What Does the Tax Free Threshold Mean in Australia? A 2025-26 Guide

- Jan 21

- 8 min read

The tax-free threshold is a core component of Australia's tax system that every earner should understand. It is the amount of income you can earn in a financial year before you are required to pay income tax. For Australian residents, this amount is $18,200 for the 2025-26 financial year. This principle is fundamental to our progressive tax system, designed to ensure low-income earners are not taxed on their initial earnings.

Understanding this threshold is vital for managing your finances, whether you're a student with a part-time job, starting your first full-time role, or juggling multiple income streams. It directly influences how much tax your employer withholds from your pay. Failing to manage it correctly, for instance by claiming it from more than one employer, is a significant compliance risk that can lead to a substantial tax debt and potential penalties from the Australian Taxation Office (ATO).

At Baron Tax & Accounting, we often observe that new entrants to the workforce or those with multiple jobs in Brisbane are unsure how the threshold applies to them. A frequent issue is claiming the threshold from more than one employer, a simple error on a TFN Declaration form that can unfortunately result in a significant tax bill at the end of the financial year. This oversight highlights the importance of understanding the basics from the start.

Understanding the Tax-Free Threshold

Think of the tax-free threshold as the first portion of your annual income that the Australian Taxation Office (ATO) does not tax. Correctly applying this rule is crucial for maintaining healthy cash flow and avoiding unexpected tax liabilities when you lodge your tax return.

The Tax-Free Threshold at a Glance

This table summarises the key figures and rules for the 2025-26 financial year, providing a clear overview for individuals, sole traders, and SMEs.

Concept | Amount (2025-26) | Who It Applies To | Key Compliance Point |

|---|---|---|---|

Tax-Free Threshold | $18,200 | Australian residents for tax purposes | Earn this much income before paying any tax. |

Pro-Rata Threshold | Varies | Residents for part of the year | The threshold is adjusted based on the number of months you were a resident. |

Non-Resident Rate | $0 | Non-residents for tax purposes | Tax is payable from the first dollar earned, with no tax-free amount. |

Claiming the Threshold | One employer at a time | Employees with one or more jobs | Ensures correct tax is withheld, avoiding end-of-year tax debt. |

Why It Matters

Properly claiming the threshold directly impacts your regular take-home pay. By instructing your main employer to apply it, you ensure the correct amount of tax is withheld from each pay cycle. This means more money in your bank account throughout the year, rather than providing the ATO with an interest-free loan that you only get back after lodging your tax return.

Australia's progressive tax system is designed so that low-income earners retain more of what they earn, with tax only applied to income above the $18,200 mark. For businesses managing their payroll obligations, a solid grasp of this is essential, and resources focused on understanding the impact of payroll courses on business can be incredibly helpful for navigating these real-world scenarios.

Core Principles of The Threshold

The system is built on a few straightforward principles to ensure fairness and simplicity for most Australian taxpayers.

One Claim Only: You can only claim the tax-free threshold from one employer or payer at any given time.

Highest Income Source: It is most strategic to claim it from your highest-paying job to maximise your regular take-home pay.

Pro-rata Application: If you become—or cease to be—an Australian resident for tax purposes part-way through the financial year, the threshold is adjusted accordingly.

Not for Non-Residents: As a general rule, if you are a non-resident for tax purposes, you are not entitled to claim the threshold.

This structure is crucial for everyone from individuals and startups to property investors balancing rental income with a day job. To get into the nitty-gritty, our detailed Australian tax-free threshold guide breaks it down even further with more examples and explanations.

How to Claim Your Tax-Free Threshold

The process for claiming the threshold is straightforward and is managed via the Tax file number declaration form provided by your employer when you start a new job. This form instructs your employer's payroll system on how much tax to withhold from your earnings.

The Key Question on Your TFN Declaration

The most critical part of this form is Question 9: "Do you want to claim the tax-free threshold from this payer?" For your primary job—the one that provides the most income—you should answer 'Yes'.

By ticking 'Yes', you authorise your employer not to tax the first $18,200 of your income for that financial year. This instruction is applied to your pay each week or fortnight. For a full walkthrough of filling this out, check out our easy guide on how to claim the tax-free threshold in Australia.

The Consequences of Not Claiming

If you tick 'No' or fail to submit the form, your employer is legally required to withhold tax from the first dollar you earn, and at a higher rate. This does not mean the money is lost permanently, but it will be held by the ATO until you lodge your annual tax return. In effect, you are giving the government an interest-free loan with your own money.

ATO Guideline: If an employee does not provide a completed TFN declaration within 14 days of starting, employers must withhold tax at the top marginal rate of 45% (plus the Medicare levy). This significant reduction in take-home pay is easily avoidable.

Claiming the threshold correctly ensures better cash flow throughout the year, placing your money in your pocket when you earn it.

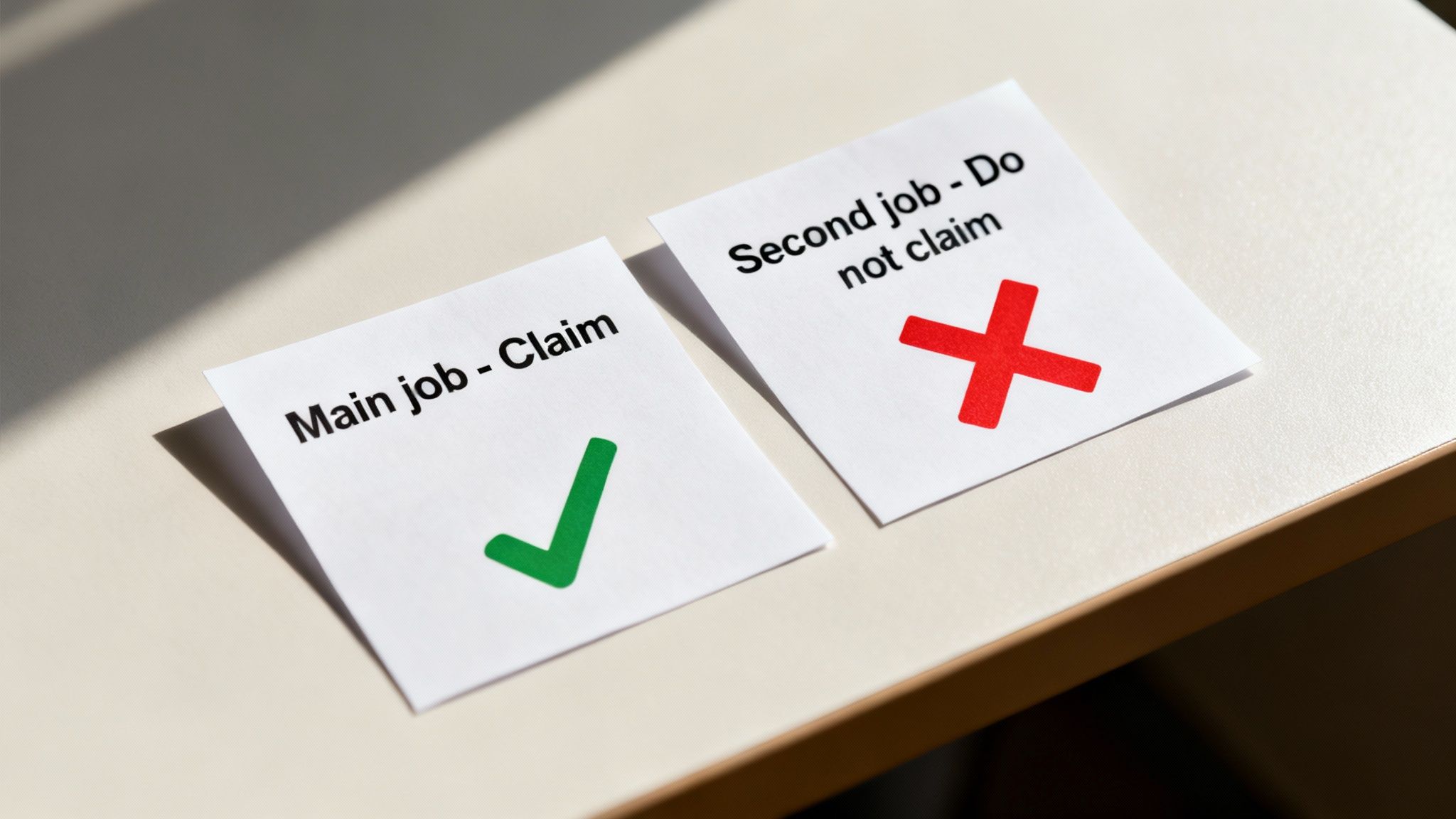

Managing the Threshold with Multiple Jobs

Juggling multiple jobs requires careful tax management. The ATO has a strict rule: you can only claim the tax-free threshold from one employer at a time. The most effective strategy is to claim it from your highest-paying job to maximise your regular take-home pay and help with week-to-week cash flow.

The Risk of Double Claiming

If you claim the threshold from two or more jobs, each employer's payroll system will assume it is your only income source and apply the full $18,200 threshold. This will result in insufficient tax being withheld throughout the year, leading to a significant tax bill when the ATO assesses your total combined income.

To manage this correctly:

For your primary job: On the Tax file number declaration, tick 'Yes' to claiming the threshold.

For all secondary jobs: You must tick 'No' to this question.

Ticking 'No' instructs your other employers to withhold tax from the first dollar you earn, ensuring your tax obligations are met as you go.

A Practical Comparison

Let’s illustrate with an example of an individual with two jobs, each paying $30,000 per year, for a total income of $60,000.

Claiming the Threshold with Two Jobs: A Comparison

Scenario | Weekly Tax Withheld (Job 1) | Weekly Tax Withheld (Job 2) | End-of-Year Tax Outcome |

|---|---|---|---|

Claiming Correctly | Taxed as if earning $30k (threshold applied). Withheld: ~$43 | Taxed from the first dollar (no threshold). Withheld: ~$149 | Small refund or minor amount owing. |

Claiming Incorrectly | Taxed as if earning $30k (threshold applied). Withheld: ~$43 | Taxed as if earning $30k (threshold applied). Withheld: ~$43 | A tax debt of approximately $5,453. |

Note: These figures are illustrative and exclude the Medicare levy for simplicity. They are based on 2024-25 tax rates as 2025-26 rates were not finalised at time of writing. |

As shown, a simple tick-box selection can prevent a substantial and unexpected tax bill.

Special Circumstances and Eligibility Rules

While the $18,200 threshold applies to most Australian residents, eligibility can change based on your residency status for tax purposes. It is critical to understand these rules to ensure compliance with the ATO.

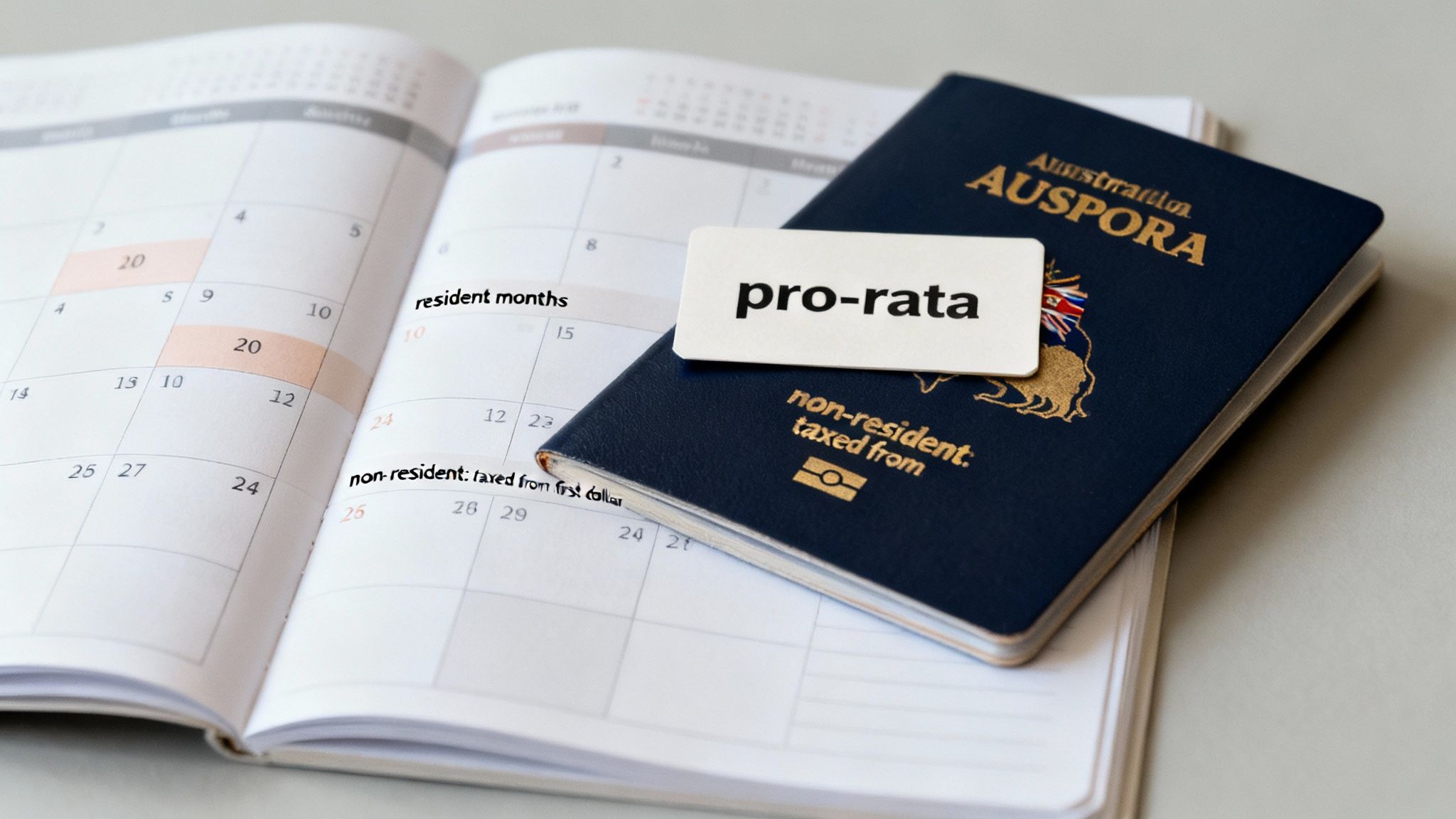

Part-Year Australian Residents

If you become an Australian resident for tax purposes—or cease to be one—partway through the financial year, you cannot claim the full $18,200. Instead, your threshold is calculated on a pro-rata basis. The ATO's formula includes a base amount of $13,464 plus a portion of the remaining $4,736, adjusted for the number of months you were a resident.

Example:

You become a tax resident on 1 January, meaning you are a resident for the final six months of the financial year.

Your pro-rata threshold is: $13,464 + ($4,736 × 6 / 12) = $15,832.

You will only start paying tax on Australian-sourced income above this amount for that period.

Non-Residents for Tax Purposes

If you are classified as a non-resident for tax purposes, you are not entitled to the tax-free threshold. This means you must pay tax from the first dollar you earn in Australia. The non-resident tax rate begins at 30 cents for every dollar up to $135,000. The tax impact is significant and immediate.

Minors and Under 18s

Individuals under 18 can claim the tax-free threshold, but special rules apply based on the type of income earned.

"Excepted" Income: This is income from employment, such as a part-time job. It is taxed at normal adult rates, and the full tax-free threshold applies.

"Unearned" Income: This includes passive income like dividends or trust distributions. If this income exceeds $416, very high tax rates apply. This is an integrity measure to prevent adults from diverting investment income to minors to reduce tax.> ATO Rule: Unearned income for minors above the threshold can be taxed at rates as high as 66%, underscoring the importance of correctly classifying income sources.

Temporary Residents

Temporary residents are generally treated as Australian residents for tax purposes. This means you can claim the full $18,200 tax-free threshold against your Australian-sourced income. The main distinction is that most foreign-sourced income earned while you are a temporary resident is not subject to Australian tax.

Frequently Asked Questions (FAQ)

What happens if I forget to claim the tax-free threshold?

If you forget to tick the 'Yes' box on your Tax File Number Declaration, your employer must withhold tax from the first dollar you earn, reducing your take-home pay. This overpaid tax is not lost; you can claim it back as a refund when you lodge your annual tax return with the ATO. You can submit an updated declaration form to your employer at any time to correct this for future pay cycles.

Can I split the tax-free threshold between two jobs?

No. The ATO's rules are explicit: you can only claim the full $18,200 threshold from one employer at a time. The system is not designed to be split. The correct procedure is to claim it from your highest-paying job and not claim it from any secondary jobs to ensure enough tax is withheld.

Do I need to do anything if my income is under $18,200?

If your total income for the financial year is less than $18,200, you generally will not have to pay any income tax. However, if your employer withheld any tax from your pay during the year, you must lodge a tax return to receive a refund of that withheld amount. The ATO's official tool, 'Do I need to lodge a tax return?', provides specific guidance based on your circumstances.

Does the tax-free threshold apply to superannuation or Centrelink payments?

The tax-free threshold applies to your total taxable income. This includes certain taxable Centrelink payments, such as the JobSeeker Payment or Age Pension. Superannuation withdrawals are taxed under a separate set of complex rules based on your age and other factors. While parts of a super payout can be tax-free, this is distinct from the $18,200 income tax threshold.

Summary: Key Takeaways

The Threshold Amount: For the 2025-26 financial year, Australian residents can earn up to $18,200 tax-free.

Claim from One Employer Only: To avoid a tax debt, claim the threshold only from your highest-paying job.

Residency Matters: Your eligibility is determined by your tax residency status. Non-residents cannot claim the threshold, while part-year residents receive a pro-rata amount.

Lodge to Get Refunds: If your income is below $18,200 but tax was withheld, you must lodge a tax return to get it back.

Get Professional Tax Advice

Navigating Australian tax law can be complex. Understanding fundamentals like the tax-free threshold is the first step, but personalised advice ensures you remain compliant and financially efficient. For expert guidance tailored to your specific circumstances, contact a qualified professional.

Baron Tax and Accounting is here to help you navigate your tax obligations with clarity and confidence.

Website: https://www.baronaccounting.com

Email: info@baronaccounting.com

Phone: +61 1300 087 213

Whatsapp: 0450468318

Comments