How to Decrease Taxable Income: A Practical Guide for Australians

- Jan 19

- 14 min read

Reducing your taxable income in Australia isn't about finding complex loopholes. It's about strategic financial management—claiming every deduction you are legally entitled to and smartly timing your income and expenses according to Australian Taxation Office (ATO) rules. For most individuals and small businesses, the two most effective strategies are maximising work-related deductions and making concessional contributions to superannuation. Both directly lower your assessable income, which is the primary goal of tax planning.

It is crucial to understand that incorrectly calculating your taxable income, even unintentionally, can lead to significant compliance risks. The ATO imposes strict penalties for understating income or overclaiming deductions. These can include administrative penalties, interest charges on shortfall amounts, and a formal audit, making accurate record-keeping and a clear understanding of tax law essential for both individuals and businesses.

At Baron Tax & Accounting in Brisbane, we frequently observe clients whose financial situations evolve, making their tax obligations more complex. For instance, a salaried employee might start a small side business or purchase a rental property, which introduces new income streams and deduction opportunities that are often overlooked without professional guidance. A common pattern is seeing new sole traders misinterpret ATO guidelines on vehicle expenses, leading to missed deductions or compliance issues.

Understanding Your Taxable Income In Australia

In Australia, your taxable income is calculated using a straightforward formula set by the ATO: your total assessable income minus all allowable deductions. This final figure is critical as it determines which marginal tax rate applies to your income and calculates your Medicare levy.

Here’s a quick breakdown of the core components:

Total assessable income is the sum of your salary, wages, business profits, interest, dividends, and any rental returns.

Allowable deductions can include a wide range of ATO-approved costs like work-related expenses, self-education, donations, and investment-related expenses.

Net taxable income is what’s left after you subtract your deductions from your assessable income. This figure dictates your tax bill.

Key Risks And Penalties

The ATO enforces strict compliance regarding taxable income. Understating your income or overclaiming deductions can trigger an audit, often resulting in back-dated interest charges and significant administrative penalties. This is why accurate, diligent record-keeping is not just good practice—it is your primary defence against compliance action.

Once you have a firm grasp of your taxable income baseline, you can start planning how to legally and effectively reduce it. Knowing what the ATO counts as assessable income is the first step. From there, you can explore powerful techniques like prepaying expenses before 30 June or making pre-tax super contributions.

How Deductions Lower Taxable Income

The relationship is simple: every legitimate deduction you claim directly reduces your assessable income. Think of it this way—each dollar you deduct is a dollar the ATO cannot tax.

Common deductions that have a significant impact include:

Work-related expenses like uniforms, tools, and home office costs.

Vehicle and travel expenses when used for earning income (provided you maintain proper records).

Investment and rental property expenses, covering everything from interest and maintenance to management fees.

Self-education costs that have a direct connection to your current employment.

Timing Income And Expenses

Beyond deductions, timing can be a powerful tool. For businesses, deferring invoices until the next financial year can also defer the income—and the tax you pay on it.

Conversely, you can bring deductions forward. Prepaying expenses like insurance premiums or professional subscriptions before 30 June can accelerate your deductions into the current financial year. Just be sure to adhere to the ATO’s 12-month rule to ensure your claims are compliant.

It all starts with a clear understanding of what makes up your assessable income. With that foundation, you can build a smart, multi-faceted strategy to lower your taxable income while staying fully compliant.

Make Every Legitimate Deduction Count

Claiming every deduction you are entitled to is the most direct way for both individuals and businesses to lower their taxable income. This requires a solid grasp of the Australian Taxation Office (ATO) rules for your specific situation, whether you're an employee, a sole trader, or running a company.

Getting Home Office Expenses Right

Following recent ATO changes, claiming work-from-home expenses requires more specific records. The fixed-rate method—currently 70 cents per hour you work from home—is designed to cover your main running costs like internet, phone, electricity, stationery, and other consumables.

To use this method, you must have records to prove the hours you worked from home, such as a timesheet, diary, or roster. It's also critical to remember this rate doesn't cover the depreciation of your office equipment like computers or furniture; you must claim those separately.

Navigating Vehicle and Travel Expenses

For many, vehicle expenses represent a significant deduction opportunity, but this area is closely monitored by the ATO. To claim your car expenses, you generally have two options:

Cents per kilometre method: This allows you to claim a set rate (currently 88 cents per kilometre) for up to 5,000 business kilometres per car, each year. You don't need receipts for every trip, but you must be able to show how you calculated your business kilometres—for example, with diary entries.

Logbook method: This is more involved, requiring you to keep a detailed logbook for a continuous 12-week period to determine the business-use percentage of your car. You can then claim that percentage of all your car's running costs, including fuel, insurance, registration, and depreciation. For those who use their vehicle heavily for work, this method almost always yields a larger deduction.

Self-Education and Professional Development

You can claim a deduction for self-education expenses, but only if the course directly relates to your current job. The study must either maintain or improve the specific skills required for your role or be likely to lead to an income increase. Claiming a course that is only vaguely related to what you do or is designed to help you secure a new job is not permissible.

Commonly Overlooked Deductions for Individuals and Sole Traders

Many valuable deductions are missed simply due to a lack of awareness. This table highlights some of the most frequently forgotten expenses for both employees and sole traders.

Deduction Category | Eligibility for Individuals (Employees) | Eligibility for Sole Traders | Key ATO Requirement |

|---|---|---|---|

Home Office Running Costs | Yes, if working from home. | Yes, if business is run from home. | Must keep a record of hours worked from home. |

Union/Professional Fees | Yes, if related to your job. | Yes, if a business requirement. | The fees must be directly linked to earning your income. |

Work-Related Travel | Yes, for travel between workplaces, not to/from home. | Yes, for travel between clients or to suppliers. | Cannot claim the daily commute. |

Tools and Equipment | Yes, for items used for work. Depreciation rules apply. | Yes, for business assets. Instant asset write-off may apply. | Must apportion for any personal use. |

Income Protection Insurance | Yes, premiums are generally deductible. | Yes, if held outside of superannuation. | Policy must be separate from your super fund. |

Always check the specific ATO guidelines for each claim.

Deductions for Sole Traders and Small Businesses

Running your own business expands the range of claimable operating expenses significantly. For entrepreneurs, having solid tax strategies for business owners is fundamental to financial success.

Common business deductions include:

Operating Costs: Rent for your premises, utility bills, and office supplies.

Staff Costs: Salaries, wages, and superannuation contributions for your employees.

Asset Depreciation: The decline in value of your business assets like vehicles, tools, and equipment. Small businesses can often take advantage of simplified depreciation rules like the instant asset write-off.

For a more comprehensive look at what you might be able to claim, refer to our detailed guide on individual tax deductions.

Real-World Scenario: Employee vs. Sole Trader

Let's compare an IT consultant (employee) and a freelance graphic designer (sole trader) who both purchase a new $2,500 laptop.

The IT Consultant (Employee): He can claim the depreciation of the laptop over its effective life. If he uses it 80% for work and 20% for personal use, he can only claim 80% of the depreciation expense each year.

The Graphic Designer (Sole Trader): As a small business owner, she might be able to use the instant asset write-off (depending on current ATO thresholds). If she also uses it 80% for work, she could potentially claim a $2,000 deduction in the same year of purchase.

This comparison highlights how business structure and ATO rules can significantly alter tax outcomes. The single most important factor for maximising deductions is maintaining meticulous, organised records to substantiate every claim.

Using Superannuation to Lower Your Tax Bill

Superannuation is one of the most powerful and effective tools available to Australians for reducing their tax liability. By contributing extra money into your super fund, you can directly lower your taxable income for the financial year. The principle is simple: you move money from your personal income, which is taxed at your higher marginal rate, into the concessionally taxed superannuation environment.

This tax benefit is achieved through what the Australian Taxation Office (ATO) calls concessional contributions. These are before-tax contributions, which include your employer’s mandatory Superannuation Guarantee (SG) payments, any additional amounts contributed via salary sacrificing, and any personal contributions you choose to claim as a tax deduction.

How Concessional Contributions Work

When you make a concessional contribution, the money is taxed at only 15% within your super fund. For most working Australians, this is a significant discount compared to their personal marginal tax rate, which can be as high as 45% (plus the Medicare levy). The difference between these two tax rates is your immediate saving.

There are two primary ways to make these contributions:

Salary Sacrificing: An arrangement with your employer where they direct a portion of your pre-tax salary straight into your super fund.

Personal Deductible Contributions: Ideal for sole traders or those whose employers don't offer salary sacrificing. You make contributions from your own bank account and then claim them as a tax deduction. To do this, you must lodge a ‘Notice of intent to claim’ form with your super fund and receive an acknowledgement before you file your tax return.

Our detailed breakdown on how to salary sacrifice super provides a practical guide for Australians.

The Annual Concessional Contributions Cap

There is a limit on how much you can contribute at this low tax rate each year. This is the concessional contributions cap. Exceeding it means the excess amount will be taxed at your marginal rate, and you may incur an additional charge.

For the 2025-26 financial year, the general cap is $30,000. This limit includes all concessional contributions:

Your employer’s compulsory SG payments.

Any amount you salary sacrifice.

Any personal contributions you claim as a deduction.

From the 2025-26 financial year, this cap is set to increase to $30,000.

A Practical Example of Tax Savings

Consider Chloe, who earns $95,000 a year. Her employer pays the mandatory 12% Superannuation Guarantee, which is $11,400 for the year. This leaves her with $18,600 of available cap space for 2025-26.

Without Salary Sacrifice: Chloe’s taxable income is $95,000, and her marginal tax rate is 30% (plus Medicare).

With Salary Sacrifice: Chloe arranges to sacrifice an extra $15,000 of her pre-tax salary into super.

This single action reduces her taxable income from $95,000 to $80,000. The $15,000 she sacrificed is taxed at just 15% inside her super fund, not at her personal rate of 30%. This results in an immediate tax saving of $2,250 for the year, while also boosting her retirement savings.

Using Carry-Forward Unused Cap Space

A powerful feature is the ability to use 'carry-forward' unused cap space. If your total super balance was under $500,000 on 30 June of the previous financial year, you can carry forward any unused cap amounts from the last five years.

This 'catch-up' rule is particularly beneficial for individuals with fluctuating incomes, those who have taken time off work, or those nearing retirement who wish to make a large, tax-effective contribution. This can create a significant tax deduction, making it a highly effective strategy for decreasing taxable income.

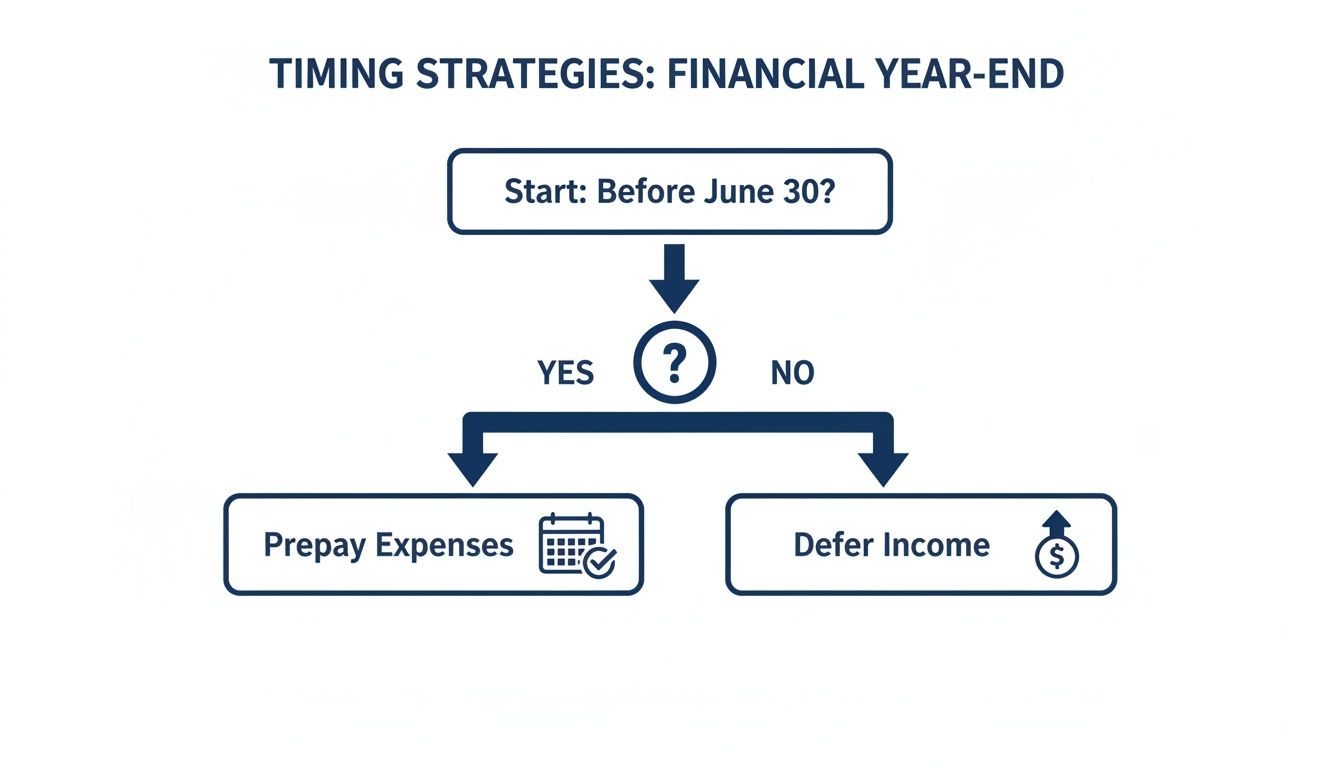

Play the Calendar: Strategic Timing of Income and Expenses

Effective tax planning often depends on timing. As 30 June approaches, one of the most powerful strategies to lower your taxable income is to manage when money comes in and when it goes out. This means legally pulling deductions into the current financial year or pushing income into the next one.

The principle is straightforward: bring expenses forward and delay income. By prepaying for claimable expenses now, you reduce your taxable income for this year. By holding off on receiving income until after 1 July, you defer the tax you’ll owe on it.

Prepaying Expenses to Lock in an Immediate Deduction

Both individuals and small businesses can gain an immediate tax benefit by prepaying certain expenses. The ATO's 12-month rule allows you to claim a full deduction in the current financial year for an expense that covers a period of 12 months or less, even if most of that period falls into the next financial year.

Common examples of prepayable expenses include:

Insurance Premiums: Pay your professional indemnity or business insurance policy for the next year in June.

Professional Subscriptions: Renew memberships to industry bodies or subscriptions to trade journals.

Interest on Loans: Prepay the interest on a business or investment property loan.

Rent or Lease Payments: Paying July's rent for your business premises in June.

The service period you are paying for cannot exceed 12 months.

Holding Off on Income Until the New Financial Year

Just as you can pull deductions forward, you can often push income back. This tactic is most effective for sole traders and businesses that operate on a cash basis, meaning you recognise income when the money is received, not when the invoice is sent.

If you are a sole trader on a cash basis and complete a project in late June, you could wait and send the invoice on or after 1 July. The payment will then be received in the new financial year and be taxed as part of next year's income.

This strategy is not available for businesses on an accruals basis, as income is recognised when it is earned (i.e., when the invoice is issued), regardless of when payment is received.

A Practical Scenario: Putting Timing into Action

Imagine a freelance consultant operating as a sole trader. It’s late June, and her taxable income is approaching the next tax bracket.

Prepay an Expense: Her professional indemnity insurance is due in August. She pays the $2,000 annual premium on 25 June, securing a $2,000 deduction for the current year.

Defer Income: She finishes a project on 28 June and is owed $5,000. She sends the invoice on 2 July, pushing that income into the next financial year.

With these two decisions, she has lowered her taxable income for the current year by $7,000. This illustrates why timing is a cornerstone of any end-of-year tax plan. We've compiled an end-of-financial-year checklist to help you track these opportunities.

Tax Timing Strategies Before 30 June

Here’s a summary of key timing strategies to manage your taxable income before the end of the financial year.

Strategy | Who It's For (Individual/Business) | How It Reduces Taxable Income | ATO Guideline/Limit |

|---|---|---|---|

Prepay Expenses | Individuals & Small Businesses | Brings forward deductions into the current tax year, lowering current taxable income. | Must fall under the 12-month rule (service period is 12 months or less). |

Defer Income | Businesses on a Cash Basis | Pushes income recognition into the next financial year, deferring the tax liability. | Only works if income is recognised upon receipt of payment, not when invoiced. |

Make Super Contributions | Individuals & Sole Traders | Personal concessional contributions are deductible. | Capped at $30,000 per year (including employer contributions). Must clear by 30 June. |

Realise Capital Losses | Individuals with Investments | Sell underperforming assets to offset capital gains realised during the year. | Losses can only be offset against capital gains, not other income. |

Thinking strategically about when you act can have a significant impact on your final tax bill. These are legitimate, ATO-recognised methods for managing your financial affairs efficiently.

Choosing The Right Business Structure For Tax Efficiency

Selecting the right business or investment structure is a critical financial decision. It determines how your profits are taxed, the extent of your personal asset protection, and your administrative workload. The choice between operating as a sole trader, a company, a trust, or a partnership has a significant impact on your final tax bill.

Comparing Tax Rates: Sole Trader vs Company

The primary difference lies in the tax rate.

As a sole trader, all business profits are considered your personal income and are taxed at your individual marginal tax rate, which can be as high as 45% (plus the Medicare levy).

A company is a separate legal entity. Its profits are taxed at a flat corporate rate. For small businesses meeting the eligibility criteria, this rate is currently 25%. The tax advantage becomes clear as your personal income pushes you into higher tax brackets.

When a Company Structure Makes Sense

A company structure is ideal for businesses focused on reinvesting profits for growth. Post-tax profits can remain in the business bank account, having been taxed at only the flat 25% rate, providing more capital for future investment. As a sole trader, the same profit would be taxed at your higher marginal rate, leaving less cash for reinvestment.

The Strategic Power of a Trust

Trusts, particularly discretionary or family trusts, offer unique flexibility. A trust itself does not pay tax; instead, it distributes its income to beneficiaries, such as family members.

The trustee has the discretion to decide how much income each beneficiary receives each financial year. This allows for the strategic distribution of profits to family members in lower tax brackets, such as a non-working spouse or adult children studying at university. By spreading the income, you can utilise their lower marginal tax rates and reduce the family's overall tax liability.

A Real-World Scenario: When to Incorporate

Consider Alex, a freelance consultant operating as a sole trader with a taxable income of $150,000. Alex will be paying tax at marginal rates up to 37%.

If Alex establishes a company, the business would pay tax at just 25% on that $150,000 profit. Alex could then pay themselves a director's salary of $80,000 (taxed at personal rates) and retain the remaining $70,000 in the company for future investment. That retained profit is taxed only at the 25% corporate rate. This single structural change dramatically lowers Alex's total tax liability for the year.

FAQ: Answering Your Top Tax Questions

Here are answers to some of the most common questions we receive from clients about legally reducing their taxable income.

Can I claim expenses if I work from home?

Yes. If you work from home, you can claim the additional running expenses you incur. The Australian Taxation Office (ATO) provides two main methods:

The Actual Cost Method: This requires calculating the work-related percentage of all running costs, such as electricity, internet, and phone bills. It demands detailed record-keeping but can result in a larger deduction.

The Fixed Rate Method: This simpler option allows you to claim a set rate of 70 cents for every hour you work from home. This rate covers energy, internet, phone, and stationery costs. You must keep a record of your hours.

The fixed rate does not cover the depreciation of assets like computers, monitors, or office desks; these must be claimed separately. For official details, refer to the ATO's guide on working from home expenses.

Is salary sacrificing into super always a good idea?

For many Australians, salary sacrificing is an excellent strategy to boost retirement savings and reduce tax. By directing pre-tax salary into your super fund, the money is taxed at the concessional rate of 15%, which is typically lower than an individual's marginal tax rate. However, consider the following:

Your Income: The benefits are most significant for those in higher tax brackets.

Access to Your Money: Funds contributed to superannuation are generally locked away until you reach preservation age. This may not be suitable if you need access to the cash for other goals.

The Caps: You must remain under the annual concessional contributions cap ($30,000 for the 2025-26 financial year), which includes your employer's contributions.

It is advisable to seek financial advice to determine if this strategy aligns with your personal circumstances and long-term goals.

What is the difference between tax minimisation and tax avoidance?

This is a critical distinction under Australian law.

Tax Minimisation is the legal arrangement of your financial affairs to pay the least amount of tax required by law. It involves claiming all entitled deductions, using tax offsets, and making strategic choices like contributing to superannuation. It operates within the legal framework.

Tax Avoidance involves using artificial or contrived schemes to gain a tax benefit not intended by the law. The ATO has strict anti-avoidance rules, and engaging in such activities can lead to audits, back-taxes, interest, and severe penalties.

Can my business prepay expenses to get a deduction this year?

Yes, this is an effective end-of-financial-year strategy for many small businesses. The ATO's 12-month rule allows you to claim an immediate deduction for certain prepaid expenses. If you pay for something covering a period of 12 months or less, you can claim the full deduction in the current financial year, even if part of the service extends into the next one. Common examples include:

Insurance premiums

Rent for business premises

Professional subscriptions

Website and domain hosting services

Ensure your business qualifies for small business entity concessions and that the expense is eligible.

Summary

Reducing your taxable income legally in Australia relies on a proactive and informed approach. By implementing sound strategies, you can significantly lower your tax liability while remaining fully compliant with ATO regulations.

Key Takeaways:

Maximise Deductions: Claim every legitimate work-related, investment, and business expense. Meticulous record-keeping is essential to substantiate your claims.

Utilise Superannuation: Make concessional contributions through salary sacrificing or personal deductible contributions to take advantage of the low 15% tax rate within super.

Strategic Timing: Prepay expenses before 30 June to bring deductions forward and, if applicable, defer income into the next financial year to delay tax.

Choose the Right Structure: The structure of your business (Sole Trader, Company, Trust) has a profound impact on your tax obligations. Review it as your income grows.

Call to Action

Tax laws are complex and subject to change. The strategies outlined in this guide provide a general overview, but personalised advice is crucial to ensure they are appropriate for your specific financial situation. A qualified tax professional can help you navigate the rules, identify all available opportunities, and develop a tailored plan to legally minimise your tax.

Contact us for a consultation to review your tax position and ensure you are making the most of every opportunity to reduce your taxable income.

Baron Tax and Accounting

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213

Whatsapp: 0450468318

Line: Barontax

Comments