How Do I Claim the Home Office Tax Deduction in Australia?

- Dec 8, 2025

- 9 min read

Working from home allows many Australians to claim a portion of their household running costs as a tax deduction, which can significantly lower their taxable income. However, navigating the Australian Taxation Office (ATO) rules is crucial to ensure your claim is compliant and maximised.

This guide explains what the home office tax deduction is and why understanding the rules matters. Incorrectly claiming expenses is a common red flag for the ATO, which can lead to audits, claim denials, and financial penalties. Staying informed about your obligations under ATO regulations is the best way to avoid compliance risks while ensuring you receive the deductions you are entitled to.

Determining Your Eligibility for Home Office Deductions

Before calculating any expenses, you must confirm your eligibility. The ATO has strict criteria, and simply checking emails from the couch is not enough to qualify. The foundation of any claim is that you must have incurred additional, work-related expenses as a direct result of performing your job from home.

The Core ATO Eligibility Criteria

To successfully claim a home office deduction, you must satisfy these three conditions:

You must have spent the money yourself and were not reimbursed by your employer.

The expense must be directly related to earning your income, not a private or domestic cost.

You must have adequate records to prove the expense and your work-from-home hours.

Failure to meet all three criteria will likely result in the ATO rejecting your claim during a review. The key compliance risk here is making a claim without sufficient proof, which the ATO may treat as a false or misleading statement.

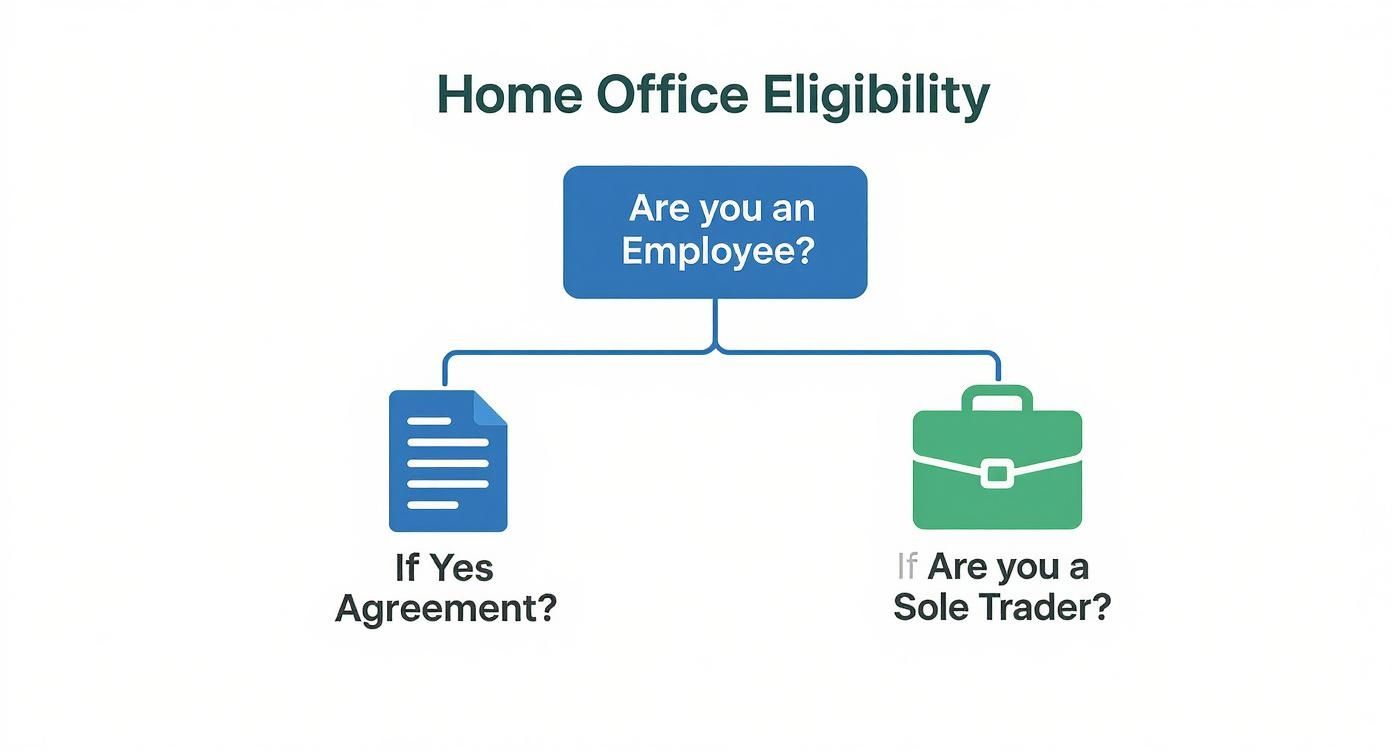

Employee vs. Sole Trader Scenarios

Your employment status significantly impacts what you can claim. The rules differ for employees and business owners.

For employees, eligibility hinges on your formal work arrangement. If your employer requires you to work from home, either full-time or on a hybrid basis, you are generally eligible to claim running expenses. However, if you choose to work from home for personal convenience (e.g., finishing tasks after hours), you typically cannot claim these costs as they are not a requirement of your employment.

For sole traders and other business owners, the rules are more accommodating. If your home is your principal place of business, you can claim a portion of your home running costs. This may still apply even if you operate from another location, provided substantial business activities occur at home. It is vital to distinguish between running expenses (e.g., electricity, internet) and occupancy expenses (e.g., rent, mortgage interest), as claiming the latter can create Capital Gains Tax (CGT) implications when you sell your home. For a deeper dive into what you can claim, our comprehensive guide on Australian tax deductions offers valuable insights.

According to the ATO, the expense must be incurred in the course of gaining or producing your assessable income. Convenience is not a sufficient reason; the work-from-home arrangement must be part of your employment duties.

Choosing Your Calculation Method: Fixed Rate vs Actual Cost

Once you have confirmed your eligibility, you must decide how to calculate your deduction. The ATO provides two methods: the revised fixed rate method and the actual cost method. Your choice will affect your final deduction amount and the record-keeping requirements. The optimal method depends on your work hours, specific expenses, and willingness to manage detailed records.

This flowchart provides a basic overview of how your employment status is the first step in determining your claim, leading into the calculation methods.

The Fixed Rate Method

For those seeking a straightforward approach, the ATO’s fixed rate method is the simplest option. From 1 July 2024, this method allows you to claim a flat rate of 70 cents for each hour you work from home.

This all-inclusive rate covers several common running expenses:

Energy (electricity and gas) for lighting, heating, cooling, and electronic equipment.

Internet expenses.

Mobile and home phone usage.

Stationery and computer consumables (e.g., printer ink, paper).

A key advantage is that you no longer need a dedicated home office to use this method. However, the ATO requires you to keep a complete record of your actual hours worked for the entire financial year. A timesheet, diary, or spreadsheet is essential.

Diving into the Actual Cost Method

If you have significant home office expenses and are prepared to maintain detailed records, the actual cost method may yield a larger deduction. This method requires you to calculate the specific work-related portion of each home office expense individually.

You must meticulously track all relevant costs and use a reasonable basis to apportion the work-related component. A common approach is to calculate the floor area of your workspace as a percentage of your home's total area and apply this to shared utility bills.

Under this method, you can claim the work-related portion of expenses such as:

Electricity and gas.

Home and mobile phone bills (see our detailed guide on the mobile phone tax deduction).

Internet services.

The decline in value (depreciation) of office furniture and equipment.

Cleaning costs for your designated work area.

The ATO enforces strict record-keeping requirements for the actual cost method. You must retain all receipts and bills and be able to show your calculations for how you apportioned each expense. Estimates are not acceptable.

Fixed Rate vs Actual Cost Method: A Comparison

To help you decide, this table compares the two methods directly, highlighting the key differences in compliance and potential outcomes.

Feature | Fixed Rate Method | Actual Cost Method |

|---|---|---|

Simplicity | High – A simple calculation of hours worked multiplied by 70 cents. | Low – Requires detailed calculations for each individual expense. |

Record-Keeping | Must keep a complete log of hours worked and proof of payment for the expenses covered by the rate. | Must keep all receipts, bills, and detailed calculations showing the work-use apportionment for every claim. |

What's Covered | Bundles energy, internet, phone, and stationery into one rate. You can still claim depreciation on assets separately. | Each expense is calculated and claimed individually. |

Potential Deduction | Generally provides a smaller deduction but is much simpler to calculate and substantiate. | Can result in a higher deduction, particularly for those with high running costs or significant asset depreciation. |

Ultimately, review your expenses and work patterns. If your actual costs are high or you've invested heavily in office equipment, the actual cost method may be more beneficial. Otherwise, the fixed rate method offers a compliant, low-effort alternative.

Mastering Your Record-Keeping for ATO Compliance

Accurate record-keeping is the cornerstone of a successful home office tax deduction claim. The ATO has stringent rules, and non-compliance can lead to claim denials, audits, and penalties. Your records are the evidence that validates your claim.

Essential Records for Your Claim

The specific documents required depend on your chosen calculation method. A universal rule is that all records must be kept for at least five years from the date you lodge your tax return.

Checklist for the Fixed Rate Method:

A complete log of all hours worked from home for the entire income year (e.g., timesheet, diary, spreadsheet).

At least one quarterly bill for each expense category covered by the rate (e.g., electricity, internet) to prove you incurred the costs.

Receipts for any depreciating assets claimed separately (e.g., desk, computer over $300).

Checklist for the Actual Cost Method:

A diary or log detailing your work-from-home pattern over a representative four-week period to establish a pattern of use.

Receipts, invoices, or bank statements for every running expense claimed.

Detailed calculations showing your apportionment methodology (e.g., floor space calculation, itemised phone bills).

The ATO uses sophisticated data matching to verify claims against employer data and industry benchmarks. Unusually high claims or round-number estimates are easily flagged. Precise, contemporaneous records are your best defence against scrutiny.

Streamlining Your Record-Keeping

Modern tools can simplify record-keeping. Using dedicated accounting software for small businesses or receipt-scanning apps can help automate the process and create an organised, digital audit trail. This not only saves time but also ensures you have clear, accessible proof if the ATO requests substantiation. In cases where receipts are lost, our guide on what you can claim on tax without receipts explains the ATO's limited exceptions.

Claiming Depreciation on Your Home Office Assets

In addition to running costs, the equipment you purchase for your home office—such as a computer, desk, or ergonomic chair—can also be claimed. The ATO allows you to deduct the decline in value of these assets over time, a process known as depreciation. Understanding how to calculate and claim depreciation is essential for maximising your tax return.

The ATO provides an online Depreciation and Capital Allowances Tool to help calculate the decline in value of assets based on their cost and effective life.

Assets Costing Under $300

For assets costing less than $300, the rules are simple. You can claim an immediate deduction for the full business-use portion in the year of purchase.

Example: You buy an office chair for $250 that is used 100% for work. You can claim the full $250 as a deduction in that year's tax return.

Depreciating Assets Over $300

For assets costing $300 or more, you must claim the deduction over the asset's effective life (the ATO's estimate of its usable lifespan).

To calculate your deduction, you must:

Determine the cost of the asset.

Establish its effective life from ATO guidelines.

Calculate the work-use percentage.

Calculate the annual decline in value.

Practical Example: Depreciating a LaptopYou purchase a laptop for $2,000. The ATO determines its effective life is 3 years. You use it 80% for work and 20% for private purposes.* Claimable Amount: $2,000 x 80% = $1,600* Annual Deduction (Straight-Line Method): $1,600 ÷ 3 years = $533.33You can claim a deduction of $533.33 each year for three years.

Correctly managing business asset depreciation is crucial. This includes non-tech items like office furniture; finding the best corner desk for your home office is a legitimate claimable asset. Always keep receipts and a logbook to substantiate your work-use percentage.

FAQ: Common Home Office Tax Deduction Questions

1. Can an employee claim rent or mortgage interest?

No. Under Australian tax law, employees working from home cannot claim occupancy expenses such as rent, mortgage interest, council rates, or property insurance. The ATO classifies these as private or domestic expenses. Claiming these costs is a significant compliance error unless you are operating a business from home where your home office qualifies as a genuine 'place of business', which can have Capital Gains Tax (CGT) implications.

2. Can I claim deductions if I don't have a dedicated home office room?

Yes, but only if you use the fixed rate method (70 cents per hour). This method was specifically designed by the ATO to accommodate modern work arrangements where an employee may work from a shared space like a lounge room or dining table. If you use the actual cost method, you must have a dedicated workspace to accurately calculate the work-related portion of shared household expenses based on floor area.

3. What records must I keep if I use the 70 cents fixed rate method?

Even with the simpler fixed rate method, the ATO requires strict record-keeping. You must keep:

A record of your actual hours worked from home for the entire financial year (e.g., a timesheet, diary, or spreadsheet). Estimates are not acceptable.

Proof that you incurred the running expenses covered by the rate, such as at least one quarterly electricity bill, internet bill, or phone bill.

Receipts for any depreciating assets you claim separately (e.g., office furniture or equipment costing over $300).These records must be kept for five years, as per ATO guidelines.

4. What are the biggest mistakes to avoid when claiming home office expenses?

The most common ATO red flags are:

Claiming occupancy expenses as an employee: This is incorrect and will likely trigger an ATO review.

Double-dipping: Claiming individual expenses like internet or phone bills in addition to using the all-inclusive 70 cents fixed rate.

Poor record-keeping: Using estimates for hours worked or being unable to produce receipts to substantiate claims. The ATO's data-matching systems easily detect these errors, which can lead to penalties. You can learn more about the ATO's approach to working from home expenses directly on their website.

Summary of Key Takeaways

Correctly claiming the home office tax deduction is essential for maximising your tax return while remaining compliant with ATO regulations.

Eligibility is Key: You must have incurred the expenses yourself, and they must be directly related to earning your income.

Choose the Right Method: The fixed rate method (70 cents/hour) is simple but may yield a smaller deduction. The actual cost method can be more lucrative but requires meticulous record-keeping.

Records are Non-Negotiable: The ATO requires detailed proof for all claims. Keep logs of hours, receipts, bills, and calculations for at least five years.

Avoid Common Errors: Do not claim occupancy expenses as an employee, avoid double-dipping, and never rely on estimates.

Depreciation Matters: Claim the decline in value for assets costing over $300 to maximise your return.

Contact Us

Navigating the nuances of the home office tax deduction can be complex. The best calculation method depends on your individual circumstances, and ATO rules are continually updated. For personalised advice tailored to your situation, contact the experts at Baron Tax and Accounting. We ensure you claim everything you are entitled to while meeting all your compliance obligations.

Baron Tax and Accounting

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213