Tax Deductions for Small Business in Australia

- Jul 6, 2025

- 8 min read

Trying to get your head around Australian tax law can feel like a mammoth task. But here’s the thing: understanding your tax deductions is one of the most powerful things you can do for your small business’s financial health. Stop thinking of your business expenses as just costs. Instead, see them for what they really are—opportunities to reduce your taxable income and seriously improve your cash flow.

Your Straightforward Plan to Tax Deductions

Think of this guide as your no-nonsense plan to figuring out what you can claim and how to do it right. We're going to turn tax time from something you dread into a genuine opportunity for growth.

We’ll break down everything from the coffees you buy for client meetings to major asset purchases, all with clear, practical advice. You'll get a real-world understanding of what the Australian Taxation Office (ATO) actually considers a legitimate business expense.

By the time you’re done here, you’ll have the confidence to claim every dollar you're entitled to. This isn't just about saving money; it's about staying compliant while building a stronger, more profitable business.

The Three Golden Rules of Claiming Business Expenses

Getting these principles right is the most critical first step. It’s the foundation for building a tax strategy that's not just effective, but also keeps you out of trouble with the ATO. Every single claim you make must pass this simple three-part test.

The Foundational Principles

The rules themselves are pretty straightforward, but where people often get tripped up is applying them correctly, especially in those common grey areas.

Rule 1: Business Purpose: The expense must be directly related to earning your business income, not for your private enjoyment. If you bought it purely for personal reasons, you can't claim it. Simple as that.

Rule 2: Apportionment: If an expense is for both business and personal use, you can only claim the business portion. This is a big one for things like your car, home office, and mobile phone.

Rule 3: Proof of Purchase: You must have the records to prove you spent the money. No receipt, no bank statement, no deduction. The ATO is very clear on this.

For example, you can claim the cost of work-related calls on your mobile phone bill, but not the calls you made to your family and friends. The same logic applies when you use your car. Our guide on car tax deductions in Australia dives much deeper into how to get this apportionment right.

Claiming Your Day-to-Day Operating Expenses

It’s not just the big-ticket items that count at tax time. The real gold is often found in the small, everyday costs of running your business. These operating expenses are all the little things you pay for just to keep the lights on and the doors open. The good news? Almost all of them are fully deductible.

Many business owners are great at claiming major costs like office rent or staff wages, but they often let the smaller, recurring expenses slip through the cracks. Those little costs add up fast, and a proper review of your spending can uncover a surprising amount of missed deductions.

Common Operating Expense Deductions

Take a moment to think about all the regular payments that keep your business ticking over. Many common, and easily forgotten, deductions include things like:

Bank fees and merchant processing charges on your transactions.

Professional subscriptions to industry journals or memberships in trade organisations.

Insurance premiums for business liability or to protect your assets.

Marketing and advertising costs, from website hosting to social media ad campaigns.

Just remember, for anything that's used for both business and personal life, like your internet bill, it's vital to correctly apportion the costs to stay compliant.

Understanding Capital Expenses and Asset Write-Offs

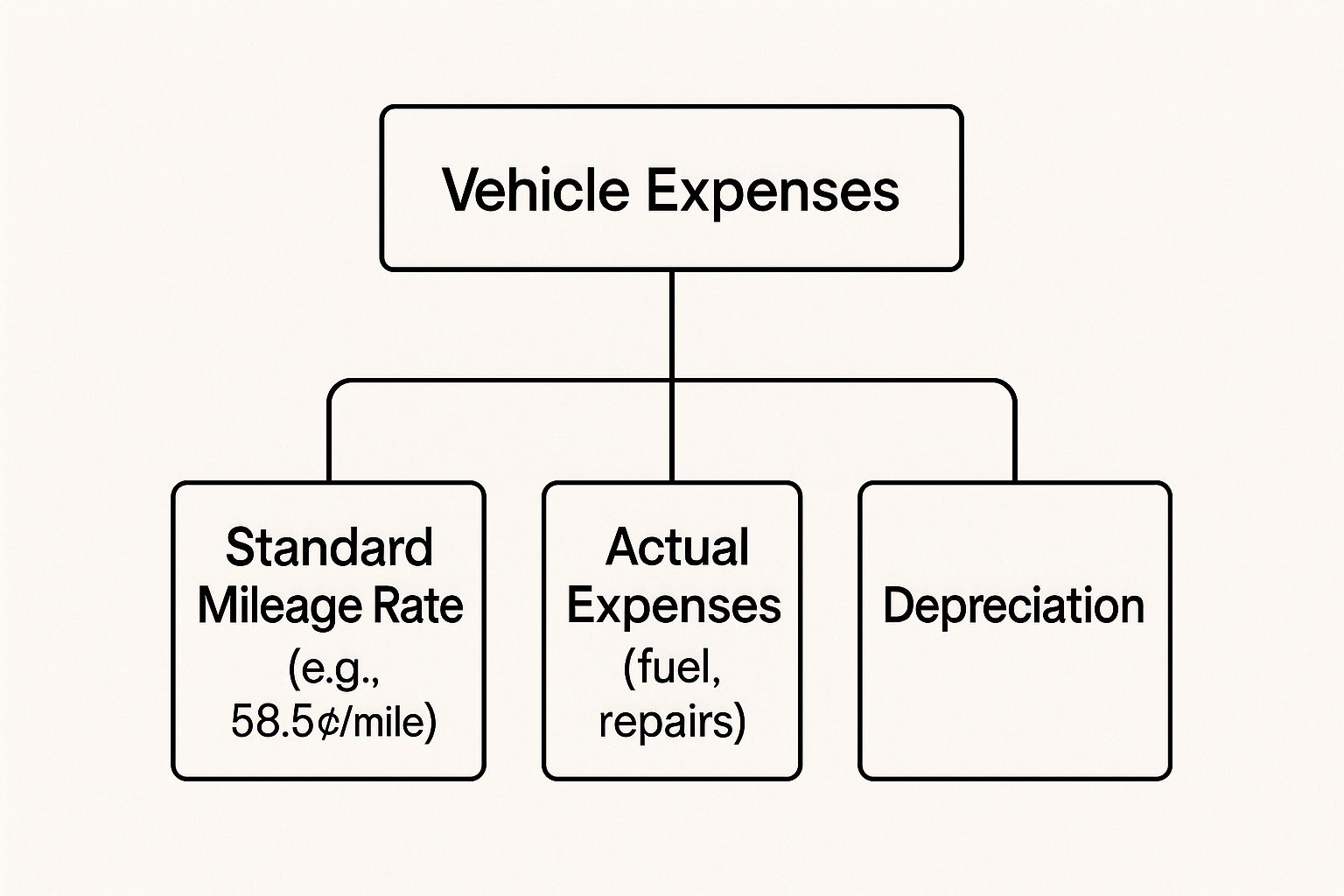

When you run a business, not all expenses are created equal. Buying a new vehicle or specialised machinery isn't the same as buying stationery. These big-ticket items are known as capital expenses, and instead of claiming them all at once, you typically deduct their cost over several years. This process is called depreciation.

But what if you could get the tax benefit straight away? That's exactly where the Instant Asset Write-Off scheme comes in. It's one of the most powerful tax perks for small business owners in Australia, allowing you to claim the full cost of an eligible asset in the very same year you buy it and start using it.

Imagine you're a cafe owner who just bought a new $15,000 coffee machine. Instead of depreciating that cost over five or ten years, the scheme lets you deduct the entire $15,000 from your taxable income immediately. This can make a huge difference to your cash flow.

As you can see, there are different ways to handle these claims, especially for things like vehicles. You might opt for a simple cents-per-kilometre method or dive into the actual costs, including depreciation.

ATO Instant Asset Write-Off Thresholds (Example)

The rules for the Instant Asset Write-Off have changed over the years, so it's crucial to know which thresholds apply to your purchase. The table below gives you an idea of how the cost and purchase date determine your eligibility.

Eligibility Criteria | Details for Income Year |

|---|---|

Asset cost | Less than the relevant threshold (e.g., $20,000) |

Business turnover | Less than the aggregated turnover threshold (e.g., $10 million) |

Purchase and use date | Asset first bought and used (or installed ready for use) within a specific timeframe (e.g., 1 July 2023 - 30 June 2025) |

Remember, these figures are just examples and are subject to change based on government legislation. Always check the current ATO guidelines for the financial year you're claiming in.

Depreciation and asset write-offs can get complicated, especially with changing rules.

Building an Audit-Proof Record-Keeping System

A tax deduction is only as good as the evidence you have to back it up. In the eyes of the Australian Taxation Office (ATO), if you can’t prove an expense, it simply didn’t happen. This is about more than just "keeping receipts"—it's about building a bulletproof system.

Every record you keep needs to have specific details to be considered valid. This includes the supplier's name and ABN, the date of the transaction, the exact cost, and a clear description of what you bought. While most business owners know to keep invoices and bank statements, things like vehicle logbooks are just as crucial.

Key Record-Keeping Requirements

Legally, you must hold onto these records for five years after you’ve lodged your tax return. Getting into the habit of a systematic approach means you’ll always be ready for an ATO query and can substantiate every single claim with confidence. You can dive deeper into this with our detailed guide on [tax record keeping](https://www.baronaccounting.com/post/tax-record-keeping-kr).

Thankfully, modern accounting software and cloud-based apps can automate a lot of this heavy lifting, saving you time and cutting down on human error.

Going Beyond Deductions: Valuable Tax Concessions for Small Businesses

Claiming individual expenses is just one piece of the tax puzzle. The Australian government also offers broader tax concessions specifically to give small businesses a leg up. Getting your head around these can seriously cut down your tax bill and make a real difference to your bottom line.

Think of it as strategic tax planning. Knowing what you're eligible for can free up cash, boost your financial health, and give you more to reinvest back into your business.

The Reduced Corporate Tax Rate

One of the biggest wins for eligible companies is the reduced corporate tax rate. For the 2024-2025 financial year, small businesses with an aggregated turnover of less than $50 million are taxed at 25%. That’s a decent drop from the standard 30% rate.

This isn't just a minor discount; it’s a direct saving that lets you keep more of your hard-earned profit.

Beyond standard deductions, small businesses, especially startups, should explore valuable startup tax credit benefits that can significantly reduce their tax liability.

And it’s not just for companies. If you’re running an unincorporated business, like a sole trader, you might be able to claim the small business income tax offset. This provides a direct reduction in the tax you personally have to pay, which is always a welcome bonus.

Your Next Steps to Maximising Deductions

You now have a solid roadmap to all the tax deductions available for your small business. The biggest takeaway? Think of tax planning as a powerful tool for growth, not just another boring admin task.

By carefully tracking every expense, getting a handle on depreciation rules, and taking advantage of every government concession you're entitled to, you can make a real difference to your bottom line. Don't leave money on the table—use this guide as a checklist to see where you can improve.

The next step is to get a rock-solid record-keeping system in place. Stay on top of your obligations with a clear [small business compliance checklist](https://www.baronaccounting.com/post/small-business-compliance-checklist). And of course, getting professional advice is the final piece of the puzzle to make sure you're claiming every single dollar you're owed while staying compliant.

Frequently Asked Questions

When you're running a small business, tax deductions can feel like a minefield. It's no surprise that the same questions pop up time and time again. Let’s clear up some of the most common ones we hear from business owners.

Can I Claim Home Office Expenses?

Yes, you certainly can. If your home is your principal place of business, you’re entitled to claim a portion of your household running costs. This includes things like electricity, heating, cooling, and your internet bill.

The ATO gives you two main ways to figure this out:

Fixed-rate method: This is a straightforward option where you claim a set rate for each hour you work from home. It's designed to cover the basics without complex calculations.

Actual cost method: This method is more detailed. It involves working out the specific business-use percentage of your actual utility bills and other home office costs.

No matter which path you take, the golden rule is to have a dedicated workspace and keep good records. A simple logbook or diary tracking your work-from-home hours is essential.

Are Meals and Entertainment Tax Deductible?

This is a big one and a major source of confusion. As a general rule, taking a client out for a meal just to be social is considered 'entertainment', and the ATO says no, it's not tax-deductible.

However, there are a few important exceptions. If you're travelling overnight for business, the cost of your meals is typically deductible because it's part of your travel costs. Likewise, providing light refreshments like coffee and biscuits during a client meeting in your office is also claimable. The key is knowing the difference between sustenance and entertainment. If you’re unsure, it’s always best to get professional advice for your specific situation.

How Do I Claim an Asset Used for Both Business and Private Purposes?

It's very common for assets like a car, phone, or laptop to be used for both work and personal life. When this happens, you have to apportion the expense, meaning you can only claim the business-use percentage as a deduction.

For a vehicle, the most bulletproof way to prove your business use is to keep a detailed logbook for 12 consecutive weeks. For other items like a phone or laptop, you need a reasonable, documented basis for your calculation, like a simple usage diary. Just remember, claiming 100% of the cost for a mixed-use item is a huge red flag for the ATO and should be avoided unless you can truly prove it was used exclusively for business.

• Need assistance? We offer free online consultations: – 📞 Phone: 1800 087 213 – 💬 LINE: barontax – 📱 WhatsApp: 0490 925 969 – ✉️ Email: info@baronaccounting.com – Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments