Claiming Total Deductible Borrowing Expenses in Australia

- Aug 11, 2025

- 12 min read

When you take out a loan for an investment property, most people focus on the big numbers: the purchase price and the interest rate. But there are a handful of other costs—the setup fees—that are crucial for maximising your tax return. These are what the Australian Taxation Office (ATO) calls deductible borrowing expenses, and understanding them is a must for any savvy investor.

What Exactly Are Borrowing Expenses?

Think of borrowing expenses as all the administrative and legal hoops you have to jump through to secure the finance for your investment. These are the one-off fees directly related to establishing the loan, not the property purchase itself.

This is an important distinction. The ongoing interest you pay is a separate deduction, usually claimed in the same year you pay it. Borrowing expenses, however, have their own set of rules for how and when you can claim them.

Common Examples of Deductible Costs

So, what kind of fees are we talking about? If you’ve paid any of the following to get your investment loan across the line, they generally fall into this category:

Loan establishment fees: The upfront charge from your bank or lender just to set up the loan.

Lender's Mortgage Insurance (LMI): A big one. If your deposit was less than 20%, you likely paid LMI. While it protects the lender, the premium is a borrowing expense for you.

Valuation fees: Any fees charged for the lender's mandatory valuation of the property before they approved the funds.

Mortgage broker fees: Did you use a broker to find the best deal? Their fee or commission is a claimable borrowing expense.

Stamp duty on the mortgage: Be careful here. This is not the main stamp duty you paid on the property transfer. It’s a much smaller, specific duty charged on the loan document itself.

It’s easy to get these mixed up with other costs. To help clarify, here’s a quick-reference table.

Deductible vs Non-Deductible Loan Costs

This table shows which costs are generally deductible as borrowing expenses and which are treated differently for tax purposes, like being part of the property's cost base for Capital Gains Tax (CGT).

Deductible as a Borrowing Expense | Not Deductible as a Borrowing Expense |

|---|---|

Loan Application/Establishment Fees | Stamp Duty on the Property Transfer |

Lender's Mortgage Insurance (LMI) | Solicitor/Conveyancer Fees for the Property Purchase |

Mortgage Broker Fees/Commissions | Building and Pest Inspection Fees |

Valuation Fees (for loan approval) | Council Rates and Land Tax (deductible elsewhere) |

Stamp duty on the Mortgage (Loan Document) | Insurance on the Building (deductible elsewhere) |

Remember, costs in the right-hand column aren't necessarily lost—many are capital costs that reduce your capital gains when you eventually sell the property. Others are regular running expenses claimed elsewhere on your tax return.

According to the ATO, how you claim these costs depends entirely on the total amount. If your total borrowing expenses are $100 or less, you can claim the full amount in that same income year. Simple. But if they add up to more than $100, the deduction must be spread out (or apportioned) over five years.

This five-year rule exists because the loan provides a benefit over a long period, so the tax deduction for setting it up should be spread out to match. This makes keeping meticulous records of every single one of these initial fees absolutely non-negotiable if you want to get your tax right.

How to Calculate Your Borrowing Expense Deduction

Knowing you can claim borrowing expenses is one thing, but figuring out the exact amount is where it gets a little tricky. This is especially true if your total setup costs tipped over the $100 mark. The Australian Taxation Office (ATO) has a specific way it wants you to handle this, and it’s not just a one-and-done claim in your first tax return.

The logic behind it is pretty simple: your loan benefits you over its entire life, so the tax deduction for setting it up should also be spread out. For most investment property loans, this means you'll be claiming a portion of the costs over a five-year period.

The Five-Year Apportionment Rule

When your total deductible borrowing expenses add up to more than $100, you generally can't claim the whole lot in the year you paid for them. Instead, you need to spread, or apportion, that deduction over five years (or the life of the loan, if it’s shorter).

But it's not as simple as just dividing the total cost by five. The ATO requires a pro-rata calculation based on how many days you actually had the loan in each financial year. This makes sure your deduction perfectly matches the period the loan was active.

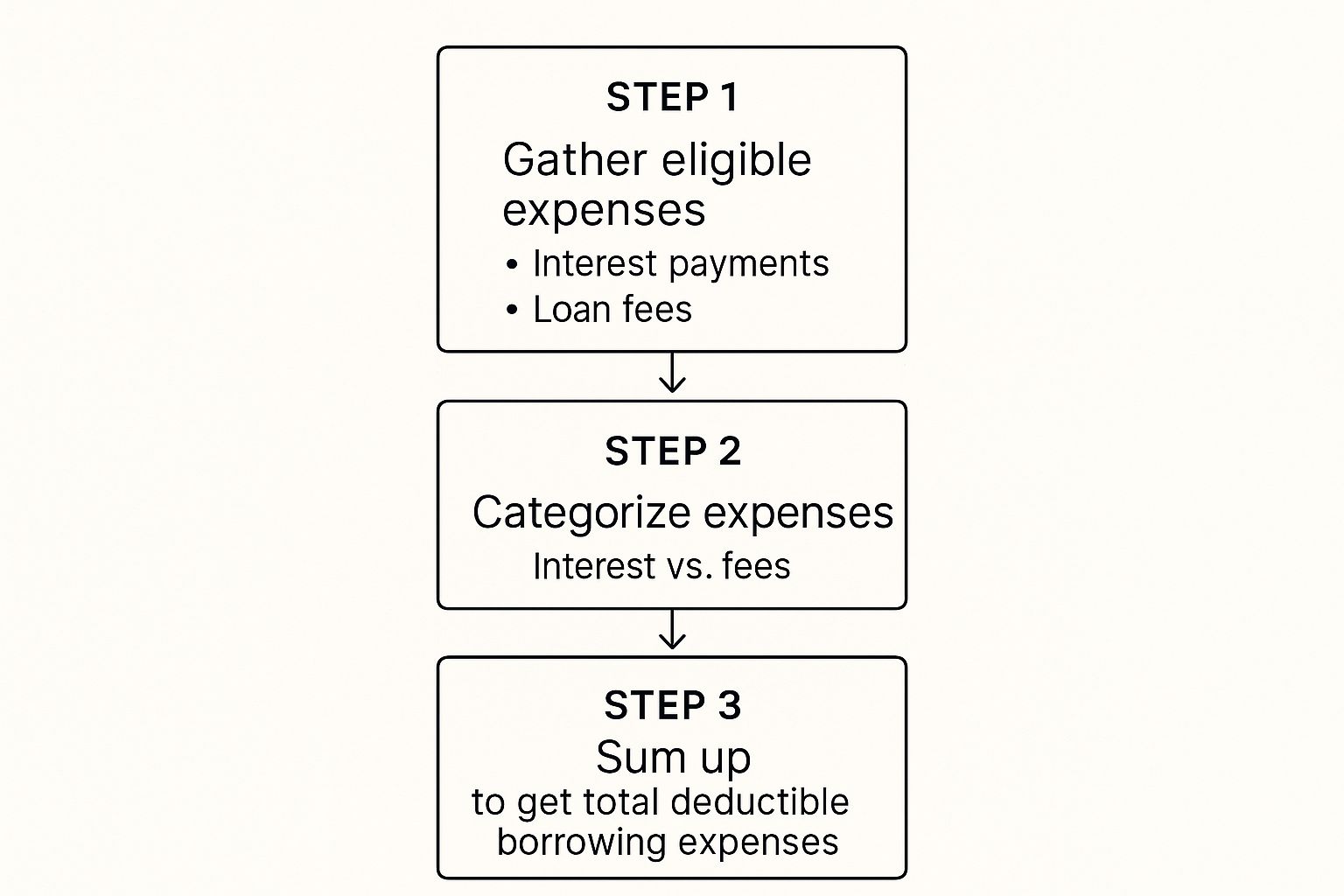

This infographic breaks down what you need to tally up before you even start the calculation.

It’s all about gathering every single eligible cost first. Once you have that total, you’re ready to work out your annual deduction.

A Step-by-Step Calculation Example

Let’s walk through a real-world scenario. Imagine you took out a loan for your investment property, and it settled on 1 October 2023. Your total borrowing expenses, including things like establishment fees and Lenders Mortgage Insurance, came to $4,000.

Step 1: Calculate the Deduction for Year 1 (2023-24 financial year)

First, you need to count how many days you had the loan in the first financial year. From 1 October 2023 to the end of the financial year on 30 June 2024, there are 274 days.

The formula looks like this:

(Total Borrowing Expenses × Days Held in Year 1) / (5 × 365)

Let’s plug in our numbers:

($4,000 × 274) / 1825 = $600.55

So, for your 2023-24 tax return, you can claim a deduction of $600.55.

Step 2: Calculate the Deduction for Subsequent Years

For the next few full financial years (Years 2, 3, and 4), the maths is much simpler because you held the loan for the full 365 days (or 366 in a leap year!).

The formula for a full year is:

(Total Borrowing Expenses × 365) / 1825

And with our numbers:

($4,000 × 365) / 1825 = $800

You would claim $800 in each of those three years. In the final year, you simply claim the remaining balance. Getting these figures right is a crucial part of lodging an accurate return. You can find more on what you can claim in our guide on tax deductions for rental property.

What if the Loan Is Repaid Early?

Here’s a key exception to the five-year rule. What happens if you pay off the loan before the five years are up? The good news is you don’t forfeit the rest of your deduction.

The ATO allows you to claim the entire remaining balance of your un-claimed borrowing expenses as a deduction in the financial year you pay off the loan.

For example, if you paid off your loan in full during Year 3, you’d claim the standard $800 deduction for Year 3 plus the entire un-claimed amount from Years 4 and 5, all in your Year 3 tax return. This ensures you get the full tax benefit you were always entitled to.

Handling Mixed-Use Loans to Stay Compliant

One of the quickest ways to attract unwanted attention from the ATO is claiming 100% of the costs on a loan used for both investment and private purposes. This is where apportionment comes into play. It’s simply the ATO’s way of saying you must fairly split your claims between the income-producing part and the private part of the loan.

Getting this wrong can lead to some serious headaches, like an ATO audit or penalties for over-claiming. The rule is simple: you can only claim deductions for the portion of your loan that helps you earn assessable income.

The Problem with Mixed-Use Loans

A mixed-use loan happens when one loan account is used for different things. For example, you might draw down on your investment property loan or use a redraw facility to buy a car for personal use, pay for a holiday, or wipe out some credit card debt.

While it seems convenient at the time, this action immediately taints the loan from a tax perspective. You can no longer claim all the interest or 100% of the borrowing expenses. You now have to figure out what percentage of the loan is for the investment and what percentage is private.

Key Takeaway: The moment you use funds from an investment loan for a private purchase, you must start apportioning your expenses. The ATO expects you to calculate the deductible part based on the percentage of the loan used for income-generating activities.

How to Correctly Apportion Borrowing Expenses

Figuring out the deductible portion of your total deductible borrowing expenses needs a clear and logical method. The most straightforward way is to work out the percentage split based on how the money was used from the very beginning.

Let’s walk through a simple example:

You take out a single loan of $500,000.

Of that, $450,000 is used to buy an investment property.

The remaining $50,000 is used to buy a new car for personal use.

Here’s how the calculation works:

Calculate the income-producing percentage: ($450,000 ÷ $500,000) = 90%

Calculate the private-use percentage: ($50,000 ÷ $500,000) = 10%

Now, let's say your total borrowing expenses to set up this $500,000 loan were $4,000. You can only claim the share that relates to the investment.

Deductible Portion: $4,000 × 90% = $3,600

This $3,600 becomes the new total you use for your five-year apportionment calculation. The other $400 is a private expense and can’t be claimed.

Your Non-Negotiable Guide to Record Keeping

When it comes to your tax return, an ATO deduction is only as strong as the paperwork backing it up. For total deductible borrowing expenses, this isn't just a friendly tip—it's an absolute must. Without a clear and organised paper trail, your claims could easily be challenged or even denied during an audit, quickly turning a nice tax refund into a stressful tax debt.

Let's be clear: proper record-keeping is more than just stuffing a few receipts into a shoebox and hoping for the best. It’s about methodically gathering every single document related to setting up your investment loan. This diligence is your best defence, ensuring you can justify every dollar you claim. Think of it this way: good organisational habits now mean a stress-free tax time and more money in your pocket later.

The Five-Year Rule

The ATO has a straightforward rule: you need to keep all your relevant records for at least five years from the date you lodge your tax return.

But here’s a crucial detail for borrowing expenses—since they are often claimed over five years, the clock starts ticking from your final claim. This means a document from 2024 for a five-year claim might need to be kept safe all the way until 2034 or even longer. It’s a marathon, not a sprint.

Essential Document Checklist for Borrowing Expenses

To keep your claims audit-proof, you need to build a comprehensive file for each investment property loan. It’s like creating a case file that proves, without a doubt, that your expenses are legitimate.

Here’s a simple checklist of the must-have documents the ATO will want to see.

Document Type | What to Keep | Why It's Important |

|---|---|---|

Loan Agreement | The full, signed contract from your lender. | This is the primary proof of the loan's existence, its purpose, and its terms. |

Loan Statements | All bank statements showing drawdowns and repayments. | These are critical for proving how funds were used, especially for mixed-use loans. |

Broker Invoices | The final invoice from your mortgage broker. | This document substantiates the fee you paid for their services. |

LMI Contract | The policy document for Lender's Mortgage Insurance. | It confirms the premium amount, which is often a significant borrowing expense. |

Lender Fee Invoices | Receipts for all establishment, application, or valuation fees. | These smaller costs add up and must be individually proven. |

Mortgage Duty Notice | Any state government notice for stamp duty on the mortgage. | This proves you paid the specific tax on the loan document, not the property. |

Keeping these documents organised doesn't have to be a headache. Modern tools make it simple—a dedicated folder in a cloud storage account or even a well-labelled physical binder for each property will do the trick. The secret ingredient is consistency.

Why the ATO Scrutinises Property Deductions

A lot of investors claim these deductions, including borrowing expenses, to achieve negative gearing. This is a common strategy where a property’s running costs are higher than the rent it brings in. That net loss can then be used to reduce other taxable income, like a salary, leading to a smaller tax bill.

This reality gives the ATO a pretty strong reason to make sure every single claim is above board. Audits aren't just random checks; they’re often aimed squarely at areas where mistakes are common, such as miscalculating total deductible borrowing expenses or incorrectly splitting costs for mixed-use loans.

The Scale of the Issue

The figures really tell the story. Data shows that among Australia’s 2.2 million property investors, the average claimed deductions hover around $13,500 per property each year. What's more, nearly 60% of these investors report a net loss, which has prompted the ATO to step up its audit activity to ensure claims are legitimate.

Understanding this context is crucial. The ATO's scrutiny isn't personal; it's a calculated response to a major source of tax revenue leakage. It underscores just how important it is to get your borrowing expense claims right from the get-go. For many, getting through these details is tricky, which is where professional tax preparation services become invaluable for ensuring everything is compliant and accurate.

Key Insight: A small error on one tax return might seem like no big deal. But when you multiply that by millions of investors, these mistakes can add up to billions in lost tax revenue. That’s exactly why the ATO pours resources into data-matching and audit programs for rental properties.

Properly documenting and calculating your claims isn't just about good habits; it’s about protecting yourself from potential penalties. While the rules for investors are specific, understanding broader tax principles is always a plus. For instance, our guide on tax tips for apprentices and trainees also highlights how critical accurate record-keeping is for maximising your return.

Let Our Experts Take the Wheel

You've now got a solid grasp of the rules around claiming borrowing expenses. But as many investors find out, turning that knowledge into a flawless tax return is a different ball game. The ATO's rules are notoriously strict, and a tiny oversight can end up costing you dearly down the track.

Getting your claim for total deductible borrowing expenses spot on is crucial, especially when you're dealing with the five-year apportionment rule or the fiddly calculations for a mixed-use loan. This is where having a professional in your corner really pays off.

The Baron Tax & Accounting Advantage

At Baron Tax & Accounting, we live and breathe this stuff. We specialise in helping property investors navigate these exact challenges. Our team of registered tax agents knows the ins and outs of property tax law, making sure you stay fully compliant while we find every last dollar you're entitled to.

Here’s how we help:

Spot every eligible cost so no expense gets left behind.

Nail the calculations and apportionment, even for those tricky mixed-use loans.

Make sure your records are audit-proof and meet the ATO's standards.

Handing your tax over to an expert does more than just cut your audit risk—it gives you back your time. Instead of wrestling with confusing tax forms, you can get back to what you do best: managing your investments and planning your next move.

Your Partner in Success

Think of us as part of your financial team. We take the stress out of tax time by handling all the nitty-gritty details with precision and care. Our goal isn’t just to tick the boxes for the ATO; it's to make sure you get the best possible financial outcome.

Let us handle the complexity so you can chase your investment goals with confidence. By making sure your total deductible borrowing expenses and all other claims are lodged perfectly, we help secure your financial footing for years to come.

Frequently Asked Questions

When you're dealing with borrowing expenses, a few common questions always seem to pop up. Let's tackle some of the most frequent queries we get from property investors to clear up any lingering confusion about your total deductible borrowing expenses.

Can I Claim Stamp Duty as a Borrowing Expense?

This is a big one, and a very common point of confusion. In short, no—the large stamp duty fee you pay when you buy a property is not a borrowing expense. The ATO sees it as a capital cost. This means it gets added to your property's cost base, which later helps reduce your capital gains tax when you eventually sell.

However, there's a small exception. Some state or territory governments charge a separate, much smaller stamp duty specifically on the mortgage or loan agreement itself. If that's the case, that specific cost is deductible. You just need to be able to show that the fee relates directly to the loan document, not the property transfer.

What Happens if I Refinance My Investment Loan?

Refinancing actually triggers a really useful ATO rule. When you pay out your original loan to start a new one, you don’t forfeit the deductions you haven't claimed yet.

The ATO lets you claim the entire un-deducted balance of your borrowing expenses from the original loan as a single, lump-sum deduction in the financial year you refinance.

Any new costs you incur to set up the new loan, like new establishment or valuation fees, are then treated as fresh borrowing expenses. If these new costs add up to more than $100, you’ll simply start a new five-year claim period for them.

Are Mortgage Protection Insurance Premiums Deductible?

No, mortgage protection insurance premiums are not something you can claim. They don't qualify as a borrowing expense or even a general rental deduction. The ATO views this as a purely personal expense.

The logic here is that the policy protects your personal ability to make repayments (say, if you lost your job), rather than being a cost directly tied to earning rental income. Because of that, it falls outside what you can claim for your investment.

📌 Curious about your tax refund? Try our free calculator:👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage:🌐 www.baronaccounting.com

Comments