Tax Guide for Teachers and Education Professionals

- Jul 31, 2025

- 13 min read

Let's be honest, tax time can feel like a real chore. When your days are spent shaping young minds, the last thing you want to do is get bogged down with paperwork and confusing tax rules. But for Aussie teachers and education professionals, getting your head around your entitlements is the key to a much better tax refund.

From professional development courses to the colourful supplies you buy for your classroom, so many of your day-to-day work costs are actually tax-deductible. You just need to know what to look for.

Your Go-To Teachers and Education Professionals Tax Deduction Checklist

Think of this guide as your cheat sheet for tax time. It’s designed to walk you through exactly what you can claim, so you can feel confident you’re not leaving any money on the table this financial year.

Before we get into the nitty-gritty, it's good to see the big picture. The Australian Taxation Office (ATO) lets you claim deductions for expenses you incur to earn your income. For educators, this opens up a whole world of specific claims that many people don't even realise exist. We've seen countless teachers surprised by how quickly those small, everyday purchases add up to some serious savings.

The Main Buckets for Your Claims

To kick things off, let's break down the major areas where teachers typically find deductions. Getting these organised first makes everything else much easier.

Self-Education & Professional Development: This is a big one. It covers things like courses, seminars, and textbooks that help you stay on top of your game or improve the skills you need for your current teaching role.

Home Office Expenses: All those hours spent planning lessons, marking assignments, and handling admin from home count. You can claim a portion of your utility bills, internet, and even the decline in value of your home office gear.

Work-Related Travel: Your daily trip from home to school isn't claimable, unfortunately. But, if you travel between different campuses, drive to an excursion, or attend an off-site meeting, those kilometres are deductible.

Tools, Equipment & Supplies: This covers a huge range of items. We’re talking about the stationery, art supplies, and books you buy for your classroom, plus a portion of your personal laptop and phone costs if you use them for work.

The goal here isn't just to tick boxes; it's to feel empowered. When you understand what you can claim, you can be sure you're not paying a dollar more in tax than you have to.

To give you a handy overview, we've put together a quick guide to some of the most common deductions for teachers. It's a great starting point for gathering your receipts and getting organised. We'll dive into more specific, real-world examples after this.

Quick Guide to Common Teacher Tax Deductions

Here’s a snapshot of the main tax-deductible expense categories that the ATO recognises for Australian teachers and education professionals.

Deduction Category | Examples of Claimable Items | Key ATO Requirement |

|---|---|---|

Self-Education | Course fees, textbooks, stationery, union fees, journal subscriptions | The study must directly relate to and improve skills in your current job. |

Home Office Expenses | Electricity, gas, internet, decline in value of office furniture | You must keep a record of hours worked from home (e.g., a diary or timesheet). |

Car & Travel Expenses | Travel between campuses, to excursions, or parent-teacher meetings | Home-to-work travel is not claimable; a logbook is often the best proof. |

Work-Related Clothing | Uniforms with a logo, protective items (e.g., lab coats, sun hats) | Conventional clothing, even if your school has a dress code, is generally not deductible. |

Tools & Classroom Supplies | Stationery, art materials, books, teaching aids, a portion of laptop/phone costs | The expense must be for your work and not already paid back by your employer. |

With this table as your guide, you're already on the right track. Remember, the key is having the right records to back up every claim you make.

Claiming Self-Education and Professional Development

As a teacher, your own learning never really stops, does it? Continuous professional development is a huge part of your career, and thankfully, the Australian Taxation Office (ATO) gets it. You can claim deductions for self-education expenses, but the rules can be a bit of a maze.

Getting it right is key to claiming with confidence. For an expense to be deductible, there has to be a clear, direct link between the course you're taking and your current teaching role. The study must be about maintaining or improving the specific skills and knowledge you use in the classroom every day.

What Qualifies as Deductible Self-Education?

The ATO draws a pretty clear line in the sand. If you're studying for a formal qualification, it must have a strong enough connection to your current job. For example, a primary school teacher doing a Master of Education would almost certainly be able to claim those costs.

On the flip side, if a course is only vaguely related to your job or is designed to help you get a new one, it’s not deductible. Think of a high school English teacher undertaking a law degree—that’s a no-go, as it’s preparing them for a completely different career.

The main takeaway? It all boils down to relevance. The education must boost your skills for your current job, not pave the way for a new one. If you can draw a straight line from what you're learning to your daily teaching duties, you're on solid ground.

This is especially important given how stable teaching careers can be. The Australian Institute for Teaching and School Leadership (AITSL) found that in previous years, 69% of teachers had ongoing contracts, and 70% of those worked full-time. This career stability makes ongoing, relevant professional development crucial.

Common Deductible Education Expenses

Once you've established your course is eligible, you can start looking at all the associated costs. It’s often much more than just the tuition fees and can really add up.

Here are some of the things you can typically claim:

Course and Tuition Fees: The most obvious one, of course.

Textbooks and Academic Journals: All your required reading materials are on the list.

Stationery and Supplies: Don't forget pens, notebooks, and the costs of printing and photocopying.

Travel Costs: This can include trips from your home or workplace to your place of education and back.

Decline in Value of Assets: You can claim the work-related portion of the depreciation for big-ticket items like laptops and computers you use for your studies.

Investing in extra skills through accredited Continuing Professional Development (CPD) courses can also bring tax benefits, as long as they are directly related to your role.

Maximising Your Home Office Deductions

For most teachers and education professionals, the school bell doesn't signal the end of the workday. The reality is that lesson planning, marking, and admin tasks frequently follow you home, turning a part of your house into a crucial workspace.

Because of this, the Australian Taxation Office (ATO) allows you to claim deductions for the costs of running your home office. Knowing how to do this correctly is key to getting the return you're entitled to without creating a headache for yourself down the line. It all comes down to picking the right method for your situation.

Choosing Your Claim Method

The ATO has updated its rules, so it's vital to understand the two main options available for claiming your work-from-home expenses.

The Fixed-Rate Method: This is the simpler, more straightforward path. For the 2024-2025 financial year, you can claim a flat rate of 70 cents for every hour you work from home. This rate covers your energy bills (electricity and gas), phone and internet usage, plus stationery and computer consumables. You can still make separate claims for the decline in value (depreciation) of bigger items like your desk, chair, or computer.

The Actual Cost Method: This route requires much more detailed records, but it can often lead to a bigger deduction if your expenses are high. You'll need to calculate the specific work-related percentage of all your home office running costs, from electricity and internet bills to the depreciation of your equipment.

So, which one is for you? It really depends. If you've invested in a lot of new office gear or your utility costs are significant, the actual cost method might be worth the extra effort. If you prefer to keep things simple, the fixed-rate method is a fantastic, no-fuss option.

The Importance of Meticulous Records

Whichever method you choose, the ATO's golden rule is non-negotiable: if you can't prove it, you can't claim it. You absolutely cannot just estimate your hours or expenses.

Data from the Australian Teacher Workforce Data Report shows that a significant number of full-time teachers work well over standard hours, with much of that happening at home. This highlights just how many hours you could potentially claim, but only with the right proof.

To make sure your claim is solid, you must keep:

A diary, timesheet, or planner showing the total hours you worked from home across the entire income year.

Receipts or proof of purchase for any depreciating assets you claim, like a new laptop or office furniture.

At least one monthly or quarterly bill for each utility you claim under the actual cost method (like your internet or electricity bill).

Without these records, your entire home office claim could be at risk if the ATO decides to audit. For a more detailed look at the requirements, check out our comprehensive guide on work from home tax deductions. Perfecting your documentation is the best way to claim what you deserve with complete confidence.

Claiming Work-Related Travel and Car Expenses

As a teacher, your job often spills out beyond the classroom walls, turning your car into a vital piece of work equipment. While your daily drive from home to your main school isn't claimable (the ATO sees that as a private expense), plenty of other trips you make throughout the day absolutely are. Getting this right is a huge part of making sure you’re not leaving money on the table come tax time.

Think about it: trips between different campuses, driving to a sports carnival, heading to a professional development seminar, or even that off-site parent-teacher night. These kilometres add up fast over a school year, and they represent a significant, and often overlooked, tax deduction.

Cents Per Kilometre vs The Logbook Method

The Australian Taxation Office (ATO) gives you two ways to claim your car expenses. The best one for you really boils down to how much you drive for work and how you prefer to keep records.

The Cents Per Kilometre Method: This is the straightforward choice. You can claim up to 5,000 work-related kilometres per car, each year, using a set rate. For the 2024–25 income year, that rate is 88 cents per kilometre. While you don't need receipts for every little thing, you do need to be able to show the ATO how you worked out your kilometres. A simple diary or calendar notes of your work trips will usually do the trick.

The Logbook Method: This one requires a bit more effort upfront, but it can lead to a much larger claim if you do a lot of driving. You'll need to keep a detailed logbook for a continuous 12-week period. This logbook helps establish your car's work-use percentage, which you can then apply to all your car's running costs for up to five years. We're talking fuel, insurance, registration, servicing, and even the depreciation (decline in value) of your vehicle.

Key Insight: If you find yourself driving more than 5,000 work-related kilometres a year, the logbook method will almost certainly give you a bigger tax deduction. The initial 12 weeks of tracking takes discipline, but the financial payoff over the next five years can be well worth it.

If you’re tossing up between the two methods or just want to make sure your records are up to scratch, have a look at our detailed guide on how to claim your car expenses tax deduction.

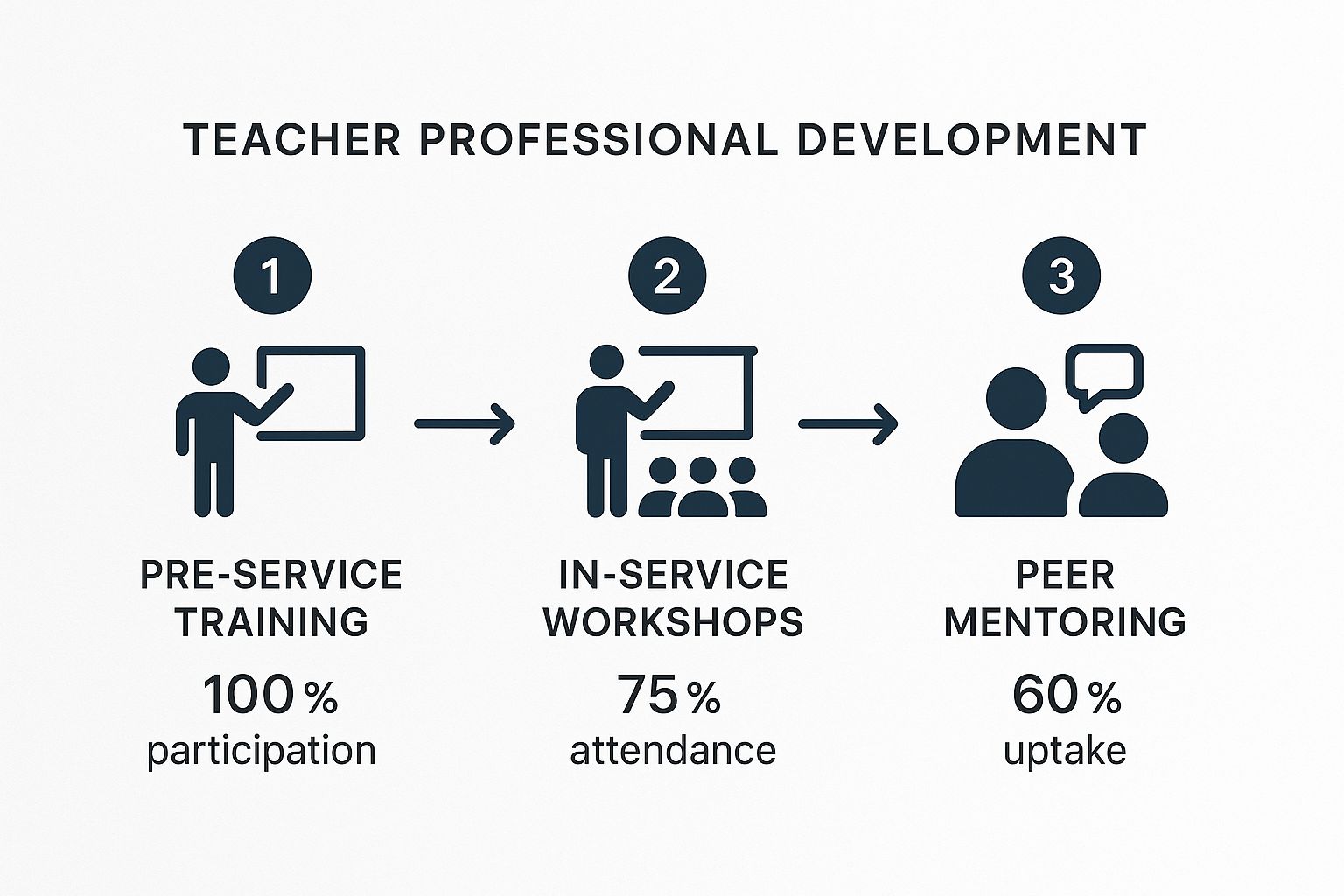

The image below gives a great visual of how ongoing professional development—which often happens off-site—is a key part of a teacher's career, highlighting just how common work-related travel is.

As you can see, things like workshops and mentoring sessions involve a huge number of educators, and these almost always require travel.

Other Claimable Travel Expenses

Don't forget, your travel claims aren't just about your car.

Did you catch public transport, a taxi, or a rideshare to get to a school camp, an excursion, or a conference? Those fares are deductible too. Just be sure to hang onto the receipts or digital records as proof of the expense.

By carefully tracking every work-related journey, you can be confident you’re claiming every single dollar you’re entitled to.

Spotting Other Common Deductions for Educators

Beyond the big-ticket items like self-education and travel, a whole host of smaller, day-to-day expenses can seriously boost your tax refund. For teachers and education professionals, these often-missed deductions are where you can really sharpen your return and make sure you’re not leaving money on the table.

Think of this as your final check for all those miscellaneous, yet incredibly valuable, claims. Many educators just don't realise how many of their out-of-pocket costs are claimable. It’s not just about stationery; it’s about everything you buy to do your job well.

Fees, Subscriptions, and Essential Costs

A great place to start is with your professional fees. These are costs directly tied to your employment, which makes them almost always fully deductible.

Union and Professional Association Fees: Your annual dues for teaching unions or other professional bodies are a straightforward claim.

Teaching Registration: The fee to renew your state or territory teaching registration is a non-negotiable cost of the job, so it’s deductible.

Working with Children Check: Any cost you incur to get or renew this mandatory check can also be claimed.

Don't forget about subscriptions. Any money you've spent on academic journals, teaching magazines, or online resources relevant to your subject area is also deductible.

Classroom Supplies and Protective Items

Every teacher knows the feeling of dipping into their own pocket for classroom supplies. The good news? When you pay for these yourself and aren't reimbursed, the costs are deductible. This covers everything from whiteboard markers and posters to stickers and learning games.

You can also claim protective gear needed for your job. This might be sunglasses for playground duty, a sun hat for the sports carnival, or even a lab coat if you're a science teacher. Along the same lines, if you have to complete a first aid course as a requirement of your role, the fees are claimable.

The rule of thumb is simple: if you spent the money to help you do your job, it wasn't a private expense, and you weren't paid back for it, you should be looking to claim it. Every little bit adds up to a bigger refund.

Teachers often purchase specialised tools to enhance their teaching methods. For instance, investing in assistive technology for educators), particularly for supporting students with learning differences, can be a deductible expense.

Splitting Your Tech and Phone Costs

Claiming a portion of your personal laptop, tablet, or phone bill is another very common deduction for teachers. The key is to calculate a reasonable work-use percentage.

For example, if you figure out that you use your personal phone for work-related calls and messages 30% of the time, you can claim 30% of your monthly bill. To back this up, the ATO likes to see a diary kept over a typical four-week period to establish this work-use pattern.

For a deeper dive into what you can and can't claim, have a look at our comprehensive guide on common individual tax deductions.

Common Tax Questions from Teachers

When it comes to tax time, we find that teachers and education professionals often have a unique set of questions. Your job involves specific expenses that don't always fit neatly into standard deduction categories. Let's walk through some of the most frequent queries we get, so you can claim with confidence.

Can I Claim Gifts I Buy for My Students?

This is easily one of the most common questions we hear, but unfortunately, the answer is no. Any gifts you buy for students, whether it's for their birthday or as an end-of-year treat, are considered a private expense by the Australian Taxation Office (ATO).

The ATO’s view is that these are acts of personal kindness, not a cost that's essential for you to earn your income. It doesn't matter if it feels like an expectation at your school; the link to your assessable income just isn't strong enough for it to be claimable.

How Do Travel Claims Differ for Relief Teachers?

For relief or casual teachers, your travel claims can look very different—and often much more generous—than those of your permanently employed colleagues. Because you don't have one fixed, regular place of work, your travel from home to various schools is often a deductible expense.

This is a massive point of difference, as the daily commute from home to a single workplace is almost always a private, non-deductible cost. But for you, each school is a distinct work site. This makes it absolutely critical to keep a detailed logbook or diary of every work-related trip to back up your claims.

Key Takeaway: For relief teachers, travel to different schools is work, not a commute. Meticulous record-keeping is your best friend when it comes to substantiating these more complex travel claims.

Are My Registration and Checks Deductible?

Yes, absolutely. Any costs directly tied to maintaining your professional status are essential for you to earn an income, which makes them fully tax-deductible.

This covers things like:

Teaching Registration Fees: Your annual fee to stay registered as a teacher is a classic work-related expense.

Working with Children Check: The cost to get or renew this check is also deductible, as it’s a non-negotiable requirement for your job.

Just be sure to hang onto the receipts for both of these crucial professional expenses.

What Records Do I Absolutely Need to Keep?

The ATO has a golden rule that's simple and non-negotiable: no proof, no claim. You are legally required to keep records for five years from the date you lodge your tax return, so getting your paperwork in order is the most important part of the whole process.

Here’s a quick rundown of the must-haves:

Receipts and Invoices: For every single expense, no matter how small.

Logbook: This is essential if you're using the logbook method for car expenses.

Diary or Timesheet: You'll need this to prove the hours you worked from home.

Purchase Receipts for Assets: For bigger items like a new laptop or office furniture, you need that original receipt to calculate its decline in value (depreciation).

Using a dedicated app or even just a simple folder system on your computer can make record-keeping feel less like a chore. For a complete guide on navigating the entire tax process, check out our post on how to file taxes from start to finish.

Need an Expert to Check Your Tax Return?

Sorting out tax as a teacher or education professional can feel like wading through mud. With all the specific rules around self-education, home office hours, and unique work-related expenses, it's easy to wonder if you've missed something. This is where getting a second set of eyes can make all the difference, ensuring you claim every single dollar you're entitled to.

Thinking about getting organised for the next financial year already? Smart move. A great place to start is our detailed tax return checklist. It’s designed to help you structure your record-keeping from day one, which is honestly the secret to a stress-free tax time.

Let the team at Baron Accounting take the weight off your shoulders. We'll handle the complexities, making sure your return is accurate, compliant, and maximised for the best possible outcome. That way, you can get back to focusing on what you do best—educating.

• Need assistance? We offer free online consultations: – Phone: 1800 087 213 – LINE: barontax – WhatsApp: 0490 925 969 – Email: info@baronaccounting.com – Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments