How to Register as a Self-Employed Sole Trader in Australia

- Jan 11

- 11 min read

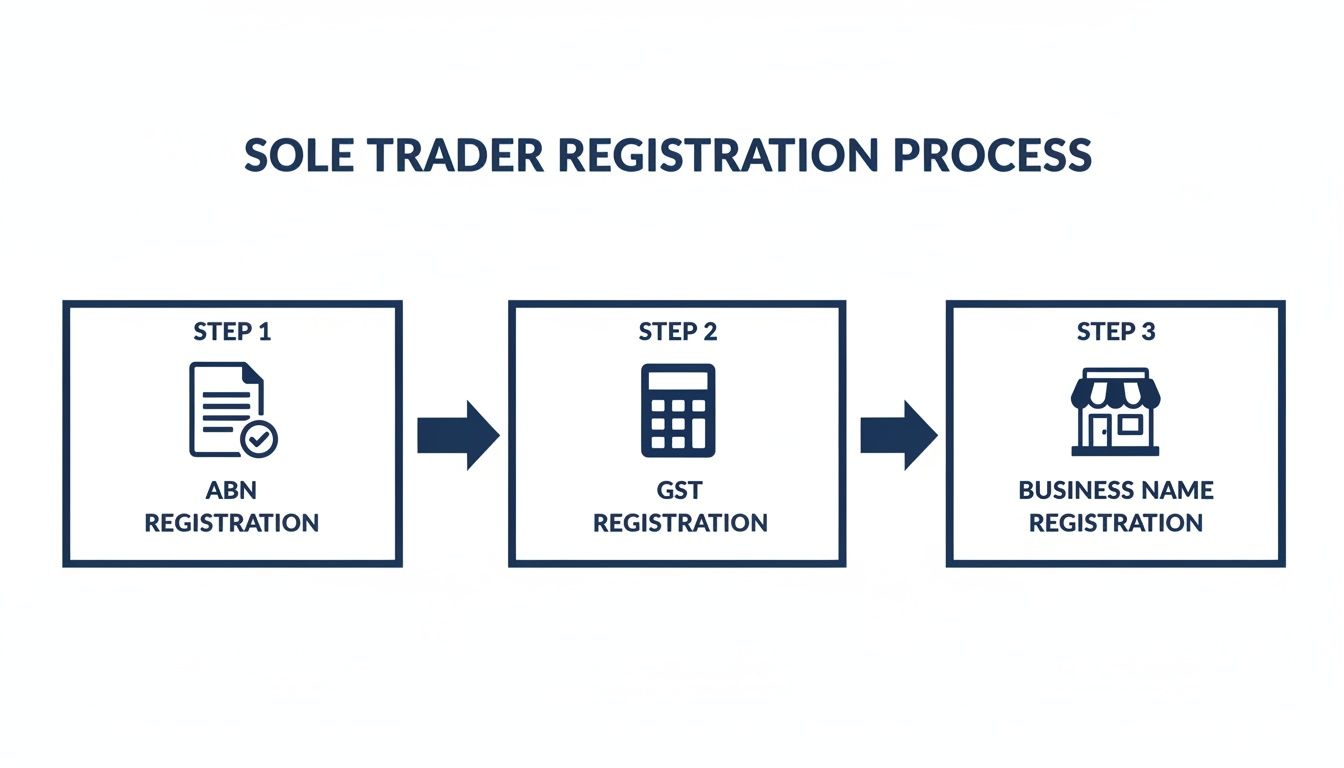

Thinking about becoming a self-employed sole trader in Australia? It's a popular and straightforward way to start a business, particularly for freelancers and contractors. However, operating legally requires careful setup. You'll need an Australian Business Number (ABN), must determine if you need to register for Goods and Services Tax (GST), and register a business name if you plan to trade under something other than your personal name.

This matters because incorrect registration can lead to significant compliance risks. The Australian Taxation Office (ATO) imposes penalties for failing to meet tax and reporting obligations, such as lodging tax returns or Business Activity Statements (BAS). Without proper registration, you may also face difficulties securing business loans or opening a business bank account. This guide provides a step-by-step process to ensure you establish a compliant and solid foundation for your new venture.

Your Step-by-Step Guide to Becoming a Sole Trader in Australia

Operating as a sole trader is the simplest business structure in Australia because you are the business. You have complete control over all decisions, and all profits (after tax) are yours. However, this simplicity comes with a critical responsibility you must understand from the outset.

Understanding the Core Concept: Unlimited Liability

As a sole trader, the legal concept of unlimited liability is paramount. Unlike a company, there is no legal separation between you and your business. In the eyes of the law, you are one and the same.

This has two major implications:

Total Control: You make all the decisions without needing to consult partners or a board of directors.

Personal Risk: You are personally responsible for all business debts. If your business cannot pay its suppliers or a loan, creditors can legally pursue your personal assets, such as your car, savings, or even your home.

Understanding this trade-off between control and personal risk is non-negotiable. It shapes the financial commitments you are personally making and helps prevent serious financial complications later on.

Why Correct Registration Matters

Following the correct process to register as a self-employed sole trader is not merely administrative. It legitimises your business with the ATO and other government agencies, creating a compliant foundation for all future operations.

Failure to register correctly can lead to severe consequences, including:

Penalties from the ATO for failing to lodge required tax returns or BAS.

Difficulties obtaining business finance or opening a bank account.

Illegal trading under an unregistered business name.

This guide will walk you through the mandatory registrations—ABN, GST, and business name—to ensure you are set up correctly from the start.

Now that the concept of unlimited liability is clear, it's time to make your business official. These registrations are the legal foundation of your operation and must be completed correctly to trade smoothly and remain compliant.

Each registration serves a distinct purpose and is managed by a specific government body.

Sole Trader Registration Checklist: ABN, GST, and Business Name

This table outlines the essential registrations, their purpose, the responsible government body, and when they are required.

Registration Item | Purpose | Governing Body | When It Is Required |

|---|---|---|---|

Australian Business Number (ABN) | Identifying your business to the government and other businesses for tax and invoicing. | Australian Business Register (ABR) | Before you begin any business activities or issue invoices. |

Goods and Services Tax (GST) | Collecting a 10% tax on most goods and services on behalf of the ATO. | Australian Taxation Office (ATO) | Mandatory if your annual turnover is $75,000 or more. Optional if below this threshold. |

Business Name | Legally trading under a name that is not your personal legal name. | Australian Securities and Investments Commission (ASIC) | Before you trade or advertise using your chosen business name. |

Let's examine each of these registrations in more detail.

Step 1: Your Australian Business Number (ABN)

The most crucial first step is obtaining an Australian Business Number (ABN). This unique 11-digit number identifies your business to the government and is essential for invoicing other businesses.

Without an ABN, other businesses are legally required by the ATO to withhold tax from your payments at the highest marginal rate, severely impacting your cash flow. An ABN is also a prerequisite for registering for GST and securing an Australian domain name. Applying for an ABN is free via the official Australian Business Register (ABR) website. It also signals to the ATO that you are operating a legitimate business, which is necessary for claiming tax deductions.

Recent data from the Australian Bureau of Statistics (ABS) highlights a significant trend, with over 63% of all actively trading businesses in Australia being non-employing businesses, the majority of which are sole traders. You can explore the latest data on Australian businesses from the ABS.

Step 2: Navigating Goods and Services Tax (GST)

Once you have an ABN, you must assess your GST obligations. This is managed by the ATO.

You must register for GST if:

Your annual business turnover (gross income before expenses) is $75,000 or more, or you project it will be.

You provide taxi or ride-sharing services (e.g., Uber), regardless of your turnover.

You want to claim fuel tax credits for your business.

You have 21 days to register for GST once you meet the $75,000 threshold.

If your turnover is below $75,000, you can register for GST voluntarily.

Expert Insight: Voluntary GST registration allows you to claim GST credits on business-related purchases (e.g., laptops, software, materials), effectively reducing their cost by 10%. The trade-off is the requirement to charge GST on your sales and lodge a regular Business Activity Statement (BAS) with the ATO.

For a detailed analysis, see our comprehensive guide to GST registration in Australia.

Step 3: Registering Your Business Name

The final step is registering a business name if you intend to trade under a name different from your own. This is a legal requirement managed by the Australian Securities and Investments Commission (ASIC).

For example, if your name is Jane Smith and you invoice as "Jane Smith," no business name registration is needed. However, if you wish to trade as "JS Designs" or "Smith Creative Solutions," that name must be registered. This registration protects your business name nationally and prevents others from using it, though it is different from a trademark. Trading under an unregistered name can result in penalties.

You can register your business name online through the ASIC service, which will be linked to your ABN. Always search the register first to ensure your desired name is available.

Keeping Up With Your Tax and Super Duties

Once you've officially registered as a self-employed sole trader, your focus must shift to ongoing compliance with the Australian Taxation Office (ATO). This involves managing your tax payments through Pay As You Go (PAYG) instalments and reporting your GST through the Business Activity Statement (BAS).

These systems are designed to help you manage your tax obligations throughout the year, preventing a large, unmanageable tax debt at the end of the financial year.

Getting Your Head Around Pay As You Go (PAYG) Instalments

After you lodge your first tax return with business income, the ATO will likely place you in the PAYG instalments system. This is not an additional tax but a method of prepaying your expected income tax in quarterly instalments. This system improves cash flow management and helps you avoid a substantial tax bill. The ATO calculates your initial instalment based on your last tax return, but you can vary this amount if your income changes significantly.

Expert Advice: A crucial habit for every sole trader is to set aside a portion of every payment received for tax. A good rule of thumb is 25-30%. Transferring this into a separate high-interest savings account ensures funds are available when your tax payments are due.

Nailing Your Business Activity Statement (BAS)

If you are registered for GST, lodging a BAS is a regular requirement, typically quarterly. This statement summarises your business's financial activity for the period.

On your BAS, you report:

The total GST collected on your sales.

The total GST paid on your business purchases.

Your PAYG instalment amount.

The net amount of GST collected versus paid determines whether you owe the ATO or are due a refund. Accurate and timely BAS lodgment is essential, as late or incorrect submissions can attract significant penalties from the ATO.

Don't Forget About Your Superannuation

As a sole trader, no one is required to make superannuation contributions on your behalf. This is a significant change from being an employee, where employers must contribute under the Superannuation Guarantee scheme. You are 100% responsible for funding your own retirement.

Ignoring superannuation is a major financial risk. It is highly recommended that you make personal concessional (before-tax) contributions to a super fund. These contributions are typically taxed at a concessional rate of 15%, which is often lower than your marginal income tax rate. Furthermore, you can generally claim a tax deduction for these contributions, reducing your overall taxable income for the year.

Mastering these financial responsibilities is critical for long-term success. ATO compliance and diligent cash-flow management are foundational to building a sustainable business.

Essential Bookkeeping and Record Keeping Habits

Effective financial management is the bedrock of a successful sole trader business. The Australian Taxation Office (ATO) legally requires you to keep detailed financial records for at least five years. This includes all sales invoices, expense receipts, and bank statements. Failure to comply can result in significant penalties.

Disciplined bookkeeping from the moment you register as a self employed sole trader is one of the smartest business decisions you can make.

Setting Up Your Financial Foundation

The first and most critical step is to open a separate bank account for your business. Mixing business and personal finances creates confusion, makes it difficult to track income and expenses accurately, and can raise red flags with the ATO. A dedicated business account provides a clear financial trail, simplifying tax preparation and financial analysis.

Choosing Your Record Keeping System

Your record-keeping system should match your business's complexity.

For simple operations: A well-designed spreadsheet may be sufficient for tracking income and expenses.

For growing businesses: Investing in accounting software like Xero, MYOB, or QuickBooks is highly recommended. These platforms automate invoicing, expense tracking, and can simplify BAS preparation.

The objective is to have a system that provides an accurate, real-time snapshot of your financial health. This data is crucial for making informed business decisions.

Mastering Tax-Deductible Expenses

A key benefit of being a sole trader is the ability to claim deductions for business-related expenses, which reduces your taxable income. However, you must be able to substantiate every claim with a record, such as a receipt or invoice.

Common deductible expenses for a sole trader include:

Vehicle and travel costs: Expenses related to using your car for business purposes.

Home office expenses: A portion of utility and occupancy costs if you work from home.

Tools and equipment: The cost of items necessary for your work.

Professional development: Fees for training that improves skills relevant to your business activities.

If audited by the ATO, you must produce evidence for any deduction claimed. A good practice is to digitise all receipts by taking a photo or scan to prevent them from being lost or fading.

Is The Sole Trader Structure Right for You?

Before registering, it is wise to confirm that the sole trader structure is the best fit for your circumstances. While its simplicity is appealing, the associated unlimited liability may not be suitable for every business. Considering alternatives like a company or partnership from the start ensures your business is built on the right legal and financial foundation.

Weighing the Pros and Cons

The primary benefit of the sole trader structure is its simplicity. Setup is fast and inexpensive, and ongoing administrative requirements are minimal compared to other structures. Profits are taxed at your personal marginal tax rate, which can be advantageous for those in lower income brackets.

The main disadvantage is unlimited liability. Because you and the business are legally indistinct, your personal assets are at risk to cover business debts or legal claims. This is a critical consideration for businesses in high-risk industries or those planning to take on significant debt.

Sole Trader vs Company: A Quick Comparison

Many new business owners weigh the sole trader structure against a proprietary limited (Pty Ltd) company. A company is more complex and expensive to establish and maintain, but it offers crucial legal protection.

Key benefits of a company structure:

Asset Protection: A company is a separate legal entity, meaning your personal assets are generally protected from business debts. This is known as limited liability.

Tax Rates: Companies are taxed at a fixed corporate rate (currently 25% for eligible small businesses), which can be lower than higher personal income tax rates.

Perception and Growth: A 'Pty Ltd' designation can enhance business credibility and is often necessary for raising capital or bringing in investors.

The main drawbacks are higher setup costs and stricter annual compliance obligations with both the ATO and ASIC, leading to increased accounting fees.

The decision depends on your risk tolerance and business goals. A sole trader structure is an excellent starting point for low-risk ventures. However, if your business involves significant debt, employees, or potential liabilities, the protection of a company structure is invaluable.

Sole Trader vs Company vs Partnership: A Structural Comparison

This table provides a high-level comparison of the main business structures in Australia.

Feature | Sole Trader | Company (Pty Ltd) | Partnership |

|---|---|---|---|

Legal Status | You and the business are a single entity. | A separate legal entity from its owners (shareholders). | Two or more owners; not a separate legal entity. |

Liability | Unlimited. Personal assets are fully at risk. | Limited. Personal assets are generally protected. | Unlimited. All partners are jointly and severally liable. |

Tax | Taxed at personal marginal income tax rates. | Taxed at the fixed corporate tax rate (25% for small businesses). | Each partner pays tax on their share of the net profit. |

Setup Cost | Very low (ABN and business name registration). | Higher (ASIC registration and legal/accounting fees). | Low, but a formal partnership agreement is crucial. |

Administration | Minimal and straightforward. | Complex annual compliance with ASIC and the ATO. | Moderate; requires careful management and a partnership agreement. |

Is a Partnership a Better Fit?

A partnership involves two or more individuals carrying on a business together. It allows for the pooling of capital and skills. However, partners typically have unlimited liability, meaning you are personally liable for business debts, including those incurred by your partners. A comprehensive, legally drafted partnership agreement is essential to govern the relationship and responsibilities.

Choosing the right structure is a critical decision. For a more detailed comparison, our guide on choosing between a sole trader vs company in Australia provides further analysis.

FAQ: Registering as a Self-Employed Sole Trader

Starting as a sole trader often raises many questions. Here are clear answers to some of the most common queries we receive.

How Long Does It Take to Get an ABN?

Applying for an Australian Business Number (ABN) through the Australian Business Register (ABR) website is typically fast. If all your information is correct and your identity can be verified electronically, you may receive your ABN immediately upon submission. However, if there are discrepancies or manual checks are required, the process can take up to 28 days. To avoid delays, ensure all details, including your Tax File Number (TFN), are accurate before applying.

What are the Penalties for Missing a BAS Deadline?

Missing a Business Activity Statement (BAS) deadline can result in a Failure to Lodge (FTL) penalty from the Australian Taxation Office (ATO). According to the ATO, the penalty is calculated at one penalty unit (currently $313) for every 28-day period (or part thereof) that the BAS is overdue, up to a maximum of five penalty units ($1,565 for small entities). If you anticipate missing a deadline, it is crucial to contact the ATO or your tax agent proactively to request an extension or discuss a payment plan.

How Do I Pay Myself as a Sole Trader?

As a sole trader, you do not pay yourself a formal wage or salary. Because you and the business are the same legal entity, all profits are considered your personal income. To pay yourself, you simply transfer funds from your business bank account to your personal account. These transactions are known as 'drawings' and are not classified as a business expense, meaning they are not tax-deductible. You are taxed on the total net profit of your business for the financial year, regardless of the amount you draw.

Is Business Insurance Required for a Sole Trader?

While not legally required to obtain an ABN, operating without appropriate business insurance is a significant risk due to unlimited liability. The specific insurance needed depends on your industry and business activities.

Public Liability Insurance: Essential if you interact with the public, clients visit your premises, or you work on-site. It covers claims of injury or property damage caused by your business activities.

Professional Indemnity Insurance: Crucial for those providing professional advice or services (e.g., consultants, designers). It protects against claims of financial loss due to your alleged negligence or errors.

Personal Accident and Illness Insurance: As a sole trader, you do not have access to paid sick leave or workers' compensation. This insurance provides an income if you are unable to work due to injury or illness.

Seeking advice from a qualified insurance broker is a vital step in protecting your business and personal assets.

Navigating the requirements to become a sole trader can be complex. At Baron Tax and Accounting, we specialise in providing clear, practical advice to help you start and grow your business with confidence. For personalised assistance with your ABN, GST, tax, and superannuation obligations, please contact our team.

Baron Tax and Accounting Website: https://www.baronaccounting.com Email: info@baronaccounting.com Phone: +61 1300 087 213 Whatsapp: 0450468318 Line: Barontax

Comments