How Do Novated Leases and FBT Work in Australia? A Clear Guide

- 1 day ago

- 12 min read

A novated lease is a three-way agreement for a vehicle between an employee, their employer, and a finance company. It allows you to bundle a new car and all its running costs into a single payment, deducted directly from your pre-tax salary. However, this arrangement immediately brings Fringe Benefits Tax (FBT) into play.

Understanding the relationship between a novated lease and FBT is critical to maximising the financial benefits. Because your employer provides a non-cash benefit (the car), the Australian Taxation Office (ATO) requires FBT to be calculated. Failing to manage this FBT liability correctly can negate the tax savings you gain from salary packaging, leading to unexpected costs and compliance issues for your employer.

Understanding the Novated Lease and FBT Connection

You cannot discuss a novated lease without understanding Fringe Benefits Tax. The two are fundamentally linked. The moment your employer facilitates the provision of a car for your private use, an FBT obligation is created.

While the FBT liability legally falls on the employer, the cost is almost always passed back to the employee through their salary package. The primary goal of a well-structured novated lease is to manage this FBT liability—ideally reducing it to zero—to preserve the tax benefits of using pre-tax funds.

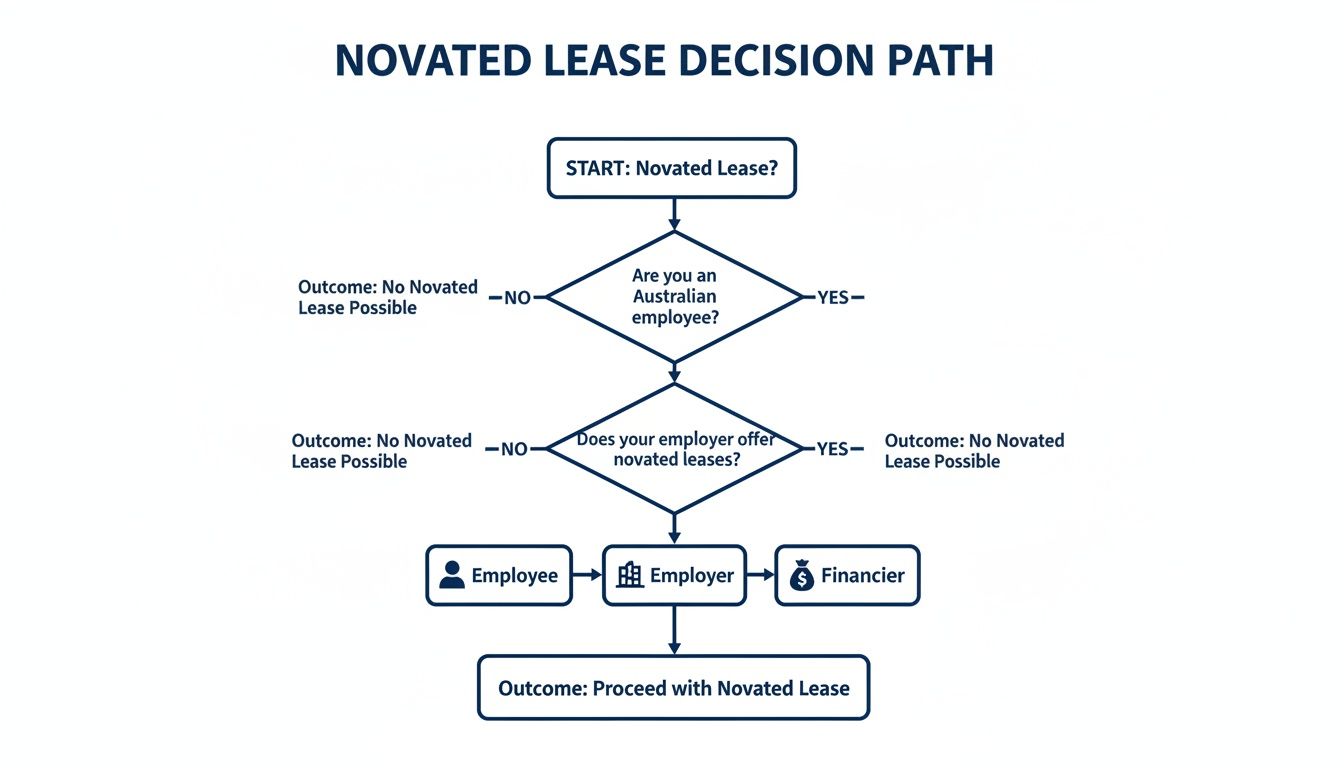

The Three Parties Involved

To understand how FBT applies, it's essential to recognise the roles of each party:

The Employee: You select the vehicle and agree to have the lease payments and running costs deducted from your salary. You are also responsible for covering any FBT liability, typically by making post-tax contributions.

The Employer: Acting as the facilitator, your employer deducts payments from your salary and forwards them to the financier. They hold the legal responsibility for calculating, reporting, and remitting any FBT to the ATO.

The Financier: This is the finance company that owns the vehicle. They lease it to you through the arrangement facilitated by your employer.

This structure is a classic example of salary packaging. To understand how this fits into broader remuneration strategies, our guide on the benefits of salary sacrifice provides further context.

The ATO defines a car fringe benefit as occurring when an employer makes a car they own or lease available for an employee's private use. A novated lease squarely meets this definition, making FBT management an essential component of the arrangement.

The Recent Surge in Novated Leasing

The connection between novated leases and FBT has gained significant attention recently, largely due to the Australian Government's FBT exemption for zero and low-emission vehicles. This incentive has dramatically increased the popularity of novated leasing, transforming it from a niche benefit into a mainstream strategy for financing a new vehicle, particularly an electric one.

How the ATO Calculates FBT for Your Novated Lease

When an employer provides a car via a novated lease, the Australian Taxation Office (ATO) requires its taxable value to be determined. This figure is used to calculate the Fringe Benefits Tax (FBT) owed. Understanding this calculation is crucial, as it directly impacts the overall savings of your salary package.

The ATO provides two methods for this calculation. Your employer or their salary packaging provider will typically assess both to select the one that results in the lowest taxable value, thereby minimising FBT and maximising your savings.

The flowchart below illustrates the three-party agreement that defines a novated lease.

This structure is precisely what triggers FBT, making the choice of calculation method a critical part of the financial arrangement.

The Statutory Formula Method

The Statutory Formula Method is the most common approach due to its simplicity. It calculates the taxable value based on the car's original cost, irrespective of the actual kilometres driven for business or private purposes.

This method applies a flat statutory rate of 20% to the car's base value, making it a straightforward option, especially for employees who primarily use their vehicle for personal travel.

The ATO’s formula is: Taxable Value = (Base Value of the Car × 0.20 × Number of Days Available) / Number of Days in FBT Year – Employee Contribution

Example: Statutory Formula Calculation

Car's Base Value (incl. GST): $45,000

Statutory Rate: 20%

Availability: The car is available for the full FBT year (1 April – 31 March).

First, calculate the initial taxable value: $45,000 × 20% = $9,000

To eliminate any FBT liability, the employee would need to make post-tax contributions (known as the Employee Contribution Method or ECM) totalling this $9,000 over the FBT year.

The Operating Cost Method

The second option is the Operating Cost Method, often called the logbook method. This approach calculates the taxable value based on the total running costs of the car and the percentage of that use which is private. For employees with significant business-related travel, this method can result in substantial FBT savings.

To use this method, you must maintain a detailed logbook for a continuous 12-week period that accurately reflects your typical travel patterns. This logbook serves as the official record to substantiate your business-use percentage.

The ATO formula for this method is: Taxable Value = (Total Operating Costs × Private Use Percentage) – Employee Contribution

Example: Operating Cost Method Calculation

Total Annual Operating Costs (fuel, insurance, rego, servicing): $12,000

Logbook Details: Total travel is 15,000 km, with 9,000 km for business.

Business Use: (9,000 km / 15,000 km) = 60%

Private Use: 100% - 60% = 40%

Now, calculate the taxable value: $12,000 (Operating Costs) × 40% (Private Use) = $4,800

In this scenario, post-tax contributions of only $4,800 would be required to reduce the FBT liability to zero. This is a significant saving compared to the $9,000 required under the Statutory Method for the same vehicle. For those wanting to delve deeper, our guide on how to manage Fringe Benefits Tax (FBT) in Australia provides more detail.

According to the ATO, the Operating Cost Method requires detailed records of all car expenses and a logbook to substantiate the business-use percentage. Failing to maintain these records means you must default to the Statutory Formula Method.

Which Method Is Right for You?

The best method depends entirely on your vehicle usage. A direct comparison typically makes the optimal choice clear.

Comparing FBT Calculation Methods: Statutory vs. Operating Cost

This table breaks down the two ATO-approved methods to help you determine which best suits your circumstances.

Feature | Statutory Formula Method | Operating Cost Method |

|---|---|---|

Calculation Basis | A flat 20% of the car's base value. | The private-use percentage of total car running costs. |

Best For | Employees with high private use or those who prefer not to keep a logbook. | Employees with significant, consistent business use of their vehicle. |

Record Keeping | Minimal. No logbook is required. | Requires a detailed 12-week logbook and records of all operating costs. |

Predictability | Highly predictable. The taxable value is fixed based on the car's cost. | Taxable value can fluctuate annually based on running costs and usage patterns. |

Your salary packaging provider will perform these calculations to ensure the most tax-effective outcome. However, understanding the mechanics empowers you to make informed decisions about your vehicle use and record-keeping.

The FBT Exemption for Electric Vehicles Explained

The Australian Government's Fringe Benefits Tax (FBT) exemption for electric vehicles has significantly impacted the novated lease market. This powerful incentive makes leasing an eligible electric or low-emission car substantially more affordable, driving a major shift in consumer vehicle choices.

This policy is a primary driver behind the recent surge in EV adoption. According to the Australian Financial Industry Association (AFIA), novated leasing has become the dominant financing method for EVs. In one year, AFIA members financed nearly $2.5 billion in electric vehicles, with novated leasing accounting for an astonishing 92% of all new EV financing each month.

Which Vehicles Qualify for the FBT Exemption?

To qualify for the FBT exemption, a vehicle must meet specific criteria set by the Australian Taxation Office (ATO):

Vehicle Type: It must be a zero or low-emissions vehicle. This includes Battery Electric Vehicles (BEVs), Hydrogen Fuel Cell Electric Vehicles (FCEVs), and, until 1 April 2025, Plug-in Hybrid Electric Vehicles (PHEVs).

Value Threshold: The vehicle's value must be below the luxury car tax (LCT) threshold for fuel-efficient vehicles. For the 2024-25 financial year, this threshold is $91,387.

Usage Date: It must have been first held and used on or after 1 July 2022.

A critical deadline applies to Plug-in Hybrid Electric Vehicles (PHEVs). The FBT exemption will not be available for new PHEV leases established on or after 1 April 2025. However, arrangements in place before this date will remain exempt for the life of that specific lease agreement.

Understanding the Reportable Fringe Benefits Amount (RFBA)

While the employer receives the FBT exemption and pays no FBT, the value of the car benefit must still be reported on the employee's income statement. This is known as the Reportable Fringe Benefits Amount (RFBA).

Even with a fully FBT-exempt EV, the employer must calculate the grossed-up taxable value of the benefit and report it. Although you don't pay income tax on the RFBA, it is added to your taxable income to determine your 'Adjusted Taxable Income' (ATI).

How Your RFBA Affects Your Finances

An RFBA can have a tangible impact on your financial situation. Government agencies like the ATO and Services Australia use your ATI to determine eligibility for benefits and liabilities for certain payments.

Specifically, a higher ATI can affect:

Government benefits and payments: Such as the Family Tax Benefit.

Tax offsets: Including the private health insurance rebate.

Repayment obligations: For programs like the Higher Education Loan Program (HELP/HECS).

The Medicare levy surcharge.

This is a crucial detail to consider. While the pre-tax savings from the novated lease are significant, the resulting RFBA may influence other aspects of your finances. For more information, our guide on what Reportable Fringe Benefits are and why they matter is a valuable resource.

Navigating Your Responsibilities as an Employee and Employer

A novated lease is a three-way agreement, and its success depends on both the employee and employer understanding and fulfilling their distinct responsibilities. Clear roles ensure the arrangement remains compliant, efficient, and free from unexpected issues.

The Employee's Role and Obligations

As the employee, you are responsible for the day-to-day management of the vehicle and ensuring the lease remains tax-effective.

Your key obligations include:

Vehicle Maintenance: Keeping the car serviced according to the manufacturer's schedule and maintaining it in good condition.

Accurate Record-Keeping: If using the Operating Cost Method, maintaining a compliant 12-week logbook is mandatory to substantiate your business-use percentage with the ATO.

Making Contributions: Making required post-tax contributions to reduce the FBT liability to zero is a critical step in maximising tax benefits.

Budget Management: Managing your driving and vehicle expenses to stay within the budget allocated in your salary package.

A significant consideration is what happens if you change jobs. Upon termination of employment, the novation agreement ends, and full financial responsibility for the lease reverts to you. Your options are typically to pay out the lease, transfer it to a new employer, or refinance the residual amount.

The Employer's Role and Obligations

The employer acts as the administrator, holding the legal and tax responsibilities from the ATO's perspective. Their role is crucial for compliance.

An employer’s core duties include:

Payroll Deductions: Accurately processing pre-tax and post-tax deductions from the employee’s salary and remitting payments to the finance company.

FBT Calculation and Payment: The employer is legally responsible for calculating, reporting, and paying any FBT to the ATO. While the employee’s contributions cover the cost, the compliance burden lies with the employer.

Reporting RFBA: The employer must calculate and report the Reportable Fringe Benefits Amount (RFBA) on the employee's annual income statement, even if the FBT liability is zero.

According to the ATO, employers must lodge an FBT return if they have a liability. Non-compliance can lead to significant penalties, making a thorough understanding of FBT rules essential.

Clarifying Responsibilities in a Novated Lease

This table provides a clear breakdown of key responsibilities for both parties in a novated lease agreement.

Responsibility Area | Employee Role | Employer Role |

|---|---|---|

Vehicle Choice | Selects the vehicle and negotiates the price. | No direct role, but must agree to facilitate the arrangement. |

Lease Payments | Funds payments via pre-tax and post-tax salary deductions. | Manages payroll deductions and remits payment to the financier. |

Running Costs | Manages spending to stay within the allocated budget. | Processes payments for running costs from the employee's salary package. |

Logbook (OCM) | Maintains an accurate 12-week logbook to prove business use. | Uses logbook data to calculate the FBT taxable value. |

FBT Liability | Covers the cost of any FBT via post-tax contributions (ECM). | Calculates, reports, and remits FBT to the ATO. Holds legal liability. |

End of Employment | Assumes full financial responsibility for the lease and vehicle. | Ceases payroll deductions and terminates the novation agreement. |

Comparing Novated Leasing to Car Loans and Allowances

When deciding on the best way to finance a new car, it's essential to compare a novated lease against traditional options like a car loan or a car allowance. The key differences lie in tax efficiency, ownership structure, and overall cost.

The primary advantage of a novated lease is its tax effectiveness. By bundling the vehicle's purchase price and running costs into payments from your pre-tax salary, you lower your taxable income. Additionally, you save the GST on the vehicle's purchase price and its ongoing expenses—a benefit not available with a personal loan.

Novated Lease vs Traditional Car Loan

A traditional car loan is a straightforward debt agreement. You borrow money, buy the car, and make repayments from your after-tax income. While you have immediate ownership, this simplicity comes at a higher tax cost.

With a standard car loan:

Payments are post-tax: All loan and running cost payments are made with money that has already been taxed.

You pay full GST: The GST on the purchase price and all expenses is an unavoidable cost.

Ownership is immediate: The car is your asset from day one, providing complete freedom to sell or modify it.

Novated Lease vs Car Allowance

A car allowance is a fixed amount added to your salary by your employer to cover vehicle expenses. While it seems like a simple cash payment, it is treated as taxable income by the ATO.

A car allowance is fully assessable income and is taxed at your marginal tax rate. This significantly reduces the net amount available to you for vehicle expenses.

For example, if you receive a $15,000 annual car allowance and your marginal tax rate is 32.5%, you will pay $4,875 in tax, leaving you with only $10,125. This makes a novated lease a far more tax-efficient option.

Making the Right Financial Decision

The table below compares the key features of each financing option to help you make an informed decision.

Feature | Novated Lease | Car Loan | Car Allowance |

|---|---|---|---|

Tax Efficiency | High. Payments from pre-tax salary lower taxable income. GST savings on car price and running costs. | None. Repayments are made with after-tax money. No GST savings. | Low. Allowance is taxed at your marginal rate, reducing its net value. |

Ownership | Financier owns the vehicle. Option to buy at the end of the lease. | You own the vehicle from the start. | You own the vehicle. |

Flexibility | Tied to employment. Requires action (transfer, payout) if you change jobs. | Complete flexibility. Independent of your employer. | Complete flexibility. Independent of your employer. |

Budgeting | Simple. All costs are bundled into a single payroll deduction. | Complex. Requires separate budgeting for loan, fuel, insurance, servicing, etc. | Complex. You must manage all vehicle costs from your after-tax allowance. |

Overall Cost | Often lower due to significant income tax and GST savings. | Generally higher due to the absence of tax benefits. | Higher due to the allowance being fully taxable. |

FAQ: Common Questions About Novated Leases and FBT

1. What happens to my novated lease if I leave my job?

When you cease employment, the novation agreement with that employer terminates. Full financial responsibility for the lease reverts to you. You typically have three options:

Pay out the lease and take ownership of the car.

Transfer the lease to a new employer by establishing a new novation agreement.

Refinance the remaining amount into a standard personal car loan. It is advisable to discuss these options with your lease provider before signing the agreement.

2. Can I get a novated lease for a second-hand car?

Yes, many providers offer novated leases for used vehicles. This can be a cost-effective way to access the tax benefits of a novated lease. However, finance companies often have restrictions on the age of the vehicle at the start and end of the lease term. The FBT calculation methods and ATO rules are identical for both new and used cars.

3. How does the Reportable Fringe Benefits Amount (RFBA) affect my finances?

The RFBA is the grossed-up value of the car benefit you receive, which must be reported on your income statement even if no FBT is paid (e.g., due to the EV exemption). The ATO and other government agencies use this amount to calculate your 'Adjusted Taxable Income' (ATI). A higher ATI can impact your eligibility for government benefits (like Family Tax Benefit), tax offsets (like the private health insurance rebate), and your repayment obligations for schemes like HECS-HELP.

4. Is the FBT exemption for EVs a permanent policy?

No tax policy is guaranteed to be permanent. The FBT exemption for plug-in hybrid electric vehicles (PHEVs) is scheduled to end for new arrangements from 1 April 2025. While the exemption for battery electric and hydrogen fuel cell vehicles currently has no end date, the policy is subject to future government review. For the most current information, always refer to the official ATO website.

Summary

Effectively managing a novated lease and FBT is key to maximising the significant savings this type of arrangement offers. While it's an excellent way to finance a vehicle and its running costs using pre-tax income, success depends on correctly handling your FBT obligations.

Key Takeaways:

FBT is integral to a novated lease. Providing a car for private use is a fringe benefit, which automatically triggers FBT considerations.

Two calculation methods are available. The ATO permits either the Statutory Formula (a flat 20% of the car's value) or the Operating Cost Method (based on your actual business-use percentage).

Post-tax contributions eliminate FBT. Making Employee Contributions from your after-tax salary is the standard method for reducing your FBT liability to zero.

EVs offer a significant FBT advantage. An ATO exemption can eliminate FBT on eligible electric vehicles, though the benefit's value is still reported as an RFBA on your income statement.

Get Professional Tax Advice

The tax rules surrounding novated leases are complex and can significantly impact your financial outcome. While this guide provides a comprehensive overview of novated lease and FBT principles, it is not a substitute for professional advice tailored to your individual circumstances.

If you’re looking for expert guidance on your tax and accounting needs, get in touch with Baron Tax and Accounting.

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213

Comments