What is a Discretionary Trust? An Australian Guide to Asset Protection & Tax Planning

- 1 day ago

- 13 min read

A discretionary trust, commonly known in Australia as a family trust, is a powerful legal structure for holding assets on behalf of a group of potential beneficiaries. Its defining feature is flexibility—the trustee has the absolute discretion to decide which beneficiaries receive income or capital, how much they get, and when they get it. This control is what makes it a popular tool for strategic tax planning and protecting family wealth.

This guide explains how discretionary trusts work under Australian law, the key compliance risks set by the Australian Taxation Office (ATO), and the practical benefits and drawbacks for individuals and businesses. Failing to comply with ATO regulations, such as the strict 30 June distribution deadline, can lead to significant penalties, including tax at the highest marginal rate.

How Does a Discretionary Trust Work in Australia?

At its core, a discretionary trust separates the legal ownership of an asset from the beneficial enjoyment of it.

Think of it as a secure family vault. The trustee holds the key (legal ownership) and is responsible for managing everything inside. The assets, however, are held for the benefit of the family members (the beneficiaries). This separation is a cornerstone of asset protection and tax strategy for many Australian families and SMEs.

However, a discretionary trust is a formal legal arrangement governed by a trust deed and subject to strict compliance obligations under Australian law.

The Key Roles Within a Discretionary Trust

Understanding the roles of each party is essential to grasping how the structure functions according to Australian regulations.

Role | Role and Responsibilities in an Australian Context |

|---|---|

The Settlor | This individual or entity establishes the trust by providing the initial sum of money (the 'settled sum', often as low as $10). The settlor cannot be a beneficiary. Once the trust is created, their role is complete. |

The Trustee | The legal owner and manager of the trust's assets. The trustee makes all decisions, including how to distribute income and capital, and is responsible for all legal and tax compliance, such as lodging the annual trust tax return. The trustee can be an individual or, more commonly, a company (a 'corporate trustee'). |

The Beneficiaries | The group of individuals or entities who may receive income or capital from the trust. They have no fixed entitlement or legal right to any trust assets; their potential benefit is entirely at the trustee's discretion each financial year. |

The Appointor | Often called the "ultimate controller," this person holds the power to appoint and remove the trustee. This critical role holds the real power, ensuring the trust is managed in line with the family's long-term objectives. |

Main Goals and Key Regulatory Rules

Discretionary trusts are typically established for two primary reasons: asset protection and tax effectiveness.

Asset Protection: Because the assets are legally owned by the trustee, they are generally separated from the personal finances of the beneficiaries. If a beneficiary faces bankruptcy, litigation, or business failure, the assets held in the trust are typically protected from their creditors.

Tax Planning Flexibility: Each financial year, the trustee can decide how to distribute the trust's taxable income among the beneficiaries. By distributing to family members in lower tax brackets, the overall tax liability for the family can be significantly reduced.

This flexibility is closely monitored by the Australian Taxation Office (ATO) to prevent tax avoidance. There are serious compliance risks, such as making improper distributions or violating anti-avoidance provisions like Section 100A of the Income Tax Assessment Act 1936.

Non-compliance can lead to severe penalties, often resulting in the trust's income being taxed at the highest marginal tax rate. Before establishing a trust, it is crucial to compare various business structures with a qualified professional to determine the most suitable option for your circumstances.

ATO Compliance Alert: The ATO is unequivocal: if a trustee fails to make and document a valid resolution to distribute the trust's income by 30 June each year, the trustee may be assessed on that income at the top marginal tax rate. For the 2024-25 financial year, this is 47% (including the Medicare Levy). This is a costly and easily avoidable compliance failure.

How a Discretionary Trust Actually Operates

Think of a discretionary trust as a private investment fund for a family. It has a manager (the Trustee), a portfolio of assets (the Trust Property), and a list of potential investors (the Beneficiaries). The entire operation is governed by a formal rulebook, the Trust Deed.

The Trustee's primary duty is to manage the assets in accordance with the Trust Deed for the benefit of the beneficiaries. This structure creates a critical separation: one entity has legal control, while a different group receives the financial benefits.

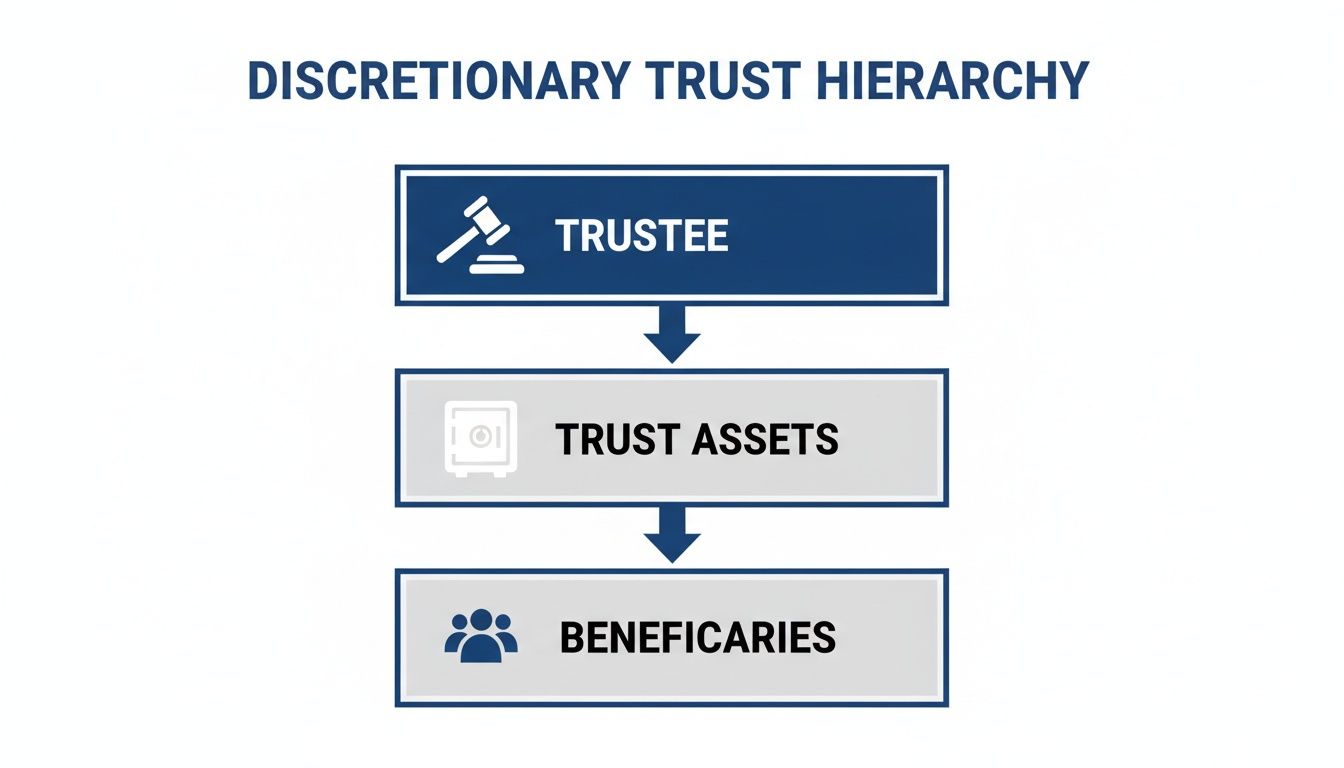

This diagram illustrates the clear hierarchy, showing the relationship between the trustee, the assets they control, and the beneficiaries who may benefit from distributions.

The trustee sits at the top, holding legal authority over the trust's assets. They then exercise their discretion to determine how income or capital is distributed to the beneficiaries.

The Power of Discretion in Practice

The term "discretionary" is the key to this trust's power. It grants the trustee the absolute authority to decide:

Who receives a distribution from the pool of potential beneficiaries.

How much income or capital each selected beneficiary receives. Distributions do not have to be equal.

When to make these distributions.

Crucially, beneficiaries have no automatic or fixed entitlement to the trust's assets or income. They cannot demand a payment. All they possess is a "mere expectancy"—a hope that the trustee will exercise discretion in their favour. This principle is fundamental to the asset protection capabilities of the trust.

The Annual Distribution Resolution: A Critical Deadline

The trustee's discretion is formally exercised at a critical point each year. Before midnight on 30 June, the trustee must formally resolve and document how the trust's taxable income for that financial year will be distributed among the beneficiaries.

This decision, known as a trust distribution resolution, is not an informal discussion. It must be a formal, written record that clearly specifies which beneficiaries are made "presently entitled" to specific amounts or percentages of the year's income.

Failure to make a valid resolution by this deadline has severe tax consequences. The ATO may determine that no beneficiary is "presently entitled" to the income. In this scenario, the trustee is assessed on the trust's entire net income at the highest individual marginal tax rate—currently 47% (including the Medicare levy). This penalty underscores why diligent annual administration is non-negotiable.

Who Truly Holds the Control?

While the trustee manages the day-to-day operations, the Appointor often holds the ultimate power. The Appointor has the authority to appoint and remove the trustee. Because of this "hire and fire" capability, they are the true controller of the trust.

In a typical family trust, the parents might act as joint Appointors. They may then appoint a company (of which they are the directors) as the trustee. This common structure provides:

Centralised control with the key decision-makers.

Enhanced asset protection through the use of a corporate trustee.

A clear succession plan for transferring control to the next generation.

This dynamic between the Appointor and trustee is the engine of the trust, ensuring the family's assets are managed according to their strategic goals.

The Real-World Advantages of a Discretionary Trust

So, why do Australian families and businesses establish discretionary trusts? The primary drivers are robust asset protection and significant tax planning flexibility. These are powerful strategic tools for sound financial management.

Understanding how these advantages are applied in practice clarifies why this structure is a popular choice for securing a family's financial future.

Building a Financial Fortress with Asset Protection

A primary benefit of a discretionary trust is its ability to create a protective barrier around assets. Because the assets are legally owned by the trustee—not the beneficiaries—they are generally shielded from the personal financial liabilities of those beneficiaries.

For example, consider an adult child who is a potential beneficiary. If their business fails or they are subject to litigation, any assets they own personally could be at risk from creditors.

However, if those same assets were held within a discretionary trust, creditors typically could not access them to settle the beneficiary's personal debts. This is because the beneficiary has no fixed entitlement to the assets, only a 'hope' of receiving a distribution. A creditor cannot compel a trustee to sell trust property to pay a beneficiary's debts.

This separation of legal ownership (trustee) from beneficial interest (beneficiaries) is the core principle of asset protection within a trust. It acts as a firewall that can safeguard family wealth from business failures, litigation, or relationship breakdowns.

Smart, Flexible Tax Planning

This ability to strategically allocate income on an annual basis is a powerful tool for legally minimising a family's collective tax burden. According to ATO data for the 2021-22 income year, there were over 967,000 trusts in Australia, highlighting their central role in the economy.

Income Streaming in Action: A Practical Example

Imagine a family trust generates $100,000 in net taxable income for the financial year. The potential beneficiaries include:

Parent A: A high-income earner, already paying tax at the top marginal rate (47%).

Parent B: Works part-time and has an annual income of $20,000.

Adult Child: A university student with no other income.

If Parent A received the $100,000 directly, they would pay approximately $47,000 in tax.

With a discretionary trust, the trustee can make a more tax-effective resolution. At year-end, they might distribute the income as follows:

$0 to Parent A.

$60,000 to Parent B.

$40,000 to the Adult Child.

By splitting the income this way, it is taxed in the hands of beneficiaries who are in lower tax brackets (or below the tax-free threshold). This strategy can result in substantial tax savings for the family.

This flexibility also allows for the streaming of specific types of income:

Capital Gains: Can be distributed to a beneficiary who can utilise the 50% CGT discount (for assets held over 12 months) or has capital losses to offset the gain.

Franked Dividends: Can be directed to low-income beneficiaries who can fully utilise the attached franking credits to reduce or eliminate their tax liability.

This ability to tailor distributions annually based on changing circumstances provides a level of tax planning that is impossible with most other structures.

Navigating Critical Tax and Compliance Obligations

Operating a discretionary trust in Australia involves strict tax and compliance obligations enforced by the Australian Taxation Office (ATO). Adhering to these rules is non-negotiable for maintaining the trust's validity and avoiding significant financial penalties.

Managing a trust requires the same diligence as running a business, demanding meticulous records, timely filings, and a clear understanding of the rules governing income distribution.

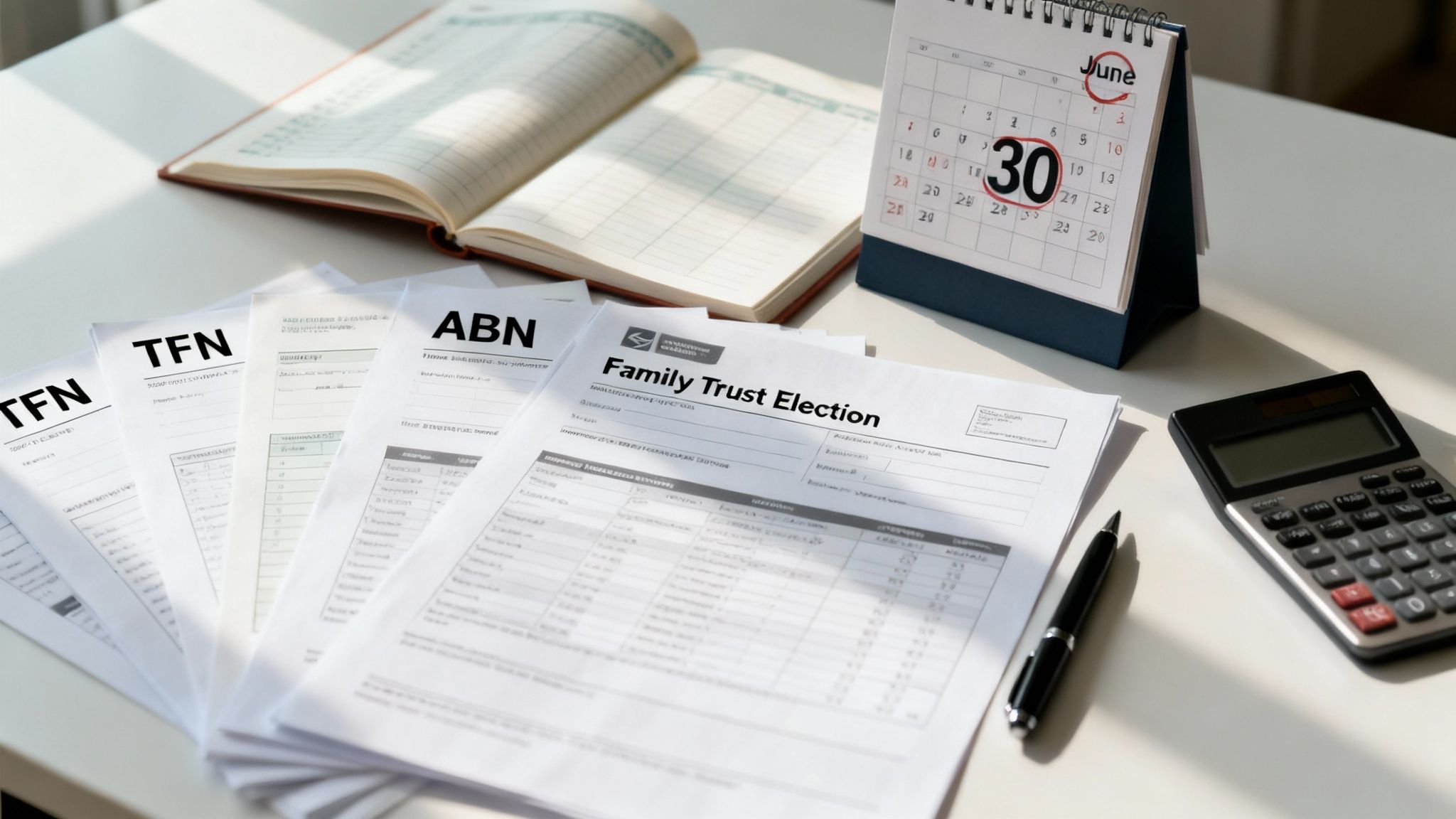

Foundational Compliance Steps

Before a trust can operate, it must be correctly registered with the relevant Australian government agencies.

Trust Tax File Number (TFN): The trust must obtain its own TFN from the ATO. This is its unique identifier for all tax-related matters, including lodging its annual trust income tax return.

Australian Business Number (ABN): If the trust is carrying on an enterprise in Australia, it must have an ABN. This is essential for business operations, such as issuing tax invoices and claiming GST credits.

Goods and Services Tax (GST) Registration: A trust must register for GST if its annual GST turnover is $75,000 or more. Failure to register when required can lead to back-dated GST liabilities and penalties.

Completing these registrations from the outset ensures the trust is recognised as a legitimate entity by the ATO.

The Critical Role of a Family Trust Election

A Family Trust Election (FTE) is a formal choice made to the ATO, which defines a "family group" around a specified individual. While making an FTE is optional, it is often essential for accessing key tax concessions.

Without an FTE, a trust may be prevented from passing on franking credits from share dividends to beneficiaries or utilising prior-year tax losses to offset current-year income.

Warning: Once an FTE is made, distributing income or capital to anyone outside the defined family group triggers the Family Trust Distribution Tax (FTDT). This tax is levied at the top marginal tax rate (47%), which effectively negates any tax benefit from the distribution and imposes a significant penalty.

Navigating Capital Gains and Income Distributions

Managing Capital Gains Tax (CGT) is a key responsibility for a trustee. When a trust sells an asset for a profit, the gain is included in its net income.

A major advantage of a discretionary trust is the ability to stream this capital gain to specific beneficiaries. If a beneficiary receives the gain and the asset was held for over 12 months, they can apply the 50% CGT discount to halve their taxable gain.

However, trustees must be aware of ATO anti-avoidance rules, particularly Section 100A, which targets "reimbursement agreements." This rule applies where income is distributed to a low-tax-rate beneficiary (e.g., an adult child) on paper, but the financial benefit is ultimately enjoyed by someone else (e.g., the parents). If the ATO determines an arrangement falls under Section 100A, the distribution is voided, and the trustee is assessed on that income at the top marginal rate.

The complexity of these rules highlights the need for careful planning and professional advice. The ATO provides detailed guidance on its website, including Taxation Ruling TR 2022/4, which outlines its compliance approach to Section 100A.

Potential Disadvantages and Risks to Consider

While discretionary trusts offer significant benefits, they are not suitable for every situation and come with potential drawbacks, costs, and complexities.

Trapped Tax Losses

A significant limitation is the treatment of tax losses. If a trust incurs a tax loss (for example, from a negatively geared investment property or a business activity), that loss is trapped within the trust.

It cannot be distributed to beneficiaries to offset their personal taxable income. The loss can only be carried forward to offset the trust's future income. This can be a major disadvantage compared to holding an asset personally, where negative gearing losses can directly reduce your taxable income from other sources.

Administrative Complexity and Ongoing Costs

A discretionary trust is a formal legal entity that requires ongoing administration and incurs costs.

Setup Costs: A properly drafted trust deed from a solicitor is required. This initial investment ensures the trust is structured correctly for your specific needs.

Annual Compliance: The trust must prepare annual financial statements and lodge a trust income tax return with the ATO. This requires professional accounting services, with annual fees typically ranging from $1,500 to $5,000+, depending on the complexity of the trust's activities.

Record-Keeping: Meticulous record-keeping is mandatory. All transactions, trustee resolutions, and distribution decisions must be documented to demonstrate compliance with the trust deed and ATO regulations.

The Potential for Family Disputes

The core feature of a discretionary trust—the trustee's absolute discretion—can also be a source of family conflict. When one person or entity has complete control over the distribution of wealth, it can lead to disagreements among beneficiaries.

A trustee’s decisions are legally binding. Beneficiaries have very limited grounds to challenge them unless the trustee has acted in bad faith, not in the best interests of beneficiaries, or breached the trust deed. This power imbalance can strain relationships, especially during succession planning or when beneficiaries have differing financial needs.

Financial and Regulatory Hurdles

Operating a trust can present other challenges. Banks and lenders are often more cautious when lending to a trust compared to an individual. They frequently require personal guarantees from the directors of the corporate trustee, which can undermine the asset protection benefits.

Furthermore, tax laws governing trusts are subject to change. The government regularly reviews trust taxation, and proposed reforms can alter the strategic landscape. A structure that is tax-effective today may require adjustment in the future to remain compliant and beneficial.

Summary: Key Takeaways

A discretionary trust, also known as a family trust in Australia, is a flexible structure where a trustee holds assets for a group of beneficiaries. The trustee has complete discretion to decide who receives income or capital each year.

Primary Benefits: The two main advantages are asset protection (shielding assets from beneficiaries' personal creditors) and tax flexibility (distributing income to low-tax-rate family members to reduce the overall family tax bill).

Key Disadvantage: Tax losses are 'trapped' inside the trust and cannot be distributed to beneficiaries to offset their other income.

Compliance is Critical: A trust must have its own TFN and ABN (if applicable) and lodge an annual tax return. The trustee must make a formal, written trust distribution resolution by 30 June each year.

Failure to Comply: If the 30 June deadline for distribution resolutions is missed, the trustee can be taxed on the trust's income at the highest marginal rate (47%).

Costs and Complexity: Trusts involve setup costs, annual accounting fees, and significant administrative responsibilities. They are not a "set and forget" solution.

Frequently Asked Questions (FAQ)

Can I be the trustee and a beneficiary in my own discretionary trust?

While it is legally possible for a person to be both a trustee and a beneficiary, it is generally not recommended. This arrangement can weaken the asset protection benefits of the trust, as it blurs the separation between the controller and the beneficiary. In some cases, if the sole trustee is also the sole beneficiary, a court may find that a valid trust does not exist. The standard and recommended practice is to appoint a separate trustee, preferably a corporate trustee, to maximise asset protection.

What happens if income is not distributed by 30 June?

According to the ATO, if a trustee fails to make a valid resolution to distribute all of the trust's income by midnight on 30 June, the trustee can be assessed on that undistributed income. This is known as a 'trustee assessment' and is taxed at the highest marginal tax rate, which is currently 47% (including the Medicare Levy). This is a punitive rate designed to enforce compliance with the annual deadline.

How much does it cost to set up and run a trust in Australia?

The costs can be broken into two parts:

Setup Costs: Engaging a solicitor to draft a tailored trust deed can cost anywhere from several hundred to a few thousand dollars. Registering a corporate trustee with ASIC also involves a fee.

Annual Running Costs: These include accounting fees for preparing annual financial statements and the trust's tax return. For a simple trust holding passive investments, this may start from around $1,500 per year. For trusts running a business or with complex investments, annual fees can exceed $5,000.

Can a discretionary trust own my family home?

A trust can legally own your family home, but it is generally a disadvantageous strategy from a tax perspective. In Australia, an individual's main residence is typically exempt from Capital Gains Tax (CGT) when sold. If the home is held in a discretionary trust, this valuable main residence exemption is lost. This means that when the property is eventually sold, the trust could be liable for a significant CGT bill on any capital gain.

What is the difference between a discretionary trust and a unit trust?

The fundamental difference lies in the entitlement of the beneficiaries.

In a discretionary trust, beneficiaries have no fixed entitlement to income or capital. Their share is determined each year at the trustee's discretion. This provides flexibility and asset protection.

In a unit trust, beneficiaries (called 'unitholders') hold a fixed number of units, similar to shares in a company. Their entitlement to income and capital is directly proportional to the number of units they hold. This structure is rigid and is often used for joint ventures between unrelated parties.

Disclaimer: The information provided in this article is for general guidance only and does not constitute professional tax, legal, or financial advice. The content is based on laws and regulations current at the time of publication and is subject to change. You should seek personalised advice from a qualified professional to address your specific circumstances.

Contact Us

For professional advice on setting up or managing a discretionary trust tailored to your specific financial situation, please contact our team of experienced accountants.

Baron Tax and Accounting

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213