's look at the Millers. They purchased a house on a one-hectare block in regional NSW back in 2015. For the next eight years, this was their only home. Their kids attended the local school, they were on the electoral roll at that address, and all their bills were sent to the property.

In 2023, they sold the house for a hefty profit. Because they ticked all the boxes—living there continuously, having land under two hectares, and not using it to earn income—they were entitled to the full CGT exemption on their main residence. The entire profit was theirs to keep, completely tax-free.

This shows how meeting these conditions translates into a huge financial win. The story changes, however, if a property is also used to earn income, like being partially rented out. To dive deeper into that scenario, check out our guide on understanding capital gains and rental property.

Navigating Partial Exemptions And Special Rules

Let's be honest, real life rarely fits into a neat little box. Things happen—you might get a great job offer in another city, decide to rent out a spare room to help with the mortgage, or even start a small business from your home office.

The Australian Taxation Office (ATO) gets this. That's why the cgt exemption main residence rules aren't just a simple yes or no. They include important provisions for partial exemptions and a few special circumstances to cover how life actually works. While getting a full exemption is always the goal, a partial one can still save you a massive amount on your tax bill.

The Powerful Six-Year Absence Rule

One of the most valuable and frequently used special provisions is the six-year absence rule. This rule is a game-changer. It allows you to move out of your home, rent it out, and still treat it as your main residence for CGT purposes for up to six years.

This is incredibly helpful for anyone who needs to relocate for work temporarily, goes on an extended overseas trip, or just wants to try living somewhere else for a while. As long as you don't claim another property as your main residence during that time, the home you've moved out of remains protected from CGT.

Key Insight: The six-year rule isn't a one-time deal. It resets every single time you move back in and re-establish the property as your home. So, you could move out for two years, move back in for a year, and then if you move out again, a fresh six-year period starts.

Using Your Home to Generate Income

Things get a bit more complicated with CGT the moment your home starts making you money. When you use part of your home to produce assessable income—like renting out a room on Airbnb or running a business from a dedicated office space—you generally lose the full exemption.

Instead, you'll be looking at a partial exemption. The tax office will want to apportion the capital gain based on two key factors:

The floor area of your home that was used for income-producing purposes.

The period of time it was used for that purpose.

For example, if you rented out a room that takes up 20% of your home's floor area for exactly half the time you owned the property, you'd likely have to pay CGT on 10% of your total capital gain (which is 20% of the area for 50% of the time).

If you are renting out part of your home, it's critical to know all the tax implications, not just CGT. You can learn more about what you can claim in our guide on tax deductions for rental property owners.

It's not always straightforward, as you can see. Life throws curveballs, and sometimes your main residence isn't just a home. The table below breaks down some common scenarios where your CGT exemption might only be partial.

Common Scenarios Leading to Partial CGT Exemption

Situation | Impact on Exemption | Calculation Basis |

|---|---|---|

Renting out a room | Partial exemption applies. | Based on the floor area of the room and the length of time it was rented. |

Running a business from home | Partial exemption applies. | Based on the floor area used for the business and the period of use. |

Using the Six-Year Rule | Can maintain full exemption for up to six years while absent and renting it out. | If you exceed six years, a partial exemption is calculated for the excess period. |

Owning a new home before selling the old one | A temporary overlap is allowed. | The six-month overlap rule can protect both properties from CGT for a short period. |

These are the most common situations we see, but remember, every case is unique. The key is to keep excellent records so you can accurately calculate the portion of your property's use that wasn't purely residential.

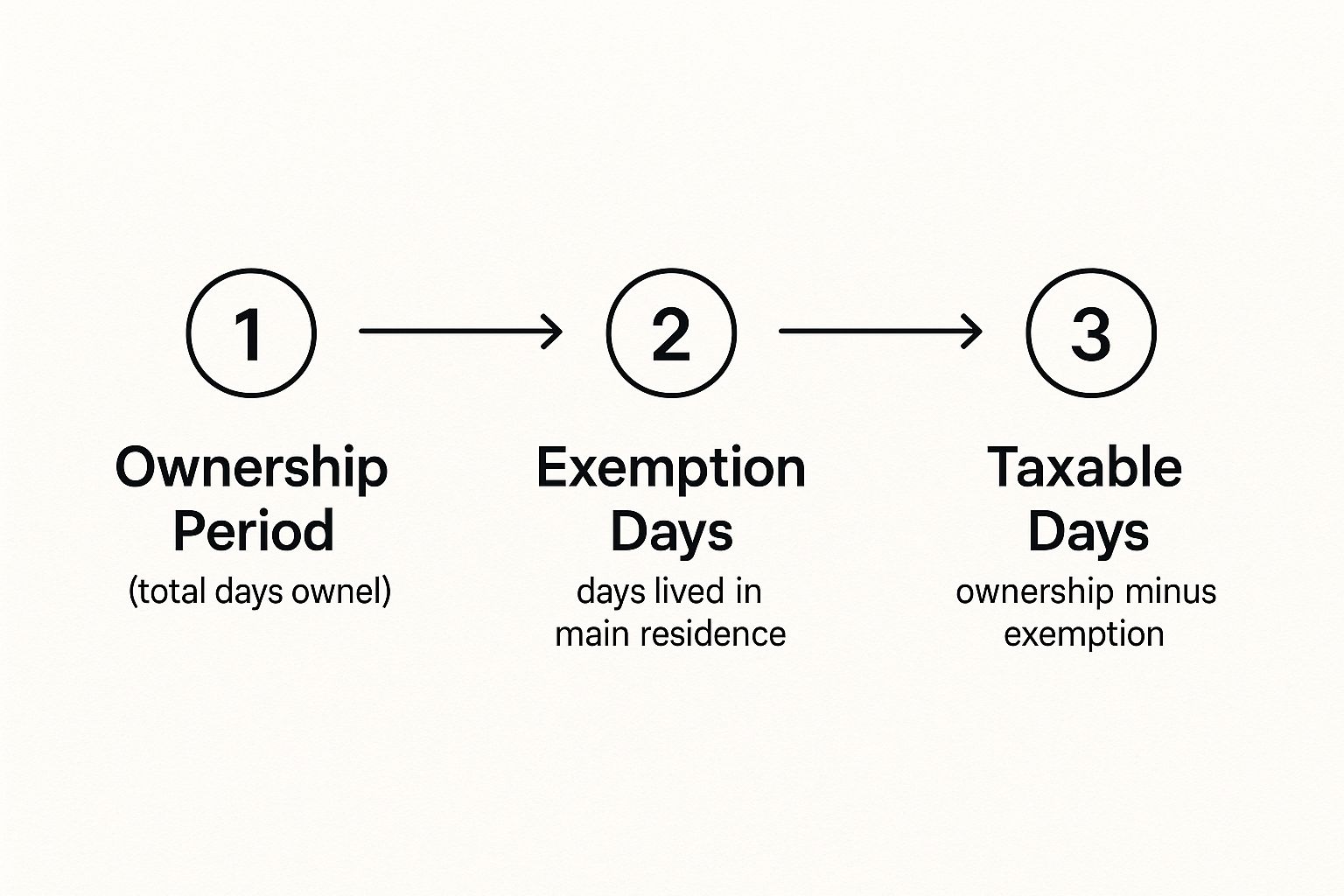

Calculating Your Partial Exemption

When you only get a partial exemption, you have to work out the taxable part of your capital gain. The way we do this is by figuring out how many days the property was not treated as your main residence.

The formula itself looks pretty simple on the surface:

Total Capital Gain × (Non-Main Residence Days ÷ Total Ownership Days) = Taxable Capital Gain

This calculation makes sure you're only paying tax on the capital growth that happened during the period the property wasn't fully exempt.

As this shows, the core idea is splitting your ownership period into two parts for tax purposes. One part is exempt, and the other is taxable. This lets you isolate the gain that is actually subject to CGT.

The Six-Month Overlap Rule

What happens if you buy your new dream home before you've managed to sell your old one? Don't panic. The ATO provides a very practical transition period known as the six-month rule. This rule lets you treat both your old and new properties as your main residence for up to six months.

This handy concession applies if you meet these conditions:

Your old property was your main residence for a continuous three months in the 12 months before you sell it.

You didn't use it to generate any income during that specific 12-month period.

The new property becomes your main residence.

This rule is an absolute lifesaver when moving house. It stops you from getting hit with an automatic CGT bill just because the sale and purchase dates didn't line up perfectly.

How Building and Renovating Affect Your Exemption

So, you're not just buying a standard house. Maybe you're building your dream home from the ground up or planning a massive renovation. These scenarios have their own special wrinkles when it comes to the CGT main residence exemption, and the Australian Taxation Office (ATO) has specific rules you need to know.

Getting these rules right from the start is crucial. You don't want your hard work and investment to end with a surprise tax bill you never saw coming.

Let's start with building a new home. It usually begins with an empty block of land, which, on its own, can't be your main residence. But don't worry, there's a special provision for this. It’s often called the 'four-year rule', and it lets you treat the land as your main residence before the house is even built.

This rule gives you a generous window—up to four years—from when you buy the land to when you finish building and actually move in.

Meeting the Conditions for Building

Of course, this concession isn't a free-for-all. To qualify, you have to tick a few boxes for the ATO.

Here are the key requirements:

You must finish building the home on the land.

You have to move in as soon as it's practical to do so after construction finishes.

You must live there as your main residence for at least three months after moving in.

And this is a big one: you can't treat any other property as your main residence during that construction period.

Tick all these boxes, and the land is treated as your main residence right from the day you bought it, keeping its CGT-free status safe.

How Renovations and Improvements Impact CGT

What about that big extension you're planning or the shiny new kitchen you've just installed? These are called capital improvements, and the money you spend on them is incredibly important for your property’s tax situation, especially if it ever becomes partly taxable.

Every dollar you spend on these improvements gets added to the property’s cost base. Think of the cost base as the total amount your property has cost you over its life—the purchase price, stamp duty, and all these capital improvement costs combined.

A higher cost base is your best friend if your property ever becomes subject to CGT. It directly reduces your capital gain, which means you pay less tax. This is why keeping meticulous records of every renovation receipt is so important.

Let’s look at an example. Say you bought your home for $500,000. A few years later, you spend $150,000 on a major extension. Your new cost base is now $650,000. If you later sell for $1,000,000 and a portion of that gain is taxable (maybe you rented it out for a while), your taxable gain is calculated from $650,000, not the original $500,000. That simple bit of record-keeping could easily save you thousands in tax.

Subdividing Your Block

Thinking of splitting your block in two? Be aware that subdividing your land effectively creates two separate assets for tax purposes. Your main residence exemption will only cover the new, smaller block that your house sits on (as long as it’s under two hectares).

When you sell the newly created vacant block, it will be fully exposed to Capital Gains Tax. The cost base for this new block isn't zero; it's a portion of the original cost base of your entire property. This is usually worked out based on a professional valuation at the time of the subdivision.

This is a tricky area. It’s highly recommended you get professional advice to make sure the cost base is calculated correctly to minimise your tax hit on the sale.

The CGT Exemption for Australian Expats and Foreign Residents

For Aussies living and working abroad, the rules around the CGT exemption for your main residence have gone through a massive shake-up. If you're an expat or planning to move overseas, understanding these changes isn't just a good idea—it's financially critical. A simple shift in your tax residency status could mean the difference between a tax-free sale and a huge CGT bill.

Recent law changes have basically wiped out the main residence exemption for most people who are foreign residents for tax purposes when they sign the contract to sell their home. This means if you sell your Australian home while living overseas, you generally can't claim the exemption, no matter how long you lived in it before you left.

This is a huge departure from the old rules and has blindsided many expats. The family home, once a safe asset, is now fully exposed to CGT for non-residents, with the entire capital gain from the day you bought it becoming taxable.

The Life Events Test: A Crucial Exception

But it's not all bad news. The Australian Taxation Office (ATO) has left a small but vital lifeline open. You might still be able to claim the main residence exemption if you pass the "life events test".

This test lets you keep the exemption if you sell your home while you're a foreign resident, but only if you've been overseas for six years or less. On top of that, you must have gone through one of these specific life events during that time:

Terminal Medical Condition: You, your spouse, or your child under 18 gets diagnosed with a terminal medical condition.

Death: Your spouse or your child under 18 passes away.

Divorce or Separation: You go through a formal separation, divorce, or the breakdown of a de facto relationship, which results in the property being transferred.

As you can see, these are very specific and serious situations. If you don't fit into these strict boxes, the exemption is unfortunately off the table.

Resident vs Non-Resident: A Tale of Two Tax Outcomes

To really see the stark difference these rules make, let's look at a quick example.

Imagine Sarah, an Australian tax resident, and David, a foreign resident. They both sell their Australian homes, which were their main residences for the entire time they owned them. Both walk away with a $400,000 capital gain.

Sarah (Australian Resident): As a resident, she gets the full main residence exemption. Her taxable capital gain is $0. She pays no tax on the profit.

David (Foreign Resident): Because he’s a foreign resident and doesn’t meet the life events test, he can't claim the exemption. His entire $400,000 capital gain is taxable.

This one rule difference means David is staring down a massive tax bill while Sarah pays nothing. It just goes to show why timing your property sale around your residency status has become such a critical financial decision.

It’s worth remembering that foreign residents often face different tax obligations and might not get access to benefits like the tax-free threshold. You can get more details by reading our complete guide to the Australian tax-free threshold.

Keeping the Right Records is Your Best Defence

Getting your CGT exemption for your main residence isn't just about ticking boxes. You have to be able to prove you met the rules, often years after you've sold the place. The Australian Taxation Office (ATO) can come knocking for proof at any time, and solid records are your only real line of defence. Without the right paperwork, even a perfectly good claim can be questioned or even thrown out.

Think of it like this: your claim is the story of you living in your home, and your records are the hard evidence that proves every word of it is true. Even if you're 100% sure you qualify for a full exemption and won't owe a dollar in tax, keeping these documents is not optional. It's essential.

Your Must-Have Document Checklist

Good documentation is the secret to a stress-free tax time. You should start collecting these records from the moment you buy the property and keep them safe until long after you’ve sold it.

Here’s a simple checklist of the absolute essentials:

Contracts of Sale: Make sure you have the final purchase and sale contracts. These are critical as they lock in the dates and prices.

Ownership Costs: This includes all the upfront expenses like stamp duty, legal fees, and any other costs tied to buying and selling. Keep every single receipt.

Capital Improvements: This is a big one. Hold onto receipts for any major renovations, extensions, or significant upgrades. These costs add to your property's cost base, which is crucial if you ever need to calculate a partial exemption.

Proof You Lived There: This is what proves it was your home. Keep copies of utility bills, your registration on the electoral roll, and any other official mail sent to you at that address.

To make sure your documentation is watertight, it pays to have a good system.

How to Report the Sale on Your Tax Return

This catches a lot of homeowners out. Even if you qualify for a full main residence exemption and owe no tax, you still have to report the sale on your tax return. The ATO needs to see the transaction has occurred.

You must declare the property sale in the capital gains tax section of your income tax return. You’ll enter the property details and the capital gain amount, and then apply the full exemption. This brings the net capital gain from the sale down to $0.

Forgetting to report the sale can look like a red flag to the ATO and might trigger an audit or at least a 'please explain' letter. It's a simple but necessary step to show you're compliant and to officially close the book on the property sale.

Of course, if your situation is more complicated—maybe you ran a business from home and only get a partial exemption—the calculations get trickier. You'll need to work out the exact non-exempt portion of your capital gain and report that taxable amount. In these scenarios, your detailed records go from being just helpful to being absolutely critical for getting the numbers right.

Got Questions About the Main Residence Exemption? We Have Answers

When you start digging into the main residence exemption, it's natural for a few tricky "what if" scenarios to pop up. Let's tackle some of the most common questions homeowners ask, so you can handle these situations with confidence.

What Happens If I Inherit a Main Residence?

Inheriting a home comes with its own unique set of CGT rules. If the person who passed away owned the home before CGT was introduced (back on 20 September 1985), you're generally in the clear and won't face any CGT when you sell.

If they bought it after that date, you might still qualify for a full exemption. This usually applies if you sell the property within two years of their death, as long as it wasn't used to earn income by you or the deceased.

This is a complex area where dates and how the property was used are everything. Getting professional advice here is always a smart move.

Key Takeaway: That two-year window to sell an inherited home is a critical deadline. Missing it could expose you to a hefty CGT bill that might have been completely avoidable.

Can I Choose Which Property Is My Main Residence?

Yes, you absolutely can. If you own more than one home, you have the flexibility to nominate which one is treated as your main residence for tax purposes. The only catch is that a family can only have one main residence at any given time.

You officially make this choice when you sell one of the properties. The smart play here is to nominate the property that has racked up the biggest capital gain as your main residence for the period you owned both. This ensures you use the exemption where it saves you the most money. The only time this rule bends is during the six-month overlap when you're moving from one home to another.

Does Knocking Down and Rebuilding My Home Affect the Exemption?

Not necessarily. Demolishing your home and building a new one doesn't automatically cancel your exemption, but you have to play by the 'four-year rule'. This rule lets you treat the land as your main residence while you build, keeping its CGT-free status intact.

To make sure you qualify, you need to:

Finish the new build and move in as soon as it's practically possible.

Live in the new home as your main residence for at least three months after moving in.

Avoid claiming any other property as your main residence during the construction period.

Remember, the costs of demolition and rebuilding get added to the property's cost base. This is incredibly important because it reduces any potential capital gain if the property becomes partially taxable down the track—for example, if you later decide to rent it out.

• Need assistance? We offer free online consultations: – Phone: 1800 087 213 – LINE: barontax – WhatsApp: 0490 925 969 – Email: info@baronaccounting.com

– Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments