Tax Tips for Medical Professionals and Other Medical Professionals

- Aug 20, 2025

- 18 min read

Working in healthcare is one of the most demanding jobs out there. Your days are complex, and frankly, your tax obligations can feel just as complicated. This guide is built to cut through that complexity for doctors, nurses, paramedics, specialists, and other medical professionals here in Australia. We'll break down the essentials—from reporting all your different income streams correctly to making sure you claim every single work-related deduction you're entitled to.

Your Guide to Australian Tax Obligations

Let's be honest, they don't cover the Australian tax system in medical school. But getting it right is a critical part of your professional life. The financial landscape for medical pros is unique, with its mix of income sources, very specific work-related expenses, and compliance rules set by the Australian Taxation Office (ATO).

Understanding these details is the key to not just meeting your obligations, but actually improving your financial health. Think of this guide as your practical roadmap. We'll walk through the core parts of your tax return, step-by-step, so you can handle your finances with confidence.

A Growing and Complex Field

Australia's healthcare and social assistance sector is our largest and fastest-growing industry, mostly thanks to an ageing population and ever-changing healthcare needs. The field is projected to grow by 14.2% in the five years up to May 2026, which means about 249,500 new jobs.

This growth isn't just about numbers; it creates a huge variety of roles and employment setups. You might be a salaried employee at a hospital, an independent locum contractor, or a private practice owner. Each one of these structures has completely different tax implications.

It's a common mistake to think all medical professionals follow the same tax rules. Your specific role—whether you’re a GP, a registered nurse, a surgeon, or a physiotherapist—directly shapes what income you need to report and which deductions are available to you.

What This Guide Will Cover

To give you a clear path forward, this guide will systematically tackle the key areas every medical professional should be thinking about at tax time. Our goal is to give you a structured approach that makes the whole process simpler and empowers you to make smart financial decisions. While this article gives a solid overview for many roles, our ultimate tax guide for doctors in Australia dives even deeper for physicians.

Here’s a quick look at what we'll get into:

Reporting Diverse Income: How to correctly handle everything from your standard salary to locum work, allowances, and private practice fees.

Unlocking Deductions: A full rundown of the common (and often missed) work-related expenses you can claim.

High-Value Claims: A closer look at the big ones, like car and home office expenses, that can make a real difference.

Record-Keeping Essentials: Practical tips to keep your records ATO-compliant without all the stress.

Avoiding Common Pitfalls: We'll flag the frequent mistakes people make so your tax return is accurate and audit-proof.

To make navigating this guide even easier, we've put together a quick checklist of the topics we'll cover. Use it to jump straight to the sections you need most.

Your Tax Season Checklist at a Glance

Tax Area | Key Focus | Why It Matters for Your Return |

|---|---|---|

Income Reporting | Locum work, private fees, allowances | Ensures you accurately report all earnings beyond your base salary to avoid ATO issues. |

Work-Related Deductions | Uniforms, self-education, equipment | Maximises your refund by claiming every legitimate expense related to your job. |

Car & Travel Expenses | Kilometres, logbooks, transport costs | A significant deduction area, but requires precise record-keeping to claim correctly. |

Home Office Claims | Running costs, dedicated space | Essential for anyone doing admin, research, or telehealth from home. |

Record-Keeping | Digital tools, ATO requirements | Good records are your best defence in an audit and make tax time much smoother. |

This table is your quick-reference tool. Now, let's dive into the details of each of these areas.

Reporting Your Income Beyond a Standard Salary

For most doctors, nurses, and other medical professionals, income is rarely a simple, one-size-fits-all figure. Your primary salary is the starting point, but your total earnings likely include several other streams that you must declare to the Australian Taxation Office (ATO).

Understanding how to report these different income sources is the first real step to lodging an accurate tax return. It ensures you have a complete picture of your assessable income before you even start thinking about what you can claim. Getting this right from the beginning sets you up for a much smoother, stress-free tax time.

Identifying Your Assessable Income Streams

So, what is assessable income? It’s simply all the income the ATO looks at when working out how much tax you owe. For those in the medical field, this often goes well beyond a standard payslip and includes payments specific to the healthcare industry. It’s absolutely vital to capture everything to avoid any trouble down the track.

Here are the common income types you’ll need to report:

Salary and Wages: This is the easy one. It’s your regular pay from a hospital or clinic, plus any overtime, bonuses, or paid leave you’ve received.

Locum and Contract Work: Money earned from temporary or contract roles is fully assessable. If you’re working as a sole trader, this gets reported as business income.

Allowances and Reimbursements: Any extra payments for specific duties or conditions, like on-call allowances, uniform allowances, or travel reimbursements, must be declared.

Private Practice Fees: If you run a private practice, all income from patient fees, Medicare benefits, and payments from private health insurers is considered business income.

Government Payments: This includes payments from programs like the Practice Incentives Program (PIP) or the Workforce Incentive Program (WIP).

The Nuances of Locum and Contract Income

Working as a locum or an independent contractor gives you great flexibility, but it also completely changes your tax responsibilities. Unlike a salaried employee where the employer withholds tax (PAYG withholding), contractors are generally responsible for managing their own tax.

This means you’ll probably need to put aside a portion of your earnings to cover your income tax and Medicare levy. You might also need to register for GST and lodge Business Activity Statements (BAS) if your annual turnover hits the $75,000 threshold. There’s no getting around it—you have to accurately track all your income and business expenses.

Think of yourself as a small business. Every dollar you earn from contract work needs to be recorded. Failing to declare this income is one of the fastest ways to get unwanted attention from the ATO.

Beyond your standard salary, many medical professionals generate significant income through their practice. Learning how to manage and grow this is key to smart financial planning.

Reporting Investment and Other Income

Of course, your professional life is just one part of your financial world. Any income you earn from sources outside of your medical work also has to be declared. This is an area people sometimes overlook, but it's just as important for staying on the right side of the ATO.

Common examples include:

Interest from your bank accounts.

Dividends from any shares you own.

Capital gains from selling assets like property or shares.

Rental income from an investment property.

Keeping detailed records for all these income streams throughout the financial year is non-negotiable. Getting this foundational step right makes the next part—calculating your deductions—so much easier.

Unlocking Your Work-Related Tax Deductions

Once you’ve nailed down your income reporting, the next big step is claiming every single work-related deduction you’re entitled to. This is where you can seriously shift the needle on your tax outcome, lowering your taxable income and hopefully boosting your refund. For doctors, nurses, and other medical professionals, the list of potential claims is surprisingly long and very specific to the industry.

It’s a common story: many medical professionals miss out on claiming things they’re perfectly entitled to, simply because they don't know they can. It goes beyond the obvious things like professional registration fees – think about the cost of laundering your scrubs or subscriptions to medical journals. Every dollar really does count.

And we're not talking about a small group of people here. Australia’s Health Care and Social Assistance industry is the country's largest employer, making up about 16.1% of the total workforce as of February 2024. With over 2.3 million people in this sector, getting a handle on these tax rules is a big deal for a huge chunk of the population. You can see the full breakdown of this massive workforce over on the Jobs and Skills Australia website.

The ATO's Three Golden Rules for Deductions

Before we get into the nitty-gritty of what you can claim, you need to understand the three core principles that the Australian Taxation Office (ATO) applies to every single work-related claim. If your expense doesn't tick all three of these boxes, you can't claim it. Simple as that.

You had to have spent the money yourself and weren't paid back. If the hospital covered your conference ticket, you can't claim it again on your tax return.

The expense must be directly tied to earning your income. There has to be a clear, logical link between what you bought and your job as a medical professional.

You must have a record to prove it. This usually means a receipt, but things like bank statements or a detailed logbook can also work.

Think of these rules like a quick diagnostic checklist for each expense. Before you claim anything, just run it through this three-point test. Does it pass? If so, you're good to go. If not, best to leave it off your return.

Key Deduction Categories for Medical Professionals

To make this a bit easier to digest, let's group the most common deductions into a few key areas. This way, you can work through them systematically and make sure you haven't forgotten anything.

Professional Development and Self-Education

The medical field never stands still, and staying up-to-date is non-negotiable. The good news is that the costs of maintaining and sharpening your skills are generally tax-deductible, as long as the education directly relates to your current job.

You can usually claim expenses like:

Course and conference fees: This covers any seminars, workshops, and conferences designed to build on your existing expertise.

Professional journals and subscriptions: The cost of publications like The Lancet or the MJA are absolutely claimable.

Textbooks and reference materials: Any books directly relevant to your medical specialty are fair game.

Stationery and supplies: Think notebooks, pens, and the cost of printing course materials.

Essential Tools and Equipment

Every medical professional has their go-to tools. The cost of buying and maintaining the equipment you need to do your job is a clear-cut deduction.

A few common examples include:

Stethoscopes, thermometers, and blood pressure monitors.

Medical bags and specialised briefcases.

Protective gear like goggles, masks, and gloves, but only if you have to pay for them yourself.

Depreciation on pricier items (those over $300), like a top-of-the-line ophthalmoscope or a portable ultrasound machine.

Work-Related Travel Expenses

Travel claims can get a little tricky, but they often represent a major deduction opportunity. The key is knowing the difference between deductible work-related travel and your regular, non-deductible commute to and from home.

Deductible travel usually includes:

Driving between different work sites, like going from your main clinic to a hospital for a consultation.

Making house calls to visit patients.

Travelling to attend a conference or training course that isn't at your usual place of work.

You can claim costs like fuel, public transport fares, and even accommodation and meals if you have to travel overnight for work. This is especially crucial for sole traders to get right. Our in-depth guide on self-employed tax deductions dives much deeper into this and is well worth a read.

Protective Clothing and Uniforms

If you’re required to wear a specific uniform that clearly identifies you as a medical professional (like scrubs with a hospital logo), you can claim the costs of buying, laundering, and repairing it.

The ATO has some pretty specific guidelines here:

You can claim $1 per load for washing, drying, and ironing if the load is made up entirely of work clothes.

You can claim 50 cents per load if you mix in other personal laundry items.

Of course, you can always claim the actual costs if you’ve kept detailed records of your expenses.

While these rules are tailored for medical staff, it never hurts to look at the bigger picture. Learning how other industries approach their claims can offer a fresh perspective on documentation. There are many strategies for maximizing your tax deductions out there that highlight the universal importance of good record-keeping, and applying those core principles will only make your tax return stronger.

A Closer Look at High-Impact Deductions

Claiming for your scrubs and subscriptions is a good start, but there are a few big-ticket expenses that can really move the needle on your taxable income. For doctors, nurses, and other medical professionals, these larger claims usually centre on your car, your home office, and significant professional fees.

Getting these right is vital. They offer substantial tax savings but, unsurprisingly, also attract more attention from the Australian Taxation Office (ATO). Let's walk through these key areas so you can claim with confidence and keep yourself out of the ATO's spotlight.

Claiming Your Work-Related Car Expenses

For many in the medical field, your car is basically a mobile office. You might be driving between hospitals for different shifts, doing home visits with patients, or even hauling bulky equipment from one clinic to another. If that sounds like your day-to-day, you can claim a deduction for the work-related portion of your car expenses.

The ATO gives you two ways to do this, and the best choice really depends on your specific situation.

The Cents Per Kilometre Method: This is the straightforward option. For the 2024-25 financial year, you can claim 88 cents per kilometre for up to a maximum of 5,000 business kilometres per car. The beauty of this method is its simplicity – you don't need a shoebox full of receipts for fuel or servicing. You do, however, need to be able to show the ATO how you calculated those kilometres, like a simple diary of your work-related trips.

The Logbook Method: This one requires more admin, but it can lead to a much bigger tax deduction, especially if you spend a lot of time on the road for work. You’ll need to keep a detailed logbook for a continuous 12-week period, noting down every single trip—both for work and personal use. This logbook then establishes a business-use percentage that you can apply to all your car's running costs (think fuel, insurance, rego, servicing, and even the car's depreciation) for up to five years.

Choosing the right method is key. A surgeon who only drives between their private rooms and the hospital a few times a week might find the cents per kilometre method is enough. But a community nurse who is constantly driving to patients' homes would almost certainly get a better result with the logbook method.

Choosing Your Car Expense Method Logbook vs Cents Per Kilometre

Deciding between these two isn't always easy. This table breaks down the key differences to help you figure out which method will give you the better tax outcome based on your work travel.

Feature | Cents Per Kilometre Method | Logbook Method |

|---|---|---|

Claim Limit | Capped at 5,000 business kilometres. | No limit on kilometres, based on your actual business-use percentage. |

Record Keeping | Simpler. Need a diary or record of work trips to justify kilometres claimed. | More intensive. Requires a detailed 12-week logbook, plus receipts for all car running costs. |

What You Claim | A flat rate (88 cents per km for 2024-25) to cover all expenses. | A percentage of your actual car expenses, including fuel, insurance, rego, repairs, and depreciation. |

Best For | Professionals with infrequent or lower work-related car use. | Professionals who drive extensively for work and have higher running costs. |

Ultimately, if you drive a lot for work, the extra effort of keeping a logbook usually pays for itself several times over in tax savings.

The Home Office Deduction in the Age of Telehealth

With telehealth consultations becoming standard and administrative work piling up outside of clinical hours, home office claims are more relevant than ever for medical professionals. If you regularly work from home, you can likely claim a portion of your home running expenses.

The main way to claim now is the fixed-rate method, which lets you claim 70 cents for every hour you work from home. This rate is a package deal, covering your electricity and gas, internet, mobile and home phone usage, plus stationery and computer bits and pieces. A big plus is that you no longer need a separate, dedicated room to use this method.

To claim using the revised fixed-rate method, you must keep a record of the total hours you worked from home for the whole year. A simple timesheet or diary entry works perfectly. You also need to keep records like bills or receipts for the expenses covered by the rate, just to prove you actually incurred them.

It's important to remember that you can still make separate claims for the decline in value (depreciation) of your big-ticket office gear, like computers, monitors, and desks. And if you happen to own an investment property that you work from, figuring out how these rules overlap with rental property claims is a must. We cover this in more detail in our guide on tax deductions for rental property.

Don't Forget Your Professional Fees and Subscriptions

Beyond your car and home, a huge chunk of your deductions will come from the essential costs of being a registered and insured medical professional in Australia. These aren't optional—they're the cost of entry to your profession, and thankfully, they are fully deductible.

Make sure you're not missing these:

AHPRA Registration: Your annual fees to the Australian Health Practitioner Regulation Agency are a direct cost of earning your income.

Medical Indemnity Insurance: The premiums for your professional indemnity insurance are a critical and completely deductible expense.

Professional Association and Union Fees: Your memberships for organisations like the AMA, ANMF, or other specialist colleges are all claimable.

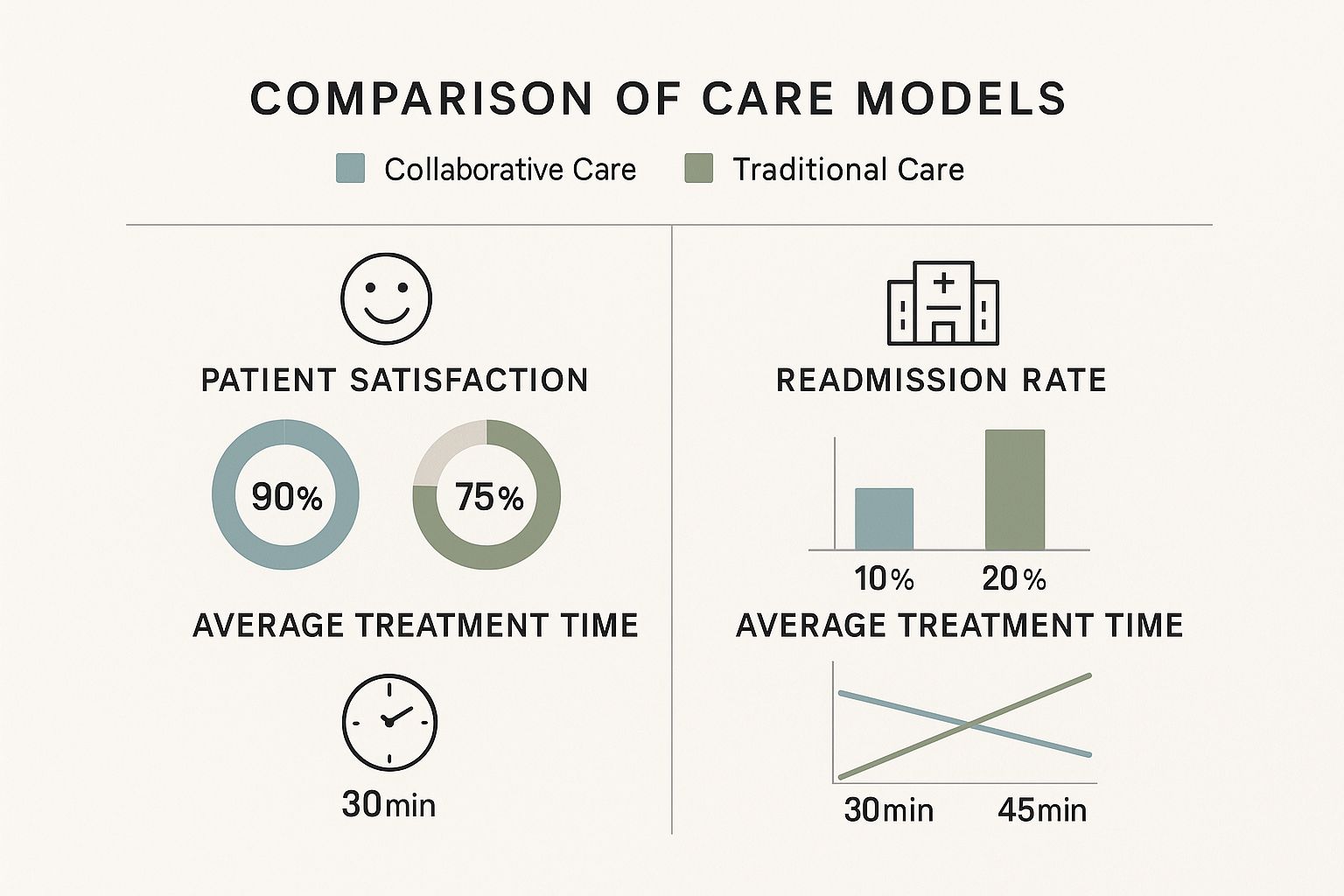

These memberships keep you connected to industry advancements, like the collaborative care models highlighted below.

As the data shows, these modern approaches lead to better patient outcomes across the board. Staying current through conferences and associations isn’t just good for your patients; it's a deductible part of your professional development.

Mastering Your Record-Keeping for ATO Compliance

For doctors, nurses, and other medical professionals, keeping meticulous records is just as vital to your financial health as accurate patient charting is to clinical outcomes. Let’s be honest, a shoebox full of receipts just won’t cut it. A disorganised approach to your finances can lead to missed deductions and, worse, unwanted attention from the Australian Taxation Office (ATO).

Building a solid system isn't just a good idea; it's non-negotiable for a stress-free tax time. It’s about more than just holding onto receipts. You need to understand what the ATO actually accepts as proof and use modern tools to make the whole process painless. Think of it as shifting tax time from a frantic scramble for documents to a calm, organised review.

What Counts as a Valid Record?

For every expense you claim, the ATO needs to see clear, undeniable proof. A simple credit card statement showing a purchase often isn't enough on its own to seal the deal.

A proper proof of purchase must show all the key details:

The supplier’s name

The exact amount of the expense

What the goods or services were

The date you paid for it

The date the document was issued

This is why a proper tax invoice is your best friend. For those tiny claims under $10 where getting a receipt isn't practical, a simple diary note with the details might pass. But always, always aim to get an invoice.

Think of each receipt as a piece of evidence you're presenting to make your case for a deduction. The stronger and more detailed your evidence, the more airtight your claim will be if the ATO ever comes knocking.

Luckily, we live in the digital age. Apps designed for expense tracking are a game-changer. You can just snap a photo of a receipt, and the app will digitise the important info and store it securely in the cloud. This gets rid of the physical clutter and makes pulling everything together at tax time incredibly straightforward. To make sure you're not missing anything, grab our comprehensive tax return checklist.

The Five-Year Rule and Why It’s So Important

Here’s a hard and fast rule from the ATO: you must keep your financial records for five years from the date you lodge your tax return. This isn't a suggestion; it's a requirement. Whether your records are paper or digital, you have to be able to produce them if asked during this period.

This five-year window is your safety net. It’s what allows you to back up every claim and defend your tax position if you're ever audited. If you lose those records, the ATO can simply disallow your claims, which could mean paying back tax, plus interest and penalties. No one wants that.

Right now, Australia is facing a major healthcare worker shortage, putting immense pressure on professionals like you. This is especially true in rural and remote areas, which can have up to 50% fewer healthcare professionals than cities. With your time being more valuable than ever, a slick digital record-keeping system isn't a luxury—it's a critical strategy for staying on top of your professional and financial life.

Common Tax Mistakes for Medical Professionals to Avoid

Lodging your tax return feels like the final sprint after a long financial year, but a few common slip-ups can turn into costly setbacks. Think of this section as your pre-flight check, highlighting the specific financial missteps that frequently trip up doctors, nurses, and other medical professionals. Getting these details right is your best defence for an accurate, audit-proof tax return.

Navigating the tax system means steering clear of both small oversights and major blunders. Even seasoned practitioners can fall into traps that attract unwanted attention from the Australian Taxation Office (ATO).

Mixing Private and Work-Related Travel

Travel claims are one of the most scrutinised areas for medical pros. While the journey between two separate workplaces—say, from your private clinic to a hospital appointment—is deductible, your daily commute from home to your main workplace is always considered private travel. It’s not claimable.

A classic mistake is claiming an entire trip when only part of it was for work. For instance, if you drive from home to a patient’s house for a home visit and then head to your clinic, only the second leg of that journey (from the patient’s home to the clinic) is deductible. Meticulous logbooks are your absolute best friend here.

Over-Claiming Self-Education Expenses

Continuous professional development is a non-negotiable part of a medical career, but not every course is tax-deductible. The expense must have a direct, clear connection to your current role and how you earn your income right now.

A junior doctor can’t claim the full cost of a specialist qualification course. Why? Because it’s designed to land them a future promotion or role, not to improve the skills needed for their current one. The expense has to maintain or improve the skills you use in your job today.

This distinction is crucial. Claiming education that qualifies you for a completely new profession or opens up a new income stream is a major red flag for the ATO.

Inaccurate Home Office Calculations

With telehealth appointments and admin tasks increasingly handled from home, claiming home office expenses is pretty standard. However, calculation errors are just as common. You must keep a diligent record of your hours worked from home to correctly use the ATO’s revised fixed-rate method.

Forgetting to make a separate claim for depreciating assets (like that new laptop or monitor) is another frequent pitfall. The 70 cents per hour fixed rate covers your running costs like internet and electricity, but it doesn’t include the decline in value of your expensive equipment.

While keeping your finances in order is key, it's also wise to stay informed on other professional risks, such as by understanding medical malpractice definitions and their career implications. Similarly, understanding how your income affects other tax obligations is vital; get the details in our guide on the Medicare Levy Surcharge for 2024. Engaging a tax agent who truly understands the medical field can provide invaluable peace of mind, ensuring every claim is legitimate and maximised.

Got Questions? We’ve Got Answers

Working in medicine brings its own set of unique tax questions. Here are some of the most common queries we get from doctors, nurses, and other medical professionals, answered simply and clearly.

Can I Claim My Daily Commute?

Unfortunately, your regular trip from home to your main workplace (like a hospital or your primary clinic) is considered private travel by the ATO, so you can’t claim it. This holds true even if you’re on call or travelling for an early or late shift.

However, once you're on the clock, travel between different work locations is another story. For example, if you drive from your clinic to the hospital to see a patient, and then head off to do a home visit, the costs for both of those trips are deductible.

Are Meals and Coffee During Shifts Deductible?

Grabbing a coffee or a quick lunch during your shift is generally seen as a private expense by the ATO and can’t be claimed. They view it as part of the normal cost of living that applies to everyone, regardless of their job.

The big exception? If you’re required to travel and stay overnight for work—say, for a locum placement in a regional town or an interstate conference—then your meal costs can be claimed as part of your travel expenses.

How Do I Claim for Expensive Equipment?

For big-ticket items costing over $300, like an ultrasound machine or specialised surgical tools, you can't claim the full cost in the year you buy it. Instead, you claim the decline in its value over time, which is known as depreciation.

Think of it this way: the ATO has an 'effective life' for every asset, which is its estimate of how long the item can be used to earn you income. You claim a portion of its cost each year to account for wear and tear, until its value has been fully written off.

Is the Interest on a Practice Buy-In Loan Deductible?

Yes, absolutely. If you’ve taken out a loan to buy into a private practice, the interest you pay on that loan is generally tax-deductible. This is because the loan is directly tied to generating your income through your share of the practice's profits.

Just be sure to keep meticulous records of the loan agreement and all your interest payments throughout the year. You'll need them to back up your claim.

Time for an Expert Opinion?

As a doctor or medical professional, you spend your days navigating complex situations with precision. Your finances deserve the same level of expert care. Trying to untangle Australian tax law on your own is not just time-consuming—it's risky. A simple oversight could mean missing out on significant deductions or, worse, facing compliance issues with the ATO.

Our team lives and breathes the financial world of the medical industry. We know the specific deductions you’re entitled to and the best strategies to ensure you keep more of your hard-earned income. Think of us as your financial specialists, here to take the stress out of tax time so you can focus on your patients.

Don't leave your financial health to chance. Let's make sure your tax strategy is as sharp and effective as your clinical skills. A quick chat can bring the clarity and peace of mind you need.

• Need assistance?

We offer free online consultations:

– LINE: barontax

– WhatsApp: 0490 925 969

– Email: info@baronaccounting.com

– Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator:👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage:🌐 www.baronaccounting.com

Comments