How to Manage Fringe Benefits Tax (FBT) in Australia: A Clear Guide for Employers

- Dec 9, 2025

- 11 min read

What exactly is Fringe Benefits Tax (FBT)? In simple terms, it's a tax paid by employers on certain non-cash benefits provided to their staff or their associates (like family members). It sits alongside the Pay As You Go (PAYG) withholding system to ensure all forms of employee remuneration—whether cash salary or valuable perks—are taxed appropriately under Australian law.

Understanding and managing FBT is not optional; it is a critical compliance obligation for any Australian business with employees. Failing to meet these obligations can lead to significant penalties from the Australian Taxation Office (ATO). This guide provides a clear, step-by-step overview of what FBT is, how to calculate it, and your reporting responsibilities.

Why FBT Matters for Your Business and the Risks of Non-Compliance

Fringe Benefits Tax was introduced to prevent tax avoidance through non-cash remuneration. Without FBT, a business could pay employees in valuable benefits—such as a company car or private health insurance—instead of a cash salary, effectively sidestepping income tax. The FBT system ensures fairness and integrity in the tax system.

Crucially, the FBT liability falls on the employer, not the employee receiving the benefit. This makes understanding your FBT obligations essential for maintaining tax compliance and managing business expenses effectively.

The Purpose and Scope of FBT

The core purpose of FBT is to ensure that an employee's total remuneration package is taxed consistently, regardless of its composition. The rules apply broadly to most business structures, including:

Companies

Trusts

Partnerships

Sole Traders with employees

Foreign companies with an Australian presence

FBT covers benefits provided to current, former, or future employees and their associates. The net is cast wide to capture all forms of non-salary rewards, making it one of the most important accounting tips for small business owners to master.

Key Compliance Risks and Penalties

Ignoring FBT obligations or making calculation errors can result in significant financial penalties. The ATO enforces compliance strictly and will impose penalties for failure to lodge an FBT return or for incorrect calculations.

A common misconception is that a legitimate business expense cannot also attract FBT. However, if that expense provides a personal benefit to an employee—such as using a company vehicle for a private weekend trip—it can trigger an FBT liability.

Penalties typically include failure-to-lodge fines plus interest on any outstanding FBT liability. This underscores the importance of accurate record-keeping and a thorough understanding of the FBT rules.

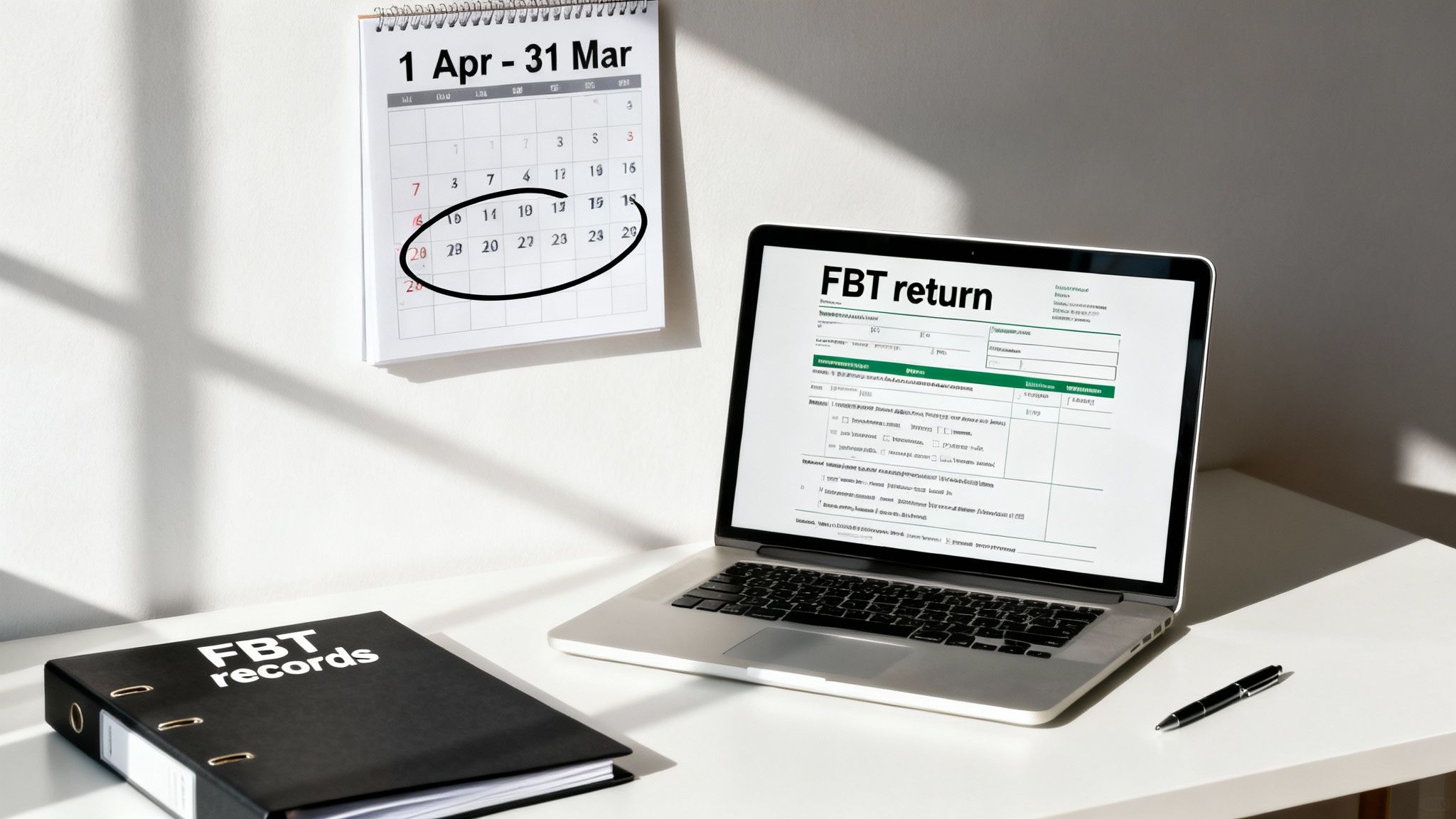

The Unique FBT Year

A common point of confusion is the FBT calendar. It does not align with the standard 1 July to 30 June income tax year. Instead, the FBT year runs from 1 April to 31 March. This requires businesses to track benefits provided within this specific period for accurate and timely reporting.

The FBT rate is also subject to change and is typically aligned with the top personal income tax rate plus the Medicare levy to discourage tax-driven salary packaging. You can view historical rates and thresholds on the ATO website.

Identifying Common Types of Fringe Benefits

To manage FBT effectively, you must first be able to identify what constitutes a fringe benefit in your daily operations. The ATO categorises these benefits to provide clarity for employers. Here are the most common types you are likely to encounter.

Car Fringe Benefits

A car fringe benefit is the most common type and arises when a car owned or leased by the business is made available for an employee's private use. The ATO’s definition of "private use" is broad and includes:

An employee's daily commute between home and work.

Use of the vehicle by the employee’s family members for personal trips.

The car being garaged at or near the employee's home, which implies availability for private use.

According to the ATO, the mere availability of the car for private use is often sufficient to create a fringe benefit, even if the employee does not actually use it for a private journey. This is a critical detail that many employers overlook.

Expense Payment Fringe Benefits

This is a broad category covering situations where an employer pays or reimburses an employee for their private expenses. An expense payment fringe benefit occurs if you settle a cost that is not a business-related expense.

Common examples include:

Paying an employee’s personal mobile phone or home internet bill.

Reimbursing an employee for their children's school fees or childcare costs.

Covering an employee's private health insurance premiums.

If the expense is purely for business purposes, no FBT arises. However, as soon as the payment covers a personal cost, an expense payment fringe benefit has likely been provided.

Property Fringe Benefits

A property fringe benefit is created when an employer provides property to an employee, either for free or at a discount. The term "property" encompasses nearly any tangible item.

This can include goods from your business inventory or other purchased assets. For example, if a retail business gives an employee a free item of clothing, it constitutes a property benefit. Similarly, if a technology company provides an employee with a laptop for personal use that they are allowed to keep, FBT will apply. The value of the benefit is the difference between the item's market value and any amount the employee paid.

Note that providing company shares to employees is governed by a different and more complex set of rules. You can learn more in our guide on how an employee share scheme builds wealth.

Entertainment Fringe Benefits

This is one of the most complex areas of FBT. An entertainment fringe benefit can arise when you provide food, drink, or recreation to employees. Examples include:

Taking staff out for a social lunch or dinner.

Hosting an annual staff Christmas party.

Giving employees tickets to a sporting event or concert.

The rules are highly nuanced; for example, providing light refreshments in the office during work hours is generally acceptable, whereas a three-course meal at a restaurant is almost certainly considered entertainment. Factors such as location, timing, and the nature of the provision all influence the outcome. Meticulous record-keeping is essential in this category.

How to Calculate Your FBT Liability

Calculating your FBT liability involves a clear, multi-step process defined by the ATO. It requires determining the taxable value of the benefit, "grossing up" this value, and then applying the current FBT rate.

This process ensures that FBT is calculated accurately, meeting your compliance obligations and avoiding potential ATO scrutiny.

Step 1: Valuing the Benefit

The first step is to calculate the taxable value of the fringe benefit. The ATO has specific valuation rules for each category of benefit. For some benefits, like an expense payment reimbursement, the taxable value is simply the amount you paid. For others, such as cars, the valuation is more complex. It is critical to use the correct ATO-approved valuation method for each benefit.

Step 2: The Gross-Up Process

Once you have the taxable value, you must "gross up" this amount before applying the FBT rate. This process converts the benefit's value into a higher, grossed-up figure. This figure represents the pre-tax salary an employee would need to earn to purchase the benefit with their own after-tax funds.

The gross-up ensures that the amount of FBT paid by the employer is equivalent to the income tax that would have been paid if the employee had received cash salary instead. There are two gross-up rates, determined by whether you can claim a Goods and Services Tax (GST) credit for the benefit provided.

Type 1 Gross-Up Rate: The higher rate, used for benefits where you are entitled to a GST credit.

Type 2 Gross-Up Rate: The lower rate, used for benefits where you are not entitled to a GST credit (e.g., GST-free items).

Using the correct rate is mandatory. This concept is also fundamental to salary packaging, which you can learn more about in our guide on unlocking salary sacrifice benefits.

Calculating Car FBT: Two Key Methods

Car benefits are the most common source of FBT liability. The ATO provides two methods for calculating their taxable value, and your choice can significantly impact your final tax bill.

FBT Calculation Methods for a Car Benefit

Feature | Statutory Formula Method | Operating Cost Method |

|---|---|---|

Calculation Basis | A flat 20% of the car's original cost (base value). | Based on the actual costs of running the car, multiplied by the private use percentage. |

Record-Keeping | Simpler. Requires records of availability and employee contributions but no logbook. | Demands detailed records. An ATO-compliant logbook is essential to substantiate business use. |

Best For | Cars with high private use or when avoiding the administrative burden of a logbook is preferred. | Cars with a high, verifiable percentage of business use. |

Key Advantage | Simplicity and predictable cost. | Can result in a significantly lower FBT liability if business use is high. |

Your decision involves a trade-off between administrative convenience and potential tax savings.

The Statutory Formula Method

This method applies a flat statutory rate of 20% to the car’s base value (generally the original purchase price, including GST). The calculation also considers the number of days the car was available for private use. Any financial contributions made by the employee towards running costs will reduce the final taxable value.

This method is popular among employers seeking simplicity, but it may not be the most tax-effective option if the car is used infrequently for personal trips.

The Operating Cost Method

This method is based on the actual costs of running the car, including fuel, insurance, registration, and servicing. To use this method, you must maintain an ATO-compliant logbook for a continuous 12-week period to separate business use from private use. The taxable value is the total running cost multiplied by the percentage of private use. For vehicles with high business usage, this method can result in a substantially lower FBT liability.

Key FBT Exemptions and Concessions

Not all benefits provided to employees attract FBT. The ATO provides several important exemptions and concessions designed to reduce the compliance burden for employers, particularly for minor, infrequent, or work-related benefits. Understanding these rules allows you to structure employee rewards in a tax-effective and compliant manner.

The Minor Benefits Exemption

The minor benefits exemption is one of the most useful provisions. It allows employers to provide small, infrequent perks without triggering an FBT liability. For a benefit to be considered 'minor', it must satisfy two conditions:

Value: The taxable value of the benefit must be less than $300 (including GST).

Frequency: The benefit, and any similar benefits, must be provided infrequently and irregularly.

The ATO assesses the total context. A single birthday gift worth $250 would likely be exempt. However, providing a $250 gift voucher every month would be considered regular and would fail the frequency test, making every voucher subject to FBT.

The ATO considers the total value of all similar benefits provided to an employee during the FBT year (1 April – 31 March). For practical examples, see our guide on how to handle Christmas staff gifts and parties.

Work-Related Item Exemptions

Certain items provided to employees primarily for work-related use are exempt from FBT. The most common category is 'portable electronic devices'. As a general rule, an employer can provide one of each of the following items to an employee each FBT year, tax-free:

Laptops and tablets

Mobile phones

Calculators

GPS navigation receivers

Computer software

The primary condition is that the item must be used mainly for work purposes. This exemption is generally limited to one item of each type per employee per FBT year, unless it is a replacement for a lost or damaged item.

Other common work-related exemptions include:

Tools of Trade: Equipment required for an employee to perform their duties.

Protective Clothing: Items such as steel-capped boots, high-visibility vests, or other required safety gear.

Briefcases.

Concessions for Not-for-Profit Organisations

The FBT system includes special rules for certain not-for-profit (NFP) organisations, such as public benevolent institutions, health promotion charities, and public hospitals. These organisations are often eligible for an FBT exemption or rebate, allowing them to provide benefits up to a specified value cap to their employees FBT-free. These caps are a powerful tool for NFPs to offer more attractive remuneration packages and compete for talent. The specific cap amount and eligibility criteria depend on the type of organisation.

Your FBT Reporting and Lodgement Obligations

Understanding how to calculate FBT is only half the battle; meeting your reporting and lodgement obligations is crucial for compliance. Failure to do so will attract ATO scrutiny and penalties. This involves knowing key dates, maintaining meticulous records, and understanding how FBT is reported on employee income statements.

Managing the FBT cycle correctly is a non-negotiable part of running a compliant Australian business.

Key Dates and Deadlines

It is essential to mark these dates in your calendar. The FBT year is different from the standard income tax year.

FBT Year End: The FBT year concludes on 31 March each year.

Lodgement and Payment Deadline: If lodging your own FBT return, the due date is 21 May. If you use a registered tax agent, this deadline is generally extended to 25 June.

Missing these deadlines can result in late lodgement penalties and interest charges from the ATO.

Record-Keeping Essentials

Robust record-keeping is the foundation of FBT compliance. Without adequate documentation, you cannot accurately calculate your liability or substantiate any exemptions claimed during an ATO review. Your records must prove the taxable value of benefits and support your calculations.

Essential records include:

Car Logbooks: If using the operating cost method for a vehicle, an ATO-compliant logbook is mandatory.

Employee Declarations: Signed declarations are often required to confirm details, such as the percentage of work-related use for certain items.

Invoices and Receipts: Maintain all documentation related to the purchase of benefits to evidence their value.

Accurate records are more than a compliance task; they are a strategic tool. A well-maintained car logbook, for instance, can significantly reduce your FBT liability by proving a high percentage of business use.

Reportable Fringe Benefits Amount (RFBA)

It is important to differentiate between your business's FBT liability (the tax you pay) and the Reportable Fringe Benefits Amount (RFBA). The RFBA is the grossed-up taxable value of benefits provided to an employee, which must be reported on their income statement if the total exceeds $2,000 in an FBT year.

The employee does not pay income tax on the RFBA, but government bodies like Services Australia use it to assess eligibility for certain benefits and liabilities, such as the Medicare levy surcharge and child support payments. For more information, read our detailed guide on what are reportable fringe benefits and why they matter.

FBT is a significant component of Australia’s tax system. According to the Australian Bureau of Statistics, national taxation revenue reached $801.7 billion in the 2023–24 financial year, an increase of 6.1%. This context highlights why the ATO prioritises FBT compliance.

Summary

Managing Fringe Benefits Tax (FBT) is an ongoing responsibility that requires a proactive and systematic approach. By understanding the rules and implementing a robust compliance framework, you can avoid penalties and ensure your employee reward programs are both effective and tax-efficient.

Key takeaways include:

FBT is paid by the employer, not the employee, on non-cash benefits.

The FBT year runs from 1 April to 31 March.

Accurate identification and valuation of benefits like cars, expense payments, and entertainment are critical.

Record-keeping is non-negotiable, especially for claiming exemptions or using the operating cost method for cars.

Understand and apply exemptions like the minor benefits exemption (under $300 and infrequent) to reduce your liability.

Meet your lodgement and payment deadlines to avoid ATO penalties.

Call to Action

While this guide provides a comprehensive overview of your FBT obligations, Australian tax law is complex and subject to change. Professional advice tailored to your specific business circumstances is invaluable for ensuring compliance and optimising your tax position.

Contact Baron Tax and Accounting today for expert guidance on managing your FBT obligations and other business tax matters.

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213

FAQ Section

Who is responsible for paying FBT?

The employer is solely responsible for paying Fringe Benefits Tax (FBT) to the ATO. The liability does not fall on the employee who receives the benefit. However, if the grossed-up value of an employee's benefits exceeds $2,000 in an FBT year, this amount must be reported as a Reportable Fringe Benefits Amount (RFBA) on their income statement. The RFBA is used by agencies like Services Australia to assess eligibility for certain government benefits and liabilities.

Is superannuation a fringe benefit?

No, superannuation contributions made by an employer to a complying super fund are not a fringe benefit. They are governed by the superannuation guarantee rules and are treated separately from the FBT system. These contributions are generally tax-deductible for the business.

What is the minor benefits exemption?

The minor benefits exemption allows employers to provide small, infrequent benefits to employees without incurring an FBT liability. To qualify, a benefit must meet two conditions as per the ATO:

Its taxable value must be less than $300 (including GST).

It must be provided infrequently and irregularly. For example, a one-off $250 birthday gift is likely exempt. However, a regular monthly $250 voucher would fail the frequency test and become fully taxable.

How do novated leases and FBT work?

A novated lease is a three-way agreement between an employer, an employee, and a finance company for a vehicle. Since the employer provides the car, a car fringe benefit arises. However, these arrangements are typically structured to eliminate the FBT liability using the employee contribution method. The employee makes post-tax contributions from their salary to cover the car's running costs, which reduces the taxable value of the fringe benefit, often to zero. This allows the employee to benefit from salary packaging while the employer avoids an FBT bill.

Comments