How to Set Up a Trust in Australia: A Comprehensive Guide

- Jan 10

- 11 min read

A trust is a legal arrangement where a person or company (the trustee) holds assets for the benefit of others (the beneficiaries). In Australia, trusts are a foundational tool for wealth management, asset protection, and tax planning. Understanding how to establish one correctly is crucial for anyone looking to secure their family's financial future or structure a business venture effectively.

This guide explains what a trust is, why it is a powerful financial tool, and the key steps and compliance risks involved in setting one up. Incorrectly establishing or managing a trust can lead to significant financial penalties from the Australian Taxation Office (ATO) and may invalidate the asset protection benefits you sought to create.

Why Trusts Are a Powerful Tool in Australia

Before diving into how to set up a trust in Australia, it’s important to understand why they are so widely used. A trust creates a formal legal separation between your personal assets and those held for others. This separation provides a vital layer of protection against financial risks, as assets held within the trust are generally shielded from creditors if you or your business face financial difficulty.

However, a trust is not just a defensive measure; it is a proactive tool for strategic wealth management. The primary benefits include:

Asset Protection: By legally separating assets from an individual, a trust can safeguard wealth from business failures or personal liability claims.

Tax-Effective Distribution: Discretionary or family trusts allow the trustee to distribute income to beneficiaries in lower tax brackets, which can significantly reduce a family's overall tax liability.

Succession and Estate Planning: A trust provides a clear, flexible framework for passing wealth to the next generation, often avoiding the complexities and potential disputes associated with relying solely on a will.

Confidentiality: Unlike a company registered with ASIC, the details of a trust are not typically on a public register, offering greater privacy.

Understanding the Compliance Landscape

While trusts offer significant advantages, they operate under strict rules enforced by the Australian Taxation Office (ATO). The ATO closely scrutinises any arrangement that appears to be established solely for tax avoidance, particularly those involving aggressive income-splitting strategies. It is crucial that your trust is established for genuine commercial or family-related reasons.

The ATO's anti-avoidance provisions, such as Part IVA of the Income Tax Assessment Act 1936, can be applied to arrangements deemed to be a sham. A real-world example of how these rules are tested can be seen in our analysis of family trusts and the Bendel case.

The use of trusts in Australia has grown significantly, with data from the ATO showing a steady increase in trust registrations for asset management and estate planning. Ensuring full compliance with regulatory requirements from day one is essential to harnessing the benefits of a trust without falling foul of the law.

Choosing the Right Trust Structure for Your Goals

Selecting the correct trust structure is the most critical initial decision. It is not a one-size-fits-all scenario; the optimal choice depends on your specific objectives regarding asset protection, income distribution, and long-term wealth strategy. An inappropriate structure can lead to unnecessary tax complications and a lack of flexibility.

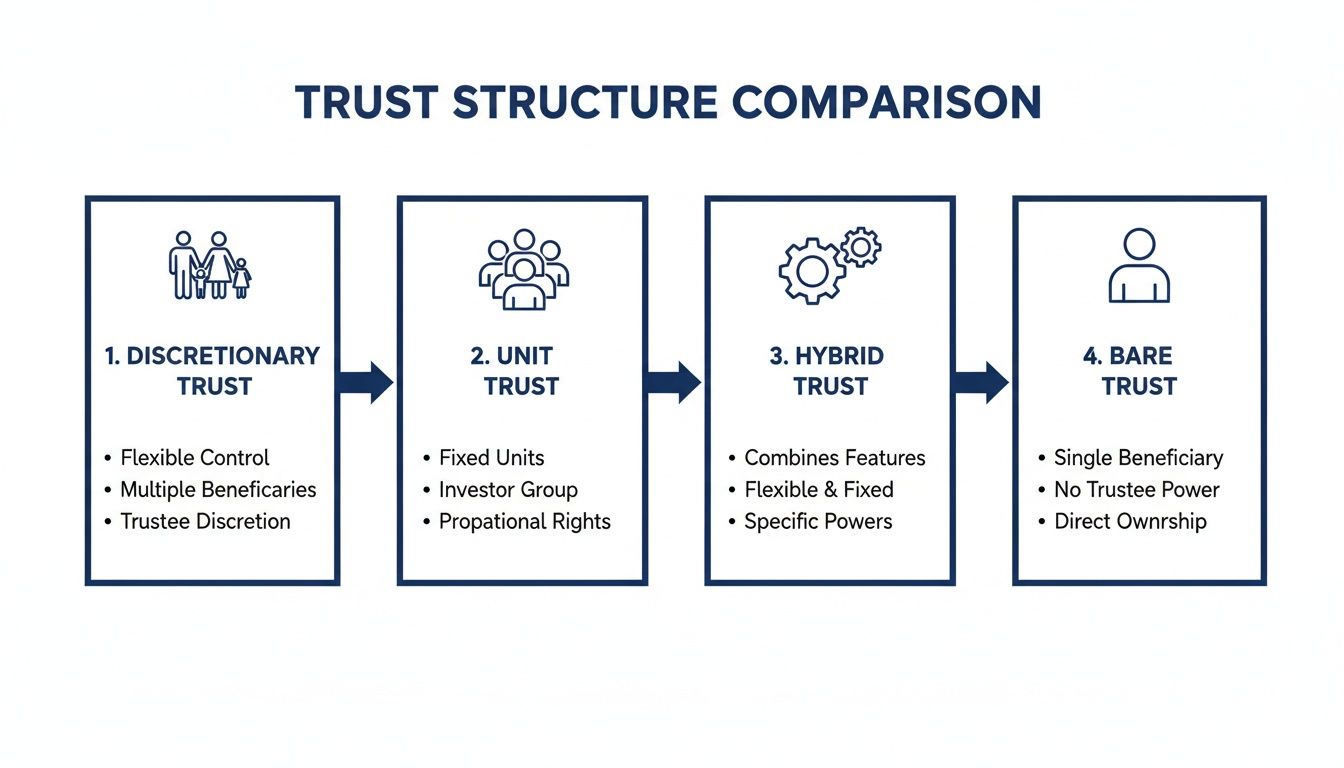

Let's examine the common trust types available in Australia. Each is designed for a specific purpose, and understanding their differences is key to determining how to set up a trust in Australia correctly.

The Popular Choice: Discretionary (Family) Trusts

A Discretionary Trust, commonly known as a Family Trust, is the most popular structure for families managing assets or operating a business. Its primary advantage is flexibility.

The trustee has the 'discretion' to determine which beneficiaries receive income or capital each financial year and in what proportion. This is a significant benefit for tax planning. For example, a family business operating through a discretionary trust could distribute profits to adult children in low tax brackets, thereby utilising their lower marginal tax rates and minimising the family's collective tax bill.

The main drawback is that beneficiaries have no fixed entitlement to the trust's assets, which can sometimes complicate succession planning or securing finance.

For Unrelated Parties: Unit Trusts

A Unit Trust operates on the principle of fixed entitlements. The trust's property is divided into "units," similar to shares in a company. Beneficiaries (unitholders) own a specific number of units, and their share of the income and capital is directly proportional to their unit holding.

This transparent, fixed structure makes unit trusts ideal for unrelated parties undertaking a joint investment, such as a property development project. Each party's stake is clearly defined from the outset, leaving no ambiguity regarding profit distribution.

A key ATO consideration for unit trusts is Capital Gains Tax (CGT). The disposal of units by a unitholder is a CGT event. The fixed entitlement structure often simplifies the application of the 50% CGT discount for assets held for more than 12 months, a calculation that can be more complex in discretionary trusts.

A Blend of Both: Hybrid Trusts

A Hybrid Trust combines elements of both discretionary and unit trusts. For instance, it might issue units that define entitlements to capital while giving the trustee discretion over income distribution.

While this offers theoretical advantages, the complexity is a major disadvantage. Hybrid trusts are less common because their intricate nature can attract additional scrutiny from the ATO. They require a meticulously drafted trust deed and expert ongoing management to remain compliant, making them suitable only for very specific commercial scenarios.

For a deeper comparison of these structures against other business models like companies or sole traders, our guide on choosing the right business structures in Australia provides valuable insights.

The Simplest Form: Bare Trusts

A Bare Trust is the most basic trust structure. The trustee's sole duty is to hold a specific asset for a beneficiary who has an absolute and immediate right to both the asset and any income it generates. The trustee acts merely as a nominee and must transfer the asset to the beneficiary upon request.

Bare trusts are typically used for a single, specific purpose, such as holding shares for a minor until they reach 18 years of age. They are also essential for Self-Managed Super Funds (SMSFs) undertaking a Limited Recourse Borrowing Arrangement (LRBA) to acquire property. While simple, they offer none of the asset protection or tax flexibility of other trust types.

Comparing Common Australian Trust Types

This table provides a side-by-side comparison of the main trust structures.

Trust Type | Primary Use Case | Income Distribution Flexibility | Asset Protection Level | Best For |

|---|---|---|---|---|

Discretionary Trust | Family wealth management and business operations. | High - Trustee decides allocations annually. | High | Families seeking tax-effective income splitting and asset protection. |

Unit Trust | Joint ventures and property investments between unrelated parties. | Low - Fixed entitlement based on units held. | Moderate | Unrelated parties investing together with clearly defined stakes. |

Hybrid Trust | Complex commercial arrangements needing specific features. | Varies - Can have both fixed and discretionary elements. | Varies | Sophisticated investors requiring a custom, complex structure. |

Bare Trust | Holding a single asset for a specific beneficiary (e.g., for a minor or an SMSF). | None - Beneficiary is absolutely entitled. | Low | Simple asset-holding scenarios like for minors or SMSF borrowing. |

This table offers a high-level overview. The right choice depends entirely on your personal circumstances, financial goals, and intended beneficiaries.

Getting Down to Brass Tacks: How to Legally Set Up Your Trust

Establishing a trust in Australia is a formal legal process involving a series of deliberate steps. Each step is critical to ensure the trust is valid, compliant, and fit for purpose. Errors or omissions can create significant legal and tax problems.

The foundational decision is choosing the correct type of trust for your objectives.

This visual guide breaks down the most common structures, highlighting their suitability for different goals—from protecting family wealth to facilitating joint investments.

As shown, a discretionary trust provides flexibility for a family, whereas a unit trust offers a rigid structure better suited for unrelated investors. This initial choice is fundamental.

Nailing the Trust Deed: Your Rulebook

The trust deed is the legal cornerstone of the trust. It is the governing document that sets out the rules, powers, and duties of the trustee, the rights of the beneficiaries, and the overall purpose of the trust. Using a generic online template is not advisable.

It is imperative to engage an experienced solicitor to draft the trust deed. A professionally drafted deed will contain crucial clauses providing flexibility and protection.

Key elements a comprehensive trust deed will cover include:

Vesting Date: The date the trust ends. In Australia, this is typically 80 years from its establishment, in line with the rule against perpetuities.

Trustee Powers: A detailed list of what the trustee is legally permitted to do with the trust's assets.

Beneficiary Classes: A clear definition of who can benefit from the trust's income or capital.

Appointor’s Role: A specific outline of the appointor's power to appoint and remove the trustee.

A poorly drafted deed can trigger unintended tax consequences or be declared invalid by a court.

Appointing the Key Players

With the deed drafted, the key roles must be formally appointed. Each role carries significant legal responsibilities.

The Trustee is the legal owner of the trust assets and is responsible for managing them according to the deed and Australian law. The trustee has a fiduciary duty to act in the best interests of the beneficiaries. A trustee can be an individual or a company (a 'corporate trustee').

A corporate trustee is almost always recommended. This structure enhances asset protection by creating a clear legal separation. If an individual trustee is sued personally, their own assets may be at risk. A corporate trustee limits liability to the assets held within that company, providing a critical layer of financial security.

The Appointor holds the ultimate power to remove and appoint trustees. This strategic role ensures long-term control of the trust remains with the intended person.

The Beneficiaries are the individuals or entities for whose benefit the trust was created. They can be named specifically or defined as a class of people, such as "the children and grandchildren of Jane Doe."

The Final Steps: Settlement and Admin

A trust legally comes into existence when it holds property. The settlor, typically an independent third party like a family friend or accountant, "settles" the trust by giving an initial sum—often $10—to the trustee. This act, combined with the signing of the deed, formally establishes the trust.

Following this, several administrative tasks must be completed. Establishing a trust involves costs; professional fees for drafting the deed typically range from $1,500 to $5,000. Once established, you must apply for a Tax File Number (TFN) and an Australian Business Number (ABN) from the ATO, which can take up to 28 days.

Stamp duty, a state-based tax on the trust deed, must also be paid. Costs vary by jurisdiction; in NSW, it is a flat $500 for most discretionary trusts, while in Victoria it can be higher, especially if property is involved.

Finally, you must determine if the trust needs to register for GST. According to ATO rules, GST registration is mandatory if the trust is carrying on an enterprise with an annual turnover of $75,000 or more.

Meeting Your Ongoing Trust Management and ATO Obligations

Establishing a trust is the first step; diligent ongoing management and adherence to compliance obligations are what preserve its value. Neglecting these duties can undermine the trust's benefits and attract unwanted attention from the ATO.

A trust is not a "set and forget" vehicle. It is an active legal structure that requires regular attention to remain compliant and serve its intended purpose.

The Annual Compliance Rhythm

Each financial year requires trustees to complete several critical tasks to ensure all income is properly accounted for and distributed according to tax law. Missing these deadlines can result in severe penalties.

The most critical date is 30 June. Before midnight, the trustee of a discretionary trust must pass and document a resolution detailing how the trust's income for that financial year will be distributed among its beneficiaries.

Failure to make a valid trustee resolution by 30 June is a costly error. In such cases, the ATO may assess the trustee on the trust's entire net income at the highest marginal tax rate, which is 47% (including the Medicare levy). This single oversight can completely negate any tax-planning benefits the trust was designed to provide.

Ongoing duties include:

Meticulous Record-Keeping: The trust must have its own bank account. All transactions, invoices, and expenses must be meticulously recorded. Commingling trust funds with personal or business accounts is a serious compliance breach.

Annual Financial Statements: A balance sheet and a profit and loss statement must be prepared for the trust each year.

Lodging the Trust Tax Return: The trust must lodge its own annual tax return with the ATO, detailing its income, expenses, and distributions to beneficiaries.

Navigating Common Compliance Traps

Even well-intentioned trustees can encounter common pitfalls. Understanding these risks is key to proactive management. Beyond the initial setup, effective trust administration requires a deep understanding of the critical responsibilities of a trustee.

A complex area is managing Unpaid Present Entitlements (UPEs). A UPE arises when a trustee resolves to distribute income to a beneficiary, but the cash has not yet been paid. The ATO scrutinises how UPEs are managed, particularly when the beneficiary is a private company. Incorrectly handling a UPE can trigger Division 7A of the tax act, potentially treating the unpaid amount as a loan and an unfranked dividend, resulting in a significant tax liability.

The ATO's general anti-avoidance rules under Part IVA are another major consideration. These provisions allow the ATO to cancel any tax benefit obtained from a scheme if its dominant purpose was determined to be tax avoidance. This is why a trust must be established and operated for legitimate purposes like asset protection or succession planning, not solely to minimise tax.

The Importance of Accuracy in a High-Scrutiny Environment

The number of trusts in Australia has grown from around 300,000 in 2000 to over 920,000 today, according to ATO data. This growth has led to increased ATO oversight. Lodging an accurate annual trust tax return is more important than ever, as penalties for errors or late lodgements can be severe.

For trustees, this means every decision must be commercially justifiable and every transaction clearly documented. For example, distributing capital gains requires careful planning to ensure beneficiaries can access applicable CGT concessions. For more information, refer to our guide on how Capital Gains Tax applies to trusts.

Diligent and proactive management is the best defence against an ATO audit and protects the long-term integrity of your trust structure.

Summary

Setting up a trust in Australia is an active strategy that requires careful planning, expert legal drafting, and a commitment to ongoing compliance. It is not a passive document to be filed away.

The key takeaways are:

Structure is Foundational: The initial choice between a discretionary, unit, hybrid, or bare trust is the most critical decision and will dictate the trust's flexibility, asset protection, and tax outcomes.

The Deed is Non-Negotiable: The trust deed is the legal rulebook. It must be professionally drafted by a solicitor to be valid and effective.

Follow the Formalities: The trust must be properly settled, key roles (trustee, appointor, beneficiaries) must be formally appointed, and necessary registrations (TFN, ABN, GST) must be completed. A corporate trustee is highly recommended for asset protection.

Compliance is Continuous: Ongoing duties include meticulous record-keeping, maintaining a separate bank account, and passing a trustee resolution before 30 June each year to avoid penalty tax rates.

FAQ Section

How much does it cost to set up a trust in Australia?

The cost varies based on complexity. Key expenses include:

Legal Fees: A professionally drafted trust deed typically costs between $1,500 and $5,000.

Corporate Trustee Setup: If using a corporate trustee, the ASIC company registration fee is $576 (for the 2023-24 financial year).

Stamp Duty: This state-based tax varies. For example, in NSW, it is $500 for a discretionary trust deed.

Accounting Fees: Costs for advice and lodging applications for a TFN and ABN.

Can I be the trustee of my own family trust?

Yes, an individual can be the trustee of their own family trust. However, it is generally not recommended. The purpose of a trust is to separate legal ownership (trustee) from beneficial ownership (beneficiaries). When one person is the sole trustee and a primary beneficiary, this separation is blurred, which can attract ATO scrutiny and potentially weaken asset protection. Using a corporate trustee, where you are the director, provides a clearer and more robust legal separation.

How long does it take to get a trust up and running?

The process is relatively quick if all information is prepared.

Drafting the Deed: 2–5 business days.

Company Registration (if needed): 1–2 business days.

Signing and Settlement: Can be done in one day.

ATO Registrations (TFN/ABN): The ATO advises allowing up to 28 days, though it is often faster. Realistically, a trust can be fully established and operational within one to two weeks.

What happens if a trust beneficiary lives overseas?

Having a non-resident beneficiary introduces significant tax complexity. According to the ATO, the trustee is generally required to withhold tax from distributions of Australian-sourced income to non-residents. These beneficiaries are not entitled to the Australian tax-free threshold, and their access to the 50% CGT discount is limited. Incorrectly managing these obligations can make the trustee personally liable for the tax. This area requires specialist advice.

Call to Action

Navigating trust law and ATO regulations is complex. To ensure your trust is structured correctly, remains compliant, and is aligned with your financial goals, professional guidance is essential.

Contact Baron Tax and Accounting today for personalised advice to protect your assets and achieve your objectives.

Baron Tax and Accounting

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213