How Do I Set Up a Business in Australia? A Step-by-Step Guide

- Jan 10

- 12 min read

Starting a business in Australia is an exciting prospect, but establishing the correct legal and financial foundations from day one is critical. The initial decisions you make—from choosing a business structure to completing essential registrations—will significantly impact your personal liability, tax obligations, and long-term success. Failing to comply with Australian regulations can lead to substantial penalties from bodies like the Australian Taxation Office (ATO) and the Australian Securities and Investments Commission (ASIC).

This guide provides a clear, step-by-step pathway through the setup process. It explains why each decision matters and outlines the key compliance risks involved, ensuring you build a robust and legally sound business from the ground up.

Your Essential First Steps to Starting a Business in Australia

Launching a new venture requires careful navigation of Australia's regulatory landscape. This isn't just about administrative tasks; it's about building a stable platform for growth. Incorrect setup can lead to severe consequences, including unexpected tax bills, personal asset exposure, and financial penalties. This guide will break down the process into actionable steps, focusing on the critical decisions required to operate legally and efficiently.

Key Focus Areas For A Successful Launch

Before diving into the details, it's important to understand the main components of setting up a business. These elements are interconnected and form the foundation of your enterprise.

Choosing Your Business Structure: This is your first major decision. Whether you operate as a sole trader, partnership, company, or trust will determine your legal status, tax obligations, and the extent of your personal liability.

Completing Essential Registrations: An Australian Business Number (ABN) is mandatory for all businesses. Depending on your structure and revenue, you may also need an Australian Company Number (ACN) and registrations for Goods and Services Tax (GST) and Pay As You Go (PAYG) withholding.

Ensuring Day-One Compliance: From the outset, you must have systems in place for reporting income, managing superannuation for employees, and lodging regular statements with the ATO.

The entrepreneurial spirit in Australia is absolutely buzzing right now. We're seeing a huge spike in new businesses launching, which just goes to show how important a well-planned setup is if you want to stand out from the crowd.

Thousands of new businesses are popping up every month, creating a vibrant but fiercely competitive environment. It’s a good idea to get familiar with the common challenges for small businesses in Australia before you jump in.

Why Getting Professional Advice Early Is A Game-Changer

While you can attempt the setup process independently, Australian tax and corporate law are complex. Engaging an expert accountant from the beginning is one of the most valuable investments you can make.

An experienced advisor ensures you select the optimal structure for your specific goals and risk tolerance. Finding the right accountant for small business can help you avoid costly compliance errors and establish a solid financial foundation for future growth.

Choosing the Right Business Structure for Your Venture

Your business structure is the blueprint for your enterprise. It is a foundational decision that directly shapes your personal liability, tax obligations, and ongoing administrative workload. Selecting the correct structure is crucial for aligning your business with your long-term goals and personal risk comfort level.

For example, a freelance graphic designer may find the simplicity and low cost of a Sole Trader structure ideal. Conversely, a growing tech startup seeking investment will require the legal protection and scalability of a Proprietary Limited (Pty Ltd) Company. The wrong choice can lead to unnecessary costs, complex compliance burdens, and exposure of personal assets, such as your family home.

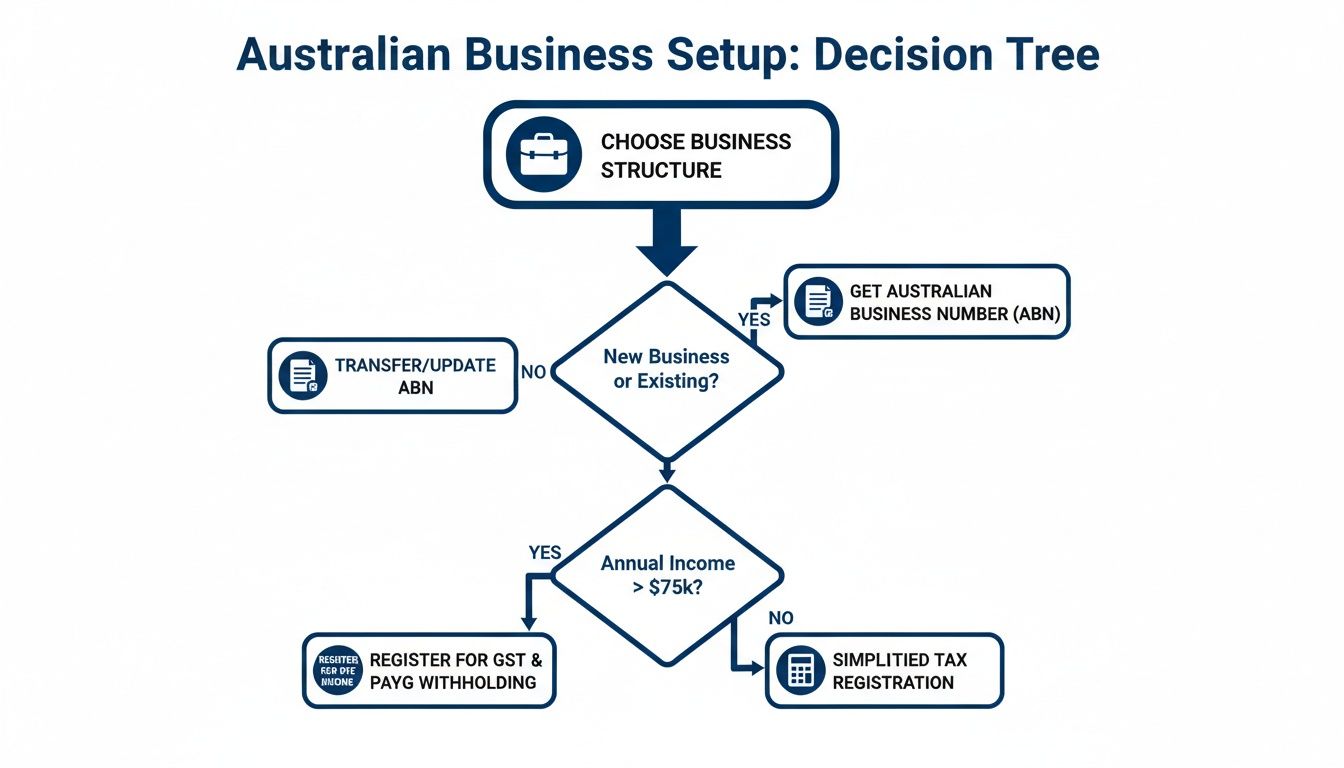

This decision tree illustrates the path from selecting a structure to completing all necessary tax registrations. It highlights that your choice of structure is the critical first step that influences all subsequent compliance requirements.

The Four Main Business Structures in Australia

Each structure has distinct advantages and disadvantages. Let's examine them to help you determine the most suitable option.

Sole Trader: This is the simplest and most common structure. You are the business, and all profits are taxed as your personal income. However, you have unlimited liability, meaning your personal assets are at risk if the business incurs debt.

Partnership: This structure involves two or more people or entities operating a business together. Like sole traders, partners generally have unlimited liability for business debts, including those incurred by other partners. Profits are distributed among partners and taxed at their individual rates.

Company: A company is a separate legal entity, distinct from its owners (shareholders). This structure offers the strongest asset protection, as liability is generally limited to the value of shares. Companies pay tax at the corporate tax rate and are subject to stricter regulatory requirements from ASIC.

Trust: A trust is a more complex arrangement where a trustee (an individual or a company) holds assets for the benefit of others (the beneficiaries). Trusts offer excellent asset protection and tax planning flexibility but are more expensive and complicated to establish and administer.

Comparison of Australian Business Structures

This table provides a side-by-side comparison of the main features of each business structure to help you make an informed decision.

Feature | Sole Trader | Partnership | Company (Pty Ltd) | Trust |

|---|---|---|---|---|

Legal Status | You and the business are one entity. | Partners and the business are one entity. | A separate legal entity from its owners (shareholders). | Not a separate legal entity; a relationship governed by a trustee. |

Liability | Unlimited. Personal assets are at risk. | Unlimited. Partners are jointly and severally liable. | Limited. Liability is restricted to the company's assets. | Limited. Trustee (often a company) is liable, protecting beneficiaries. |

Tax Rate | Your individual marginal tax rate. | Partners are taxed at their individual marginal rates. | A fixed corporate tax rate (currently 25% for eligible businesses). | Beneficiaries are taxed on distributed income at their marginal rates. |

Setup Cost | Very low (just a business name registration). | Low (partnership agreement is recommended). | Higher (ASIC registration fees apply). | Highest (requires a formal trust deed). |

Compliance | Minimal. Lodge your personal tax return. | Moderate. Lodge a partnership tax return and individual returns. | High. Annual ASIC reviews, separate company tax return, director duties. | High. Requires a trustee, minutes, and careful administration. |

Best For... | Freelancers, contractors, and small one-person businesses. | Professional services (e.g., lawyers, accountants) or joint ventures. | Businesses aiming for growth, seeking investment, or needing asset protection. | Family businesses, asset protection, and flexible income distribution. |

As the table shows, there is no one-size-fits-all solution. The optimal structure depends on your specific circumstances, industry, and future ambitions.

Choosing a business structure is a balancing act between asset protection, tax effectiveness, cost, and administrative complexity. What works for a small local café will not be suitable for a business planning to seek venture capital funding.

For a deeper dive into the specific pros and cons of each option, our detailed guide on Australian business structures offers a comprehensive breakdown. Making an informed decision now can save you from costly and stressful restructuring down the track.

Getting Your Business Registrations and Numbers Sorted

After selecting your business structure, you must register it with the Australian government. These registrations provide the unique identifiers that legitimise your business, enabling you to trade, employ staff, and manage your tax obligations correctly. Delaying these steps can result in penalties from the ATO. Let's walk through the necessary registrations, including the ABN, ACN, GST, and PAYG withholding.

First Up: Your Australian Business Number (ABN)

The ABN is your business's public identity. It is a unique 11-digit number that identifies you to the government and other businesses. You will need it for almost all business activities, including invoicing, registering a business name, and opening a business bank account.

Applying for an ABN through the Australian Business Register (ABR) is a primary step. It allows you to claim GST credits and prevents other businesses from withholding tax from payments made to you. For a deeper dive, our guide covers your guide to ABN and tax return compliance.

For Companies: Registering with ASIC for Your ACN

If you have chosen a company structure, you must first register with the Australian Securities and Investments Commission (ASIC). Upon successful registration, ASIC will issue a unique nine-digit Australian Company Number (ACN).

The ACN is your company's official identifier and must be displayed on all public company documents. Only after receiving your ACN can you apply for an ABN and other tax registrations.

Do You Need to Register for GST?

Goods and Services Tax (GST) is a 10% tax on most goods and services sold in Australia. Understanding when to register is a common challenge for new business owners.

The rules are clear:

You must register for GST within 21 days if your business turnover is expected to reach $75,000 or more in a 12-month period.

For non-profit organisations, the threshold is $150,000.

Certain industries, such as taxi or ride-sourcing services, must register for GST from their first dollar of income.

A Word of Warning: The ATO imposes significant penalties on businesses that fail to register for GST when required. This can include back-paying the GST you should have collected, plus interest and penalties.

Even if your turnover is below the $75,000 threshold, you can register for GST voluntarily. This allows you to claim back the GST paid on your business expenses (GST credits), but it also requires you to lodge regular Business Activity Statements (BAS).

Hiring Staff? You'll Need PAYG Withholding

If you plan to hire employees, you are legally required to register for Pay As You Go (PAYG) withholding. This system requires you to withhold tax from your employees' wages and remit it to the ATO on their behalf. This is a fundamental obligation for any employer in Australia, and the amounts withheld are reported and paid through your BAS.

A Real-World Look: Café Owner vs. Freelance Writer

Let's compare how these registration requirements apply to two different businesses.

The Café Owner: A new café is likely to exceed the $75,000 GST threshold quickly. The owner will need an ABN, GST registration, and PAYG withholding registration to pay their staff.

The Freelance Writer: A freelance writer starting out may only need an ABN. They can operate below the GST threshold and will not need PAYG withholding registration unless they hire an employee.

Your registration needs are directly linked to your business model, revenue projections, and staffing plans. Understanding these obligations is crucial for a successful business setup.

Figuring Out Your Tax and Super Obligations

Once your business is registered, your focus must shift to ongoing compliance. Meeting your tax and superannuation obligations is a non-negotiable legal requirement. Failure to do so can result in significant penalties from the ATO and damage your business's reputation. Understanding these duties from the beginning will prevent future stress and financial hardship.

How Your Business Structure Shapes Your Tax Bill

Your chosen business structure directly determines how you report income and pay tax.

Sole Traders and Partnerships: As a sole trader, your business income is treated as your personal income. You declare it on your individual tax return and pay tax at your personal marginal rate. For partnerships, the business itself does not pay tax; profits are distributed to the partners, who each report their share on their individual tax returns.

Companies: A company is a separate legal entity that pays tax on its profits at the corporate tax rate. For eligible small and medium businesses, this rate is currently 25%. The company must lodge its own separate tax return annually.

Trusts: In a trust structure, the trust generally does not pay tax directly. Instead, its income is distributed to beneficiaries, who then pay tax on that income at their individual rates.

Here’s a critical piece of advice: one of the most common traps new company directors fall into is treating company money like their personal bank account. Any money you take out has to be properly recorded as a salary, a dividend, or a loan. Each of those has different tax consequences, and mixing them up can land you in serious trouble.

What's the Deal with the Business Activity Statement (BAS)?

If your business is registered for GST, you will need to lodge a Business Activity Statement (BAS). This form is used to report and pay several key taxes to the ATO.

Most businesses lodge their BAS quarterly. On the BAS, you report:

Goods and Services Tax (GST): The GST collected on sales, less any GST credits claimed on business purchases.

Pay As You Go (PAYG) Withholding: The tax withheld from employee wages.

PAYG Instalments: Prepayments towards your business's expected annual income tax liability.

Lodging your BAS accurately and on time is essential for compliance.

Your Responsibilities When You Hire Staff

Employing staff introduces new legal and financial obligations, primarily superannuation and payroll reporting.

Superannuation Guarantee (SG)

You are legally required to pay superannuation contributions for all eligible employees under the Superannuation Guarantee (SG) scheme. You must pay the SG amount, which is a percentage of an employee's ordinary time earnings, into their chosen super fund at least quarterly.

Failing to pay the correct amount of super on time results in the Superannuation Guarantee Charge (SGC). The SGC includes the missed super, interest, and an administration fee, and it is not tax-deductible, making it a very costly mistake.

Single Touch Payroll (STP)

All employers in Australia must use Single Touch Payroll (STP) enabled software to report payroll information to the ATO. Each time you pay your employees, your software automatically sends a report to the ATO detailing their salaries, wages, tax withheld, and superannuation information. This system provides the ATO with real-time visibility of your payroll compliance.

Fringe Benefits Tax (FBT)

If you provide non-cash benefits to your employees in addition to their salary, you may be liable for Fringe Benefits Tax (FBT). This applies to benefits such as a company car for private use, payment of health insurance, or low-interest loans. FBT is separate from income tax and is calculated on the value of these benefits.

Your Practical Business Setup Checklist and Timeline

To manage the setup process effectively, we have broken it down into a logical sequence, from initial planning to commencing trade. This roadmap highlights critical dependencies—such as needing an ABN before opening a business bank account—and helps you budget for associated costs.

Phase 1: Initial Planning and Structuring

This foundational stage is where you solidify your business idea and make key legal and financial decisions.

Finalise Your Business Plan: Document your goals, target market, and financial projections.

Choose Your Business Structure: Decide between a sole trader, partnership, company, or trust.

Register Your Business Name: If you are not trading under your personal name (sole trader) or legal company name, you must register a business name with ASIC.

Phase 2: Registrations and Legal Setup

This phase involves making your business official with the government to secure your right to operate.

Apply for an ACN (if you’re a company): Register with ASIC to obtain your Australian Company Number.

Apply for Your ABN and TFN: Use the Australian Business Register (ABR) to get your Australian Business Number and a business Tax File Number.

Register for GST and PAYG: If you expect to meet the $75,000 turnover threshold or plan to hire staff, register for Goods and Services Tax (GST) and Pay As You Go (PAYG) withholding.

A common mistake we see is people trying to open a business bank account before getting their ABN and ACN. The banks need these numbers to verify your business, so get your government registrations done first to make the process smooth.

Phase 3: Financial and Operational Setup

With legal registrations complete, you can now build the financial and operational systems for your daily activities.

Open a Business Bank Account: Keep your business and personal finances separate from day one.

Set Up Your Bookkeeping Software: Implement a system like Xero or MYOB to track income and expenses.

Arrange Business Insurance: Obtain public liability, professional indemnity, or other necessary insurance for your industry.

Understand Your Compliance Obligations: Familiarise yourself with your responsibilities. Our detailed small business compliance checklist is a great resource to guide you.

FAQ: Setting Up a Business in Australia

Here are answers to some of the most frequently asked questions from new entrepreneurs, based on official guidance from Australian government agencies.

Do I need an ABN for a small side hustle?

Yes. If you are 'carrying on an enterprise,' you must register for an Australian Business Number (ABN), even for a small side business. According to the Australian Business Register, an enterprise includes activities done in the form of a business. An ABN is free to register and is necessary for issuing professional invoices and avoiding tax being withheld from payments made to you.

What's the difference between a business name and a company name?

A company name is the legal name of a company registered with ASIC (e.g., 'Coastal Cafes Pty Ltd') and is protected nationwide. A business name is the trading name your customers know you by (e.g., 'The Daily Grind'). Any business structure (sole trader, company, etc.) must register its business name with ASIC unless it is trading under the exact legal name of the individual or company.

When do I have to register for GST?

According to the ATO, you must register for GST if your current or projected annual turnover is $75,000 or more ($150,000 for non-profit organisations). You have 21 days to register once you reach this threshold. An exception applies to taxi, limousine, and ride-sourcing service providers, who must register for GST regardless of their turnover.

How much does it cost to register a company in Australia?

The government fee paid to ASIC to register a standard proprietary limited company is currently $576. There is also an ongoing annual review fee, which is currently $310 for a standard proprietary company. These fees are subject to change, so always check the latest schedule on the ASIC website.

Can a non-resident set up a business in Australia?

Yes, a non-resident can establish a business in Australia. However, under the Corporations Act 2001, an Australian company must have at least one director who ordinarily resides in Australia. Alternatively, an overseas business can register as a foreign company to operate as a branch in Australia. Non-residents must also comply with all ATO tax obligations on Australian-sourced income. Seeking professional legal and accounting advice is strongly recommended to ensure full compliance.

Summary

Setting up a business in Australia correctly from the start is fundamental to its long-term viability and success.

Key Takeaways: * Structure is Foundational: Your choice between sole trader, partnership, company, or trust dictates your liability, tax, and compliance obligations. * Registrations are Non-Negotiable: An ABN is mandatory for all businesses. ACN, GST, and PAYG registrations depend on your structure and operations. * Compliance is Ongoing: From day one, you must manage tax, superannuation, and payroll reporting in line with ATO and Fair Work regulations. * Professional Advice is an Investment: Navigating complex Australian laws without expert guidance can lead to costly errors and penalties.

Call to Action

Getting the foundations right is key to building a successful business. From setup and registration to tax compliance and financial management, having an expert in your corner makes all the difference.

At Baron Tax and Accounting, we provide clear, practical guidance tailored to your new venture, ensuring you start on solid ground.

Ready to get your business off to the best possible start? Contact us for a personalised consultation.

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213