The Definitive Guide to Your Car Logbook for the ATO

- 6 days ago

- 10 min read

If you use your car for work, the ATO logbook method is one of two ways you can claim your running costs back at tax time. It’s a detailed approach that involves tracking your travel to figure out what percentage of your car’s use is for business, and then claiming that slice of your total car expenses. This article is based on the Current Financial Year (FY YYYY–YY) at the time of writing. While it takes a bit more effort than the simpler cents per kilometre method, it often leads to a much bigger tax deduction, especially for people who are on the road a lot for their job.

From our daily practice at Baron Tax & Accounting, we observe that many Brisbane-based sole traders initially find the logbook process cumbersome. However, once a consistent tracking habit is formed, the resulting tax deduction almost always justifies the initial effort, particularly for those with high vehicle usage.

Why the Logbook Method Is Often the Best Way to Go

The logbook method unlocks the potential for a significantly higher tax deduction on your vehicle expenses. Unlike the cents per kilometre method, which caps your claim at a set number of business kilometres a year, the logbook method has no such limit. Instead, you get to claim the actual business-use percentage of all your car's running costs.

This is a game-changer if you do a lot of driving for work or if your car is expensive to run. Think high fuel costs, insurance premiums, or depreciation. Yes, it demands good record-keeping, but the payoff is a robust, evidence-backed claim that accurately reflects what you’ve spent and stands up to ATO scrutiny.

Who Should Use the ATO Logbook Method?

This method is a perfect fit for anyone who can show a substantial amount of work-related car use. This typically includes:

Sole Traders and Contractors: Think consultants, sales reps, or tradies who are constantly driving to client sites, making deliveries, or moving between jobs.

Employees: If you have to use your personal car for work tasks—beyond just driving to and from the office—like visiting clients, attending off-site meetings, or running work-related errands.

Small Business Owners: If your company owns vehicles used by yourself or your staff, a logbook is essential for accurately claiming the business portion of all running costs.

Logbook Method vs Cents Per Kilometre

So, which method should you choose? It all comes down to your personal circumstances—your travel habits, your car's running costs, and how much admin you're willing to do.

The logbook method requires more upfront effort but can deliver a much larger deduction in the long run. The cents per kilometre method is simple, but it’s capped and might leave you out of pocket. For a deeper dive into the alternative, check out our complete guide on the cents per kilometre method. Ultimately, it’s about running the numbers and seeing which approach leaves you in a better financial position come tax time.

What to Include in Your ATO Compliant Logbook

Getting your car logbook right from the very first entry saves a world of pain later on. A compliant logbook is the core evidence you need to prove the business side of your vehicle use. If you miss key details, the ATO can dismiss your entire claim during a review.

Every entry needs to be precise. You're essentially building a case for your tax deduction, and each detail makes that case stronger. It's about more than just dates and kilometres; it’s about painting a clear, undeniable picture of your work-related travel.

Essential Vehicle and Logbook Period Details

Before you record your first journey, your logbook needs some foundational details. These are non-negotiable for the ATO.

Vehicle Information: State the car's make, model, engine capacity, and registration number.

Logbook Period: Clearly write down the start and end dates of your continuous 12-week logbook period.

Odometer Readings: You must record the odometer reading on the first day of the period and the final reading on the last day.

Total Kilometres: Calculate the total distance the car travelled during the full 12 weeks.

Business Kilometres: Tally up all the kilometres from your work-related trips over the period.

Business-Use Percentage: Divide the business kilometres by the total kilometres, then multiply by 100.

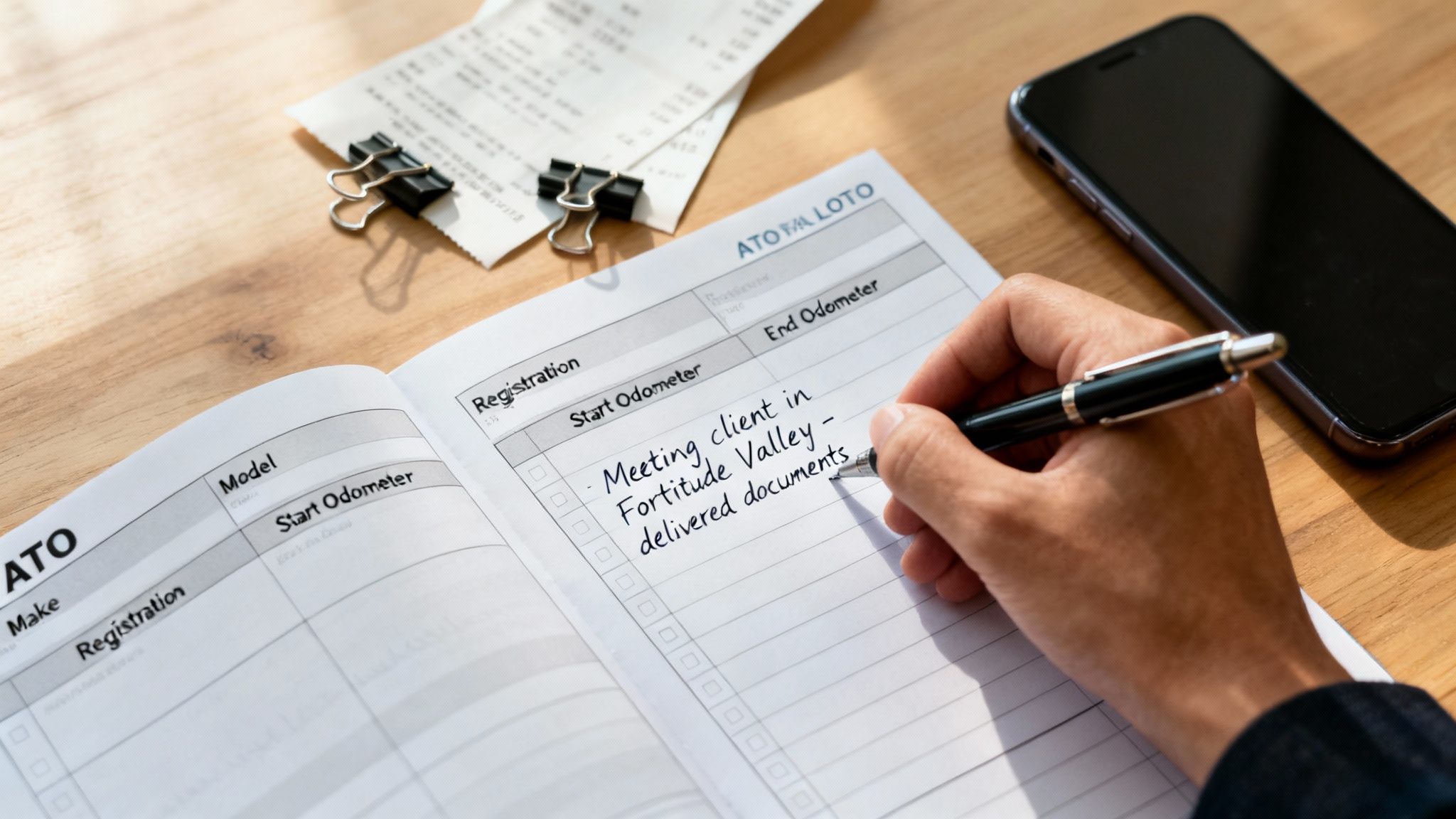

Recording Each Journey Correctly

For every single trip you take during those 12 weeks, you need to log specific information. The Australian Taxation Office is very clear: you must maintain a detailed logbook for a continuous 12-week period to establish your business-use percentage.

For every journey, both business and private, you must note down:

The date the journey started and ended.

The odometer readings at the start and end of the trip.

The total kilometres you drove.

A clear, specific reason for the journey.

A vague entry like "client visit" is a red flag for the ATO. Your descriptions must be detailed enough for an outsider to understand the business purpose. Strong tax record-keeping creates a clear and provable trail.

Strong vs. Weak Journey Descriptions

Let's look at a few examples to show what a compliant description looks like compared to a weak one.

Weak Description (High Audit Risk) | Strong Description (ATO Compliant) |

|---|---|

Client Visit | Met with Sarah at Tech Solutions in Fortitude Valley to finalise software contract. |

Supplier Run | Picked up urgent building materials from ABC Supplies in Rocklea for the Johnson project. |

Meeting | Attended monthly board meeting at our head office in Brisbane CBD. |

Post Office | Dropped off client invoices and picked up business mail at Australia Post, Chermside. |

Private | Personal trip - groceries and school pickup. |

You must record your private trips, too. Just writing "private" is fine for these, but they are essential for calculating your total kilometres, which you need for that all-important business-use percentage.

Step-by-Step Guide: Getting Your 12-Week Logbook Right

Kicking off your 12-week logbook period is about forming a solid habit. The goal is to create an accurate picture of how you typically use your vehicle, which is your ticket to a maximised and defensible claim.

Step 1: Pick Your 12-Week Window

First, you need to choose the right 12-week period. The ATO requires this window to be representative of your travel patterns throughout the year. Avoid starting your logbook during an unusually slow period or, conversely, during a period of unusually high travel. Either way, you'll end up with a skewed business-use percentage.

Step 2: Choose Your Tool: Apps vs. Paper

Next, decide how you'll record everything. The ATO accepts both digital apps and paper logbooks, as long as they capture all the required details.

Digital Logbook Apps: These are often the easiest option. Many use GPS to automatically track your trips, letting you classify them as business or private with a quick swipe. They eliminate the risk of forgetting to log a trip and do the calculations for you.

Paper Logbooks: The classic approach. It's cheap and doesn't rely on a charged phone, but it requires serious discipline to manually record every detail for every trip.

Step 3: Log Every Trip Consistently

Forgetting to log even a handful of trips can throw off your calculations.

Set a daily reminder: A simple alarm on your phone can prompt you to review and log the day's travel.

Log trips on the spot: As soon as you finish a journey, record it.

Batch your private trips: You can often record a series of short personal trips (like the school run, then groceries) as a single entry. Just be sure to note the start and end odometer readings for that block of travel.

Practical Brisbane Example

Let's walk through a day for Alex, a consultant working from a home office in Brisbane. This shows how to correctly log a mix of business and private travel.

Morning: Drives child to school (Private trip).

10 am: Drives from the school to Fortitude Valley for a client meeting (Business trip).

12 pm: Drives to a supplier in Woolloongabba to pick up materials (Business trip).

1 pm: Drives to another client meeting in Sunnybank (Business trip).

3 pm: Drives from Sunnybank back to the home office to continue working (Business trip).

Evening: Drives to the local supermarket (Private trip).

Here’s what Alex’s logbook entries for that day would look like:

Date | Start Odo | End Odo | KM | Purpose of Journey | Type |

|---|---|---|---|---|---|

15/07/YYYY | 25,100 | 25,105 | 5 | Private - School drop-off | Private |

15/07/YYYY | 25,105 | 25,115 | 10 | Travel to meet client (ABC Corp) in Fortitude Valley | Business |

15/07/YYYY | 25,115 | 25,122 | 7 | Pick up materials from Print Co. in Woolloongabba | Business |

15/07/YYYY | 25,122 | 25,134 | 12 | Travel to meet client (XYZ Solutions) in Sunnybank | Business |

15/07/YYYY | 25,134 | 25,150 | 16 | Travel from client meeting back to home office | Business |

15/07/YYYY | 25,150 | 25,154 | 4 | Private - Groceries | Private |

By keeping this level of detail for 12 continuous weeks, you build a solid record that can be used for up to five years. For more details on what constitutes a business trip, see our guide on how to claim your car expenses tax deduction.

Calculating Your Business Use Percentage and Claimable Expenses

Once your 12-week logbook is complete, it's time to calculate your business-use percentage. This is the key number that determines how much of your car’s total running costs you can claim.

The formula is straightforward:

This percentage is the single most important figure to come out of your efforts. It’s the definitive ratio of how much your car was used for earning your income versus personal travel.

Applying Your Percentage to Total Car Expenses

You get to apply this percentage to the total running costs of your car for the entire financial year, not just the 12-week period. This is why keeping every single receipt and invoice for your car is just as crucial as keeping the logbook.

What Car Expenses Can You Claim?

The logbook method allows you to claim the business portion of a broad range of actual costs, provided you have proof.

Fuel and Oil: Petrol, diesel, or electricity charging costs.

Repairs and Servicing: Regular maintenance, new tyres, and mechanical fixes.

Registration and Insurance: Annual registration and insurance premiums.

Loan Interest: Interest paid on a car loan.

Cleaning Costs: Car washes and detailing.

Depreciation (Decline in Value): A claim for the loss in the car’s value as it ages.

For a deeper dive into what’s deductible, including specific costs like electric car maintenance costs, check out our complete guide on navigating the complexities of car tax deductions in Australia.

A Worked Example

Let's use Chloe, a freelance designer in Brisbane, as an example.

1. Logbook Data (12-Week Period):

Total kilometres travelled: 5,000 km

Total business kilometres: 4,000 km

2. Business-Use Percentage Calculation:

(4,000 km ÷ 5,000 km) × 100 = 80% business use

3. Total Car Expenses (Full Financial Year):Chloe kept every receipt for the year.

Expense Category | Annual Cost |

|---|---|

Fuel and Oil | $4,500 |

Registration & Insurance | $2,000 |

Servicing and Tyres | $1,200 |

Loan Interest | $1,800 |

Depreciation | $5,500 |

Total Annual Costs | $15,000 |

4. Final Tax Deduction Calculation:Chloe applies her 80% business-use percentage to her total annual costs.

$15,000 (Total Costs) × 80% (Business Use) = $12,000

By diligently keeping a and all her receipts, Chloe can claim a $12,000 tax deduction for her car expenses.

Logbook Lifespan and Record-Keeping Checklist

A single, well-kept logbook can remain valid for up to five consecutive financial years. However, its validity depends on your circumstances remaining relatively consistent.

When to Start a New Logbook

The ATO requires a new 12-week logbook if your driving patterns change significantly. This usually occurs if:

Your job or role changes.

You move house or change your main workplace.

You get a new car (each vehicle needs its own logbook).

Your business operations expand, for instance, a Brisbane business starts servicing the Gold Coast.

The ATO guideline states that if your business-use percentage changes by more than 10 percentage points from your logbook's figure, you must complete a new one.

Compliance Checklist

Follow these steps to ensure you meet your record-keeping obligations.

[ ] Keep Logbook for 5 Years: Store your logbook and all related car expense records for five years from your tax return lodgement date.

[ ] Retain All Receipts: Keep every receipt for fuel, oil, repairs, insurance, registration, and loan interest.

[ ] Record Odometer Readings: Note the odometer reading at the start of the logbook period, the end of the period, and also at the start and end of each financial year (30 June).

[ ] Create a Filing System: Use a digital (cloud storage) or physical (binder) system to organise records by financial year.

[ ] Review Annually: At the end of each financial year, check if your business use has changed significantly. If it has, plan to start a new 12-week logbook.

If you've misplaced a few receipts, learn more in our guide on what you can claim on tax without receipts in Australia.

Summary

Here are the key takeaways for maintaining an ATO-compliant car logbook:

Log for 12 Continuous Weeks: Record every trip, both business and private, for a continuous 12-week period that represents your typical annual travel.

Be Specific: Vague journey descriptions like "client visit" are a major red flag. Provide clear details on the purpose of each business trip.

Keep All Receipts: Your logbook determines the business-use percentage, which you apply to your total car expenses for the entire financial year. You must have receipts to prove these costs.

One Logbook Per Car: Each vehicle requires its own separate logbook.

Valid for 5 Years: A valid logbook can be used for up to five years, but you must start a new one if your business-use percentage changes by more than 10%.

Record Private Trips: You must log all private travel to calculate your total kilometres accurately.

Frequently Asked Questions (FAQs)

What if my business driving changes significantly?

If your business use percentage changes by more than 10 percentage points compared to your logbook, the ATO requires you to complete a new continuous 12-week logbook to establish a new, accurate percentage.

Are ATO-compliant logbook apps acceptable?

Yes. The ATO accepts electronic logbooks from apps, provided they record all the required information: date, start and end odometer readings, kilometres travelled, and a clear journey purpose. Many apps use GPS to automate this process.

What is the difference between a private commute and a business trip?

Travel between your home and your regular place of work is typically considered a private commute and is not claimable. A business trip is travel required as part of performing your work duties, such as visiting a client, travelling between different work sites, or running a business-related errand.

Do I need a full logbook for the cents per kilometre method?

No, a detailed is not required for the cents per kilometre method. However, you must still keep records to show how you calculated your business kilometres, such as a diary of work-related trips.

Can I estimate my logbook entries?

No. The ATO requires actual, contemporaneous records. You cannot estimate or create a logbook after the fact. Entries must be recorded as they happen or shortly thereafter.

Need clarity on your situation?

The information provided here is general in nature and serves as a guide. Tax laws are complex, and their application can vary significantly based on your individual or business circumstances. A small error in a logbook or expense calculation can have notable financial consequences.

For advice tailored to your specific situation, it is always best to consult with a qualified tax professional. An expert can help ensure your claims are maximised, compliant, and stand up to ATO scrutiny, giving you peace of mind.

Baron Tax & Accounting

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213

Whatsapp: 0450 468 318

Comments