Understanding the Low Income Tax Offset

- Jul 12, 2025

- 11 min read

Ever heard of the low income tax offset, or LITO? Think of it as a helping hand from the Australian government, specifically designed to give a bit of a break to people on lower incomes. It’s not a cash handout, but rather a tax discount that directly cuts down the amount of tax you owe. Best of all, if you’re eligible, the ATO automatically applies it when you do your tax return.

Understanding The Low Income Tax Offset

You can think of LITO as a safety net woven into Australia’s tax system. Its whole point is to make sure that those earning less aren't hit with a tax bill that feels unfairly high compared to their income. Instead of you getting a separate payment, LITO just works quietly in the background to lower what you owe.

And the process is completely automatic. You don't need to hunt for special forms or tick any extra boxes on your tax return. The Australian Taxation Office (ATO) figures it all out based on the taxable income you report. If your income is in the right zone, the offset is applied for you. Simple as that.

What Does LITO Actually Do For You?

The main benefit is pretty straightforward: it helps you keep more of your hard-earned cash. For many low-income earners, this offset is powerful enough to wipe out their tax bill entirely.

Now, it is non-refundable, which means you won't get any leftover portion of the offset paid out to you. But what it does do is boost your chances of getting a bigger tax refund. This happens because the tax your employer withholds all year is often more than what you actually owe once LITO kicks in. That difference between what you paid and your new, lower tax bill comes right back to you as your refund.

A common misconception is that LITO is some sort of welfare payment. It's not. It’s actually a core part of our progressive tax system, built to create a fairer outcome by easing the tax burden on those with a lower capacity to pay.

Low Income Tax Offset (LITO) Rates And Thresholds

The amount of the offset you can get hinges entirely on your taxable income for the year. The maximum offset is currently $700, which goes to anyone with a taxable income of $37,500 or less. Once your income climbs above that, the offset amount starts to phase out.

Here’s a simple table to show how LITO is calculated based on the latest ATO thresholds.

Your Taxable Income | LITO Amount You Receive |

|---|---|

$37,500 or less | $700 |

$37,501 – $45,000 | $700 minus 5 cents for every $1 over $37,500 |

$45,001 – $66,667 | $325 minus 1.5 cents for every $1 over $45,000 |

More than $66,667 | $0 |

Getting your head around these thresholds is the first step to seeing how the low income tax offset can directly benefit you. It’s an automatic, powerful tool that makes a real difference at tax time, helping keep the system fair for everyone.

How to Know if You Qualify for LITO

Figuring out if you can get the Low Income Tax Offset (LITO) is thankfully quite simple. The Australian Taxation Office (ATO) boils it down to two main things to see if this handy offset is for you.

First and foremost is your taxable income for the financial year. This is what you’ve earned from all sources, after you’ve subtracted any legitimate deductions. For most people, this is just their salary before tax.

The second condition is all about your residency. You have to be an Australian resident for tax purposes to be eligible for LITO. This is an important detail, as your tax residency isn’t always the same as your citizenship.

The best part? You don’t need to jump through hoops or fill out any extra forms to claim LITO. The ATO automatically works it all out for you when you lodge your tax return. If your income is in the right bracket, the offset is applied without you lifting a finger.

Understanding the Income Thresholds

You get the biggest benefit from the Low Income Tax Offset when your income is on the lower side. As you start to earn more, the offset you receive slowly shrinks. This is often called 'tapering'.

Here’s a quick guide to who qualifies based on what you earn:

Maximum LITO: If your taxable income is $37,500 or less, you’ll get the full $700 offset.

Reduced LITO: If you earn between $37,501 and $66,667, you'll still get a piece of the pie, but it gets smaller the more you earn.

No LITO: Once your taxable income hits $66,667, the offset no longer applies.

Think of LITO like a sliding scale. It gives the most help to those who need it most, then gently phases out to make sure the benefit is targeted where it counts.

This automatic reduction is designed to keep the tax system fair and progressive. It works a bit differently from other tax rules, like the tax-free threshold. You can dive deeper into that topic in our guide on what the tax-free threshold in Australia is and see how it all fits together with your tax situation.

Real-World Scenarios

Let's put this into practice with a couple of quick examples.

Imagine a university student working part-time who earns $25,000 in a year. They would easily qualify for the full $700 LITO. In many cases, this would wipe out their entire tax bill for the year.

On the other hand, a full-time employee earning $70,000 a year wouldn't receive any LITO. Their income is just over the $66,667 cut-off. This system ensures the tax relief is kept for those on lower incomes.

How Your LITO Amount Is Calculated

Figuring out the maths behind the Low Income Tax Offset (LITO) is actually much simpler than it sounds. It’s not some secret, complex formula locked away in an ATO vault; it's a straightforward process designed to give the biggest boost to Australia's lowest earners. Your final offset really boils down to two things: a maximum offset amount and a taper rate.

Think of the LITO as a full glass of water, which represents the maximum $700 offset. This full amount is reserved for anyone with a taxable income of $37,500 or less. As your income creeps up past that point, a "taper rate" starts to slowly pour some of that water out. The more you earn, the faster it pours, until the glass is eventually empty.

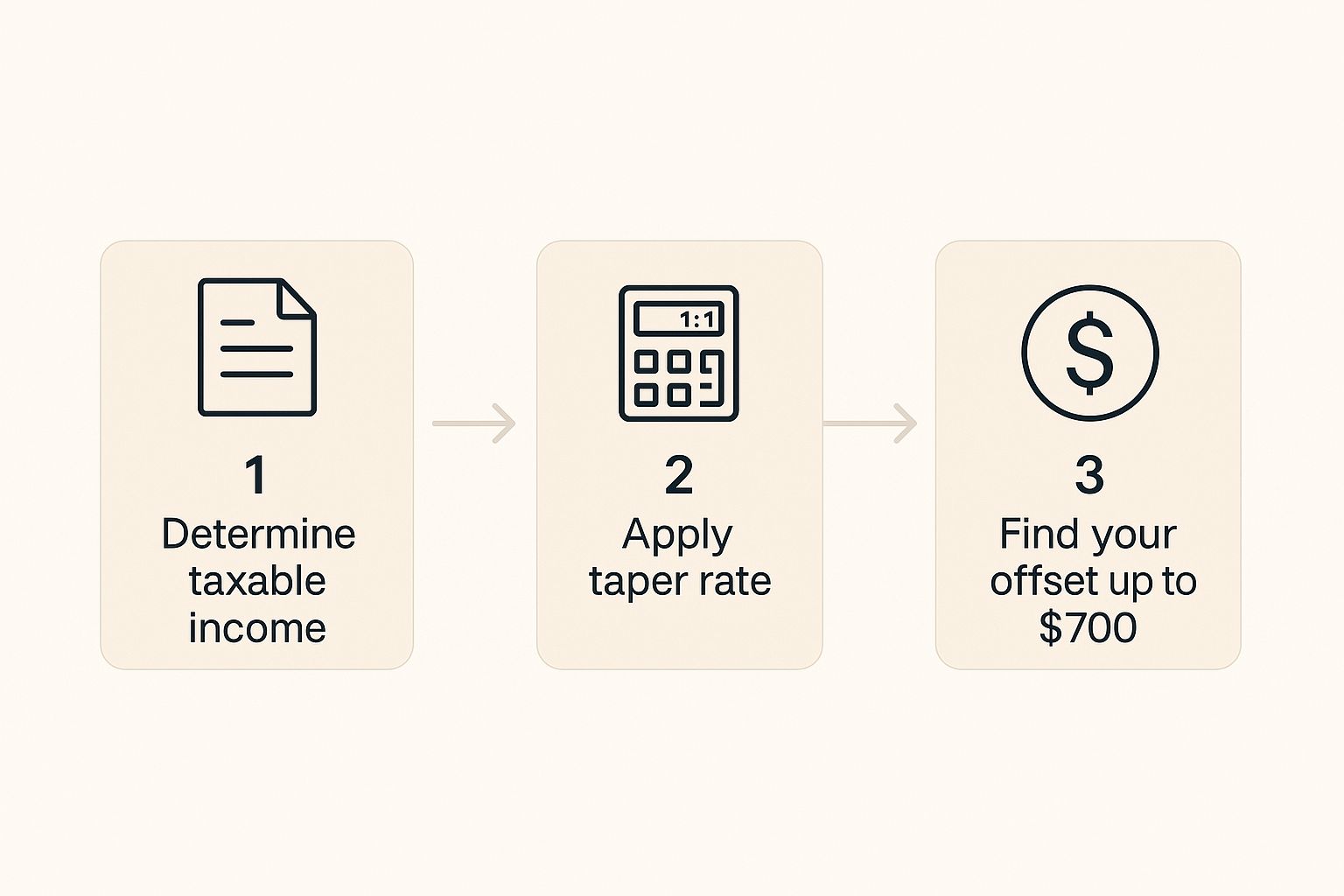

This system ensures the benefit is targeted exactly where it's needed most. This handy infographic breaks the whole thing down into three clear steps.

As you can see, calculating your LITO is a simple path from your income to your final offset, with the taper rate guiding the way.

The LITO Taper Rate Explained

So, what exactly is this "taper rate"? It's just the technical term for how quickly your LITO reduces as your income goes up. The ATO has set up two different reduction speeds.

Phase 1 (Income: $37,501 to $45,000): For every dollar you earn over $37,500, your offset reduces by 5 cents.

Phase 2 (Income: $45,001 to $66,667): The reduction then slows down. For every dollar you earn over $45,000, your offset only decreases by 1.5 cents.

Once your income goes past $66,667, the offset has completely tapered off to zero, meaning you're no longer eligible. This sliding scale is quite different from how other tax rules, like the tax-free threshold, operate. If you'd like to read up on that, our Australian tax-free threshold guide offers a clear explanation.

Worked Examples of LITO Calculations

Let's put this into practice with a few real-world scenarios to see how it works.

Example 1: Income of $37,500 An individual earning exactly $37,500 is right on the initial threshold.

Calculation: Their income doesn't go over $37,500.

LITO Received: They get the full $700 offset. Simple.

Example 2: Income of $50,000 This person's income puts them into the second taper phase. The calculation has two parts. First, we need to know what the offset is worth at the end of the first phase ($45,000). At that point, the LITO has already reduced to $325.

Income over threshold: $50,000 - $45,000 = $5,000

Reduction amount: $5,000 x $0.015 (1.5 cents) = $75

Final LITO: $325 - $75 = $250

Example 3: Income of $65,000 This income is also in the second taper phase, but it's much closer to the cut-off. Again, we start from the $325 offset amount at the $45,000 income level.

Income over threshold: $65,000 - $45,000 = $20,000

Reduction amount: $20,000 x $0.015 (1.5 cents) = $300

Final LITO: $325 - $300 = $25

As you can tell, the taper rate ensures a smooth, gradual reduction. This prevents any sudden financial cliffs or penalties just for earning a little bit more.

LITO vs LMITO: What You Need to Know

It’s easy to get the Low Income Tax Offset (LITO) and the Low and Middle Income Tax Offset (LMITO) mixed up. If you noticed your tax refund was smaller than you hoped for in the last couple of years, the end of the LMITO is almost certainly why.

Getting your head around the difference between these two is crucial for setting the right expectations come tax time.

Think of LITO as a permanent fixture in Australia's tax system—it's been around for years, quietly doing its job to help out those on lower incomes. LMITO, however, was always meant to be a temporary boost.

The Temporary Boost from LMITO

Back in 2018, the government introduced the LMITO as an extra top-up to the existing LITO. The idea was to give a bit of extra, temporary relief. It started off as a helpful offset and grew to a maximum of $1,500 in its final year, 2021–22.

But here’s the key part: LMITO was completely removed after that financial year. It's no longer available. You can see how offsets like this fit into the bigger picture by reading our guide on Australian tax rates and brackets in our comprehensive guide.

This change really caught people by surprise because many had gotten used to the larger refunds that LMITO delivered. Now that it’s gone, our tax returns are back to normal, relying only on the permanent offsets like LITO.

The main thing to remember is this: LITO is the standard, ongoing offset for low-income earners. LMITO was a limited-time bonus that has now ended.

To make it even clearer, let's put them side-by-side. The table below breaks down exactly what each offset was for, its status, and how much it was worth.

Comparing LITO and LMITO

This table summarises the key differences between the permanent Low Income Tax Offset (LITO) and the temporary Low and Middle Income Tax Offset (LMITO).

Feature | Low Income Tax Offset (LITO) | Low and Middle Income Tax Offset (LMITO) |

|---|---|---|

Status | Permanent and ongoing feature of the tax system. | Temporary measure that ended on 30 June 2022. |

Purpose | To provide consistent, targeted tax relief for low-income earners. | To provide a temporary cost-of-living boost for a wider range of earners. |

Current Availability | Yes, it is automatically applied if you are eligible. | No, it is no longer available for any income year after 2021–22. |

Maximum Offset | $700 for incomes up to $37,500. | Was $1,500 in its final year for incomes between $48,001 and $90,000. |

As you can see, LITO remains a reliable part of our tax system, whereas LMITO served its purpose and has been phased out. Understanding this difference helps explain why your tax refund may look different now compared to the 2020-2022 period.

Common Questions About the Low Income Tax Offset

When you get into the nitty-gritty of tax offsets, it’s natural for a few questions to pop up. The Low Income Tax Offset is no different. We’ve put together this section to answer the most common queries we hear, giving you clear, straightforward answers so you know exactly how LITO works for you.

Do I Have to Apply for the Low Income Tax Offset?

No, and that’s one of its best features! You don’t have to fill out any extra forms or tick any special boxes to claim it.

The Australian Taxation Office (ATO) automatically figures out if you’re entitled to LITO when you lodge your tax return. It’s all based on your taxable income. If you qualify, the offset is applied to lower your tax bill without you having to lift a finger. Your final Notice of Assessment will clearly show the offset amount you received and how it helped reduce your tax.

Can LITO Give Me a Direct Cash Refund?

This is a really common point of confusion. LITO is a non-refundable tax offset. What that means is it can only reduce the tax you owe down to zero—it can’t be paid out as a separate cash bonus.

Let’s break it down with a simple example:

Imagine your tax bill for the year works out to be $400.

You’re eligible for the full LITO of $700.

The offset will wipe out your $400 tax bill, bringing it down to $0.

But that leftover $300? It doesn’t come back to you as cash. Even so, LITO is a massive help in boosting your final tax refund. By slashing your tax bill, it ensures you get back more of the tax you’ve already paid through your employer during the year.

Does My Partner's Income Change My LITO Eligibility?

Nope! Your partner’s income has absolutely no bearing on your eligibility for the Low Income Tax Offset. LITO is assessed on your individual taxable income alone.

This is a key difference from other government benefits or tax rules that often look at your combined family or household income. When it comes to LITO, it’s all about what you earned personally. This means it's entirely possible for both you and your partner to each get the offset, as long as you both individually meet the income thresholds.

LITO is assessed on an individual basis, which is different from other obligations like the Medicare Levy Surcharge, which often depends on your combined family income. To see how that works, you can explore our guide on understanding the Medicare Levy Surcharge.

What if I Have Multiple Low-Income Jobs?

Your eligibility for LITO is based on your total taxable income from all your jobs combined, not each one separately. The ATO doesn't look at your income streams in isolation; it adds everything up to get a single figure for the financial year.

For instance, if you work a retail job earning $20,000 and moonlight in hospitality for another $25,000, the ATO will assess your LITO based on a total taxable income of $45,000. At that level, the offset would be calculated using the taper rules, meaning you'd receive a partial offset.

Let's Get Your Tax Sorted

Figuring out Australian tax law, especially offsets like LITO, can feel like a maze. The good news? You don't have to navigate it alone. Our team of tax experts is here to make sure you claim every single offset and deduction you’re entitled to, getting you the best possible refund.

Whether you've got a quick question about the low income tax offset or need us to handle your entire tax return from start to finish, we're ready to jump in. And it's not just for individuals—we can also help you uncover all the available tax deductions for your small business. .

Get in touch for a free consultation. Let's talk about how we can make tax time straightforward and, dare we say, rewarding for you. Our whole goal is to give you clarity and confidence, ensuring you walk away with the best outcome.

• Need assistance? We offer free online consultations: – 📞 Phone: 1800 087 213 – ✅ LINE: barontax – 💬 WhatsApp: 0490 925 969 – 📧 Email: info@baronaccounting.com – Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments