Meat Workers: Maximise Your Refund with Expert Tax Tips

- Sep 15, 2025

- 14 min read

If you work in the meat industry, you’re probably missing out on specific tax deductions that could seriously boost your refund. It’s a common story. This guide is here to walk you through the Australian tax system, breaking down the essentials and showing you exactly what you can claim to get the most back at tax time.

Understanding Your Tax Essentials

As a meat worker in Australia, getting your head around the tax basics is the first step to a better tax return. The work you do is tough and essential, and it comes with unique expenses that you can claim. Think of this guide as your roadmap to putting more of your hard-earned cash back where it belongs—in your pocket.

The Australian meat industry isn't just a big part of our economy; it's booming. The industry recently processed a record 8.88 million cattle, the highest annual figure since 2015. That massive number shows just how vital skilled workers like you are.

This guide keeps things simple, showing how tax rules apply directly to your role, whether you're a boner, slicer, packer, or manager.

Key Tax Concepts for Meat Workers

Let's start with the building blocks that every taxpayer needs to know, especially those in meat processing. Once you get these, the rest of the tax journey becomes much clearer.

Taxable Income: This isn't your total pay. It’s what’s left after you subtract all your allowable work-related deductions from your gross income. The lower this number, the less tax you pay.

PAYG Withholding: This stands for 'Pay As You Go.' It's the system where your employer takes out tax from your pay each week or fortnight and sends it straight to the Australian Taxation Office (ATO).

Tax Deductions: These are your golden ticket. They are the work-related costs you can claim back to lower your taxable income. For meat workers, this could be anything from specialised knives and stones to your protective boots and gloves.

Think of it like this: every dollar you spend on a legitimate work expense reduces your taxable income. That’s why keeping good records is so crucial. Each receipt you save could directly lead to a bigger refund.

Many of the tax principles for meat workers also apply to other hands-on jobs. For a wider view, our tax guide for factory workers in Australia has some great extra tips that you might find useful. The main goal here is to give you the confidence to tackle tax time, knowing you’ve claimed every single thing you're entitled to.

Unlocking Your Biggest Tax Deductions

Getting the best possible tax refund really comes down to one thing: claiming every single work-related expense you're entitled to. For meat workers, this list is probably longer than you imagine. This is where you can seriously move the needle on your tax outcome, turning everyday job costs into legitimate, money-saving deductions.

The secret isn't about finding sneaky loopholes; it's simply about understanding what the Australian Taxation Office (ATO) allows and keeping the right records. You just need to know the rules and how they apply to your specific job in the meat industry.

To claim any work-related expense, you have to meet three straightforward criteria, often called the 'golden rules' of tax.

You must have paid for it yourself and your boss didn't pay you back for it.

The expense must be directly tied to earning your income. It has to be a cost you incurred to do your job.

You must have a record to prove it. This is usually a receipt, but a bank statement can also work.

Think of these as a simple checklist. If your expense ticks all three of these boxes, you're almost certainly good to go.

Protective Clothing and Gear

Working on the floor of a meat processing plant means you need specific protective gear just to stay safe. These items are often your biggest and most clear-cut claims.

Footwear: Those steel-capped boots, non-slip gumboots, and any other required safety shoes are 100% deductible.

Protective Items: This covers all the essentials like heavy-duty gloves (both mesh and rubber), aprons, freezer jackets, and hearing protection.

Glasses: If you need prescription safety glasses for your job, their cost is also claimable.

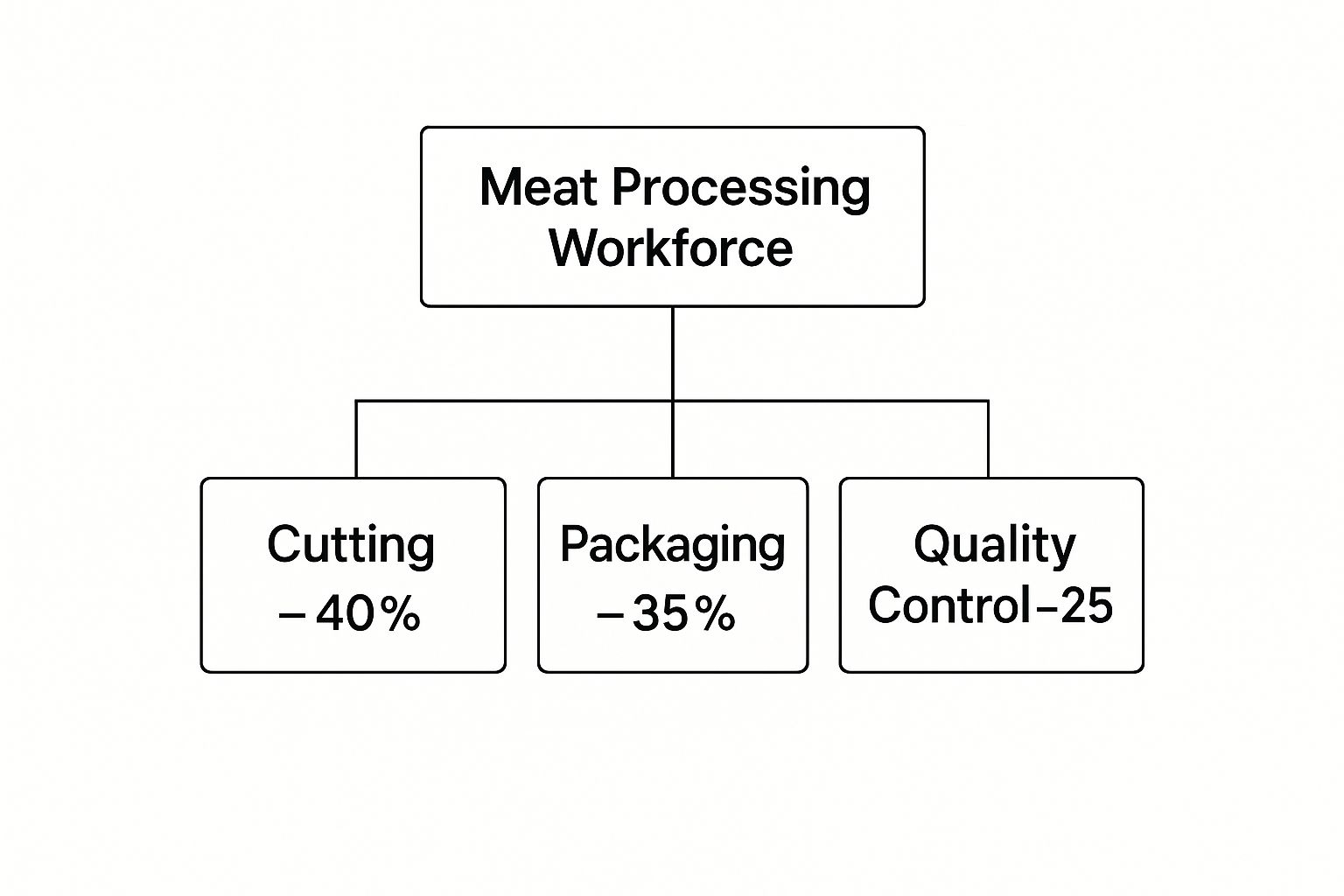

The image below gives you a sense of just how many roles within the industry rely on this kind of gear day in and day out.

As you can see, the vast majority of workers are in cutting and packaging roles. This means deductions for specialised tools and protective equipment are relevant to a huge chunk of the workforce.

Essential Tools of the Trade

If you’re a boner or a slicer, your tools are your livelihood. It makes sense, then, that the costs of buying and looking after them are deductible.

A classic mistake is claiming the cost of a new knife but forgetting about all the upkeep. That initial purchase is an obvious expense, but so are the sharpening stones, steels, and professional sharpening services you pay for throughout the year to keep your tools in top shape.

This category covers things like:

Knives, cleavers, and saws

Steels, sharpening stones, and electric sharpeners

Pouches, belts, and scabbards you use to carry your tools safely

Uniform and Laundry Expenses

If you have to wear a compulsory uniform with your employer’s logo on it, you can claim the cost of buying, mending, and cleaning it.

The ATO makes things a bit easier for laundry. You can claim up to $150 in laundry expenses without needing receipts. The accepted rate is $1 per load if it’s only your work clothes, or 50 cents per load if you mix them in with your regular washing.

To help you keep track, here's a quick summary of the most common claims for meat workers.

Common Tax Deductions for Meat Workers

This table breaks down some of the most frequent and significant work-related expenses that meat industry professionals should be claiming.

Expense Category | Specific Examples for Meat Workers | Record-Keeping Requirement |

|---|---|---|

Protective Gear | Steel-capped boots, gumboots, mesh/rubber gloves, aprons, freezer jackets, safety glasses. | Receipts or invoices for all purchases. |

Tools of the Trade | Knives, steels, sharpening stones, pouches, belts, professional sharpening services. | Receipts for both initial purchase and ongoing maintenance costs. |

Uniforms | Compulsory, logoed shirts, pants, or overalls. Includes purchase, repairs, and alterations. | Receipts for buying or mending. A diary can track laundry loads if under $150. |

Laundry Costs | Washing and drying of compulsory uniforms. | No receipts needed for claims under $150, but you need to show how you calculated it. |

Union/Association Fees | Annual membership fees for unions or professional bodies. | Annual statement from your union is perfect. |

Self-Education | Course fees for qualifications directly improving your current job skills (e.g., Certificate III in Meat Processing). | Invoices and receipts for course fees, textbooks, and required equipment. |

Phone & Internet | Portion of your personal phone/internet bill used for work calls, checking rosters, or work-related communication. | Keep a log or diary for a representative period (e.g., one month) to determine the work-use percentage. |

Remember, every little bit adds up, and keeping good records is the key to maximising your return without any stress.

Other Common Deductions

Beyond the big-ticket items, don't forget these other expenses that can add up over the year.

Union Fees: Your annual union or professional association fees are fully deductible.

Self-Education: You can claim courses directly related to improving skills in your current job, like a Certificate III in Meat Processing. Just remember, you can't claim a course you did to get the job in the first place.

Phone and Internet: If you use your personal phone or internet for work—maybe to check rosters, contact your supervisor, or complete online training—you can claim a portion of those bills.

Claiming Your Car and Travel Expenses Correctly

Travel expenses are one of the most misunderstood areas of tax, and you can bet the Australian Taxation Office (ATO) pays very close attention to these claims. For meat workers, knowing the fine line between a regular commute and deductible work-related travel is crucial for maximising your refund without raising red flags.

Getting this right can make a huge difference to your final tax bill. So, let’s clear things up.

The first and most important rule to remember is that you generally cannot claim the cost of driving between your home and your main workplace. The ATO sees this as a private expense, even if you have a long drive or work odd hours. It's just part of getting to and from work. However, there are a handful of specific situations where your travel does become deductible.

When Your Travel Is Claimable

Certain work-related trips are absolutely claimable. As a meat worker, you’re likely entitled to claim your car expenses if your situation fits one of these common scenarios:

Travel Between Work Sites: If you work at one processing plant in the morning and have to drive to a different one for an afternoon shift for the same employer, that trip is deductible. Simple as that.

Transporting Bulky Tools: This is a big one for meat workers. If you need to haul heavy or bulky tools and equipment—think a full set of knives, steels, and a heavy-duty sharpening machine—and there's no secure storage available at your workplace, you may be able to claim the trip from home to work.

Attending Off-Site Training: Driving from your workplace to TAFE to complete your Certificate III in Meat Processing, or any other work-related course, is considered deductible travel.

The critical factor for the bulky tools rule is the lack of secure on-site storage. If your boss provides a safe locker for your gear but you just prefer to take it home, the ATO will knock back that claim.

Choosing the Right Method to Claim

Once you've figured out your travel is deductible, the ATO gives you two ways to calculate your claim. Which one you choose really depends on how many k's you're clocking up for work each year.

Cents per Kilometre Method: This is the straightforward option. For the 2024-25 financial year, you can claim 88 cents per kilometre for up to 5,000 work-related kilometres. You don't need receipts for your actual car costs, but you must be able to show the ATO how you worked out your business kilometres (like keeping a diary of your trips).

Logbook Method: This one takes more effort but can lead to a much larger claim, especially if you do a lot of driving. You need to keep a detailed logbook for 12 continuous weeks to figure out the percentage of your car use that's for work. You can then claim that same percentage of all your actual car running costs, including fuel, insurance, rego, and even the car's depreciation.

Deciding between these two is a crucial step. To help you make the right call, our comprehensive guide on navigating the complexities of car tax deductions in Australia breaks down each method in much more detail.

No matter which method you go with, keeping good records is the foundation of a solid claim.

Mastering Record Management: The Start of Stress-Free Tax Filing

Thorough record management is the foundation for quick and easy tax refunds. For busy butchers, collecting receipts each year may feel cumbersome, but this simple habit is the best way to maximize refunds and avoid issues with the Australian Taxation Office (ATO).

No more shoe boxes filled with crumpled receipts are necessary. Nowadays, there are many great tools that make tracking expenses easier than ever. By keeping things organized, you won’t miss important deductions, which can lead to savings of hundreds or thousands of dollars each year.

Simple and Effective Record-Keeping Methods

You don’t need a complex system for perfect record-keeping. The key is to find a method that works for you and stick with it.

Utilize Digital Apps: The myDeductions app provided for free by the ATO is an excellent tool for this purpose. You can take photos of receipts, record expenses on the go, and even manage vehicle logbooks all from your smartphone.

Basic Spreadsheets: A simple spreadsheet on your computer or in the cloud (like Google Sheets) is also a good method. Create columns for date, item description, cost, and category (e.g., 'Tools', 'Uniforms', 'Travel Expenses') to manage your records.

Use a Dedicated Business Account: Consider using a separate bank account or credit card just for business-related expenses. This way, during tax filing season, you can easily find all deductible expenses by just reviewing your bank transactions.

The goal is to create a clear "trail of evidence." Well-organized records serve as the best shield to protect you if the ATO questions your deduction claims. A systematic approach proves that you have fulfilled your obligations diligently, bringing you peace of mind.

What Records Should You Keep?

Organization means more than just holding onto receipts. To perfectly substantiate your deduction claims, you need the right types of evidence.

Records should generally include the following:

Supplier name

Amount spent

Type of goods or services

Date of payment

Date of document issuance

This information can typically be found on standard receipts or invoices. Remember, these records must be kept for 5 years from the date you submit your tax return.

If you want to learn more about the essential requirements, check out the essential tax record management guide for Australian taxpayers. By making these simple tips a habit, you can transform the stressful tax filing period into a straightforward and clear process.

Decoding Your Payslip and Superannuation

Think of your payslip and super statement as more than just paperwork—they're a regular health check for your finances. Getting comfortable with reading them means you can spot any issues straight away, making sure you're paid correctly and your retirement savings are growing as they should. For any meat worker wanting to stay on top of their money, this is a non-negotiable skill.

Let's start with your income statement, which is the modern version of the old group certificates. This document is a summary of everything you’ve earned for the financial year and, just as importantly, how much tax has been set aside for the ATO.

Getting to Grips With Your Income Statement

These days, you don't have to wait until the end of the year to get your payment summary. Thanks to a system called Single Touch Payroll (STP), your employer sends your pay and tax details directly to the ATO every time you get paid.

This means you can log into your myGov account (linked to the ATO) anytime and see your income statement in real-time. It’s a great way to double-check that the figures on your payslips match what the tax office has on record.

Make it a habit to pop into your myGov account a couple of times a year just to check your year-to-date numbers. Finding a small mistake early is a hundred times easier than untangling a big mess come tax time. A quick look gives you peace of mind.

The meat industry is a massive part of the Australian economy, and the workload is intense. To give you an idea, chicken meat production jumped by 1.6% in just one quarter recently. With that much activity, it's vital to make sure every dollar you've earned has been accounted for. You can dig into more industry stats like this over at the Australian Bureau of Statistics.

Protecting Your Super – It's Your Money

Superannuation isn't a bonus; it's your money being put away for retirement. Your employer is legally required to pay into your super fund under the Superannuation Guarantee (SG).

For the 2025-26 financial year, the SG rate is 12% of what you earn in ordinary hours. You absolutely have to check your super statements to confirm these payments are landing in your account correctly and on schedule.

Why is this so critical?

The Power of Compounding: Even small, regular payments can grow into a massive nest egg over your working life. Missing a few can cost you thousands in the long run.

Watch Out for Lost Super: It's common for workers, especially if you move between jobs, to accidentally leave behind super accounts. Each one will keep charging fees, slowly draining your savings.

Combine and Conquer: One of the best things you can do for your future is to roll all your super into a single account. This cuts down on fees and makes your retirement savings so much easier to manage.

Spending just a few minutes each month to scan your payslip and check your super balance is one of the most powerful financial habits you can build.

Partner With a Tax Expert to Get Your Best Refund

You're an expert in your trade, and honestly, we're experts in tax. While this guide gives you a solid handle on the basics for your tax return, teaming up with a professional makes sure nothing slips through the cracks. The Australian tax system has its own set of rules, and an expert who really gets the unique demands on meat workers can make a huge difference.

An experienced tax agent knows exactly where to look for deductions you might not even know exist. They guarantee your claims are airtight and fully compliant with ATO guidelines, and they handle all the tedious paperwork. It saves you time and stress, sure, but the real win is securing the maximum possible refund you're entitled to.

Why a Specialist Makes a Difference

Choosing the right professional is everything. A general accountant is fine, but they might easily miss the industry-specific claims that someone with focused experience will spot immediately.

Think of it like this: you wouldn't use a general-purpose knife for fine boning work. The same principle applies here. Specialised knowledge delivers a much better result, ensuring precision and maximising your outcome.

We understand the costs you rack up, from maintaining your specialised tools to the specific laundry requirements for your uniform. Our team of experienced professionals can help you get your records organised, structure your claims the right way, and lodge your return with complete confidence. You can learn more about the benefits of working with dedicated tax specialists and see how we can help you this tax season.

Let us handle the complexity of tax law. You can focus on your work, knowing your finances are in expert hands. We're here to make sure you get back every single dollar you deserve.

Got Tax Questions? We've Got Answers

Tax can get tricky, and it’s natural to have questions. Chances are, other meat workers are wondering the same things you are. Here are some quick, straightforward answers to the questions we hear most often, helping you get clear on your claims before tax time rolls around.

Can I Claim My Travel From Home to Work?

As a general rule, the daily trip between your house and your main workplace is just considered your regular commute, so the ATO won't let you claim it.

But—and this is a big but for meat workers—there are a couple of key exceptions. If you’re required to haul your own bulky tools to work every day (think your full knife set, sharpening gear, etc.) because your employer doesn't give you a secure place to store them on-site, that travel might just be deductible. The same goes if your job requires you to travel between different work locations for the same boss during the day.

What's the Easiest Way to Track My Laundry Expenses?

Good news: the ATO has a simple shortcut for small laundry claims, so you don't have to keep a shoebox full of receipts. If your total claim for washing your work-specific, logoed uniforms is $150 or less, you don’t need written proof.

Here's how you can calculate your claim using the ATO's set rates:

Claim $1 per load if you wash your work gear all by itself.

Claim 50 cents per load if you toss it in with your regular clothes.

It’s a smart move to jot down in a diary or a note on your phone how often you're doing these washes, just so you can show how you worked it out. For any claim over that $150 mark, you'll need to keep proper records, like receipts from a dry cleaner or laundromat.

The work you do is crucial, especially with Australia’s beef production on the rise. We're looking at a projected 2.65 million metric tons being produced, largely thanks to huge international demand from places like the United States. This just goes to show how vital every single person in the supply chain is, and it's exactly why you need to make sure you’re claiming every dollar you're entitled to. You can read more about Australia's beef industry outlook and its global standing.

Do I Really Need a Receipt for Every Single Thing I Claim?

For most things, yes—a receipt is your golden ticket for proof of purchase. However, the ATO does cut you a little slack for those small, fiddly expenses. You don't have to keep individual receipts for items that cost $10 or less, as long as your total claim for these little purchases stays under $300.

Even without a receipt, you still need some kind of proof. A bank statement showing the transaction or a diary entry logging the date, item, and cost will do the trick.

The best strategy? Just get into the habit of keeping a receipt for every single work-related purchase. It’s easier than ever—just use your phone to snap a quick photo of the receipt. That way, you've got bulletproof evidence if the ATO ever comes knocking.

A little discipline here means you can claim your deductions without any stress.

• Need assistance? We offer free online consultations: – LINE: barontax – WhatsApp: 0490 925 969 – Email: info@baronaccounting.com – Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments