Train Drivers in Australia: Salary & Career Guide

- Aug 8, 2025

- 12 min read

Deciding to become a train driver is a massive step. It's not just another job; it’s a career that puts you in a position of huge responsibility and trust. But with that comes stability, great earning potential, and the unique thrill of piloting a massive machine across Australia's incredible rail networks. For many, it's a true lifelong calling.

Your Career as an Australian Train Driver

Think of yourself as the captain of a land ship. You're the one in charge, trusted to navigate complex webs of tracks, signals, and stations. Every single day, you're responsible for precious cargo—whether that’s hundreds of commuters heading to work or millions of dollars in freight. It’s a role that demands sharp focus, precision, and an absolute commitment to safety.

The great thing is, the profession is surprisingly diverse. There are several different specialisations, each offering a unique experience. This lets you find a niche that really fits your skills and the kind of lifestyle you want.

Types of Train Driving Roles

Getting a handle on the different roles is your first step. Before you can map out your career, you need to know what's out there. The four main specialisations available in Australia are urban passenger, regional passenger, freight, and shunting/yard driving.

To make it a bit clearer, here’s a quick summary of what each role involves.

Train Driver Roles at a Glance

Role Type | Primary Responsibility | Typical Network |

|---|---|---|

Urban Passenger | Operating frequent metro services on tight schedules. | Dense city networks (e.g., Sydney, Melbourne). |

Regional Passenger | Connecting towns and cities over longer distances with fewer stops. | Inter-city and regional lines. |

Freight | Hauling goods across the country, often in very long, heavy trains. | National and state-based freight corridors. |

Shunting/Yard | Assembling trains and moving carriages within depots for maintenance. | Rail yards and maintenance centres. |

As you can see, driving a train isn't a one-size-fits-all job. Whether you prefer the fast-paced action of a city network or the long, open stretches of the outback, there's a path for you.

Financial Prospects and Industry Outlook

The rail transport sector is a powerhouse of the Australian economy, employing around 46,000 people. It’s also well-known for offering solid, competitive pay.

In fact, recent economic data shows that rail transport workers earned an average weekly income of $2,629. That's significantly higher than many other transport sectors. If you want to dig into the numbers yourself, the latest transport safety reports from the ATSB are a great resource.

When that first job offer comes in, remember that a little preparation can go a long way. Brushing up on entry-level salary negotiation strategies can help you lock in a better starting package, setting a strong foundation for your earnings for years to come. A career as a train driver isn’t just a job—it’s a financially sound path with real stability and clear opportunities for growth.

How to Become a Qualified Train Driver

The journey to sitting in the driver's seat of a train in Australia isn't your typical job application. It's a highly structured and demanding process, built from the ground up to ensure only the most capable and safety-conscious people take control of the country's rail network. Think of it less like a standard hire and more like a specialised apprenticeship where every step is about proving your competence.

First things first, you'll need to meet some basic entry requirements. While these can differ slightly between rail operators, you’ll generally need to be at least 18 years old and have finished Year 10 or an equivalent. The big qualification you’ll be working towards is the Certificate IV in Train Driving, which is the national standard for the profession.

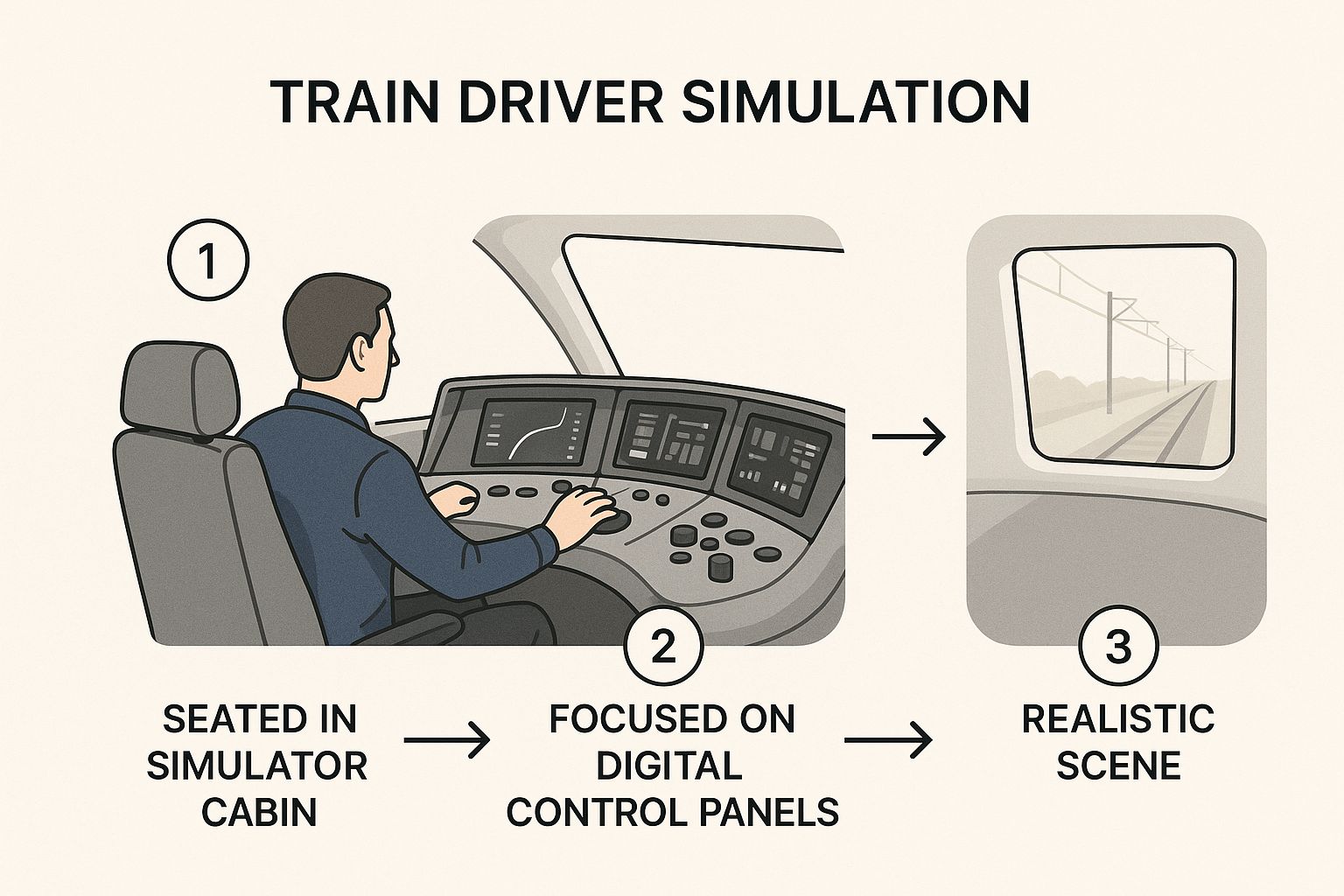

This image really captures the essence of a modern train driver, moving from complex simulator training to handling the real thing out on the tracks.

The Traineeship Pathway

Once you’ve made it through the initial screening process, you’ll officially begin your traineeship. This is where the real work starts, and it’s a mix of two crucial components:

Theoretical Classroom Learning: This is where you build the foundations. You'll dive into everything from safe working rules and complex signalling systems to network geography and emergency procedures.

Practical On-the-Job Training: After the classroom, you get into the cabin. This involves racking up hundreds of hours of supervised driving time alongside an experienced driver and trainer, learning to manage the train in all sorts of real-world conditions.

Your progress is watched like a hawk every step of the way. It’s also worth noting that most train drivers are brought on as full-time employees right from day one of their traineeship, not as contractors. Knowing your employment status is vital for getting your tax right, and you can get the full story on what that means in our guide to employees vs contractors in Australia.

A traineeship isn't just about learning the controls; it's about being conditioned to think, react, and prioritise safety instinctively. Every check and procedure is drilled into you until it becomes second nature, ensuring you follow best practices without a second thought, even when the pressure is on.

Maintaining Your Qualification

Getting qualified isn't a one-and-done deal. The rail industry is built on a culture of continuous professional development and regular competency checks to make sure every driver's skills stay sharp. This commitment to ongoing assessment is a bedrock of rail safety.

Keeping these records in order is absolutely critical. Recent findings have revealed cases where poor record-keeping by some operators has made it tough for drivers to even prove their qualifications. The Australian Transport Safety Bureau (ATSB) has pointed out the safety risks this creates, as the Rail Safety Act mandates that these competency records must be kept for at least seven years. It just goes to show that meticulous documentation from the operator is as important as skillful driving from the individual.

Navigating the Lifestyle and Challenges of the Job

Life as a train driver goes far beyond the technical skills you pick up in your traineeship. It’s a demanding career that shapes your daily routine in pretty unique ways, asking for a level of personal discipline and resilience that most other jobs just don't.

The reality of the role is built around a non-traditional schedule, one dictated by the constant movement of people and freight. This means getting used to shift work—the absolute cornerstone of the rail industry. You can expect early starts long before the sun is up, late finishes well after dark, and plenty of work on weekends and public holidays. It’s a rhythm that keeps the country moving, but it definitely requires careful management to maintain a healthy work-life balance.

The Critical Role of Fatigue Management

One of the biggest hurdles for any train driver is managing fatigue. We’re not just talking about feeling a bit tired; it's a critical safety issue that the entire industry takes incredibly seriously. An alert and well-rested driver is the number one defence against incidents on the tracks.

The biggest challenge? The irregular nature of the rosters. Working different shifts from one week to the next can throw your body's natural sleep-wake cycle completely out of whack, making it tough to get consistent, quality rest. For those shifts in low-light conditions, maintaining clear vision is also a top priority. Exploring a comprehensive guide to night driving glasses can give you a better idea of the options available to cut down glare and improve your sight after dark.

A study of over 750 Australian train drivers found that schedule irregularity was the single biggest factor hurting their sleep quality, wellbeing, and even their performance at the controls. It just goes to show how much a driver's day-to-day capability is tied to a well-managed roster.

Building Resilience and Maintaining Wellbeing

To really succeed in this lifestyle, you have to be proactive about managing your health. While rail operators have strict fatigue management policies, personal responsibility plays a huge role.

To thrive, not just survive, train drivers need to develop solid strategies for:

Prioritising Sleep: This means creating a dark, quiet sleep space and trying to stick to a routine as much as you can, even on your days off.

Healthy Nutrition and Exercise: Fuelling your body with balanced meals and staying active can give you a massive boost in energy and mental alertness.

Stress Management: Finding healthy ways to unwind, whether it's through hobbies, exercise, or mindfulness, is crucial for your long-term mental health.

Ultimately, these lifestyle factors also connect back to your financial wellbeing, especially when it comes to sorting out your taxes. For example, getting a clear picture of your income and work patterns is a vital first step when you learn how to file taxes correctly. It ensures you stay compliant while claiming every deduction you’re entitled to. Mastering the job is as much about looking after yourself as it is about professional skill.

Tax Deductions Every Train Driver Should Know

Getting your tax return right is a huge part of managing your finances as a train driver. It’s not about finding sneaky loopholes; it’s simply about understanding what the Australian Taxation Office (ATO) allows you to claim as legitimate, work-related expenses.

If you keep good records and know what you're entitled to, you can legally lower your taxable income. And that usually means a bigger tax refund in your pocket.

Think of it this way: every dollar you have to spend to earn your income is a potential deduction. The ATO gets that jobs like train driving come with specific, necessary costs. Your job is to track those costs properly so you’re only paying tax on what you actually earned, not your entire gross wage.

Uniforms and Protective Gear

One of the most common claims for any train driver is clothing. If your employer makes you wear a compulsory uniform with their logo on it, the cost of buying that uniform is deductible. Simple as that.

But it doesn't stop with just buying it. The costs to keep that uniform clean and ready for work are also claimable.

Laundry Costs: You can claim $1 per load if you’re washing your uniform with other personal clothes. If you run a separate wash with only work items, you can claim the actual cost of the wash cycle and drying.

Dry Cleaning: Hold onto those receipts! The full cost of professionally dry-cleaning your compulsory uniform is 100% deductible.

Protective gear is another big one. Any equipment you buy to keep yourself safe on the job is a legitimate claim. This covers everything from steel-capped boots and high-vis vests to sunglasses if you’re regularly working in bright, glary conditions.

Self-Education and Union Fees

The rail industry is always evolving, and ongoing learning is part of the job. If you take on a course or study that’s directly tied to your current role and helps you maintain or improve your skills, you can claim it as a self-education expense. This could be anything from renewing specific competencies to completing units for your Certificate IV in Train Driving, as long as you're already qualified and working in the role.

On top of that, any fees you pay to be a member of a union or a professional body are fully tax-deductible. These are considered a direct cost of your employment, so don’t forget to include them on your tax return.

Key Takeaway: The golden rule for any tax deduction is proof. The ATO needs you to be able to substantiate your claims. This means keeping all your receipts, invoices, and bank statements as evidence. For small, ongoing costs like laundry, a simple diary or logbook is usually enough.

Travel and Other Expenses

While your daily trip from home to your main station isn't usually claimable, some travel scenarios are. For example, if you have to travel between two different work sites during your shift or use your own car to run an errand like picking up supplies, you might be able to claim those travel costs.

For a really clear breakdown of the rules, our guide on how to claim your car expenses as a tax deduction walks you through the logbook and cents-per-kilometre methods.

Other deductions that train drivers often claim include:

The work-related percentage of your phone and internet bills.

Subscriptions to technical publications or journals relevant to the rail industry.

The cost of renewing any licences or certifications essential for your job.

By carefully tracking these expenses throughout the financial year, you put yourself in a much stronger position for a better result come tax time.

Securing Your Financial Future with Superannuation

While getting the most out of your annual tax return is a fantastic short-term win, it's just as crucial to lock in your long-term financial security. For train drivers, superannuation isn't some minor detail buried in your payslip—it's the very bedrock of your future.

Think of your career like a long-haul journey. Your super is the fuel you steadily add to the tank along the way, making sure you have more than enough to reach your retirement destination in comfort. Given the physically demanding nature of the job and the challenges of shift work, planning for life after work deserves your full attention. A healthy super balance gives you the freedom to retire when you want to, not when you have to.

Understanding The Superannuation Guarantee

In Australia, your employer is legally required to pay a percentage of your ordinary time earnings into your super fund. This is called the Superannuation Guarantee (SG). For the 2025-2026 financial year, this rate is 12%.

This is the absolute minimum your employer contributes, and it forms the foundation of your retirement savings. But let's be honest—relying on the SG alone might not be enough to fund the lifestyle you're dreaming of after you hang up the uniform for good.

How To Boost Your Retirement Savings

Thankfully, you have some powerful tools at your disposal to build a much bigger nest egg. Being proactive with your super now can make an enormous difference by the time you retire.

Salary Sacrificing: This is a smart arrangement where you and your employer agree to pay a portion of your pre-tax salary straight into your super. Because these contributions are typically taxed at a low rate of 15% (for most people), it's a brilliant way to grow your super faster while also lowering your taxable income today.

Voluntary Contributions: You can also top up your super with your own after-tax money. While you don't get an immediate tax deduction, your money still benefits from the low-tax environment inside the super fund, allowing your investments to grow much faster than they might otherwise.

Superannuation is, at its heart, a long-term investment. While it’s the core of your retirement plan, getting a handle on the broader principles of understanding long-term investing can really empower your financial decision-making for years to come.

Taking a hands-on approach to your super is one of the smartest financial moves a train driver can make. It ensures that after a long career keeping Australia moving, you'll be well and truly set up to enjoy a secure and comfortable retirement.

Got Questions? We’ve Got Answers.

A career as a train driver goes way beyond the tracks. You're constantly juggling schedules, trying to understand your pay, and thinking about the future. It's only natural to have a few questions. Here are some straightforward answers to the ones we hear most often.

What’s the Toughest Part of Being a Train Driver?

You might think it’s the technical side of things, but most experienced train drivers will tell you the real challenge is the lifestyle. The constant shift work—with its odd hours and overnight runs—can really mess with your sleep and your personal life. Staying sharp and managing fatigue isn't just part of the job; it's a constant responsibility.

Can I Claim My Drive to the Depot on Tax?

In most cases, unfortunately not. The Australian Taxation Office (ATO) views the trip from your home to your regular depot as a private expense. Think of it like any other daily commute.

However, if your shift requires you to travel from one work site to another—say, from your main depot to a different yard—that specific trip could be claimable. A good way to track this is by using the logbook method detailed in our guide on how to claim your car expenses as a tax deduction.

A Quick Tip: Always, always keep a logbook for any work-related travel you think might be deductible. When it comes to tax claims, clear proof is your best friend.

How Much Can I Realistically Boost My Super?

This one’s completely up to you and what you’re aiming for financially. The good news is that even small, regular top-ups to your super can make a huge difference over a long career, all thanks to the magic of compound earnings.

A smart way to do this is through salary sacrificing. This lets you contribute from your pre-tax income, which means you could lower your taxable income today while building a bigger nest egg for retirement. It's a win-win, especially when combined with powerful superannuation wealth strategies.

Your Financial Co-Pilot for the Journey Ahead

Feeling in control of your finances is just as important as feeling confident behind the controls of a train. At Baron Tax and Accounting, we get the unique challenges train drivers face. We're here to help you sort through the complexities of tax and super, making sure you get the most out of your money and build a secure future. For instance, understanding how different income levels impact your eligibility for things like the low income tax offset is a small detail that can play a big part in your overall financial strategy.

• Need assistance? We offer free online consultations: – LINE: barontax – WhatsApp: 0490 925 969 – Email: info@baronaccounting.com

– Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 Tax Estimate Calculator

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments