How to Register a Foreign Company in Australia: A Practical Guide

- Jan 10

- 12 min read

Expanding your business into Australia requires a critical decision before any paperwork is filed: will you operate as a foreign branch or establish a new Australian subsidiary? This choice is not a mere formality; it carries significant legal and financial consequences affecting your company's liability, tax obligations, and ongoing administrative burden. Failure to understand these implications can lead to compliance risks and financial penalties under Australian law.

This guide provides a step-by-step overview of the foreign company registration process in Australia, adhering to the requirements set by the Australian Securities and Investments Commission (ASIC) and the Australian Taxation Office (ATO).

Choosing Your Australian Business Structure

The first strategic move for any overseas company entering the Australian market is deciding on its legal identity. This decision fundamentally defines your risk exposure and operational flexibility. The core question is whether to operate as a direct extension of your parent company or create a legally separate local entity.

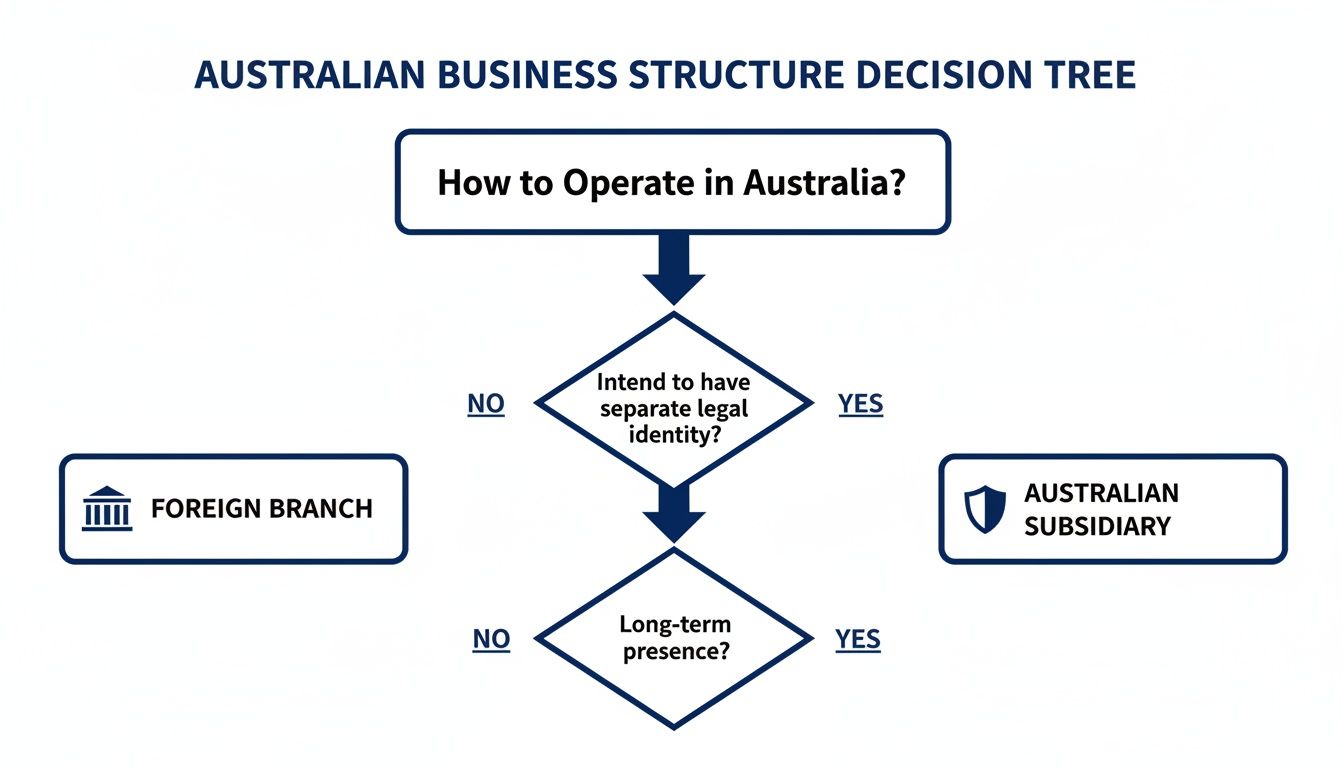

This decision tree provides a quick visual guide to the main differences.

As the graphic shows, the core difference is legal separation. A subsidiary offers a liability shield, whereas a branch does not.

Foreign Branch vs. Australian Subsidiary: A Comparison

To clarify the choice, here is a straightforward comparison of the two structures. This table outlines the key distinctions to help align your business goals with the appropriate legal framework.

Feature | Foreign Company (Branch) | Australian Subsidiary (Pty Ltd) |

|---|---|---|

Legal Status | An extension of the foreign parent company. Not a separate legal entity. | A separate Australian legal entity, owned by the foreign parent. |

Liability | Unlimited. The foreign parent is fully liable for all Australian debts and obligations. | Limited. Liability is contained within the Australian subsidiary, protecting the parent company's global assets. |

Local Perception | May be perceived as less committed to the Australian market. | Viewed as a permanent, credible local entity, enhancing trust with banks, customers, and suppliers. |

Compliance | Subject to specific reporting rules for foreign companies under the Corporations Act 2001. | Simpler, localised compliance and reporting obligations as a standard Australian company. |

Taxation | Taxed as a non-resident, which can create complex tax scenarios. | Taxed as an Australian resident company on its worldwide income, often with a more straightforward tax profile. |

While a branch may appear simpler initially, the subsidiary structure almost always offers superior long-term protection and market credibility.

Understanding the Foreign Branch Structure

Registering as a foreign company establishes an Australian 'branch'. It is crucial to understand that this is not a separate legal entity. It is the parent company, operating directly on Australian soil.

This direct link has one major consequence: unlimited liability. Any debts, lawsuits, or other obligations incurred by the Australian branch become the legal responsibility of the overseas parent. If the Australian operation faces financial difficulty, the parent company's global assets could be at risk.

A branch may be suitable for companies testing the market or those with a very low-risk profile due to its potentially faster setup. However, for most businesses planning a long-term presence, the absence of a liability shield is a significant disadvantage.

The Australian Subsidiary Advantage

The most common and generally recommended approach is to incorporate a new Australian company, typically a Proprietary Limited (Pty Ltd) company, which acts as a subsidiary. This entity is legally distinct from its foreign parent.

A subsidiary acts as a corporate veil, creating a legal separation between the Australian operations and the parent company. This separation is the primary reason most international companies choose this structure.

This setup offers several powerful benefits:

Limited Liability: The parent company's liability is typically limited to its investment in the subsidiary. Creditors of the Australian company cannot usually pursue the parent’s assets.

Enhanced Local Credibility: Operating as an Australian Pty Ltd company signals a serious, long-term commitment to the market, which is viewed favourably by local banks, customers, and suppliers.

Simpler Compliance: Although it requires creating a new entity, ongoing compliance with Australian financial reporting and tax laws can be more straightforward.

For a deeper dive into the nuances, our guide on Australian business structures covers these options in more detail.

Preparing Your Documents for Registration

Once you have chosen your business structure, the next critical stage is gathering the correct documentation. Errors or missing paperwork are the primary cause of delays and increased costs. Adhering to the requirements of the Australian Securities and Investments Commission (ASIC) from the outset is key to a smooth process.

This involves meeting fundamental legal requirements that verify your company's legitimacy and readiness to operate under Australian regulations, such as appointing local representation and providing certified corporate documents.

Appointing Your Local Representative

Australian law requires a clear point of contact on the ground. The specific requirement depends on your chosen business structure.

For a Branch (Foreign Company): You must appoint a 'local agent'. This person or company is legally responsible for ensuring the foreign company meets its obligations under the Corporations Act 2001. The local agent's office is the official address for serving legal notices, and they can be held personally liable for penalties if the company fails to comply.

For a Subsidiary (Pty Ltd Company): You must appoint at least one director who 'ordinarily resides in Australia'. This is a strict requirement meaning the person genuinely lives in Australia, not just maintains a local address. ASIC scrutinises this to ensure genuine local governance.

Your local agent or resident director is your company’s legal anchor in Australia, accountable to ASIC for compliance. Selecting a reliable and knowledgeable representative is a critical decision.

Essential Corporate Documents for ASIC

ASIC requires certified copies of several key documents to verify the identity and legal status of the parent company. "Certified" means the copy has been verified as a true copy of the original by an authorised person, such as a notary public.

The core documents you'll need are:

A certified copy of the parent company’s Certificate of Incorporation (or equivalent) from its home country.

A certified copy of the parent company’s constitution, charter, or memorandum and articles of association.

A memorandum of appointment that clearly states the powers of your local agent or resident directors.

The Director Identification Number (DIN) Requirement

Every director of an Australian company—including directors of a new subsidiary—must obtain a Director Identification Number (DIN). This is a unique, lifelong identifier designed to promote good corporate conduct and track director histories.

For non-resident directors, the paper-based application process can be a significant bottleneck. While Australian residents can apply online, overseas directors must have their identity documents certified and submit a physical application.

A straightforward online company registration might take only two business days for confirmation, but the DIN process for overseas applicants can take up to 56 business days. Realistically, foreign companies should budget 2–3 months for the entire setup process. Proactively starting the DIN application process is crucial for an efficient timeline.

Navigating the ASIC Registration Process

With your documents prepared and representatives appointed, you can proceed with the official registration with the Australian Securities and Investments Commission (ASIC). This formal step requires meticulous attention to detail to avoid delays or rejection.

The final step is receiving your company’s unique Corporate Key, which grants you access to manage your company's details online.

Lodging Your Application with ASIC

The primary application is ASIC Form 402, "Application for registration as a foreign company." This form consolidates all your gathered information for official submission.

You must provide the following non-negotiable details on Form 402:

Company Details: The full, official name of the foreign company and its place of incorporation.

Registered Office Address: A physical street address in Australia. This cannot be a post office (PO) box, as it is the official address for legal notices from ASIC.

Local Agent Details: The full name and address of your appointed local agent, including their written consent to act in this capacity.

Australia processes a high volume of applications. According to ASIC's company registration statistics, thousands of new companies are registered each month, demonstrating the system's efficiency when applications are lodged correctly.

Reserving Your Company Name

Before lodging Form 402, you must verify that your company name is available in Australia. If it is identical to an existing Australian company or business name, it cannot be used.

To prevent this issue, you can use ASIC Form 410 to reserve your name. If approved, ASIC will hold the name for two months while you finalise your registration. This is a prudent step, particularly for established brands. If your name is unavailable, your Form 402 will be rejected, forcing you to restart the process.

Understanding ASIC Fees and Timelines

A fee is payable upon lodging your registration forms. ASIC updates its fees annually, so it is essential to check the current schedule on its website before submission.

If your application is complete and error-free, ASIC typically processes it within a few business days. Any mistakes will result in a notice from ASIC, halting the process until the issue is rectified.

Upon approval, ASIC issues a Certificate of Registration and assigns an Australian Registered Body Number (ARBN), your unique identifier in Australia.

The Importance of Your Corporate Key

Shortly after registration confirmation, a letter containing your company’s Corporate Key will be mailed to your registered office address.

This 8-digit number is the secure code required to manage your company's details on ASIC's online portal. Its importance cannot be overstated.

You will need the Corporate Key to:

Lodge annual statements.

Update company details, such as a change of address or local agent.

Perform most other online compliance tasks with ASIC.

Ensure your local agent stores this key securely upon arrival, as it is essential for maintaining ongoing compliance.

Securing Your Australian Tax and Business Numbers

With your ASIC registration complete, the next crucial step is registering with the Australian Taxation Office (ATO). This involves obtaining the necessary numbers to legally trade, employ staff, and manage your tax obligations in Australia. The process begins at the Australian Business Register (ABR).

The ABR is where you will apply for your Australian Business Number (ABN), the foundation of your business identity in Australia. All other tax registrations depend on it.

Applying for an Australian Business Number (ABN)

The Australian Business Number (ABN) is a unique 11-digit identifier essential for any business operating in Australia.

Without an ABN, other businesses are required by law to withhold tax from payments made to you at the highest marginal rate, creating a significant cash flow impediment. The application is completed via the ABR portal and requires your company details, a description of your business activities, and information on your local representatives. Accuracy is paramount.

For a deeper understanding of ongoing tax duties associated with an ABN, refer to our guide on ABN and tax return compliance.

Registering for Other Key Tax Obligations

Once you have an ABN, you can proceed with other mandatory tax registrations based on your turnover and business activities.

The main registrations include:

Tax File Number (TFN): Your company, as a legal entity, requires its own TFN to lodge annual income tax returns with the ATO. This is typically applied for at the same time as the ABN.

Goods and Services Tax (GST): You must register for GST if your business has an annual turnover (or is projected to have one) of $75,000 or more. Registration is optional below this threshold.

Pay As You Go (PAYG) Withholding: If you plan to hire local employees, you must register for PAYG withholding. This obligates you to withhold tax from your employees' salaries and remit it to the ATO.

Practical Example: Foreign IT ConsultancyA UK-based IT consultancy establishes an Australian subsidiary. They immediately require an ABN and TFN. With projected revenues exceeding $100,000 in the first year, they are legally required to register for GST. When they later hire two Australian software developers, they must also register for PAYG withholding to manage payroll correctly.

Essential Post-Registration Numbers

After registration, you will manage several key numbers from ASIC and the ATO, each with a distinct purpose.

Registration Number | Governing Body | Primary Purpose |

|---|---|---|

Australian Business Number (ABN) | Australian Business Register (ABR) | Public business identification, invoicing, and avoiding withholding tax. |

Tax File Number (TFN) | Australian Taxation Office (ATO) | Lodging annual income tax returns and managing tax affairs. |

Goods and Services Tax (GST) | Australian Taxation Office (ATO) | Collecting 10% tax on most goods and services sold in Australia. |

Pay As You Go (PAYG) Withholding | Australian Taxation Office (ATO) | Withholding tax from employee salaries and other specified payments. |

Securing these numbers completes the administrative setup required for your Australian operations to be fully functional and compliant.

Meeting Your Ongoing Compliance Obligations

Successful registration is the beginning of your compliance journey in Australia. Maintaining good standing with authorities like ASIC and the ATO is an ongoing commitment essential for legal operation.

Failure to meet these recurring obligations can result in significant penalties, deregistration, and reputational damage. This rigorous compliance framework is a key reason for international investor confidence in Australia's economy, where foreign direct investment now approaches $5.0 trillion, as noted by the Department of Foreign Affairs and Trade.

The ASIC Annual Review Process

Each year, on the anniversary of your registration, ASIC will issue an annual statement. This is a legal requirement, not just a notification. You must review the statement to confirm all details are accurate and pay the annual review fee.

This process ensures the public register remains current. You must verify key details such as:

Your registered office address in Australia.

The details of your appointed local agent.

The names and addresses of directors (for a subsidiary).

Any changes must be reported to ASIC immediately. Ignoring the annual statement is a breach of the Corporations Act 2001 and will result in late fees and, eventually, deregistration proceedings.

Financial Reporting and Lodgement Duties

Foreign companies are generally required to prepare and lodge annual financial statements with ASIC that comply with Australian accounting standards.

The requirement to lodge annual financial statements is a cornerstone of corporate transparency in Australia, providing regulators and the public with a clear view of a company's financial performance.

Exemptions from this requirement may be available if your company is not a "disclosing entity" and meets other specific criteria set by ASIC. These rules are complex and depend on your company's size and structure. It is vital to seek professional advice to determine if an exemption applies.

ATO Compliance: Annual Tax and BAS Lodgements

Your obligations to the Australian Taxation Office (ATO) are equally critical. These revolve around your income and daily business transactions.

First, you must lodge an annual Australian income tax return, reporting income earned from local operations. The standard corporate tax rate is 30%, although a lower rate may apply to eligible small business entities.

Additionally, if registered for GST, you must lodge Business Activity Statements (BAS) regularly (usually monthly or quarterly). The BAS is used to report and pay GST collected, claim GST credits, and remit other taxes like PAYG withholding. Missing a BAS deadline will result in penalties and interest charges from the ATO.

FAQ: Foreign Company Registration in Australia

Is it mandatory to register to do business in Australia?

You can make occasional sales or export goods to Australia without formal registration. However, once your activities constitute "carrying on business"—defined as a pattern of regular, repeated, or significant commercial activity—registration with ASIC becomes a legal requirement under the Corporations Act 2001. Non-compliance can lead to significant penalties.

How long does the entire registration process take?

While the core ASIC registration can be completed within a few business days, a realistic timeframe for a foreign company to become fully operational is three to six months. Key factors extending this timeline include obtaining Director Identification Numbers (DINs) for non-resident directors (up to 56 business days), opening an Australian bank account (which often requires in-person verification), and certifying corporate documents in your home country.

Is a separate Australian bank account mandatory?

Yes, it is a non-negotiable compliance requirement. Whether you establish a branch or a subsidiary, your Australian entity must have its own dedicated business bank account in Australia. This is essential for tracking Australian-sourced income, managing GST and payroll obligations, and ensuring financial transparency for regulators like the ATO and ASIC.

What is the difference between a local agent and a resident director?

The required role depends on your business structure.

A local agent is required for a foreign company (branch). This person or company is legally responsible for ensuring the company meets its obligations under the Corporations Act 2001 and can be held liable for penalties.

A resident director is required for an Australian subsidiary (Pty Ltd). At least one director must 'ordinarily reside in Australia' and holds all the standard legal duties of a company director.

Is GST registration compulsory for a foreign company?

GST registration is mandatory once your Australian turnover reaches or is expected to reach $75,000 in a 12-month period. An important exception applies to non-resident businesses selling digital products or services to Australian consumers, which may require registration from the first sale under a simplified GST system. You must check the specific ATO rules applicable to your business activities.

Summary

Successfully registering a foreign company in Australia involves more than just filing forms. It requires strategic decisions, meticulous preparation, and a commitment to ongoing compliance.

Choose the Right Structure: Decide between a foreign branch (unlimited liability) and an Australian subsidiary (limited liability). A subsidiary is generally recommended for long-term risk management.

Prepare Thoroughly: Appoint a local agent or resident director, obtain Director Identification Numbers (DINs) early, and gather all required certified documents to avoid delays.

Complete All Registrations: Register with ASIC to obtain your ARBN and then with the ATO/ABR to secure your ABN, TFN, and registrations for GST and PAYG withholding as required.

Maintain Ongoing Compliance: Fulfil annual obligations, including ASIC annual reviews, financial reporting, and regular lodgement of tax returns and Business Activity Statements with the ATO.

Get Expert Guidance

Navigating foreign company registration, local agent responsibilities, and ongoing tax obligations is complex. At Baron Tax and Accounting, we specialise in guiding international businesses through this process, ensuring your entry into the Australian market is smooth, compliant, and structured for success.

Contact Us

Name: Baron Tax and Accounting

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213

Comments