Is Income Protection Tax Deductible in Australia?

- Dec 7, 2025

- 11 min read

Yes, in Australia, the premiums you pay for an eligible income protection insurance policy are generally tax deductible. However, the Australian Taxation Office (ATO) has strict rules that taxpayers must follow to claim this deduction correctly. Understanding these rules is crucial for compliance and maximising your tax return.

This guide provides clear, practical steps for individuals and business owners on how to claim income protection premiums in line with ATO regulations. We will cover the key eligibility criteria, how to handle bundled policies, the critical superannuation exception, and common mistakes that can lead to penalties or an ATO audit.

Your Guide to Claiming Income Protection Premiums

One of the most common questions we receive is whether income protection premiums can be used to lower taxable income. The short answer is yes, but it comes with important conditions. The ATO's logic is that if an expense is directly incurred to protect your assessable income, it is generally deductible. Since income protection insurance is designed to replace your salary or business income if you are unable to work, the premiums are seen as a legitimate expense.

However, there are several key compliance requirements:

No Bundled Policies: You can only claim the portion of your premium that covers income replacement. If your policy is a package that includes life insurance, Total and Permanent Disability (TPD), or trauma cover, you cannot claim the entire premium. You must identify the exact amount allocated to the income protection component.

Keep it Out of Super: Premiums for income protection policies held within a superannuation fund are not tax deductible on your personal tax return. Your super fund claims the deduction, not you. This is a common point of error and a key focus for the ATO.

Pay From Your Own Pocket: To be eligible, you must pay the premiums from your after-tax income. If your employer pays the premium as part of your salary package, you cannot claim a deduction.

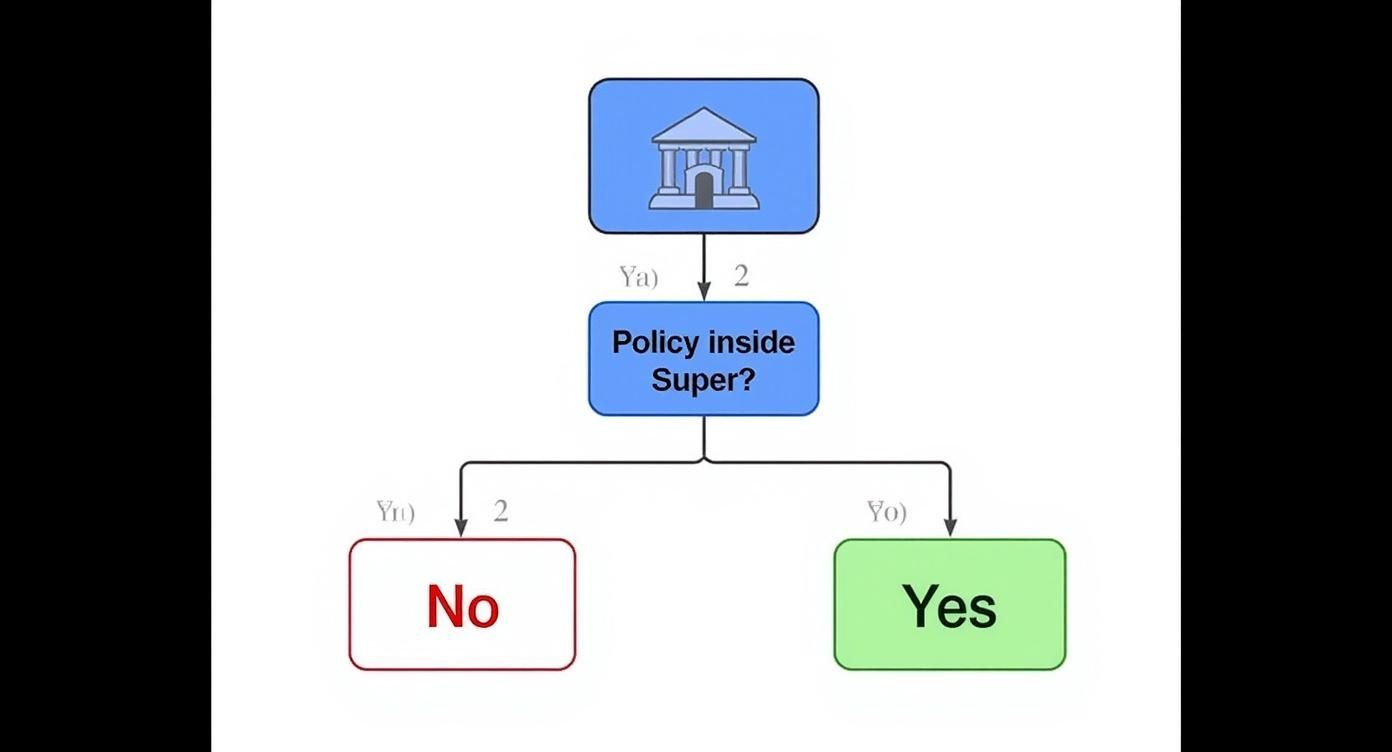

This decision tree illustrates the critical superannuation rule.

As shown, the ATO draws a clear distinction. Holding the policy outside your superannuation fund is a non-negotiable requirement for a personal tax deduction. Structuring your policy correctly from the outset is essential for compliance and avoiding ATO scrutiny.

For more detailed information on general deductions, refer to our comprehensive guide on what you can claim on tax in Australia.

Income Protection Tax Deduction Checklist

To determine if your policy premiums are deductible, use this checklist based on ATO requirements.

Eligibility Requirement | ATO Rule and Explanation |

|---|---|

Policy Held Outside Super | Your policy must be held and paid for by you personally, not through a superannuation fund. |

Income-Only Cover | The premium you claim must only be for the income protection (income replacement) component of your insurance. |

Premiums Paid by You | You must have paid the premiums yourself from your post-tax income during the financial year. |

You Are the Beneficiary | The policy must pay benefits directly to you to replace your lost income. |

Income is Assessable | The income you are insuring (e.g., your salary or business income) must be considered assessable income by the ATO. |

If your policy meets all these criteria, you can confidently claim the deduction. If not, it is advisable to consult a financial advisor or registered tax agent to review your insurance structure.

Navigating the ATO Rules for Deductibility

To claim your income protection premiums correctly, you must understand the ATO's distinction between different types of insurance cover. The core principle is that if an insurance policy pays a benefit that replaces your regular salary, wages, or business income, the premiums are generally deductible. This is because the expense is directly linked to protecting your assessable income.

However, the ATO has strict rules regarding the nature of the policy payout, which is a critical detail that often leads to incorrect claims.

The Income Replacement vs Lump Sum Rule

The determining factor for deductibility is how the policy pays out. The ATO only permits deductions for premiums on policies that provide a regular, ongoing stream of income if you cannot work due to illness or injury. This is considered an income replacement benefit.

Conversely, premiums for any policy that pays a lump sum benefit are not tax deductible. These policies are not considered to be replacing income; rather, they provide a capital sum to address a significant life event.

Common examples of insurance policies you cannot claim deductions for include:

Life insurance: Pays a lump sum upon death.

Total and Permanent Disablement (TPD) insurance: Pays a lump sum if you are permanently unable to work.

Trauma or Critical Illness insurance: Pays a lump sum upon diagnosis of a specified medical condition.

According to the ATO, "You can't claim a deduction for a premium or the component of a premium that you pay under a policy that compensates you for physical injury or for a policy that is taken out through your superannuation fund." This statement highlights the strict focus on true income replacement policies held personally.

Handling Bundled Insurance Policies

Insurers frequently offer "bundled" policies that combine income protection with other covers like life or TPD insurance. If you have such a policy, you cannot claim the entire premium. This is a common error that can trigger an ATO review.

Your insurer is obligated to provide an annual policy statement that clearly itemises the premium. This document will specify the exact amount allocated to the income protection component. This is the only figure you are permitted to claim on your tax return. The portions related to life, TPD, or trauma cover are not deductible.

For a broader understanding of allowable claims, our guide on individual tax deductions offers further clarification.

The Superannuation Exception Explained

Another definitive ATO rule is that if your income protection policy is held within your superannuation fund, the premiums are not deductible in your personal tax return.

The rationale is that your super fund is the entity paying the premium, and therefore, it is the fund that is entitled to claim the tax deduction, not you as an individual. Claiming it personally constitutes an incorrect declaration and is a compliance risk. To be eligible to claim the deduction, you must hold the policy outside of superannuation and pay the premiums from your personal, post-tax funds.

How Your Tax Rate Turns Premiums into Savings

A tax deduction is only valuable if it results in a tangible reduction of your tax liability. For income protection, this value is directly linked to Australia’s marginal tax rate system.

Under this system, different portions of your income are taxed at progressively higher rates. When you claim a deduction for your premiums, you reduce your total taxable income, which means less of your income is subject to your highest marginal tax rate.

The Real-Dollar Impact of Your Marginal Rate

The higher your income, the greater the financial benefit you receive from the same premium deduction. This is because the deduction reduces income that would have been taxed at your highest applicable rate, leading to a more significant tax saving.

For example, a taxpayer with a taxable income of $45,000 who pays a $1,000 premium might reduce their tax bill by approximately $300. In contrast, an individual earning over $180,000 could see a tax reduction of $450 from the same $1,000 premium, due to their higher marginal tax rate.

This principle is fundamental to effective tax planning. The value of any deduction is directly proportional to your marginal tax rate; a higher rate results in a more substantial tax saving.

Comparing Savings Across Different Incomes

To illustrate this, let’s analyse two scenarios for the 2024-2025 financial year, assuming both individuals pay an annual income protection premium of $2,500.

For a detailed breakdown of the tax brackets, see our guide on Australian tax rates for 2025.

Scenario 1: The Professional

Taxable Income: $70,000

Marginal Tax Rate: 30%

Premium Deduction: $2,500

Tax Saving: $2,500 x 30% = $750

For this professional, the tax deduction effectively reduces the annual cost of their insurance to $1,750.

Scenario 2: The Executive

Taxable Income: $150,000

Marginal Tax Rate: 30% (Note: For 2024-25, this rate applies up to $190,000)

Premium Deduction: $2,500

Tax Saving: $2,500 x 30% = $750

Under the revised 2024-25 tax brackets, both individuals receive the same tax benefit. This demonstrates how changes in tax legislation can impact the financial outcome of deductions. In previous financial years, the executive would have been in a higher tax bracket (e.g., 37%), resulting in a larger tax saving.

This highlights that your income protection policy is not merely a safety net but an active component of your financial strategy, with its value influenced by government fiscal policy.

How To Actually Claim Your Deduction: A Step-by-Step Guide

Knowing you are eligible to claim a deduction is the first step; lodging it correctly with the Australian Taxation Office (ATO) is the next. This section provides a practical guide to claiming your income protection premiums accurately.

First, you must obtain the necessary documentation. Before starting your tax return, locate the annual insurance statement from your provider. This document is essential as it specifies the exact deductible amount for income protection, separating it from any non-deductible coverages like life or trauma insurance.

Finding the Right Spot on Your Tax Return

With your statement ready, you need to enter the deduction at the correct label on your tax return. When lodging online via myTax, this is item D15 – Other deductions.

You may need to add this section if it is not automatically displayed. Here, you will enter the total deductible premium paid during the financial year. It is critical that the figure entered matches the amount specified for 'income protection' on your insurance statement precisely. Do not estimate or round the amount.

Nailing the Pro-Rata Calculations

The ATO requires precise calculations, particularly if your circumstances change during the financial year. Two common scenarios require careful apportionment:

Partial Year Cover: If you commenced the policy partway through the financial year, for example in January, you can only claim the premiums paid from the start date to 30 June. You cannot claim for a full 12 months.

Annual Premium Payments: If you pay your premium annually, you must apportion the cost. For instance, if you paid for a 12-month policy in April, you can only claim the portion covering the period from April to 30 June in that financial year. The remainder is claimed in the subsequent year's tax return.

The ATO's guiding principle is that you can only claim an expense for the period it provides cover within that specific financial year. Over-claiming by including future cover is a common error that can lead to adjustments and penalties.

Record-Keeping: The ATO’s Non-Negotiable

The ATO mandates that you must keep records to substantiate your claims for a minimum of five years from the date you lodge your tax return.

For your income protection claim, this includes securely filing your annual policy statements and proof of payment, such as bank statements. These documents serve as your evidence. In the event of an ATO review or audit, you will be required to produce these records to verify your claim.

Common Mistakes That Can Trigger an ATO Audit

Even with the best intentions, simple errors when claiming income protection premiums can attract unwanted attention from the Australian Taxation Office (ATO). Understanding these common pitfalls is essential for maintaining compliance.

An incorrect claim can result in it being disallowed, penalties being applied, or a comprehensive tax audit. The following are the most frequent mistakes to avoid when preparing your return.

Claiming Premiums Paid Through Superannuation

This is the most frequent and significant error. If your income protection policy is held within your superannuation fund, you cannot claim a personal tax deduction for the premiums.

Your super fund claims the tax deduction for these premiums, not you. Claiming them again on your personal tax return is considered "double-dipping" by the ATO and is a major compliance red flag.

Deducting the Entire Cost of a Bundled Policy

Many insurers offer bundled policies that combine income protection with other covers, such as life insurance, trauma insurance, or Total and Permanent Disablement (TPD) insurance. A critical error is to claim the entire premium for one of these bundled policies.

The ATO's position is clear: only the portion of the premium attributable to the income replacement component is deductible. Your annual policy statement will specify these amounts. You must only use the figure allocated to income protection.

Claiming for Policies That Do Not Replace Income

The basis for the deduction is that the policy replaces lost income. If your policy pays out a lump sum benefit—such as life, TPD, or trauma insurance—the premiums are not tax deductible.

Lump sum payouts are treated as capital in nature, not income. Confusing these different types of insurance is a common reason for incorrect claims being lodged.

Common Errors When Claiming Income Protection

This table summarises the common pitfalls and the correct ATO guidelines to ensure compliance.

Common Mistake | Correct ATO Guideline | Potential Consequence |

|---|---|---|

Claiming premiums paid by a super fund | If your super fund pays, only the fund can claim the deduction. You cannot claim it personally. | Claim denied, penalties for incorrect lodgement, potential ATO audit. |

Deducting the full premium of a bundled policy | Only the specific portion for income protection is deductible. Your statement will show this amount. | Over-claiming a deduction, which will be disallowed and may lead to penalties. |

Claiming for lump-sum policies (Life, TPD, Trauma) | Premiums for policies that pay a capital lump sum are not tax deductible. | Incorrect claim that will be rejected by the ATO. Flags your return for review. |

By ensuring your claim is accurate and fully substantiated by your policy documents, you can lodge your tax return with confidence.

Summary: Key Takeaways

Claiming a tax deduction for income protection insurance is straightforward if you adhere strictly to ATO rules. The following checklist summarises the essential compliance points to review before lodging your tax return.

Policy Location: The policy must be held personally (outside of superannuation). Premiums for policies inside super are not personally deductible.

Cover Type: The deduction is limited to the premium for the income replacement component only. Premiums for life, TPD, or trauma cover are not deductible.

Payment Source: You must have paid the premiums yourself from your post-tax income. Employer-paid premiums cannot be claimed.

Documentation: You must retain annual policy statements and proof of payment for at least five years as evidence for the ATO.

Claim Amount: Use the precise premium amount for the income protection component as specified on your annual statement. Do not estimate.

FAQ Section

Here are ATO-compliant answers to frequently asked questions about income protection and tax deductibility relevant to individuals, sole traders, and businesses.

Are Payments I Receive From an Income Protection Policy Taxable?

Yes, absolutely. An income protection benefit is designed to replace your lost salary, wages, or business income. As it is a substitute for your regular income, the Australian Taxation Office (ATO) treats it as assessable income. You must declare the full amount received on your tax return for the financial year in which you receive it. These payments will be taxed at your marginal tax rate, just like your employment or business income.

Can a Sole Trader or Business Owner Claim Income Protection Premiums?

Yes. For sole traders, partners in a partnership, and other business owners, income protection premiums are a legitimate and deductible business expense, provided the policy meets the standard ATO criteria. The rules are the same as for an employee:

The policy must cover loss of income only.

No part of the premium related to lump-sum benefits (life, TPD, trauma) can be claimed.

The policy must be held personally (not within a super fund) to claim a personal or business deduction.

What if My Employer Pays for My Income Protection Insurance?

If your employer pays your premiums as part of your salary package or as an employee benefit, you cannot claim a tax deduction for it. The fundamental principle for tax deductions is that the expense must be incurred by you and not reimbursed. In this scenario, your employer incurs the expense and is entitled to claim it as a business deduction. The ATO does not permit an expense to be claimed twice.

How Do I Calculate the Deduction for a Bundled Policy?

If you have a ‘bundled’ policy that combines income protection with other cover like life or TPD insurance, you can only claim the portion of the premium that relates to income protection. The ATO actively monitors for incorrect claims of entire bundled policy premiums.

No estimation is required. Your insurer is legally obligated to provide an annual statement that clearly breaks down the cost of each type of cover. You must use the exact dollar amount listed for the 'income protection' component when completing item D15 on your tax return.

Contact Us

Navigating income protection, tax, and superannuation rules requires careful planning and expert knowledge. For personalised advice tailored to your financial situation and to ensure full compliance with the ATO, please contact our team of experienced accountants.

Baron Tax and Accounting

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213

Comments