What Rental Property Deductions Can I Claim in Australia?

- 36 minutes ago

- 9 min read

Owning a rental property is a massive step, but your financial success doesn't just hinge on the rent you collect. It’s about smart expense management. That's where rental property deductions come in. These are the legitimate running costs of your investment that the Australian Taxation Office (ATO) allows you to claim against your rental income, reducing your taxable income and improving your cash flow.

Understanding and correctly applying these rules is critical. A mistake or an unsubstantiated claim can quickly lead to an ATO audit, adjustments, and financial penalties. Staying compliant is not just about avoiding trouble; it's about optimising your investment's financial performance according to Australian law.

Here at Baron Tax & Accounting in Brisbane, we often observe new landlords transitioning from simple individual tax returns to the more complex world of property investment. A common oversight is underestimating the detailed record-keeping required to substantiate every claim, from correctly apportioning loan interest after a redraw to distinguishing between an immediately deductible repair and a capital improvement. For instance, a client in the Brisbane suburbs recently learned that fixing a pre-existing issue identified in their building inspection was considered a capital cost, not a repair, which significantly changed their first year's tax outcome.

This guide will walk you through the essential rental property deductions, explaining the rules with practical examples to ensure you manage your tax obligations with confidence.

The Golden Rule of Deductions: Interest on Investment Loans

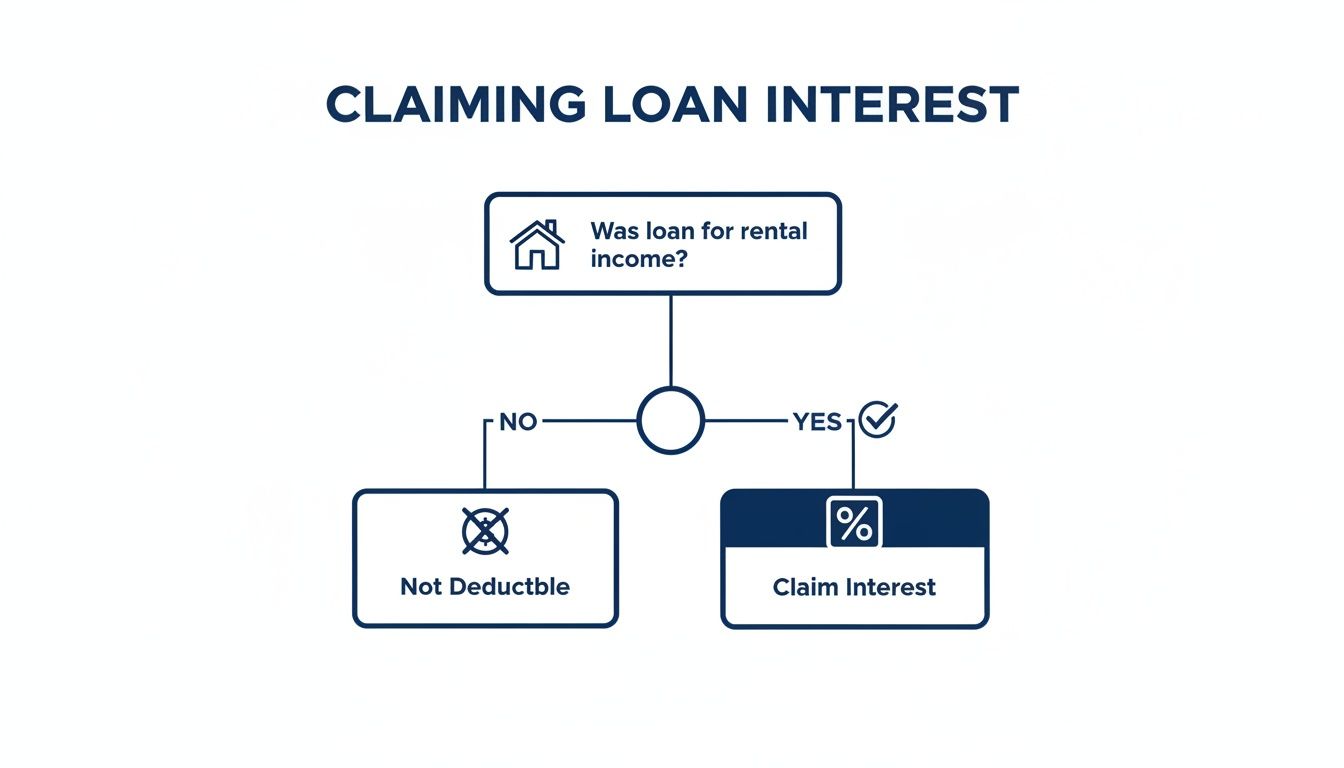

For most Australian property investors, the single largest tax deduction is the interest on your investment loan. The Australian Taxation Office (ATO) scrutinises this closely, applying a simple principle: the 'purpose test'.

The ATO's question is straightforward: was the primary purpose of borrowing the money to generate rental income? If yes, the interest you pay on that loan is generally deductible. What matters is what you used the borrowed funds for, not what you used as security for the loan.

For example, if you borrow against your family home but use the funds exclusively to purchase a rental property, the interest on that loan is deductible. Conversely, if you redraw from your investment loan to buy a personal car, the interest on that redrawn portion is not deductible because its purpose was private.

For mixed-use loans, you must meticulously apportion the interest and only claim the portion related to the rental property. The ATO requires detailed records to prove this split.

ATO Guideline: According to the ATO, you can start claiming interest as soon as you take out the loan for the property, even during construction or renovation, provided your intention is to rent out the property once it is ready.

Loan establishment fees, application fees, or Lenders Mortgage Insurance are not claimed like interest. These are considered borrowing expenses and must be claimed over five years (or the life of the loan, if shorter). For a detailed walkthrough, see our guide on how to correctly claim borrowing expenses.

Repairs Versus Improvements: A Critical Distinction for Tax Claims

Confusing a repair with an improvement is one of the most common and costly errors for property investors. The ATO treats them very differently, which impacts how you claim the expense.

A repair restores something to its original condition. It is maintenance, like fixing a leaking tap or replacing a cracked windowpane. Costs for repairs are generally 100% deductible in the same financial year you incur them.

An improvement makes something better than it was, enhancing its value or function. Examples include renovating a kitchen or replacing an entire fence. These are capital expenses, and you cannot claim the full cost upfront. Instead, the cost is claimed over many years through depreciation or as a capital works deduction.

The ATO looks at the entire scope of the work. Repainting a single wall after a tenant leaves is a repair. Repainting the entire interior of a newly purchased, run-down property is likely an improvement.

Key ATO Principle: The ATO is particularly strict on 'initial repairs'. If you fix a defect that existed when you purchased the property (e.g., a faulty air conditioner noted in the pre-purchase inspection), the cost is considered a capital expense, forming part of the property's cost base. It is not an immediately deductible repair.

The simple decision tree below highlights the ATO's 'purpose test' for loan interest, but the core idea applies here too. Are you spending money to restore something, or are you enhancing it?

Here’s a comparison of common scenarios:

Expense Example | Classification | ATO Tax Treatment |

|---|---|---|

Replacing a broken hot water system with a similar model | Repair | Immediately deductible (claim 100% this year). |

Upgrading an old hot water system to a larger, solar model | Improvement | Depreciable asset (claim over its effective life). |

Fixing loose palings on a timber fence | Repair | Immediately deductible (claim 100% this year). |

Replacing an entire timber fence with a new Colorbond one | Improvement | Capital Works (claim at 2.5% per year). |

Getting this right is fundamental to compliance. Professional advice is recommended for significant expenses.

Unlocking Value Over Time With Depreciation and Capital Works

Depreciation is a 'non-cash' deduction that allows you to claim the decline in value of your building and its assets over time. The ATO recognises that these items have a limited lifespan and lets you claim that loss as an annual deduction. This is managed under two categories: Capital Works (Division 43) and Plant and Equipment (Division 40).

Capital Works Deductions (Division 43)

This covers the "bones" of your property—the structure itself. It includes the original construction costs of the building, foundations, walls, and roof, as well as major structural improvements like an extension or a new pergola. For residential properties where construction began after 15 September 1987, you can generally claim these costs at 2.5% per year over 40 years.

Plant and Equipment Depreciation (Division 40)

These are the easily removable assets inside the property, such as carpets, ovens, air conditioners, blinds, and hot water systems. Each item has an "effective life" determined by the ATO, and you claim a deduction for its decline in value over that period.

ATO Rule Change: For residential rental properties purchased after 9 May 2017, you can no longer claim depreciation on any previously used or second-hand plant and equipment assets. You can, however, claim deductions for any brand-new assets you purchase and install.

To maximise these claims accurately and ensure compliance, it is highly recommended to engage a specialist quantity surveyor. They will prepare a tax depreciation schedule, a one-off report that details all your Division 43 and Division 40 claims for up to 40 years. The fee for this report is 100% tax-deductible. Learn more about claiming depreciation on an investment property.

Complete Checklist of Other Common Deductions

Beyond the major expenses, the day-to-day running costs of your rental property add up. Keeping meticulous records of these is essential.

Management and Administrative Costs

Property Agent Fees: Commissions, management fees, and letting fees are fully deductible.

Advertising for Tenants: Costs to list the property are deductible.

Body Corporate Fees: Regular levies are deductible. Special levies for capital improvements may need to be treated as a capital works expense.

Accountancy: Fees for preparing tax returns or managing rental property finances are deductible.

Property-Specific Levies and Charges

Council Rates: Fully deductible.

Water Charges: Service and supply charges are deductible.

Land Tax: State-based land tax is a deductible expense.

ATO Red Flag: No More Travel Claims!Since 1 July 2017, you can no longer claim travel costs for inspecting, maintaining, or collecting rent for a residential rental property. This includes deductions for car mileage, flights, or accommodation.

Upkeep and Maintenance Expenses

Gardening and Lawn Mowing: Fees for maintaining the grounds are deductible.

Pest Control: Costs for inspections or treatments are deductible.

Cleaning Costs: Professional cleaning fees, especially at the end of a tenancy, are deductible.

Financial and Insurance Deductions

Landlord Insurance: Premiums are 100% deductible.

Building, Contents, and Public Liability Insurance: All relevant insurance premiums are deductible.

Bank Fees: Fees on a bank account used solely for the rental property are deductible.

Comprehensive Checklist of Rental Property Deductions

Expense Category | Examples of Deductible Items | Key ATO Considerations |

|---|---|---|

Loan & Finance Costs | Loan interest, borrowing expenses (e.g., loan establishment fees), bank fees. | Borrowing expenses over $100 must be claimed over 5 years. Apportion interest for any private use of the loan. |

Management & Admin | Property agent fees, advertising for tenants, body corporate fees, accountancy fees. | Special body corporate levies for capital works must be claimed over time, not immediately. |

Rates, Taxes & Levies | Council rates, water rates (service charges), and land tax. | Must be apportioned if the property was not genuinely available for rent for the entire year. |

Repairs & Maintenance | Fixing broken items, plumbing repairs, pest control, lawn mowing, cleaning. | Must distinguish between a repair (immediate deduction) and an improvement (capital expense). Initial repairs are capital. |

Insurance | Landlord insurance, building insurance, contents insurance, public liability insurance. | Premiums are fully deductible in the year they are paid. |

Capital Allowances | Depreciation (Division 40): Decline in value of new assets like ovens, carpets, blinds. | You cannot claim depreciation on second-hand assets in a property bought after 9 May 2017. A quantity surveyor report is essential. |

Capital Works | (Division 43): Construction costs of the building and major structural improvements. | Typically claimed at 2.5% per year for up to 40 years. |

Other Deductions | Legal fees (for tenant issues, not purchase/sale), council planning permit fees. | Travel costs to inspect the property are not deductible. Legal fees for buying/selling are capital costs. |

Your Guide to Essential Record-Keeping and ATO Compliance

A deduction is only valid if you have the evidence to support it. The ATO requires clear, organised proof for every expense claimed. Without solid records, even legitimate claims can be denied during an audit.

What the ATO Expects You to Keep

Your record-keeping must be thorough. You should retain:

Proof of Income: Rental statements and bank statements showing rent deposits.

Proof of Expenses: All receipts, invoices, and bank/credit card statements.

Loan Documents: Statements showing interest charged.

Purchase & Sale Documents: Contracts of sale, conveyancing paperwork, and records of legal fees.

Asset & Improvement Records: A quantity surveyor's depreciation schedule and receipts for all new assets or capital improvements.

Tenancy Records: Copies of all lease agreements.

Under Australian tax law, you must keep all rental property records for at least five years from the date you lodge your tax return. Digital record-keeping is highly recommended. Scan every receipt and invoice and organise files by financial year and expense type to protect against loss and simplify tax preparation.

FAQ Section

1. Can I claim deductions if my rental property is vacant?Yes, but only if the property is genuinely available for rent. The ATO requires you to be actively trying to find a tenant. This means advertising the property at a fair market rate and ensuring it is in a suitable condition to be occupied. You cannot claim deductions if you are using the property for personal use or it is not actively on the rental market.

2. Can I claim travel expenses to inspect my property?No. As of 1 July 2017, the ATO disallowed deductions for travel expenses related to inspecting, maintaining, or collecting rent for a residential rental property. This applies to costs such as flights, car expenses (fuel or cents per kilometre), and accommodation.

3. How do I claim borrowing expenses like loan application fees?Borrowing expenses are the costs of setting up your loan, such as establishment fees, valuation fees, and Lenders Mortgage Insurance (LMI). If the total cost is $100 or less, you can claim it all in the same financial year. If it is more than $100, you must claim the deduction spread out over five years (or the term of the loan, whichever is shorter). For example, a $3,000 expense would be claimed at $600 per year for five years.

4. What happens to my deductions when I sell my rental property?Selling your rental property is a Capital Gains Tax (CGT) event. The deductions you have claimed for capital works (Division 43) and depreciation on assets (Division 40) will adjust the property's cost base. Specifically, these claims will reduce the cost base, which may result in a larger capital gain. It is crucial to have accurate records of these claims for when you calculate your CGT. For more detail, see our guide on capital gains and rental property.

Summary of Key Takeaways

Deductibility is based on purpose: Expenses are only deductible if they are directly related to earning rental income.

Interest is the largest deduction: You can claim interest on a loan used to purchase, renovate, or improve a rental property.

Know the difference between repairs and improvements: Repairs are claimed immediately, while improvements are claimed over time as capital works or depreciation.

Depreciation is a valuable non-cash deduction: Use a quantity surveyor to prepare a depreciation schedule to maximise claims for the building structure and assets.

Record-keeping is non-negotiable: The ATO requires you to keep detailed records of all income and expenses for at least five years.

Travel costs are not deductible: You cannot claim expenses for travelling to your residential rental property.

Get Professional Tax Advice

The rules surrounding rental property deductions are complex and subject to change. Getting it right ensures you meet your ATO obligations and maximise the financial return on your investment.

Contact Baron Tax & Accounting for personalised advice tailored to your specific property investment circumstances.

Baron Tax and Accounting

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213

Whatsapp: 0450468318

Line: Barontax

Comments