Unlocking Your Salary Sacrifice Benefits in Australia

- Jul 26, 2025

- 13 min read

At its heart, the main advantage of a salary sacrifice arrangement is pretty simple: it can boost your take-home pay by shrinking your taxable income. When you pay for approved expenses—like extra superannuation contributions or a car—with your pre-tax dollars, you effectively lower the amount of salary the ATO can get its hands on. The result? More money in your pocket each pay cycle.

How Salary Sacrifice Unlocks Greater Take-Home Pay

Think of your salary as a bucket of water. Before you get to use it, the Australian Taxation Office (ATO) takes a scoop out for tax. A salary sacrifice arrangement is like cleverly (and legally) taking a cup of water out of the bucket to pay for something specific before the ATO takes its share.

Because you’ve diverted some of that income, the bucket is now a little less full. This means the ATO's scoop—the tax they calculate—is smaller. It’s a completely legitimate strategy to make your salary work harder for you and fund big-ticket items more efficiently.

The Power of Pre-Tax Payments

The magic really happens because you're paying for things with money that hasn't been taxed yet. This is far more powerful than using your post-tax, take-home pay for the same purchase. It's no surprise this strategy is gaining traction; a recent survey found a whopping 81% of Australian employees would consider salary sacrificing if their employer offered it. This signals a major shift towards more flexible and tax-effective ways of getting paid.

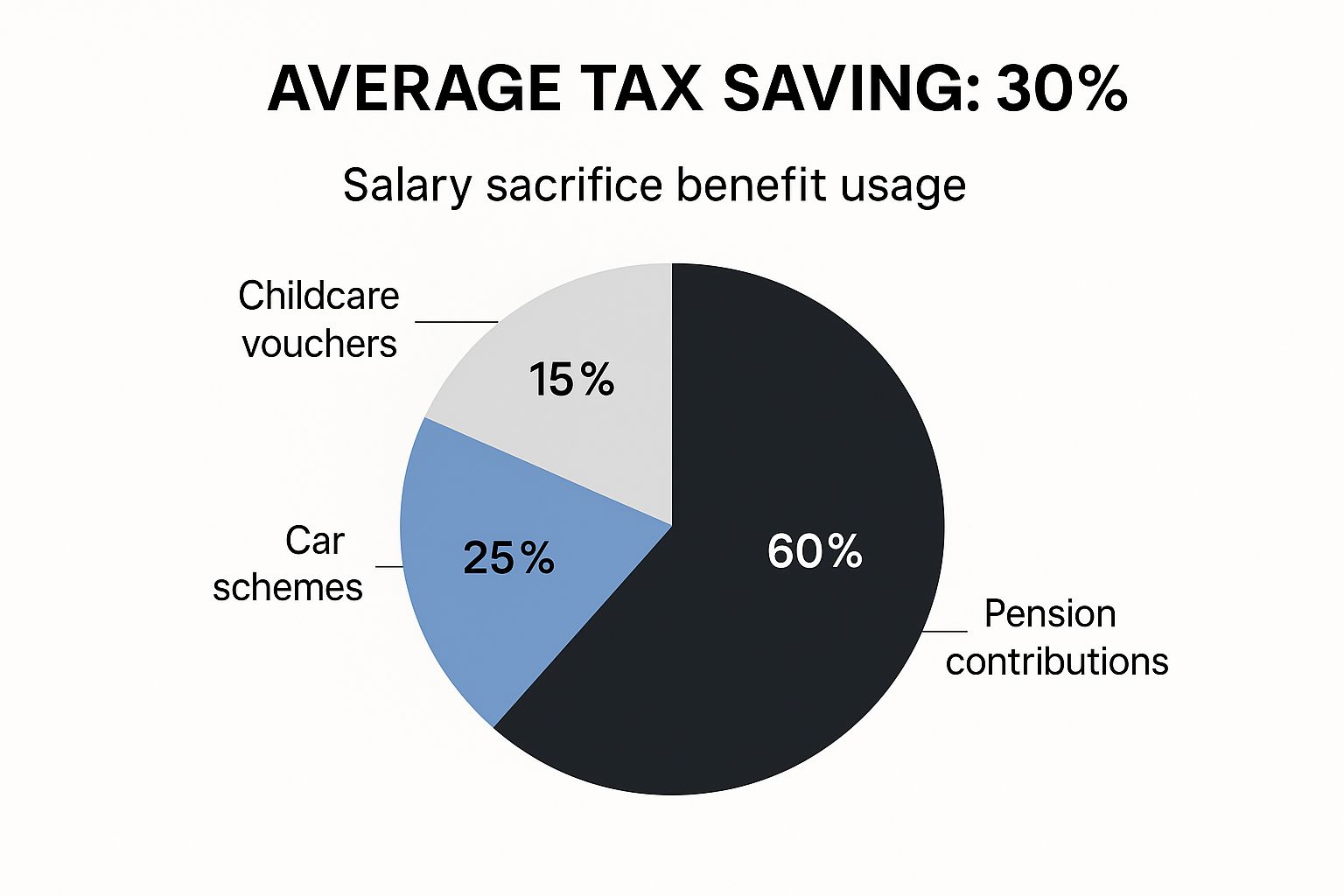

This chart shows how employees are putting this benefit to use, with superannuation being the most popular choice by a long shot.

The data makes it clear: while topping up super is the dominant strategy, a good number of people are also using salary sacrifice for major purchases like cars. To get a true feel for how these benefits fit into your overall compensation, it’s always a good idea to know your market value by checking out salary benchmarking tools.

Let's look at a quick example to see the numbers in action. This table shows a simple before-and-after scenario for someone sacrificing $10,000 of their salary into their superannuation fund.

Salary Sacrifice benefits at a Glance: Before vs. After

Metric | Without Salary Sacrifice | With Salary Sacrifice ($10,000) |

|---|---|---|

Gross Salary | $100,000 | $100,000 |

Sacrificed Amount (Pre-Tax) | $0 | $10,000 |

Taxable Income | $100,000 | $90,000 |

Income Tax Paid (Approx.) | $22,967 | $19,167 |

Net Take-Home Pay (Approx.) | $77,033 | $70,833 |

Amount in Super | (Standard SG) | (Standard SG) + $8,500 |

As you can see, sacrificing $10,000 reduces your taxable income, which in turn lowers the income tax you pay for the year. While your cash-in-hand take-home pay is lower, a significant portion of that sacrificed amount ($8,500 after the 15% contributions tax) goes directly into building your retirement wealth. You've effectively turned a tax bill into a long-term investment.

To dive deeper into the rules and mechanics, you can read our comprehensive guide on salary sacrifice arrangements. It's a powerful tool and a key part of smart personal tax planning.

Fast-Track Your Retirement with Super Contributions

The real magic is in the tax treatment. When you direct a portion of your pre-tax salary into your super fund, those contributions are taxed at a concessional rate of just 15%. For most Aussies, this is a world away from their marginal income tax rate, which can climb as high as 45%.

This immediate tax saving means more of your hard-earned money gets to work for you inside your super, compounding year after year. It’s a simple but incredibly effective way to grow your retirement savings much faster than making personal contributions from your after-tax pay.

How Much Can You Actually Save?

Let’s put some real numbers to it. Imagine Chloe, who earns $95,000 a year. Her marginal tax rate is 32.5% (plus the Medicare levy).

Chloe decides to salary sacrifice an extra $10,000 of her income into her super fund for the year.

If she takes it as normal salary: Chloe would pay $3,450 in tax on that $10,000. She'd be left with $6,550 in her pocket to spend or save.

If she salary sacrifices it to super: The contribution is taxed at only 15%, so just $1,500 goes to the ATO. A whopping $8,500 lands directly in her super fund.

Just like that, Chloe has boosted her retirement savings by an extra $1,950 that would have otherwise vanished as tax. It’s a perfect example of how a clever tax strategy can build serious wealth over time. To dive deeper into growing your funds, you can explore our guide to building superannuation wealth.

Understanding the Concessional Contributions Cap

While this strategy is fantastic, there is one important rule to watch. The Australian government sets an annual limit on how much you can contribute to your super at the low 15% tax rate. This is called the concessional contributions cap.

In Australia, one of the most popular salary sacrifice benefits is boosting superannuation. For the 2024–25 financial year, the concessional contribution cap is $30,000. This limit includes all before-tax contributions, such as your employer's mandatory payments and any amount you salary sacrifice.

It's vital to keep this cap in mind. If your employer's contributions and your own salary sacrificed amounts add up to more than the limit, the excess will be taxed at your marginal rate, wiping out the benefit. To really get ahead with your retirement goals, it helps to understand the basics of investing. This comprehensive Investing for Beginners Guide is a great place to start.

More Than Just Super: Packaging Your Everyday Expenses

Boosting your super is a brilliant long-term play, but the world of salary sacrifice benefits is much bigger than just retirement savings. You can actually package a whole range of everyday and work-related items, turning regular expenses into genuine tax-saving opportunities. It’s a powerful way to shrink your taxable income while paying for things you were going to buy anyway.

One of the most popular and impactful options out there is a novated car lease. Think of it as a three-way handshake between you, your employer, and a finance company. This agreement lets you pay for a new or used car—and all its running costs—straight from your pre-tax salary. It’s like an all-inclusive car bundle that gets paid before the taxman takes his cut.

But it’s not just about the car payments. A novated lease cleverly bundles all your major vehicle expenses, which makes budgeting a breeze and seriously boosts your savings.

What Can a Novated Lease Cover?

By using a novated lease, you can package a whole suite of car-related costs. This often includes:

Lease payments: The core cost of the vehicle itself.

Fuel: Paying for petrol or charging your EV with pre-tax dollars.

Insurance: Covering your annual comprehensive insurance premium.

Registration and CTP: Bundling these mandatory yearly costs into your package.

Servicing and Maintenance: Scheduled services and routine upkeep are covered.

Tyres: Replacing worn-out tyres when you need to.

The real magic here is that all these costs are deducted from your gross salary. This lowers your taxable income, which in turn reduces the amount of income tax you pay. It’s a far more efficient way to finance a vehicle compared to a traditional car loan, which you’d be paying from your post-tax (take-home) pay.

Packaging Your Work-Related Gear

Beyond cars, you can also package various work-related tools and expenses, as long as they are used primarily for your job. This is another fantastic way to put your salary sacrifice benefits to work on everyday essentials. The Australian Taxation Office (ATO) often considers these items exempt from Fringe Benefits Tax (FBT), which makes them quite straightforward and effective to package.

Here’s a look at some of the most common items you can package, along with some important rules to keep in mind.

Commonly Salary Sacrificed Items and Key Considerations

Benefit Item | Typical Tax Treatment | Key Consideration / ATO Rule |

|---|---|---|

Laptops & Tablets | FBT Exempt | Primarily for work use. Limited to one item per FBT year per employee. |

Mobile Phones | FBT Exempt | Must be used primarily for work purposes. |

Self-Education | Potentially FBT Exempt | The course must be directly related to improving skills for your current job. |

Novated Car Lease | Subject to FBT | The FBT is managed by your employer or provider, but the overall structure is designed to still provide you with a net financial benefit. |

Professional Memberships | Potentially FBT Exempt | Must be a membership to a professional association relevant to your role. |

As you can see, there are quite a few rules, but don't let that intimidate you. A good salary packaging provider will guide you through what’s possible for your specific situation.

A quick word on Fringe Benefits Tax (FBT). This is a tax that employers pay on certain non-cash benefits they provide to employees. While it sounds complex, you generally don't need to get lost in the weeds. Your employer or a specialist salary packaging provider will handle any FBT obligations, making sure the arrangement is structured so you still come out financially ahead.

A Special Perk for Health and NFP Sector Workers

So, what’s the secret? The Australian Taxation Office (ATO) gives certain employers in these fields special Fringe Benefits Tax (FBT) concessions. This unique status means their employees can package a huge chunk of their general living costs using pre-tax dollars, completely FBT-free, up to a very generous annual limit.

Unlocking Your FBT-Free Cap

The real magic here is what you can package. Forget just super or cars. This concession is designed for your general living expenses. We’re talking about things like:

Mortgage or Rent Payments: Imagine covering your biggest household bill with pre-tax money.

Credit Card Bills: Paying off that monthly statement before your income even gets taxed.

Personal Loan Repayments: Chipping away at loans with your untaxed salary.

Utility Bills: Taking care of everyday costs like electricity and gas.

You're essentially getting reimbursed for these common expenses from your pre-tax income. This directly lowers your taxable salary, which means you pay less income tax. It's that simple.

How Much Can You Actually Package?

The annual caps are substantial and open the door to some serious tax savings. For the current FBT year (1 April to 31 March), the limits are:

$9,010 for employees of public hospitals and other eligible public health services. $15,900 for employees of registered charities and other not-for-profit organisations.

Let’s put that into perspective. If you work for an NFP and are on a 30% marginal tax rate, maxing out the $15,900 salary packaging cap could result in around $4,770 in tax savings each year. If you also factor in the 2% Medicare Levy, your savings could exceed $5,000 annually.

Despite how incredible these benefits are, it's estimated that only 60–70% of eligible NFP employees are taking advantage of this. That means thousands of people are missing out.

If you work in one of these sectors, looking into your salary packaging options is genuinely one of the smartest financial moves you can make.

How to Set Up Your Salary Sacrifice Arrangement

So, you're ready to turn the theory of salary sacrificing into a practical financial strategy? Great. Setting up an arrangement is often more straightforward than most people think, and it's the crucial step that transforms a good idea into a real plan that boosts your bottom line.

Your first port of call should almost always be your company’s HR or payroll department. They’re the gatekeepers for this kind of benefit and will be able to tell you if your organisation offers salary packaging and, importantly, what options are on the table for you.

Start the Conversation with Your Employer

When you approach your employer, it’s a good idea to have a few key questions prepared. It shows you’ve done your research and helps you get the information you need efficiently.

Try asking these questions:

What benefits can I package? You need to know if it’s just for superannuation or if it extends to other things like a novated car lease or even a work laptop.

Is there a preferred provider? Many companies outsource the administrative side of things to third-party salary packaging specialists.

What is the process for applying? Get a clear picture of the specific steps and any paperwork you'll need to complete.

This initial chat lays the groundwork for your arrangement and makes sure you and your employer are on the same page from day one. And while you're looking at ways to improve your personal finances, it might be a good moment to consider other tax-saving avenues.

Formalise the Agreement in Writing

Once you've decided to go ahead, the next step is absolutely critical: formalise everything. A quick chat or verbal agreement simply won’t cut it. You must have a formal, written Salary Sacrifice Arrangement document. This is a non-negotiable requirement from the ATO.

This document is a legally binding agreement between you and your employer that outlines the terms of your arrangement. It must be finalised before you start earning the income you plan to sacrifice. You cannot backdate a salary sacrifice for salary or wages you’ve already received.

Your written agreement should clearly specify:

The exact amount of salary you'll be sacrificing.

The specific benefit you'll get in return (e.g., additional super contributions, car payments).

How long the arrangement will last.

This document protects both you and your employer by providing clear evidence of the agreement for tax purposes. It removes any ambiguity about your revised salary and the benefits you’re getting, keeping the entire process transparent and fully compliant with ATO rules.

Navigating the Potential Risks and Downsides

Salary sacrificing is a fantastic tool, but it's not without its quirks. Before you jump in, it’s smart to look at the whole picture – the good, the bad, and the slightly tricky. A well-thought-out agreement can be a huge win, but a rushed one might leave you with some unwelcome surprises down the track.

The first thing to get your head around is the impact on your base salary. Because you're technically lowering your gross wage on paper, this can have a ripple effect on other payments that are calculated from that base figure.

Think about things like overtime pay, annual leave loading, and even your standard employer super contributions. These are often worked out as a percentage of your base salary. Unless your agreement specifically carves out an exception, a lower base salary could mean a smaller payout for these entitlements.

Impact on Government Assessments

Another critical piece of the puzzle is how government bodies, especially the ATO, look at your income for certain obligations. This is where it gets a bit counterintuitive. While your taxable income goes down, your assessable income for certain government tests can be different.

The ATO calculates what’s called your Adjusted Taxable Income (ATI) to figure out your repayment obligations for things like HECS-HELP debts or child support. Your ATI is your taxable income plus any amounts you've salary sacrificed.

In short, you can't use a salary sacrifice arrangement to make your income look smaller for HECS-HELP or child support purposes. The ATO essentially adds the sacrificed amount back on to make sure the assessment is based on your total earnings.

Employment Status and Agreement Specifics

Finally, the type of work you do matters. The specifics of your employment can change your eligibility and how these arrangements are structured. Getting clear on your status is a vital first step in understanding all your workplace entitlements, a topic we cover in more detail in our guide comparing an employee vs contractor in Australia.

Don't let these points scare you off. They aren't reasons to avoid salary sacrificing altogether; they're just factors to be aware of. The best way to protect yourself is to have a crystal-clear, written agreement that spells out exactly how your super contributions and other entitlements will be handled. This ensures you can enjoy all the benefits without any hidden pitfalls.

Your Salary Sacrifice Questions Answered

Dipping your toes into the world of salary sacrifice can naturally bring up a few questions. To help you feel confident you're making the right move, we’ve put together clear, simple answers to the queries we hear most often from employees across Australia.

Can I Salary Sacrifice if I Work Part-Time?

Yes, absolutely. As long as your employer offers salary sacrifice, it’s generally available to full-time, part-time, and sometimes even casual employees.

The amount you can package will, of course, depend on your income and your employer’s specific policies. But the core benefit is the same—you still reduce your taxable income, potentially lowering your tax bill, no matter how many hours you work each week.

What Happens if I Change Jobs?

A salary sacrifice arrangement is tied directly to your current employer, so it automatically ends when you leave your job. If you have a benefit like a novated car lease, you’ll need to figure out what to do with it. This usually means taking over the lease payments yourself or, if you're lucky, transferring the lease to your new employer if they offer a similar program.

Key Takeaway: Always have a plan for what happens to your arrangement when you switch jobs. For super contributions, it's simpler—they just stop until you set up a new agreement with your next employer.

Can I Change or Stop My Arrangement?

Most of the time, yes. Many employers allow you to review and tweak your arrangement once a year or if you have a major life change, like a pay rise. However, this flexibility really hinges on your specific agreement and the type of benefit you're packaging.

For anything involving a contract, like a car lease, you could face penalties for ending it early. It's crucial to read the fine print in your employer's policy before you commit. Understanding these rules is just as important as knowing your individual tax deductions, as both have a real impact on your finances.

Need an Expert Eye on Your Tax Strategy?

Figuring out salary sacrifice can unlock some serious savings, but it's not something you want to just "wing it." To make sure your strategy actually fits your life—both now and for the long haul—getting some expert guidance can make a world of difference. A well-thought-out plan today is one of the top strategies for minimizing taxes in retirement tomorrow.

That's where we come in. Here at Baron Tax & Accounting, our team is ready to help you make sense of it all. We offer straightforward, professional advice to structure your finances in the most tax-effective way possible.

• Need assistance? We offer free online consultations: – Phone: 1800 087 213 – LINE: barontax – WhatsApp: 0490 925 969 – Email: info@baronaccounting.com – Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments