What Is the Instant Asset Write-Off? A Simple Guide for Australian Businesses

- Jan 10

- 10 min read

If you’ve heard business owners buzzing about the instant asset write-off, there’s a good reason. Run by the Australian Taxation Office (ATO), this scheme is one of the most powerful tools available for eligible businesses looking to manage their tax and improve cash flow. Instead of slowly claiming the cost of an asset over several years through depreciation, the instant asset write-off lets you claim an immediate, upfront tax deduction for the entire purchase price. You get the full benefit in the same year you buy the asset and start using it for a business purpose.

This matters because it directly impacts your business's cash flow and tax position. Getting the rules right is crucial. The ATO enforces strict eligibility criteria, and common mistakes—like miscalculating your aggregated turnover, claiming for non-eligible assets, or getting the cost threshold wrong—can lead to claim adjustments, financial penalties, and audits. This guide will walk you through exactly what you need to know to stay compliant and make the most of this opportunity.

Understanding the Instant Asset Write-Off

Think of the instant asset write-off as a fast-forward button for your tax savings. It’s designed to encourage businesses like yours to invest in the tools, equipment, and other assets you need to grow, without having to wait years to see the tax benefits.

This scheme is a major part of the simplified depreciation rules for small businesses. For the financial year ending 30 June 2025, the ATO has set the threshold at $20,000 per asset. This applies to businesses with an aggregated annual turnover of less than $10 million.

The government’s goal is to:

Boost Your Cash Flow: By giving you an immediate deduction, the scheme reduces your taxable income right away. This frees up cash that you can put straight back into running and growing your business.

Encourage Smart Investment: It’s a powerful incentive to upgrade old equipment or buy new assets, helping you become more productive and efficient.

Make Tax Time Simpler: For any asset that falls under the threshold, you can say goodbye to complex depreciation schedules that stretch out for years. It’s a clean, simple claim.

It’s also worth remembering that the write-off is just one piece of the puzzle. For a complete picture, it’s wise to consider how it fits within broader real estate investment tax strategies and other financial planning.

Instant Asset Write Off Snapshot

To make things crystal clear, here’s a quick summary of the key criteria for the financial year ending 30 June 2025.

Eligibility Criteria | Details (as per ATO guidelines) |

|---|---|

Asset Cost Threshold | Up to $20,000 per asset. |

Business Turnover | Aggregated annual turnover of less than $10 million. |

Asset Status | The asset must be first held, and first used or installed ready for use, by 30 June 2025. |

Asset Type | Applies to both new and second-hand assets used for a taxable purpose. |

This table gives you a handy reference, but always remember to check the specific rules for your business structure and the exact timing of your purchase.

Who Can Claim the Instant Asset Write Off?

The first step is to confirm your eligibility, as the Australian Taxation Office (ATO) has clear rules. Eligibility boils down to two main factors: your business’s aggregated turnover and the specifics of the asset you're buying.

To qualify, your business must be a small business entity. For the financial year ending 30 June 2025, this means your aggregated annual turnover must be less than $10 million.

Understanding Aggregated Turnover

'Aggregated turnover' is your gross income for an income year, plus the gross income of any entities that are connected or affiliated with you. This could be another company you control or one that operates under a similar ownership structure, whether in Australia or overseas. The ATO looks at this complete picture to ensure the incentive is directed at genuine small businesses.

Asset Eligibility Rules

Once you’ve confirmed your turnover, the next step is to ensure the asset itself qualifies. The rules are flexible but have specific conditions.

Asset Type: The write-off covers most tangible depreciating assets, both new and second-hand. This includes items like office equipment (computers, printers), vehicles for business use (utes for a tradesperson), or a new coffee machine for a café.

Timing: The asset must be first used or installed ready for use for a taxable purpose by 30 June 2025.

Asset Cost: The cost of each individual asset must be less than the $20,000 threshold. If you’re registered for GST, this cost is the GST-exclusive price. If you’re not registered, it’s the total GST-inclusive price.

This screenshot really drives home the key numbers—the turnover and asset cost thresholds are what it all hinges on. Getting your head around these figures is the foundation for a successful claim.

It’s important to note that some assets are excluded. According to the ATO, the scheme does not cover capital works (e.g., building improvements), assets you lease out long-term, or certain primary production assets. Navigating these rules helps you claim every deduction you're entitled to with confidence. For a deeper look into what else you can claim, check out our guide on what small business tax deductions you can claim.

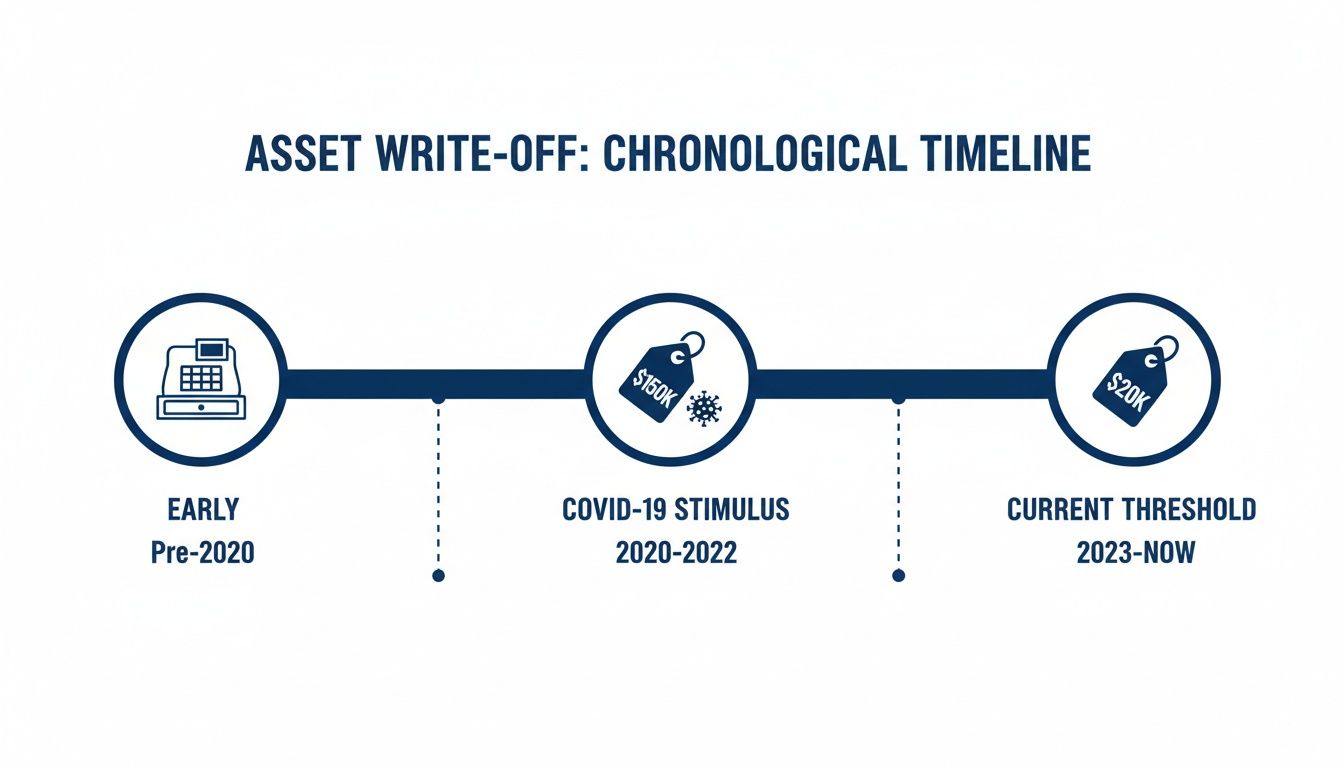

How the Write Off Thresholds Have Evolved

To fully grasp the current instant asset write-off, it’s useful to look at its history. This tax incentive has changed significantly over the years, with thresholds and rules adjusted in response to Australia's economic needs. These shifts demonstrate how the government uses the scheme to stimulate business investment during slow periods or maintain stability. For business owners, this history highlights why tax strategies cannot be static; monitoring Australian Taxation Office (ATO) announcements is essential for effective long-term planning.

The timeline below provides a summary of the write-off's evolution, from its early stages to the current rules.

From Stability to Pandemic Response

For many years, the thresholds were relatively stable. However, the COVID-19 pandemic led to unprecedented changes designed to support businesses through economic uncertainty.

These temporary measures were substantial. The threshold first increased to $30,000 for businesses with a turnover under $50 million from April 2019 to March 2020. It was then expanded significantly, with the threshold rising to $150,000 from March 2020 to June 2021 and the turnover cap increasing to $500 million. For a period, the cap was removed entirely under the ‘temporary full expensing’ measure for businesses with turnovers up to $5 billion.

After this period of volatility, the rules have returned to a more stable $20,000 threshold, which currently applies until 30 June 2025 for businesses with an aggregated turnover of less than $10 million. This provides greater certainty for planning asset purchases.

The key lesson from these historical changes is that tax incentives evolve. A strategy that is effective one financial year may not be the next, reinforcing the importance of proactive tax planning and professional advice. Even as thresholds change, the core principles of how assets lose value remain.

Claiming Your Deduction: A Step-by-Step Guide

To claim the instant asset write-off, you must follow the correct steps to ensure compliance with the Australian Taxation Office (ATO) and secure your tax benefit. The entire process is built on one fundamental rule: maintain meticulous records.

The ATO requires proper evidence for every asset you claim. This means keeping tax invoices that clearly show the asset's cost, the purchase date, and a detailed description of the item. Without this documentation, your claim could be disallowed during an audit.

The Claiming Process Explained

With your records in order, you can proceed with the claim. This involves a logical series of checks to ensure all requirements are met before lodging your tax return.

Step-by-Step Checklist:

Confirm Eligibility: First, verify that your business meets the aggregated turnover threshold (less than $10 million).

Check Asset Qualification: Ensure the asset is eligible. Most new and second-hand business assets qualify, but specific exclusions apply.

Verify Timing: Confirm the asset was both purchased and first used (or installed ready for use) for a taxable purpose by 30 June 2025.

Calculate the Correct Cost: Determine the claimable amount based on your GST status. * GST Registered: Claim the write-off on the GST-exclusive price. * Not GST Registered: Claim the write-off on the full GST-inclusive price.

Lodge Your Tax Return: Report the deduction in the appropriate section of your business tax return. The specific label will vary depending on your business structure (e.g., sole trader, company, trust).

It's important to understand that the $20,000 threshold applies on a per-asset basis. This allows you to claim the full deduction for multiple individual assets in the same year, provided each one costs less than the cap.

How Different Business Structures Claim

The final step—lodging the claim—varies by business structure. A sole trader claims the deduction in the business and professional items section of their individual tax return (MyTax). A company reports it in its company tax return. Correct reporting is essential for compliance.

This process is closely linked to your broader tax obligations, such as knowing how to lodge your BAS, as GST and income tax reporting are interconnected. Following these steps ensures your claim is compliant, accurate, and maximises the benefit for your business.

Real World Examples of the Write Off in Action

To understand the practical application of the instant asset write-off, let's review a few scenarios for different small businesses. In each case, we'll assume the business has an aggregated annual turnover under $10 million and is therefore eligible.

Scenario 1: Sole Trader Photographer (GST Registered)

Chloe, a sole trader photographer registered for GST, buys a new professional camera for $5,500 (including $500 GST).

Action: Chloe claims the $500 GST credit on her Business Activity Statement (BAS).

Write-Off Claim: Her claim is based on the GST-exclusive price of $5,000.

Result: Since $5,000 is below the $20,000 threshold, Chloe claims an immediate $5,000 tax deduction in the financial year she buys and uses the camera, reducing her taxable income by that amount.

Scenario 2: Small Café (GST Registered)

"The Daily Grind," a small café, buys a commercial coffee machine for $18,700 (including $1,700 GST).

Action: The café claims the $1,700 GST credit on its BAS.

Write-Off Claim: The claim is based on the GST-exclusive value of $17,000.

Result: As $17,000 is under the $20,000 cap, the company writes off the full $17,000 immediately. Understanding your GST obligations is crucial; our guide to GST registration in Australia provides more detail.

Scenario 3: Asset Over the Threshold

If "The Daily Grind" buys a premium coffee machine for $24,200 (including $2,200 GST), the GST-exclusive cost is $22,000.

Action: The instant asset write-off cannot be claimed because $22,000 exceeds the $20,000 threshold.

Result: The entire $22,000 cost is allocated to the café's small business depreciation pool. The asset's value is then depreciated over time according to ATO rules, typically at 15% in the first year and 30% in subsequent years.

This distinction is critical: an asset costing even one dollar over the threshold moves from an immediate full deduction to a gradual depreciation claim, significantly altering its impact on your business's cash flow for that year.

Instant Asset Write-Off Claim Scenarios

Scenario | Asset Cost (ex. GST) | Claimable Amount (Instant Write-Off) | Amount for Depreciation Pool |

|---|---|---|---|

Asset Under Threshold | $17,000 | $17,000 | $0 |

Asset at Threshold | $20,000 | $20,000 | $0 |

Asset Over Threshold | $22,000 | $0 | $22,000 |

As demonstrated, staying under the threshold has a major impact on your immediate tax position. Many businesses require insights into valuing business plant and machinery to ensure their assets are correctly costed for tax purposes.

The Future of the Instant Asset Write-Off

The future of the instant asset write-off is subject to government policy and economic conditions. Historically, its terms and thresholds have been adjusted frequently. Business owners must monitor government announcements, as today's rules may change.

Without new legislation, the write-off is scheduled to revert to a $1,000 cap with a $10 million turnover threshold. Such a significant reduction would fundamentally alter how small businesses plan asset purchases, requiring nearly all valuable assets to be depreciated over several years through the small business depreciation pool.

The Ongoing Policy Debates

To plan effectively, it is important to understand the policy discussions in Canberra. For example, a previous Coalition proposal sought to make the incentive permanent and raise the threshold to $30,000 for businesses with an annual turnover under $10 million. The Parliamentary Budget Office estimated this would reduce government revenue by $1.9 billion over the forward estimates, illustrating the significant economic impact of these policies. You can read the full costings of this proposal from the PBO.

Monitoring these potential changes allows you to build a flexible investment strategy. Whether the threshold remains at $20,000, increases, or decreases, having a plan for each scenario will ensure your business is not caught unprepared by sudden policy shifts.

Summary

What It Is: The instant asset write-off allows eligible businesses to claim an immediate tax deduction for the full cost of an asset in the year it is purchased and used.

Current Thresholds: For the financial year ending 30 June 2025, the threshold is $20,000 per asset for businesses with an aggregated annual turnover of less than $10 million.

Eligibility: The scheme applies to both new and second-hand assets first used or installed ready for use by 30 June 2025.

Assets Over Threshold: If an asset's cost exceeds the threshold, it must be depreciated over time in the small business depreciation pool.

GST Impact: GST-registered businesses claim the GST-exclusive value; non-registered businesses claim the GST-inclusive value.

Compliance: Accurate record-keeping, correct turnover calculation, and adherence to ATO rules are mandatory to avoid penalties.

Get Personalised Tax Advice

The instant asset write-off is a valuable tax incentive, but navigating the rules can be complex. The information in this guide is general in nature and should not replace professional advice tailored to your specific business circumstances. To ensure you are compliant and maximising your entitlements, it is essential to seek guidance from a qualified tax professional.

Baron Tax and Accounting Website: https://www.baronaccounting.com Email: info@baronaccounting.com Phone: +61 1300 087 213

FAQ Section

Can I claim the instant asset write-off for a second-hand asset?

Yes. The scheme covers both new and second-hand assets. The key ATO requirement is that the asset is first used or installed ready for use for a taxable purpose in the income year the deduction is claimed.

What happens if an asset costs more than the threshold?

If an asset costs more than the $20,000 threshold, it cannot be claimed as an immediate deduction. Instead, it must be added to your small business depreciation pool, where you can claim deductions for its decline in value over several years according to ATO depreciation rules.

Is the write-off threshold inclusive of GST?

This depends on your business's GST registration status, as per ATO guidelines.

If you are registered for GST, you claim the write-off on the GST-exclusive price.

If you are not registered for GST, you claim it on the total GST-inclusive price you paid.

Can I claim multiple assets in one financial year?

Yes. The $20,000 threshold applies on a per-asset basis, not as a total cap for the year. This means you can purchase and claim the full deduction for multiple assets, provided each individual asset costs less than the threshold. For more information on managing your tax obligations, our guide to ABN and tax return compliance can help.

Comments