Claiming Your Private Health Insurance Tax Offset

- Aug 1, 2025

- 17 min read

The private health insurance tax offset is a government incentive designed to make private health cover more affordable for Australians. It’s essentially a rebate you can claim to reduce the cost of your premiums.

You can get this financial help in one of two ways: either as a direct, ongoing discount on your insurance payments or as a tax offset when you lodge your annual tax return. Think of it as the government's way of saying "thanks" for helping to ease the load on the public healthcare system.

So, What Exactly Is the Private Health Insurance Tax Offset?

Let's break it down. The private health insurance tax offset isn't some complex tax trick; it’s a straightforward, income-tested rebate. The whole point is to lower your out-of-pocket costs for insurance. This incentive is a central piece of Australia’s health policy, created specifically to encourage more people to take up private health cover.

The great thing is, you have a choice in how you receive this benefit, giving you the flexibility to manage your finances in a way that works best for you.

How You Can Claim the Rebate

You can pick the method that best fits your budget and cash flow.

As a Premium Reduction: The most common way is to ask your health insurer to apply the rebate directly to your premiums. This means you simply pay less each month, fortnight, or year. It's a "set-and-forget" option that gives you immediate, ongoing savings.

As a Tax Offset: Your other option is to pay your insurance premiums in full throughout the year. Then, when it’s time to do your taxes, you claim the entire rebate back as a lump-sum tax offset. This could lead to a bigger tax refund or a smaller tax bill, depending on your situation.

This rebate also has a close relationship with another part of the tax system: the Medicare Levy Surcharge (MLS). The MLS is an extra tax that higher-income earners have to pay if they don’t have an appropriate level of private hospital cover. By having private cover (and getting the offset), many Australians can also avoid this extra surcharge. It’s a powerful two-for-one financial move.

The Bottom Line: The private health insurance tax offset is a government contribution that directly cuts the cost of your insurance. It’s income-tested, and you can claim it either upfront as a discount or later at tax time.

The Financial Impact of the Rebate

The government's contribution can make a real difference. To give you a clear picture, let's look at the numbers.

For a quick overview, this table summarises how the offset works.

How the PHI Tax Offset Works at a Glance | |

|---|---|

Feature | Description |

What it is | A government rebate to make private health insurance more affordable. |

How you get it | As a direct discount on your premiums or as a tax offset at tax time. |

Who it's for | Eligible Australians with private health insurance. |

Key benefit | Reduces your insurance costs and can help you avoid the Medicare Levy Surcharge. |

The rebate percentage changes based on your income and age, so it's a good idea to know where you stand.

For the 2024-25 financial year, the rebate is income-tested. This means the amount you get back depends on your income bracket and family status. For example, policyholders under 65 in the base income tier receive a rebate of 24.606%, which is a significant chunk off their premium costs. You can find a detailed breakdown of the rebate tiers on the ATO's official private health insurance page.

This offset works in a similar way to other tax offsets, like the Low Income Tax Offset (LITO), by directly reducing your overall tax liability. While LITO is aimed at helping low-income earners generally, the PHI offset is specifically targeted at making health insurance more accessible. Understanding how these different offsets fit together is a key part of smart tax planning.

Who Is Eligible for the Tax Offset?

Working out if you qualify for the private health insurance tax offset can feel a bit complicated, but it really comes down to just a few key things. Your income is the main test, but your age and the kind of policy you have also play a big part.

Let's break down exactly what you need to be eligible. First off, you must have a private health insurance policy and be eligible for Medicare. Secondly, that policy needs to be a complying health insurance policy from a registered Australian health fund.

So, what makes a policy ‘complying’? Put simply, it has to offer at least a basic level of hospital cover. Policies that only cover extras (like dental, optical, or physio) won't get you the tax offset. This is a crucial point, as the government’s goal here is to encourage cover that takes some pressure off the public hospital system.

Your Income Is the Deciding Factor

The biggest piece of the puzzle for both your eligibility and how much of a rebate you get is your 'income for surcharge purposes.' This isn't just your regular taxable income. The Australian Taxation Office (ATO) has a specific formula to get a full picture of your financial situation.

It's calculated by adding a few things together:

Your taxable income: This is the simple part—your total income minus any deductions you can claim.

Reportable fringe benefits: Think of non-cash perks from your employer, like a company car you use privately.

Reportable superannuation contributions: This covers any extra contributions you’ve made to your super, like personal deductible contributions or salary sacrifice arrangements.

Net investment losses: If you have losses from investments or rental properties, these get added back in for this calculation.

The ATO looks at all these components to ensure people don't artificially lower their income on paper just to get a bigger rebate. Your final 'income for surcharge purposes' is then measured against a set of income thresholds that get updated from time to time.

The Income Thresholds for the Current Year

For the 2024-25 financial year, these income thresholds are what determine your private health insurance tax offset. If your income is in the base tier, you'll get the full rebate percentage for your age group.

But if your income goes over these thresholds, your rebate percentage starts to shrink, eventually hitting zero for the highest earners. It's a tiered system designed to give the most help to low and middle-income earners.

Key Takeaway: It's not just about what's on your payslip. The ATO uses a much broader definition of income to check your eligibility for the private health insurance tax offset. A pay rise or a new fringe benefit could easily bump you into a different income tier and change your rebate.

How Age Boosts Your Rebate

Your age is another important factor in this whole equation. The government offers a higher rebate to older Australians to help them manage the cost of health cover as they get older.

The rebate is split into three age groups:

Under 65 years old

65 to 69 years old

70 years and over

If you're in the 65-69 or 70+ brackets, you'll receive a much higher rebate percentage than someone under 65, as long as your income is within the eligible tiers. The percentage is always based on the age of the oldest person covered by the policy.

You can claim this rebate in two ways. You can get it upfront through lower premiums from your insurer, or you can claim it back as a tax offset when you lodge your tax return. The ATO will use the income details from your tax return to work out your exact entitlement, with different thresholds for singles and families. For all the nitty-gritty details, you can check out the ATO's official private health insurance page.

Calculating Your Private Health Insurance Offset

Alright, let's get down to the numbers. The good news is that figuring out your private health insurance tax offset isn't as complicated as it sounds. The basic formula is straightforward: it’s your total insurance premiums for the year multiplied by a specific rebate percentage.

That percentage is the key, and it all comes down to your income and your age. Let's break down exactly how the maths works so you can get a clear picture of your potential savings.

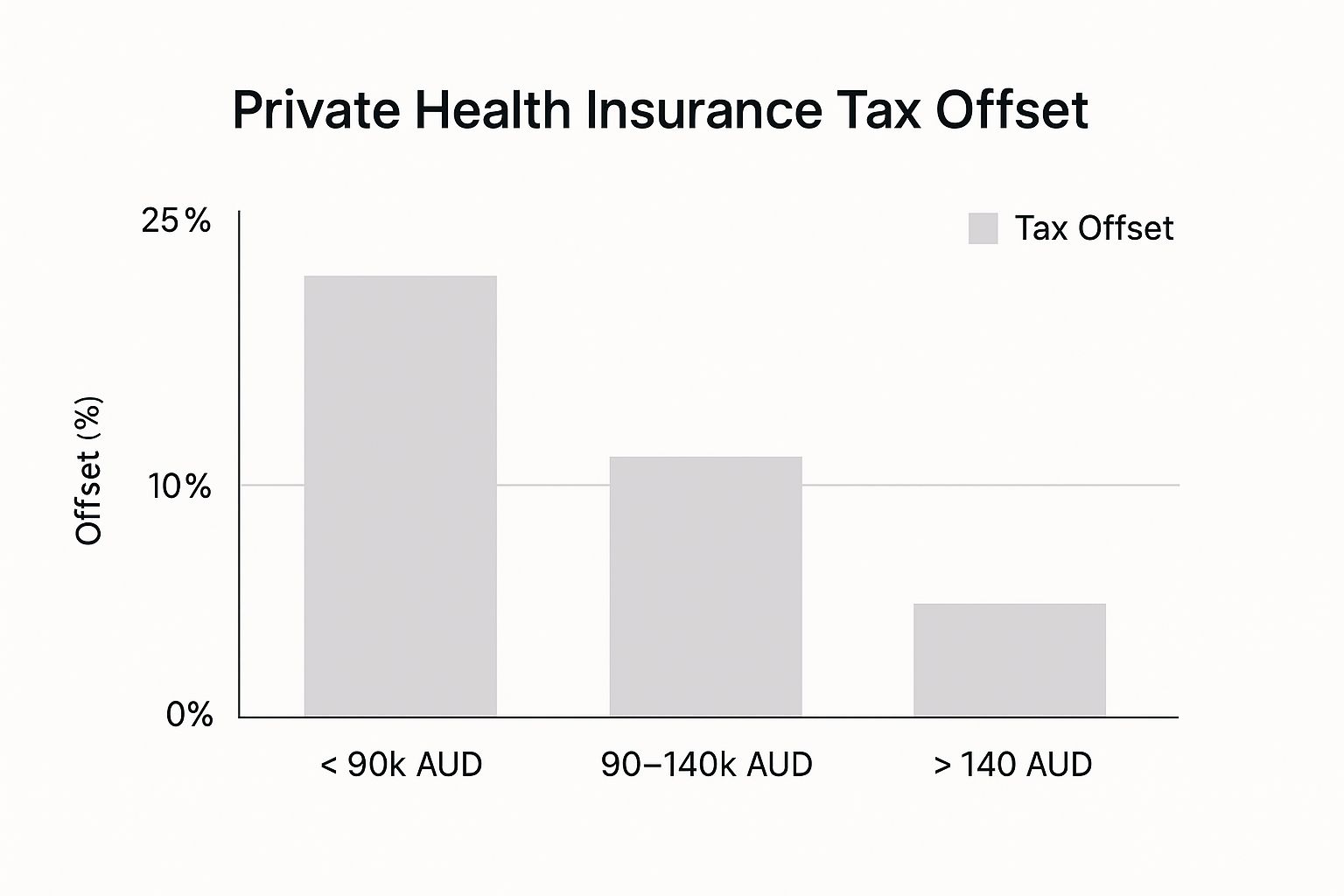

This infographic gives you a quick visual of how your income level directly shapes the rebate you're entitled to.

As you can see, the highest rebate is reserved for those in the lowest income bracket. It’s all part of the system's design to give a bit more of a helping hand to lower and middle-income earners.

Finding Your Rebate Percentage

Every year, the Australian Taxation Office (ATO) sets the income thresholds and the rebate percentages that go with them. It’s important to use the right figures for the financial year you're claiming for.

Here’s a table that lays out the income tiers and rebate rates for the 2024-25 financial year. Just find your income bracket and age group to see which percentage applies to you. A quick note for families or couples: the rebate is always calculated based on the age of the oldest person covered by the policy.

PHI Offset Income Tiers and Rebate Percentages

Income Tier | Single Income Threshold | Family Income Threshold | Rebate % (Under 65) | Rebate % (65-69) | Rebate % (70+) |

|---|---|---|---|---|---|

Base Tier | ≤ $97,000 | ≤ $194,000 | 24.606% | 28.710% | 32.813% |

Tier 1 | $97,001 - $113,000 | $194,001 - $226,000 | 16.405% | 20.508% | 24.610% |

Tier 2 | $113,001 - $151,000 | $226,001 - $302,000 | 8.202% | 12.305% | 16.407% |

Tier 3 | ≥ $151,001 | ≥ $302,001 | 0% | 0% | 0% |

It's worth remembering that for families, the income threshold goes up by $1,500 for each dependent child after the first one.

A Quick Tip: If you're not 100% sure what your 'income for surcharge purposes' will be for the year, it pays to be cautious. Telling your insurer to apply a lower rebate (by choosing a higher income tier) is a smart move. It might mean smaller discounts on your premiums now, but it can save you from a nasty tax bill later.

Worked Examples in Action

Let’s put this into practice with a couple of real-world scenarios.

Example 1: A Single Professional

Name: Liam

Age: 32

Income: $95,000

Annual Premium: $2,200

Liam’s income puts him squarely in the Base Tier for singles. Since he’s 32, his rebate percentage is 24.606%.

His offset calculation looks like this: $2,200 (premiums) x 24.606% = $541.33

So, Liam can claim a tax offset of $541.33 for the year.

Example 2: A Young Family

Names: Chloe and Ben, with one child.

Ages: Chloe is 38, Ben is 40.

Combined Income: $210,000

Annual Premium: $5,000

Their combined family income of $210,000 places them in Tier 1. The rebate is based on the oldest person's age, which is Ben at 40. This gives them a rebate percentage of 16.405%.

Their calculation is: $5,000 (premiums) x 16.405% = $820.25

The family is entitled to an $820.25 tax offset.

When Life Changes Your Calculation

Life isn't static, and neither is your income. A pay rise, a new job, getting married, or welcoming a new baby can easily push you into a different income tier partway through the year.

Don’t worry, you aren’t locked into the tier you chose at the start. When you lodge your tax return, the ATO will look at your actual income for the entire financial year to work out the correct rebate you’re entitled to.

This is exactly why it's a great idea to give your health insurer a heads-up if your income changes significantly. They can adjust your premium reduction on the spot, helping you avoid any nasty surprises come tax time. If you find yourself in a tricky tax spot, our guide on how to file taxes in Australia offers a clear roadmap to navigate it.

How to Claim Your Health Insurance Rebate

When it's time to claim your private health insurance rebate, you've got two main ways to go about it. The best choice for you really boils down to your personal finances and whether you prefer getting your savings straight away or as a lump sum later.

Let's walk through both methods so you can feel confident you're picking the right strategy.

Option 1: Get an Upfront Premium Reduction

The most common and fuss-free way to get your rebate is as an immediate discount on your premiums. Think of it as your health fund giving you a discount on every payment, which lowers how much you need to pay out of your own pocket.

To get this set up, you just need to give your health fund a call and let them know which income tier you expect to be in for the financial year. They'll then calculate your estimated rebate and apply it for you. It’s a simple "set and forget" strategy that gives you savings right away.

But there's a catch. You have to get your income tier right. If you underestimate your income and end up claiming a bigger rebate than you're entitled to, the ATO will ask for the difference back when you lodge your tax return. That can leave you with a surprise tax bill you weren't expecting.

Pro Tip: If your income tends to change or you're expecting a pay rise, it's often smarter to nominate a higher income tier (which means a lower rebate). You might pay a little more on your premiums during the year, but you'll avoid a potential tax debt and could even get a nice bonus in your tax refund.

Option 2: Claim It as a Tax Offset

The other route is to pay your health insurance premiums in full all year and then claim the entire rebate back as a tax offset on your tax return. This is often the safer option, especially if your income is a bit unpredictable.

By waiting until the end of the financial year, you guarantee that the ATO calculates your offset based on your actual income. This completely removes the risk of getting your rebate wrong and having to pay money back. For many, this results in a bigger tax refund or a smaller tax bill.

This approach does mean your premium payments will be higher throughout the year, so it takes a bit more discipline. But if you’re comfortable with that, the lump-sum reward at tax time can be a fantastic financial boost. Knowing how to handle this is a core part of doing your taxes, and our guide on how to file taxes in Australia can walk you through the entire process.

Which Path Is Right for You?

Deciding between these two options really depends on your financial style and how comfortable you are with a little bit of risk.

A premium reduction is probably best if:

You have a steady, predictable income.

You’d rather have smaller, more manageable payments each month.

Your budget works better with immediate, ongoing savings.

Claiming a tax offset might be the better choice if:

Your income fluctuates or is hard to guess (like if you're a freelancer or work on commission).

You want to completely avoid any chance of a tax debt from the rebate.

You don't mind higher premium payments now to get a larger lump sum later.

At the end of the day, both methods deliver the same financial benefit over the year. The trick is to choose the one that fits your habits and gives you the most peace of mind.

Lodging Your Claim on Your Tax Return

When tax time rolls around, claiming your private health insurance tax offset is one of those crucial steps that can really make a difference to your final refund. The whole process really boils down to one key document you’ll get from your health fund: your Private Health Insurance Statement.

Think of this statement as your cheat sheet for this part of your tax return. It contains all the specific numbers the Australian Taxation Office (ATO) needs to work out what you’re entitled to. Your fund is legally required to send this to you, and it usually lands in your inbox or mailbox by early July. It's absolutely vital to have this document in hand before you even think about lodging.

Decoding Your Private Health Insurance Statement

Once that statement arrives, you'll need to hunt down a few key pieces of information. At first glance, it might just look like a page full of numbers, but every single figure has a job to do.

You'll need to pinpoint:

Your health insurer's ID: A unique code for your specific fund.

Your membership number: This identifies your policy.

Your share of premiums paid: The total amount you personally paid for cover during the financial year.

Your share of the rebate received: If you chose to get your rebate as a discount on your premiums, this shows how much you’ve already received.

That "your share" part is especially important if you’re on a family or couple's policy. The statement should clearly break down what portion of the premiums and rebates belongs to you. Using the total policy figures instead of just your share is a classic mistake that can throw your whole claim off.

Entering the Details in Your Tax Return

With your statement ready, the next step is plugging these numbers into your tax return. If you're lodging online with myTax, the process is pretty straightforward. You’ll just need to find the 'Medicare and private health insurance' section.

myTax will prompt you to add your policy details. This is where you carefully copy the information from your statement into the matching fields on the screen. The system will ask for the Health Fund ID, your membership number, and the figures that correspond to your share of premiums and rebates (these are usually found at labels J, K, and L on your statement).

ATO Pro Tip: The ATO often pre-fills this information for you, pulling the data directly from your health fund. While this is handy, it is always your responsibility to double-check that the pre-filled numbers are a perfect match with your statement. Discrepancies can happen, and at the end of the day, you're the one accountable for what's on your return.

Common Mistakes to Avoid When Claiming

Getting this section of your tax return right means you get the correct offset and stay out of trouble with the ATO. A few simple slip-ups can cause some serious headaches later on.

Here are the most common traps to look out for:

Not Waiting for Your Statement: Jumping the gun and lodging too early without the official figures is a sure-fire way to make an incorrect claim and have to file an amendment later.

Incorrectly Splitting Premiums: On a shared policy, failing to report your share of the premiums and rebates is a very common error. You can't claim the whole lot if you only paid for half.

Blindly Trusting Pre-fill Data: While you should check it, don't just delete pre-filled data if it looks wrong. If it's different from your statement, you need to figure out why before you change it. A quick call to your fund can often clear things up.

Claiming for an Extras-Only Policy: Don't forget, only complying health insurance policies that include hospital cover are eligible for the offset. You can't claim it if you only have an extras policy.

Nailing your tax return involves more than just this one offset. For a full picture, our comprehensive tax return checklist is a fantastic resource to make sure you've got all your bases covered.

And while you're focused on the private health insurance offset, it never hurts to get a better handle on the bigger picture. Broadening your knowledge by understanding other tax benefits can help you manage your tax obligations much more effectively. By taking a careful, step-by-step approach, you can lodge your claim with confidence and make sure you’re getting every dollar you’re entitled to.

The Bigger Picture and Future of the Rebate

The private health insurance tax offset doesn't exist in a vacuum. It’s actually one part of a bigger government strategy to nudge more Australians into getting private health cover. It works alongside two other major policies you've probably heard of.

Once you see how these three pieces connect, you gain a massive advantage in making decisions about your own health cover. It helps you look past the simple monthly premium and see the whole financial chessboard.

The Three Pillars of Private Health Insurance Policy

The government uses a classic "carrot and stick" approach here, and the tax offset is only one part of that equation. The entire system really rests on three main components:

The Private Health Insurance (PHI) Rebate: This is the "carrot." It's a direct financial reward that makes your premiums more affordable, plain and simple.

The Medicare Levy Surcharge (MLS): Here’s the first "stick." It’s an extra tax of 1% to 1.5% slapped on higher-income earners who decide not to take out private hospital cover.

Lifetime Health Cover (LHC) Loading: And this is the second "stick." This policy adds a 2% loading onto your hospital cover premium for every year you’re over 30 and don't have it.

These three policies are designed to work in tandem. The rebate makes insurance cheaper to get, while the MLS and LHC make it more expensive not to have it, especially as your income grows or you get older. Together, they build a strong financial case for getting and keeping private hospital cover.

The Shifting Value of the Rebate

While the offset is a welcome bit of relief, its real-world value is being squeezed by the rising cost of insurance itself. We've all seen private health insurance premiums creep up over the last few years. The problem is, the government rebate percentage hasn't really kept pace, creating a subtle but real financial pinch for policyholders.

For example, premiums have been rising by an average of around 2.90% in recent years. The government has a formula for adjusting the rebate that's linked to inflation (CPI) and those premium hikes, but the base rebate has stayed stubbornly around 24.6%. This means, over time, the rebate covers a smaller and smaller slice of your total premium, quietly chipping away at its value. The AMA's detailed budget submission actually dives into this trend if you want to see the numbers.

The Strategic Takeaway: With premiums going up and the rebate's real value shrinking, it’s more important than ever to be proactive with your policy. Regularly reviewing your cover to make sure you’re on the right plan isn't just smart; it's essential for getting your money's worth.

Looking Ahead and Making Smart Decisions

Understanding the long-term game with the private health insurance tax offset is what separates savvy financial planning from just paying bills. When you see how the rebate, the MLS, and LHC all push and pull against each other, you can make much smarter choices about your health cover for the years ahead.

This isn't just about saving a few dollars; it's about actively managing a core part of your financial health. Thinking strategically about these moving parts is a fantastic way to maximise your tax return with expert tips and make sure your choices truly support your bigger financial picture.

Answering Your Top Questions About the PHI Tax Offset

When you get into the nitty-gritty of the private health insurance tax offset, a few common questions always seem to pop up, especially when life doesn’t go exactly to plan. We’ve pulled together the most frequent queries to give you clear, straightforward answers.

Let's tackle those lingering uncertainties you might have.

What If My Income Changes During the Year?

This is a classic scenario and something we see all the time. You might get a pay rise, switch jobs, or maybe your income takes a dip. Any of these can push you into a different income tier for the rebate.

The Australian Taxation Office (ATO) figures this out based on your total income for the entire financial year, not just what you were earning when you first told your insurer.

If your income goes up, you might find you have to repay some of the rebate you received as a discount on your premiums. On the flip side, if your income drops, you could be in for a pleasant surprise with a larger offset come tax time. The best approach? Let your health fund know as soon as your situation changes so they can adjust your premium reduction.

Key Insight: Don’t stress if your income fluctuates. The tax system is built to square everything up when you lodge your return. The main thing is to be aware that there might be an adjustment waiting for you, whether it's a credit or a bill.

Can I Claim the Offset on an Extras-Only Policy?

No, you can't. This is a crucial point that catches a lot of people out. The private health insurance tax offset is only for complying health insurance policies that include some level of hospital cover.

If your policy only covers things like dental, optical, or physio (what’s known as 'extras' or 'general treatment' cover), it won't be eligible for the government rebate. The whole point of the incentive is to encourage cover that takes some of the load off the public hospital system.

How Do We Split the Claim on a Shared Policy?

For couples or families on a single policy, it’s essential to split the claim correctly. Your annual statement from your health insurer will lay it all out for you, showing the total premium paid and each adult's specific share.

When you do your tax return, you must use your share of the numbers from that statement. You can’t just claim the full premium if you only paid for your portion. Getting this right from the start means both of you get the correct offset and keeps you out of trouble with the ATO.

If you’re interested in how to correctly portion out other shared costs, our guide on work-from-home tax deductions offers some similar tips on dividing up expenses.

• Need assistance? We offer free online consultations: – 📞 Phone: 1800 087 213 – 💬 LINE: barontax – 📱 WhatsApp: 0490 925 969 – 📧 Email: info@baronaccounting.com – Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments