Your Guide to ABN and Tax Return Compliance

- Jun 25, 2025

- 11 min read

If you're running a business in Australia, you can't talk about your tax return without talking about your Australian Business Number (ABN). Your ABN is the official ID for your business in the eyes of the Australian Taxation Office (ATO), and it's what separates your business finances from your personal life. This little number completely changes how you report your income and claim your expenses.

What's an ABN Got to Do With My Tax Return?

Think of it like this: you have two financial identities. Your Tax File Number (TFN) is for you—it’s for your wages from a job and any personal investments. Your ABN, on the other hand, is your business's public face. It’s what you use for everything related to your business activities.

This separation is absolutely critical for your abn and tax return. Working without an ABN is a red flag to the ATO that you might not be a legitimate business. It can also cause immediate financial headaches. For instance, if you invoice another business without providing an ABN, they are legally required to withhold tax from your payment at the highest possible rate. Ouch.

Keeping Business and Personal Finances Separate

The ABN draws a clear line in the sand, which is the foundation of proper tax reporting. It’s what lets you:

Report all business income: Every dollar you earn from your business activities is tracked under your ABN.

Claim business deductions: This is a big one. An ABN opens the door to a huge range of business-specific deductions that employees simply can't claim.

Deal with other businesses: Issuing proper tax invoices and operating professionally requires an ABN.

In Australia, this 11-digit number is a non-negotiable for any business structure—from sole traders and freelancers to partnerships and companies. It's the key to handling tax obligations like Goods and Services Tax (GST) and Pay As You Go (PAYG) withholding. For a deeper dive, you can learn more about how this works with the overall tax system and check out the current income tax rates.

Key Takeaway: Your ABN isn't just an administrative number. It's the key that unlocks the business section of your tax return, legitimises your operations with the ATO, and changes how you manage your money. Whether you’re a freelance graphic designer or a local tradie, you absolutely need one.

Key Differences Between an ABN and a TFN

It's common for people to mix up an ABN and a TFN, but they serve very different purposes. Here’s a simple breakdown to clear things up.

Feature | ABN (Australian Business Number) | TFN (Tax File Number) |

|---|---|---|

Primary Purpose | Publicly identifies your business for tax and business dealings. | Privately identifies you as an individual for personal tax. |

Who Needs One? | Anyone running a business (sole traders, companies, etc.). | Almost every individual who earns income in Australia. |

When Do You Use It? | On invoices, when registering for GST, dealing with other businesses. | On employment forms, with your super fund, for personal investments. |

Is it Public? | Yes, it’s listed on a public register. | No, it’s confidential and private. |

Format | An 11-digit number. | A 9-digit number. |

At the end of the day, think of your TFN as your private tax identity and your ABN as your public business identity. You need the right number for the right situation to keep your tax affairs in order.

Getting Your ABN and Figuring Out if You Need One

So, you've started a side hustle or launched a new venture. The first big question you'll face is whether you need an Australian Business Number (ABN). Before you can even apply, you have to work out if you are genuinely ‘carrying on an enterprise’. This is the term the Australian Taxation Office (ATO) uses to separate a real business from a hobby.

If your new gig is set up with the intention to make a profit and you're running it in an organised, business-like way, you'll almost certainly need an ABN. It's not just about whether money comes in; it's about your intent.

Think of it this way: baking cakes for friends and only asking for enough to cover the ingredients is just a hobby. But if you register a business name, print flyers, and start advertising to find paying customers, you've crossed the line into carrying on an enterprise.

The real difference-maker is commercial intent. A business has a structured plan to become profitable. A hobby is something you do for fun, even if you make a little cash from it now and then.

The ABN Application Process

Once you've established that you are indeed running a business, applying for your ABN is a pretty straightforward online process. You'll do this through the Australian Business Register (ABR). To make it painless, you’ll want to have a few key details ready to prove who you are and what your business is about.

To make sure your application goes through without a hitch, get these items ready beforehand:

Your personal Tax File Number (TFN): This is non-negotiable for verifying your identity.

Proof of Identity: You might need details from your driver's licence or passport.

Business Structure: You'll need to know whether you’re operating as a sole trader, partnership, company, or trust.

Business Activity Details: Be ready to give a short, clear description of what your business actually does.

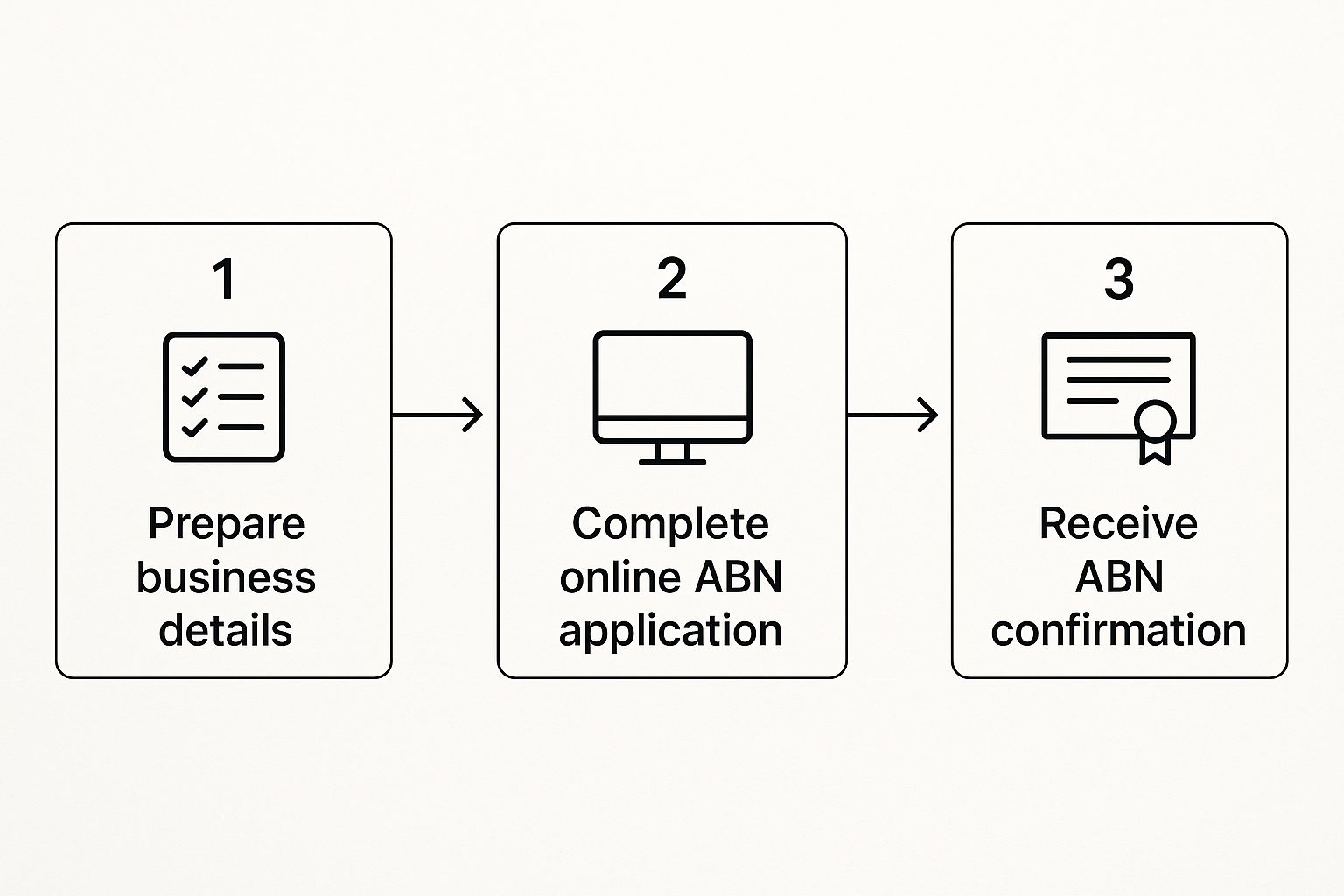

This simple flowchart breaks down the main steps to getting your ABN sorted.

Following this process will help you move smoothly from preparation to having an official ABN in your hands, making your business legitimate in the eyes of the ATO.

Getting Your Business Tax Return Ready

Once you’ve got your ABN sorted, the real work begins: managing your business finances all year round. The single best habit you can develop for a stress-free tax time is diligent record-keeping. This isn't just about ticking a box for the ATO; it’s about making sure you claim every single dollar you're entitled to.

Think of it like building a case for your deductions. Every client invoice, every receipt for a coffee meeting, and every bank statement is a piece of evidence. Get into the habit of tracking everything, from the big-ticket items right down to the small, frequent costs that really add up.

Making the Most of Your Deductions

As a sole trader, the income you earn with your ABN is added to any other income you have, and you’re taxed at progressive rates. For example, in Australia, the first $18,200 you earn is tax-free. For income between $18,201 and $45,000, you’re taxed at 16 cents for each dollar over that initial threshold. You can get the full rundown on the latest brackets on the ATO website. This structure is precisely why every deduction counts.

Here are some common tax-deductible expenses that ABN holders often claim:

Home Office Costs: A portion of your rent, electricity, and internet if you regularly work from home.

Vehicle Use: The costs of using your car for business, which you’ll need to track with a logbook.

Software & Subscriptions: Things like accounting software, design apps, or industry-specific memberships.

Professional Training: Any courses or workshops that directly help you improve your business skills.

A huge part of preparing your tax return is making sure your income is accounted for correctly. Learning about accurate pricing strategies is a great first step to ensuring your financial records are spot-on from the start.

The real game-changer is shifting your mindset from just earning money to strategically managing it. Good financial habits don't just maximise your tax return; they build a rock-solid foundation for your business's long-term health and success.

Taking this proactive approach means you’ll be prepared and confident when it's time to lodge your abn and tax return. To give you a head start, check out our detailed guide on how to maximise your tax return in Australia for more expert insights.

How to Lodge Your Business Tax Return

When tax time rolls around, you essentially have two main choices for lodging your abn and tax return. You can go it alone using the ATO's myTax portal, or you can bring in a registered tax agent for a professional touch. The right path really depends on your confidence level and how complex your business finances are.

For sole traders with simple, straightforward accounts, lodging through myTax is a popular option. The platform is built to walk you through the process, prompting you to fill out the business and professional items section. This is where you’ll declare all your ABN income and claim the deductions you've been carefully tracking all year.

Using a Tax Agent Versus DIY

On the other hand, partnering with a tax agent like us here at Baron Tax & Accounting comes with some serious perks. A good agent's expertise can be a game-changer, helping you uncover deductions you might have easily missed and making sure you get the best possible outcome.

One of the biggest advantages of using a registered tax agent is the extended lodgement deadline. This gives you valuable extra time to get everything in order, plus you get a professional set of eyes on your return, which dramatically cuts the risk of mistakes and potential ATO scrutiny.

Before you jump in, a quick checklist will help you get organised:

Income Records: Have all your invoices and statements that show what your business has earned.

Expense Receipts: Gather proof for every business-related purchase you've made.

Bank Statements: This includes both your business and personal accounts, especially if you've mixed funds.

Logbooks: A detailed logbook is a must if you plan to claim any vehicle use.

Having all this on hand makes the whole lodging process much smoother, whether you’re tackling it yourself or handing it over to a pro. For a full breakdown of the process, we cover everything in our guide to lodging a tax return in Australia with the ATO.

Common ABN Tax Mistakes and How to Avoid Them

Getting your ABN and tax return right is crucial, but a small slip-up can quickly turn into a massive headache with the ATO. The good news? Dodging the most common traps is simpler than you might think. It all comes down to building solid habits from day one to keep your business finances clean and audit-proof.

One of the biggest red flags we see is mixing personal expenses with business ones. Having an ABN doesn’t give you a free pass to claim everything you buy. For instance, claiming 100% of your car or mobile phone costs when you’re clearly using them for personal trips and chats is a direct route to getting unwanted attention from the ATO.

Forgetting to declare cash income is another classic mistake. It doesn't matter if you were paid in cash, by bank transfer, or through a third-party app—every single dollar your business earns must be reported. Not doing so can result in some pretty serious penalties.

Building Audit-Proof Habits

The secret to staying out of trouble is simple: keep meticulous records and draw a clear, bold line between your personal and business finances. This isn't just about ticking boxes for the tax man; it's about building a financially sound and resilient business.

To keep the ATO happy, focus on these key actions:

Keep a detailed logbook: If you use an asset like your car for both work and personal life, a logbook is non-negotiable. It's the only way to properly prove your business-use percentage.

Track every cent of income: Whether you use dedicated accounting software or a straightforward spreadsheet, you need a record of every single sale. No exceptions.

Question every expense: Before you claim a deduction, stop and ask yourself, "Was this purchase directly for earning my business income?" If the answer isn't a clear "yes," don't claim it.

There’s a common myth that an ABN is a magic wand that makes every purchase a tax deduction. The reality is that every single claim must be justified with records and have a direct link to your business activities.

Putting these simple practices in place creates a transparent and defensible record of your business's financial life. For a deeper look at what to prepare for this tax season, check out our guide to the 2024 tax return.

When to Partner with a Tax Professional

As your business grows, so does the complexity of your ABN and tax return. Juggling it all yourself might work for a while, but there are clear signs it’s time to bring in a professional. Think of it less as a cost and more as a strategic investment in your business's financial health and future.

This switch often becomes a no-brainer when you hit certain milestones. Registering for GST, for example, suddenly adds a whole new layer of reporting with Business Activity Statements (BAS). Hiring your first employee? Now you’ve got payroll tax and superannuation to worry about. A big jump in revenue or a change in your business structure are also key moments to call for backup.

Making the Strategic Switch

Deciding to hire an expert is a pivotal step in professionalising your business. It frees you up to focus on what you do best—running your company—while an expert handles your financial compliance. It's a proactive move that helps you structure your business for better tax outcomes and long-term growth.

And you wouldn't be alone. Millions of Australians rely on professional guidance every year.

As of April 2024, registered tax agents lodged over 8.1 million individual tax returns—that’s more than half of all lodgements. This just goes to show how many people count on expert help to manage their taxes effectively. You can dig into the numbers yourself with the official ATO lodgement statistics.

Bringing a professional on board means you have a partner who truly understands the ins and outs of tax law. When you decide it's time, being prepared makes all the difference.

If you're wondering how to find the right financial partner, our guide on choosing an accountant for your small business can help.

Common Questions About Your ABN and Tax Return

Once you've got the basics down, it’s the little details that often trip people up. Here are some of the most common questions we hear from sole traders and small business owners when it comes to managing their ABN and tax return.

Do I Really Need a Separate Bank Account for My ABN Income?

While the ATO doesn’t legally require sole traders to have one, our answer is always a firm yes, you absolutely should. Think of it as putting up a clear fence between your business and personal finances.

A separate account makes tracking income and pinpointing legitimate business expenses a breeze. When it comes to proving your claims to the ATO, it’s the difference between a smooth process and a bookkeeping nightmare. It’s the simplest, most effective step you can take for clean, stress-free financials.

What if I Have an ABN but Didn't Earn Any Income?

It’s a common scenario—you've registered your ABN, but the business hasn't taken off yet. Even if you earned zero business income for the financial year, you still need to lodge a tax return. You'll just declare $0 in the business income section.

Keep in mind, if you've stopped your business activities altogether, the ATO expects you to cancel your ABN within 28 days.

Why? An active ABN tells the ATO you're operating an enterprise. Lodging a return, even with $0 income, officially confirms your business status for that financial year and keeps your records straight.

Can I Claim Start-Up Costs from Before I Registered My ABN?

Yes, you often can! The ATO allows you to claim certain preliminary expenses you paid to get your business off the ground. They sometimes call these ‘blackhole expenditures’—costs that don't fit neatly into other categories but were essential for starting up.

These costs are usually claimed over a five-year period, not all at once in your first tax return. The rules here can be quite specific, so getting professional advice is crucial to make sure you claim everything correctly and stay compliant.

Speaking of compliance, understanding how your income affects your tax is vital. For a deeper dive, check out our comprehensive [Australian tax-free threshold guide](https://www.baronaccounting.com/post/australian-tax-free-threshold-guide).

Trying to figure out the ins and outs of your ABN and tax obligations can feel overwhelming, but you don't have to tackle it alone. The team at Baron Tax & Accounting is here to give you expert, affordable support to keep you compliant and get you the best possible outcome.

Comments