What is an Employee Share Scheme? Discover How It Builds Wealth

- Sep 11, 2025

- 17 min read

Ever heard the phrase "skin in the game"? That’s exactly what an Employee Share Scheme (ESS) is all about. It’s a program that offers you the chance to own a piece of the company you work for. Instead of your compensation being just a salary, you can get company shares—or the option to buy them later at a great price. This directly links your hard work to the company's growth and your own financial future.

What is an Employee Share Scheme?

Think of an Employee Share Scheme as the bridge that turns an employee into an owner. It’s a powerful shift. Suddenly, you're not just working for a paycheque; you have a tangible stake in the company’s success. When the business does well, the value of your shares can climb, creating a massive incentive that a simple salary can’t match. This is precisely why everyone from nimble startups to major corporations use them to attract, motivate, and keep their best people.

These schemes aren't just a niche perk anymore—they're becoming mainstream. Right now, over 1.2 million Australians are part of an Employee Share Scheme, a number that's jumped by nearly 10% since 2022. This boom is fuelled by more favourable tax rules and a growing realisation from employers that aligning the team's goals with the company's is a recipe for success.

To give you a quick snapshot, here’s a simple breakdown of what an ESS typically involves.

Key Features of an Employee Share Scheme at a Glance

Component | Brief Description |

|---|---|

Equity Grant | The company offers you shares or options as part of your compensation package. |

Vesting Period | A waiting period before you gain full ownership of the shares or can exercise your options. |

Exercise Price | For options, this is the pre-agreed price at which you can buy the shares in the future. |

Tax Implications | How and when you are taxed depends on the scheme's structure and your personal circumstances. |

Liquidity Event | The point at which you can sell your shares, usually an acquisition or IPO. |

As you can see, an ESS is more than just a bonus; it’s a structured plan for long-term shared success.

How an ESS Offer Fits into Your Pay

At its heart, an ESS is a form of compensation. It works alongside your salary to build your total financial package, but instead of just cash, you get equity.

The most common forms this takes are:

Shares: You get direct ownership of company stock from the get-go.

Options: You get the right to buy shares at a set price down the track. If the company’s value goes up, you can buy low and benefit from the growth.

Performance Rights: You’re granted the right to receive shares, but only if specific company or individual performance goals are hit.

When looking at offers, especially from private companies, it's vital to understand how the equity is valued. Concepts like a private company share valuation (e.g., 409A valuation) are key to figuring out what your equity is actually worth.

In some cases, you can even contribute to your share plan using pre-tax dollars. This works much like other salary packaging benefits. We have a detailed guide explaining the mechanics of salary sacrifice that you might find useful. It can be a very tax-effective way to build your ownership stake.

An Employee Share Scheme transforms employees from simple wage earners into vested partners. It creates a culture where everyone is pulling in the same direction because a rising tide lifts all boats—and in this case, all shareholders.

Common Types of Share Schemes in Australia

When a company offers you a stake in its future, it’s rarely a one-size-fits-all deal. Employee share schemes (ESS) come in different shapes and sizes, each with its own benefits, risks, and tax implications. Figuring out which type you’ve been offered is the first step to understanding what it really means for your finances.

In Australia, these schemes generally fall into two main buckets: plans where you get shares straight away (often at a discount), and plans where you get the right to buy shares down the track.

Let's break down the most common ones you’ll come across.

Share Acquisition Plans

A Share Acquisition Plan is your most direct path to becoming a shareholder. With this setup, the company offers you actual shares upfront, meaning you own a piece of the business from day one—though usually with a few strings attached.

These plans typically work in one of two ways:

Discounted Shares: Your employer might let you buy shares for less than what they’re currently worth on the market. The Australian Taxation Office (ATO) even offers a tax concession of up to $1,000 on this discount for eligible employees, as long as your income is below a set threshold.

Salary Sacrifice Arrangements: You can choose to give up a portion of your pre-tax salary in exchange for company shares of the same value. This can be a smart, tax-effective way to build equity, since you’re investing money before it gets taxed.

With a Share Acquisition Plan, you’re holding a tangible asset right from the start, which can be a huge motivator. The flip side is that you also take on immediate market risk—if the share price drops, so does the value of what you hold.

Share Option Plans

Unlike getting shares upfront, a Share Option Plan gives you options. An option is the right, but not the obligation, to buy a certain number of company shares at a locked-in price (the "exercise price" or "strike price") at some point in the future.

Think of it like getting a voucher to buy a TV at today's price, but the voucher is valid for the next three years. If the price of that TV skyrockets, your voucher is suddenly very valuable because you can still buy it at the old, lower price. But if the price drops, you can just let the voucher expire and lose nothing.

The real magic of a Share Option Plan is its potential upside. You only cash in if the company’s share price climbs above your exercise price, perfectly aligning your financial interests with the company's growth.

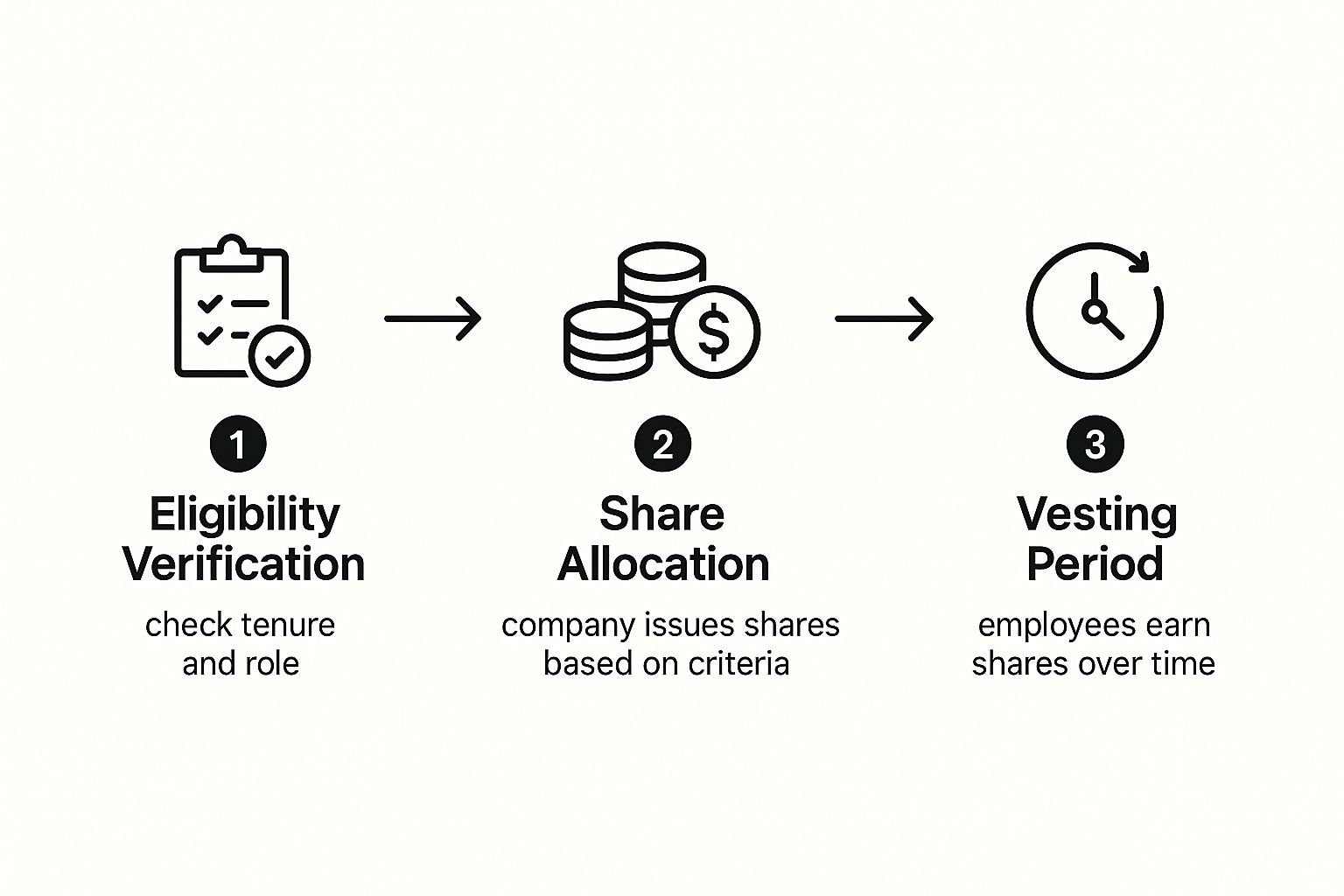

The journey from being granted an option to owning a share involves a few key steps. This infographic shows the typical process, from eligibility through to vesting.

As the visual shows, getting an ESS offer is just the beginning. Employees usually need to stick with the company for a set "vesting period" to actually earn their equity.

To make the distinction clearer, here’s a simple table comparing the two main types of plans.

Comparing Share Acquisition and Share Option Plans

Feature | Share Acquisition Plan | Share Option Plan |

|---|---|---|

What You Get | Actual shares, right away. | The right to buy shares in the future. |

Upfront Cost | Often purchased at a discount or via salary sacrifice. | No upfront cost to receive the options. |

Ownership | Immediate (though shares may be restricted). | You become a shareholder only after you "exercise" the option. |

Primary Risk | The value of your shares can fall below your purchase price. | Options can expire worthless if the share price never rises above the exercise price. |

Best For | Employees who want immediate ownership and believe in the company's current value. | Aligning employee incentives with long-term company growth and performance. |

This table highlights the core trade-offs: immediate ownership versus future potential. The right choice depends entirely on the company's goals and what it wants to incentivise.

Performance Rights and Other Variations

Of course, it doesn't stop there. Companies often mix and match concepts to create hybrid models. One of the most common is the Performance Rights Plan.

Performance rights are like options but with a fantastic twist: you don’t pay to exercise them. Instead, you’re granted the right to receive shares for free, but only if certain performance goals are met.

These goals could be tied to:

Company-wide targets: Like hitting a revenue milestone or a specific share price.

Team or individual goals: Like launching a new product or crushing sales targets.

This structure is a powerful way to incentivise great work, as the equity reward is directly linked to tangible results. You’ll often see these offered in leadership roles or in fast-growing industries.

Another popular variation is the Restricted Stock Unit (RSU). An RSU is basically a promise from your employer to give you shares at a future date, as long as you meet the vesting conditions (which is usually just staying with the company for a period of time). Unlike options, RSUs almost always have some value as long as the share price is above zero, making them a less risky form of compensation.

Knowing which type of scheme you're being offered is critical, as it shapes your potential reward, your level of risk, and how you’ll be taxed.

Navigating Australian Tax Rules for an ESS

Understanding the tax side of an Employee Share Scheme (ESS) is every bit as important as understanding the potential financial upside. The Australian Taxation Office (ATO) has specific rules that dictate how and when you pay tax on your shares or options. Getting this right is key to managing your finances and making the most of your equity.

The tax treatment might seem complicated at first, but it really boils down to one core concept: the 'taxing point'. This is the exact moment when the value of your shares or options officially becomes part of your assessable income for that financial year.

This event triggers a tax liability, even if you haven't sold the shares and don't have cash in hand. The amount you're taxed on is generally the market value of the shares at the taxing point, minus whatever you paid to get them. Think of it as income you've earned, just in the form of company equity instead of cash.

Taxed-Upfront vs Tax-Deferred Schemes

When this taxing point occurs depends entirely on the type of scheme your employer has set up. The ATO sorts ESS into two main buckets: taxed-upfront schemes and tax-deferred schemes. Figuring out which one you're in is the first step.

A scheme is usually taxed-upfront if there are no real restrictions preventing you from losing your shares or options. If there's no genuine risk of forfeiture, the ATO considers the value yours from day one. In this case, the taxing point is the year you receive the equity, and the discount you got becomes part of your taxable income for that year.

On the other hand, a tax-deferred scheme lets you push back paying tax until a later date. This is far more common, especially for options or shares that come with vesting conditions. The tax bill is delayed until the earliest of several specific events, known as a "deferred taxing point".

These trigger events typically include:

You leave your job at the company.

A maximum period of 15 years passes from when you first got the ESS interest.

The restrictions on selling your shares are lifted and there's no longer a real risk of losing them.

This delay is a huge help. It aligns the tax event much more closely with when you can actually sell the shares and access their value, rather than forcing you to find cash to pay tax on an asset you can't even touch yet.

Understanding Tax Concessions and Benefits

To encourage employee ownership, the government offers a few tax concessions that can make these schemes even more appealing by reducing what you owe.

One of the best ones is the startup concession. If you work for an eligible startup, you might not have to pay any tax on the discount you receive. To qualify, the startup has to tick a few boxes, like being unlisted, having an aggregated turnover of less than $50 million, and being incorporated for less than 10 years.

Another common break applies to taxed-upfront schemes. If your taxable income is $180,000 or less, you might be able to reduce the taxable discount by up to $1,000 per year.

The key takeaway is that the ATO provides pathways to reduce your tax burden, but eligibility is strict. Always check the specific conditions of your scheme and your personal circumstances against the ATO's requirements for the current financial year.

The Role of Capital Gains Tax

Your tax journey doesn't stop once the taxing point has passed. After you've paid income tax on the initial value or discount, any future growth in your shares' value falls under the Capital Gains Tax (CGT) rules. This is a crucial distinction to grasp.

When you eventually sell your shares, CGT applies to the profit you've made. The 'cost base' for working out your capital gain is the market value of the shares at the time of the taxing point.

Here’s how it works in practice:

You're granted options that vest in a few years, triggering a deferred taxing point.

At that taxing point, the shares are worth $5.00 each. You include this amount in your income tax return for that year. Your new cost base is now set at $5.00 per share.

You hold the shares for another two years, and then sell them for $8.00 each.

Your capital gain is $3.00 per share ($8.00 sale price - $5.00 cost base).

Better yet, if you hold the shares for more than 12 months after the taxing point, you'll likely be eligible for the 50% CGT discount. This effectively cuts the taxable capital gain in half, providing a massive advantage for long-term employee shareholders. It's also worth thinking about how other investment income, like dividends, is taxed. To get a clearer picture, check out our guide that explains what franking credits are and how they fit into your overall tax situation.

Weighing the Pros and Cons for You and Your Employer

An Employee Share Scheme (ESS) can be a fantastic way to build wealth and lock in company loyalty, but let's be honest—it's not a simple decision. Like any big financial move, you need to look at the whole picture, weighing up the exciting potential against the real risks involved.

Getting a handle on this from both an employee's and an employer's point of view makes it clear why these schemes are so popular. For an employee, an ESS can feel like hitting the jackpot. For a company, it’s a smart, strategic move to invest in its future.

Let's break down the good and the bad for both sides of the table.

The Employee Perspective

As an employee, getting invited into an ESS is your chance to get a direct slice of the success you're helping to build. It changes your mindset from just being a worker to becoming a part-owner, which is a powerful feeling, both financially and professionally.

Advantages for Employees:

Potential for Serious Financial Gain: This is the big one. If the company does well and its share value climbs, your equity could grow far beyond what you'd ever see from a pay rise. It's a direct line to building real wealth.

A Real Sense of Ownership: Owning a piece of the company creates a strong connection to your work. When you've got 'skin in the game', the company's wins feel like your wins. That’s a huge boost for job satisfaction and motivation.

Handy Tax Perks: As we've covered, tax-deferred schemes let you put off paying tax until a later, hopefully better, time. Better yet, if you hold onto your shares for over 12 months after the taxing point, you could be eligible for the 50% Capital Gains Tax discount when you decide to sell.

Disadvantages for Employees:

The Financial Risk is Real: Shares can go down just as easily as they go up. If the company struggles, your shares could end up being worth less than they were at your taxing point—or even nothing at all. This also means you're putting a lot of your financial eggs in one basket, which is always risky.

It’s Complicated and Often Illiquid: Getting your head around the fine print of an ESS can be tough. For anyone in a private company, the biggest hurdle is often liquidity. You usually can't sell your shares until a major event like an IPO or a company sale, and there's no guarantee that will ever happen.

Facing a Tax Bill with No Cash: A deferred taxing point sounds great until you realise it can trigger a tax bill before you've sold any shares. Suddenly you owe the ATO a chunk of money but have no cash from the shares to pay it, forcing you to find the funds somewhere else.

The Employer Perspective

For a business, an ESS isn't just a perk; it's a strategic investment in its most important asset—its people. It’s a way to build a high-performance culture where everyone is pulling in the same direction.

Advantages for Employers:

Attracting and Keeping the Best People: In a tight job market, a solid ESS can be the clincher for top-tier candidates. This is especially true in the startup and tech worlds, where equity is pretty much standard.

Better Alignment and Productivity: When your team members are owners, they start thinking like owners. This naturally leads to more innovation, better efficiency, and a shared drive to hit company goals because everyone shares in the rewards.

Preserving Precious Cash Flow: Offering equity is a smart way to reward employees without draining your bank account. This is a lifesaver for startups and growing companies that need every dollar for operations and expansion.

From an employer's standpoint, an ESS is more than just a benefit—it’s a cultural cornerstone. It sends a clear message that employees are trusted partners in the business journey, fostering loyalty that a paycheque alone cannot buy.

Disadvantages for Employers:

The Admin Burden and Cost: Setting up and running an ESS isn't a walk in the park. You're looking at legal setup costs, ongoing administration, regular valuations, and making sure you're compliant with ATO and ASIC rules. It can be a real drain on resources.

Diluting Ownership: Every time you issue new shares to employees, you dilute the ownership stake of your existing shareholders, including founders and investors. This has to be managed carefully to keep your early backers happy.

Communication is Key (and Hard): Explaining the nitty-gritty of an ESS—vesting schedules, tax rules, valuation—to your whole team is a huge challenge. If people don't understand it, it can lead to confusion and disappointment, completely defeating the purpose of the scheme.

How Australia's ESS Landscape Compares Globally

To really get a handle on employee share schemes in Australia, it helps to see where we fit on the world stage. How does our approach to employee ownership stack up against global heavyweights like the United States and the United Kingdom? Looking at this bigger picture explains why our schemes are structured the way they are—and where things are heading.

For a long time, Australia has been playing catch-up. Our ESS landscape was historically tangled up in complex, and frankly, restrictive tax rules. This made it incredibly difficult for startups and unlisted private companies to offer competitive equity incentives, putting them at a disadvantage when trying to attract top talent against international firms.

A Tale of Three Systems: The US, UK, and Australia

To see the differences clearly, let’s compare the general philosophies behind each country's approach.

The United States (US): Often seen as the gold standard, especially for startups. The US has a deep-rooted culture of employee ownership, powered by frameworks like Incentive Stock Options (ISOs) that give employees massive tax advantages. It’s been a key ingredient in the success of Silicon Valley.

The United Kingdom (UK): The UK also has a very mature ESS environment. Their Enterprise Management Incentive (EMI) scheme is a game-changer, designed specifically for smaller, high-growth companies. It lets them offer generous equity options to key people with minimal tax headaches.

Australia: Our system has traditionally been far more conservative. While there were some concessions, the rules were often less generous and came with more administrative baggage than in the US or UK. Unsurprisingly, this dampened participation for years.

Even with recent growth, Australia still lags behind other advanced economies in ESS adoption. A global survey placed Australia in the middle of the pack, trailing the US and parts of Europe. This gap is mostly down to our historically complex tax rules, which can make schemes hard to scale and less appealing.

Recent Reforms Aim to Level the Playing Field

Thankfully, the Australian government has recognised these shortcomings. The last few years have seen significant reforms roll out, all aimed at simplifying the rules and making ESS a much better deal for both companies and their staff.

Here are some of the key changes:

The old rule that triggered a tax bill when you left your job (cessation of employment) has been scrapped for tax-deferred schemes. This was a major pain point for employees.

The value of shares that companies can issue to employees has been increased.

The disclosure and reporting requirements for unlisted companies have been simplified, cutting down on red tape.

These updates are all about bringing Australia more in line with global best practices. They make it easier for local companies to use equity as a tool for growth and simplify the tax situation for employees. If you're ever wondering how ESS income might affect your tax-free amount, our guide explaining what the tax-free threshold is in Australia is a great place to start.

These reforms signal a clear shift in thinking. They acknowledge that employee equity isn’t just a perk—it’s a critical driver of economic growth, innovation, and talent retention in a fiercely competitive global market.

While Australia might still have a way to go to match the world’s most progressive systems, the direction of travel is clear. The ongoing simplification and improvement of ESS rules are making employee ownership an increasingly valuable and accessible part of the Australian employment landscape.

Key Questions to Ask Before Joining an ESS

Getting offered a spot in an Employee Share Scheme (ESS) is a huge vote of confidence from your employer. It’s an exciting opportunity. But before you jump in, it’s smart to treat it like any other major financial decision and do your homework.

Asking the right questions now will save you a world of confusion later. It helps you understand exactly what you’re getting into, manage your expectations, and see if this opportunity genuinely fits your personal financial goals. A vague understanding now can lead to nasty surprises down the line, especially around tax and when you can actually get your hands on the money.

Understanding the Offer and Company Value

First things first, you need to dig into the specifics of what's actually on the table. The real value of an ESS offer hangs on the company's current health and, more importantly, its future prospects.

How is the company's value determined? This is easy for a public company—just look at the current share price. But for a private company, you need to ask how they landed on that valuation. How often do they update it?

What percentage of the company does my offer represent? The number of shares or options is one thing, but knowing your stake relative to the total number of shares (often called the "fully diluted" number) gives you the real picture.

What are the vesting conditions? Get crystal clear on what you need to do to actually earn your equity. Is it just about sticking around for a certain amount of time (time-based vesting)? Or do you need to smash specific performance targets (performance-based vesting)?

Clarifying the Rules of Engagement

Once you’ve got a handle on the value, it’s time to understand the rules of the game. Every ESS has a detailed plan document that spells out how everything works. Don't be shy about asking for a copy and getting someone to walk you through anything that sounds like jargon.

Here are a few critical questions to ask about the rules:

What happens if I leave the company? You need to know the difference between being a "good leaver" (like being made redundant) and a "bad leaver" (like being fired for cause). This can make a massive difference to what happens to both your vested and unvested equity.

When and how can I sell my shares? This is a huge one, especially if you work for a private company. Are there specific "liquidity events" (like the company being sold or going public) that have to happen before you can cash out? Does the company have a program to buy back shares?

What are the specific tax implications for me? Find out if the scheme is tax-deferred or if you’ll be taxed upfront. This tells you when your "taxing point" will be and helps you plan for a potential tax bill—which can sometimes pop up before you’ve seen a cent of cash.

An ESS offer is more than just potential future wealth; it's a complex financial instrument. Taking the time to fully understand the terms and conditions empowers you to make a decision that benefits your long-term financial wellbeing, not just your immediate career.

Seeking Professional Guidance

Finally, and this is the most important part, an ESS doesn't exist in a vacuum. It becomes a piece of your overall financial puzzle, and getting an expert opinion is always a wise move. This is particularly true since an ESS means a significant chunk of your net worth could be tied up in a single company's stock.

Think about how this fits into your bigger financial plan and the importance of diversifying your stock portfolio for long-term growth to keep your risk in check. A financial advisor or a registered tax agent can help you run the numbers and figure out how the tax will play out in your specific situation. It’s also important to understand how your employment status impacts these benefits; for more on that, our article comparing an employee vs contractor in Australia offers some useful context.

Need Expert Help?

Employee Share Schemes can feel quite complex. From understanding the offer to navigating the tax implications, it’s not always easy to figure everything out on your own.

The best approach often depends on the specific type of plan and your personal financial situation. Making an informed decision is crucial to maximising the value of your shares.

Whether you're considering joining an ESS plan, facing a taxing point, or planning to sell your shares, professional advice can be invaluable. Our team of tax experts at Baron Accounting is here to provide clear solutions tailored to your circumstances. We can help you manage your tax obligations and achieve your long-term financial goals.

• Need assistance? We offer free online consultations: – Phone: 1800 087 213 – LINE: barontax – WhatsApp: 0490 925 969 – Email: info@baronaccounting.com – Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments