How Do I Claim a Foreign Income Tax Offset in Australia?

- Jan 10

- 9 min read

If you're an Australian resident earning money overseas, you've likely asked the big question: "Am I going to be taxed twice?" It's a common and valid concern. The good news is the Australian Taxation Office (ATO) has a specific mechanism to prevent this: the Foreign Income Tax Offset (FITO).

This guide explains what the FITO is, why it's crucial for your tax compliance, and how to claim it correctly. As an Australian resident for tax purposes, you are taxed on your worldwide income. Failing to declare foreign income or incorrectly claiming the FITO can lead to significant compliance risks, including ATO audits, amended tax assessments, and financial penalties. Understanding this offset is essential for meeting your legal obligations and ensuring you don't overpay tax.

What is the Foreign Income Tax Offset (FITO)?

As an Australian resident for tax purposes, you're taxed on your worldwide income. This means money earned from a job in London, dividends from a US company, or profits from a business in Singapore all need to be declared on your Australian tax return. Naturally, that income is often taxed in the country where it was earned first.

This is where the foreign income tax offset steps in to prevent double taxation.

The FITO is a non-refundable tax offset (credit) provided by the ATO for foreign income tax you've already paid. It directly reduces the Australian tax you have to pay on that same income, ensuring you don't pay more tax than the higher of the two countries' rates. It is not a cash refund of the foreign tax, but a mechanism to balance your tax obligations fairly.

Why FITO Is Essential for Compliance

Understanding FITO isn't just about saving money—it's a critical part of your tax compliance. The rules are set out in Division 770 of the Income Tax Assessment Act 1997, so following the correct process is a legal requirement.

Getting it wrong can lead to serious consequences:

ATO Audits and Adjustments: Incorrectly claiming the offset is a red flag for the ATO. This can trigger a review, leading to amended assessments and an unexpected tax bill.

Penalties and Interest Charges: If an ATO audit finds you’ve underpaid tax because of a mistaken FITO claim, you'll likely be hit with penalties and interest on the amount you owe.

Missed Savings: On the flip side, if you're entitled to the offset but fail to claim it or calculate it incorrectly, you're paying more tax than you need to.

Who Needs to Understand FITO?

The foreign income tax offset is relevant to a wide range of taxpayers. You'll need to understand how it works if you are:

An individual working overseas on assignment or working remotely for a foreign company.

An investor who receives dividends, interest, or royalties from foreign sources.

An Australian SME that invoices international clients or operates through an overseas branch.

A beneficiary of a foreign trust.

A partner in a partnership with foreign income.

For a broader look at ways to reduce your taxable income, you can explore our detailed guides on other Australian tax offsets.

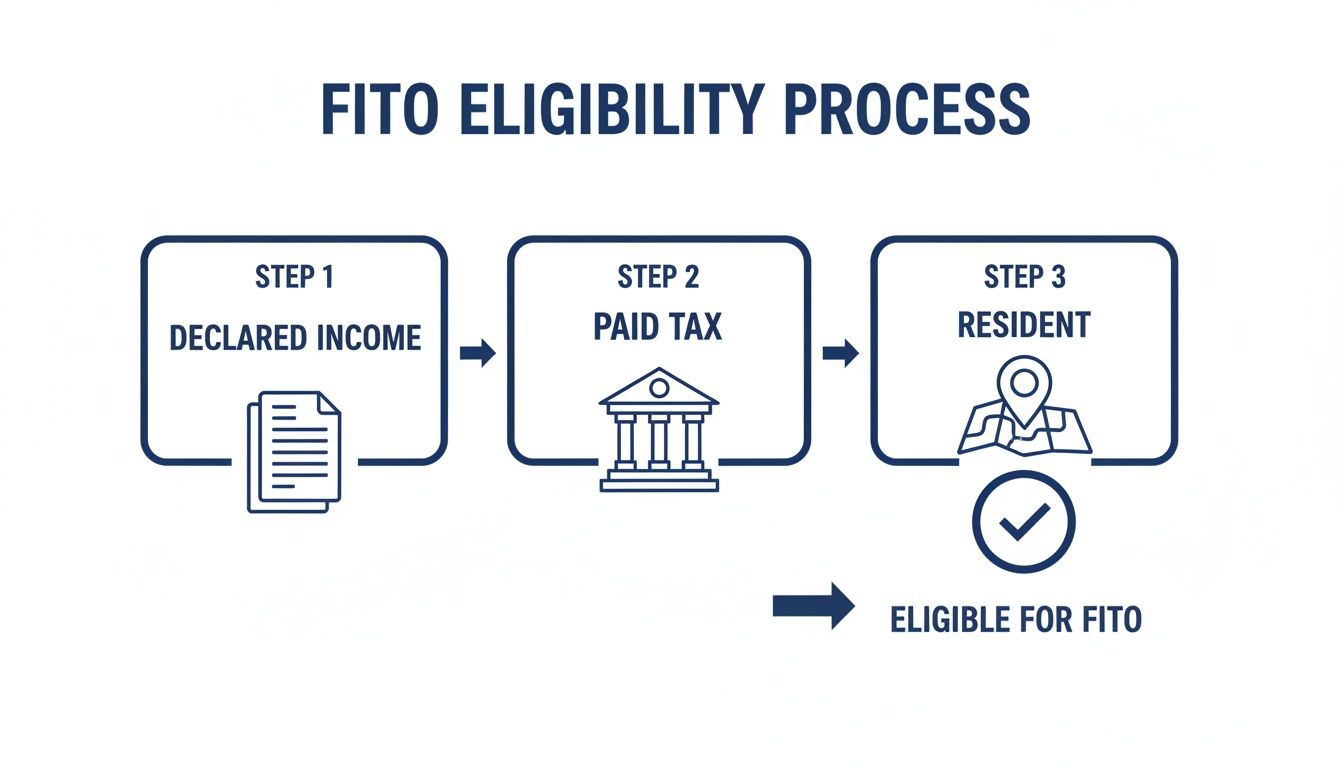

Step 1: Check Your Eligibility for the FITO Claim

Before you can claim the foreign income tax offset (FITO), the Australian Taxation Office (ATO) has a clear set of criteria you must meet. The entire FITO framework boils down to two non-negotiable conditions.

You are entitled to a foreign income tax offset if:

You have included the foreign income in your assessable income: The income you paid foreign tax on must be declared in your Australian tax return.

You have actually paid foreign tax: You need proof that you have paid, or are considered to have paid, foreign income tax on that income.

If you cannot meet both of these foundational requirements, you cannot claim the offset.

The Residency Requirement

Your status as an Australian resident for tax purposes is the cornerstone of your eligibility. Australian residents are taxed on their worldwide income, which is the very reason FITO exists—to stop you from being taxed twice on the same dollar.

Determining your residency status can be complex, involving factors like where you live, your long-term intentions, and your social and economic ties. If you're unsure about your status, it's essential to seek clarification. Our detailed guides on residency and international tax matters can provide the clarity you need.

Conversely, non-residents are generally only taxed on their Australian-sourced income, so the FITO does not typically apply to them.

Eligibility Across Different Business Structures

The FITO rules apply to various entities, but all must meet the same "income included and tax paid" rule.

Individuals: Applies if you’ve declared foreign employment income, dividends, interest, or other personal earnings from overseas.

Companies: An Australian company must include income from its overseas branches or foreign investments in its assessable income to be eligible.

Trusts and Partnerships: The offset typically flows through to the beneficiaries or partners, who include their share of the foreign income and tax paid in their own tax returns.

Sole Traders: As a sole trader, your business income is your personal income. You must include your foreign business income in your individual tax return to claim the FITO.

A Quick Eligibility Checklist

Use this checklist to confirm you meet the core ATO requirements for claiming the FITO.

Eligibility Requirement | Yes/No | Key Consideration (ATO Rules) |

|---|---|---|

Australian Resident for Tax? | Are you considered a resident for the relevant income year? | |

Declared Foreign Income? | Have you included all relevant foreign-sourced income in your Australian tax return? | |

Paid Foreign Income Tax? | Can you prove that foreign income tax was paid on this income (e.g., via payslips or assessments)? | |

Kept Adequate Records? | Do you have documents to substantiate both the income earned and the tax paid for at least five years? |

Step 2: How to Correctly Calculate Your FITO Limit

Figuring out your Foreign Income Tax Offset (FITO) requires understanding the "FITO limit," which is a cap on how much offset you can claim. This limit ensures you only get a credit for the Australian tax you would have paid on that foreign income.

Your FITO limit is the lower of two amounts:

The actual foreign income tax you’ve already paid (converted to AUD).

The amount of Australian tax that would be due on your net foreign income.

You get a credit for the tax you paid overseas, but only up to the amount you would've been taxed on that income in Australia. You cannot use the offset to get a refund if the foreign tax rate was higher than Australia's.

Understanding the FITO Limit Calculation

To work out the Australian tax payable on your foreign income, the ATO looks at your entire financial picture for the year. It’s not as simple as applying your marginal tax rate to the foreign amount. The calculation considers how that extra foreign income affects your total tax liability.

The ATO's method is to compare:

The tax on your total taxable income (including net foreign income).

The tax on your taxable income if you had no net foreign income.The difference between these two figures is your FITO limit.

Practical Calculation Examples

Let's walk through the calculation with two scenarios. For complex situations, using a reliable tax return calculator can provide a solid estimate.

Example 1: Individual Employee on Overseas Assignment

Scenario: Chloe, an Australian tax resident, is on a six-month assignment in the UK. She earns the equivalent of AUD $50,000 and pays AUD $10,000 in UK income tax. Her total taxable income for the year in Australia (including the UK earnings) is $120,000.

Step 1: Identify Foreign Tax Paid. Chloe paid $10,000 in UK tax.

Step 2: Calculate Australian Tax on Total Income. The Australian tax on her total income of $120,000 is $29,467 (using 2023-24 rates, excluding Medicare levy).

Step 3: Calculate Australian Tax Without Foreign Income. Her Australian-only income is $70,000 ($120,000 - $50,000). The tax on this amount is $12,967.

Step 4: Determine Australian Tax on Foreign Income (FITO Limit). The difference is $16,500 ($29,467 - $12,967). This is her FITO limit.

Step 5: Compare and Claim. Her limit is the lower of the foreign tax paid ($10,000) and the FITO limit ($16,500).

Result: Chloe can claim a $10,000 foreign income tax offset.

Example 2: SME with Foreign Business Income

Scenario: An Australian proprietary limited company has a total taxable income of $300,000. This includes $100,000 in net profit from its branch in Singapore, on which it paid $17,000 (17% corporate rate) in Singaporean tax.

Step 1: Foreign Tax Paid. The company paid $17,000 in Singaporean tax.

Step 2: Australian Tax on Foreign Income (FITO Limit). Assuming the company is a base rate entity, its Australian tax rate is 25%. The Australian tax payable on the $100,000 foreign profit is $25,000. This is the FITO limit.

Step 3: Compare and Claim. The limit is the lower of the foreign tax paid ($17,000) and the FITO limit ($25,000).

Result: The company can claim a $17,000 foreign income tax offset.

Currency Conversion Rules

A critical and often complex part of the calculation is currency conversion. The ATO requires all foreign income and foreign tax paid to be converted to Australian dollars. You must use the specific exchange rate applicable at the time of the relevant transaction or use an average rate published by the ATO where appropriate.

Step 3: Claiming the Offset and Keeping the Right Records

Once you've calculated your foreign income tax offset, you must claim it correctly in your tax return and have the documentation to substantiate it. The ATO has strict rules for lodging and record-keeping.

Whether you're lodging through myTax, online services for business, or a tax agent, you must report the total foreign income earned and the foreign tax paid in the foreign income section of your tax return.

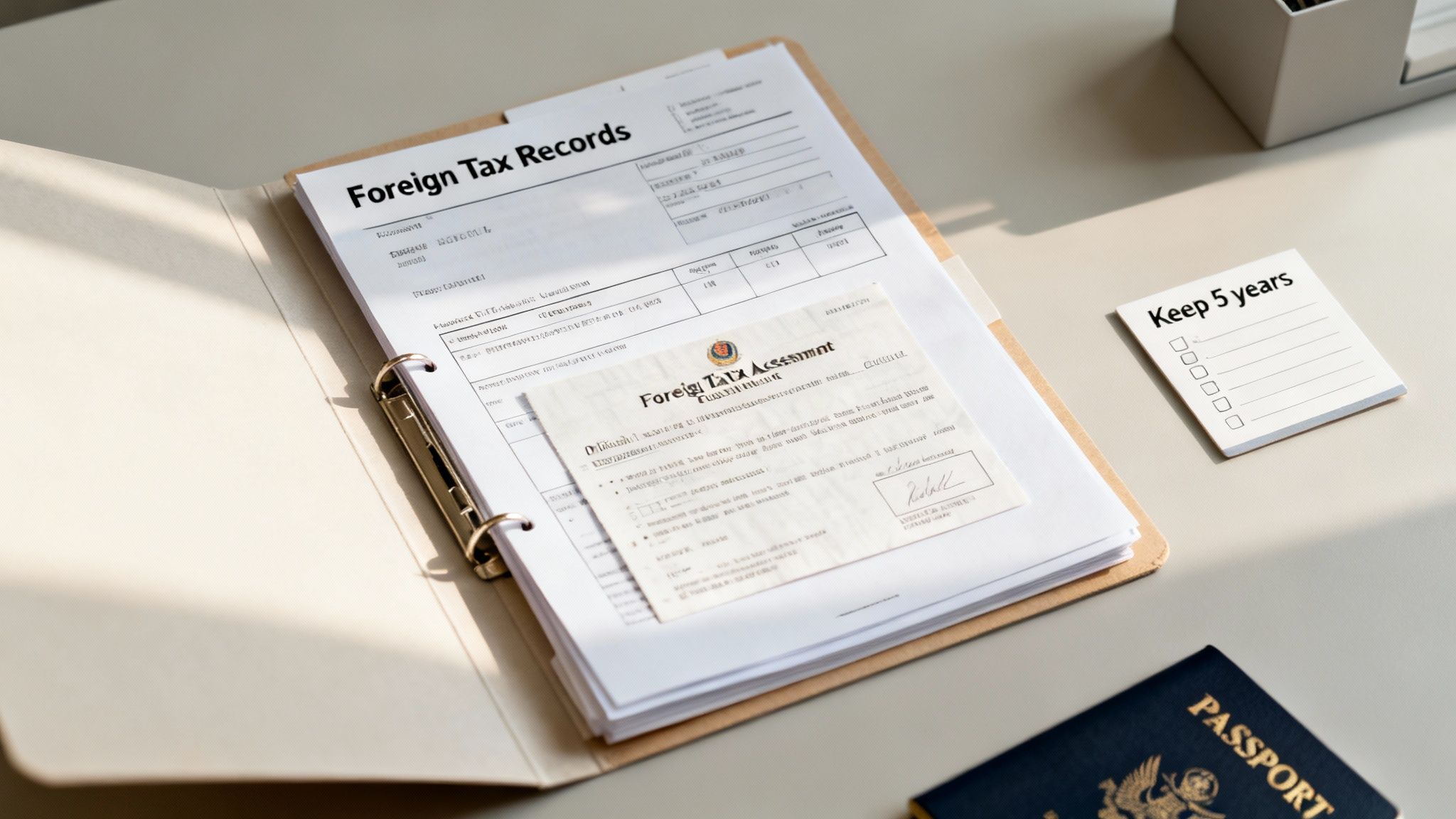

The Golden Rule of Record Keeping

The ATO works on a simple principle: if you can't prove it, you can't claim it. You must have clear, verifiable evidence that you paid tax to a foreign government.

ATO Mandate: You are legally required to keep all records related to your foreign income tax offset claim for a minimum of five years from the date you lodge your tax return.

Failing to have the right records can lead to your claim being disallowed, resulting in an amended tax assessment, potential penalties, and interest charges.

Essential Documents for Your FITO Claim

Your record-keeping system should create a clear paper trail connecting the foreign income you declared to the foreign tax you paid. Key documents include:

Official Tax Assessments: A notice of assessment (or its equivalent) from the foreign country's tax authority.

Payslips or Payment Summaries: For employment income, these must itemise gross earnings and foreign tax withheld.

Dividend and Interest Statements: These must detail the gross payment and any foreign tax deducted.

Official Receipts: Confirmation from a foreign tax office proving you've paid your tax bill.

Bank Statements: Can be used as secondary evidence showing transfers to a foreign tax authority or net amounts received after tax.

What if I Pay the Foreign Tax After Lodging?

It's common for foreign tax to be paid after you've lodged your Australian tax return due to different tax year deadlines. In this situation, you are entitled to amend your previously lodged tax return to claim the FITO. You generally have up to four years from the date of your original notice of assessment to lodge an amendment. Our guide on how to amend a tax return in Australia provides detailed steps.

FAQ: Foreign Income Tax Offset

What is the difference between a foreign tax credit and a foreign income tax offset?

In Australia, the correct legal term is the Foreign Income Tax Offset (FITO). While other countries, like the United States, use the term "Foreign Tax Credit" (FTC), the concept is similar. Both aim to provide relief from double taxation. The key feature of Australia's FITO is that it is a non-refundable offset. This means it can reduce your tax liability to zero, but you cannot get a refund for any excess offset credit.

What happens if I paid more foreign tax than my Australian tax liability on that income?

Your FITO claim is capped at your FITO limit—the amount of Australian tax you would have otherwise paid on that foreign income. If the foreign tax you paid is higher than this limit, the excess amount is lost. According to the ATO, you cannot get a refund for it, nor can you carry it forward to use in a future income year. This is why calculating the FITO limit accurately is crucial.

Can I claim a FITO for taxes like GST, VAT, or inheritance tax?

No. The ATO is very clear that the FITO is only available for foreign taxes on income, profits, or gains. You cannot claim an offset for other types of taxes such as:

Value-Added Tax (VAT) or Goods and Services Tax (GST)

Inheritance or estate taxes

Property or wealth taxes

Social security contributions (in most cases)

Attempting to claim these can result in your entire FITO claim being disallowed.

Do I still need to declare foreign income if a Double Tax Agreement (DTA) exists?

Yes, you must. A common misconception is that a DTA exempts you from declaring foreign income in Australia. This is incorrect. A DTA is an agreement between Australia and another country that allocates taxing rights to avoid double taxation. As an Australian resident, you are still required by law to declare your entire worldwide income. The DTA and the FITO then work together to provide relief.

Summary

Purpose: The Foreign Income Tax Offset (FITO) prevents Australian tax residents from being taxed twice on the same foreign-sourced income.

Eligibility: You must be an Australian resident for tax purposes, declare the foreign income in your Australian tax return, and have paid foreign income tax on it.

Calculation: Your claim is limited to the lower of the foreign tax you paid or the Australian tax payable on that net foreign income.

Record-Keeping: You must keep detailed records (e.g., foreign tax assessments, payslips, statements) for at least five years to substantiate your claim.

Compliance: Incorrectly claiming the FITO or failing to declare foreign income can lead to ATO audits, penalties, and interest charges.

Navigating the complexities of the foreign income tax offset demands a sharp eye for detail to stay compliant and get the full offset you’re entitled to. The rules around eligibility, calculations, and record-keeping are strict.

For advice that’s tailored to your specific situation, get in touch with the experts at Baron Tax and Accounting. We’ll help you manage your international tax obligations with complete confidence.

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213

Comments