Your Guide to Employee Termination Payment Tax

- Sep 9, 2025

- 14 min read

When your time with an employer comes to an end, the final payout is often a bit more complex than just your last week's wages. This lump sum is what the Australian Taxation Office (ATO) calls an Employee Termination Payment (ETP), and because it’s a specific category of payment, it gets special tax treatment.

Getting your head around what actually counts as an ETP is the essential first step to figuring out the tax you'll need to pay.

Decoding Your Employee Termination Payment

Simply put, an Employee Termination Payment is a lump sum you receive from your employer specifically because your job has been terminated. This isn't your regular salary or wages—it’s a distinct payment tied directly to the end of your employment. The ATO has some pretty strict rules here, mainly because these amounts are taxed differently from your standard income.

Think of your final pay as a package deal. Inside, you’ll find several different components. Some fall under the ETP umbrella, while others, like your unused annual leave, are handled separately for tax purposes. The whole point of the ETP classification is to offer potential tax concessions on certain parts of your payout, especially in cases like a genuine redundancy.

To give you a clearer picture, here’s a quick breakdown of what you might find in your final payment.

Components of Your Employee Termination Payment

Payment Component | What It Is | General Tax Treatment |

|---|---|---|

ETP Components | Payments made directly because of termination (e.g., redundancy, golden handshake). | Taxed concessionally up to certain caps. |

Unused Leave | Payouts for annual or long service leave you haven't taken. | Taxed separately under specific rules, not as an ETP. |

Final Wages | Your regular salary and wages owed up to your last day. | Taxed as normal income at your marginal rate. |

This table shows why it's so important to know what's what—each component is treated differently by the ATO, impacting your final take-home amount.

What’s Actually in an ETP?

Not every dollar you get in that final payout is officially part of the ETP. The ATO is very clear on what qualifies. The legal basis for ending employment, such as the principles of at-will employment, can influence the types of payments made upon termination.

Generally speaking, an ETP can include things like:

A genuine redundancy payment: This is compensation because your job was made genuinely redundant. A portion of this is often tax-free.

A 'golden handshake': Basically an extra payment offered as an incentive for an employee to retire or resign.

Payments in lieu of notice: This is money paid out when your employer doesn't require you to work through your notice period.

Compensation for wrongful dismissal: A payment made to settle a dispute over how your employment ended.

For an ETP to get concessional tax treatment, you generally must receive it within 12 months of your termination date. If the payment comes through after that deadline, it's usually taxed at your normal marginal tax rate, which could be much higher.

And What's Not an ETP?

It's just as crucial to know what’s left out. These amounts are still part of your final pay, but they're taxed under a completely different set of rules.

For instance, payouts for unused annual leave or long service leave are not ETPs. They’ll be itemised separately on your income statement and have their own specific tax rates. Likewise, any regular salary and wages owed to you up to your termination date are also excluded and just taxed as your normal income would be.

Making this distinction is key to navigating the employee termination payment tax correctly and avoiding any nasty surprises.

How Your ETP Is Actually Taxed

When you receive an Employee Termination Payment (ETP), it’s easy to assume it's just one big lump sum. But in the eyes of the Australian Taxation Office (ATO), it's a bit more complicated. The ATO splits the payment into different pieces, and each piece has its own tax rules.

Getting your head around this is the first step to understanding your final employee termination payment tax. The most important split is between the 'tax-free' part and the 'taxable' part of your ETP. This is especially common if you’ve been made genuinely redundant.

The Tax-Free Component

If your termination is a genuine redundancy, the ATO gives you a break. Part of your payout can be received completely tax-free, which can be a huge help.

This isn't a random number; it’s calculated with a set formula based on your years of service. For the 2024-2025 financial year, the formula is:

A base amount of $12,524

Plus $6,264 for each full year you worked there

Let's say you were with a company for 10 full years and were made redundant. Your tax-free amount would be $12,524 + (10 x $6,264) = $75,164. That $75,164 comes to you with no tax taken out.

The Taxable Component and Concessional Rates

Whatever is left of your ETP after the tax-free portion is carved out is called the taxable component. This part does get taxed, but thankfully, it often qualifies for special lower rates, known as concessional rates.

These rates are much better than the marginal tax rates you pay on your regular salary. But which rate you get hinges on one crucial detail: your age compared to your preservation age. Your preservation age is simply the age you can legally access your super, which is usually between 55 and 60 depending on when you were born.

Key Takeaway: Whether you’ve reached your superannuation preservation age or not is the single biggest factor that decides how the taxable part of your ETP is taxed. It determines which special rate applies, at least up to a certain limit.

How Your Age Changes Everything

The ATO has two different concessional rates based on this age milestone. It’s their way of recognising that people at different stages of their careers are in different financial situations. Knowing where you fit is key to figuring out your final tax bill.

For the 2024-2025 financial year, here’s how it works:

If you have reached your preservation age: The tax rate is a friendly 17% (including the Medicare levy).

If you are younger than your preservation age: The tax rate is higher at 32% (including the Medicare levy).

These special rates are a big help, but they don't apply forever. The ATO has caps that limit how much of your ETP can get this special treatment. The way your ETP components, age, and these caps all interact is exactly why understanding how to file taxes correctly is so critical when you're dealing with a termination payment.

Basically, after any tax-free amount is sorted, the rest of your ETP is taxed at either 17% or 32% depending on your age, up to the cap. Anything that goes over these ETP caps gets hit with the highest marginal tax rate of 47% (including Medicare). It can get tricky, fast.

Understanding the ETP Caps and Thresholds

While getting a concessional tax rate on your termination payment is a huge plus, there are limits. The Australian Taxation Office (ATO) has put caps in place to control how much of your ETP gets this special treatment. Getting your head around these caps is crucial for figuring out the final tax on your payment.

Think of these caps like a ceiling. Any part of your ETP that sits under this ceiling gets taxed at the lower concessional rate (either 17% or 32%, depending on your age). But any amount that goes over the ceiling gets hit with the highest marginal tax rate, which is currently a hefty 47% (including the Medicare levy).

There are two main caps to be aware of, and the one that applies to you depends on your total income for the year.

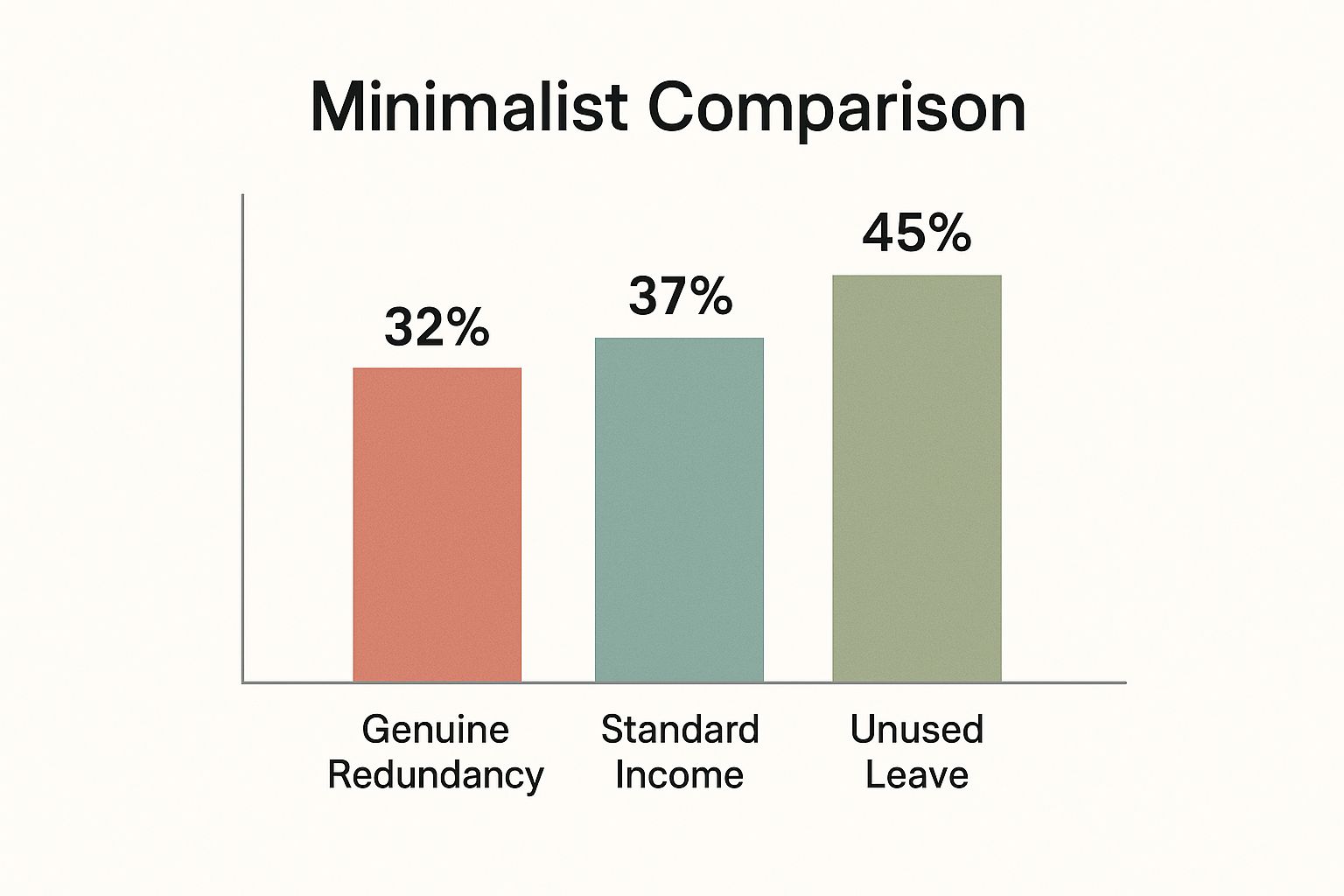

This image gives you a great visual idea of how different parts of a termination payment are taxed compared to your regular pay.

As you can see, the tax rules for things like redundancy and unused leave are quite different from your normal salary, which is why understanding the specifics is so important.

The ETP Cap

First up is the most common limit, simply called the ETP cap. This is the standard cap that applies to most termination payments. For the 2024-2025 financial year, the ETP cap is set at $245,000.

This cap is indexed each year, which means it usually nudges up slightly to keep pace with inflation. It's a lifetime limit, but it's also reduced by any concessionally taxed ETPs you've received in the past.

Example 1: Let's say your taxable ETP is $200,000. Because this is well under the $245,000 cap, the whole amount will be taxed at your concessional rate (17% or 32%). Easy.

Example 2: Now, imagine your taxable ETP is $300,000. The first $245,000 gets the concessional rate. The extra $55,000 that goes over the cap will be taxed at the top rate of 47%.

The Whole-of-Income Cap

The second limit is the whole-of-income cap, and this is where things can get a bit more tricky. This cap can actually override the standard ETP cap and is designed to stop people with very high total incomes from getting an unfair tax break on their payout.

The whole-of-income cap is $180,000 and, unlike the ETP cap, it doesn't get indexed annually. It's a lower, fixed cap that kicks in if your other taxable income for the year, plus your ETP, pushes you over $180,000.

Key Point: To see if the whole-of-income cap applies, you first add up your other taxable income (salary, investments, etc.) and your ETP. If that total is less than $180,000, you can forget about this cap and just use the standard $245,000 ETP cap.

However, if your total taxable income (including the ETP) for the financial year will be more than $180,000, your concessional tax break is limited. The cap becomes $180,000 minus your other taxable income for the year.

This is a perfect example of why it's so important to see the bigger picture with your finances. Understanding how different parts of the tax system interact, like the tax-free threshold in Australia, is vital for good planning.

To make this clearer, let's compare the two caps side-by-side.

ETP Cap vs Whole-of-Income Cap

Feature | ETP Cap | Whole-of-Income Cap |

|---|---|---|

Threshold (2024-25) | $245,000 | $180,000 |

Indexed? | Yes, it increases annually. | No, it is a fixed amount. |

When It Applies | This is the default cap for most ETPs. | Applies when your total annual taxable income (including the ETP) exceeds $180,000. |

How It Works | Caps the amount of ETP eligible for concessional tax rates. | Reduces the available concessional cap based on your other income for the year. |

So, what’s the final verdict? The ATO requires you to apply whichever cap is lower. For most people, the standard $245,000 ETP cap will be the one to use. But if you’ve earned a good income from other sources in the same year you receive your termination payment, you absolutely must check if the $180,000 whole-of-income cap will reduce your tax concession.

How to Calculate Tax on Your Termination Pay

Knowing the rules and caps is one thing, but seeing the numbers in action is where it all really clicks. Let’s walk through two practical, step-by-step examples to show you exactly how employee termination payment tax is calculated.

These scenarios cover the most common situations you're likely to encounter: an employee under preservation age and one who has reached it. Think of these as a solid template for figuring out your own tax position.

Example 1: Redundancy for an Employee Under Preservation Age

Meet Sarah. She’s 45 years old and has just been made genuinely redundant after 12 complete years of service with her company. Her total termination payment comes to $150,000.

Because Sarah is under her preservation age, the taxable part of her ETP will be taxed at the concessional rate of 32% (which includes the Medicare levy).

Let's break down how her final payout is calculated.

Step 1: Calculate the Tax-Free Portion

First up, we need to work out the tax-free part of her genuine redundancy payment using the ATO’s formula for the 2024-2025 financial year.

Base amount: $12,524

Amount per year of service: $6,264

Calculation: $12,524 + (12 years x $6,264) = $87,692

This means a hefty $87,692 of Sarah's payout is completely tax-free.

Step 2: Determine the Taxable Component

Next, we just subtract the tax-free amount from the total payment to find out what’s left to be taxed.

Total ETP: $150,000

Subtract tax-free portion: $150,000 - $87,692 = $62,308

Sarah’s taxable ETP component is $62,308.

Step 3: Apply the Correct Tax Rate

The taxable component of $62,308 is well under the $245,000 ETP cap for 2024-2025, so the whole amount gets the concessional rate. Since Sarah is under her preservation age, the 32% rate applies.

Tax Calculation: $62,308 x 0.32 = $19,938.56

The tax withheld on the taxable portion of her payment will be $19,938.56.

Step 4: Calculate the Final Payout

Finally, let's put it all together to see what Sarah will actually take home.

Total Gross Payment: $150,000

Less Tax Withheld: $19,938.56

Net Payment: $150,000 - $19,938.56 = $130,061.44

Sarah will receive a final payment of $130,061.44 in her bank account.

Example 2: Termination for an Employee at Preservation Age

Now, let’s look at David. He’s 60 years old, so he’s reached his preservation age. David receives a "golden handshake" ETP of $100,000 when he retires. This isn’t a genuine redundancy, which means there’s no tax-free component involved.

Because David has hit his preservation age, his taxable ETP is taxed at the much lower concessional rate of 17% (including the Medicare levy).

Step 1: Determine the Taxable Component

This one’s straightforward. Since it’s not a genuine redundancy, the entire payment is considered the taxable component.

Total ETP: $100,000

Taxable Component: $100,000

Step 2: Apply the Correct Tax Rate

David’s $100,000 taxable ETP is also well below the $245,000 ETP cap. As he’s at preservation age, the 17% rate is what we’ll use.

Tax Calculation: $100,000 x 0.17 = $17,000

So, the tax withheld from David's ETP will be $17,000.

Step 3: Calculate the Final Payout

To figure out his take-home amount, we simply subtract the tax from the gross payment.

Total Gross Payment: $100,000

Less Tax Withheld: $17,000

Net Payment: $100,000 - $17,000 = $83,000

David will receive a final payment of $83,000.

Crucial Reminder: These examples are here to guide you. Your own situation, including any other income you’ve earned during the year and past ETPs you might have received, can change the final numbers. It's always a good idea to confirm everything with your employer and a tax professional.

As you can see, your age and the reason for leaving your job make a huge difference to the tax you'll pay. By following these steps, you can get a much clearer picture of what to expect in your final pay.

Your Employer’s Role in Your ETP

When you receive an Employee Termination Payment (ETP), it’s easy to focus on your own tax obligations. But your employer has a critical role to play right from the start, acting as the first point of contact with the ATO for your payment.

Their main job is to calculate and withhold the right amount of tax from your ETP before the money ever lands in your bank account. This is the Pay As You Go (PAYG) withholding system at work. They’ll use the rules we’ve already covered—your age, the ETP caps, and why you’re leaving—to figure out the correct concessional rate for the taxable part of your payout.

The Paperwork You Need to Check

Once the tax is sorted, your employer reports the details to the ATO and gives you a summary of the payment. This used to be a physical , but these days you’ll find it as an Income Statement available through myGov.

This document is incredibly important. It breaks down everything for you:

The total ETP amount you were paid.

Which parts are taxable and which are tax-free.

Exactly how much tax was withheld.

Make sure you check this statement carefully. The figures on it are what you'll need to report your ETP correctly in your annual tax return. A simple mistake here can cause delays or an incorrect tax assessment later on.

Reporting and Lodgement

Your employer finalises your payment through Single Touch Payroll (STP), which sends the information directly to the ATO. When you or your accountant get ready to do your tax return, these ETP details should already be pre-filled in your myGov portal.

Your job is simply to double-check that the pre-filled numbers match the income statement your employer provided. It's crucial not to lump your ETP in with your regular salary and wages. Your tax return has a specific section just for ETPs, and putting the figures in the right place ensures the ATO applies the correct, lower tax rates.

Sometimes, the lines can get blurry between different working arrangements. Knowing if you're an employee or a contractor in Australia is the first step to understanding which payment and tax rules apply to you.

Beyond Your Income Tax: An Employer's Payroll Tax Obligations

Your employer's responsibilities don't stop with your income tax. They also have their own taxes to think about, particularly payroll tax. In states like New South Wales, for example, most ETPs are considered taxable wages and must be included in the employer's payroll tax calculations, as outlined by Revenue NSW.

This just goes to show how an ETP impacts both sides. For you, the key takeaway is this: your employer handles the initial tax withholding and reporting. Your role is to make sure the final numbers are accurately reported in your tax return using the official documents they give you.

Common Questions About ETP Tax

When you're navigating the rules around a final payout, plenty of specific questions can pop up. The world of employee termination payment tax has its own unique rulebook, and it's easy to get tangled up in what applies to your situation.

To help clear the air, we've pulled together answers to some of the most common questions people ask when they receive an Employee Termination Payment (ETP). This section is all about giving you quick, direct answers to those tricky points.

Are Unused Leave Payouts Part of an ETP?

This is a frequent point of confusion, but the short answer is usually no. Any payments you receive for unused annual leave and long service leave are treated and taxed completely separately from your ETP. They will show up as a different item on your Income Statement.

These leave payouts are typically taxed at your normal marginal rates. That said, for certain unused leave that was accrued before 18 August 1993, a lower tax cap of 32% might apply. The main thing to remember is that they don't get the same concessional treatment as the ETP itself.

What Happens if My Payment Is Over the Cap?

If the taxable part of your ETP goes over the relevant cap—whether it's the $245,000 ETP cap or the $180,000 whole-of-income cap for the 2024-2025 financial year—that excess amount gets taxed differently.

Any portion of your ETP that pushes past the limit is taxed at the highest marginal tax rate, which currently sits at 47% (including the Medicare levy). The lower concessional rates of 17% or 32% only apply to the amount that fits within the cap.

Important Note: Don't worry about calculating this yourself. Your employer is responsible for withholding the correct amount of tax from the payment before it ever hits your bank account.

How Do I Report an ETP on My Tax Return?

Your employer handles the initial reporting by sending the ETP details to the ATO through Single Touch Payroll. Because of this, the information should appear pre-filled in your tax return when you log in to myGov.

It’s absolutely crucial to double-check that this info is correctly placed in the specific ETP section of your return. You should never add your ETP to the regular salary and wages field, as this will cause it to be taxed incorrectly at a much higher rate. Always compare the pre-filled data against the Income Statement your employer gave you.

Even though ETPs are taxed concessionally, you can still claim standard work-related expenses against your other income. To make sure you're not leaving money on the table, check out our complete guide to individual tax deductions.

Can I Roll My ETP Into My Super Fund?

No, you can't roll an ETP directly into your superannuation fund. An ETP is considered a payment made directly to you after your employer has already withheld the required tax.

However, once you receive the net payment in your bank account, you are absolutely free to make a personal contribution to your super. This would just be treated as a standard contribution, subject to the usual caps and rules. It’s simply a separate transaction that you choose to make yourself.

Getting Your Termination Payment Right

Let's be honest, figuring out the tax on an employee termination payment can feel like wading through mud. Between the different caps, thresholds, and how your age plays into it all, it’s easy to get lost. Getting every last detail calculated and reported correctly is non-negotiable if you want to steer clear of trouble with the ATO and actually hold onto as much of your final payment as possible.

But you don’t have to tackle this beast on your own.

Here at Baron Tax & Accounting, our team of registered tax agents live and breathe this stuff. We specialise in untangling these exact kinds of messy situations. We’ll give you clear, straight-to-the-point guidance on your ETP, making sure you know your obligations and that your tax return is lodged perfectly. With the right professional advice, you can stop worrying and start learning how to maximise your tax position for the better.

Let us handle the numbers so you can focus on what’s next for you.

• Need assistance? We offer free online consultations:

– LINE: barontax

– WhatsApp: 0490 925 969

– Email: info@baronaccounting.com

– Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator:👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage:🌐 www.baronaccounting.com

Comments