A Guide to Self Employed Tax Deductions

- Jul 7, 2025

- 15 min read

If you’re self-employed in Australia, one of the biggest keys to a healthy financial life is getting your head around tax deductions. Think of it this way: any money you spend to directly earn your income is a potential deduction. Claiming these self-employed tax deductions is how you lower your taxable income and, ultimately, keep more of your hard-earned cash.

Your Guide to Self Employed Tax Deductions

Let's be honest, navigating your tax obligations when you work for yourself can feel overwhelming. The best place to start is by understanding exactly what you can claim. The Australian Taxation Office (ATO) keeps things pretty simple with two golden rules that every sole trader needs to live by.

The Two Golden Rules of Deductions 1. The expense must have been for your business, not for private use. 2. You must have records to prove it.

It’s a straightforward but powerful framework. From the moment you kick off your business, every dollar you spend to bring in income could be a dollar that lowers your tax bill.

What Can You Actually Claim?

The scope of self-employed tax deductions is surprisingly broad and covers a lot of your day-to-day operations. The real goal is to spot all your legitimate business costs, no matter how small they seem. They really add up over a financial year.

Here are some of the usual suspects:

Home Office Expenses: A percentage of your home running costs, like electricity, internet, and phone bills.

Vehicle and Travel Costs: Expenses from using your car for business trips, plus flights and accommodation when you travel for work.

Tools and Equipment: The cost of assets that help you do your job, whether it’s a new laptop or specialised machinery.

Operating Expenses: The everyday costs that keep your business running, like software subscriptions, stationery, and professional insurance.

To help you get a clearer picture, here’s a quick summary of the most common deductions we see.

Common Tax Deductions At a Glance

This table breaks down some of the most frequent tax deductions for self-employed Aussies. Use it as a checklist to see what might apply to your business.

Deduction Category | What It Covers | Common Examples |

|---|---|---|

Home Office | The cost of running your business from home. | Portion of internet & phone bills, electricity, stationery, depreciation on office furniture. |

Vehicle & Travel | Expenses related to using your car or travelling for work. | Fuel, insurance, registration, flights, accommodation, meals (for overnight trips). |

Tools & Equipment | The cost of assets you need to perform your work. | Computers, software, power tools, machinery, protective clothing. |

Professional Services | Fees paid for professional advice and services. | Accountant fees, legal advice, business coaching. |

Education & Training | Costs for courses that improve skills in your current role. | Seminars, workshops, online courses, technical publications. |

Insurance | Premiums for business-related insurance policies. | Public liability, professional indemnity, income protection. |

Remember, this isn't an exhaustive list, but it’s a solid starting point for identifying where you can save.

Superannuation: The Commonly Missed Deduction

One of the most valuable—and most overlooked—deductions for the self-employed is personal superannuation contributions. Unlike regular employees who get super paid by their boss, sole traders are in charge of their own retirement savings.

Making personal contributions to your super isn't just a smart move for your future; it’s also a fantastic tax deduction. It’s a win-win. Many self-employed people miss this, perhaps because of fluctuating income or just not knowing it's an option. To get a deeper dive into the specific claims you can make, you might find our guide on tax deductions for small business helpful. Getting these things right from the start will set you up for long-term financial success.

Claiming Home Office Expenses The Right Way

For many self-employed professionals, the line between home and work has pretty much disappeared. Your home office isn't just a room anymore; it's the engine room of your entire business.

This makes getting your head around home office expenses one of the most vital self-employed tax deductions you'll ever make. When you get this right, you get every dollar you're entitled to without catching the ATO's eye for the wrong reasons.

The first step is figuring out which method to use for your running costs. The ATO gives you two main paths: the 'fixed rate' method and the 'actual cost' method. Each comes with its own set of rules and paperwork, and your choice can genuinely impact your final tax return.

The Fixed Rate Method Simplified

Think of the fixed rate method as the grab-and-go option. It's simple and doesn't require a mountain of receipts.

From the 2024-25 financial year onwards, the ATO brought in a new, revised fixed rate of 70 cents per hour you work from home. This single rate bundles up your key running costs into one straightforward calculation.

So, what’s packed into that 70 cents?

Energy Costs: The electricity and gas for lighting, heating, and cooling your workspace.

Phone and Internet: Your work-related mobile, home phone, and internet usage.

Stationery and Consumables: Things like printer paper, ink cartridges, and pens.

The biggest win here is simplicity. You don't have to painstakingly calculate the business percentage of every single utility bill. All you need is a record of the total hours you worked from home during the financial year—a simple diary or timesheet will do the trick.

The Actual Cost Method Explained

Now for the more hands-on approach. The actual cost method takes more effort, but it can often lead to a much bigger deduction if your expenses are on the higher side.

Just as the name implies, you calculate the real costs you've paid and then claim the specific business-use portion of each expense. This means you need to be a meticulous record-keeper.

With this method, you can claim the business portion of costs like:

Electricity and gas bills for your home.

Your phone and internet bills.

The cost of cleaning your dedicated home office space.

Depreciation of your office furniture and equipment (like your desk, chair, and computer).

Key Insight: To use the actual cost method, you absolutely must have a dedicated home office area. You then need to work out what percentage of your home's floor space that area occupies.

For instance, if your dedicated office makes up 10% of your home's total floor area, you can claim 10% of your electricity bill. For your phone and internet, you'll need to figure out a reasonable percentage based on how much you use it for work versus personal life. It's more work, but it can definitely pay off.

Depreciation: The Hidden Deduction

Depreciation is a big piece of the home office puzzle that many people overlook. It applies to those bigger-ticket items that last for more than a year—think desks, ergonomic chairs, computers, and printers. You generally can't claim the full cost in the year you buy them (unless it's eligible for an instant asset write-off).

Instead, you claim the decline in the asset's value over its "effective life." Let's say you buy a new computer for $1,500, use it 100% for your business, and the ATO says its effective life is three years. You could then claim a depreciation deduction of $500 each year for those three years.

Making sure your office is set up properly not only helps with productivity but can also strengthen your claims.

Turning Car and Travel Costs Into Deductions

If you use your personal car for work, you’re sitting on one of the most significant self-employed tax deductions you can claim. But be warned: this is also an area the Australian Taxation Office (ATO) watches like a hawk, so getting your records right is non-negotiable. Do it correctly, and you can turn everyday work trips into valuable tax savings.

First things first, you need to know the difference between a legitimate business trip and a private commute. Your daily drive from home to your main workplace doesn't count, even if you quickly drop something off on the way. However, any travel between different work sites, visits to clients, or trips to pick up business supplies are all fair game for deductions.

Choosing Your Claim Method

When it comes to claiming your car expenses, the ATO gives you two ways to do it. The best one for you really boils down to how much you drive for work and how much effort you're willing to put into tracking it all. Picking the right method can make a huge difference to your final tax return.

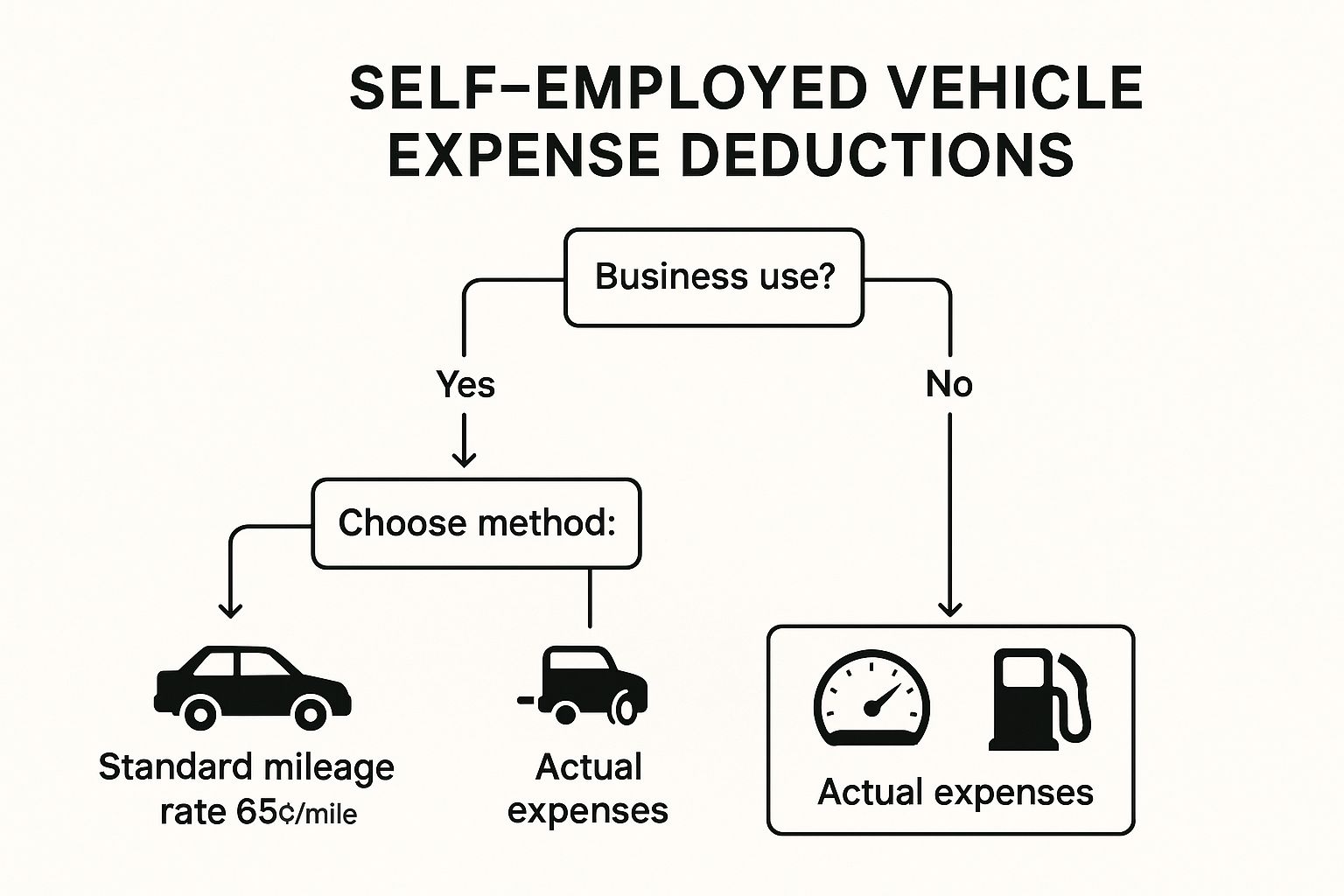

This infographic lays out the decision pretty clearly, helping you see which path makes the most sense.

As the visual shows, once you’ve confirmed you use your car for business, you need to choose between the simple cents per kilometre method or the more involved logbook (actual expenses) method.

The Cents Per Kilometre Method

This is by far the simpler of the two options. It’s a straightforward way to claim a set rate for every kilometre you travel for business.

How it works: You can claim up to a maximum of 5,000 business kilometres per car, each year.

The rate: The ATO sets this rate annually. For the 2024-25 financial year, it’s 88 cents per kilometre.

Record-keeping: You don’t need receipts for every little thing, but you must be able to show how you calculated your business kilometres. A diary of your work-related trips is usually enough to prove it.

This method is perfect if you only drive for work occasionally and want to keep the admin to a minimum. That single rate is designed to cover all your running costs—fuel, rego, insurance, and even the car's depreciation.

The Logbook Method

If you use your car a lot for work, the logbook method will almost always give you a much bigger deduction. It takes more work, but it’s based on what you actually spent on your vehicle.

To use this method, you need to:

Keep a detailed logbook for at least 12 weeks straight.

Write down the odometer reading at the start and end of that 12-week period.

Log every single journey—the date, start and end odometer readings, kilometres driven, and a clear reason for the trip.

Key Takeaway: That 12-week logbook establishes your 'business-use percentage'. You then apply this percentage to all your car expenses for the year, including fuel, oil, registration, insurance, servicing, and even depreciation.

The good news is that a single logbook is valid for five years, as long as your driving habits don't drastically change. For a deeper dive, our comprehensive 2024-25 guide to car tax deductions has more detailed examples to help you master this method.

Deducting Other Business Travel

Don't forget, your travel deductions go beyond just your car. If you need to travel away from home overnight for work, you can also claim the costs for:

Flights, train, bus, or taxi fares.

Accommodation.

Meals and other small incidentals.

The crucial rule here is that the travel must be directly linked to earning your income. A trip to a work conference in another city? Deductible. Tacking on a week-long personal holiday at the end? Not so much. You have to separate the business and private parts of your trip and only claim for work-related expenses. Meticulous records, with all your receipts and itineraries, are your best friend if the ATO ever comes knocking.

Deducting Your Tools, Equipment and Operating Costs

While your home office and car expenses are big-ticket items, they're only part of the puzzle. The day-to-day running of your business relies on a whole host of tools, equipment, and other operational costs—all of which are potential self employed tax deductions. Finding these hidden savings in your everyday spending is the key to maximising your tax return.

Think of your business like a machine. Your home office is the control room and your car gets things from A to B, but the machine itself needs fuel and maintenance to run. These are your operating costs, and every single one that’s directly tied to earning your income is a legitimate deduction.

This is where you need to broaden your view beyond the most obvious claims. It’s about scrutinising every business purchase, from a new laptop down to the monthly fee on your business bank account, and seeing it as a way to lower your taxable income.

Identifying Everyday Operating Costs

So many self-employed professionals miss out on valuable deductions simply because they dismiss small, recurring expenses. These costs might feel minor on their own, but trust me, they add up to a significant amount over a full financial year.

Let's break down some common operating costs you absolutely should be tracking:

Tools of the Trade: This covers any gear essential for your work. It could be a new lens for a photographer, a power drill for a carpenter, or a high-resolution monitor for a graphic designer.

Protective Clothing: If your work demands specific safety gear like steel-capped boots, high-vis vests, or safety glasses, the cost is deductible.

Software and Subscriptions: Those monthly or annual fees for software like Adobe Creative Cloud, Microsoft 365, accounting platforms, or industry-specific programs are all fully deductible.

Professional Association Fees: Your membership fees to professional bodies or unions related to your line of work are a valid business expense.

Bank Fees: Any monthly account fees or transaction charges on your dedicated business bank account can be claimed.

Capital Expenses and Depreciation

What about the bigger, pricier items like machinery or high-end computer systems? These fall into a category called capital expenses. Instead of claiming the full cost in one hit, you generally deduct their value over time through a process called depreciation.

Depreciation simply accounts for the asset's drop in value as it gets older and wears out. The ATO provides clear guidelines on the "effective life" of different assets, which tells you how many years you can claim the deduction for.

The Power of the Instant Asset Write-Off For certain eligible businesses, the government's instant asset write-off scheme is a game-changer. It lets you immediately deduct the full cost of some assets in the year you buy and start using them. This is a powerful tool for boosting your business's cash flow, as you get the tax benefit straight away instead of spreading it out.

This policy is a key part of the government's strategy to back small businesses. Australia’s tax system has seen major reforms aimed at helping the self-employed sector grow. Since 2015, for example, corporate tax rates for small businesses have been progressively lowered, fuelling investment and expansion. These supportive policies are often linked to positive economic outcomes, such as job growth, demonstrating the government's focus on building a favourable environment for entrepreneurs. You can explore a brief history of Australia's evolving tax system on Wikipedia.

Choosing Between Immediate Deduction and Depreciation

Deciding whether to write off an asset instantly or depreciate it can have a real impact on your finances. The right choice really depends on your business's current financial health and what you expect in the future.

Instant Write-Off: This gives you a large, immediate deduction. It's fantastic if you've had a high-income year and want to seriously reduce your tax bill, giving you a quick cash flow injection.

Depreciation: This method spreads the deduction over several years. It can be a smarter move if you expect your income to grow, as it provides a steady stream of deductions to offset future profits.

Getting your head around these options allows you to make strategic decisions that fit your business goals. By carefully tracking all your equipment purchases and operating costs, you ensure no saving opportunity is missed, turning routine business spending into a powerful tax-reduction strategy.

Mastering Record Keeping and Avoiding Common Mistakes

In the eyes of the Australian Taxation Office (ATO), a deduction without a record is just an expensive guess. Mastering your record-keeping isn't just about staying compliant; it's about building an audit-proof system that lets you confidently claim every single self-employed tax deduction you're entitled to. This simple habit transforms tax time from a stressful chore into a strategic advantage for your business.

The golden rule is straightforward: if you can't prove you spent the money, you can't claim the deduction. This makes your organisational system one of the most important tools in your business arsenal.

The Essentials of ATO Record Keeping

The ATO is very clear about what good records look like. Whether you use a shoebox or sophisticated software, your system must be able to verify every claim you make on your tax return.

Generally, your records need to show five key things:

How much you spent.

The date you paid the expense.

The date you received the item or service.

The name of the supplier.

A clear description of what you bought.

For most expenses, a tax invoice or receipt has everything you need. The ATO requires you to hang onto these records for five years from the date you lodge your tax return.

Key Insight: Go digital! Using accounting software or even free apps to snap photos of receipts the moment you get them is a game-changer. It eliminates the risk of losing those flimsy paper slips and creates an organised, searchable, and secure archive of all your potential deductions.

Common Pitfalls to Sidestep

Year after year, many self-employed people get tripped up by the same simple mistakes. Knowing what they are is the first step to avoiding them and building a much more robust financial system.

The biggest mistake by far is mixing business and personal expenses. Do yourself a favour and open a separate business bank account from day one. This creates a clean, undeniable trail of business income and spending, making it incredibly easy to spot and prove your deductions.

Another frequent error is keeping a sloppy or incomplete car logbook. Just guessing your business-use percentage is a huge red flag for the ATO. You need to keep a detailed logbook for a continuous 12-week period, capturing every journey to establish a defensible percentage you can use for up to five years.

Finally, people often miscalculate the business-use percentage of shared costs like phone and internet bills. You can’t just claim 50% because it feels right. You need a reasonable basis for your claim, like analysing a typical monthly bill to work out your actual work-related usage.

Building an Audit-Proof System

Getting into a strong record-keeping habit is the cornerstone of managing your self employed tax deductions effectively. It’s easier than you think, and it not only gets you ready for tax time but also gives you priceless insights into the financial health of your business.

The history of Australia's tax system shows why good records are so important. Federal income tax was introduced back in 1915, but it was the PAYE system in 1942 that really brought more self-employed individuals into the formal tax system. While top tax rates have dropped significantly since then, the principle of needing to prove your claims has only grown stronger. A well-documented expense is always your best defence.

Frequently Asked Questions

When you're navigating the world of self-employed tax deductions, a lot of specific questions tend to pop up. We get it. To help you claim with confidence, we've put together answers to some of the most common queries we hear from sole traders and freelancers across Australia.

Can I Claim Expenses From Before I Officially Started My Business?

Yes, you often can, but the Australian Taxation Office (ATO) has specific rules around this. Costs you rack up while getting your business off the ground—things like legal advice or company registration fees—are what's known as 'blackhole expenditures'.

You generally can't claim these preliminary costs all in one go. Instead, the ATO lets you deduct them over a five-year period. It’s absolutely vital to keep meticulous records of these initial setup costs; you'll need them to back up your claim down the track.

What Is the Difference Between a Repair and a Capital Improvement?

This is a huge one and a very common point of confusion. Getting this distinction right is essential for keeping your tax reporting accurate and above board.

A repair is all about restoring something to its original working condition. Think of it like fixing a broken part on your work printer to get it printing again. The cost of that repair is fully deductible in the same financial year you paid for it.

An improvement, on the other hand, enhances an asset, making it better than it was originally. For instance, upgrading your standard work laptop with a more powerful processor and extra memory isn't a repair—it's an improvement. These costs are considered capital expenses and are claimed over time through depreciation, not as an immediate, full deduction.

How Does GST Affect My Tax Deductions?

How you handle Goods and Services Tax (GST) in your deductions comes down to one simple question: are you registered for it?

If you are registered for GST: You’ll claim the GST you paid on a business purchase as a credit on your Business Activity Statement (BAS). When it comes to your income tax return, you deduct the expense excluding the GST. So, for a $110 tool ($100 + $10 GST), you'd claim a $10 credit on your BAS and a $100 deduction at tax time.

If you are not registered for GST: The process is much simpler. You can claim the full purchase price, including the GST, as a business deduction on your tax return. Using the same example, you would claim the full $110.

Getting these details right is a core part of lodging an accurate tax return. Correctly managing GST and your deductions from day one saves a lot of headaches later and ensures you’re not leaving money on the table.

Let's Get Your Taxes Sorted

Getting on top of your self-employed tax deductions isn’t just about ticking boxes for the ATO—it’s about taking control of your financial future. When you know the rules and keep good records, tax time stops being a headache and becomes a real chance to make your business financially stronger. It's how you make sure more of your hard-earned money stays right where it belongs: with you.

Of course, we know that digging through the fine print of Australian tax law is the last thing most business owners want to do. It’s complicated, and it takes time you’d rather spend on your actual work. That’s where our team at Baron Tax & Accounting comes in. We specialise in helping sole traders and small businesses across Australia find every single deduction they're entitled to and build solid, audit-proof systems.

Let us take the guesswork out of your tax return so you can get back to what you do best. We provide one-on-one support to help you maximise your refund and stay completely compliant.

Partnering with a professional doesn't just save you time; it gives you the peace of mind that comes from knowing an expert has your back. Our goal is to make your taxes as simple and effective as possible.

If you’re ready for personalised advice, we’d love to chat. We’re here to answer your questions and give you the support you need to succeed.

• Need assistance? We offer free online consultations: – Phone: 1800 087 213 – LINE: barontax – WhatsApp: 0490 925 969 – Email: info@baronaccounting.com – Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments