What is the Penalty for an Overdue Tax Return in Australia?

- Jan 12

- 12 min read

An overdue tax return penalty is the Australian Taxation Office's (ATO) method for ensuring taxpayers lodge on time. This isn't a single flat fee; it's typically a combination of two distinct charges: a Failure to Lodge (FTL) penalty for missing the lodgement deadline, and a General Interest Charge (GIC) if you also have a tax liability. Understanding these is crucial for managing your compliance obligations and minimising financial risk.

Understanding the ATO's Late Lodgement Penalties

Discovering you've missed a tax deadline can be stressful, but understanding the consequences puts you back in control. The ATO's penalty framework is designed to be fair; it treats the act of lodging late and the act of failing to pay tax as separate issues, each with its own penalty.

The primary penalty, the Failure to Lodge (FTL) penalty, applies to any individual or entity that does not submit their return by the due date. This fine is structured to increase the longer the return is outstanding, serving as a clear deterrent. A common misconception is that this penalty only applies if you owe the ATO money. In reality, an FTL penalty can be applied even if you are entitled to a refund. For a detailed breakdown of this year's deadlines, refer to our guide on Australia Tax Return Due Dates.

The Two Types of Tax Penalties

To accurately assess the financial impact of a late return, it's essential to distinguish between the two types of penalties.

Here is a clear overview of what you may be facing.

ATO Penalties for Late Tax Returns at a Glance

Penalty Type | Who It Applies To | How It's Calculated |

|---|---|---|

Failure to Lodge (FTL) Penalty | Any taxpayer who misses their tax return due date. | A fine calculated in 'penalty units' for every 28-day period the return is late. |

General Interest Charge (GIC) | Any taxpayer with an unpaid tax debt from the late return. | Interest that accrues and compounds daily on the outstanding tax amount, starting from the original payment due date. |

Let's examine these in more detail.

Failure to Lodge (FTL) Penalty: This is a penalty for failing to meet your lodgement obligation on time. It is calculated in blocks of 28 days for each period your return is overdue and applies regardless of your final tax position.

General Interest Charge (GIC): This charge only applies if you have a tax liability. It functions like interest on a loan, accruing daily on the unpaid amount until the debt is settled in full.

Ignoring these penalties is a significant compliance risk. A minor penalty can escalate quickly, and prolonged non-compliance will attract further ATO scrutiny. This can lead to the ATO issuing a default assessment, where they estimate your income and tax liability—often resulting in a much higher figure than your actual obligation.

The ATO's penalties are not merely punitive. They are a mechanism to ensure the integrity and fairness of the tax system, reinforcing the obligation for all taxpayers to contribute on time.

Understanding how these penalties are calculated is vital for individuals, sole traders, and companies. Now, let's examine the specific calculation methods used by the ATO.

How the ATO Calculates Failure to Lodge Penalties

The Failure to Lodge (FTL) penalty is not an arbitrary figure. The Australian Taxation Office (ATO) calculates it using a structured system based on penalty units.

A penalty unit is a fixed monetary value used to calculate Commonwealth fines. For every set period your tax return is overdue, the ATO applies one or more penalty units, increasing the total fine. This ensures the penalty is proportional to the length of the delay.

Understanding Penalty Units

For individuals and small businesses, the ATO applies one penalty unit for every 28-day period (or part thereof) that a tax return is overdue. The penalty therefore increases in predictable increments.

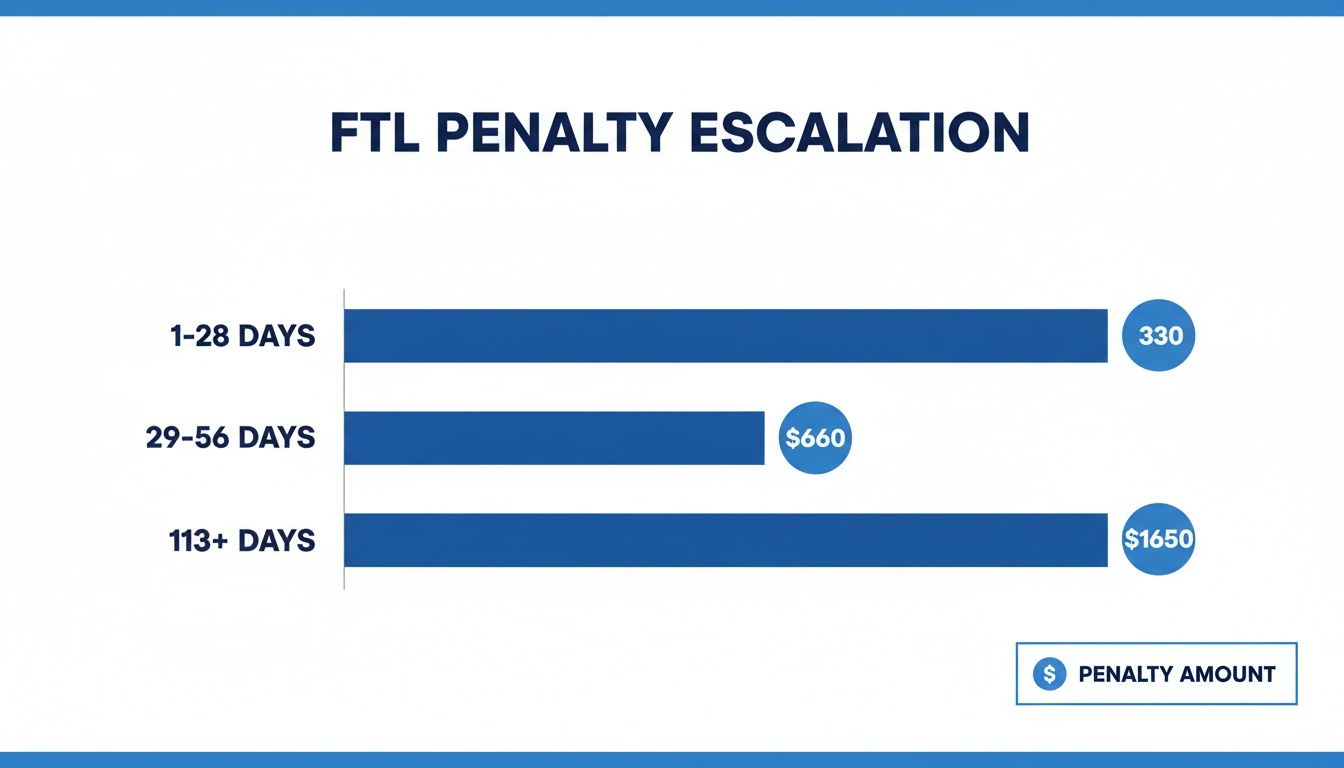

The value of a penalty unit is periodically adjusted by the government to reflect economic changes. As of the current financial year, one penalty unit is $330. This structured system means a fine of $330 for being 1-28 days late, which can rise to a maximum of $1,650 (five penalty units) for returns over 112 days overdue—even if you are due a refund.

How the Penalty Escalates Over Time

The penalty grows as the delay continues. The ATO will apply additional penalty units until the statutory maximum for that entity size is reached. For individuals and small businesses, the cap is five units.

Here is a breakdown of the escalation process:

1 – 28 Days Late: The ATO applies 1 penalty unit.

29 – 56 Days Late: A second unit is applied, for a total of 2 penalty units.

57 – 84 Days Late: The penalty increases to 3 penalty units.

85 – 112 Days Late: A fourth unit is added, for a total of 4 penalty units.

113+ Days Late: The maximum of 5 penalty units is applied.

This tiered system makes it clear that prompt action is essential. The longer you delay lodging, the higher the cost. If you are unsure of your potential tax liability, using a reliable tax return calculator can provide a useful estimate.

The ATO's penalty unit system is designed as a transparent deterrent. It ensures the consequences for late lodgement are consistent and predictable, removing ambiguity about the potential financial impact.

The following table illustrates how the FTL penalty accumulates for an individual or small business.

ATO Failure to Lodge (FTL) Penalty Escalation for Individuals and Small Businesses

This table details the FTL penalty increase for each 28-day period an income tax return is overdue, based on the current penalty unit value of $330.

Days Overdue | Penalty Units Applied | Total Penalty Amount |

|---|---|---|

1 – 28 Days | 1 | $330 |

29 – 56 Days | 2 | $660 |

57 – 84 Days | 3 | $990 |

85 – 112 Days | 4 | $1,320 |

113+ Days | 5 | $1,650 |

The rapid multiplication of the penalty underscores the importance of addressing overdue returns immediately. Understanding this calculation is the first step in interpreting any penalty notice you receive.

Understanding the General Interest Charge on Tax Debt

In addition to the F_ailure to Lodge (FTL) penalty_, the Australian Taxation Office (ATO) applies a General Interest Charge (GIC) to any outstanding tax liability. This is where costs can escalate significantly. Unlike the fixed FTL fine, the GIC is an interest rate applied to your unpaid tax.

GIC functions similarly to credit card interest. It begins accruing from the original payment due date and, critically, it compounds daily. This means you pay interest not only on the principal tax debt but also on the accumulated interest, causing the debt to grow at an accelerating rate.

How GIC Is Calculated

The GIC rate is determined quarterly by the ATO. It is based on the 90-day Bank Accepted Bill rate, plus a 7% uplift. Its purpose is to compensate the government for the revenue delayed past the statutory deadline.

The daily compounding nature of GIC makes it a powerful incentive for timely payment. A manageable tax debt can quickly become a serious financial burden if left unaddressed. Procrastination is detrimental, as every day of delay increases the final amount payable.

This chart illustrates how the initial FTL penalty climbs, establishing a base fine that GIC will then build upon if a tax debt is also present.

As shown, the FTL penalty quickly reaches its $1,650 maximum for small entities, creating a significant penalty before any GIC is applied to the underlying tax debt.

Higher Stakes for Businesses

While the GIC rate is uniform, the ATO applies multipliers to FTL penalties for larger businesses to reflect their greater tax obligations.

Medium Entities: Face a 2x multiplier on FTL penalties.

Large Entities: Are subject to a 5x multiplier.

Significant Global Entities: Face a 500x multiplier.

These multipliers apply only to the FTL penalty, not the GIC, but they demonstrate the ATO's serious stance on corporate compliance. A large company could face an FTL penalty of up to $8,250 for a single late return, in addition to the daily compounding GIC on any tax owed.

The General Interest Charge ensures a level playing field. It discourages taxpayers from using unpaid tax as a form of credit and ensures those who pay on time are not disadvantaged.

The combination of a maximum FTL penalty and daily compounding GIC can create a significant financial liability. This highlights the importance of not only lodging returns but also addressing any associated tax debt promptly.

Putting the Penalties Into Perspective: Practical Examples

Theoretical knowledge is useful, but practical examples demonstrate how ATO penalties apply in real-world scenarios. The following examples for individuals, sole traders, and companies illustrate how quickly costs can accumulate.

Example 1: Individual Entitled to a Refund

Sarah is an employee who is due a $1,200 tax refund. Due to personal circumstances, she lodges her tax return 120 days after the due date.

A common assumption is that no penalty applies if a refund is due. This is incorrect. The Failure to Lodge (FTL) penalty is for the act of late lodgement, irrespective of the final tax assessment.

Days Overdue: 120 days.

Penalty Calculation: As 120 days exceeds the 112-day threshold, the maximum penalty for an individual applies.

FTL Penalty: 5 penalty units x $330 per unit = $1,650.

General Interest Charge (GIC): $0, as there was no tax debt.

Result: The ATO will apply the $1,650 penalty against her $1,200 refund. Instead of receiving a refund, Sarah now has a $450 debt to the ATO. This demonstrates that being entitled to a refund does not exempt a taxpayer from lodgement deadlines.

Example 2: Sole Trader with a Tax Liability

Ben is a sole trader who lodges his income tax return 150 days late and is assessed with an $8,000 tax liability. In this scenario, both the FTL penalty and the General Interest Charge (GIC) apply.

The FTL penalty is calculated based on the delay.

FTL Penalty: Ben is well over the 113-day mark, so the maximum 5 penalty units are applied, resulting in a $1,650 penalty.

The GIC is the more significant cost. It has been accruing daily on his $8,000 debt since the original due date. Due to daily compounding, the interest grows exponentially.

General Interest Charge (GIC): Calculated daily on the $8,000 for the full 150-day overdue period. The final amount will depend on the GIC rate for the relevant quarters but will add hundreds of dollars to his liability.

Result: Ben is liable for his original $8,000 tax debt, the $1,650 FTL penalty, plus the accrued GIC. His total liability will be well over $10,000, showing how penalties escalate when a tax debt is present.

Example 3: Small Company with Overdue BAS

A small proprietary limited company has failed to lodge two quarterly Business Activity Statements (BAS). Each BAS is a separate lodgement obligation.

BAS 1 (Quarter 1): 60 days overdue.

BAS 2 (Quarter 2): 30 days overdue.

The ATO can apply an FTL penalty for each outstanding document.

Penalty for BAS 1: 60 days overdue falls into the third 28-day block (57-84 days), attracting 3 penalty units ($990).

Penalty for BAS 2: 30 days overdue falls into the second 28-day block (29-56 days), attracting 2 penalty units ($660).

Result: The company faces a total FTL penalty of $1,650 ($990 + $660) for the late lodgements. If these BAS returns also resulted in a GST liability, GIC would be applied to those amounts from their respective due dates. This example shows how penalties can compound across multiple obligations, turning a minor issue into a major financial problem.

A Step-by-Step Guide to Fixing Your Overdue Return

Realising a tax return is overdue can be daunting, but inaction will only worsen the situation. A structured approach is key to resolving the issue and mitigating penalties. This guide provides a clear roadmap for managing your overdue lodgement.

The immediate priority is to stop the accrual of penalties. The Failure to Lodge (FTL) penalty is calculated in 28-day blocks, so every day of delay risks increasing the fine. Do not let the fear of a tax bill prevent you from lodging—payment arrangements can be addressed separately with the ATO.

Step 1: Gather Your Essential Documents

Before lodging, you must collate all necessary financial records for the relevant year. This ensures an accurate return and prevents future complications.

A checklist of required documents typically includes:

Income Statements: From all employers (much of this data may be pre-filled in your myGov account).

Bank Interest Records: Statements detailing interest earned.

Other Income: Records for income from investments, rental properties, or sole trader activities.

Deductions and Receipts: All receipts for work-related expenses you intend to claim, preferably sorted by category.

Step 2: Lodge the Overdue Return Immediately

Once your documents are in order, lodge the return without delay. This is the single most effective action to prevent further FTL penalties.

If you discover an error on a previously lodged return, it is better to lodge the current one on time and then correct the past mistake. Our article explains how to amend a tax return in Australia.

Step 3: Proactively Communicate with the ATO

Silence is detrimental when dealing with the ATO. If you anticipate a tax debt you cannot pay immediately, or if you face difficulties with lodgement, contact the ATO or engage a registered tax agent. Proactive communication demonstrates that you are taking your obligations seriously.

The ATO is increasing its enforcement activities. In the 2023-24 financial year, it issued 8,710 director penalty notices for issues like unpaid superannuation. This indicates a broader trend of cracking down on all overdue lodgements, from income tax returns to Business Activity Statements (BAS).

Step 4: Request a Penalty Remission if Applicable

If there is a valid reason for the late lodgement, you may be eligible for a penalty remission. The ATO has the authority to remit an overdue tax return penalty in specific circumstances.

To successfully request a remission, you must provide a reasonable explanation supported by evidence. A strong compliance history significantly improves your position.

Common grounds for remission include:

Extenuating Circumstances: Serious illness, a death in the immediate family, or the impact of a natural disaster are typically considered valid reasons.

Good Compliance History: If the late lodgement is an isolated incident in an otherwise compliant record, the ATO is more likely to grant a remission.

Step 5: Arrange a Payment Plan if Needed

If your lodged return results in a tax debt that you cannot pay in full, do not panic. The ATO offers payment plans to help manage the debt over time.

These can often be established online via myGov or by contacting the ATO directly. This is a responsible step that helps you avoid more severe debt recovery actions.

Frequently Asked Questions (FAQ)

Navigating an overdue tax return penalty raises many questions. Here are clear, ATO-aligned answers to common queries from individuals and businesses.

Does the overdue tax return penalty apply if I am getting a refund?

Yes, the Failure to Lodge (FTL) penalty can apply even if you are due a refund. Lodging on time is a legal obligation separate from paying tax. The penalty is for failing to meet the lodgement deadline, regardless of your final tax position. While the ATO may exercise its discretion and not apply a penalty in cases where a refund is due, it reserves the right to do so, particularly for taxpayers with a history of late lodgements or who have ignored reminder notices.

Can the ATO waive a Failure to Lodge penalty?

Yes, the ATO has the power to waive, or 'remit', an FTL penalty in full or in part. A request for remission can be made by you or your tax agent, but it must be supported by a valid reason and, where possible, evidence. The ATO is more likely to grant a remission under specific circumstances, such as a serious illness, natural disaster, or if the taxpayer has an excellent compliance history. Forgetting or being too busy are generally not considered sufficient grounds. According to the ATO, a penalty may be remitted if "it is fair and reasonable to do so," indicating decisions are made on a case-by-case basis.

What happens if I never lodge a tax return?

Ignoring your lodgement obligations will lead to escalating consequences far more severe than a standard overdue tax return penalty. After initial reminders, the ATO will take further action:

Default Assessment: The ATO can issue an estimated assessment of your income and tax liability based on available third-party data. This default assessment is often higher than the actual liability and becomes a legally enforceable debt.

Prosecution: In cases of prolonged or deliberate non-compliance, the ATO can initiate legal proceedings, which may result in court-imposed fines or even a criminal conviction.

Failing to lodge is a serious breach of Australian tax law.

How far back can the ATO chase unlodged returns?

There is no statutory time limit for the ATO to compel the lodgement of an outstanding tax return. While their primary focus is typically on recent years, they have the legal authority to pursue unlodged returns from many years prior. This is especially true if they suspect a significant tax debt or tax evasion. It is always advisable to voluntarily disclose and lodge all outstanding returns to achieve a better outcome.

Summary: Key Takeaways

Facing an ATO penalty for an overdue tax return can be stressful, but the solution lies in proactive and decisive action. Open communication and prompt lodgement are your most effective tools for minimising financial penalties and demonstrating your commitment to compliance.

Here are the critical takeaways:

Two Key Penalties Exist: The Failure to Lodge (FTL) penalty applies for late submission, while the General Interest Charge (GIC) accrues on any unpaid tax debt.

Lodge First, Arrange Payment Later: Lodge your return immediately to stop FTL penalties from increasing. Payment arrangements for the tax debt can be negotiated with the ATO afterwards.

Penalties Escalate Quickly: FTL penalties increase in 28-day blocks, while GIC compounds daily on your tax debt, rapidly magnifying the total amount owed.

Communication is Crucial: Ignoring the issue is the worst strategy. Contacting the ATO or your tax agent can open up solutions like penalty remissions or manageable payment plans.

Businesses Face Higher Stakes: FTL penalties are multiplied for medium and large businesses, making timely lodgement a non-negotiable aspect of corporate governance.

To ensure all your documentation is in order, our tax return checklist provides a useful starting point.

This article contains general information only. For advice tailored to your specific circumstances, please contact Baron Tax and Accounting.

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213

Whatsapp: 0450468318

Comments