What is the Australian Deferred GST Scheme? A Guide for Importers

- Jan 10

- 12 min read

Staring at a massive, upfront Goods and Services Tax (GST) bill for your imports is enough to give any business owner a headache. It’s a huge cash flow hurdle. Thankfully, the Australian Taxation Office (ATO) has a practical solution: the Deferred GST (DGST) Scheme. This guide explains what the scheme is, why it matters for your business, and the critical compliance risks you need to manage.

The DGST scheme allows eligible businesses to postpone paying the 10% GST at the border and instead account for it on their next Business Activity Statement (BAS). Think of it as an interest-free, short-term credit line from the government, designed to keep your cash working for you, not tied up in customs. However, failing to meet its strict rules, such as late BAS lodgement, can result in immediate removal from the scheme and significant financial penalties.

How the Deferred GST Scheme Eases Import Cash Flow

The Deferred GST Scheme is a powerful tool for any Australian business that relies on imports. Instead of paying 10% GST to the Australian Border Force (ABF) the moment your goods land, the scheme allows you to defer that payment until your next monthly BAS is due.

This simple shift is a game-changer for cash flow management. It aligns a major tax obligation with your regular reporting cycle, freeing up precious working capital that would otherwise be stuck in transit. You can use that cash to invest in more inventory, cover operating costs, or fuel your business's growth.

The Core Mechanism of Deferral

The real genius of the scheme is in how it balances out on your BAS. When you lodge your monthly BAS, you report the deferred GST amount from your imports at label 7A. In the very same form, you claim that exact amount back as a GST credit (an input tax credit) at label 1B. For most businesses, this creates a neutral cash impact—the liability is cancelled out by the credit.

This process has been a lifeline for businesses of all sizes since its introduction. Its sole purpose is to ease the cash flow pressure that border taxes create.

Practical Example: A company imports goods valued at $250,000. Normally, they would face a $25,000 GST bill on the spot at customs. Under the DGST scheme, that $25,000 is simply reported and offset on their next monthly BAS, meaning no cash actually leaves their bank account to clear the goods.

Understanding the Compliance Risks

While the benefits are significant, the scheme is not a free-for-all. The ATO only grants access to businesses with a clean compliance record. If you fail to lodge or pay your monthly BAS on time, even once, you can be removed from the scheme immediately.

This would trigger a sudden cash flow crisis, forcing you to revert to paying GST at the border again. It’s a stark reminder that before accessing such arrangements, you must have your tax fundamentals in order, like knowing how to register for GST in Australia. This foundational knowledge is non-negotiable.

Meeting the Eligibility Criteria for GST Deferral

Access to the Deferred GST Scheme is a privilege the Australian Taxation Office (ATO) grants to businesses with a solid compliance track record. It is reserved for businesses that consistently prove they can be trusted with the cash flow advantages the scheme offers.

To qualify, your business must meet several non-negotiable requirements. The ATO will verify each one before granting approval.

Foundational Requirements for Applicants

Before applying, ensure your business ticks every box:

Hold a valid Australian Business Number (ABN): This is essential for all Australian tax and business activities.

Be registered for Goods and Services Tax (GST): This is a critical first step. For a detailed walkthrough, see our guide to GST registration in Australia.

Lodge your Business Activity Statements (BAS) monthly: The scheme is built around a monthly reporting cycle. If your business lodges quarterly or annually, you must switch to monthly lodgements to qualify.

Passing these initial checks is just the start. The ATO also closely examines your compliance history to determine if your business is a low-risk candidate.

Demonstrating a Good Compliance History

A 'good compliance history' means proving your business is reliable and has been diligent with its tax obligations.

According to the ATO, a strong compliance history means you have no outstanding tax debts, a clean record of lodging all required statements on time, and have not committed any GST-related offences in the past three years.

The scheme is built on trust. Maintaining that trust means staying on top of your financial management and meeting every deadline, every time.

Deferred GST Scheme Eligibility Checklist

Requirement | Description | ATO Compliance Focus |

|---|---|---|

Valid ABN | Your business must hold and maintain an active Australian Business Number. | Essential for all tax identification and reporting. Non-negotiable. |

GST Registration | You must be registered for GST. This is a fundamental prerequisite. | Confirms your business is part of the GST system. |

Monthly BAS Lodgement | You must lodge your Business Activity Statements on a monthly basis. | The scheme's mechanics are tied to monthly reporting cycles. |

Electronic Interaction | You must be set up to deal electronically with the ATO and Border Force. | Ensures seamless data exchange, often via the Integrated Cargo System (ICS). |

No Outstanding Debts | Your business cannot have any overdue tax debts with the ATO. | Demonstrates financial responsibility and reliability. |

On-Time Lodgement Record | All previous tax statements (like BAS and income tax returns) must be lodged on time. | Shows a consistent pattern of meeting compliance deadlines. |

No Recent Offences | You must not have been convicted of any GST-related offences in the last three years. | A clean record proves your business operates with integrity. |

Meeting these criteria is non-negotiable. Government data reveals that at any given time, roughly 33% of businesses using the scheme are non-compliant with at least one condition, putting their access at serious risk. For a deeper analysis of these risks and opportunities, you can explore this comprehensive guide to deferred GST.

Your Step-by-Step Application Guide

Applying for the Deferred GST Scheme is a straightforward administrative process, provided you meet all eligibility criteria. This step-by-step guide outlines exactly what you need to do.

Step 1: Prepare Your Business for Monthly Lodgement

First, your business must be lodging its Business Activity Statement (BAS) on a monthly cycle. If you currently lodge quarterly or annually, you must switch.

You can change your lodgement cycle through your registered tax or BAS agent, or via the ATO's online services for business. This is not optional—the entire deferred GST system is built around monthly reporting.

Step 2: Gather Your Information

The application itself is not paperwork-heavy, but having the correct details ready is essential. You will primarily need your Australian Business Number (ABN) and your business’s full legal name.

When you apply, the ATO will use your ABN to review your compliance history, including lodgement and payment records for all tax types (BAS, income tax, etc.). It is crucial to ensure all your accounts are up to date with no outstanding debts before you submit the application.

Step 3: Submit Your Application to the ATO

You have several options for lodging your application:

Through a Registered Agent: This is often the most efficient method. Your tax or BAS agent can manage the application for you, ensuring accuracy and handling communications with the ATO.

Via Online Services for Business: You can complete and submit the application yourself through the ATO’s secure business portal.

By Phone: For simple cases, you can also apply by contacting the ATO directly.

Important Note: Your customs broker cannot apply on your behalf. This is a tax matter handled by the ATO, not the Australian Border Force.

Step 4: Wait for Official ATO Approval

After submission, the ATO will review your eligibility and compliance history. They typically aim to process applications within 28 days.

You will receive written confirmation once approved. Do not assume you are in the scheme until you have this official notice. Attempting to defer GST prematurely can lead to customs delays and compliance issues. Once you have the approval letter, you are cleared to use the scheme for your next importations.

Correctly Reporting Deferred GST on Your BAS

Participating in the Deferred GST Scheme provides a fantastic cash flow benefit, but this advantage is directly tied to accurate monthly Business Activity Statement (BAS) reporting. Mastering this process is non-negotiable for staying compliant with the Australian Taxation Office (ATO).

The process relies on an 'offsetting' effect: you declare the GST you've deferred and, in the same BAS, claim it back as a credit. This neutralises the cash impact but demands precision.

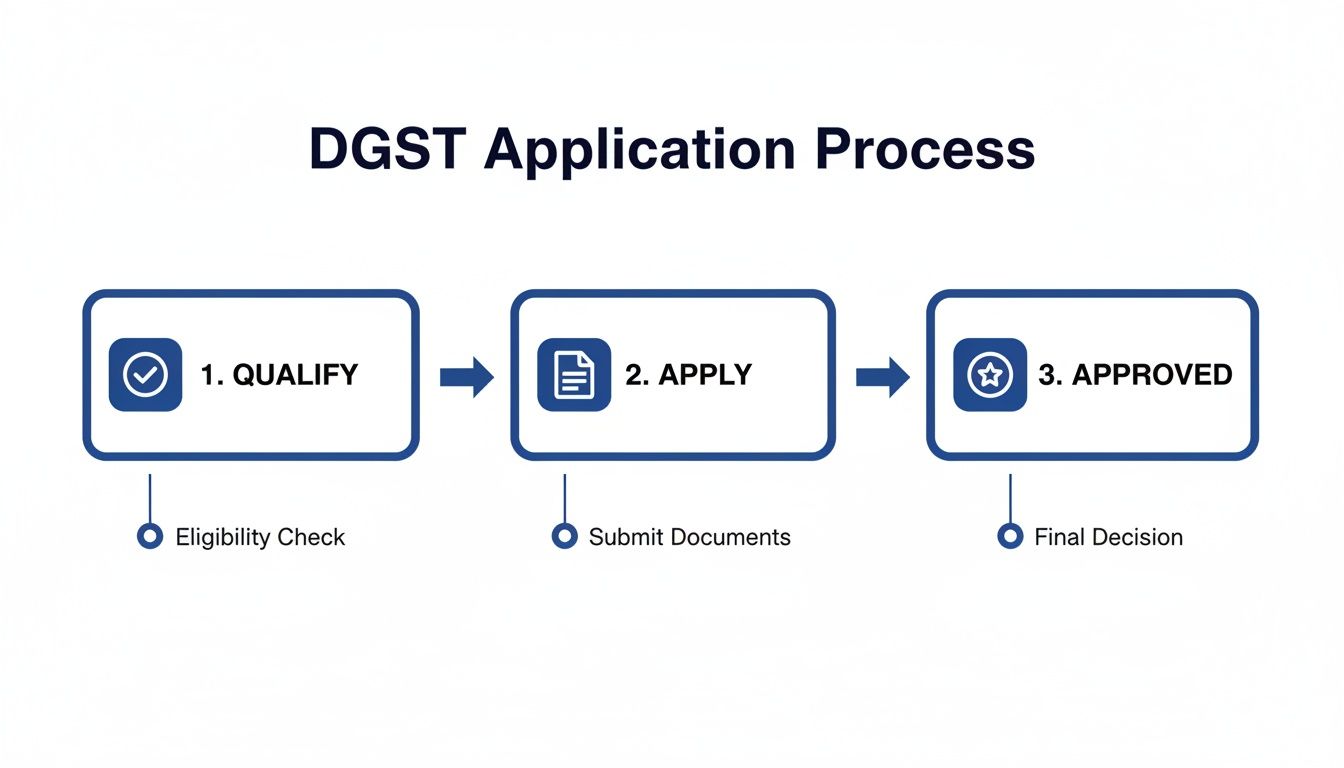

The journey from qualification to approval is designed to ensure only compliant businesses gain access, as illustrated below.

Locating Your Official Deferred GST Figure

You do not calculate the deferred GST amount yourself. This is a critical rule.

The figure is officially calculated by the Australian Border Force (ABF). Each month, you or your customs broker will receive a Deferred GST Statement from the ABF's Integrated Cargo System (ICS). This document is your single source of truth—it lists the exact total amount of GST deferred on all your imports for that reporting period.

The total GST figure shown on your monthly Deferred GST Statement from the ABF is the only number you should use on your BAS. Do not use figures from your accounting software or commercial invoices. This is a common error that can trigger a compliance breach.

Completing the Key BAS Labels

With your official Deferred GST Statement in hand, you enter that single figure into two specific labels on your monthly BAS:

Label 7A (Deferred GST): Report the total deferred GST amount from your ABF statement here. This declares your GST liability to the ATO.

Label 1B (GST on purchases): Include the exact same amount in your total GST credits for the month. This is where you claim it back as an input tax credit for your business purchases.

This two-step entry creates the cash flow benefit. The liability at 7A is instantly cancelled out by the credit at 1B. For more details on the BAS process, our guide on how to lodge your BAS is a valuable resource.

BAS Reporting: Deferred GST vs Standard GST

BAS Treatment | Standard GST on Imports | Deferred GST Scheme |

|---|---|---|

GST Paid at Customs | Paid $10,000 cash upfront to clear goods. | Paid $0. GST is deferred. |

BAS Label 7A (Deferred GST) | $0 (Nothing to report here). | $10,000 is reported. |

BAS Label 1B (GST on purchases) | $10,000 is claimed as a credit. | $10,000 is claimed as a credit. |

Net Cash Impact on BAS | $10,000 refund is processed, but only after lodging the BAS. Cash is tied up for weeks or months. | $0. The liability at 7A and credit at 1B cancel each other out in the same BAS. No cash is tied up. |

Worked Example of BAS Reporting

Business: An Australian SME importing electronic components.

Import Value: In May, they import goods where the GST component is $15,000.

Action: They are approved for the Deferred GST Scheme.

When lodging their May BAS (due in June), they receive their Deferred GST Statement from the ABF confirming the $15,000 figure.

Here’s how they complete their BAS:

At Label 7A, they enter $15,000.

At Label 1B, they add $15,000 to their other GST credits from local business purchases.

The $15,000 liability is perfectly offset by the $15,000 credit. The net cash impact on their BAS for this import is zero. This process avoids the significant cash flow impact of paying that tax at the border.

Weighing the Benefits and Compliance Risks

The Deferred GST Scheme offers a significant cash flow advantage but comes with incredibly strict compliance rules. It is crucial to understand both sides: powerful financial flexibility versus zero tolerance for error.

Pros: Unlocking Working Capital

The primary benefit is the immediate improvement in working capital. By deferring the 10% GST payment from the point of import to your monthly BAS, you free up a significant amount of cash.

Practical Example: A wholesale business importing $200,000 worth of stock each month would normally need $20,000 in cash for every shipment just to clear customs. With the scheme, that $20,000 remains in their bank account, available for:

Purchasing more inventory: Capitalise on supplier discounts or meet unexpected customer demand.

Covering operating costs: Smoothly pay wages, rent, and marketing expenses.

Investing in growth: Fund a new product line, market expansion, or technology upgrades.

This benefit effectively turns a large tax bill into a rolling, interest-free credit line from the Australian Taxation Office (ATO).

Cons: The Unforgiving Nature of Compliance Risks

While the upside is massive, the risks are just as serious. The ATO’s trust is conditional, and staying in the scheme requires flawless compliance.

The biggest compliance tripwires include:

Late BAS Lodgement: A single late monthly BAS can result in immediate removal from the scheme. The ATO is notoriously strict on this.

Inaccurate Reporting: Errors in reporting the deferred amount on your BAS can attract penalties and ATO scrutiny.

Falling into Tax Debt: An outstanding debt with the ATO for any tax type will jeopardise your eligibility.

Losing DGST status is a sudden financial shock that can disrupt your entire operation.

Case Study: The Cost of a Single Slip-Up A retail business misses its June BAS deadline by one week. The ATO removes them from the DGST scheme. Their next shipment, worth $150,000, lands at the port. They are now faced with an unexpected $15,000 GST bill that must be paid on the spot. This drains their operating account, stock is delayed at the docks, and a major cash flow crisis ensues.

This scenario highlights why robust financial systems are non-negotiable.

Government analysis shows that around 13,000 businesses participate in the scheme, deferring $26 billion in GST annually. However, that same analysis found that roughly one-third of these businesses are not fully compliant, primarily with on-time lodgements. As you can read in the full government report, this statistic is a massive red flag.

Summary: Key Takeaways on the Deferred GST Scheme

For Australian importers, the deferred GST scheme is one of the most powerful cash flow management tools available. It allows you to delay paying the 10% GST on imported goods, shifting the obligation from the border to your next monthly Business Activity Statement (BAS).

Core Benefit: Frees up significant working capital by avoiding upfront GST payments at customs.

Mechanism: The GST liability is reported (Label 7A) and claimed as a credit (Label 1B) on the same monthly BAS, resulting in a neutral cash flow impact for most businesses.

Eligibility is Key: Access is a privilege granted by the ATO to businesses with a strong compliance history.

Strict Compliance: To remain in the scheme, you must have a valid ABN, be GST-registered, lodge your BAS monthly and on time, and have no outstanding tax debts.

Consequences of Failure: A single late BAS lodgement or payment can result in immediate removal from the scheme, triggering a sudden cash flow crisis.

The deferred GST scheme offers a strategic advantage but demands meticulous administration and a proactive approach to tax compliance.

Frequently Asked Questions (FAQ)

What happens if I lodge my monthly BAS late?

Lodging your Business Activity Statement (BAS) late is the fastest way to be removed from the Deferred GST Scheme. The Australian Taxation Office (ATO) is extremely strict on this rule. A single late lodgement can result in your business being disqualified, forcing you to pay GST upfront at the border for all future imports. This can cause a sudden and severe cash flow problem. (Reference: ATO conditions for the Deferred GST scheme)

Can sole traders use the Deferred GST Scheme?

Yes, absolutely. The scheme is available to all business structures, including sole traders, companies, partnerships, and trusts. Eligibility is based on compliance history and meeting the scheme's requirements, not on the type of business entity. A sole trader must have a valid ABN, be registered for GST, lodge their BAS monthly, and maintain a good compliance record with the ATO.

How do I find the correct figure for BAS label 7A?

You do not calculate this figure yourself. The correct amount for Label 7A (Deferred GST) is provided by the Australian Border Force (ABF). Each month, your customs broker will provide you with a Deferred GST Statement from the Integrated Cargo System (ICS). This official report contains the exact total GST deferred on your imports for that period. You must use this figure for your BAS. (Reference: Australian Border Force, Integrated Cargo System)

Is there a fee to apply for the scheme?

No. The ATO does not charge any fees to apply for or participate in the Deferred GST Scheme. It is a free government initiative designed to assist Australian businesses with their cash flow. However, you should account for any professional fees charged by your tax agent or accountant for managing the application and your ongoing BAS compliance.

Can I switch back to quarterly BAS lodging later?

You can request to switch back to quarterly reporting, but doing so will make you ineligible for the Deferred GST Scheme. Monthly BAS lodgement is a mandatory condition. If you revert to a quarterly cycle, the ATO will remove you from the program, and you will have to pay GST at the border again for all future shipments.

Do I need a customs broker to use the scheme?

While not a strict legal requirement, it is practically essential to use a customs broker. Your broker manages customs declarations and, critically, provides the official monthly Deferred GST Statement from the ABF's system. Without this report, you cannot accurately complete label 7A on your BAS. A good broker ensures your imports are cleared efficiently and your tax reporting is based on accurate, official data.

What if my business is new and has no compliance history?

New businesses are eligible to apply. The ATO understands you will not have an extensive compliance history. They will assess your application based on whether you have set up your business correctly from the start. As long as you have a valid ABN, are registered for GST, and have committed to lodging your BAS monthly, your application has a strong chance of approval.

Navigating the Deferred GST Scheme requires careful planning and flawless execution. For expert guidance on eligibility, application, and ongoing compliance to protect your cash flow, contact Baron Tax and Accounting. Our team ensures your business meets all ATO requirements, so you can focus on growth.

Website: https://www.baronaccounting.com Email: info@baronaccounting.com Phone: +61 1300 087 213

Comments