Sole Trader vs Company in Australia: Which Structure is Right for You?

- 1 day ago

- 8 min read

Deciding whether to operate as a sole trader or a company is a critical decision for any Australian business owner. This choice fundamentally shapes your tax obligations, personal liability, and administrative responsibilities. Understanding the differences is not just about paperwork; it's about setting up your business for success while managing compliance risks enforced by the Australian Taxation Office (ATO) and the Australian Securities and Investments Commission (ASIC).

Why does this matter? Choosing the wrong structure can lead to unnecessary tax burdens, expose your personal assets to business risks, and create significant administrative headaches. For instance, operating as a sole trader when a company structure is more appropriate could mean paying more tax and putting your family home at risk if the business fails. Conversely, setting up a company too early can saddle you with compliance costs and complexities you don't need. Key compliance risks include incorrect tax reporting, failure to meet director's duties under the Corporations Act 2001, and potential penalties for insolvent trading.

This guide will provide a clear, step-by-step comparison based on current Australian regulations to help you make an informed decision.

Key Differences at a Glance

This table provides a high-level overview of the critical distinctions between operating as a sole trader and a proprietary limited (Pty Ltd) company in Australia.

Feature | Sole Trader | Company (Pty Ltd) |

|---|---|---|

Legal Status | You and the business are a single legal entity. | A separate legal entity from its owners (shareholders). |

Liability | Unlimited personal liability for all business debts. | Liability is limited to the company's assets. Personal assets of directors and shareholders are generally protected. |

Tax Rate | Taxed at your individual marginal income tax rates (0% to 45% + Medicare levy). | Taxed at the flat corporate rate. For the 2023-24 financial year, this is 25% for base rate entities. |

Setup Cost | Low. Registering for an Australian Business Number (ABN) is free. | Higher. Requires ASIC registration fees (currently over $500). |

Ongoing Compliance | Simple. Report business income on your individual tax return. | More complex. Requires annual ASIC reviews, separate company tax returns, and adherence to the Corporations Act 2001. |

Asset Protection | None. Personal and business assets are legally the same. | Strong protection for personal assets from business debts and lawsuits, known as the "corporate veil". |

Legal Status and Asset Protection: Understanding Your Risk

The most significant difference between a sole trader and a company is their legal status. This distinction is the foundation for asset protection, liability, and how your business is perceived by lenders, clients, and regulators like the ATO and ASIC.

The Sole Trader: Simplicity with Unlimited Liability

As a sole trader, you are the business. In the eyes of the law, there is no separation between you and your business operations. This structure is simple to set up and manage, which is its main appeal.

However, this simplicity comes with a major risk: unlimited personal liability. If your business incurs debts it cannot pay, creditors can legally pursue your personal assets to recover the funds. This includes your family home, car, and personal savings.

Practical Example: A sole trader landscaper accidentally causes significant damage to a client's property. If their public liability insurance is insufficient to cover the claim, the client can sue the landscaper personally. A court judgment could force the sale of the landscaper's personal assets to pay the damages.

This exposure is a critical compliance risk. For more details on your obligations, refer to our guide to ABN and tax return obligations.

The Company: A Separate Legal Entity with Limited Liability

A proprietary limited (Pty Ltd) company is a distinct legal entity, separate from its owners (shareholders) and managers (directors). This structure is established under the Corporations Act 2001 and is regulated by ASIC.

The key benefit is limited liability, which creates a "corporate veil" between the business and your personal finances. If the company fails or is sued, creditors can generally only claim against the company's assets. Your personal assets remain protected.

Practical Example: If the same landscaper operated as a company, the lawsuit would be against "Landscaper Pty Ltd". Any financial liability would be limited to the assets owned by the company (e.g., its tools, vehicles, and bank account). The director's personal home and savings would be shielded from the claim.

Exceptions to Limited Liability: The corporate veil is not absolute. Directors can be held personally liable in cases of:

Insolvent Trading: Allowing the company to incur debts when it is unable to pay them.

Director's Guarantees: Personally guaranteeing a business loan or lease.

Breaches of Director's Duties: Engaging in fraudulent or reckless behaviour.

Tax Obligations: A Comparison of Rates and Rules

Your choice of business structure directly impacts how much tax you pay and how you report your income to the ATO.

How Sole Traders Are Taxed

As a sole trader, your business profit is treated as your personal income. It is added to any other income you earn and taxed at your individual marginal tax rates.

Tax Rates: For the 2023-24 financial year, these rates range from 0% to 45%.

Medicare Levy: You must also pay the Medicare levy, currently 2% of your taxable income.

Reporting: Business income is declared in the business and professional items schedule of your individual tax return.

Practical Example: A sole trader earns a net profit of $120,000.

This amount is added to their personal taxable income.

Based on 2023-24 ATO rates, the income tax is approximately $29,467.

The Medicare levy is $2,400 (2% of $120,000).

Total Tax Payable: ~$31,867.

How Companies Are Taxed

A company pays tax on its own profits at a flat corporate tax rate.

Tax Rate: For base rate entities (companies with an aggregated turnover of less than $50 million), the tax rate for 2023-24 is 25%.

Reporting: The company must lodge a separate company tax return.

Practical Example: A company earns a net profit of $120,000.

The company pays corporate tax of $30,000 (25% of $120,000).

Total Tax Payable: $30,000.

This leaves $90,000 as after-tax profit within the company.

Accessing Profits from a Company

The money left in the company after tax is not yours to spend personally. To access it, you must formally distribute it in an ATO-compliant way:

Salary or Wages: The company can pay you a salary as a director. This is a tax-deductible expense for the company, but you will pay personal income tax on it. The company must also meet PAYG withholding and superannuation obligations.

Dividends: The company can distribute after-tax profits to shareholders as dividends. These often come with franking credits, which offset the personal tax payable by the shareholder.

Incorrectly taking money from a company can lead to severe penalties under Division 7A of the tax act. For compliance dates, check out our guide on Australia's company tax return deadline.

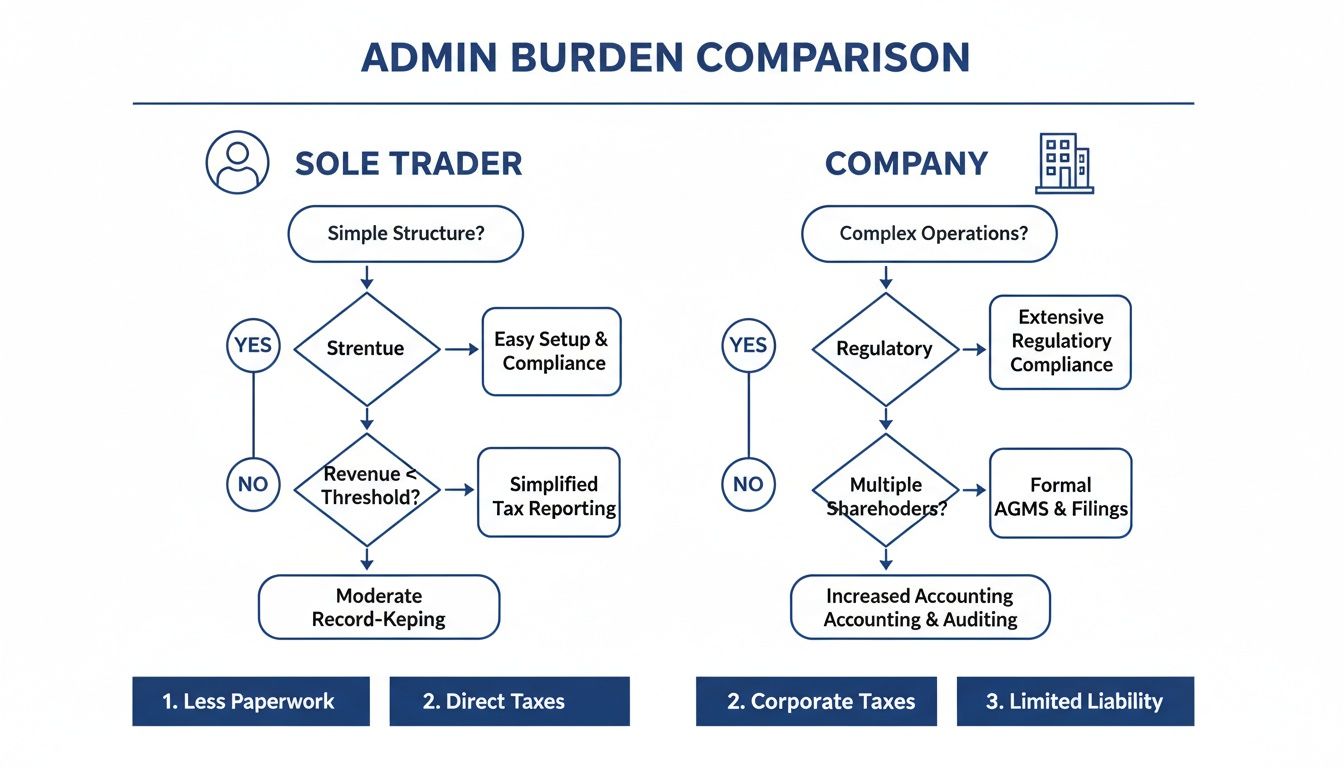

Costs and Administrative Burden

The day-to-day reality of running your business is heavily influenced by the administrative requirements of your chosen structure.

Sole Trader: Simple and Low-Cost

Setup: Free ABN registration via the Australian Business Register (ABR). A small fee is required to register a business name with ASIC if not using your personal name.

Ongoing Compliance: Minimal. Lodge one individual tax return annually. There are no annual review fees.

Superannuation: You are responsible for your own superannuation contributions. This is not mandatory, which can be a significant long-term risk.

Company: Formal and Higher-Cost

Setup: Must be registered with ASIC, which involves a fee (over $500).

Ongoing Compliance: Significant. This includes lodging a separate company tax return, paying an annual ASIC review fee (over $300), maintaining detailed financial records, and complying with director's duties.

Superannuation: If you are paid a salary as a director, the company is required by law to pay the Superannuation Guarantee (currently 11% for 2023-24) into your nominated fund.

Making the Right Choice: A Practical Checklist

Use this checklist to determine which structure best fits your business needs.

1. What is your expected annual profit?

Under $100,000: A sole trader structure is often more straightforward and tax-effective.

Over $120,000: A company structure may offer significant tax savings due to the flat 25% corporate rate, allowing more profit to be retained for growth.

2. What is your personal risk tolerance?

Low Risk (e.g., freelance writer): A sole trader structure might be acceptable if you have minimal debt and low liability exposure.

High Risk (e.g., construction, manufacturing, professional services): A company structure is highly recommended to protect your personal assets from business lawsuits and debts.

3. Do you plan to hire employees or raise capital?

Hiring Staff: A company provides a formal structure for managing payroll, superannuation, and workers' compensation obligations.

Raising Capital: A company is essential. It is the only structure that allows you to issue shares to investors to raise funds. You cannot sell a stake in a sole trader business.

Frequently Asked Questions (FAQ)

1. Can I change from a sole trader to a company later? Yes, this is a common pathway for growing businesses. The process involves registering a new company with ASIC and transferring your business assets (like the business name and client list) to it. However, this transfer can trigger a Capital Gains Tax (CGT) event. The ATO provides small business CGT concessions, but it is crucial to seek professional advice to manage the tax implications.

2. What happens if my sole trader business fails? As a sole trader, you have unlimited personal liability. If your business cannot pay its debts, creditors can legally pursue your personal assets, including your home and savings, to settle the outstanding amount. According to the Australian Financial Security Authority (AFSA), business-related debt is a common cause of personal bankruptcy.

3. Does a company structure make it easier to get a business loan? Not necessarily for new businesses. While a company appears more formal, most banks will require a personal guarantee from the director(s) for a business loan. This guarantee legally obligates you to repay the debt personally if the company defaults, effectively bypassing the corporate veil for that specific loan.

4. As a sole trader, do I need a separate bank account for my business? While not legally required by the ATO, it is a non-negotiable best practice. Using a separate business bank account creates a clear audit trail, simplifies bookkeeping, ensures you claim all legitimate deductions, and prevents the common error of mixing personal and business expenses.

5. What are my superannuation obligations as a director vs. a sole trader? A sole trader is responsible for their own retirement savings; there is no legal requirement to make super contributions. For a company director paid a salary, the company must pay the Superannuation Guarantee (SG) on top of their wages, just like any other employee. This is a strict legal requirement enforced by the ATO.

Summary: Key Takeaways

Choosing between a sole trader and a company structure is a foundational decision with long-term consequences.

Choose Sole Trader if:

You are just starting out with low profit forecasts.

Your business has low risk and minimal debt.

You value simplicity and low administrative costs above all else.

Choose Company if:

Your business is profitable (e.g., over $120,000 per year) and you want to reinvest profits tax-effectively.

You operate in a high-risk industry and need to protect your personal assets.

You plan to hire employees, raise capital, or eventually sell the business.

Get Personalised Advice

The information in this guide is general in nature. Your ideal business structure depends on your unique financial situation, industry, and long-term goals. Making the right choice from the start can save you thousands in tax and protect your personal wealth.

Contact us for tailored advice to ensure your business is structured for success.

Baron Tax and Accounting

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213

Comments