Unlocking Value With a House Depreciation Schedule

- 3 days ago

- 9 min read

A house depreciation schedule is a critical document for any Australian property investor seeking to maximise their tax returns. It is a detailed report that outlines the decline in value of an investment property's structure and the assets within it, allowing investors to claim this depreciation as a significant tax deduction. This article is based on the Current Financial Year at the time of writing.

At Baron Tax & Accounting, we frequently observe that many Brisbane investors are unaware of the full extent of deductions available until they obtain a professionally prepared schedule. A comprehensive report from a qualified quantity surveyor identifies all claimable assets, significantly boosting an investor's annual tax return and improving the property's overall cash flow.

What Is a House Depreciation Schedule?

A house depreciation schedule is a comprehensive report, prepared by a specialist quantity surveyor, that details the tax deductions available from an investment property's wear and tear over time. The Australian Taxation Office (ATO) recognises this decline in value as a legitimate, claimable expense against rental income.

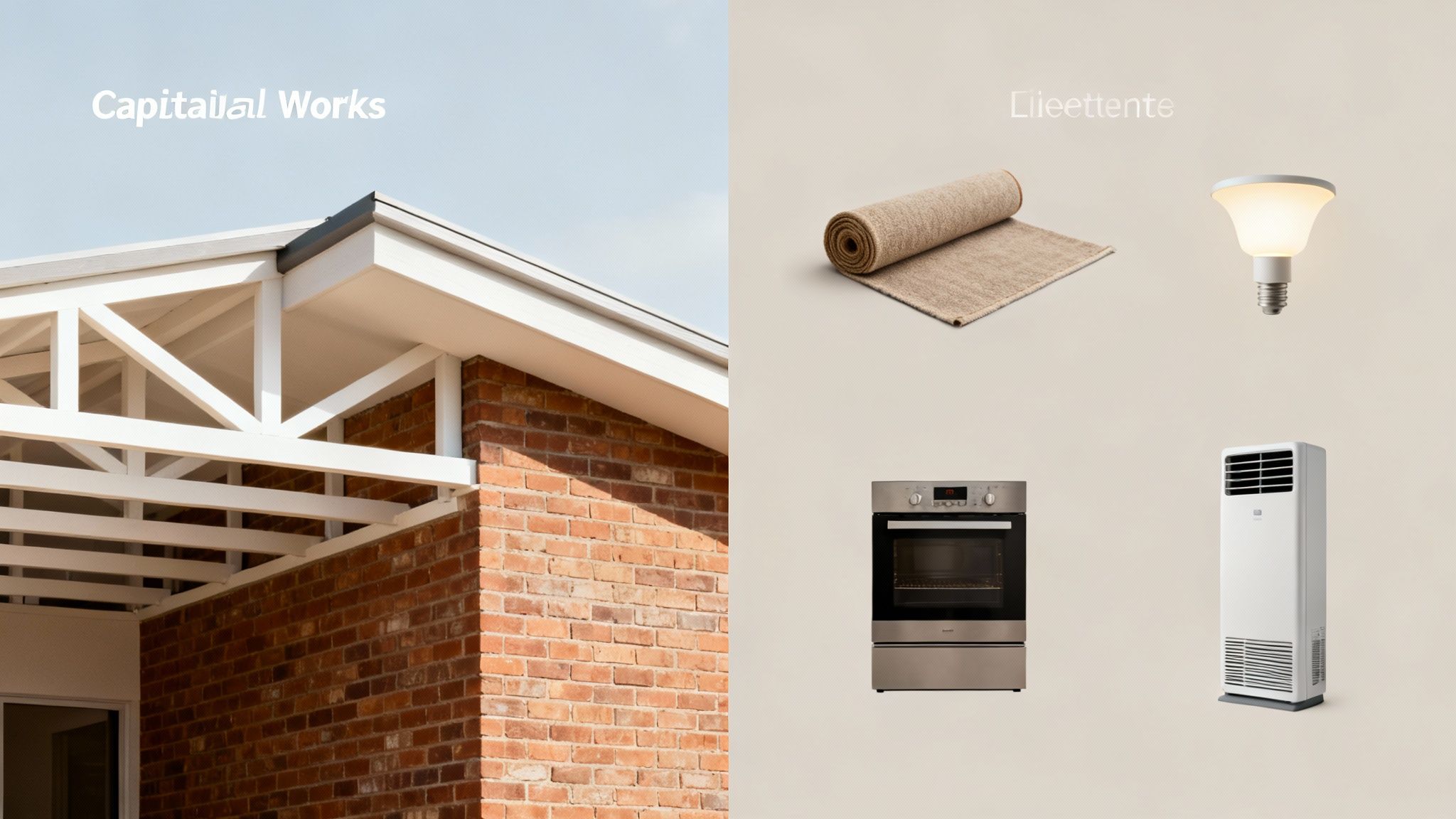

The concept is similar to a car losing value as it ages. An investment property's building structure, along with its fixtures and fittings like carpets, ovens, and air conditioners, also lose value. This loss is known as depreciation, and the ATO allows investors to claim it as a non-cash tax deduction.

Core Components of a Depreciation Schedule

To maximise tax returns, it is essential to understand the two distinct categories of depreciable assets, each with specific rules and rates.

graph TD

A[House Depreciation] --> B[Capital Works (Division 43)];

A --> C[Plant & Equipment (Division 40)];

B --> B1["Building's fixed structure"];

B --> B2["Examples: Walls, roof, foundation"];

B --> B3["Depreciates slowly (e.g., 2.5% over 40 years)"];

C --> C1["Removable or mechanical assets"];

C --> C2["Examples: Ovens, carpets, air conditioners"];

C --> C3["Depreciates faster based on effective life"];Capital Works (Division 43): This category covers the building's permanent structure and fixed items. This includes the foundation, walls, roof, doors, and built-in cupboards. These assets are depreciated at a set rate over a long period.

Plant and Equipment (Division 40): This category includes easily removable or mechanical assets, often referred to as fixtures and fittings. Examples include ovens, dishwashers, carpets, blinds, and smoke alarms. These items have a shorter effective life and depreciate more quickly.

A professional schedule meticulously lists every qualifying asset in a property, from the concrete slab to the ceiling fans. It calculates the annual deduction for each item and provides a forecast of these claims for up to 40 years. This provides a clear, year-by-year figure for your accountant, ensuring all legitimate deductions are claimed without guesswork. The key benefit is that this is a non-cash deduction—it reduces taxable income without requiring an actual cash outlay during the financial year.

Capital Works vs Plant and Equipment Deductions

A house depreciation schedule clearly separates claims into two categories as defined by the Australian Taxation Office (ATO): Capital Works and Plant and Equipment. Understanding this distinction is vital as each category has unique rules and depreciation rates that affect your tax return.

Understanding Capital Works (Division 43)

Capital Works deductions, also known as Division 43 claims, relate to the decline in value of the building’s core structure. These are the fixed components of the property. The deductions are based on the historical construction cost, not the property's purchase price.

Common examples of Capital Works include:

The building's foundations, walls, floors, and roof

Built-in kitchen cupboards, doors, and windows

Driveways, fences, and retaining walls

Pipes and electrical wiring

For qualifying residential properties, the ATO allows these deductions to be claimed at a standard rate of 2.5% per year over a 40-year period.

Exploring Plant and Equipment (Division 40)

Plant and Equipment, or Division 40 assets, are items that are generally removable or mechanical. These fixtures and fittings have a limited effective life and depreciate more quickly than the building's structure. The ATO assigns an individual 'effective life' to each item, which determines the rate of depreciation and often results in larger deductions in the initial years of ownership.

Typical Plant and Equipment assets include:

Carpets and vinyl flooring

Ovens, cooktops, and rangehoods

Air conditioning units and ceiling fans

Blinds, curtains, and light fittings

Hot water systems and smoke alarms

The following table summarises the key differences:

Attribute | Capital Works (Division 43) | Plant & Equipment (Division 40) |

|---|---|---|

Asset Type | Fixed structural components of the building. | Removable or mechanical fixtures and fittings. |

Examples | Walls, roof, foundations, built-in cupboards. | Carpets, ovens, air conditioners, blinds. |

Depreciation Rate | Generally 2.5% per year (prime cost method). | Varies based on the ATO's effective life of each asset. |

Depreciation Period | 40 years from the construction completion date. | Varies from a few years to over a decade. |

The Critical 2017 Legislative Changes

Investors must be aware of legislative changes introduced in May 2017 that affect claims for Plant and Equipment in second-hand residential properties. Under current ATO rules, an investor who purchases a pre-owned residential property cannot claim depreciation on existing or 'second-hand' Plant and Equipment assets. Deductions can only be claimed for brand-new assets purchased and installed after the property is acquired.

For instance, if you purchase a rental property in Brisbane that includes a five-year-old air conditioner, you cannot claim depreciation on that unit. However, if you replace it with a new one, you can claim depreciation on the new unit immediately. These rules do not affect Capital Works claims, which can still be claimed on qualifying properties. A quantity surveyor's report correctly identifies and excludes non-claimable second-hand assets, ensuring the schedule is fully compliant.

How a Depreciation Schedule Boosts Your Cash Flow

A house depreciation schedule is a powerful tool for improving an investment's financial performance by providing a 'non-cash' deduction. Unlike out-of-pocket expenses such as council rates or agent fees, depreciation allows you to claim a deduction for the property's wear and tear without any money leaving your bank account during the year.

By claiming these deductions, you lower your taxable income, which can result in a larger tax refund or a smaller tax liability. It is one of the most effective ways to improve the cash flow of an investment property.

Turning Paper Deductions into Real Cash

To illustrate how this works, consider a practical Brisbane-based example. An investor has a depreciation schedule showing a total claim of $10,000 for the financial year. If this investor is in the 32.5% marginal tax bracket, the deduction directly reduces their taxable income by the full $10,000.

Depreciation Claim: $10,000

Marginal Tax Rate: 32.5%

Tax Saved: $10,000 x 0.325 = $3,250

This results in a direct tax saving of $3,250. This money can be used to pay down the mortgage, cover maintenance costs, or contribute to a future investment.

The Value of a Professional Report

To claim maximum deductions and ensure compliance, a report from a qualified quantity surveyor is essential. The Australian Taxation Office (ATO) specifies that only these professionals have the required expertise to estimate construction costs and asset values, particularly for older properties. Attempting to prepare a schedule yourself or asking an accountant to estimate values is not compliant and will likely be rejected by the ATO.

A professionally prepared house depreciation schedule is a one-off cost that provides benefits for the entire life of the investment, forecasting all claimable deductions for up to 40 years. For many Australian investors, property depreciation is the second-largest deduction claimed after loan interest. The fee for obtaining the report is also 100% tax-deductible, and in most cases, the tax savings from the first year's claim will exceed the cost of the report. For more information, you can review our guide on other common rental property deductions in Australia.

How To Get A Quantity Surveyor Report

To claim property depreciation, you must obtain a tax depreciation schedule prepared by a qualified quantity surveyor. The Australian Taxation Office (ATO) mandates this, as only these professionals possess the necessary expertise to estimate construction costs for tax depreciation purposes. They are trained to identify and value every depreciable item in a property. More information on their role can be found in this article about What Is a Quantity Surveyor?.

Checklist: The Process of Obtaining a Report

Here is a step-by-step guide to engaging a quantity surveyor:

[ ] Step 1: Request a Quote: Contact a quantity surveying firm with your property's details (address, purchase date, price) to receive a fixed-fee quote.

[ ] Step 2: Provide Documentation: Supply key documents, including the contract of sale and records of any renovations or improvements.

[ ] Step 3: Arrange a Site Inspection: The quantity surveyor will arrange a visit to the property to measure the building, identify materials, and list all Plant & Equipment assets.

[ ] Step 4: Cost Estimation and Calculation: The quantity surveyor estimates the original construction costs and calculates depreciation for both Capital Works and Plant & Equipment according to ATO rules.

[ ] Step 5: Receive the Final Report: You will receive a comprehensive 40-year schedule, ready to be provided to your accountant for inclusion in your tax return.

Understanding The Cost And Return

The cost of a depreciation schedule should be viewed as a one-off investment with a significant return. For a standard residential property, the fee typically ranges between $500 and $800.

The entire fee for the report is 100% tax-deductible. In almost all instances, the tax savings generated in the first year alone will be substantially greater than the report's initial cost. This single, deductible payment unlocks up to 40 years of potential tax savings.

Common Depreciation Mistakes to Avoid

Claiming property depreciation can significantly reduce your taxable income, but it requires careful adherence to ATO rules. Avoiding common errors is crucial to maximising deductions and maintaining compliance.

Mistake 1: Assuming an Older Property Is Ineligible

A common misconception is that properties built before September 1987 offer no depreciation benefits. While you cannot claim Capital Works on the original structure of a pre-1987 building, any renovations or improvements made since that date are claimable. Most older homes have undergone updates, such as new kitchens, bathrooms, or extensions, which all contain depreciable assets. A quantity surveyor can identify and value these improvements, often uncovering substantial deductions.

Mistake 2: Attempting a DIY Depreciation Schedule

Preparing a depreciation schedule yourself or asking an accountant to estimate the values is a critical error. The ATO is explicit that only a qualified quantity surveyor is authorised to estimate construction costs for depreciation. A self-assessed schedule is non-compliant and will be rejected during an ATO review, potentially leading to amended tax returns, penalties, and interest charges.

Mistake 3: Forgetting to Update the Schedule After Renovations

A depreciation schedule is not a static document. If you undertake significant renovations, the schedule must be updated. For example, if you spend $30,000 on a new kitchen, these new assets can be depreciated. It is also important to account for the assets that were removed. A quantity surveyor can perform a "scrapping" valuation on the old assets, allowing you to claim an immediate deduction for their remaining value. They will then add the new assets to your schedule, ensuring your claims remain accurate and maximised.

Summary

A house depreciation schedule is an essential tool for property investors to legitimately lower taxable income and improve cash flow. It functions as a "non-cash deduction," providing a tax benefit without requiring a direct cash expense during the year.

The key to maximising these deductions lies in understanding the two main categories: Capital Works (the building's structure) and Plant & Equipment (removable fixtures and fittings). Obtaining a report from a qualified Quantity Surveyor is mandatory according to the ATO. The fee for this report is tax-deductible and typically pays for itself in tax savings within the first year. Data from BMT Tax Depreciation on property market trends suggests that while both houses and units offer significant deductions, units often yield higher average claims in the first year.

Frequently Asked Questions (FAQs)

Is my investment property too old to claim depreciation?

Not necessarily. While you generally cannot claim Capital Works on residential properties built before 15 September 1987, you can claim depreciation on any renovations or upgrades completed after this date. A quantity surveyor can assess the property to identify these claimable improvements.

Can I claim depreciation on a property I used to live in?

Yes. You can begin claiming depreciation from the date the property is genuinely available for rent. You cannot claim for the period you occupied it as your main residence. A quantity surveyor will value the assets at the time it first became an investment property. Be aware this may have Capital Gains Tax (CGT) implications upon sale.

How much does a house depreciation schedule cost?

For a standard residential property, the one-off fee is typically between $500 and $800. This fee is 100% tax-deductible, and the tax savings in the first year usually exceed the cost of the report.

Do I need a new schedule after renovating my property?

Yes, it is highly recommended. A quantity surveyor can perform a 'scrapping' valuation on the assets you removed, allowing an immediate deduction for their remaining value. They will then update your schedule to include the new assets, ensuring your future claims are maximised and accurate.

Can I claim depreciation if my property was unoccupied?

Yes, you can claim depreciation for any period the property was genuinely available for rent, even if it was vacant. The ATO requires that the property was actively advertised for lease. It is advisable to keep records of rental listings as proof of availability.

Before you finalise this

The information provided in this article is general in nature and is not intended to be personalised financial or tax advice. Property investment tax laws are complex, and the potential deductions and outcomes can vary significantly based on your individual circumstances, the property's history, and current legislation.

To ensure you are fully compliant with ATO requirements and are maximising your legitimate deductions, it is always recommended to seek professional advice. Consulting with a qualified tax agent and a quantity surveyor will provide clarity on your specific situation and help you make informed financial decisions.

Mandatory Contact Section – Always at the End

Baron Tax & Accounting

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213

Whatsapp: 0450 468 318