How Can I Get an FBT Exemption for a Car in Australia?

- Jan 10

- 11 min read

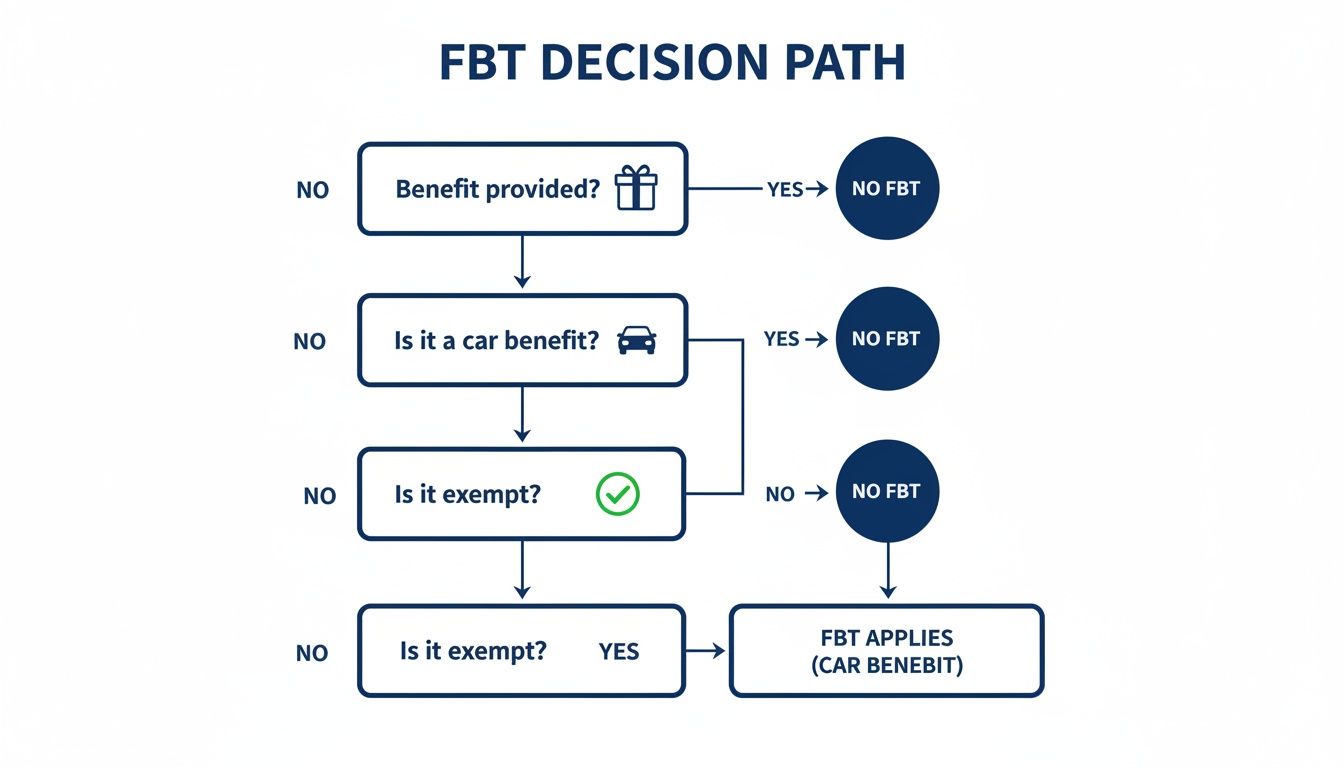

Providing an employee with a car for private use is a common perk, but it can trigger a significant tax liability for your business known as Fringe Benefits Tax (FBT). However, Australian tax law includes specific provisions for an 'FBT exemption car', allowing you to offer this benefit without the hefty tax bill.

Understanding these exemptions is crucial for any business providing company vehicles. It's a key strategy for reducing your tax obligations and managing costs effectively. The main exemptions apply to eligible electric vehicles and certain commercial 'workhorse' vehicles, but only if their private use is strictly limited.

Getting the rules wrong can lead to substantial, unexpected tax bills and penalties from the Australian Taxation Office (ATO). The FBT rate is a steep 47%, so any compliance error is costly. This guide provides a step-by-step breakdown of how to qualify for these valuable exemptions and stay compliant.

Understanding Car FBT and Its Exemptions

Fringe Benefits Tax (FBT) is a tax employers pay on benefits provided to employees outside of their standard salary or wages. One of the most common examples is a company car that an employee can use for personal travel, such as their daily commute, weekend trips, or running errands.

Mistakes in calculating or applying FBT can result in significant tax liabilities and ATO penalties. At a rate of 47%, an FBT miscalculation can severely impact your business's bottom line.

Why FBT Exemptions Are So Important

An 'FBT exemption car' is a vehicle that, despite being a benefit, is not subject to FBT. This provides significant financial advantages for both the employer and the employee.

For Employers (SMEs, Corporations): A full FBT exemption directly reduces the cost of providing the vehicle, freeing up capital and minimising tax administration. In a competitive employment market, offering FBT-exempt vehicles can be a powerful tool for attracting and retaining skilled staff.

For Employees (Individuals): An exemption makes salary packaging a vehicle, particularly an eligible Electric Vehicle (EV), far more affordable. By paying for the car and its running costs from pre-tax salary, employees reduce their taxable income, which increases their net take-home pay.

According to the Australian Taxation Office (ATO), these exemptions are deliberate policy measures designed to encourage specific behaviours, such as the adoption of more environmentally friendly vehicles.

This guide will explain how to qualify for the two primary FBT exemptions: the popular concession for electric vehicles and the long-standing rules for 'workhorse' commercial vehicles. Correctly applying these rules is essential for managing business costs and making informed decisions about company vehicles or salary packaging.

How The Electric Vehicle FBT Exemption Works

A significant FBT exemption was introduced for Zero and Low Emissions Vehicles (ZLEVs), making it much more financially viable for employees to salary package an electric car.

To qualify for this fbt exemption car benefit, the vehicle must meet specific criteria set by the ATO.

First, the car must be one of the following types:

Battery Electric Vehicle (BEV): A car that runs exclusively on an electric motor, powered by a battery.

Hydrogen Fuel Cell Electric Vehicle (FCEV): A vehicle powered by converting hydrogen into electricity.

Plug-in Hybrid Electric Vehicle (PHEV): A car with both an internal combustion engine and a battery that can be charged externally. Note: The FBT exemption for PHEVs will no longer be available for new arrangements from 1 April 2025.

Key Eligibility Conditions

The most critical conditions for the ZLEV FBT exemption are:

Value Threshold: The car’s value at its first retail sale must be below the luxury car tax (LCT) threshold for fuel-efficient vehicles. This threshold is indexed annually, so you must use the correct figure for the relevant financial year.

First Held and Used Date: The car must have been first held and used on or after 1 July 2022. This rule was implemented to incentivise the purchase of new ZLEVs.

ZLEV FBT Exemption Eligibility Checklist

This table summarises the key criteria a vehicle must meet to qualify for the FBT exemption.

Eligibility Criterion | ATO Requirement Summary |

|---|---|

Vehicle Type | Must be a Battery Electric Vehicle (BEV), Hydrogen Fuel Cell Electric Vehicle (FCEV), or (until 1 April 2025) a Plug-in Hybrid Electric Vehicle (PHEV). |

Date of First Use | The car must have been first held and used on or after 1 July 2022. |

Value at First Retail Sale | The value must be below the luxury car tax (LCT) threshold for fuel-efficient vehicles for the relevant year. |

Luxury Car Tax (LCT) Status | The vehicle must not have had LCT paid or payable on its supply or importation. |

Failure to meet even one of these criteria will disqualify the vehicle from the FBT exemption, potentially resulting in an unexpected tax bill.

What The Exemption Covers

The FBT exemption applies not only to the vehicle itself but also to its associated running costs when part of a salary packaging arrangement.

Typical running costs that can be included are:

Registration and CTP insurance

Comprehensive car insurance

Routine servicing and repairs

Replacement tyres

Electricity costs for charging the vehicle (including at home)

The ATO made this exemption available from 1 July 2022 for ZLEVs meeting the criteria, including the value cap, which was $89,332 for the 2023–24 financial year. The federal government introduced this policy to reduce the financial barriers to EV ownership and encourage their adoption.

Qualifying For The Commercial Vehicle Exemption

The ATO has a long-standing FBT exemption for 'workhorse' vehicles, such as utes and panel vans, that are not primarily designed for carrying passengers.

However, providing an employee with a ute does not automatically qualify for the exemption. Eligibility depends entirely on how strictly its private use is controlled.

The Limited Private Use Test

To claim the commercial fbt exemption car rule, an employer must demonstrate to the ATO that the employee's private use of the vehicle was ‘minor, infrequent, and irregular’. The ATO provides specific guidelines to define this.

For example, a tradesperson driving their work van from home to various job sites is considered work-related use. The daily commute between home and a regular place of work is also generally acceptable. However, using the van for a weekend camping trip or for significant personal errands would likely disqualify it from the exemption.

Defining Minor, Infrequent And Irregular Use

The ATO has established clear limits to prevent misuse of the exemption. To meet the limited private use test, the following conditions must be satisfied throughout the FBT year (1 April to 31 March):

Home-to-Work Travel: The journey between an employee's home and their regular workplace is permitted.

Minor Detours: A small detour during the commute is acceptable, provided it adds no more than two kilometres to the total journey.

Other Private Trips: The total of all other private journeys must not exceed 1,000 kilometres for the FBT year, and no single return private journey can be longer than 200 kilometres.

These limits are strict. If an employee uses a work ute for a 300km round trip for personal reasons, the FBT exemption for that vehicle is void for the entire year.

Essential Compliance Steps For Employers

To protect your business and validate your claim, you must implement robust compliance systems.

A strong compliance strategy includes:

A Written Policy: Establish a formal, written policy outlining the rules for private use of company vehicles. This policy should be signed by every employee with access to a vehicle.

Regular Monitoring: Periodically check vehicle odometers and discuss private use with employees to ensure they remain within the ATO's limits.

Employee Education: Ensure staff understand the rules and the significant tax consequences for the business if these rules are breached.

By taking these proactive steps, you can provide necessary work vehicles while legally minimising your FBT liabilities.

Understanding The Financial Impact Of An FBT Exemption

An FBT exemption can save a business a substantial amount of money. To appreciate the benefit, it's important to understand the cost of providing a car that is not exempt from FBT.

When a vehicle is subject to FBT, the ATO provides two methods for calculating the tax liability.

FBT Calculation Methods For Non-Exempt Cars

The Statutory Formula Method: This is the simpler option. It applies a flat rate of 20% to the car's base value, regardless of kilometres driven.

The Operating Cost Method: This method calculates FBT based on the actual costs of running the car and its percentage of private use. It requires detailed records, such as a logbook, but can result in a lower FBT liability if business use is high.

Example: A business provides an employee with a car valued at $50,000. Using the Statutory Formula Method, the taxable value is $10,000 (20% of $50,000). The FBT payable would be $4,700 ($10,000 x 47%). This is a direct annual cost to the business.

The Financial Power Of An FBT-Exempt Car

If the same $50,000 vehicle qualifies for an FBT exemption (e.g., an eligible EV), the FBT payable is $0.

The financial impact is immediate. The employer saves the entire $4,700 in FBT. This saving directly improves the company's profitability each year the benefit is provided.

This is why structuring car benefits to meet exemption criteria is such a powerful financial strategy. It involves using government-approved incentives to legally reduce tax obligations.

Government Policy And Purchasing Decisions

Tax incentives like the EV exemption are deliberate government policies designed to influence consumer and business behaviour. The FBT exemption for ZLEVs, often referred to as the Electric Car Discount, is a clear example of using the tax system to promote a shift towards sustainable transport.

The Treasury estimated that this FBT exemption would represent a tax expenditure of around $1.35 billion in the 2025–26 financial year, highlighting its significant impact. This shows the government's commitment to making electric vehicles more financially accessible for businesses and their employees.

Real World Examples of FBT Savings in Action

Practical examples help illustrate how FBT exemptions translate into real financial savings for businesses and employees.

Case Study 1: The Workhorse Ute Exemption (Small Business)

A small plumbing business provides a dual-cab ute to its lead plumber for travelling between job sites and carrying equipment.

To secure the FBT exemption, the business implements a clear vehicle use policy.

Written Agreement: The plumber signs a policy acknowledging that the ute is primarily for work purposes and that private use must adhere to the ATO's 'minor, infrequent, and irregular' guidelines.

Logbook and Monitoring: The business maintains records of the ute's odometer readings, confirming that private travel remains well below the 1,000 km annual limit and no single return trip exceeds 200 km.

Outcome: By meeting these conditions, the business avoids paying the 47% FBT on the ute’s value, saving thousands of dollars in tax each year. This money can be reinvested into the business.

Case Study 2: The Electric Vehicle Novated Lease (Individual Employee)

An employee at an SME earns $120,000 per year and decides to acquire a new, FBT-exempt electric vehicle (EV) valued at $65,000 through a novated lease (a form of salary packaging).

Because the EV is FBT-exempt, the lease payments and running costs are deducted from the employee's pre-tax salary.

This arrangement significantly reduces the employee's taxable income, which in turn lowers their income tax and Medicare levy payable, increasing their net pay.

Here is a simplified comparison:

Financial Aspect | Without Novated Lease | With FBT-Exempt Novated Lease |

|---|---|---|

Gross Annual Salary | $120,000 | $120,000 |

Pre-Tax Lease & Running Costs | $0 | -$15,000 (example) |

Taxable Income | $120,000 | $105,000 |

Estimated Income Tax | ~$31,167 | ~$25,717 |

Annual Tax Saving | - | ~$5,450 |

This example shows a potential annual tax saving of over $5,000. This incentive has had a noticeable impact on the Australian car market. Data from the Federal Chamber of Automotive Industries (FCAI) shows a significant increase in EV sales since the FBT exemption was introduced in July 2022, with salary packaging firms confirming the exemption has made EVs far more affordable for many Australians.

Meeting Your ATO Record Keeping Obligations

Claiming an FBT exemption requires more than just meeting the eligibility criteria; you must be prepared to prove your compliance to the ATO through meticulous record-keeping. Proper documentation is your primary defence during an ATO review or audit.

Without a clear paper trail, the ATO can disallow your claim, leading to significant FBT liabilities and penalties.

Documentation For Commercial Vehicles

For 'workhorse' vehicles, your records must prove that any private use was minor, infrequent, and irregular.

Essential records include:

A Clear Company Policy: A formal, written policy outlining the rules for private vehicle use. This should be signed by each employee with access to the vehicle.

Consistent Logbooks or Records: Up-to-date records of odometer readings that demonstrate private travel remained within the ATO's strict limits (under 1,000 km annually, with no single return trip over 200 km).

Records For Zero and Low Emission Vehicles (ZLEVs)

While a logbook for private use is not required to claim the ZLEV exemption, other documentation is essential to prove eligibility.

You must retain records that verify:

The Vehicle's Value: The original purchase invoice showing the car's value at its first retail sale was below the LCT threshold for that year.

Associated Running Costs: If running costs are part of a salary packaging arrangement, you must keep receipts for all expenses, such as insurance, registration, servicing, and electricity for charging.

A critical compliance point is that even though the benefit is exempt from FBT for the employer, its value must be reported on the employee's income statement as a Reportable Fringe Benefits Amount (RFBA).

The RFBA is not directly taxed but is used by the ATO and other government agencies (like Services Australia) to determine an employee's eligibility for certain benefits and liabilities, such as:

Medicare levy surcharge

Compulsory HECS-HELP repayments

Child support assessments

Certain family assistance payments

Ensuring your payroll system correctly calculates and reports the RFBA is a crucial compliance step for both the business and its employees.

Summary

Navigating Fringe Benefits Tax rules for vehicles can be complex, but mastering the principles allows for significant tax savings. The two primary pathways to an FBT exemption car are for eligible Zero and Low Emissions Vehicles (ZLEVs) and for commercial 'workhorse' vehicles.

Key Takeaways:

FBT is a 47% tax on non-salary benefits, making exemptions highly valuable.

ZLEV Exemption: Applies to eligible electric, hydrogen, and (until 1 April 2025) plug-in hybrid vehicles first used after 1 July 2022 and valued below the LCT threshold.

Commercial Vehicle Exemption: Requires proving that private use is 'minor, infrequent, and irregular' according to strict ATO limits (e.g., under 1,000 km per year).

Record-Keeping is Non-Negotiable: You must maintain detailed records, including purchase invoices, vehicle policies, and logbooks (for commercial vehicles), to substantiate your claim to the ATO.

RFBA Reporting: Even FBT-exempt benefits must be reported on an employee's income statement, affecting their overall financial position.

By correctly applying these rules and maintaining diligent records, your business can legally reduce its tax burden and offer more attractive employee benefits.

FAQ Section

Can I claim an FBT exemption on a second-hand EV?

Yes, a second-hand Zero or Low Emissions Vehicle (ZLEV) can qualify for the FBT exemption, provided it meets all the standard ATO criteria. The two most important tests are that the vehicle must have been first held and used on or after 1 July 2022, and its value at its original first retail sale (not the price you paid) must have been below the luxury car tax threshold for that year. The exemption is tied to the vehicle's history from its first sale.

Does the commercial vehicle exemption apply to all utes?

No, the FBT exemption for commercial vehicles does not automatically apply to all utes, especially dual-cab models often used as family vehicles. The vehicle must be designed primarily for work, and its private use must be strictly limited to 'minor, infrequent, and irregular' as defined by the ATO. If a dual-cab ute is regularly used for the school run, weekend trips, or grocery shopping, it will likely fail the private use test, and FBT will be payable.

What happens if I change jobs with a novated lease?

A novated lease is a three-way agreement between you, your employer, and a finance company. If you leave your job, the 'novation' agreement with that employer ends. You typically have several options: pay out the remainder of the lease, refinance it as a standard personal car loan, or negotiate with your new employer to take over the novation arrangement.

Are running costs included in the EV FBT exemption?

Yes, for eligible ZLEVs provided under a salary packaging arrangement, the FBT exemption extends to associated running costs. This includes registration, insurance, servicing, tyres, and the cost of electricity used for charging (including at home). Including these costs significantly reduces the vehicle's total cost of ownership. This is detailed in the Treasury Laws Amendment (Electric Car Discount) Act 2022.

Contact Us

The rules surrounding Fringe Benefits Tax can be complex and are subject to change. To ensure your business is compliant and making the most of available exemptions, it is crucial to seek professional advice tailored to your specific circumstances.

Contact Baron Tax and Accounting today for expert guidance on FBT, salary packaging, and other business tax matters.

Baron Tax and Accounting

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213

Comments