Tax Guide for Factory Workers in Australia

- Aug 22, 2025

- 16 min read

Let’s be honest, for most factory workers, tax time feels like just another complicated job to do after a long shift. But figuring out your tax obligations is the first step to making sure you aren't overpaying and that you get every dollar you're entitled to back in your pocket. It all boils down to knowing what counts as income and what you can claim as an expense.

Your Essential Guide to Tax as a Factory Worker

When you work in a factory, your income isn't just your standard weekly pay. The Australian Taxation Office (ATO) looks at all the money you make from your job as assessable income. This means your base pay plus any of the extras you pick up along the way.

Getting your head around these different bits of income is key. It's the foundation for lodging your tax return correctly and, more importantly, spotting where you can make some claims.

Understanding Your Total Income

Your income as a factory worker is usually made up of a few different parts, and the ATO considers all of them taxable. Keeping a mental note of these is crucial for an accurate tax return.

Here’s what typically needs to be reported:

Wages and Salary: This is the straightforward part – your regular pay for the hours you put in on your standard shifts.

Overtime Pay: All those extra hours you work to get ahead? Yep, that extra pay needs to be included.

Allowances: Any special payments for things like meals, tools, or tricky working conditions are generally taxable.

Bonuses and Commissions: If you get a performance-based payment or an annual bonus, that's also part of your assessable income.

Your employer takes care of the first step by withholding tax from each paycheque through the Pay As You Go (PAYG) system. They send this money straight to the ATO for you. At the end of the financial year, your income statement shows your total earnings and how much tax you've already paid.

The Power of Record-Keeping

If there's one habit that will save you money at tax time, it's this: keep your receipts. The ATO’s rule is simple – if you can't prove you spent it, you can't claim it.

Keeping clear and organised records isn't just about staying out of trouble; it's your best tool for getting a bigger tax refund. Every single receipt for a work-related purchase could be a dollar back in your bank account.

Start a simple system right now. It could be a folder, a shoebox, or even just a folder in your phone's photo gallery. Snap a picture of every receipt for tools, protective gear, or anything else you buy for your job. While keeping your finances in order is important, so is your health on the job; for instance, understanding UK workplace safety compliance offers good insights into maintaining a safe environment, even with differing local rules.

By getting a solid grip on what counts as income and tracking what you spend, you're setting yourself up for a stress-free tax return.

Claiming Your Uniform and Protective Gear Expenses

Getting a clear picture of what qualifies is the first step to maximising your refund without accidentally making a mistake. The key difference the ATO looks for is whether you have a compulsory uniform or just a general dress code. One is deductible, the other isn’t.

What Qualifies as a Deductible Uniform

To claim the cost of your work clothes, they generally need to be specific to your job and not something you'd wear in your everyday life. A good rule of thumb is to ask yourself: "Could I wear this to the shops without it being obvious where I work?" If the answer is yes, you probably can't claim it.

A compulsory uniform is a specific set of clothes your employer insists you wear, which usually identifies you as part of the business.

Here's what generally counts:

Branded Uniforms: Clothes with a company logo permanently stitched or printed on them (like a shirt, jacket, or hat) are almost always claimable.

Non-Compulsory Uniforms: Even if it’s not required, you can claim clothing if it's officially registered with AusIndustry. This is less common but worth checking.

Occupation-Specific Clothing: This refers to items uniquely tied to a profession, like a chef's chequered pants. This is less likely in a factory unless your role is highly specialised.

The main idea is simple: if your employer makes you buy and wear clothing that has their logo, you can claim its cost and upkeep. But if your boss just says "wear a plain black t-shirt and trousers," that's considered a general dress code, and you can't claim those expenses.

Claiming Protective Clothing and Gear

This is a big one for factory workers. The ATO allows you to deduct the cost of any clothing and equipment that protects you from getting sick or injured on the job. Since safety is everything on the factory floor, these claims can add up quickly.

You can claim a deduction for essential safety items like:

Steel-Capped Boots: A must-have for protecting your feet from heavy objects.

Safety Glasses or Goggles: For shielding your eyes from sparks, chemicals, or debris.

High-Visibility Vests and Shirts: Crucial for making sure you’re seen in busy or low-light areas.

Heavy-Duty Gloves: To protect your hands from cuts, burns, or hazardous materials.

Overalls and Heavy-Duty Trousers: If they offer protection beyond what normal clothes would.

Helmets and Hard Hats: A standard requirement in many industrial settings.

Because these items are essential for your safety, their costs are legitimate work-related expenses. Just be sure to keep your receipts for everything you buy—they're your proof for the ATO.

How to Claim Laundry Expenses

After buying the gear, you've got to keep it clean. The ATO lets you claim the costs of laundering these items, and you've got a couple of options.

The Cents-Per-Load Method: This is the easiest way. For the 2024-25 financial year, you can claim $1 per load if it's a wash containing only your work clothes. If you mix in your personal items, you can claim 50 cents per load. You don't need receipts for this, but you do need to be able to explain to the ATO how you worked it out (e.g., one load after every shift). The total claim using this method is capped at $150.

Dry-Cleaning Costs: If your uniform has to be professionally dry-cleaned, you can claim the full amount. For this, you absolutely must keep all your dry-cleaning receipts to prove the expense.

By keeping track of what you spend on compulsory uniforms, protective gear, and laundry, you can add some solid deductions to your tax return and get more of your hard-earned money back in your pocket.

Claiming Your Tools and Equipment

For any factory worker, having the right gear isn't just a nice-to-have; it's essential for getting the job done safely and efficiently. Whether it's power drills, specialised diagnostic tools, or even just a good quality toolbox, these costs can really add up.

The good news is the Australian Taxation Office (ATO) lets you claim these work-related expenses. But how you claim them all comes down to the price tag. Getting this right is the key to making sure you claim everything you're entitled to.

The $300 Rule: Claim It All, Right Now

The ATO keeps things simple for smaller, everyday tools. If you buy a piece of equipment for your job that costs $300 or less, you can claim an immediate, 100% deduction for it in the same financial year. Easy as that.

This is perfect for all those smaller items you buy throughout the year. Think of things like a new set of spanners, a power drill, or a tough new toolbox. As long as it's for work, you write off the full cost straight away.

Here are a few common examples that fall under this rule:

Hand tools like hammers, screwdrivers, and pliers.

Power tools such as drills, sanders, or angle grinders.

Logbooks, calculators, or electronic organisers needed for your role.

Protective cases to keep your equipment safe.

Just one golden rule: keep the receipts. Even for a $50 purchase, the ATO wants to see proof you actually bought it.

What About the Big Stuff? Understanding Depreciation

So, what happens when you need to fork out for something more expensive? Maybe it’s a specialised diagnostic machine or a high-end welding unit that costs well over $300. You can't claim the whole amount in one hit. Instead, you claim its depreciation.

Depreciation is just a fancy word for an item losing value over time from wear and tear. It’s like buying a new car – it’s worth less the moment you drive it off the lot. The ATO lets you claim this loss in value as a deduction each year over the tool's expected lifespan.

Analogy: Claiming a Slice of the PieThink of your expensive new tool as a whole pie. Instead of eating the whole thing at once (claiming the full cost upfront), the ATO wants you to claim one slice each year. That slice represents the tool's 'wear and tear' for the year, and you keep claiming a slice each year until the pie is gone.

This method spreads the tax deduction over the years you're actually using the tool to earn your income, which makes perfect sense for items built to last.

Other Must-Know Deductions for Factory Workers

Beyond your tools, there are a few other common expenses that factory workers can often claim. If it’s a cost you have to pay to do your job, there’s a good chance you can claim it.

One of the biggest ones is union and professional association fees. If you're part of a union, your annual membership fees are fully deductible. The ATO sees this as a direct cost of your employment.

Another key area is the work-related portion of your phone and internet bills. Do you use your personal phone to call your supervisor, check rosters online, or complete mandatory training modules from home? You can claim a percentage of those bills.

To do this, you’ll need to keep a record—a four-week diary is usually enough—to figure out what percentage of your use is for work. If you work out that 20% of your phone use is for work, you can claim 20% of your phone bill as a tax deduction.

Claiming Car and Travel Expenses the Right Way

Car and travel expenses are a goldmine for tax deductions, but they're also an area where many factory workers make honest mistakes. Getting the rules right can mean serious savings, so let's clear up exactly what you can and can't claim.

First, the most important rule: your daily commute from home to your regular factory is considered private travel by the ATO. That means it’s not deductible. However, don't let that discourage you. Plenty of other work-related journeys often get missed, and that's where you can claim back some cash.

When Can You Claim Car Expenses?

The golden rule is that the travel must be a direct part of earning your income, not just getting you to the front door. If you find yourself using your personal car for work tasks during your shift, you can almost certainly claim those kilometres.

Here are a few common scenarios where factory workers can claim travel:

Driving between different work sites: Your boss asks you to head from your main factory to another site for part of the day.

Picking up supplies or equipment: You have to make a quick run to a supplier for urgent materials needed on the factory floor.

Attending off-site training or meetings: You’re sent to a different location for a course, conference, or a meeting that's part of your job.

Carrying bulky tools: This one is tricky. In very specific cases, if you have no secure place to store bulky tools at work and must transport them, you might be able to claim your home-to-work travel. The ATO is incredibly strict here, so it’s always best to get professional advice first.

Once you’ve sorted out which trips are work-related, the next step is picking the right method to calculate your claim.

Method 1: The Cents Per Kilometre Method

This is the simplest, no-fuss way to claim your car expenses. It's perfect for people who only do occasional work-related travel and want to avoid the headache of tracking every single fuel receipt and service bill.

For the 2024-25 financial year, the rate is 88 cents per kilometre. You can claim a maximum of 5,000 work-related kilometres per car using this method. Do the math, and that’s a potential deduction of $4,400.

While you don't need receipts for running costs with this method, you can't just pluck a number out of thin air. The ATO expects you to have a record, like a simple diary or note, showing how you worked out the distance you travelled for work.

This method is quick and easy, but if you use your car for work a lot, you could be leaving money on the table. That’s where the second method shines.

Method 2: The Logbook Method

If you’re regularly on the road for work, the logbook method will almost always get you a much bigger tax deduction. It takes a bit more effort upfront, but the payoff is usually well worth it. This method works by calculating a work-use percentage for your car.

Here’s a step-by-step look at how it works for a factory worker:

Keep a Logbook: You’ll need to keep a detailed logbook for a continuous period of at least 12 weeks. This means recording every trip—both work and private.

Calculate Your Percentage: At the end of the 12 weeks, tally up your total kilometres and your work-related kilometres. For example, if you drove 4,000 km in total and 1,000 km of that was for work, your work-use percentage is 25%.

Apply the Percentage: Now for the good part. You can claim 25% of all your car's running costs for the whole year. This includes fuel, oil, registration, insurance, interest on your car loan, and even the car's depreciation.

The best part? Your logbook is valid for five years, as long as your work situation stays roughly the same. For anyone clocking up serious work-related mileage, this is the way to go. To dive deeper, our detailed guide covers all aspects of navigating car tax deductions in Australia.

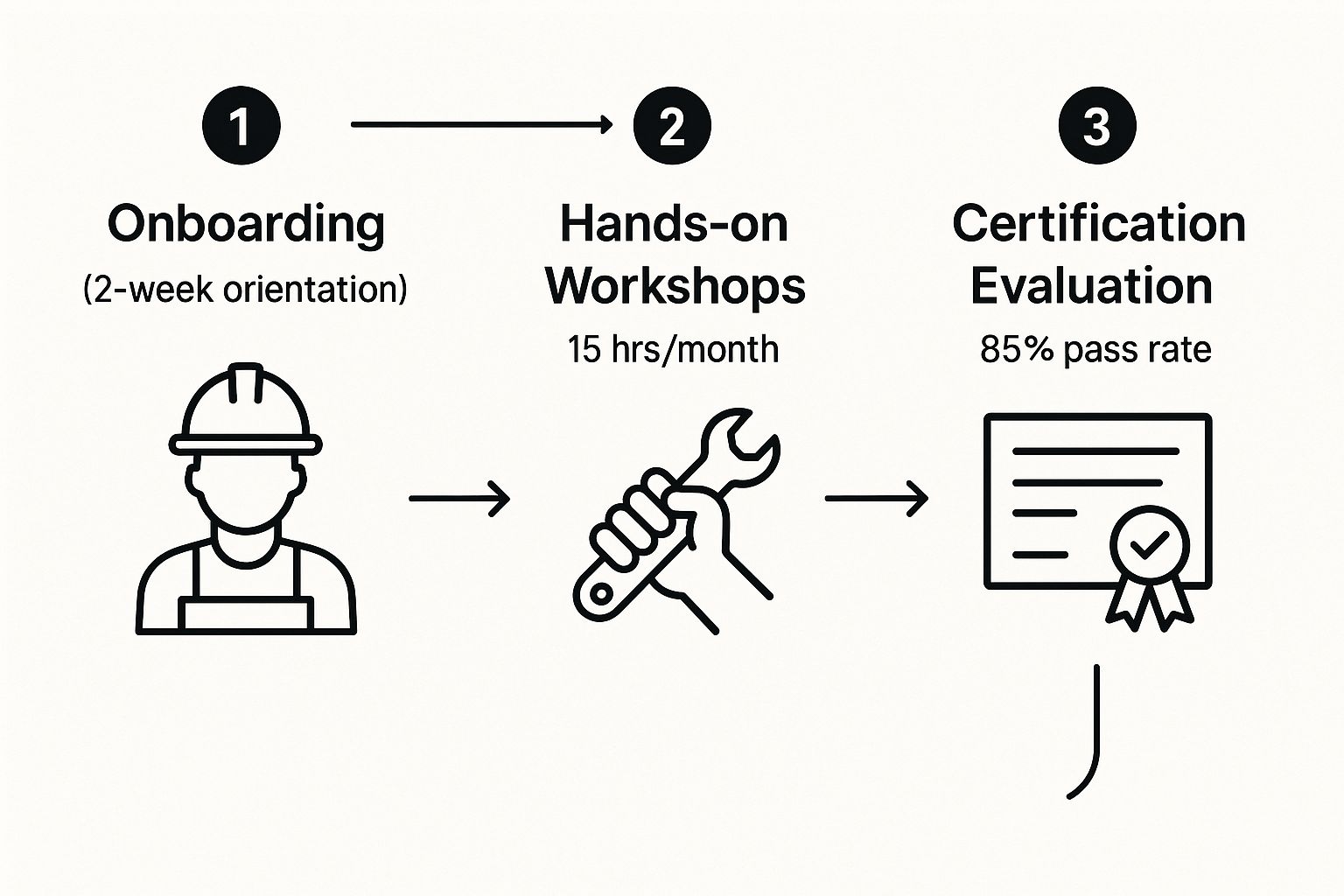

The image below shows a typical path for skill development. Any travel you do to attend these kinds of workshops would be a perfect example of a deductible expense.

It’s a great reminder that ongoing training is vital, and the costs of getting there can directly lower your taxable income.

Turning Self-Education Expenses into Tax Deductions

The training you take on must have a direct, clear connection to your current role. This means the course or study has to be about maintaining or improving the specific skills you’re already using to earn your income.

Establishing the Direct Link to Your Job

The ATO is quite strict about this connection. To be claimable, the self-education must lead to a formal qualification and be directly aimed at improving your performance or boosting your income in your current job. Think of it as sharpening the tools you already have, not buying a whole new toolbox for a completely different trade.

For instance, a welder who enrols in an advanced certification for a new welding technique can absolutely claim those costs. That training directly beefs up their existing skills. But if that same welder decided to do a business degree to open their own café, those expenses would not be deductible. Why? Because it’s for a new, separate income-earning activity.

The core question to ask yourself is: "Will this course help me do my current factory job better or earn more within this role?" If the answer is a clear yes, you are likely on the right track to claim a deduction.

Getting this principle right is what separates a legitimate, work-related expense from a personal development choice in the eyes of the ATO.

What Self-Education Expenses Can You Claim?

Once you've confirmed your course is eligible, you can claim a whole range of associated costs. It’s not just about the big-ticket tuition fees; all the little expenses really add up. That’s why keeping detailed records of everything is your best friend here.

Here’s a quick checklist of common self-education costs you can claim:

Course and tuition fees: The main cost of your study.

Textbooks and academic journals: Any books or publications you’re required to buy.

Stationery: Think pens, notebooks, highlighters, and printing costs.

Travel expenses: The cost of getting from your home or workplace to your training venue.

Decline in value (depreciation): For equipment costing over $300, like a laptop you bought just for the course.

Alright, you’ve done the hard yards tracking your income and digging up receipts for deductions. Now for the final push: lodging your tax return.

This part can feel a bit daunting, but it’s really just about putting all the pieces together in the right order. Let's walk through it so you can get it done smoothly and confidently.

Step 1: Get Your Paperwork in Order

Before you even think about logging into myGov, take a moment to gather all your documents. Being organised now will save you a world of headaches later. Think of it like setting up your tools before a big shift—good prep makes the job a whole lot easier.

Here's a quick look at everything you'll need to have ready.

Your Tax Lodgement Checklist

Use this table to make sure you have all the essential info and documents rounded up before you start.

Category | Documents Needed | Why It's Important |

|---|---|---|

Income | Your finalised Income Statement from your employer (found in myGov). | This is the official record of your earnings and the tax you've already paid. It's the starting point for your whole return. |

Refund | Your current Bank Account Details (BSB and account number). | This is where the ATO will send your refund. You definitely want this to be correct! |

Deductions | All your receipts and records for tools, uniforms, protective gear, training, etc. | This is your proof. Without receipts, you can't claim the deductions that lower your taxable income. |

Car Expenses | Your 12-week logbook and receipts for all running costs (if using this method). | To claim car expenses accurately, the ATO requires detailed records like a logbook to justify your work-related travel percentage. |

Memberships | Your annual union fee statement. | Union fees are a common and fully deductible expense for factory workers, so don't miss out on this one. |

Once you’ve got this pile of paperwork sorted, you’re in a great position to tackle the next step.

Step 2: Choose How You Want to Lodge

As a factory worker, you’ve got a couple of options for lodging your return. There’s no single "best" way—it really depends on how complex your finances are and how confident you feel doing it yourself.

Option 1: Do It Yourself with myTax

This is the ATO’s free online tool, accessed through your myGov account. It's a pretty good option if your tax situation is straightforward—say, you have one job and just a handful of simple deductions.

The system is smart and pre-fills a lot of your income details straight from your employer, which saves time. The downside? It's on you to know what you can claim. It won’t flag potential deductions you might have missed.

Option 2: Use a Registered Tax Agent

This is where you bring in an expert. A registered tax agent, like our team here at Baron Accounting, does a lot more than just fill in the boxes on a form.

We dig deep into your specific situation to uncover every single deduction you’re entitled to, especially those specific to factory workers that are easy to overlook. We also make sure your claims are solid and meet ATO rules, which significantly lowers your chances of an audit.

Think of a tax agent's fee as an investment. Not only can it lead to a much bigger refund, but the fee itself is tax-deductible on next year's return. It's a smart move that often pays for itself.

Step 3: Lodge and You're Done

Once you’ve picked your method, it’s time to lodge. If you're going the myTax route, you’ll work your way through the online form, carefully entering your deductions and double-checking all the pre-filled information before you hit submit.

If you decide to go with a tax agent, your job is much simpler. You just hand over your documents, and they take care of the entire process. To make it even easier, we've put together a simple guide with more details on how to lodge your tax return online with an expert. It breaks everything down, turning tax time from a major headache into a simple task.

Let’s Get Your Maximum Refund Sorted

Keeping good records and knowing exactly what you can claim is the key to getting the best possible tax refund. While this guide covers the most common deductions we see for factory workers, getting a professional to look over everything can make a huge difference. Our team is here to help you get through the process, making sure your return is spot-on and you get back every dollar you're entitled to.

To make life easier, checking out some easy expense tracker tools can be a game-changer for keeping your receipts in order. For a deeper dive, our article on how to maximise your tax return in Australia is packed with more expert tips to boost your refund this financial year.

A Few Common Questions From the Workshop Floor

When it comes to tax deductions, a few questions pop up time and time again. Getting these details right is key to making sure you get back every dollar you're entitled to. Let's clear up some of the most common queries.

Can I Claim My Lunch and Coffee Breaks?

This is a big one, but generally, the answer is no. The ATO sees meals, drinks, and snacks you have during a normal workday as a private expense. It doesn't matter if you have to buy it from the on-site canteen because you can’t leave for your break – it’s still not claimable.

There is one major exception, though. If your job requires you to travel and stay away overnight, you can then claim your meal costs as part of your travel expenses. But for your day-to-day shifts, that morning coffee is on you.

I Bought a Tool for Over $300. Can I Claim It All at Once?

Nope, you can’t claim the full amount in the same year you bought it. For any single work tool or piece of equipment that costs more than $300, you need to claim its decline in value over time. This is what accountants call depreciation.

Think of it like claiming the "wear and tear" of the item over its useful life. The ATO has guidelines for how long most assets are expected to last, so you just claim a portion of its cost each year until the value runs out. For anything costing $300 or less, you can claim the full amount straight away.

What if I Don't Have Receipts for Everything?

When it comes to the ATO, records are everything. Their golden rule is simple: no proof, no claim. To be safe, you need a receipt, invoice, or bank statement that proves you actually spent the money and that it was for work.

However, the ATO does give a little bit of leeway in a couple of specific situations where you don't need a classic receipt (but you still need to be able to show how you worked out your claim). These are:

Laundry expenses if your total claim is under $150.

Car expenses if you use the cents per kilometre method (which covers you for up to 5,000 km).

For pretty much everything else—especially your tools, protective gear, and any courses you took—you absolutely must have a valid receipt.

• Need assistance?

We offer free online consultations:

– LINE: barontax

– WhatsApp: 0490 925 969

– Email: info@baronaccounting.com

– Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator:

For more resources and expert tax insights, visit our homepage:

Comments