Claim Your Car Expenses Tax Deduction

- Jul 14, 2025

- 14 min read

Thinking about claiming a car expenses tax deduction? You’re not alone. The first thing to get straight is that you can only claim deductions for work-related travel. This is a completely different beast to your daily commute to and from your main workplace, a distinction that trips up many people come tax time.

Understanding Your Claim Eligibility

Before you even think about tallying up kilometres or digging for old fuel receipts, the most critical step is figuring out if you’re even eligible to claim. The Australian Taxation Office (ATO) has very clear guidelines, and it all boils down to their definition of "work-related" travel. Getting this right from the start is the foundation of a solid, compliant tax deduction.

The biggest point of confusion? The daily commute. Driving from your home to your regular place of work is almost always considered private travel, which means it’s not deductible. This holds true even if you drive a massive distance, work odd hours, or have zero public transport options. From the ATO’s perspective, where you choose to live is a personal matter.

However, the moment you’re "on the clock," the rules shift in your favour.

What is Considered Work-Related Travel?

Your travel becomes deductible when the journey itself is a necessary part of doing your job. We’re not just talking about driving to a single office; this is about the travel required to earn your income throughout the workday.

Here are a few classic examples of travel that the ATO green-lights for a deduction:

Driving between separate job locations: Think of a project manager who has to visit two different construction sites on the same day. That travel between sites is claimable.

Visiting clients or customers: If you're a sales rep driving to a client's office for a pitch, that's a textbook example of deductible travel.

Attending work-related conferences or meetings away from your usual workplace: That trip across town for a training seminar definitely qualifies.

Key Takeaway: The ATO's logic is actually quite simple. If the travel is an integral part of your work duties and not just a way of getting you to your starting point, it's very likely deductible.

To make it even clearer, here’s a quick-reference table to help you distinguish between travel you can and can't claim.

Claimable vs Non-Claimable Car Travel

Travel Scenario | Is It Claimable? | ATO Rationale |

|---|---|---|

Driving from home to your regular office | No | This is considered a private commute. |

Driving from your office to visit a client | Yes | Travel is part of performing your duties. |

Driving between two separate workplaces (for two different employers) | Yes | Travel between two places of income-earning activity. |

Attending a work conference or training away from your office | Yes | Travel is for a work-related purpose. |

Driving home from your regular office | No | This is also considered a private commute. |

Transporting bulky tools required for work (with no secure storage at work) | Yes (Potentially) | The necessity of transporting bulky items makes the travel deductible. |

This table should help you quickly assess most common travel situations. Always remember the core principle: is the journey itself part of earning your income?

When Your Commute Might Be Claimable

While the "no commute" rule is pretty firm, there are a couple of very specific, limited exceptions. One of the most common is when your employer requires you to transport bulky tools or equipment that simply can’t be stored securely at the workplace.

For instance, a tradesperson who must lug a heavy drop saw, a collection of power tools, and ladders to a new worksite each day could potentially claim that travel. The key is that the tools must be genuinely bulky—your laptop bag or a small briefcase won't cut it—and there must be no secure area to leave them at work. You can’t just choose to take them home; it must be a requirement of the job.

The Cents Per Kilometre Method Explained

For many Aussies, the cents per kilometre method is a refreshingly straightforward way to claim a car expenses tax deduction. It’s designed for pure convenience. You get to claim your work-related car trips without drowning in a shoebox full of receipts for fuel, oil, and everything in between.

This approach essentially bundles all your running costs—fuel, registration, insurance, and general wear and tear—into one simple, flat rate for every kilometre you drive for work.

The real beauty here is its simplicity. Forget tracking every little expense; your main job is just to keep a log of the business kilometres you travel. This makes it a fantastic option if you don't use your car for work all that often, or if you just prefer a "less-admin" approach to your taxes.

How The Rate Works

Each financial year, the Australian Taxation Office (ATO) sets a specific rate. For both the 2024-25 and 2025-26 income years, that rate is 88 cents per kilometre. This figure is an all-inclusive average, meant to cover every typical cost of running your car for work purposes.

To figure out your deduction, you just multiply your total work-related kilometres by this rate. It’s that simple.

There is one very important catch, though. You can only claim a maximum of 5,000 work-related kilometres per car, per year using this method. This caps your potential deduction at $4,400 for the 2024-25 tax year (which is 5,000 km x $0.88). If you drive more than that for work, you'll almost certainly be better off using the logbook method instead.

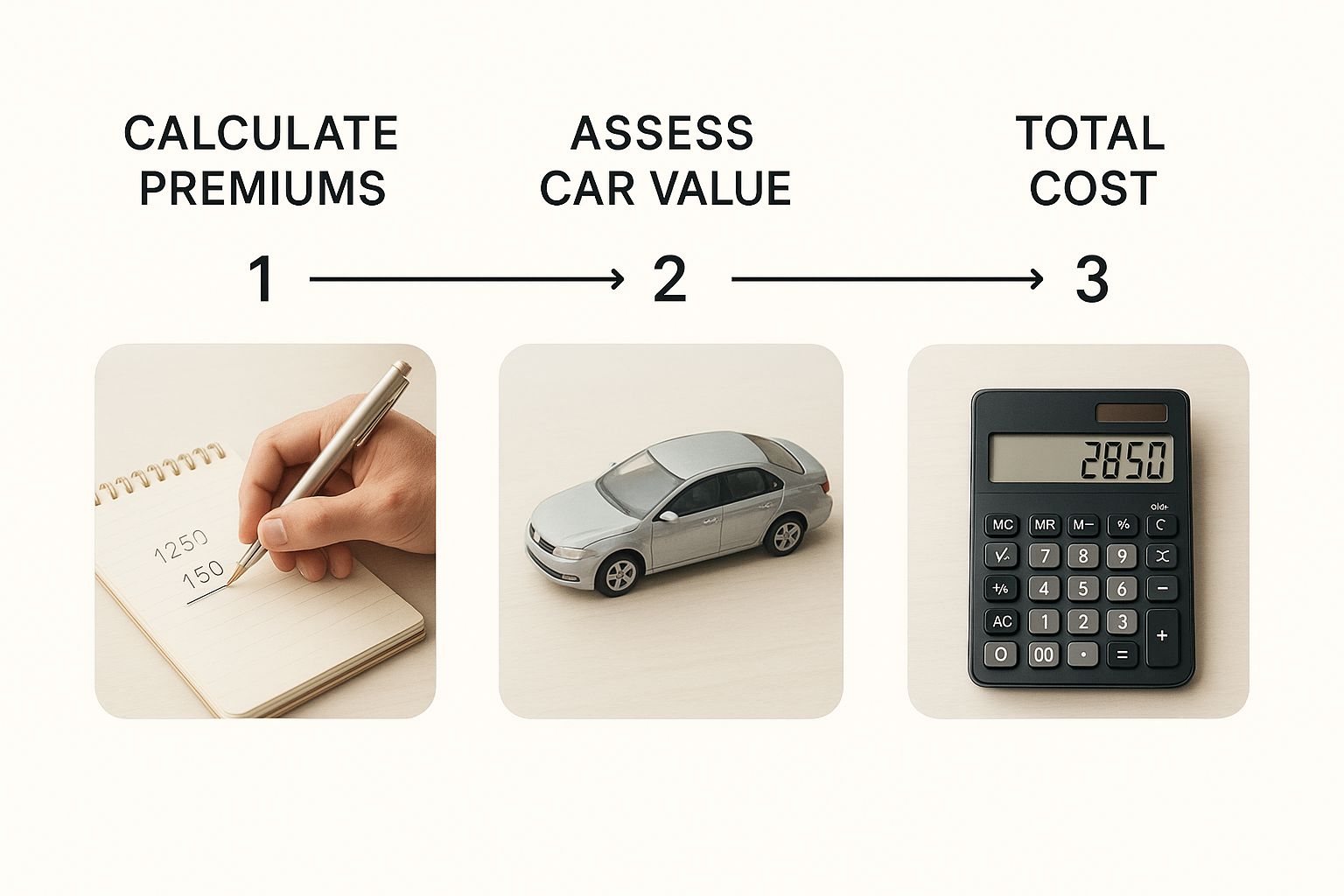

This infographic breaks down just how simple the calculation is.

As you can see, the whole process hinges on tracking your kilometres and applying the standard rate, letting you sidestep the headache of adding up individual receipts.

What Records You Need to Keep

While you get to skip the receipt-hoarding for running costs, you can't just pluck a number out of thin air. The ATO still needs you to show them how you worked out your total business kilometres. You must have written evidence.

A simple diary, a spreadsheet on your computer, or a dedicated smartphone app all work perfectly.

For every work trip, you should make a note of:

The date of the journey

The reason for your trip (e.g., “Visit client in Parramatta”)

The total kilometres you travelled

Practical Tip: The easiest and most accurate way to do this is by recording your car's odometer readings at the start and end of each work trip. This gives you precise, defensible evidence if the ATO ever asks questions.

A Practical Example

Let’s look at a real-world scenario. Imagine Sarah, a marketing consultant based in Melbourne. Throughout the financial year, her work-related driving looks like this:

20 trips to visit different clients, averaging 40 km each (800 km total)

15 trips to attend industry networking events, averaging 30 km each (450 km total)

5 quick trips to the post office to mail promotional packs, averaging 10 km each (50 km total)

Her total work-related travel for the year adds up to 1,300 kilometres.

To calculate her deduction, she just does the simple maths:

1,300 km x $0.88 = $1,144

Sarah can claim a $1,144 deduction for her car expenses.

While this method is much simpler, it's always smart to understand both options to make sure you're getting the biggest possible tax return. For a full breakdown, check out our complete 2024-25 guide to car tax deductions in Australia.

Maximizing Returns with the Logbook Method

If your car is less of a simple commuter and more of a mobile office, the cents per kilometre method is probably costing you money. For anyone who drives a lot for work, the logbook method is your ticket to a much bigger car expenses tax deduction. It does ask for a bit more admin work, but believe me, the financial reward is often well worth the effort.

This approach lets you claim the business-use percentage of what you actually spend on your car, not just a flat rate. It’s tailor-made for people whose work keeps them on the road. Think sales reps, tradies visiting multiple job sites, or small business owners doing their own deliveries. If that sounds like you, this method was designed for you.

Mastering the ATO-Compliant Logbook

The heart and soul of this method is, you guessed it, the logbook. The Australian Taxation Office (ATO) is quite specific here: you need to keep a detailed logbook for a continuous period of at least 12 weeks. The key is that this 12-week window must be a fair representation of your typical travel for the year.

Whether you go old-school with a notebook or use a digital app, your logbook must track these details for every trip during that period:

The start and end dates of the 12-week logbook period.

Your car's odometer reading at the start and the end of the 12 weeks.

The total number of kilometres you drove during the logbook period.

The total number of kilometres driven specifically for work.

For each work-related trip, you need to note the date, start and end odometer readings, total kilometres, and the reason for the journey (e.g., "Meeting with client at their office" or "Travel between Site A and Site B").

Once your 12 weeks are up, you can calculate your business-use percentage. Just divide the work-related kilometres by the total kilometres and multiply by 100. The best part? As long as your driving patterns stay roughly the same, a valid logbook is good for up to five years.

Expert Insight: A common mistake is to only log work trips. To get your percentage right, the ATO needs to see the total distance travelled. That means recording the odometer reading on day one and at the end of the 12 weeks is crucial.

Claiming Your Actual Car Expenses

Once you've locked in your business-use percentage, you can claim that exact portion of all your car's running costs for the entire financial year. This is where the real value is, as it covers so much more than just petrol.

The list of claimable expenses is extensive:

Fuel and oil: Every dollar you spend at the petrol station.

Registration and insurance: The cost of your annual rego and insurance premiums.

Repairs and maintenance: This includes regular servicing, new tyres, and any unexpected mechanical fixes.

Loan interest: If you have a car loan, the interest component of your repayments is claimable.

Depreciation: This is a big one people often miss. It’s the decline in your car's value over the year.

For this method, keeping receipts for every single one of these costs is absolutely non-negotiable. Your claim stands on two pillars: the logbook to prove your business use and the receipts to prove your total costs. For business owners, understanding how these deductions fit into the bigger picture is key. Our guide on tax deductions for small business can provide some excellent context here.

A Worked Example of the Logbook Method

Let's put this into practice with a real-world scenario. Meet David, a freelance IT consultant who spends his days driving between client offices. He diligently keeps an ATO-compliant logbook for 12 weeks.

Total kilometres travelled in 12 weeks: 6,000 km

Work-related kilometres in 12 weeks: 4,500 km

First, we calculate his business-use percentage: (4,500 km / 6,000 km) x 100 = 75%

Now, let's add up his total car expenses for the whole financial year:

Fuel and Oil: $3,500

Registration & Insurance: $1,500

Servicing & Tyres: $800

Loan Interest: $1,200

Depreciation: $4,000

Total Annual Expenses: $11,000

To work out his deduction, David applies his business-use percentage to his total expenses: $11,000 (Total Expenses) x 75% (Business Use) = $8,250

David can claim a massive $8,250 tax deduction for his car expenses. Compare that to the $4,400 cap on the cents per kilometre method, and it’s easy to see how a little extra record-keeping can put thousands back in your pocket.

Keeping Records the ATO Will Love - Car expenses tax deduction

When it comes to claiming car expenses, a successful tax deduction hangs on one thing above all else: proof. Your claim is only as strong as the records you keep, and the Australian Taxation Office (ATO) has crystal-clear expectations.

Whether you go for the straightforward cents per kilometre method or the more detailed logbook method, meticulous records are completely non-negotiable. It’s one of the fastest ways to have your claim questioned or flat-out denied. The responsibility is on you to back up every dollar and kilometre you claim.

Luckily, once you have a good system, staying compliant is easier than you think.

Records for the Cents Per Kilometre Method

Even though this method is designed for simplicity, you can't just pull a number out of thin air. The ATO needs to see written evidence showing how you actually calculated your total business kilometres.

This doesn't have to be a major headache. A simple diary, a dedicated spreadsheet, or even a note-taking app on your phone will do the job.

For each work-related trip, you need to jot down:

The date of the journey.

Where you started and where you ended up.

The reason for the trip (e.g., "Client meeting in Richmond," "Visit supplier").

The total kilometres you travelled for that specific trip.

Expert Tip: The gold standard here is to record your car's odometer reading at the start and end of each work trip. This gives the ATO undeniable, precise evidence of your travel, leaving zero room for doubt.

Records for the Logbook Method

If you’ve decided the logbook method is the way to go to maximise your return, your record-keeping duties step up a notch. Your entire claim rests on two pillars: the logbook itself and proof of all your car's running costs.

You absolutely must have both of these elements ready:

A compliant logbook: This means detailing every single trip—both for business and private use—over a continuous 12-week period. This is what establishes your crucial business-use percentage.

Receipts for every single expense: You need proof for every cost you plan to claim. This means holding onto digital or paper receipts and invoices for fuel, insurance, registration, loan interest, servicing, new tyres, and any repairs.

While a bank statement showing a fuel purchase is helpful, an actual invoice or receipt detailing exactly what was bought is always better.

Using Digital Tools to Stay Organised

Let's be honest, manually tracking every single trip and stuffing receipts in your glovebox is a recipe for disaster. It feels like a chore, and it's easy to miss things.

Thankfully, modern tech offers a much smarter way. There are plenty of smartphone apps out there specifically designed to track your mileage using GPS. They also let you snap photos of your receipts and categorise them on the spot.

Using these tools doesn't just save you a ton of time; it drastically improves your accuracy. To cut down on errors and make life even easier, look into automating data entry for faster, more reliable results. By embracing a digital system, you can be confident your records are organised, complete, and ready to go at tax time.

Common Mistakes to Avoid on Your Tax Return

Navigating the rules for a car expenses tax deduction can feel like walking a tightrope. One wrong move, and you could be looking at a smaller tax refund or, even worse, an unwelcome review from the Australian Taxation Office (ATO).

Let's break down some of the most common slip-ups I see people make, so you can lodge your return with confidence.

Probably the biggest and most frequent mistake is trying to claim your daily commute. That drive from your house to your regular workplace? The ATO almost always considers this private travel, making it not deductible. It doesn't matter if you have a long drive or work odd hours – this rule is pretty firm.

Getting the Details Wrong

Sloppy record-keeping is a massive red flag for the ATO. When it comes to tax claims, accuracy is everything. "Guesstimates" just won't cut it.

Here are a few detail-oriented mistakes that can get you into trouble:

"Guesstimating" Kilometres: Whether you're using the cents per kilometre method or the logbook method, your claim has to be based on actual, recorded work-related travel. Plucking a "reasonable" number out of thin air is a fast track to having your entire claim thrown out.

Using an Old, Invalid Logbook: Your logbook is good for up to five years, but there's a catch. It's only valid if your driving patterns haven't significantly changed. If you’ve switched jobs, moved to a new house, or your work duties have been shuffled around, that old business-use percentage is no longer accurate. You’ll need to start a fresh 12-week logbook.

Forgetting to Keep Receipts: If you're using the logbook method, your claim rests on two pillars: the logbook itself and proof of every single running cost you're claiming. Claiming for fuel, insurance, or repairs without the receipts or invoices to back them up means your deduction is unsubstantiated in the eyes of the ATO.

Key Takeaway: The ATO lives by a simple motto: "no proof, no claim." Every kilometre and every dollar must be backed up by clear, timely records. This isn't just a suggestion; it's a fundamental requirement for a successful claim.

Claiming What You Shouldn't

Beyond the daily commute, a few other incorrect claims often pop up. A classic example is trying to "double-dip" by claiming expenses that your employer has already paid you back for. If you received a reimbursement for the fuel you used on a client visit, you can't then turn around and claim that same cost as a tax deduction.

Understanding these common pitfalls is the first step towards a stress-free tax time. For a wider look at what you can and can't claim, check out our guide on individual tax deductions to make sure your entire return is spot-on. Getting it right from the start means you get the full refund you’re entitled to, without any nasty surprises.

Frequently Asked Questions

When it comes to claiming car expenses, a few tricky situations always seem to pop up. Let's tackle some of the most common questions we get from clients just like you.

Can I Claim Car Expenses if My Employer Reimburses Me?

The short answer is generally no. You can't claim a deduction for any car expenses your employer has already paid you back for. The ATO sees this as "double-dipping," and it's a definite no-go.

However, it's a completely different story if you receive a car allowance. This is a fixed amount your employer pays you, and it gets treated as part of your assessable income. You must declare the allowance on your tax return, but the good news is you can then claim a deduction for your actual work-related car costs using either the cents per kilometre or logbook method.

My Logbook Is a Few Years Old. Do I Need a New One?

Great question. A well-kept logbook is valid for up to five years, which is fantastic. But there's a catch: this only applies if your driving habits haven't really changed.

The ATO is quite clear on this. You need to start a fresh 12-week logbook if your circumstances change in a way that significantly alters your business-use percentage.

A new logbook is needed if you: * Change jobs or your office location moves. * Move house, which changes your travel distances to work or clients. * Get a new role or different duties that mean you're driving a lot more (or less) for work.

Even if nothing major has changed, it’s smart to quickly review your logbook's business-use percentage each year. This helps ensure it still accurately reflects your travel and keeps you on the right side of the ATO.

What if I Use More Than One Car for Work?

You can absolutely claim deductions for every car you use for work. The crucial thing is that you must keep separate records for each vehicle. You can't just lump all the expenses or kilometres together.

Here’s how it works for each method:

Cents per Kilometre Method: You can claim a maximum of 5,000 business kilometres *per car*. So, if you use two cars for work, you could potentially claim up to 10,000 km in total.

Logbook Method: Each car needs its own dedicated 12-week logbook. You'll also need to calculate the total running costs and the business-use percentage for each one separately. You can't just apply the percentage from your primary work car to your second vehicle.

Need an Expert Eye on Your Tax Return?

Sorting out car expense deductions can feel like a maze. The ATO rules are incredibly specific, and getting it right is the key to maximising your refund without raising any red flags. It's easy to get lost in the details, but you don't have to figure it all out on your own.

Our team lives and breathes this stuff. Whether you have a quick question about your logbook or need someone to handle the whole process and lodge your tax return online for you, we’re here to help. We’ll make sure you claim every dollar you're entitled to so you can file with complete confidence.

• Need assistance? We offer free online consultations: – Phone: 1800 087 213 – LINE: barontax – WhatsApp: 0490 925 969 – Email: info@baronaccounting.com – Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments