Your Guide to Rental Property Tax Deductions

- Jul 25, 2025

- 15 min read

Welcome to your guide on mastering Australian rental property tax deductions. If you're a property investor, understanding exactly what you can claim is the key to unlocking your investment's true financial potential.

The core principle is pretty straightforward: if you spent money to earn rental income, you can probably claim it as a deduction. But, as with all things tax-related, the devil is in the details, and the Australian Taxation Office (ATO) has specific rules you need to follow.

Building Your Deduction Strategy

Think of owning a rental property less like a passive investment and more like running a small business. Managing your expenses effectively is absolutely crucial for your bottom line. Having a solid grasp of your tax deductions isn't just a year-end task; it's the foundation of a smart investment strategy that directly boosts your cash flow and long-term returns.

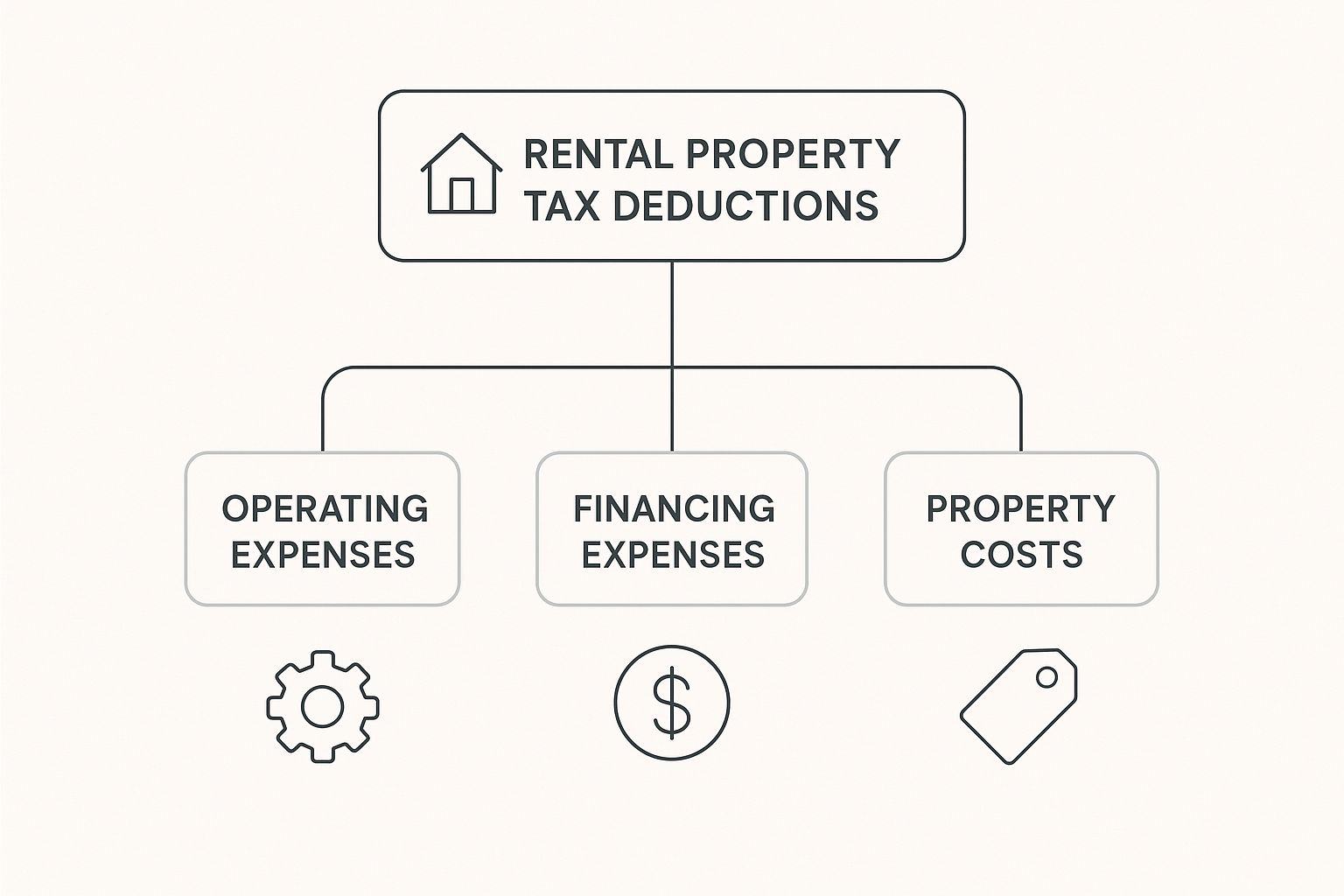

The ATO allows claims for a whole host of expenses, but they all fall into two main categories. Getting your head around these is the first, most important step.

Looking at your expenses this way helps you keep your records organised and makes sure you don’t miss a single potential claim when it's time to do your tax return.

The Two Types of Deductions

The most fundamental concept to lock down is the difference between expenses you claim right away and those you have to claim over several years.

We've put together a simple table to break it down.

Immediate Claims vs Claims Over Time

Deduction Type | Description | Examples | Claim Period |

|---|---|---|---|

Immediate Deductions | These are your everyday running costs for the property. | Council rates, property management fees, advertising for tenants, minor repairs, pest control. | Claimed in full in the same financial year you pay for them. |

Deductions Over Time (Capital Allowances) | These are for bigger-ticket items that have a lasting benefit, often called 'capital works' or 'depreciating assets'. | The building's original construction cost, a new kitchen renovation, buying a new dishwasher or air conditioner. | You claim a portion of the cost each year over the asset's effective life (depreciation). |

Getting this right isn't just about good bookkeeping—it's an ATO requirement. Mistaking a capital improvement (like a new deck) for an immediate repair (like fixing a broken step) can lead to incorrect claims and put you on the wrong side of the tax office.

The Three Golden Rules of Claiming

Before we dive into the nitty-gritty, there are three non-negotiable rules from the ATO. To be claimable, an expense must meet all three criteria:

It must be for your rental property. You can't claim any portion of an expense that relates to your own personal use.

You must have already incurred the expense. This means you've either paid for it or have a legal obligation to pay for it. You can't claim something you're just planning to buy.

You must have a record to prove it. Keep your receipts, invoices, and bank statements. No proof, no deduction. It's that simple.

Key Takeaway: If you use your property for both private and rental purposes (like a holiday home you sometimes rent out), you can only claim the portion of expenses that directly relates to when it was rented or genuinely available for rent. You'll need to apportion everything accurately.

A big part of your strategy involves managing your financing costs, which are often the largest single deduction. Getting familiar with different investor loan interest rates can give you a better picture of this significant expense.

And these deductions really add up. For the 2023-24 financial year, Australian landlords claimed an average of $13,810 per property in deductions. You can dig into more detail on the financial impact of these tax rules in reports from the Parliamentary Budget Office.

Claiming Your Everyday Running Costs

Once you get your head around the difference between immediate deductions and those you claim over time, you can zero in on the expenses that give you a tax benefit straight away. These are your everyday running costs—the money you spend to keep your rental property ticking over and earning you an income.

Think of them as the fuel for your investment engine. The best part? You can claim a full deduction for these costs in the same financial year you pay for them. These expenses pop up frequently, so keeping meticulous records is non-negotiable. Let's walk through the most common running costs you can claim.

Your Comprehensive Checklist of Running Costs

To make sure you don't miss a thing, here’s a breakdown of the typical expenses you can claim immediately. These are the costs directly tied to managing your property and keeping it tenanted.

Advertising for Tenants: Any money spent finding new tenants is fully deductible. This includes online listings, newspaper ads, or even a simple "For Rent" sign.

Body Corporate and Strata Fees: If your property is part of a strata scheme, these regular admin and maintenance fees are deductible. Just be aware that any portion of these fees that go into a special-purpose fund for major capital works might need to be treated differently.

Council Rates and Land Tax: These government charges are a standard part of property ownership and are deductible each year.

Water Charges: You can claim the cost of water supply and usage charges you pay for the property. Naturally, this doesn't include any costs your tenant reimburses you for.

Insurance: Premiums for your building, contents, and public liability insurance policies are all deductible.

Property Agent Fees: All fees and commissions you pay a real estate agent for managing the property, collecting rent, and finding tenants are claimable.

Pest Control: The cost of regular pest inspections and treatments is a maintenance expense, so you can claim it immediately.

Gardening and Lawn Mowing: If you pay someone to maintain the garden and mow the lawns, these costs are deductible.

General Administrative Costs: This is a catch-all for things like bank fees on your investment property's account, plus the cost of stationery, postage, and phone calls directly related to managing the property.

For a deeper dive into these and other potential claims, you can read our detailed guide on tax deductions for rental property.

The Biggest Deduction of All: Loan Interest

For most property investors, the interest paid on the investment loan is, by a huge margin, the largest single rental property tax deduction. This simple fact really drives home how crucial the right loan structure is for your investment's bottom line. The ATO lets you claim the interest portion of your loan repayments for the entire period your property was rented or genuinely available for rent.

Just how important is this deduction? According to the ATO, around 75% of landlords claimed interest-related deductions in the 2021-22 financial year, with the total amount claimed nearing $24 billion.

Crucial Point: You can only claim the interest on the loan, not the principal repayments (the part that pays down what you actually borrowed). Your loan statements should always separate these two components clearly.

Things can get a bit tricky if your loan has a mixed purpose. For instance, if you redraw money from your investment loan to buy a new car for personal use, you can no longer claim the interest on that redrawn portion.

Example: Apportioning a Mixed-Use Loan Let's say you have a $400,000 investment loan. You then redraw $40,000 for a family holiday. From that moment on, only 90% of the loan interest is tax-deductible because 10% of the loan is now for private purposes. Getting this apportionment right is absolutely vital to stay on the right side of the ATO.

Repairs, Maintenance, or Improvements?

Getting this wrong is one of the most common—and costly—mistakes a property investor can make. The Australian Taxation Office (ATO) draws a very firm line between what’s considered a repair, general maintenance, or a capital improvement. A simple misclassification can lead to denied tax deductions, amended returns, and even penalties.

Here’s a simple way to think about it: imagine your rental property is a complete, single entity. Any money you spend to restore or preserve a part of that entity is likely a repair or maintenance. But if you spend money to significantly upgrade, add to, or change the character of the whole thing, you're looking at an improvement. Understanding this difference is the secret to claiming your deductions correctly.

What Is a Repair?

A repair is exactly what it sounds like—it’s work you do to fix something that has broken, been damaged, or worn out while you’ve been renting out the property. The goal is simply to bring an asset back to its original working condition, not to make it better than it was before.

For instance, if a tenant accidentally cracks a window and you call a glazier to replace the pane, that’s a repair. You're just fixing what's broken. The same goes for replacing a few storm-damaged fence palings.

ATO Guideline: A repair is all about restoration, not replacing an entire asset. The great thing about repairs is that the cost is generally deductible in the same financial year you pay for it.

What Is Maintenance?

Maintenance is the work you do to prevent things from breaking or getting worse. It's about keeping the property and all its bits and pieces in good working order. Think of it as proactive care for your investment.

Common examples of maintenance include:

Servicing the air conditioner or hot water system.

Repainting interior walls that are looking faded or have started peeling.

Getting regular pest control treatments done.

Mowing the lawns and looking after the garden.

Being on top of your maintenance can save you from huge repair bills down the track and make your assets last longer. It’s worth checking out some essential roof maintenance tips, for example, to see how regular checks can stop small issues from turning into major headaches. Just like repairs, maintenance costs are immediately deductible.

What Is an Improvement?

This is where so many investors get tripped up. An improvement is any work that goes beyond a simple fix. It’s something that boosts the property's value, fundamentally changes its character, or extends its useful life. Unlike repairs and maintenance, you can't claim the cost of improvements straight away.

Instead, these costs are classified as capital works (for the structure) or depreciating assets (for things like appliances). This means you have to claim the expense bit by bit over several years.

The Test to Tell the Difference

When you're trying to figure out where an expense fits, ask yourself these questions:

Does it replace a whole, distinct item? Swapping out a broken-down stove for a brand-new one is an improvement, as the stove is a complete asset. Just fixing the stove’s faulty heating element? That's a repair.

Does it provide something new? Adding a deck where there wasn't one, building a carport, or installing an air conditioner for the first time are all classic improvements.

Does it substantially upgrade the asset? If you replace a basic laminate benchtop with a fancy granite one, that's an improvement. You've significantly upgraded the quality and character of the kitchen.

The Critical Rule for Initial Repairs

The ATO is very strict about what it calls "initial repairs." These are costs you incur to fix defects, damage, or wear and tear that already existed when you bought the property. Even if it looks and feels like a repair (like fixing a leaky roof that was leaking when you signed the contract), the ATO treats it as a capital expense.

Example: The Initial Repair Trap

Let's say you buy a rental property and find the hot water system is on its last legs. You spend $1,500 to replace it right after settlement. Because this problem was there when you took ownership, the ATO sees that $1,500 as part of the cost of acquiring the property. You can’t claim an immediate deduction. Instead, that cost gets added to the property's cost base (for capital gains tax) or is claimed as a depreciating asset over its effective life.

This rule stops people from buying rundown properties, claiming massive immediate deductions to fix them up, and then selling for a quick profit. Always get a clear picture of the property's condition at purchase to make sure you classify any immediate work correctly.

How to Claim Your Property's Depreciation

Depreciation is one of the most powerful—and most misunderstood—tax deductions available to Aussie property investors. Unlike paying the council rates or agent fees, this is a ‘non-cash’ deduction. What does that mean? You don't actually have to spend any money during the financial year to claim it.

Instead, depreciation lets you claim a deduction for the wear and tear on your building and the assets inside it as they get older. For many landlords, this is where thousands of dollars in tax savings are hiding in plain sight.

To get it right, you need to understand the two distinct parts of depreciation as defined by the Australian Taxation Office (ATO). Nailing this difference is the key to a correct and maximised claim.

Capital Works Building Allowances (Division 43)

First up, we have Capital Works, which you'll often hear referred to as Division 43 deductions. Think of this as the "bones" of your property—the building’s core structure and any items that are permanently fixed in place.

You can claim these deductions for things like:

The original construction cost of the building (if built after 15 September 1987).

Structural improvements and additions, like a new room, deck, or pergola.

Fixed items such as kitchen cupboards, doors, sinks, and retaining walls.

Generally, you can claim these costs at a rate of 2.5% per year for 40 years from the date construction was finished. If you're planning a major upgrade, understanding the full cost to add a second storey is a great example, as those kinds of expenses are claimed back over time through Capital Works deductions.

Plant and Equipment Assets (Division 40)

The second part is Plant and Equipment, also known as Division 40 assets. These are all the items inside the property that can be easily removed. They have a much shorter lifespan than the building structure itself.

Common examples include:

Carpets and blinds

Ovens, cooktops, and rangehoods

Dishwashers and air conditioning units

Hot water systems and smoke alarms

The ATO gives each of these assets an 'effective life,' and you claim its decline in value over that specific period. A carpet, for instance, might have an effective life of 10 years, while a dishwasher’s might be 8 years. For a deeper dive, check out our detailed guide on depreciation for your investment property, where we break down these asset classes further.

The savings here really add up. In the 2021-22 financial year, landlords claimed over $8.7 billion in capital works deductions and another $3.7 billion for plant and equipment, demonstrating just how significant these claims are.

The Gold Standard: A Quantity Surveyor Report

While you could try to estimate these values yourself, it’s a minefield. It's incredibly easy to miss out on thousands in valid deductions or, worse, make an error that attracts the ATO's attention. This is why getting a tax depreciation schedule prepared by a qualified quantity surveyor is the gold standard.

A quantity surveyor is a construction cost expert who is recognised by the ATO. They inspect your property, identify every single depreciable asset, and calculate its value. The result is a comprehensive report that sets out your claims for up to 40 years. Best of all, the one-off fee for the report is 100% tax-deductible.

Important Changes for Second-Hand Assets

One crucial point to remember: the rules changed back in 2017. If you bought your residential rental property after 7:30 PM (AEST) on 9 May 2017, you can no longer claim depreciation on any previously used plant and equipment assets.

This means if you buy an established property, the existing oven, carpets, and blinds are off-limits for depreciation claims. However, you can absolutely claim deductions for any brand-new assets you buy and install yourself. Crucially, these rule changes don't affect your ability to claim the big-ticket Capital Works (Division 43) deductions for the building's structure.

Navigating Common Investor Scenarios and Pitfalls

Real-world property investing is rarely a straight line. As an investor, you'll often run into unique situations that don't fit neatly into the usual deduction boxes. Staying on the right side of the Australian Taxation Office (ATO) means knowing how to handle these common, and sometimes tricky, scenarios.

From holiday homes that double as personal getaways to the details of co-ownership, understanding the specific rules is key to avoiding costly mistakes. Let's walk through some of the most frequent challenges you might face on your investment journey.

Apportioning Expenses for Private Use

One of the most common issues we see is when a property is used for both private and rental purposes. This is classic for holiday homes – you rent it out for most of the year but block out a few weeks for your own family trips. The ATO is crystal clear on this: you can only claim deductions for the portion of expenses that relate to the period the property was genuinely available for rent.

You can't just claim 100% of the costs if you used it yourself. You must correctly apportion your expenses between rental and private use.

Example: The Holiday Home Calculation

Let's say your beach house was rented out for 100 days and you used it for your own holidays for 20 days. For the rest of the year (245 days), it was vacant but actively listed for rent on sites like Airbnb or Stayz. This means it was genuinely available for rent for a total of 345 days (100 rented + 245 available).

Deductible Portion: 345 / 365 days = 94.5%

Private Use Portion: 20 / 365 days = 5.5%

So, you can claim 94.5% of all your eligible expenses—like loan interest, council rates, and insurance—as rental property tax deductions. The other 5.5% is a private expense and can't be claimed.

The Pitfall of Pre-Purchase Expenses

This is a trap for new players. Many investors assume they can immediately claim costs they paid before the property title was even in their name. The ATO has very strict rules here. Generally, any money you spend investigating or buying your rental property is not immediately deductible.

Instead, these costs are considered capital expenses. They get added to the property's cost base, which is used to calculate your capital gains tax (CGT) when you eventually sell.

Key Rule: Costs like building and pest inspection reports done before purchase, stamp duty, and conveyancing fees are all part of your acquisition cost. You can't claim them as an immediate rental deduction in the first year.

Understanding Negative Gearing

Negative gearing is a term that gets thrown around a lot, but it's often misunderstood. It’s not some complicated tax scheme; it's a simple outcome. A property is negatively geared when your deductible expenses for the year are higher than the rental income it brings in, creating a net rental loss.

This rental loss can then be offset against your other taxable income, like your salary. For instance, if you have a net rental loss of $10,000 and a salary of $90,000, your taxable income for the year drops to $80,000. This often results in a bigger tax refund.

Other Common Traps to Avoid

Keep these other common pitfalls in mind to stay compliant:

Travel to Inspect Property: As of 1 July 2017, the rules changed. You generally cannot claim deductions for the cost of travel to inspect, maintain, or collect rent for a residential rental property.

Co-ownership: If you own a property with a spouse, family member, or business partner, you must split the rental income and expenses according to your legal ownership percentage. If you own it 50/50, you each declare 50% of the income and claim 50% of the deductions on your respective tax returns.

Keeping Records: Your Key to Audit-Proof Claims

Even the most legitimate rental property tax deductions are worthless without one crucial thing: proof.

Think of the Australian Taxation Office (ATO) as a strict but fair judge; they need to see the evidence. Without solid records, your claims can be challenged or even flat-out rejected during an audit. That can quickly turn your expected tax savings into a stressful tax bill.

Meticulous record-keeping is the absolute bedrock of a stress-free, audit-proof tax return. It’s not just about staying out of trouble. It’s about making tax time a smooth, confident process where you can justify every single dollar you claim.

Your Essential Record-Keeping Checklist

So, what exactly do you need to hold onto? Your records should paint a clear financial picture of your investment property for the entire year.

Your essential files should always include:

Proof of Income: All rental agreements and bank statements showing every rental income deposit.

Proof of Expenses: Every single receipt, tax invoice, and credit card statement for all your costs, no matter how small they seem.

Loan Documents: Your original loan agreements and all bank statements that clearly show the interest you've been charged.

Legal & Purchase Documents: The contract of sale for the property and all associated conveyancing paperwork.

Capital Works Records: All contracts, receipts, and professional reports (like those from a quantity surveyor) related to construction or improvements.

The ATO’s Golden Rule: You must keep these records for at least five years from the date you lodge your tax return. This gives the ATO a reasonable window to review your claims if they need to.

Staying organised is half the battle. Many investors use dedicated apps or cloud storage to snap photos of receipts the moment they get them. Others prefer a simple spreadsheet and a good old-fashioned folder system.

Honestly, the method doesn't matter as much as your consistency. Trust me, your future self will thank you for getting organised today.

Ready to Take Control of Your Rental Property Tax deductions?

Figuring out your rental property tax deductions can feel like navigating a maze. It’s easy to get tangled up in the details, wondering if you're claiming everything you're entitled to or accidentally crossing a line with the ATO. From everyday running costs to the tricky bits like depreciation, getting it right makes a huge difference.

A quick chat with an expert can uncover deductions you didn't even know existed and give you the confidence that everything is handled correctly. It’s about making your investment work smarter, not harder.

Whether this is your first investment property or you’re managing a growing portfolio, our team is here to help clear the fog. We also handle other business tax matters—for instance, our guide to GST registration in Australia is a great place to start if you have questions about GST.

Getting professional advice is simply the best way to ensure you’re not leaving money on the table.

• Need assistance? We offer free online consultations: – Phone: 1800 087 213 – LINE: barontax – WhatsApp: 0490 925 969 – Email: info@baronaccounting.com – Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments