Family Trust vs Company: Which Australian Structure is Right for You?

- Jan 10

- 11 min read

Choosing between a family trust and a company in Australia involves a critical trade-off. A trust offers superior tax flexibility and valuable Capital Gains Tax (CGT) benefits, while a company provides simpler profit retention and a distinct legal identity. Your choice will fundamentally shape how you manage assets, protect your wealth, and meet your obligations to the Australian Taxation Office (ATO) for years to come.

This decision is one of the most important an Australian entrepreneur or investor will make, dictating everything from annual tax liabilities and asset protection to long-term compliance costs. Mismanagement carries significant risks, such as director penalty notices from the ATO for companies or the punitive Family Trust Distribution Tax if a trust is not handled correctly according to strict ATO guidelines.

Comparing the Core Structures: Family Trust vs Company

A company is a separate legal entity, distinct from its owners (shareholders) and managers (directors), as defined by the Corporations Act 2001 and regulated by the Australian Securities and Investments Commission (ASIC). It can own assets, incur debt, and engage in legal action in its own name.

A family trust is a legal relationship established by a trust deed, where a trustee holds assets on behalf of beneficiaries (family members). This distinction is key to their unique advantages and disadvantages. For a broader overview, explore our guide on Australian business structures.

According to ATO data for the 2021-22 financial year, over 987,000 trusts were active in Australia, reporting total business income of over $515 billion, highlighting their popularity for flexible income management.

Here is a clear comparison based on ATO and ASIC regulations:

Feature | Family Trust | Company |

|---|---|---|

Legal Status | A legal relationship governed by a trust deed. | A separate legal entity under the Corporations Act 2001. |

Asset Ownership | Trustee holds assets for beneficiaries. | Company owns assets in its own right. |

Tax on Profits | Profits are distributed and taxed at beneficiaries' marginal rates. | Profits are taxed at the flat corporate rate (currently 25% for eligible SMEs). |

Profit Retention | Must distribute all income annually to avoid penalty tax. | Can retain profits for reinvestment after paying corporate tax. |

CGT Discount | Eligible beneficiaries can access the 50% CGT discount. | Not eligible for the 50% CGT discount. |

Regulatory Body | Governed by its trust deed and ATO rules. | Regulated by ASIC and the ATO. |

Legal Structure: Entity vs Relationship

Understanding the fundamental legal nature of a company versus a trust is essential. A company, recognised as a separate legal entity under the Corporations Act 2001, can own assets, sign contracts, and incur debt entirely in its own name, separate from its shareholders and directors.

A trust, conversely, is a legal relationship. It is an obligation set out in a trust deed where a trustee (an individual or a company) holds assets for the benefit of beneficiaries. The trust itself cannot own anything; the trustee holds legal title to the assets but must manage them according to the deed for the beneficiaries' benefit.

Control and Ownership Explained

This core difference—entity versus relationship—directly impacts control and financial benefits.

In a company, the roles are clearly defined by corporate law:

Shareholders are the owners, holding shares that represent their portion of the company's value.

Directors, appointed by shareholders, manage the company's day-to-day operations and are bound by strict duties under the Corporations Act 2001. For more on these duties, see our guide to registering a company in Australia.

In a family trust, the roles are more interconnected:

The Trustee has legal control and manages the assets, deciding on investments and distributions. A corporate trustee is often used for enhanced asset protection.

The Beneficiaries (usually family members) can receive income or capital. They do not legally own the assets but have a right to be considered for distributions.

The Appointor holds ultimate control, with the power to appoint and remove the trustee, ensuring the trustee acts in the beneficiaries' best interests.

This separation of legal ownership (trustee) and beneficial enjoyment (beneficiaries) is a trust's primary strength, providing both asset protection and tax flexibility. A company's profits belong to the company until formally distributed as dividends. Understanding this is the first step in choosing the right structure.

A Detailed Tax Comparison for Business Owners

The tax treatment of a family trust versus a company directly impacts your financial efficiency and compliance with ATO regulations.

Core Tax Treatment and Income Flow

A company is a separate taxpayer. It earns profit and pays tax at a fixed corporate rate—currently 25% for businesses with an aggregated turnover under $50 million. After-tax profits can be retained within the company for reinvestment.

A family trust acts as a conduit for income. It typically does not pay tax itself but must distribute all net income to its beneficiaries before 30 June each year. Beneficiaries then report this income on their personal tax returns and pay tax at their individual marginal rates, which can be up to 47% (including the Medicare levy).

Profit Retention vs. Division 7A

A company is ideal for retaining profits. It can build cash reserves for expansion or manage cash flow by holding onto post-tax profits.

A trust must distribute all its net income annually. Failure to do so results in the trustee being taxed at the highest marginal rate, a penalty designed to enforce its flow-through nature.

For profitable businesses needing to retain capital, a company’s 25% tax rate is highly effective. Trusts must distribute all net income, which can create high tax liabilities if there are limited low-tax beneficiaries.

However, companies face a significant compliance risk: Division 7A of the Income Tax Assessment Act 1936. These complex ATO rules prevent shareholders or their associates from taking money from the company as tax-free "loans." Such payments can be deemed unfranked dividends and taxed at personal marginal rates, negating the benefit of the corporate tax rate.

The Capital Gains Tax (CGT) Advantage for Trusts

While companies excel at retaining trading income, trusts hold a significant advantage when selling assets: the 50% Capital Gains Tax (CGT) discount.

If a family trust holds an asset (e.g., property, shares) for more than 12 months, the capital gain from its sale can be halved before distribution. The individual beneficiaries then pay tax on their share of the discounted gain.

A company is not eligible for this discount. It pays tax on 100% of the capital gain at the corporate rate. This makes a trust a more tax-effective vehicle for holding long-term growth assets.

Strategic Use of a Bucket Company

A hybrid structure can offer the best of both worlds. A family trust operates the business, and a "bucket company" is named as one of its beneficiaries.

Example:

A family trust generates $200,000 in profit.

It distributes $50,000 each to two adult children with no other income, who pay tax at low marginal rates.

The remaining $100,000 is distributed to the bucket company, which pays tax at the 25% corporate rate.

This strategy caps the tax on the retained portion of the profit at 25%, providing the flexibility of a trust with the profit retention benefits of a company.

Comparative Analysis: Family Trust vs Company

Feature | Family Trust | Company |

|---|---|---|

Primary Tax Treatment | A conduit; income is taxed in the hands of beneficiaries at their marginal rates. | A separate legal entity; pays tax on profits at the corporate rate (25% for eligible SMEs). |

Profit Retention | Must distribute all net income annually to avoid penalty tax. | Can retain profits after paying corporate tax, ideal for business reinvestment. |

Capital Gains Tax (CGT) | Eligible for the 50% CGT discount on assets held over 12 months. | Not eligible for the 50% CGT discount. |

Key Tax Risk | Ensuring valid distributions are made by 30 June; high tax if beneficiaries are on high marginal rates. | Division 7A rules on loans or payments to shareholders and associates. |

Income Splitting | Excellent flexibility to stream income to various family members annually. | Less flexible; profits are distributed as dividends in proportion to shareholding. |

Comparing Asset Protection and Liability

A primary reason for moving beyond a sole trader structure is asset protection. Both companies and trusts can create a firewall between business debts and personal assets, but they achieve this differently.

The Company and Its Corporate Veil

A proprietary limited company offers a shield known as the ‘corporate veil’. The company is a separate legal person, meaning its debts and liabilities belong to it, not the directors or shareholders. Creditors can generally only pursue assets owned by the company.

However, this veil can be pierced in specific circumstances:

Insolvent Trading: Directors can be held personally liable if they allow the company to incur new debts when they know it is insolvent.

Personal Guarantees: Directors often sign personal guarantees for loans or leases, making them personally responsible for the company's default.

ATO Director Penalty Notices: The ATO can hold directors personally liable for unpaid Pay As You Go (PAYG) withholding and superannuation guarantee charge (SGC) obligations.

How a Family Trust Protects Assets

A family trust provides asset protection through the separation of legal and beneficial ownership. Assets are legally owned by the trustee but held for the benefit of beneficiaries.

If a beneficiary faces bankruptcy or legal action, creditors generally cannot claim trust assets because the beneficiary does not legally own them; they only have a right to be considered for distributions.

The core strength of a trust lies in this separation. Since beneficiaries don't legally own the trust's assets, those assets are shielded from claims arising from a beneficiary's personal or business dealings.

This makes trusts highly effective for protecting family wealth. For specific applications, our guide on buying property through a trust offers further detail.

The Ultimate Protection: The Corporate Trustee

For the most robust asset protection, a family trust with a corporate trustee (a company established solely to act as trustee) is recommended. This creates two layers of protection:

Trust-Level Protection: Trust assets are separate from the personal assets of any beneficiary.

Trustee-Level Protection: The trustee’s liability is limited to the assets held by the trustee company itself. As this company holds no significant assets of its own, creditor claims are effectively quarantined.

An individual trustee's personal assets are at risk if the trust incurs liabilities it cannot cover. A corporate trustee mitigates this risk.

Costs and Compliance Obligations You Must Know

Choosing a structure comes with ongoing financial and administrative responsibilities mandated by ASIC and the ATO. Failure to comply can result in significant penalties.

Getting Started: Upfront Costs

A company setup involves:

ASIC Registration Fee: The government fee to incorporate the company.

Legal Documents: Costs for drafting a company constitution and shareholder agreements.

A family trust setup typically involves:

Drafting the Trust Deed: A solicitor is required to draft a compliant and robust trust deed.

Setting up a Corporate Trustee: This includes the ASIC fee to register the trustee company.

Ongoing Compliance and Annual Fees

A company has clear, recurring obligations to ASIC:

Annual Review Fee: An annual fee paid to ASIC to maintain registration.

Solvency Declaration: Directors must pass an annual solvency resolution.

Record Keeping: Companies must maintain detailed financial records, meeting minutes, and member registers as per the Corporations Act 2001.

A family trust’s compliance is primarily governed by its deed and ATO rules:

Annual Distribution Resolutions: The trustee must resolve and document how trust income will be distributed to beneficiaries before 30 June each year. Failure to do so can result in the trustee being taxed at the highest marginal rate.

Trust Deed Adherence: The trust must be managed strictly in accordance with its deed.

The nature of compliance differs significantly. Company duties are largely procedural tasks for ASIC. A trust’s critical duty—the annual distribution resolution—is a major legal and financial decision with severe tax consequences if mishandled.

Our small business compliance checklist provides a framework for managing these obligations.

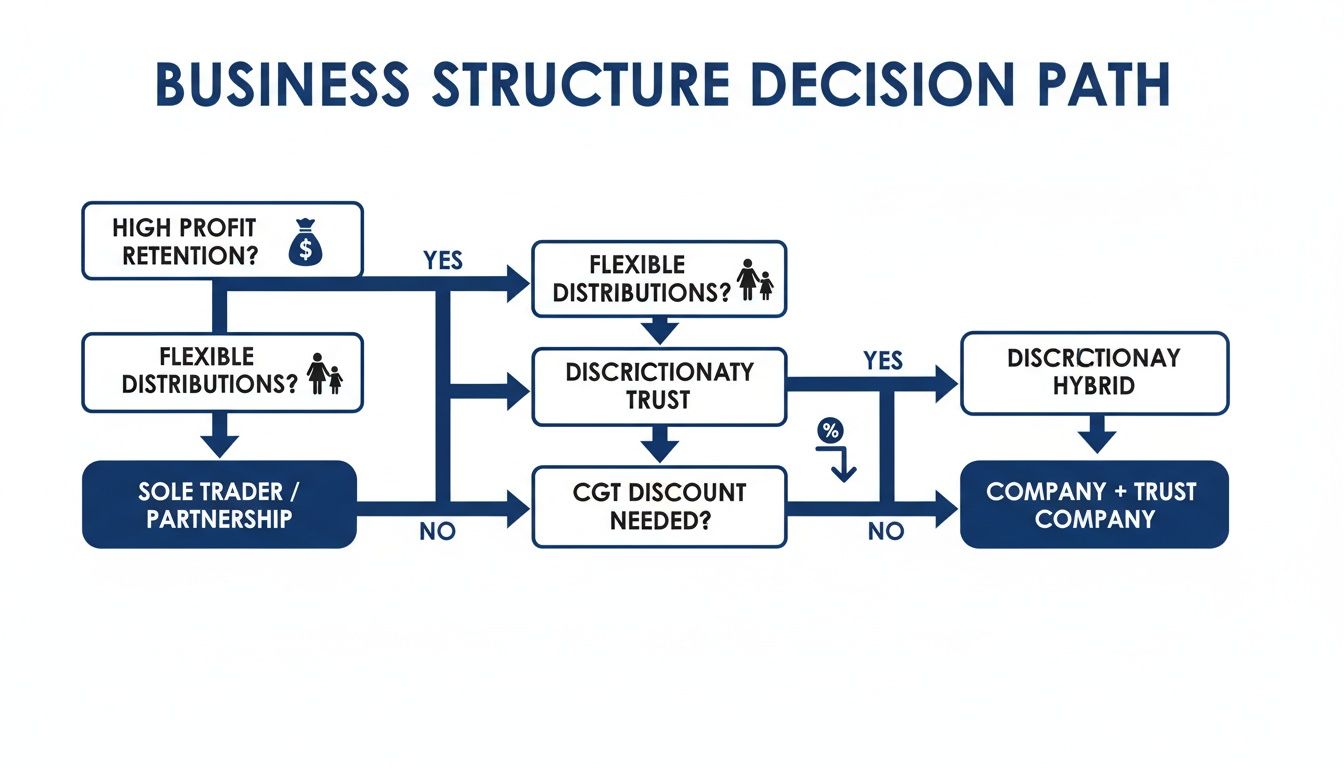

Which Structure Is Right for You? A Practical Guide

The optimal structure depends entirely on your specific business goals, investment strategy, and family situation.

Scenario 1: The Family-Run Small Business

Goal: Distribute profits tax-effectively to support the family, including university-aged children with low incomes.

Recommendation: Family Trust.

Reason: The trust can stream income to family members on lower marginal tax rates, utilising their tax-free thresholds and minimising the family's overall tax burden. This is far more efficient than director salaries or company dividends taxed at higher personal rates.

Scenario 2: The High-Growth Startup

Goal: Reinvest all profits back into the business for growth and potentially seek external investment.

Recommendation: Proprietary Limited Company.

Reason: A company can retain profits after paying the 25% corporate tax rate, which is essential for funding growth. A trust's mandatory annual distributions would make this impossible. Furthermore, issuing shares to investors is straightforward in a company structure.

Scenario 3: The Long-Term Property Investor

Goal: Build a portfolio of investment properties to hold for long-term capital growth.

Recommendation: Family Trust.

Reason: The 50% Capital Gains Tax (CGT) discount is the key advantage. When the properties are sold after being held for over 12 months, the trust can pass this significant concession to its beneficiaries, substantially reducing the tax payable. A company is not eligible for this discount.

The decision pivots on your primary objective. For flexible income splitting and CGT efficiency, a trust excels. For capital retention and scalability, a company's structure is purpose-built.

FAQ: Family Trust vs Company in Australia

Can a family trust run a business in Australia?

Yes, it is a common and effective way to structure a family business. Typically, a corporate trustee (a company) is established to manage the business operations on behalf of the trust. This provides limited liability protection for the individuals involved while allowing for flexible profit distribution through the trust. The arrangement must be managed according to the trust deed and ATO regulations.

Does Division 7A affect family trusts?

Division 7A of the Income Tax Assessment Act 1936 applies specifically to private companies to prevent tax-free distributions to shareholders via loans. It does not directly apply to trusts. However, it becomes a critical issue if a family trust distributes income to a corporate beneficiary (a "bucket company"), and that company then lends money back to the trust or its beneficiaries. Those loans must comply with strict Division 7A rules (e.g., have a formal loan agreement and minimum interest rate) or the ATO will treat them as taxable unfranked dividends.

Is it better to own investment properties in a trust or a company?

For most long-term property investors in Australia, a discretionary (family) trust is superior. The primary reason is access to the 50% Capital Gains Tax (CGT) discount for assets held longer than 12 months. A trust can distribute this discounted capital gain to beneficiaries, significantly lowering the tax liability. A company is not eligible for the CGT discount and pays tax on 100% of the capital gain at the corporate rate.

How do I choose between a sole director company and a family trust?

The choice depends on your financial goals.

Sole Director Company: Ideal for business growth through profit retention. You can reinvest earnings in the company after they are taxed at the 25% corporate rate. It is a simple, clean structure for expansion.

Family Trust: Best for tax-effective profit distribution and holding appreciating assets. Its strength lies in income splitting among family members to minimise the overall family tax bill and leveraging the 50% CGT discount on asset sales.

Summary: Key Takeaways

The decision between a family trust and a company requires careful consideration of your financial objectives and compliance capacity.

A family trust excels at:

Tax-effective income splitting among family members.

Accessing the 50% Capital Gains Tax (CGT) discount for long-term investments.

Asset protection by separating legal ownership from beneficial enjoyment.

A company is superior for:

Retaining profits for business growth at the fixed corporate tax rate.

Providing a clear legal structure (the corporate veil) for liability protection.

Attracting external investment through the issuance of shares.

There is no single "best" answer. An incorrect structure can lead to higher taxes, unnecessary compliance costs, or inadequate asset protection. This strategic decision must align with your long-term vision and be compliant with ATO and ASIC regulations.

Get Expert Guidance on Your Business Structure

Choosing the right structure is a critical foundation for your financial success. The complexities of Australian tax and corporate law mean that professional advice is not just recommended—it's essential.

Our team at Baron Tax and Accounting specialises in helping SMEs, family businesses, and investors navigate these decisions. We can help you build a compliant, tax-effective structure that aligns perfectly with your goals.

Contact Baron Tax and Accounting for a consultation.

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213