Mastering Negative Gearing Tax Benefits in Australia

- Aug 11, 2025

- 16 min read

Negative gearing is one of the most talked-about strategies for Australian property investors, and for good reason. At its simplest, the main tax benefit is that you can deduct your net rental loss from your other income, like your salary. This lowers your total taxable income, often leading to a smaller tax bill or a bigger refund when tax time rolls around.

Understanding Negative Gearing Tax Benefits

So, how does it all work? Negative gearing happens when your investment property costs more to own and manage than the rental income it brings in. The Australian Taxation Office (ATO) lets you claim this shortfall, known as a net rental loss, as a tax deduction. It’s helpful to think of your property like a small business—if it runs at a loss for the year, that loss can be used to offset your other earnings.

But this isn't just a short-term game. It's a long-term strategy where investors are willing to accept a yearly loss, banking on the property's value growing over time. The negative gearing tax benefits you get each year are what make holding onto the asset more affordable while you wait for that all-important capital growth.

The Mechanics of a Net Rental Loss

To see this in action, you need to tally up all your property-related income and expenses. The formula is refreshingly simple:

Total Rental Income - Total Deductible Expenses = Net Rental Income or Loss

When your expenses are higher than your income, you have a net rental loss. This is the number that becomes a powerful tool at tax time. To really illustrate this, let's look at a quick example of how a net rental loss is calculated.

A Quick Look at How Negative Gearing Works

Financial Component | Example Annual Amount | What This Means for Your Investment |

|---|---|---|

Gross Rental Income | $26,000 | This is the total rent collected from tenants over the financial year. |

Loan Interest | $25,000 | The interest portion of your mortgage repayments. Often the biggest expense. |

Rates & Insurance | $4,500 | Includes council rates, water rates, and landlord/building insurance. |

Repairs & Fees | $2,000 | Covers property management fees and general maintenance costs. |

Total Deductible Expenses | $31,500 | The sum of all claimable costs associated with holding the property. |

Net Rental Loss | -$5,500 | The shortfall ($26,000 - $31,500) that can be claimed as a tax deduction. |

As you can see, the $5,500 loss directly reduces the investor's taxable income for the year, which is the core benefit of negative gearing.

Common Deductible Expenses

The secret to making the most of your claim is knowing exactly what you can deduct. The ATO allows a surprisingly wide range of costs, which all add up to create that net rental loss.

Here are some of the most common ones:

Loan Interest: For most investors, the interest paid on the mortgage is the single largest deductible expense.

Property Management Fees: Any fees you pay to a real estate agent to manage the property and its tenants.

Council and Water Rates: These are the standard charges from your local and state authorities.

Insurance: This includes landlord insurance, building insurance, and even contents insurance for items you provide for tenants.

Repairs and Maintenance: The costs of general upkeep to ensure the property stays in a good, tenantable condition.

Body Corporate Fees: If your property is a unit, townhouse, or apartment in a strata complex, these fees are deductible.

By keeping good records of these expenses all year, you can precisely calculate your net rental loss. This figure then goes straight into your personal tax return, where it works to lower your taxable income and unlock the benefits that make this strategy so popular.

How Negative Gearing Reduces Your Tax Bill

So, what's all the fuss about? The core appeal of negative gearing is its direct, positive impact on your annual tax return. It’s a mechanism that turns a "paper loss" from your investment property into real, tangible savings by slashing the amount of tax you owe.

The process itself is surprisingly straightforward. The net rental loss from your property is simply subtracted from your other income, like your salary.

This simple subtraction is where the magic happens. By lowering your total taxable income, you effectively drop down the tax ladder. This can mean paying significantly less tax for the financial year or, even better, getting a much larger tax refund from the Australian Taxation Office (ATO). It’s a powerful feature of our tax system that makes holding a property much more affordable, especially in its early growth years.

The Offset Mechanism Explained

Think of your income in two separate buckets. Your main job salary goes into the first bucket. The profit or loss from your investment property goes into the second.

When that property bucket ends up with a negative balance (a loss), the ATO lets you tip that loss into your salary bucket. This shrinks the total amount of income you're taxed on.

For anyone paying tax at a marginal rate of 30% or higher, every dollar of loss you claim from the property saves you 30 cents or more in tax. This direct offset is what provides the immediate cash flow relief that makes the strategy so popular.

Let’s walk through a clear "before and after" to see how it works in the real world. Meet Chloe, an investor.

Scenario: Chloe's Tax Situation

Annual Salary: $110,000

Investment Property Net Rental Loss: $12,000 for the financial year

Now, let's see how her tax bill changes with and without the investment property.

Chloe's Tax Without the Property

With no investment property, Chloe's tax is calculated on her full salary.

Taxable Income: $110,000

Tax Payable (approximate, based on 2024-2025 rates): Based on the ATO's tax rates, her tax would be $23,788 plus the Medicare Levy.

This is a standard calculation based purely on her employment income.

Chloe's Tax With the Property

Now, let's bring the investment property into the picture. This is where the negative gearing tax benefits kick in. The $12,000 loss is subtracted from her salary before the tax is calculated.

Original Taxable Income: $110,000

Net Rental Loss: -$12,000

New Taxable Income: $110,000 - $12,000 = $98,000

Tax Payable (approximate, based on 2024-2025 rates): Her new tax bill on $98,000 would be just $20,188, plus the Medicare Levy.

The Result: By using negative gearing, Chloe reduces her tax bill by $3,600 for the year ($23,788 - $20,188). This saving is the $12,000 loss multiplied by her 30% marginal tax rate.

This annual tax saving helps cover the cash shortfall needed to hold the property, making the long-term investment far more sustainable. It’s a perfect example of how a calculated loss on paper generates a direct financial win. And while negative gearing is powerful, exploring other general strategies to save money on taxes can help you optimise your finances even further.

Ultimately, negative gearing isn't some shady loophole. It's a recognised part of Australian tax law, designed to encourage private investment in the housing market. By understanding exactly how this reduction works, you can plan your investment with confidence and see why so many Aussies use property to build long-term wealth.

Who Actually Benefits from Negative Gearing?

There’s a common myth floating around that negative gearing is a secret handshake reserved for surgeons, lawyers, and high-flying execs. While they certainly can and do use it, the reality on the ground paints a much different picture. The truth is, the people who most often benefit from negative gearing tax benefits are everyday working Australians.

Legally, any Australian resident who owns an investment property that makes a net rental loss is eligible to claim the associated tax deductions. There are no income tests or gatekeepers deciding who can or can't participate. This accessibility is a huge reason why it’s so widely used across countless professions and income levels.

And it's not just a theory; the data from the Australian Taxation Office (ATO) consistently busts the "rich person's loophole" myth. Year after year, it shows the strategy is most common among people on middle incomes—the very people who form the backbone of our communities.

A Look at the Everyday Investor

When you picture a typical property investor, a nurse, a teacher, or a tradie might not be the first image that comes to mind. But these are exactly the people who make up the majority of investors using negative gearing in Australia. They’re not using it to dodge tax, but as a practical stepping stone to build long-term financial security for their families.

The numbers don't lie. Recent ATO data shows that over 1.28 million Australians negatively gear their properties. What’s really telling is that about two-thirds of these investors have a taxable income under $80,000 a year, with the average tax deduction claimed sitting around $8,700. You can dig deeper into these figures in this insightful report on property investment trends.

This data gets to the heart of the matter: Negative gearing is not a loophole for the wealthy. It's a mainstream financial strategy that helps make property investment achievable for a much broader range of Australians, allowing them to plan for their future.

Why It Appeals to Such a Broad Audience

So, what makes negative gearing so popular across the board? It all comes down to managing cash flow. For a middle-income earner, the ongoing cost of holding an investment property could easily be too much to handle without some kind of financial relief.

The annual tax refund you get from negative gearing helps bridge the gap, covering the shortfall from mortgage repayments, council rates, and maintenance. This makes the investment sustainable year after year while you wait for the property’s value—the capital growth—to do the heavy lifting.

Makes Investment Accessible: It lowers the barrier to entry, giving people who aren't high-income earners a chance to get into the property market.

Supports Long-Term Goals: The tax benefits provide the breathing room needed to hold onto an asset for the long haul, which is where real capital growth happens.

Encourages Rental Supply: By making property investment more viable for more people, it directly adds to the number of rental homes available for everyone.

It's a feature of Australia's tax system that’s been around for over a century, and it plays a vital role in supporting the national rental market.

The Role of Younger Investors

Negative gearing isn't just for those in the middle of their careers, either. It’s also being picked up by younger generations who are getting a head start on their financial future. The very same ATO data reveals that over 103,000 investors under the age of 30 are using negative gearing.

For these younger Aussies, the strategy offers a practical pathway to owning an asset that can grow in value over decades. It lets them get a foothold in the property market much sooner than they might have been able to otherwise.

From a young professional just starting out to a family planning for retirement, the benefits are clear. Negative gearing is a widely used, legitimate strategy that helps a diverse mix of Australians work towards their financial goals through property investment.

Essential Tax Deductions for Your Investment Property

To get the most out of negative gearing, you need to know exactly what you can claim. Think of it like a puzzle – every legitimate expense is a piece, and you need all of them to see the full financial picture. The Australian Taxation Office (ATO) lets you deduct a huge range of costs, but only if the property was genuinely up for rent.

Keeping good records isn't just a smart move; it's the only way to make sure you're not leaving money on the table. Let’s break down what you can claim.

Core Ongoing Expenses

These are the regular, predictable costs that form the backbone of your annual tax deductions. Most landlords will face these expenses year after year.

Loan Interest Payments: For almost every investor, the interest on the property loan is the single biggest deduction. Remember, you can only claim the interest part of your repayments, not the principal that pays down your actual loan.

Council and Water Rates: Straightforward and simple. The regular bills from your local council and water authority are fully deductible for the period your property was available for rent.

Landlord and Building Insurance: The premiums you pay for building, contents, and public liability insurance are a must-have for protecting your asset, and thankfully, they're also fully deductible.

Body Corporate or Strata Fees: If you own a unit, apartment, or townhouse, those regular fees for maintaining common areas and managing the building are claimable.

To be fully prepared, it’s a good idea to familiarise yourself with the full list of essential rental property tax deductions you're entitled to.

Property Management and Tenancy Costs

Getting and keeping good tenants also comes with its own set of claimable costs. These are all directly tied to the business of earning rental income.

Property Management Fees: Hired a real estate agent to handle the day-to-day? Their management fees, rent collection commissions, and any other admin charges are deductible.

Advertising for Tenants: The costs of finding new tenants—whether it's online listings, newspaper ads, or an agency's letting fee—can all be claimed.

Lease Preparation: Any money spent on drawing up or registering a new lease agreement is another easy deduction.

Key Insight: Don't forget the small stuff! Many investors miss out on claiming minor costs like stationery, postage, and phone calls made directly for property matters. They might seem small, but they really do add up over a year.

Repairs, Maintenance, and Depreciation

This is where things get a bit more technical, covering both out-of-pocket expenses and "non-cash" deductions for wear and tear. Getting this right is crucial.

Repairs and Maintenance A repair is all about fixing something to bring it back to its original condition—think fixing a leaky pipe or a cracked window. Maintenance is work done to stop things from getting worse, like repainting a wall to prevent it from deteriorating. The great thing is, these costs are usually 100% deductible in the year you pay for them.

An improvement, however, is different. This is when you make something better than it was, like a full kitchen renovation. You can't claim these costs upfront; instead, they are treated as capital works and are written off over many years. For a deeper dive, check out our guide to rental property tax deductions.

Depreciation (Capital Allowances) Depreciation is one of the most powerful tools for property investors because it's a non-cash deduction. You get to claim it without actually spending any money that financial year. It’s the ATO’s way of acknowledging that your building and the assets inside it are slowly losing value.

Capital Works (Division 43): This is the deduction for the building’s structure itself—the bricks, mortar, walls, and roof. For residential properties built after 15 September 1987, you can typically claim 2.5% of its construction cost each year for 40 years.

Plant and Equipment (Division 40): This covers all the removable fixtures and fittings inside, like carpets, ovens, blinds, and air conditioners. The ATO gives each item an "effective life," and you can claim its value decline over that specific period.

To make sure you don't miss a cent, a quantity surveyor can create a depreciation schedule for you. This report breaks down exactly what you can claim for both the building and its assets each year, unlocking thousands in potential deductions.

A Real-World Example of Negative Gearing

Theory is one thing, but seeing the numbers in action really brings a concept to life. To properly understand how negative gearing tax benefits work, let's walk through a practical case study.

Meet Alex, a marketing professional from Brisbane who earns a salary of $95,000 a year. Seeing the long-term potential in real estate, Alex has just purchased an investment apartment. Let’s break down the property's finances for the 2024-2025 financial year to see exactly how negative gearing plays out on a tax return.

Setting the Scene: Alex's Investment

First, we need a clear picture of the income and expenses tied to Alex's new property. Keeping meticulous records is the bedrock of any successful tax claim, and Alex has tracked every dollar.

Annual Rental Income:

The apartment rents for $500 per week, generating a total annual income of $26,000.

Annual Deductible Expenses:

Loan Interest: The interest paid on the mortgage for the year is $24,000.

Council & Water Rates: These essential service fees come to $3,500.

Property Management Fees: The real estate agent's management fees total $2,080.

Insurance: Landlord and building insurance premiums cost $1,500.

Repairs & Maintenance: A few minor repairs throughout the year added up to $800.

Depreciation: Alex hired a quantity surveyor who prepared a depreciation schedule, identifying $4,500 in claimable deductions for the building's structure (capital works) and its assets (plant and equipment).

With these figures, we can now calculate the property's performance on paper.

Calculating the Net Rental Loss

To figure out the net rental loss, we simply subtract the total deductible expenses from the total rental income. This final number is what directly impacts Alex's tax position.

Total Income: $26,000

Total Expenses: $24,000 + $3,500 + $2,080 + $1,500 + $800 + $4,500 = $36,380

The calculation is pretty straightforward:

$26,000 (Income) - $36,380 (Expenses) = -$10,380 (Net Rental Loss)

This $10,380 paper loss is the key that unlocks the tax benefits of negative gearing. It’s worth noting how depreciation—a non-cash deduction—plays a huge role in creating this loss. Understanding the details of depreciation on an investment property is essential for any serious investor looking to maximise their claims.

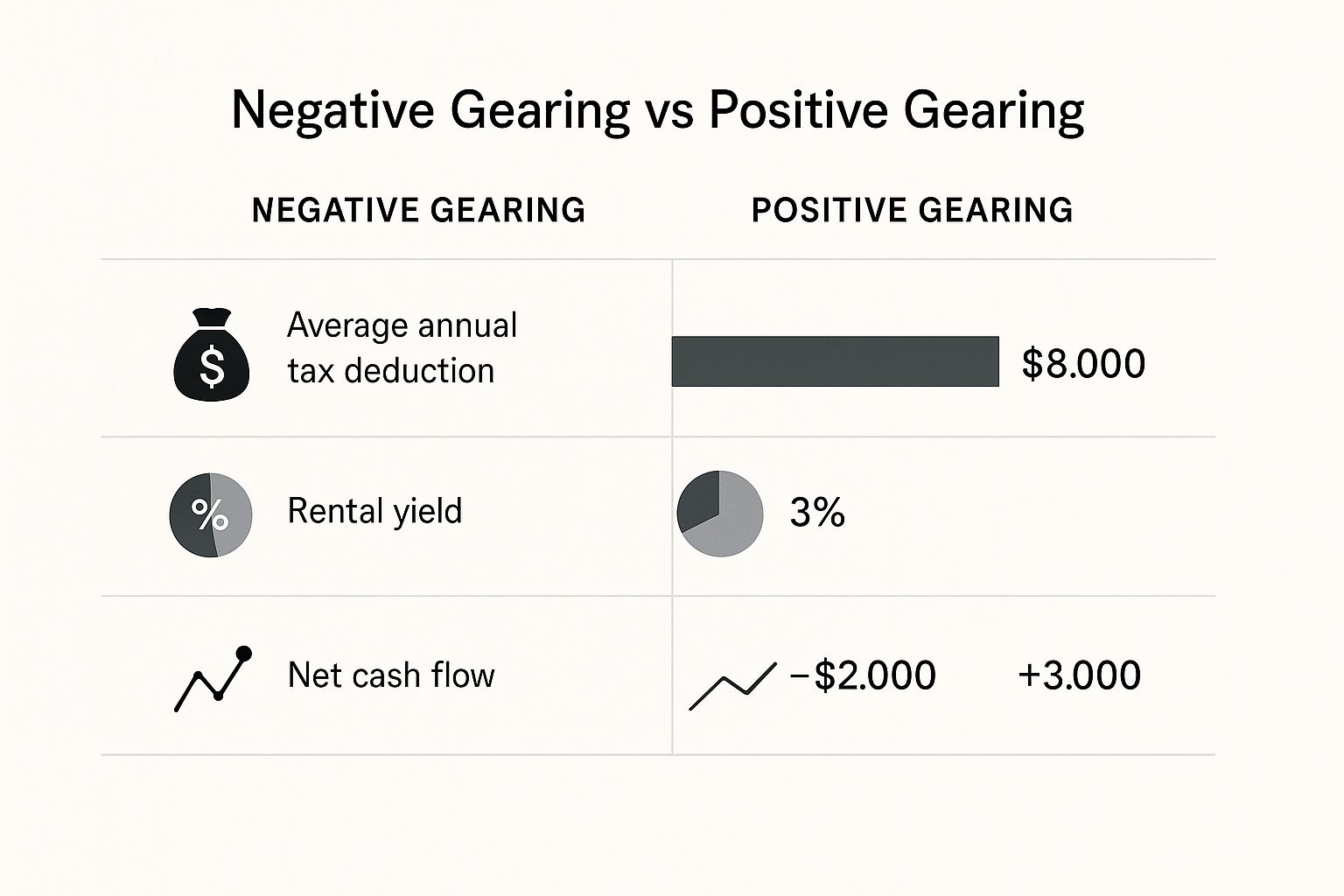

The infographic below gives a great visual comparison of how a negatively geared property stacks up against a positively geared one, highlighting the differences in cash flow and tax deductions.

As you can see, while the negatively geared property has a cash shortfall, the tax deduction is significantly larger. This is the core appeal of the strategy.

The Final Tax Impact

So, how does this all translate to Alex’s final tax bill? To make it crystal clear, we'll compare Alex’s tax liability with and without the investment property.

Case Study: Alex's Negative Gearing Calculation

This table provides a side-by-side look at Alex's tax situation, showing the direct financial impact of the negatively geared property.

Calculation Step | Without Investment Property | With Negatively Geared Property |

|---|---|---|

Salary | $95,000 | $95,000 |

Net Rental Loss | $0 | -$10,380 |

Taxable Income | $95,000 | $84,620 |

Tax Payable (approx. 2024-25 rates) | $19,288 | $16,174 |

Annual Tax Saving | - | $3,114 |

The results are clear. The $10,380 net rental loss is subtracted from Alex's salary, reducing the total income that the ATO can tax. This leads to a direct tax saving.

The Result: By using negative gearing, Alex has reduced the annual tax bill by $3,114 ($19,288 - $16,174). This refund is a direct consequence of the property's paper loss.

The Long-Term Goal: Capital Growth

That annual tax saving of $3,114 is what makes holding the investment property far more manageable. While Alex does have an out-of-pocket cash loss for the year, the tax refund helps to cover a significant chunk of it.

But the yearly tax saving isn't the main prize. The real objective here is long-term capital growth. Alex is betting on the property's value appreciating significantly over the years. When it's eventually sold, that profit will be subject to Capital Gains Tax (CGT), but the tax benefits received along the way made the entire investment journey more affordable, turning a yearly paper loss into a powerful wealth-building strategy.

The Risks and Rewards of Negative Gearing

While the negative gearing tax benefits are certainly a major drawcard, it's vital to see this for what it is: a long-term investment strategy, not a shortcut to instant wealth. Like any investment, it has its own set of risks and rewards that you need to weigh up carefully. Getting this balance right is the key to making a smart decision that actually helps your financial future.

At its heart, the whole strategy hinges on one powerful assumption: that your property will be worth more in the future than it is today.

The Ultimate Reward: Capital Growth

The main prize you're chasing here is significant capital growth. This is simply the increase in your property's market value from the day you buy it to the day you eventually sell it. The annual tax deductions you get from negative gearing are really just a financial helping hand, making it more affordable to hold onto the property while you wait for this growth to happen.

Think of the tax breaks as the support act. Capital growth is the main event. A successful investment means that years down the track, the profit you make from selling the property will dwarf the total cash shortfalls you covered along the way. That long-term profit is the real goal.

The Primary Risk: Market Stagnation

This brings us squarely to the biggest risk: negative gearing is fundamentally a bet on the property market. You are deliberately losing a bit of money each year in the hope that future capital growth will more than make up for those losses.

The core risk is that you are relying entirely on future market performance to make your investment worthwhile. If the property market stagnates, or worse, declines, you could be left with an underperforming asset that costs you money every year without any prospect of a profitable sale.

This is the nightmare scenario where you get all the pain (ongoing cash losses) with none of the gain (capital appreciation). Before you jump in, you have to ask yourself if you’re genuinely comfortable with this possibility. How your property's final sale price is taxed is also a critical piece of the puzzle; understanding the rules around capital gains and rental properties is essential before you even start.

The Importance of a Financial Buffer

Another major risk is simply underestimating the true cost of holding a property. Unexpected expenses aren't a matter of if, but when.

Sudden Repairs: A hot water system could burst, or a wild storm could damage the roof, leaving you with a bill for thousands of dollars in urgent repairs.

Vacancy Periods: Your property might sit empty for weeks or even months between tenants, which means zero rental income to help cover the mortgage and bills.

Interest Rate Rises: If interest rates climb, your loan repayments could jump significantly, making your annual cash shortfall even bigger.

Without a healthy financial buffer—a savings account dedicated purely to your investment property—these common events could put you under serious financial pressure. Having enough cash set aside to cover at least three to six months of all property expenses is a non-negotiable part of any responsible investment plan. It’s what allows you to ride out the tough times without being forced to sell at a loss.

Your Next Steps and Professional Advice

You’ve now got a solid handle on the mechanics of negative gearing. But turning that knowledge into a smart, wealth-building investment is a whole different ball game. The most successful strategies are always tailored to an individual’s financial situation and their goals for the future.

It's easy to get focused on the annual tax refund, but that's just a secondary benefit. The real goal of negative gearing is to build long-term wealth by owning property, using the tax breaks to make holding that asset more affordable along the way.

Why Professional Guidance Is Essential

Before you even think about signing a contract, getting professional advice is non-negotiable. An investment strategy that’s perfect for your friend might be completely wrong for you. A qualified expert can look at your circumstances from all angles.

A great tax agent and financial advisor work in tandem to build a rock-solid foundation for your investment. They make sure your strategy is not only fully compliant with ATO rules but also perfectly aligned with what you want to achieve financially. Their expertise is what allows you to move forward with confidence.

The true value of getting advice is in structuring your investment correctly from day one. This proactive approach helps you sidestep expensive mistakes and puts you in the best position to claim the maximum negative gearing tax benefits the law allows.

Structuring Your Investment Correctly

How you choose to own the property has huge consequences for tax, asset protection, and even estate planning down the track. Should you buy it in your own name, as a joint tenant with your partner, or maybe through a trust? Each structure comes with its own set of pros and cons.

An advisor can walk you through these options, clearly explaining which structure makes the most sense for your personal needs. Getting this decision right is fundamental to building a secure and successful property portfolio.

For a deeper dive into what you can claim once you have a tenant, have a look at our guide to rental property tax deductions. The world of property investing is much easier to navigate when you have a clear roadmap and expert support.

• Need assistance? We offer free online consultations: – LINE: barontax – WhatsApp: 0490 925 969 – Email: info@baronaccounting.com – Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments