How to File Taxes in Australia A Simple Guide

- Jul 20, 2025

- 17 min read

Filing your taxes in Australia boils down to a pretty simple exchange: you tell the Australian Taxation Office (ATO) what you’ve earned, and you claim any eligible expenses you paid to earn that income. It’s a process that can feel daunting, but with a bit of preparation, it’s entirely manageable.

Your Essential Pre-Lodgement Checklist

Let's be honest, the secret to a stress-free tax time isn't some magic formula—it's preparation. Diving into your tax return without getting your documents in order is a recipe for frustration. Think of this first phase as setting the foundation. Get this right, and everything else falls into place much more smoothly.

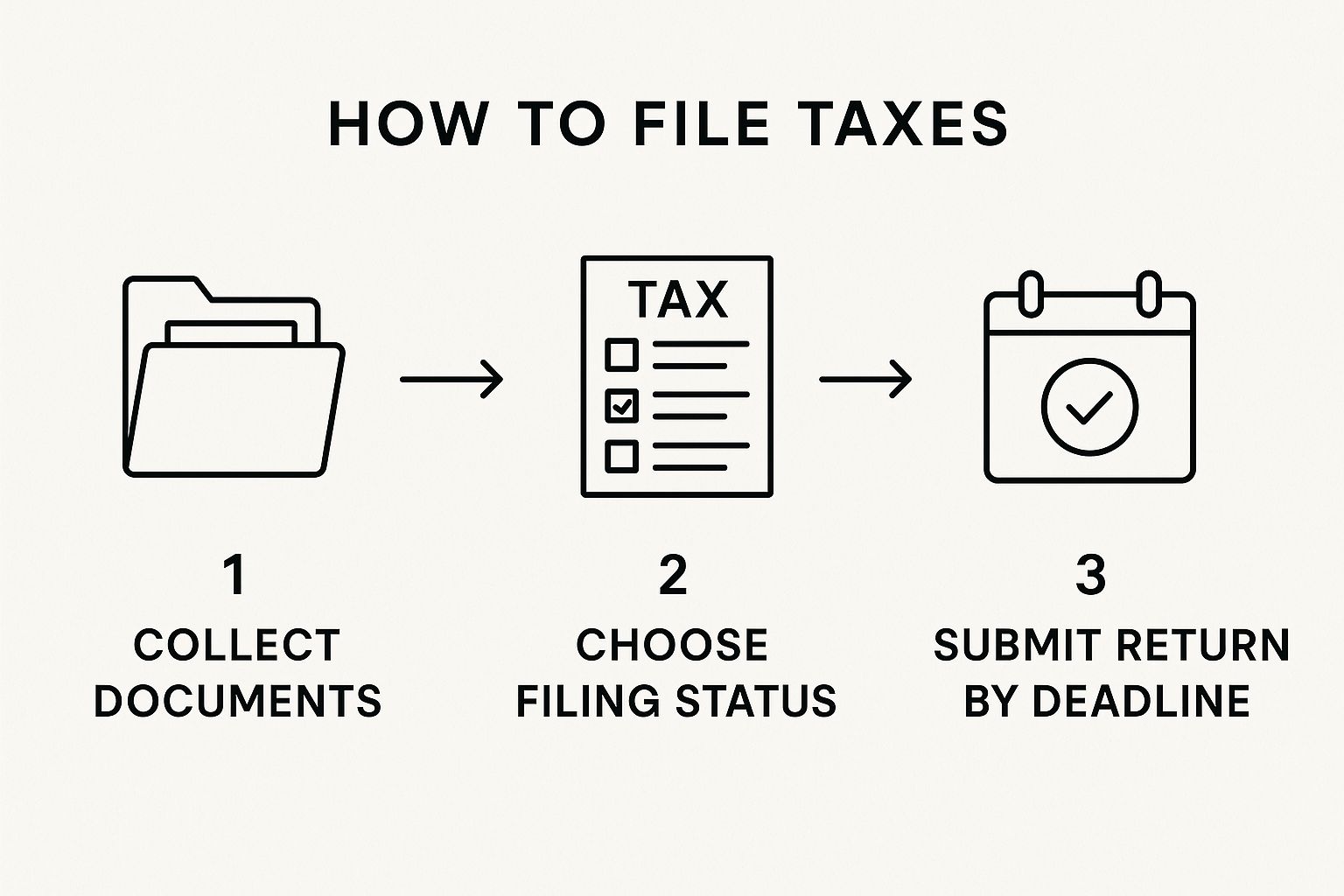

This simple flowchart lays out the journey ahead.

As you can see, gathering your paperwork is the bedrock of the entire process. Without it, you can't move forward.

The Non-Negotiables Before You Start

Before you even think about numbers and deductions, there are two absolute must-haves. These are the keys that unlock the entire system and allow the ATO to identify you correctly.

Your Tax File Number (TFN): This is your personal identifier with the ATO. You simply can't lodge a tax return without it. Make sure you have it handy and keep it secure.

A myGov Account Linked to the ATO: For most people, myGov is the main portal for dealing with government services. Your account needs to be active and properly linked to the ATO to access their online services, like myTax. Sorting this out early saves a world of pain later.

Expert Tip: Check your TFN and myGov connection well before the deadline. It's a five-minute job that can prevent hours of headaches caused by last-minute access problems. Trust me, it's the most common roadblock we see.

Gathering Your Financial Paperwork

Once you’ve confirmed your access, it's time to play detective and gather all your financial documents. The more organised you are at this stage, the easier it will be to report your income accurately and, just as importantly, claim every single deduction you're entitled to. You're essentially putting together a financial puzzle; you need all the pieces to see the complete picture.

To make sure you don't miss a thing, our team has put together a detailed guide. For a complete rundown, take a look at our comprehensive tax return checklist.

To give you an idea of the scale we're talking about, ATO statistics show that for the 2024 financial year, over 15.7 million individual tax returns were lodged. It's a huge annual task for the country. Interestingly, tax agents filed more than 9.5 million of these returns, while self-preparers handled over 6.0 million. This shows a healthy mix of Aussies who prefer expert help and those who feel confident going it alone.

Having all your information ready from the start makes the process so much faster, whether you choose to do it yourself or work with a professional service like ours at Baron Tax & Accounting. A little organisation truly goes a long way.

Here’s a quick table to summarise the essential documents and information you should have before you begin.

Tax Filing Checklist Before You Begin

Item | What It Is | Where to Find It |

|---|---|---|

Tax File Number (TFN) | Your unique 9-digit number with the ATO. | Your payslips, previous tax returns, or correspondence from the ATO. |

Income Statements | Details of salary, wages, and other income. | Pre-filled in myTax or from your employer(s). |

Bank Interest | Interest earned from your bank accounts. | Your bank statements or often pre-filled in myTax. |

Deduction Receipts | Proof of work-related expenses. | Your own records: digital receipts, bank statements, invoices. |

Private Health Insurance | Your annual statement for the tax rebate. | Your health fund will send this to you or make it available online. |

Getting these items together first will make the actual filing process much more efficient and less stressful.

Reporting Your Income Correctly

Getting your tax return right starts with one fundamental task: reporting every dollar you’ve earned. It’s about more than just the regular salary that hits your bank account. The ATO wants the full story of your financial year, which means you need to account for all your income sources, no matter how small they might seem.

Trust me on this—under-reporting your income is the fastest way to get a letter from the ATO you don't want. Their data-matching systems are incredibly sophisticated these days, pulling information from your employer, your bank, government agencies like Centrelink, and even share registries. It's best to assume they already know about most of your earnings before you even log in to start.

Beyond Your Standard Paycheque

For most of us, our main income comes from our job. Your employer handles the heavy lifting here, reporting your salary and the tax they've withheld directly to the ATO. This information pops up in your income statement, which you’ll find pre-filled in myTax, usually by late July.

The key is not to stop there. It's your job to add any other income that hasn't been automatically included.

Common sources people sometimes forget include:

Bank Account Interest: Yep, even that few dollars of interest on your savings account is taxable income. You'll find the total on your annual bank statement or by checking your online banking portal.

Share Dividends: If you own shares, any dividends are considered income. Your share registry, like Computershare or Link Market Services, sends out an annual statement with all the details you need.

Government Payments: Any payments from Centrelink or the Department of Veterans' Affairs count as taxable income. The good news is these are almost always pre-filled by the ATO.

Rental Income: For all the property investors out there, every cent of rent you receive needs to be declared. On the flip side, this also opens the door to claiming a whole host of deductions, which we'll get into later.

Getting this right is the cornerstone of filing your taxes correctly. Missing even small amounts can lead to the ATO adjusting your return and potentially hitting you with penalties.

Income from Side Hustles and the Gig Economy

The gig economy has made earning extra cash easier than ever, but it definitely adds a wrinkle to your tax return. Whether you're driving for a ride-sharing service, delivering food, or doing freelance work online, that income is 100% assessable.

Unlike a regular job, no tax is automatically taken out. This is a big one: you are personally responsible for putting money aside to cover your tax bill at the end of the year.

A Real-World Scenario: Let's look at Sarah, a graphic designer who freelances on the side. Over the year, she earned $8,000 from different clients. She has to declare that entire amount as business income on her return. Since no tax was withheld, it gets added to her salary from her main job, and she’ll be taxed on her total combined income.

It's vital to understand how this extra income affects your overall tax rate. Australian income tax rates for residents in the 2024-25 financial year start at 0% for income up to $18,200. From there, it’s 16% on income between $18,201 and $45,000, 30% for $45,001 to $135,000, 37% for earnings between $135,001 and $190,000, and a top rate of 45% on anything over $190,000 (not including the Medicare levy).

What About Superannuation?

Finally, a quick word on super. The standard compulsory super contributions your employer makes—the Superannuation Guarantee—are not part of your taxable income.

However, other types of contributions are treated differently. Any reportable superannuation contributions, like amounts you've salary-sacrificed or personal contributions you've claimed a deduction for, will be listed on your income statement. While they aren't taxed like your salary, they are used to work out your eligibility for certain government benefits and things like HELP debt repayments. Making sure all your income sources are accurately reported is the single most important step for a smooth, stress-free tax time.

Finding Every Work-Related Deduction You Deserve

Once you've got all your income sorted, the next mission is to shrink your taxable income. This is where your work-related deductions become your best friend. Claiming every legitimate expense is the most powerful way you can influence your tax outcome, often meaning you pay less tax or get a bigger refund back in your pocket.

Think about it like this: the government only wants to tax your work profit, not the money you had to spend just to earn that income in the first place. This part of your tax return is your chance to show the ATO exactly what those costs were.

Before we get into the nitty-gritty, you absolutely have to know the ATO's three golden rules. Every single expense you claim must tick all three of these boxes:

You had to spend the money yourself and weren't paid back for it by your boss.

The expense must be directly linked to earning your income.

You must have a record to prove it (think receipts, invoices, or bank statements).

If a claim fails even one of these tests, it's not a goer. It’s that simple.

Common Deduction Categories Unpacked

Work expenses can look wildly different from person to person. What a nurse claims will be nothing like an office worker's deductions, and a tradie's list will be completely different from a freelance writer's.

Let's walk through some of the most common categories with a few real-world examples.

Vehicle and Travel Expenses This is a huge one for many Aussies, but it's also an area the ATO watches like a hawk. You can claim the costs of using your personal car for work, like driving between different job sites or visiting clients. What you can't claim is the daily commute between your home and your main workplace—that's considered private travel.

You have two ways to claim these costs:

Cents per kilometre method: This is the straightforward choice. You can claim a set rate of 88 cents per kilometre for the 2024–25 income year, capped at 5,000 business kilometres per car. You don't need a folder stuffed with receipts, but you do need to be able to show how you worked it out, like keeping a simple diary of your work-related trips.

Logbook method: This one takes more effort but can lead to a much bigger claim if you use your car a lot for work. You’ll need to keep a detailed logbook for at least 12 continuous weeks to work out your car's business-use percentage. You can then claim that percentage of all your car's running costs—fuel, insurance, rego, services, and even its depreciation.

Home Office Expenses With so many of us working from home these days, claiming home office expenses has become standard practice. The rules here are quite specific. You generally need a dedicated area to work from and be able to show you’re incurring extra running costs because you're working from home.

There are two main methods to calculate your claim:

Fixed rate method: This is the simple, no-fuss option. For the 2024–25 financial year, you can claim a flat rate of 70 cents for every hour you work from home. This handy rate is a shortcut that covers your electricity and gas, internet, phone usage, and stationery. You just need proof of the hours you worked, like a timesheet or a diary.

Actual cost method: This involves adding up the work-related portion of every single one of your home office expenses. It's definitely more complex and demands meticulous records for every bill, but if you have significant costs, it can really pay off.

Scenario in Action: Meet Liam, a graphic designer who works from his home office three days a week. He can't claim a portion of his rent or mortgage interest. But he can claim his Adobe Creative Cloud subscription and a percentage of his electricity bill. Using the fixed rate method, he just tracks his hours. With the actual cost method, he'd need to keep all his utility bills and carefully calculate the work-related percentage.

Industry-Specific Claims You Shouldn't Overlook

Beyond the big, common categories, tons of deductions are tied directly to what you do for a living. This is where a little bit of careful thinking about your specific job can really help you maximise your return.

Tools and Equipment: A carpenter can claim his power tools, just as a photographer can claim her cameras and lenses. For any single item that costs over $300, you typically claim its decline in value (depreciation) over a few years, rather than all at once.

Protective Clothing: That sun hat for working outdoors, the steel-capped boots on a construction site, or the high-vis vest you need in the warehouse are all claimable. A standard business suit or regular office attire, however, is considered private clothing and can't be claimed.

Self-Education Expenses: Did you do a course or some training that's directly related to your current job? If it's likely to help you maintain or even increase your income, you can claim the costs. For more information on how your income impacts your tax obligations, check out our guide on how to claim the tax-free threshold in Australia.

At the end of the day, successfully lodging your tax return comes down to being both thorough and honest. Keep good records, make sure you understand the rules, and never try to claim something you aren't entitled to. If you're ever in doubt, getting a bit of professional advice gives you peace of mind and ensures you get the best possible result.

Mastering Your Tax Record-Keeping Habits

If claiming deductions is how you boost your tax refund, then solid record-keeping is the foundation that holds it all together. It's not a chore to be dreaded; think of it as your year-round strategy for a stress-free tax season and a better financial outcome.

Developing good habits here is your best defence against last-minute panic and potential questions from the Australian Taxation Office (ATO). The rule is simple: if you can't prove you spent it, you can't claim it. Let's walk through some practical ways to make sure every dollar you spend to earn your income is properly accounted for.

What Counts as a Proper Record?

So, what does the ATO actually consider a "valid record"? It’s a bit more than just a line on your bank statement. While that proves you spent the money, it often fails to show the most important detail: what you actually bought.

For a record to hold up under scrutiny, it needs to have a few key details:

The name of the supplier

How much you spent

A description of the goods or services

The date you paid for the item

The date the document was created

This is precisely why a tax invoice or a detailed receipt is the gold standard. A bank statement on its own might not cut it if the ATO decides to take a closer look at your claims.

Simple Strategies for Year-Round Tracking

The thought of keeping every single receipt probably sounds like a nightmare, but modern tools make it surprisingly manageable. The real secret is finding a system that clicks with you and then sticking to it.

Here are a few methods I see clients use successfully:

Go Digital with Apps: The easiest route for many is using an app. The ATO’s own myDeductions tool is great, but other third-party expense trackers also let you snap a quick photo of a receipt, tag it, and forget about it until tax time.

The Digital Folder Method: If you prefer a more hands-on approach, this low-tech system is brilliant. Just create a folder on your computer for the financial year (e.g., "Tax 2025"). Scan or photograph your receipts as you get them and give them a clear name like "Bunnings_Tools_Aug24.pdf". For peace of mind, make sure your digital files are backed up; explore some good cloud backup solutions for small businesses to protect against data loss.

The Trusty Spreadsheet: Never underestimate a simple spreadsheet. Set up columns for the date, supplier, item description, and cost. This method forces you to engage with your spending and gives you a clear running total of your potential deductions.

Guidance from the ATO for the 2024-25 financial year consistently highlights the importance of organising tax documents early. Keeping digital or physical copies of your receipts throughout the year is crucial for substantiating claims and avoiding the stress of an audit.

How Long to Keep Your Records

Once your tax return is lodged, don't rush to the shredder. The ATO requires you to hang onto your records for at least five years from the date you lodge your return.

This five-year window exists so the ATO can review or audit past returns if needed. Having your documents organised and accessible makes this process painless and proves your claims were legitimate right from the start.

The Logbook: A Special Case

For certain claims, a simple receipt just isn't enough. The most common situation where you'll need more detailed proof is when claiming car expenses using the logbook method.

If you go down this path, you'll need to maintain a detailed logbook for a continuous 12-week period. In it, you'll document every single trip, noting the odometer readings, dates, and the purpose of the journey. This process helps you calculate a business-use percentage for your car, a figure you can then apply to all your vehicle's running costs for up to five years (as long as your driving habits don't significantly change).

Adopting these simple habits can transform tax time from a frantic paper chase into a calm, organised task. It’s genuinely the best thing you can do to support your claims and file with absolute confidence.

Lodging Your Return and Understanding the Outcome

Alright, you've done the heavy lifting. You've wrangled your income details and tallied up your deductions. Now for the final, and most important, part of the process: lodging your tax return with the Australian Taxation Office (ATO).

This is where all your preparation pays off. Let's walk through how to submit your return and what to expect once you’ve hit that button.

Choosing Your Lodgement Path

When it comes to filing your taxes in Australia, you have two main roads you can go down. The right choice really comes down to how complex your finances are, your own confidence with the numbers, and frankly, how much time you want to spend on it.

Going it alone with myTax: The ATO provides a free online platform called myTax, which you can get to through your myGov account. It's a solid option if your tax affairs are pretty straightforward—we're talking a standard salary, maybe a bit of bank interest, and a few simple deductions. The system even pre-fills a lot of your info, which is a great head start.

Bringing in a professional: If you're dealing with things like an investment property, capital gains from selling shares, or you have ABN income, it's almost always a smart move to use a registered tax agent. An expert, like our team here at Baron Tax & Accounting, can often spot deductions you didn't even know existed and will make sure your return is spot-on, which seriously lowers your chances of an audit down the track.

To help you figure out what’s best for you, here’s a quick comparison.

Factor | DIY with myTax | Registered Tax Agent |

|---|---|---|

Cost | Free | A fee applies (but it's tax-deductible). |

Deadline | October 31 (firm) | Extended deadline, often until May. |

Support | ATO online help and call centres. | Personalised advice and support from an expert. |

Complexity | Best for simple financial situations. | Ideal for complex returns with investments or business income. |

Confidence | Requires you to be confident in your own claims. | Peace of mind that an expert has reviewed your return. |

Navigating the Post-Lodgement Journey

Once you've submitted your return, your job is done for the moment. The ATO's systems get to work, and for most online lodgements, you can expect a result in about two weeks. As tax becomes more digital, being ready for electronic submissions is key. It's worth getting your head around the shift to digital tax processes to stay ahead of the curve.

The first thing you'll receive from the tax office is your Notice of Assessment (NOA). This document is crucial. It’s the ATO’s official summary of your tax for the year, telling you if you’re getting a refund, if you owe more tax, or if you’ve landed on zero.

Key Takeaway: I can't stress this enough: always compare your NOA against the estimate you got when you filed. Discrepancies can and do happen. If the ATO has changed something, your NOA will include an explanation. It’s on you to check it.

Tracking Your Refund or Managing a Tax Bill

Getting a refund? Fantastic! You can keep an eye on its progress through your myGov account or the ATO app. The status will typically change from ‘processing’ to ‘issued’ just before the money appears in your bank account.

If you have a tax bill to pay, the NOA will spell out the amount and the due date. Don't panic if the amount is more than you can pay in one go. The ATO is usually quite reasonable and allows eligible people to set up a payment plan. The worst thing you can do is ignore it—that just leads to penalties and interest.

What If You Made a Mistake?

It happens. You file your return, breathe a sigh of relief, and then remember a dividend payment you forgot or a deduction you missed. The good news is, it's fixable.

You can lodge an amendment to correct the error. You generally have a two-year window from the date on your NOA to make changes.

Answering Your Top Australian Tax Questions

Even the most organised person has questions come tax time. It’s completely normal. Over the years, we've heard just about everything at Baron Tax & Accounting, but a few questions pop up time and time again.

Let's clear up some of the most common sticking points so you can move forward with confidence.

What’s the Real Deadline for Lodging My Tax Return?

This is a big one. If you’re lodging your own tax return through the ATO's myTax portal, you have a hard and fast deadline: 31 October every year. Miss that, and you risk getting a "please explain" from the tax office, along with potential penalties.

But here’s a tip many people don't realise: using a registered tax agent like us gives you a massive advantage. We can typically get you an automatic extension, sometimes pushing your due date well into the next year. The catch? You have to be signed on as our client before the 31 October cut-off to be eligible.

Pro Tip: Falling behind schedule can lead to financial penalties. If the deadline is looming, it's always smarter to get professional help. You can learn more about the consequences by reading up on navigating penalties for a late tax return.

Can I Really Claim a Deduction Without a Receipt?

Ah, the age-old question! The short answer is: not usually. The Australian Taxation Office (ATO) is pretty strict about needing evidence for your claims. If you don't have a receipt, you generally can't claim the deduction.

What if I Realise I’ve Made a Mistake on My Return?

First off, don't panic. It happens to the best of us and it’s a fixable problem. If you spot an error after you've lodged, you can simply request an amendment. This is straightforward to do yourself through your myGov account, or you can just ask your tax agent to sort it out for you.

You generally have a two-year window from the date your Notice of Assessment was issued to correct a mistake. It’s always far better to be proactive and fix it yourself rather than wait for the ATO to find it. Honesty can save you from potential penalties and interest charges down the track.

Do I Have to Lodge a Return if I Earned Less Than the Tax-Free Threshold?

This is a surprisingly common point of confusion. Even if your income for the year was under the $18,200 tax-free threshold, you might still need to lodge.

Here’s why: if your employer withheld any tax from your pay throughout the year (check your income statement to see), filing a tax return is the only way you can get that money back as a refund.

If you earned below the threshold and are certain no tax was taken out, you should still let the ATO know. You can do this by submitting a 'non-lodgement advice'. This simply tells them you don't need to file for the year and stops them from flagging your account as overdue.

Let the Experts Handle Your Tax Return

Let's be honest, lodging your own tax return can be a real headache. You spend hours trying to make sense of ATO rules, all while worrying you’ve missed a key deduction that could be costing you money. It doesn't have to be this way.

At Baron Tax & Accounting, we live and breathe Australian tax law so you don't have to. Our job is to take the stress and guesswork out of the entire process. We dive deep into your situation to find every single deduction you're entitled to, ensuring your return is not only maximised but also fully compliant.

Forgetting a document is a common slip-up. Maybe you're not sure where to find your income statement now that they're digital. We can walk you through things like how to get your PAYG summary and other essential paperwork. The goal is simple: give you complete peace of mind and achieve the best possible financial outcome for you.

Why wrestle with confusing forms and regulations? Let us do the heavy lifting.

Need assistance? We offer free online consultations: * – Phone: 1800 087 213 * – LINE: barontax * – WhatsApp: 0490 925 969 * – Email: info@baronaccounting.com – Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments