What Small Business Tax Deductions Can I Claim in Australia?

- Dec 10, 2025

- 11 min read

A tax deduction is a business expense you can subtract from your total income, which lowers the amount of tax you have to pay. The Australian Taxation Office (ATO) has one core rule: for an expense to be claimable, it must be directly related to earning your business income. Understanding deductions isn't just about compliance; it's a fundamental strategy for improving cash flow and legally minimising your tax liability. Failing to claim legitimate deductions means paying more tax than necessary, while incorrect claims can lead to significant ATO penalties and audits.

Understanding Your Small Business Tax Deduction Entitlements

Navigating your tax obligations can feel overwhelming, but mastering deductions is a cornerstone of smart financial management. Every eligible expense you claim reduces your taxable income. This directly translates into paying less tax and keeping more of your hard-earned money in the business for growth, new equipment, or managing day-to-day costs.

Why Deductions Are Crucial for Your Bottom Line

Think of your taxable income as the final figure the ATO uses to calculate your tax. Every legitimate deduction you make shrinks that figure. The lower your taxable income, the lower your tax bill. This isn't tax avoidance—it's ensuring you pay only the tax required by law.

This is especially powerful for small businesses. For example, for the financial year ending 30 June 2025, companies classified as Base Rate Entities (BREs) benefit from a lower corporate tax rate of 25%, compared to the standard 30%. To qualify, your company must have an aggregated turnover below $50 million and 80% or less of its income must be passive. This tax break makes every single deduction even more valuable.

The Risks of Non-Compliance

While maximising deductions is smart, you must follow ATO rules. The ATO actively monitors claims, and non-compliance can have serious consequences. If your claims are incorrect or you cannot substantiate them with records, you could face:

Financial Penalties: The ATO can impose significant fines for incorrect or unsubstantiated claims.

ATO Audits: A pattern of questionable claims can trigger a full audit of your business's financial records, which is stressful, disruptive, and time-consuming.

Repayment of Tax: You will be required to repay the tax you should have originally paid, plus interest charges.

An audit-proof system for tracking and proving your expenses is non-negotiable. It’s not just good business practice; it's essential protection. For a solid primer on your core duties, check out our guide to ABN and tax return compliance.

The Three Golden Rules for Claiming Business Deductions

To understand tax deductions for your small business, you don’t need to memorise the entire tax act. The Australian Taxation Office (ATO) simplifies it to three fundamental principles. If an expense passes all three tests, you can generally claim it with confidence.

Rule 1: The Expense Must Be for Your Business

This is the most critical rule. The expense must be directly linked to earning your assessable business income. You cannot claim personal, domestic, or private expenses. The connection to your business operations must be clear and direct.

For example, buying a coffee machine for your café's staff kitchen is a valid business expense. Buying the same machine for your home is a private expense and cannot be claimed, even if you do some business paperwork at home.

According to the ATO, "You can claim a deduction for most expenses from carrying on your business, as long as they are directly related to earning your assessable income." This is the foundation of every business deduction.

The expense must be for running your business—not a capital, private, or domestic cost.

Rule 2: You Must Apportion for Mixed Use

Business and personal life often overlap. You might use your personal mobile for client calls or your home internet for work emails. The ATO understands this, leading to the second rule: if an expense is for both business and private use, you can only claim the business portion.

This is called apportionment. You must use a reasonable, logical method to calculate the business-use percentage.

Example: A Graphic Designer's Phone Bill A freelance graphic designer’s mobile plan costs $100 a month. After reviewing their call logs and data usage, they determine that 60% of the phone’s use is for contacting clients and managing projects. Therefore, they can claim a tax deduction for 60% of their bill, which is $60 per month or $720 for the financial year. Claiming the full $100 would be incorrect and could attract ATO scrutiny.

Rule 3: You Must Have Records to Prove It

This final rule is crucial for compliance. You must have records to substantiate your claims. If the ATO audits you, a bank statement alone is insufficient. You must be able to show precisely what you spent, who the supplier was, and the date of the transaction.

Your records must prove the total expense and, for mixed-use items, your method for calculating the business percentage. This is your primary defence in an audit. Proper proof includes:

Tax invoices and receipts

Contracts or agreements

Bank and credit card statements (as supporting evidence)

Logbooks (for vehicles) or diaries (for travel)

Without proof, the ATO considers the deduction invalid, regardless of its legitimacy. Strong record-keeping is non-negotiable.

Common Deductible Business Expenses

Now that you understand the rules, let's apply them to your daily business spending. Identifying every potential tax deduction for your small business is one of the most effective ways to reduce your tax bill and improve cash flow. From office rent to vehicle fuel, every cost directly tied to earning income is an opportunity to lower your taxable profit.

Day-to-Day Operating Costs

These are the essential expenses that keep your business running. They are generally straightforward to claim, provided you have the necessary documentation.

Common operating costs include:

Rent and Utilities: Lease payments for your office, shop, or workshop, plus electricity, gas, and internet.

Office Supplies: Stationery, printer ink, postage, and other consumables.

Insurance: Premiums for business cover, such as public liability, professional indemnity, or asset insurance.

Professional Fees: Payments to accountants, lawyers, or business consultants.

Bank Fees: Monthly account-keeping and transaction fees on your business bank accounts.

Salaries and Superannuation: Wages paid to your staff and their superannuation contributions.

Motor Vehicle Expenses

If you use a vehicle for business purposes, you can claim its running costs. For sole traders and partnerships, the ATO provides two main methods.

The Cents Per Kilometre Method

This is the simpler option. You can claim a set rate per business-related kilometre, up to a maximum of 5,000 kilometres per car, per year. For the 2024–25 income year, the rate is 88 cents per kilometre.

You don’t need a detailed logbook, but you must be able to show the ATO how you calculated your kilometres (e.g., with diary notes of work-related trips). This method is an all-inclusive claim covering fuel, registration, insurance, and depreciation, so you cannot claim these costs separately.

The Logbook Method

This method requires more effort but often results in a larger tax deduction, especially for high business use. You must keep a detailed logbook for 12 continuous weeks to establish your business-use percentage.

Once you have this percentage, you can apply it to all your car’s actual running costs for the year, including:

Fuel and oil

Registration and insurance

Repairs and servicing

Interest on your car loan

Depreciation (the decline in the vehicle’s value)

A logbook is generally valid for five years, provided your driving habits do not change significantly.

Home-Based Business Expenses

Working from home allows you to claim a portion of your household running costs related to your business activities. The ATO offers two methods for this.

Fixed-Rate Method

This method simplifies calculations by allowing you to claim a set rate for each hour you work from home. From 1 July 2024, the fixed rate is 70 cents per hour.

This rate covers the business portion of your:

Energy bills (electricity and gas)

Phone usage (mobile and landline)

Internet

Stationery and computer consumables

You must claim the depreciation on capital items like laptops or office desks separately. You also need to keep a record of the total number of hours worked from home, such as a timesheet or diary.

Actual Cost Method

The actual cost method allows you to claim the actual business portion of every home office expense. This requires detailed calculations and records to separate personal and business use.

With this method, you calculate the business percentage of costs like:

Heating, cooling, and lighting for your workspace.

The decline in value of your office furniture and equipment.

Cleaning costs for your dedicated work area.

Phone and internet bills, based on an itemised breakdown.

While more complex, this method can yield a higher deduction if you have a dedicated home office with significant expenses.

Common Small Business Tax Deductions Checklist

Expense Category | Description | Record-Keeping Requirement |

|---|---|---|

Operating Costs | Day-to-day expenses like rent, utilities, insurance, and office supplies. | Invoices, receipts, bank statements. |

Motor Vehicle | Costs for using your car for business, calculated via logbook or cents/km. | Logbook, diary entries, receipts for fuel, rego, insurance. |

Home Office | A portion of household bills (internet, electricity) when working from home. | Diary of hours worked, receipts for bills, floor plan for area calculation. |

Marketing & Advertising | Costs for promoting your business, like social media ads or website fees. | Invoices from agencies, receipts for ad spend. |

Travel Expenses | Flights, accommodation, and meals for business-related travel. | Itinerary, receipts, travel diary for trips over 6 nights. |

Salaries & Super | Wages paid to employees and their superannuation contributions. | Payslips, superannuation clearing house records. |

Repairs & Maintenance | Costs to repair and maintain business assets, not improve them. | Invoices for services, receipts for materials. |

Legal & Professional Fees | Fees for accountants, lawyers, or consultants. | Invoices for professional services rendered. |

Bank Fees & Interest | Monthly bank fees and interest paid on business loans. | Bank statements showing fees and interest charges. |

Depreciation | Decline in value of business assets like laptops, tools, and vehicles. | Asset register, purchase receipts. |

Use this table to review your expenses and ensure you haven't missed any potential deductions.

Claiming Capital Expenses and Depreciating Assets

The ATO treats business purchases in two ways. Day-to-day costs (e.g., stationery) are claimed in full immediately. However, major purchases like vehicles, machinery, or computers are capital expenses—investments that provide long-term benefits.

Because these assets have a longer lifespan, you generally cannot claim the full cost upfront. Instead, you claim a portion of their value each year as they age. This process is called depreciation. The government often introduces special rules, like the instant asset write-off, to help small businesses with their cash flow.

The Instant Asset Write-Off Explained

The instant asset write-off is a powerful tax incentive that allows eligible businesses to claim the full cost of an asset in the same financial year it is purchased and used. Instead of depreciating the cost over several years, you receive the entire tax benefit immediately, providing a significant cash flow boost.

The rules and thresholds for this incentive can change, so it's crucial to stay updated. As of the 2024-25 financial year, the government has set the instant asset write-off threshold at $20,000 for businesses with an aggregated turnover of less than $10 million. This allows you to immediately deduct the business portion of assets costing less than this amount.

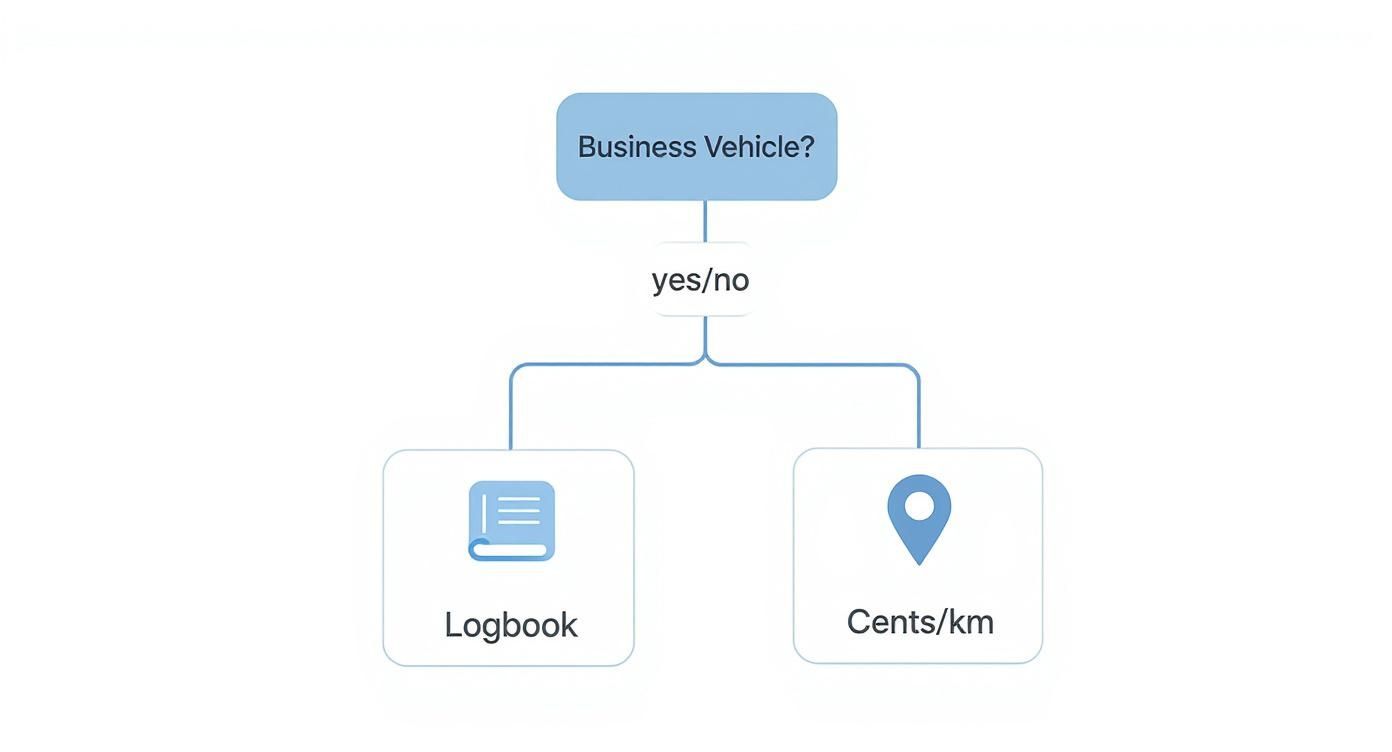

This flowchart provides a simple visual guide for claiming vehicle expenses, one of the most common capital purchases for a small business.

You have two main options: the straightforward cents-per-kilometre method or the more detailed logbook method, which can often lead to a larger deduction.

Instant Write-Off vs. Traditional Depreciation: An Example

Imagine a construction business with a $5 million turnover buys a new ute on 1 February 2025. The cost is $18,000 (excluding GST), and it is used for the business immediately.

With the Instant Asset Write-Off: The business can claim the full $18,000 as a deduction on its 2024–25 tax return. This immediately lowers its taxable income by the full purchase price.

With Traditional Depreciation: Without the write-off, the ute would be depreciated over its effective life (e.g., 8 years). The deduction in the first year would only be a fraction of the cost, providing a much smaller upfront tax benefit.

The immediate cash flow difference highlights the value of the write-off for growing businesses.

Simplified Depreciation and the Small Business Pool

If an asset costs more than the instant asset write-off threshold, eligible small businesses can use simplified depreciation rules. These assets are placed into a small business depreciation pool.

Assets are pooled together and depreciated at a collective rate. You claim a deduction of 15% of the asset's cost in the year it's added to the pool. In subsequent years, you claim 30% of the pool's opening balance. This simplifies bookkeeping by eliminating the need to track depreciation for each individual item. If the entire pool balance drops below the instant asset write-off threshold at the end of the financial year, you can write off the remaining amount.

Avoiding Common and Costly Deduction Mistakes

No business owner wants to receive a query from the Australian Taxation Office (ATO). While it's important to claim all legitimate deductions, certain mistakes can raise red flags and trigger an audit. The ATO's data-matching capabilities are increasingly sophisticated and effective at identifying unusual claims.

The Blurring Lines Between Business and Personal

This is the most frequent error, especially for sole traders. Claiming 100% of an expense that is partly for personal use is a major compliance risk.

Common mistakes include:

Claiming the entire mobile phone bill despite significant personal use.

Deducting 100% of car expenses without a logbook to substantiate business travel.

Writing off a family holiday because a few work emails were answered.

Claiming private expenses like groceries or entertainment as "client meetings."

The rule is absolute: if an expense has mixed use, you must have a reasonable basis for apportioning the cost and only claim the business portion.

Inadequate Record-Keeping

"No receipt, no deduction" is a core ATO principle. A bank statement proves a transaction occurred but does not detail what was purchased. Messy or incomplete records can lead to deductions being disallowed during an audit.

The ATO requires a tax invoice or receipt as primary evidence. Your records must be organised, detailed, and stored for at least five years. Without this paper trail, even a legitimate business expense can be rejected, resulting in a tax shortfall, interest, and potential penalties.

Misunderstanding Government Incentive Programs

Government incentives like the instant asset write-off are closely monitored by the ATO to prevent misuse. It is crucial to read the eligibility criteria and rules carefully before making a claim. Staying informed about the ATO's focus areas for small businesses can help you avoid common pitfalls.

FAQ: Your Small Business Tax Deduction Questions

Here are clear, ATO-compliant answers to some of the most frequently asked questions about small business tax deductions.

Can I claim travel expenses for a mixed-purpose trip?

Yes, but you must apportion the costs. You can only claim the portion of expenses that directly relates to your business activities. For example, if you attend a 4-day conference in another city and stay for an additional 3 days for leisure, you can only claim costs related to the 4 business days. You must keep a travel diary and detailed records to justify your apportionment, as mixed-purpose travel is a known ATO focus area.

Are my superannuation contributions tax deductible?

Yes, super contributions you make for your eligible employees are a deductible business expense, provided you pay them on time to a complying super fund. For sole traders or partners, personal super contributions are claimed as a personal deduction in your individual tax return, not as a business expense. For company directors, super paid for your services is deductible for the company. Late payments may not be deductible and can attract penalties under the Superannuation Guarantee Charge.

What happens if I lose a receipt for an expense?

The ATO's general rule is "no receipt, no deduction." However, there is a minor exception for small cash expenses. You can claim individual expenses of $10 or less each, up to a total of $200 per financial year, without a receipt. You must still record the details (cost, date, item) in a diary. For any expense over $10, or if the total of small expenses exceeds $200, a tax invoice or receipt is mandatory.

Can I claim my work clothing as a deduction?

This is a commonly misunderstood area with strict ATO rules. You can only claim a deduction for:

A compulsory uniform clearly identifying your business (e.g., with a logo).

A non-compulsory uniform registered with AusIndustry.

Protective clothing required for your job (e.g., steel-capped boots, high-vis vests).The cost of conventional clothing, such as a business suit, is not deductible, even if worn exclusively for work. If your clothing qualifies, you can also claim laundering and dry-cleaning costs. For specific advice, it is best to consult an accountant for your small business.

Summary: Key Takeaways for Your Business

Mastering your small business tax deductions is essential for financial health and compliance. Here are the key takeaways:

The Three Golden Rules: Every claim must be for your business, apportioned for private use, and supported by records.

Record-Keeping is Non-Negotiable: Maintain detailed invoices and receipts for at least five years. A bank statement is not enough.

Maximise Incentives: Take advantage of government programs like the instant asset write-off, but ensure you meet all eligibility criteria.

Avoid Common Pitfalls: Strictly separate business and personal expenses, and be meticulous with your documentation to stay off the ATO's radar.

Australian tax law is complex and subject to change. While this guide provides a solid foundation, professional advice tailored to your specific circumstances is invaluable.

Don’t navigate tax compliance alone. For personalised advice that ensures you meet your obligations while optimising your financial position, contact the experts at Baron Tax and Accounting.

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213

Comments