How to Get PAYG Summary: Easy Step-by-Step Guide

- Jun 28, 2025

- 10 min read

Let's get straight to it. Your old PAYG summary is now called an income statement, and the quickest way to get your hands on it is through your myGov account linked to the ATO. This digital document has all the crucial details you need for your tax return, like your total earnings, tax withheld, and superannuation contributions.

What Is a PAYG Summary and Why Does It Matter Now?

Reviewing a PAYG summary both on screen and in print – a key step in lodging your Australian tax return accurately.

If you’ve been in the Aussie workforce for a while, you probably remember the annual ritual of waiting for a paper PAYG summary to land in your mailbox after 30 June. These days, that whole process has been turned on its head for most of us, all thanks to Single Touch Payroll (STP).

This shift from paper to pixels means getting your payment information is faster and more streamlined than ever. The document, now officially an income statement, is the complete record of the salary and wages you've received from an employer over the financial year. It's more than just a payslip summary; it's the bedrock of your tax lodgement. You can’t accurately declare your income to the Australian Taxation Office (ATO) without it.

The Shift to Single Touch Payroll (STP)

When STP reporting kicked in on 1 July 2019, it fundamentally changed how employers handle payroll. They now report your salary, tax withheld, and super contributions straight to the ATO every time they pay you.

What does this mean for you? Your year-to-date information is constantly updated and ready for you to check online. It's a massive leap forward from the old system of waiting for one summary at the end of the year.

Your income statement is the ATO’s official record of your employment income. Using this finalised data is critical for lodging an accurate tax return and avoiding potential amendments or penalties down the track.

PAYG Summary vs. Income Statement at a Glance

With all this talk of new names and systems, it's easy to get confused. Here’s a simple table to show what's changed between the old PAYG summary and the new income statement.

Feature | Old PAYG Summary (Pre-STP) | New Income Statement (Post-STP) |

|---|---|---|

Format | Mostly paper, mailed by employer | Digital, available via myGov |

Availability | Annually, after 30 June | Real-time, updated with each pay run |

Access | Sent by employer | Accessed directly by you via myGov |

Official Name | PAYG Payment Summary | Income Statement |

Data Source | Employer-generated annual report | Direct ATO feed via Single Touch Payroll |

Basically, the information is the same, but how you get it is now much more efficient and gives you more control.

Information on Your Income Statement

Think of your income statement as the definitive report card for your earnings and tax. It’s the primary document you'll need when you sit down to do your tax. If you need a refresher on the whole process, you can explore our guide to lodging an Australian tax return with the ATO.

Here are the key details you'll find on your statement:

Your total gross payments (your salary and wages before tax).

The total amount of tax your employer withheld.

Any reportable fringe benefits amounts (RFBA).

Reportable employer superannuation contributions (RESC).

It’s the one document that neatly wraps up your financial year's earnings from a specific job, making tax time a whole lot clearer.

Finding Your Income Statement in myGov and the ATO Portal

For most Aussies, grabbing your PAYG summary (now officially called an income statement) is quickest through your myGov account. This is a huge improvement from the old days of waiting for paperwork to show up in the mail. The system puts you in the driver's seat, giving you direct access whenever you need it.

First, you'll need to log in to myGov. On your dashboard, you’ll see a list of your linked services. The one you're looking for is the Australian Taxation Office.

If you haven't linked the ATO to your myGov account yet, the system will walk you through it. It’s a crucial one-time setup where you'll need some personal details to prove it's you, like info from an old ATO letter or your bank account details they have on file.

Locating Your Employment Details

Once you’re inside the ATO portal, find the ‘Employment’ tab on the menu. A click on that will take you to a new screen. From there, select ‘Income statements’.

This is where the magic happens. You'll see a complete list of your income statements from every employer who has reported your earnings through Single Touch Payroll (STP). It’s all organised by financial year, so whether you need the latest one for your current tax return or one from a few years back, it's easy to find.

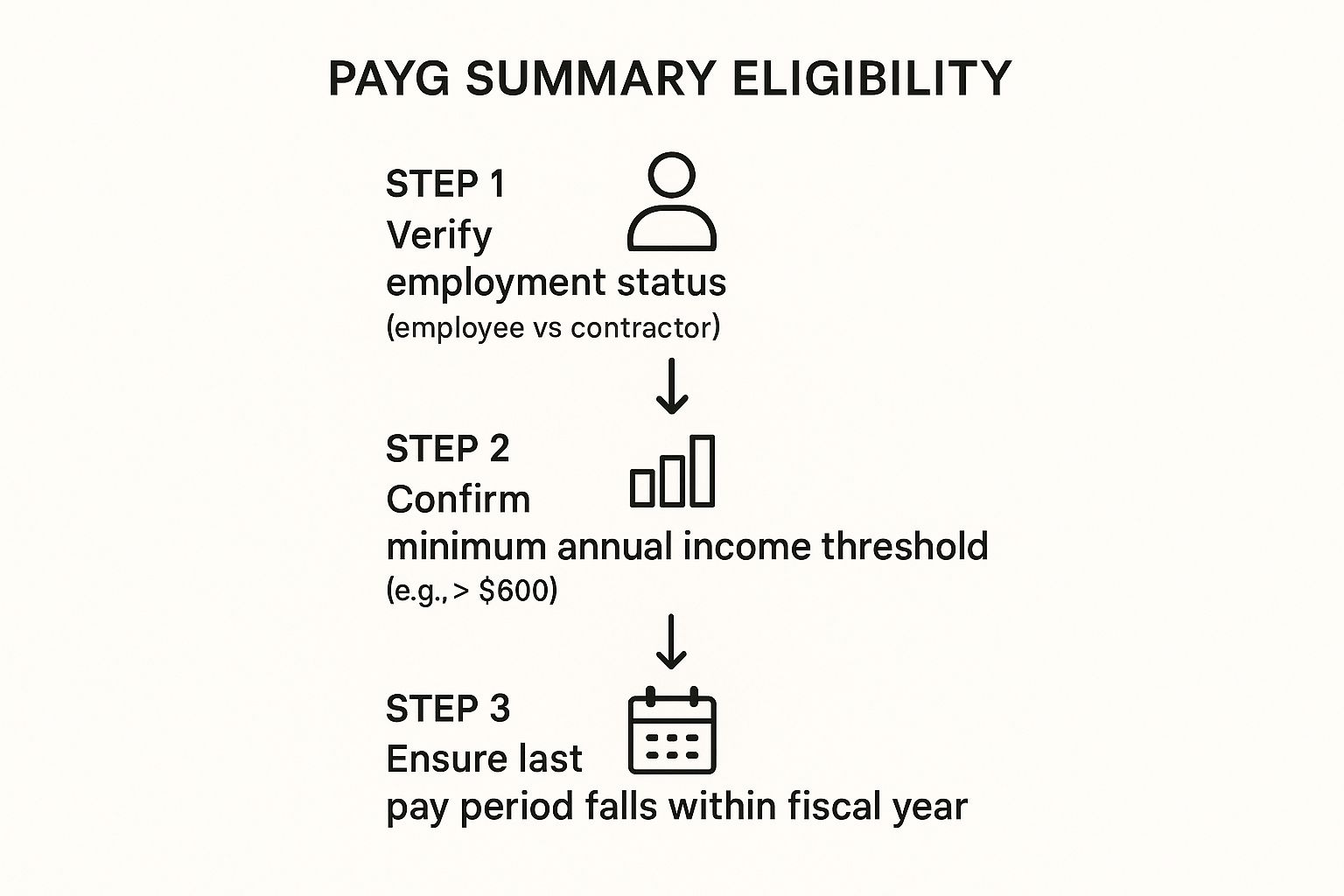

The image below breaks down the key things that determine if your information will even be there in the first place.

As the guide shows, being classified as an employee and earning over certain thresholds are the first steps before your payment data even populates in the system.

Now, here's a critical detail to pay close attention to. Next to each income statement, you'll see a status. It will either say ‘Not tax ready’ or ‘Tax ready’.

Crucial Tip: You absolutely must wait until this status changes to ‘Tax ready’ before you lodge your tax return. If you jump the gun and lodge while it’s still unfinalised, you’re using data that might change. This often results in the ATO amending your return later on, which can easily lead to an unexpected tax debt.

This status is basically your employer giving the ATO the final nod, confirming they've reported everything for the financial year. While you can view your year-to-date figures anytime, only the ‘Tax ready’ status means the numbers are locked in and good to go.

Once it's finalised, you can use those figures with confidence. Want to get a rough idea of what your refund might look like? Give our handy tax refund calculator a try for a quick estimate.

When Your Income Statement Has Not Been Finalised

A PAYG employment contract document, often used to determine tax obligations before income statements are finalised.

It’s a common frustration we see every year. You log into myGov, ready to get your tax return sorted, only to find your income statement is stubbornly marked 'Not tax ready'. This can be a real headache, especially when you’re eager to lodge and get your refund.

First, don't panic. Employers have until 14 July to finalise their payroll information with the ATO. If it’s still early July, a little patience is usually all you need. The systems often just need a moment to catch up.

But what happens if that date comes and goes, and your statement is still unfinalised? Or worse, you glance at the figures and something looks completely wrong? Your first step should be a simple, professional check-in with your employer. A polite email or a quick call to the payroll or HR department is the most direct way to get an update.

What To Do When Waiting Isn't Working

So, you've contacted your employer but you're still stuck in limbo. Waiting around forever isn’t a strategy, especially if you need to lodge your return promptly. You have other options.

This is the point where you need to be proactive. If you aren't getting a clear answer, you can:

Follow up in writing: This creates a paper trail and documents your attempts to resolve the issue.

Gather your own records: Your final payslip of the financial year is your best friend here. It contains all the year-to-date totals you’ll need.

Contact the ATO: If your employer remains unresponsive after a reasonable period, you can contact the ATO directly for assistance.

A word of warning: It might be tempting to just use the 'Not tax ready' information to get your return lodged. We strongly advise against this. If the final figures are different, the ATO will likely issue an automatic amendment later on, which could leave you with an unexpected tax debt.

Thankfully, these kinds of issues are becoming less common as financial systems get better. For instance, as Australia’s card payments market continues to grow—it's projected to expand by 6.3% in 2025—the underlying technology helps ensure payroll data is sent to the ATO more accurately. You can read more about how payment trends affect financial records over on globaldata.com.

To be ready for anything, it always pays to have your own records organised. Our tax return checklist is a great resource to make sure you have everything you need when it’s finally time to lodge.

Requesting Your Summary Directly from an Employer

While using myGov is usually the smoothest way to get your hands on your PAYG summary info, it’s not your only option. Sometimes, you just need to go straight to the source.

This is especially true if your employer hasn't switched over to Single Touch Payroll yet, or if you're hitting a wall with technical glitches on the myGov portal. It happens. In these cases, a direct request is your best move.

All you need to do is ask your employer for a copy of your income statement. If they can’t provide that, your final payslip for the financial year will do the trick. That document should have all the critical year-to-date totals you need for your tax return.

Who to Contact and What to Say

Knowing who to ask can be half the battle. Your first port of call should almost always be your company's payroll department or the human resources (HR) team. These are the people who manage all the payment records and can pull up the documents you need.

Not sure how to phrase your request? A simple, professional email is the way to go. It gets the job done without any fuss.

Here’s a quick template you can tweak and use:

Subject: Request for Income Statement / Final Payslip for [Your Name] Dear [Payroll/HR Manager Name], I hope you are well. I am writing to request a copy of my income statement for the [Financial Year] financial year. If that isn't available, would you be able to provide me with my final payslip showing the year-to-date totals, please? I need this information to finalise my tax return. Thank you for your assistance. Kind regards, [Your Name] [Your Employee ID, if applicable]

This same approach works even if you need to contact a previous employer. Of course, things get a bit more complicated if the business has closed down. If that’s the case, your next step is to get in touch with the appointed liquidator or administrator.

Having a solid backup plan like this ensures you can still get your taxes lodged correctly and on time. This is just one of the many practical strategies we cover when we teach you [how to maximise your tax return in Australia with expert tips](https://www.baronaccounting.com/post/maximize-tax-return-australia-expert-tips).

Using a Tax Agent to Handle Everything for You

If the thought of navigating the ATO system or chasing up old documents makes you groan, bringing a registered tax agent on board is a smart, stress-free move. It's the perfect solution if you're strapped for time, run a business, or just want the peace of mind that comes from having a professional in your corner.

When you authorise a professional like Baron Tax & Accounting, we get direct access to your income statement through the ATO's dedicated tax agent portal. This secure channel means we see what the ATO sees, allowing us to spot and fix discrepancies often before you even know they exist.

What a Tax Agent Handles for You

The process couldn't be simpler. Once you’re signed on as a client, we become your authorised representative with the ATO.

This means we can:

Immediately see all your income statements, even those that haven't been finalised in your myGov account.

Contact employers for you to chase up any missing or incorrect details.

Talk directly to the ATO to sort out any issues that might pop up.

Handing things over to a tax agent is about more than just getting your PAYG summary. It’s about getting a final, expert review of your entire tax situation, which is an invaluable safeguard against costly mistakes.

Investing in Accuracy and Peace of Mind

This service goes far beyond just pulling a document for you. A good agent makes sure every figure is correct and all the necessary information is accounted for before lodging your return.

What's more, our expertise is critical for finding opportunities you might otherwise miss. We often find that clients aren't aware of all the financial benefits and deductions available to them. To see what you could be claiming, have a look at our detailed guide on individual tax deductions. Think of it as an investment in getting your tax right.

Got Questions About Your PAYG Summary? We've Got Answers

When you're trying to track down your PAYG summary, it’s easy to get tangled up in tax jargon. A few key questions always seem to pop up, but don't worry—getting clear answers doesn't have to be a mission.

Let's clear up a common point of confusion right away: the difference between a simple payslip and your annual summary. Think of a payslip as just one scene; it shows what you earned and the tax paid for a single week or fortnight. Your income statement (the new name for a PAYG summary) is the whole movie—it's the finalised, year-long story of your earnings with that one employer. You absolutely need these finalised totals for your tax return.

What Does 'Not Tax Ready' Mean?

You’ve logged into myGov, found your income statement, but see the words 'Not tax ready' next to it. What does that mean? It’s simple: your employer hasn't officially signed off on your yearly pay details with the ATO yet.

It is crucial that you wait until this status flips to 'Tax ready'. Lodging your return with unfinalised figures is asking for trouble. The final numbers could change, and you might find yourself with an unexpected tax bill from the ATO after they process an amendment.

Waiting for the 'Tax ready' status is your green light. It confirms that your employer and the ATO agree the numbers are final, correct, and ready to go for your tax return. Don't lodge without it.

What If I Had Multiple Jobs?

Juggled a few jobs throughout the financial year? No problem. When you check your myGov account, you'll see a separate income statement listed for each employer who reported your earnings.

When you do your tax return, you must declare the income from all of these sources. The ATO gets this information anyway, so making sure every statement is included is essential for lodging a correct and compliant return. Each job adds to your total taxable income, and leaving one out is a classic mistake that can cause headaches later on.

Feeling like it's all a bit much? Let the experts at Baron Tax & Accounting take it from here. We can access your statements, check everything for accuracy, and work to get you the best possible refund. It's all done for an affordable fee with no upfront payment needed. Lodge your tax return with confidence today.

Comments