What is Personal Service Income? An ATO Guide for Australian Contractors

- Jan 10

- 14 min read

If you're a contractor, consultant, or freelancer in Australia, you have likely encountered the term ‘Personal Service Income’ or PSI. Understanding these rules, set by the Australian Taxation Office (ATO), is critical for tax compliance and avoiding significant penalties.

Simply put, PSI is income produced mainly from your personal skills, knowledge, or effort. It is not income from selling goods or using significant assets. The primary purpose of the PSI rules is to prevent individuals who operate like employees from using business structures (like companies or trusts) to claim tax deductions that are not available to regular employees, thereby ensuring fairness in the tax system. Getting this wrong can lead to severe compliance risks, including substantial tax adjustments, interest, and penalties from the ATO.

What Is Personal Service Income (PSI)?

Personal Service Income (PSI) is a specific income category defined by the Australian Taxation Office (ATO). It applies to income generated predominantly from an individual's personal skills or labour, even when that income is channelled through a business structure such as a company, partnership, or trust.

For example, an IT consultant paid for their problem-solving expertise or a graphic designer creating a brand logo generates PSI. The core value they provide comes directly from their personal effort and expertise, which is distinct from a business that earns income by selling products or operating large-scale equipment.

Why The PSI Rules Matter

The ATO implemented the PSI regime to ensure tax equity. The rules prevent individuals who are effectively working in an employee-like capacity from accessing business tax deductions that standard employees cannot claim.

Failure to comply with these rules can result in serious consequences:

Significant Tax Adjustments: The ATO can disregard your business structure for tax purposes and re-calculate your tax, treating the income as if it were paid directly to you.

Interest and Penalties: Incorrectly applying the PSI rules can attract interest on unpaid tax and penalties for lodging an incorrect tax return.

Loss of Deductions: Many deductions claimed by the business entity could be denied, leading to a substantial increase in your taxable income.

The core of the PSI issue is distinguishing between a genuine independent business and a contractor operating similarly to an employee. Understanding this distinction is crucial, as the tax implications are fundamentally different. For a detailed comparison, refer to our guide on employee vs contractor in Australia.

Identifying PSI in Your Business

The first step in compliance is to determine if your income is PSI. The ATO provides a clear test: if more than 50% of the income received for a specific contract is for your labour, skills, or expertise, then all the income from that contract is considered PSI.

This guide provides a step-by-step walkthrough of this rule and the subsequent tests required to determine your tax obligations. Correctly applying these rules is essential for avoiding financial penalties and ensuring your business operations are structured correctly from the outset.

The 50 Percent Rule for Identifying PSI

The initial step in navigating the Personal Service Income (PSI) framework is applying the ‘50 percent rule’. This is the ATO's primary test to determine if your income falls under the PSI rules. The principle is straightforward but foundational to all subsequent steps.

For each contract, you must assess whether the client is paying primarily for your personal services or for the supply of materials and equipment. If more than 50% of the contract value is for your labour, skills, or expertise, the entire amount from that contract is classified as PSI. This requires a careful analysis of your invoices to distinguish between payment for your time and knowledge versus payment for goods or the use of major assets.

Applying the Rule in Practice

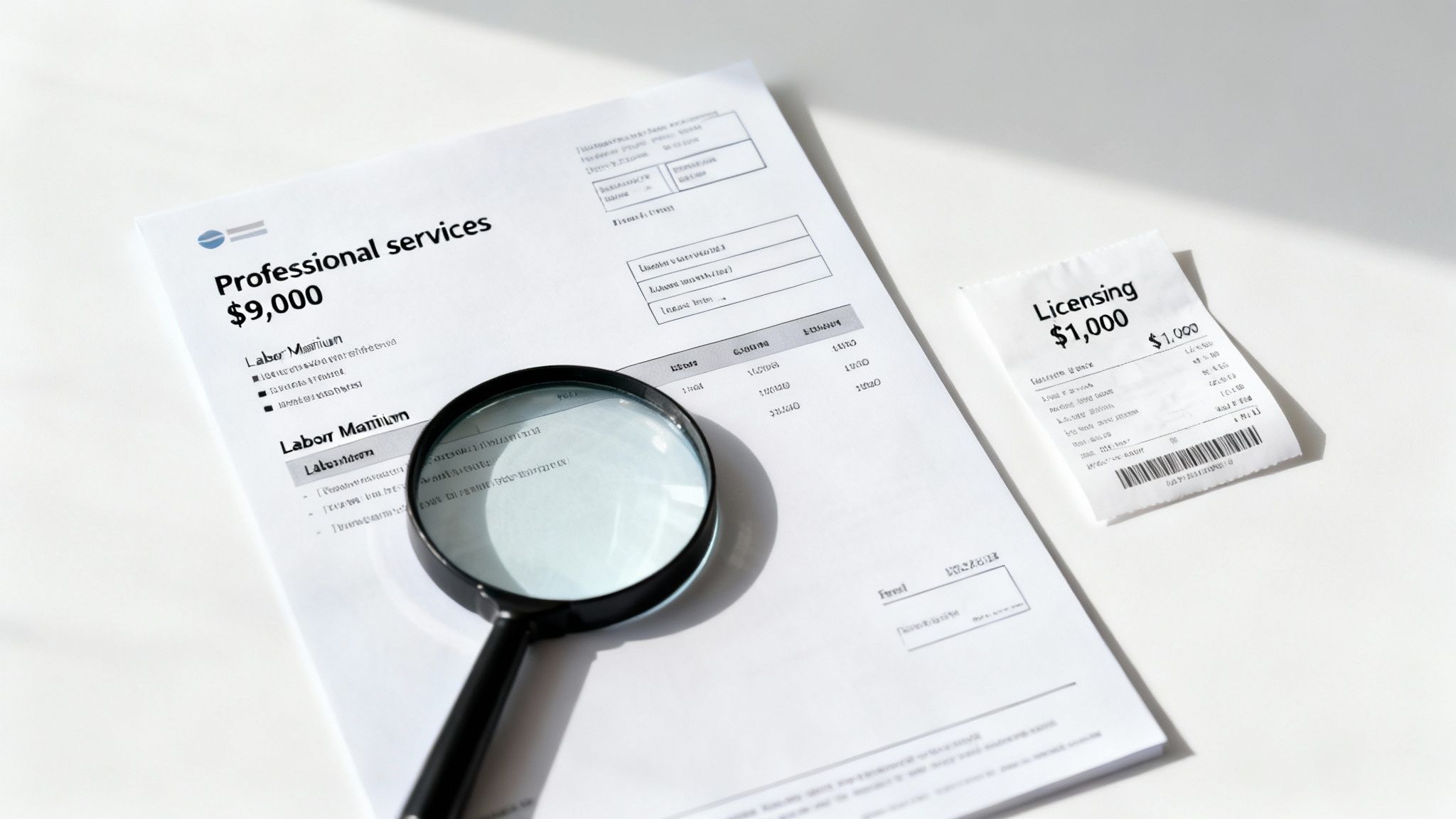

Consider an IT consultant who invoices $10,000 for a completed project. The invoice itemises $1,000 for software licensing fees and $9,000 for their strategic advice, project management, and implementation work.

In this case, the consultant's personal effort constitutes 90% of the contract's value. As this exceeds the 50% threshold, the ATO classifies the full $10,000 as Personal Service Income. The dominant component of the payment was the individual's expertise.

Similarly, a freelance marketing consultant who charges $5,000 for developing a brand strategy generates PSI because the income is derived almost entirely from their intellectual and creative labour, not from selling goods or using substantial equipment.

Industry-Specific Scenarios

The 50 percent rule applies differently across various industries. Correctly interpreting it for your specific context is crucial.

Construction Trades: A plumber invoices $500 for a job. $100 is for parts (pipes, fittings), and $400 is for labour. Since labour constitutes 80% of the invoice, the income is PSI.

Creative Professionals: A freelance writer bills $2,000 for a series of articles. The entire amount is PSI, as the value is directly linked to their writing and research skills.

Engineering Consultants: An engineer who bills $15,000 for creating design specifications and conducting site inspections will have their income classified as PSI, as it is a direct result of their professional expertise.

According to the Australian Taxation Office (ATO), if over 50% of the income from a contract is for your personal skills, it is treated as PSI. This integrity rule is designed to prevent individuals from using company or trust structures solely to reduce their tax liability. For more information, refer to the ATO's guidance on Working out if the PSI rules apply.

If your income is identified as PSI, you must proceed to the next set of tests to determine if you are operating a Personal Services Business (PSB), which we will discuss next.

How PSI Rules Impact Your Tax Deductions

When the Personal Service Income (PSI) rules apply, they significantly restrict the tax deductions you can claim. The ATO treats you similarly to an employee for tax purposes, meaning many typical business expenses become non-deductible.

The rationale is to create a level playing field. If you are not operating what the ATO defines as a genuine Personal Services Business (PSB), you are limited to claiming deductions available to a regular employee. This prevents individuals from using a corporate or trust structure solely to access broader business deductions while functioning like an employee. Understanding this distinction is critical, as it directly impacts your taxable income and final tax liability.

The Two Worlds of Deductions: PSB vs. PSI

The difference in allowable deductions between operating a PSB and being subject to the PSI rules is stark. The ATO recognises a PSB as a legitimate business, allowing it to claim a wide range of expenses incurred in generating income.

Conversely, if the PSI rules apply, you face strict limitations. Many contractors are surprised to find that expenses they consider essential for their work are disallowed because they did not pass the PSB tests.

Key Deduction Limitations Under PSI

When the PSI rules are in effect, several key deductions are specifically denied. These are typically expenses an employee cannot claim against their salary.

The main non-deductible expenses include:

Rent for a home office: Occupancy expenses like rent, mortgage interest, rates, or land tax for your home office are not deductible.

Payments to associates: You cannot deduct payments made to a spouse or family member for non-principal work, such as bookkeeping or administrative support.

Superannuation for associates: Superannuation contributions for an associate performing non-principal work are also not deductible.

Certain travel expenses: The cost of travel between your home and your main place of work is generally considered a non-deductible commute, the same as for an employee.

A key integrity measure of the PSI regime is the attribution of income. The net PSI is not taxed at the lower corporate tax rate; instead, it is attributed to the individual who performed the services. This income is added to their personal taxable income and taxed at their marginal tax rates. There is no special PSI tax rate.

The Financial Impact of Attribution

When the PSI rules apply, the income is "attributed" to you personally. This can significantly increase your tax liability.

For example, a consultant earning $100,000 through a company might expect to be taxed at the 25% small business company tax rate. However, if the income is PSI, that $100,000 is added to their personal income, potentially pushing them into a higher marginal tax bracket, such as 37% or 45% (plus Medicare levy).

PSI Rules vs PSB Deductions: A Comparison

To clarify the difference, the following table compares claimable expenses for a PSB versus an individual subject to the PSI rules. This highlights the financial benefit of qualifying as a PSB. For a comprehensive overview of general business claims, see our guide on self-employed tax deductions.

Expense Type | Deductible under PSI Rules? | Deductible as a PSB? | Key ATO Considerations |

|---|---|---|---|

Client Entertainment | No | Yes | Must have a clear, documented connection to producing assessable income. |

Home Office Occupancy | No | Yes | Only if the business premises test is met (e.g., a dedicated and separate area used exclusively for business). |

Payments to a Spouse | No (for non-principal work) | Yes | The payment must be a market-rate salary for work integral to earning the business's income. |

Commuting Expenses | No | No | Travel between home and a regular place of work is typically non-deductible for both. |

Super for Yourself | Yes | Yes | Both can claim deductions for personal super contributions, subject to concessional contribution caps. |

Business Insurances | Yes | Yes | Professional indemnity and public liability insurance are generally deductible for both. |

As shown, the ability to deduct expenses like home office occupancy costs or payments to associates for principal work can significantly impact your tax outcome. Passing the PSB tests is not merely about compliance—it's about ensuring you can claim all legitimate business deductions.

Qualifying as a Personal Services Business (PSB)

If your income is identified as PSI, the next critical step is to determine if you are operating a Personal Services Business (PSB). Qualifying as a PSB is the key to accessing standard business tax deductions and avoiding the restrictive PSI rules.

Operating as a PSB signals to the Australian Taxation Office (ATO) that you are running a genuine, independent business, not operating as a disguised employee. To qualify, you must pass a series of tests established by the ATO. This section provides a step-by-step guide to navigating these tests.

This flowchart illustrates the ATO's process for determining if the PSI rules limit your deductions.

Failing to qualify as a PSB results in limited deductions, underscoring the importance of successfully passing these tests.

The Results Test: The Primary Pathway

The Results Test is the ATO’s preferred and most definitive method for qualifying as a PSB. It is considered the strongest indicator of a genuine business. To pass, you must satisfy all three of the following conditions for at least 75% of the PSI earned during the financial year:

Paid for a specific result: You are paid to achieve a specific outcome, not for the hours you work. For example, a web developer is paid to deliver a functioning website, not for their time spent coding.

Provide your own equipment: You are required to supply the primary tools and equipment necessary to complete the work. A freelance photographer who uses their own cameras, lighting, and editing software meets this condition.

Liable for defects: You are contractually responsible for rectifying any defects in your work at your own expense.

Passing the Results Test is the most direct way to qualify as a PSB. If you meet these three conditions for 75% of your PSI, you are considered a PSB for that income year and do not need to consider the other tests.

The 80% Rule and Further Tests

Before proceeding to other tests, you must consider the 80% rule. If 80% or more of your PSI in a financial year comes from a single client (and their associates), you generally cannot self-assess using the subsequent tests. In this case, your only options are to pass the Results Test or apply to the ATO for a PSB determination.

If you do not pass the Results Test and less than 80% of your PSI comes from one client, you can then proceed to the other tests. You only need to pass one of the following three tests to qualify as a PSB.

The Unrelated Clients Test

This test demonstrates that you actively market your services to the public and work for multiple clients. To pass, you must meet both of the following conditions:

You earn PSI from two or more clients who are not related to each other or to you.

You actively seek work from the public. This can be demonstrated through advertising, having a public website, or being listed in a professional directory.

A management consultant who provides services to three different companies during the year and maintains a professional website advertising their services would likely pass this test. The structure of your operations is key, and understanding different business structures is essential for compliance.

The Employment Test

The Employment Test assesses whether you are operating a business that engages other workers. You pass this test if you meet one of these two conditions:

You engage other individuals or entities to perform at least 20% of the principal work (by market value).

You have one or more apprentices for at least half of the income year.

For example, if an engineering firm bills $200,000 for a project and pays a subcontracted engineer $50,000 to perform core design work, it would pass this test because the subcontracted work represents 25% of the project's value.

The Business Premises Test

The final test is the Business Premises Test. To pass, you must maintain a dedicated business location that meets all of the following criteria at all times during the year:

Owned or leased by you: The premises are owned or leased by your business entity.

Used exclusively for business: The space is used almost exclusively for your business activities. A home office must be a dedicated, separate area not readily adaptable for private use.

Physically separate: The location is physically separate from your private residence and your clients' premises.

A graphic designer who leases a dedicated studio space in a commercial building, separate from their home, would pass this test.

Meeting Your Compliance and Record-Keeping Obligations

Maintaining compliance with the Australian Taxation Office (ATO) is non-negotiable when dealing with Personal Service Income (PSI). Meticulous record-keeping is not just good practice; it is a legal requirement for demonstrating compliance.

Regardless of whether you operate as a sole trader, company, or trust, accurate reporting is crucial. A structured approach ensures you meet your obligations and are prepared for any potential ATO review.

Reporting PSI on Your Tax Return

The method for reporting PSI depends on your business structure. The ATO requires specific labels on tax returns to be completed correctly.

Sole Traders: You must report PSI at the relevant sections of your individual tax return, including the business and professional items schedule.

Companies, Partnerships, or Trusts: The business entity reports the PSI it received. If the PSI rules apply (i.e., you are not a PSB), the net PSI is then attributed to the individual who performed the work. That individual declares this attributed income on their personal tax return.

This attribution process for companies and trusts ensures the income is taxed at the individual's marginal tax rate, preventing it from being retained in the business structure to benefit from a lower tax rate.

PAYG and Superannuation Obligations

When the PSI rules apply to income earned through a company, partnership, or trust, specific obligations are triggered. The business must treat the attributed PSI as if it were a salary paid to you.

This means the business must:

Withhold PAYG: Withhold Pay As You Go (PAYG) tax from the payments and remit it to the ATO, just as an employer does.

Pay Superannuation: Make superannuation guarantee contributions into a complying super fund on your behalf. The current legislated rate is 11% of ordinary time earnings.

Warning: Failure to meet these PAYG withholding and superannuation obligations can result in significant penalties from the ATO. These are common compliance failures for contractors, making timely and accurate payments essential.

Essential Record-Keeping for PSI

Robust documentation is your primary defence during a tax review. Your records must clearly demonstrate how you assessed your income and provide evidence of how you meet the PSB tests if you are claiming that status.

Here is a checklist of essential documents to maintain:

Client Contracts: Agreements should clearly define the scope of work, payment terms, and liability for defects, showing you are paid for a result.

Detailed Invoices: Invoices must align with contract terms and provide a breakdown of costs where applicable (e.g., labour vs. materials).

Evidence for PSB Tests: Retain proof that you meet the relevant test. This could include copies of advertisements (Unrelated Clients Test), subcontractor invoices and agreements (Employment Test), or lease agreements for commercial premises (Business Premises Test).

Frequently Asked Questions About Personal Service Income (PSI)

Navigating the complexities of Personal Service Income can be challenging for contractors and consultants. Here are clear answers to some of the most common questions, based on Australian Taxation Office (ATO) guidelines.

Can I still operate through a company if I earn PSI?

Yes, you can operate your business through a company or trust even if you earn PSI. The PSI rules do not prohibit the use of these structures for legitimate purposes, such as asset protection or liability limitation.

However, if your income is classified as PSI and you do not qualify as a Personal Services Business (PSB), the tax advantages of the structure are neutralised. The ATO will "look through" the company, and the net PSI is attributed directly to the individual who performed the services. This income is then taxed at your personal marginal tax rates on your individual tax return, eliminating the benefit of the lower corporate tax rate.

What happens if the ATO finds I have misclassified my income?

If an ATO review determines you have incorrectly applied the PSI rules, the consequences can be significant. The ATO will issue amended assessments, recalculating the tax on the attributed income at your personal marginal tax rates for previous years.

In addition, you will likely face:

Back taxes: A tax bill for the difference between tax paid and tax owed.

Interest charges: The ATO will apply interest, such as the Shortfall Interest Charge (SIC), on the unpaid tax.

Administrative penalties: Penalties may be applied for making a false or misleading statement in your tax return, depending on the circumstances. Proactive compliance is the best strategy to avoid these outcomes.

If 80% of my income is from one client, am I automatically subject to the PSI rules?

Earning 80% or more of your PSI from a single client means you are subject to the 80% rule. This does not automatically mean the restrictive PSI deduction rules apply, but it does limit your options for qualifying as a PSB.

If you are subject to the 80% rule, you cannot self-assess using the unrelated clients test, employment test, or business premises test. Your only pathway to qualifying as a PSB is by passing the Results Test. The Results Test is considered by the ATO to be the strongest indicator of an independent business. If you meet all three conditions of the Results Test for at least 75% of this work, you are a PSB. If not, your final option is to apply to the ATO for a Personal Services Business Determination.

Are certain industries more scrutinised for PSI by the ATO?

Yes. While the PSI rules apply universally, the ATO focuses its compliance activities on industries where income is predominantly derived from an individual's personal skills and expertise. These industries have a higher inherent risk of generating PSI.

Industries that receive closer scrutiny include:

Information Technology (IT) consultants and contractors

Engineers and project managers

Financial services and management consultants

Medical professionals operating as independent contractors

Media, marketing, and creative professionals

Working in these fields does not guarantee a PSI problem, but it necessitates extra diligence in correctly applying the PSI and PSB tests each financial year to ensure compliance.

Summary: Key Takeaways for PSI Compliance

Navigating the Personal Service Income rules is a fundamental compliance requirement for Australian contractors, consultants, and freelancers.

Definition: PSI is income generated mainly from your personal skills or labour.

First Step: Always apply the 50% rule to determine if your income is PSI.

The Goal: If you have PSI, you must pass one of the PSB tests (starting with the Results Test) to access standard business tax deductions.

Consequences of Failure: Failing to qualify as a PSB means your deductions are limited to what an employee can claim, and the net income is attributed to you personally.

Obligations: If the PSI rules apply, your business entity may have PAYG withholding and superannuation guarantee obligations.

Record-Keeping: Meticulous records are essential to prove your PSB status and defend your position in an ATO review.

Given the financial risks associated with non-compliance, seeking professional advice is a prudent business decision. An experienced accountant can ensure your structure is compliant with current ATO regulations and optimised for tax effectiveness, protecting you from costly penalties and audits.

Need Help with Your PSI?

Determining whether your income is PSI and if you qualify as a Personal Services Business can be complex. The ATO's rules are intricate, and an unintentional error can lead to significant financial penalties.

If you are uncertain about your PSI obligations or want an expert to review your position, our team is here to assist. We provide clear, practical advice tailored to your specific circumstances, ensuring you remain compliant and tax-effective.

Baron Tax and Accounting

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213

Comments