Maximize Your Work From Home Tax Deductions Today

- Jul 13, 2025

- 13 min read

With remote work becoming a permanent fixture in Australia, getting your head around work from home tax deductions is no longer just a nice-to-have—it's essential for making sure you get back everything you're entitled to at tax time. You can claim these expenses using two different approaches: the straightforward fixed rate method or the more hands-on actual cost method. The key is that you must be incurring extra costs because you're working from home.

Your Guide to Claiming WFH Expenses

As working from home cements its place in the modern Australian workplace, so does the need to understand exactly what you can claim. And let's be clear, these deductions aren't just for business owners. If you're an employee who regularly works from home, you're almost certainly eligible to lower your taxable income.

The real decision comes down to choosing the right method for your situation. The Australian Taxation Office (ATO) gives you two main paths to follow:

The Fixed Rate Method: This is the simplified, no-fuss option. You claim a set rate for every hour you work from home, which is designed to cover a bundle of common running costs without needing a mountain of receipts.

The Actual Cost Method: This route requires you to calculate the genuine work-related percentage of all your home office expenses. It's more work and demands better record-keeping, but it can often lead to a much bigger deduction if your costs are significant.

First Things First: Are You Eligible?

Before you start digging through bills and pulling out the calculator, you need to be sure you can even make a claim. The ground rules are simple: you must be working from home to carry out your employment duties—not just checking a few emails on the couch after dinner. Crucially, you also need to be spending your own money on additional, deductible expenses as a direct result of working from your home.

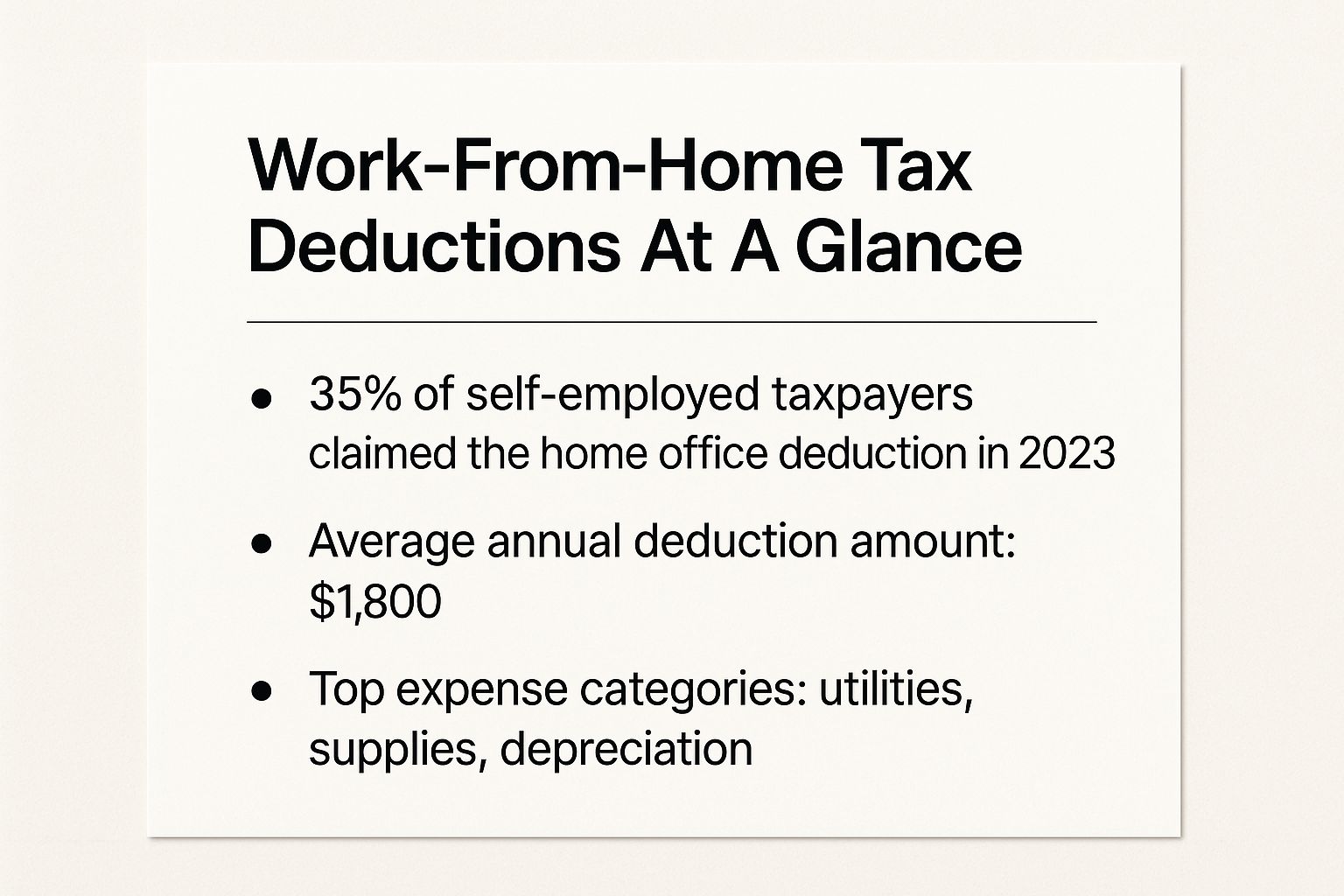

This snapshot gives you a quick idea of the WFH deduction landscape, based on recent data from Aussie taxpayers.

As you can see, plenty of people are claiming these costs, with utilities and the depreciation of assets like desks and computers being major factors.

Key Takeaway: If there's one thing to remember, it's this: meticulous record-keeping is non-negotiable. Whether you choose the fixed rate or the actual cost method, the ATO demands proof. That means holding onto receipts, bills, and keeping a diary of the hours you've worked from home.

Your choice between the two methods really boils down to your specific expenses and how much effort you're prepared to put into tracking everything. Let’s dive into both methods so you can figure out which one makes the most sense for you.

To make it easier, here’s a quick comparison of the two ATO-approved methods for claiming your work from home expenses. This table breaks down what each method covers and the kind of records you’ll need to keep.

Comparing ATO Deduction Methods for WFH

Feature | Fixed Rate Method | Actual Cost Method |

|---|---|---|

What it Covers | Energy, internet, phone, stationery, and computer consumables. | The actual work-related portion of all running expenses, including depreciation of assets. |

Simplicity | High. You only need to track hours worked. | Low. Requires detailed calculations and apportionment for each expense. |

Record-Keeping | A timesheet or diary of hours worked. | All receipts, bills, and a clear basis for calculating the work-use percentage (e.g., floor area). |

Best For | People with lower expenses or those who prefer convenience. | People with high running costs or significant asset purchases (like a new desk or computer). |

Potential Deduction | Capped by the set hourly rate. | No cap, based on your actual, proven costs. Can be much higher. |

Ultimately, take a look at your own spending and record-keeping habits. The actual cost method might yield a bigger refund, but only if you have the documentation to back it up. If you don't, the fixed rate method is a safe and simple alternative.

Choosing The Fixed Rate Method

If you're looking for a more straightforward way to claim your work-from-home expenses, the ATO's fixed rate method might be just what you need. It’s designed for convenience, letting you claim a set rate for every hour you work from home. This saves you the headache of calculating the work-related slice of every single utility bill.

Think of it as the simple, no-fuss option. It’s perfect if you want to claim your deductions without getting buried in complex calculations and mountains of paperwork. But "simple" doesn't mean you can just guess. To stay on the right side of the ATO, you need to know exactly what this rate covers and what it doesn't.

What Is Included In The Fixed Rate?

The hourly rate is essentially a package deal, bundling together the most common running expenses into one neat figure. When you choose this method, you’re claiming for:

Energy: This covers the electricity and gas you use for lighting, heating, and cooling your home office space.

Internet: The cost of keeping your home internet connection running.

Phone: Your work-related use of both your home and mobile phones.

Stationery and Consumables: Think printer paper, ink, pens, and other small office supplies.

With remote work now a permanent part of the landscape, the ATO has updated this rate to reflect today's costs. The fixed rate is 70 cents per hour. Just remember, this isn't for occasionally checking emails after hours; it’s for those with a regular, established work-from-home arrangement.

What You Must Claim Separately

It's absolutely critical to understand that the fixed rate isn't a catch-all. The biggest things it excludes are the decline in value (depreciation) of your big-ticket items.

Key Takeaway: You can't use the fixed rate method and then try to claim your entire internet bill as a separate deduction. The ATO sees this as "double-dipping," and it's a huge red flag that could trigger an audit.

If you’ve bought new gear for your home office, you can definitely still claim it. You just have to do it as a separate deduction. This includes things like:

The depreciation of office furniture, such as your desk and chair.

The decline in value of your tech, like a computer, monitor, or printer.

Any costs for repairing and maintaining your work equipment.

Other running costs not bundled into the fixed rate.

Record-Keeping Under This Method

Even with this simplified method, the "no records needed" myth is a dangerous one. The ATO still expects you to back up your claim. You can’t just pluck a number out of thin air at tax time.

You must be able to show:

A record of your hours: You need to keep a log of the total number of hours you worked from home throughout the financial year. A simple diary, a spreadsheet, or your employer's timesheets will do the trick.

Proof you paid for expenses: You need to hold onto at least one receipt or bill for each of the expense categories the fixed rate covers. For example, keep one electricity bill, one phone bill, and one internet bill from the financial year to prove you actually incurred these costs.

This method offers a much cleaner way to handle your work from home tax deductions, but good habits are key. For more tips on making sure you get everything you're entitled to, check out our guide on how to maximise your tax return in Australia.

Maximising Your Claim with the Actual Cost Method

While the fixed-rate method is a straightforward option, the actual cost method is where you can potentially see a much bigger tax deduction. This approach is perfect if you’ve invested seriously in your home office setup, but be warned: it demands meticulous record-keeping.

Instead of a simple hourly rate, you’ll be calculating the genuine, work-related portion of every single running cost. Yes, it’s more work. But if you’ve got significant home office expenses, the extra effort can make a real difference to your tax return.

Tallying Up Your Running Costs

Under this method, you can claim the work-related percentage of a broad range of expenses. The trick is to fairly divvy up the costs between your personal and work use.

Common running costs you can claim include:

Energy bills: The electricity and gas used for heating, cooling, and lighting your dedicated workspace.

Phone and internet: The work-related percentage of your service bills.

Stationery and supplies: Think printer paper, ink, notebooks, and other consumables you chew through for work.

Cleaning: The cost of cleaning your dedicated home office area.

To figure out the work-related portion, you need a logical way to calculate it. For utilities, the most common approach is to use your home office's floor area as a percentage of your home's total area.

Here’s a real-world example: If your dedicated home office takes up 10% of your home's total floor space, you can generally claim 10% of your electricity and gas bills. Crucially, you must have a dedicated room or area set aside for work to use this calculation.

Claiming Depreciation on Your Big-Ticket Items

One of the major upsides of the actual cost method is claiming depreciation on your pricier home office assets. This is where you account for the decline in value of items that help you earn your income.

You can claim depreciation for assets such as:

Desks and proper ergonomic chairs

Computers, laptops, and monitors

Printers and scanners

Filing cabinets and bookshelves

For any asset costing over $300, you claim its decline in value over its "effective life," not the full cost in one go. For items under $300, you can usually claim an immediate deduction for the entire work-related portion. This is also a key area of focus for tax deductions for small business, where managing assets is vital.

Why Your Records Are Everything

The ATO is strict about evidence for claims made under the actual cost method. Your records are your best friend here. You absolutely must keep:

A detailed logbook or diary for a representative four-week period. This helps establish a clear pattern of work-related use for shared expenses like your phone and internet.

Every single receipt and itemised bill for each expense you claim. Digital or paper, just keep them safe.

A depreciation schedule to track the value of your assets over their lifespan.

When you start itemising like this, you’ll often find deductions you hadn’t even considered. Maybe it’s a subscription to specific remote work productivity tools you need for your job. This detailed approach ensures every legitimate expense is captured, building a solid, audit-proof tax claim.

Keeping Records to Secure Your Refund

Think of your records as the foundation of your claim. If that foundation is weak, the whole thing can crumble under the slightest scrutiny. To secure your refund with confidence, you need a system for both your paper and digital documents that you stick with throughout the year, not just in a last-minute scramble before 30 June.

What Constitutes Valid Proof?

Different expenses require different kinds of evidence. Just having a bank statement showing a payment to your power company isn't going to cut it; the ATO wants to see the specific details.

Here’s a breakdown of what you’ll actually need for common WFH expenses:

Utility Bills: Always keep the itemised bill, not just the payment summary. This document shows the usage period and cost breakdown, which is absolutely essential for calculating your work-related portion.

Asset Purchases: For anything like a desk, chair, or computer, you must hold onto the tax invoice. It proves the date of purchase, the cost, and the supplier details—all information you'll need for depreciation calculations.

Phone and Internet: Your monthly bill showing the plan cost is the starting point. But you’ll also need a logbook or a similar record to back up your work-use percentage.

A core principle the ATO lives by is that you must have actually incurred the expense and have proof of it. Strong documentation removes any doubt, makes your claim undeniable, and ensures you get the maximum refund you're legally entitled to.

Developing good habits here is a non-negotiable. Our guide on tax record keeping offers a complete system to keep you organised and compliant. It's a great resource for building a robust file that stands up to any questions.

Tracking Your Time and Usage

Beyond receipts for things you've bought, you need records that show how you used your time and resources for work. This is where diaries and logbooks become your best friends.

Your Diary of Hours Worked

If you're claiming any WFH expenses, you have to track your hours. A simple spreadsheet, a physical diary, or even a notes app on your phone will do the job. Just make sure it clearly captures the date and the number of hours you worked from home each day. To validate claims under the revised fixed rate method, the ATO needs to see a continuous record for the full income year.

The Four-Week Logbook

For shared running expenses like your phone and internet under the actual cost method, a four-week logbook is essential. For this representative period, you must track every single use—both personal and work-related—to establish a fair percentage.

You can then apply this percentage across the entire year, as long as your work patterns stay more or less the same. Without this logbook, calculating your work-use percentage is just guesswork, which is a massive red flag for the ATO.

Common Work From Home Tax Deduction Mistakes to Avoid

Navigating work from home tax deductions can feel like a minefield. It's so easy to make a small mistake that could shrink your refund or, worse, attract unwanted attention from the ATO. Even with the best of intentions, people trip up.

Let's walk through the most common pitfalls so you can lodge a tax return that’s both compliant and gets you every dollar you're entitled to.

The shift to remote work in Australia has been huge. The latest stats show around 41% of employed Australians now regularly work from home. This means more of us than ever can claim these deductions, but it also means the ATO is seeing more errors as people get used to the rules.

Claiming Occupancy Costs as an Employee

This is probably the biggest and most costly mistake we see. As an employee working from home, even if it's full-time, you cannot claim occupancy expenses.

These are the big-ticket costs tied to owning or renting your property, such as:

Rent payments

Mortgage interest

Council rates

Home and contents insurance

These deductions are almost exclusively for sole traders or business owners running their business from home. For an employee, claiming these is a massive red flag for the ATO and will almost certainly be rejected.

ATO’s Stance: The tax office is crystal clear on this. For employees, your home's main purpose is considered private and domestic, not for generating income. Occupancy costs are therefore not deductible. The only, very rare, exception is if you have a dedicated space with a separate entrance used exclusively for clients—something that almost never applies to a standard employee setup.

Double-Dipping on Your Expenses

Another common slip-up is "double-dipping," especially when using the fixed rate method. Think of the 70 cents per hour fixed rate as a package deal—it's designed to cover the running costs of your home office, including an allowance for your phone, internet, and stationery.

A classic mistake is claiming the 70 cents per hour rate and then also trying to claim a separate deduction for your mobile phone or internet bill. The ATO’s systems are sharp and built to catch this kind of overlap.

If you want to claim the actual cost of your phone or internet, you need to use the actual cost method for all your running expenses. You can’t mix and match. This same principle applies to other areas of tax, like we discuss in our guide on deductions for Uber drivers, where you can't claim your car expenses using two different methods at once.

Your Top WFH Deduction Questions Answered

Even after you think you've got the rules down pat, a few tricky questions always seem to pop up right when you're about to lodge your tax return. Getting these common queries sorted is the final hurdle to claiming your work from home tax deductions with confidence. Let's run through some of the questions we hear most often from our clients.

We’ve gone through the different methods and the paperwork involved, but these practical, real-world questions are often what makes or breaks a smooth tax time.

As an Employee, Can I Claim My Rent or Mortgage Interest?

This is a massive one, and the short answer is almost always no. If you're an employee who works from home, you simply can't claim these kinds of occupancy expenses. This bucket includes major costs like:

Rent payments

Mortgage interest

Council and water rates

Property insurance

The ATO sees these as private, domestic costs. They only become deductible in the rare situation where your home is officially your principal place of business—a scenario that usually only applies to sole traders or people running a business from their home, not your typical employee.

What if I'm Missing a Receipt for Something?

Look, we get it. Life happens, and keeping track of every single docket can be a challenge. If you've lost a receipt for a small, low-cost item, a bank or credit card statement showing the purchase details can sometimes pass as evidence with the ATO.

But don't make a habit of it. For any significant purchase, and especially for assets that cost over $300, you absolutely must have the proper tax invoice. If the ATO questions your claim and you can't provide solid proof, they have every right to deny the deduction. At the end of the day, you can't claim what you can't prove.

Pro Tip: Set up a dedicated folder on your computer or phone and get into the habit of snapping a photo of every receipt the moment you get it. This tiny bit of organisation can save you a world of pain and protect your claims down the track.

Do I Really Need a Diary for the Fixed Rate Method?

Yes, you 100% do. A huge misconception is that the "simpler" fixed rate method means you can skip the record-keeping. That's just not true. Under the revised rules, you are required to keep a detailed record of the total number of hours you worked from home for the entire financial year.

This could be a timesheet from your employer, a spreadsheet you maintain, or even a simple diary. Whatever you use, it needs to be a complete log. You also need to hang on to at least one paid bill for each type of running cost the rate covers (like one phone bill and one electricity bill) to prove you were actually out-of-pocket for these expenses.

For a deeper dive into what you can and can't claim, our guide on how to get tax deductions is a great resource to check out.

Feeling Stuck? Let's Get Your Tax Return Sorted

Trying to make sense of the work from home tax deduction rules can feel like a maze. It’s completely normal to feel a bit overwhelmed. You want to claim everything you're entitled to, but you also want to do it right and avoid any unwanted attention from the ATO.

That's where a second pair of expert eyes can make all the difference. Think of it like this: just as there are high standards for someone starting a CPA firm, you should expect the same level of diligence from your tax agent. A quick review by a professional can spot deductions you might have missed and ensure your records are solid enough to back everything up.

Don't risk leaving money on the table or making a simple mistake that could cost you later. Our team is here to cut through the confusion and give you peace of mind.

• Need assistance? We offer free online consultations: – Phone: 1800 087 213 – LINE: barontax – WhatsApp: 0490 925 969 – Email: info@baronaccounting.com – Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments