Tax Guide for Guards and Security Employees

- Aug 31, 2025

- 15 min read

As a guard or security professional in Australia, getting the most back at tax time boils down to one thing: knowing your work-related expenses inside and out. Your job isn't a standard 9-to-5 desk gig, and your tax deductions aren't either. From licence renewals to the specific gear you need on shift, many of your costs can be claimed back.

Think of this guide as your complete financial patrol plan for tax season. We're here to help you spot and claim every single dollar you're entitled to.

Your Essential Tax Guide for the Guards and Security employees

Because you work in security, your tax situation has its own unique set of rules. The Australian Taxation Office (ATO) is very specific about what guards can and can't claim, and getting this right is the key to a healthy tax return.

Our mission here is simple: to cut through the jargon and give you a clear, straightforward roadmap. We'll walk you through all the essentials, so you can feel confident and compliant when you lodge your return.

Starting With the Basics

First things first, we need to lock down your employment status. This is the absolute foundation of your tax return, as it dictates how you’re taxed, what your super obligations are, and which deductions you’re eligible for.

It really comes down to two main categories:

Employee: You're an employee if you work for a company that tells you what to do, gives you the tools for the job, and pays you a regular wage with tax already taken out (PAYG, or Pay As You Go).

Contractor: You're a contractor if you run your own show under an ABN (Australian Business Number). You have control over how your work gets done and you send invoices to get paid.

Getting this distinction right from the start is non-negotiable. For security contractors especially, keeping track of income and expenses can get complicated, which is where modern cloud accounting solutions can make life a whole lot easier.

To make this crystal clear, here’s a quick side-by-side comparison.

Employee vs Contractor At a Glance

Responsibility | Employee (PAYG) | Contractor (ABN) |

|---|---|---|

Tax Withholding | Employer withholds tax from your pay (PAYG). | You are responsible for your own tax payments. |

Superannuation | Employer must pay super guarantee into your fund. | You are responsible for your own super contributions. |

Deductions | Can claim specific work-related expenses. | Can claim a wider range of business-related expenses. |

GST | Not applicable. | May need to register for and charge GST. |

Invoicing | Not required. You receive a payslip. | Must issue invoices for services rendered. |

This table is just a starting point, but it highlights the fundamental differences you need to be aware of.

What This Guide Covers

We've structured this guide to build your knowledge one step at a time. We're going to dive deep into the major deduction categories you can claim, including:

Vehicle and travel costs for getting between sites or doing mobile patrols.

The expenses tied to buying and laundering your mandatory uniform.

Costs for renewing licences and any self-education directly related to your role.

Consider this your strategic brief for tax time. Stick with us, and you'll gain the intel you need to handle your tax obligations like a pro, ensuring you don't pay a cent more than you have to. Let's get started.

Are You an Employee or a Contractor?

First things first: getting your employment status right is the single most important step for any security professional when it comes to tax time. Get this wrong, and you could be in for a nasty surprise from the Australian Taxation Office (ATO).

Whether you’re classified as an employee or a contractor completely changes the game. It dictates how you’re taxed, what super you’re entitled to, and the deductions you can claim. The rules for guards and security employees are specific, and a simple misunderstanding can lead to unexpected tax bills and penalties down the line.

Think about two common scenarios in the security industry. In one corner, you have a guard working full-time at a corporate high-rise. They wear a company-supplied uniform, work a set roster, and report to a manager. In the other corner, you have a security officer hired for a one-off music festival. They use their own comms gear, work the hours specified in their contract, and send an invoice to the event organiser afterwards.

These two situations perfectly illustrate the core differences the ATO looks at to figure out where you stand.

The ATO's Key Tests

The ATO doesn’t just take a written agreement at face value. They look at the practical reality of how you work. To do this, they apply a few key tests to build a complete picture of your working relationship.

Control: Who calls the shots? If an employer tells you how, where, and when to do your job, you’re likely an employee. A contractor, on the other hand, generally has more freedom to get the work done as they see fit.

Equipment: Who’s providing the gear? If the company gives you the uniform, vehicle, and two-way radio, that points towards an employee relationship. Contractors are usually expected to provide their own significant tools and equipment.

Payment Method: How do you get paid? A regular wage or salary paid weekly or fortnightly is a classic sign of employment. Contractors are typically paid a fixed amount for a specific result and have to submit an invoice to get their money.

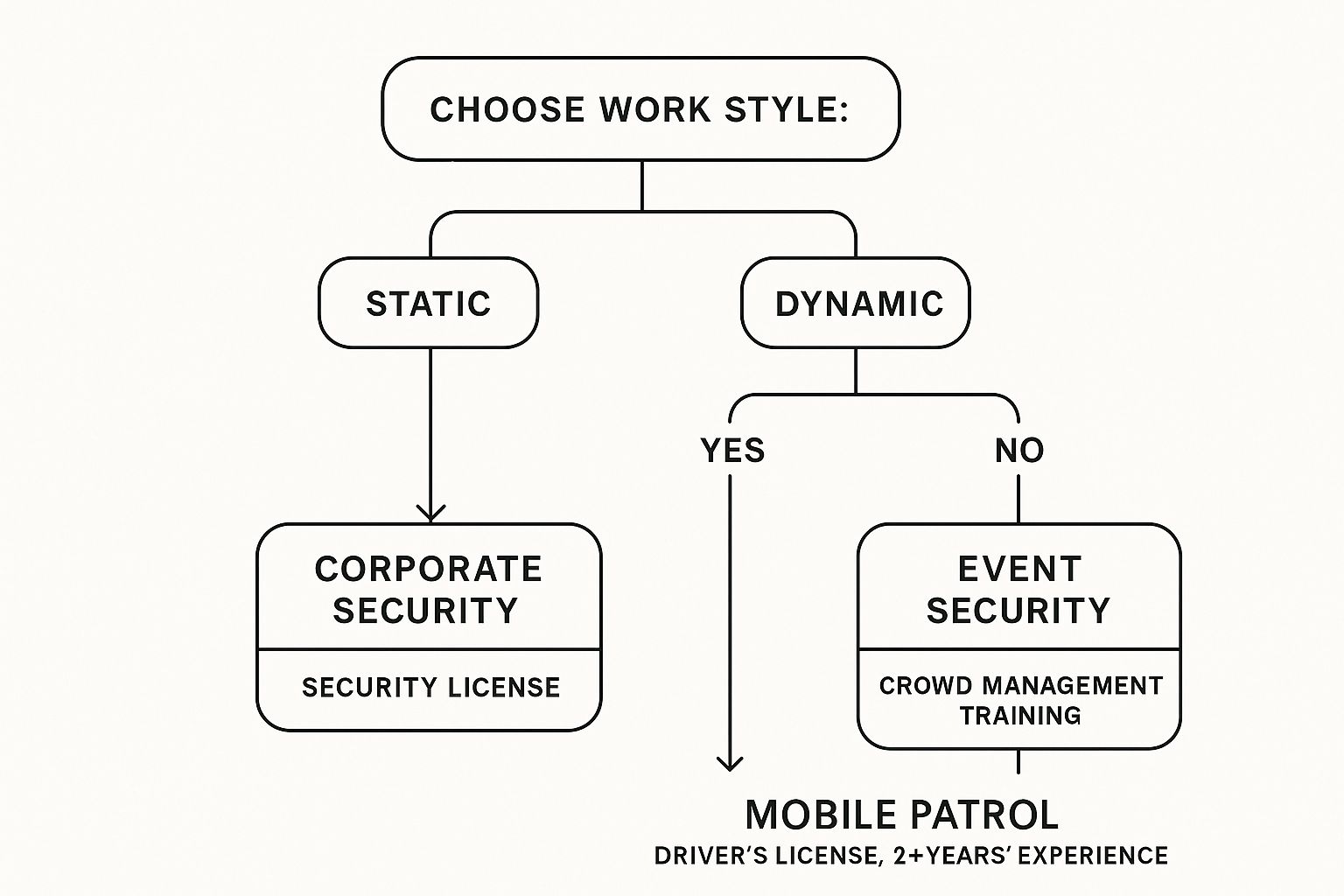

This image gives you a good visual breakdown of how different roles in the security sector can push you into one category or the other.

As you can see, whether your work is static, mobile, or event-based often shapes the expectations around your role, which in turn influences how the ATO sees your employment status.

The Role of an Australian Business Number (ABN)

Having an ABN is a big clue that you’re running a business. If you’re a contractor, you absolutely need one to send invoices for your services.

But here’s the crucial part: simply holding an ABN doesn't automatically make you a contractor. The ATO always looks at the bigger picture—the true nature of your working relationship is what really counts. For those trying to manage different contractors and keep everything above board, using dedicated contractor management software can be a huge help in defining roles and responsibilities clearly.

Getting this distinction right is vital. If you’re classified incorrectly, you could be missing out on thousands in superannuation contributions or find yourself with a hefty tax debt when you lodge your return.

A Complete Checklist of Tax Deductions

Nailing your tax return is all about knowing what you can claim. For guards and security personnel, your list of work-related expenses goes way beyond the usual office supplies. Claiming everything you're entitled to is the surest way to lower your taxable income and get a healthier tax refund.

Think of it like compiling a detailed incident report: every legitimate expense needs to be documented properly, with evidence to back it up. We’ve put together this checklist to make sure you don’t miss any common—or commonly forgotten—deductions specific to the security industry.

The Three Golden Rules of Deductions

Before we get into the specifics, let's lock in the Australian Taxation Office (ATO)'s 'Three Golden Rules'. These are the absolute foundation for any expense you want to claim. Get these right, and you're on solid ground.

You must have spent the money yourself and weren't reimbursed. If your boss paid for your new steel-capped boots or gave you a travel allowance that fully covered your fuel costs, you can’t claim it.

The expense must directly relate to earning your income. There has to be a clear and direct link between what you bought and your job as a security officer.

You must have a record to prove it. This is your evidence—a receipt, an invoice, or a bank statement. No proof, no claim.

According to the ATO, one of the biggest reasons claims get rejected is a lack of records. Keeping organised digital or physical copies of your receipts isn't just a good idea; it's non-negotiable for a hassle-free tax time.

To give you a clearer picture, here’s a breakdown of the most common deductions available to security staff, what you can claim, and what the ATO expects from you.

Common Tax Deductions for Security Personnel

Deduction Category | Examples for Security Staff | What the ATO Requires |

|---|---|---|

Licences & Fees | Security licence renewals, firearms licence renewals, union or professional association fees, and mandatory background or police checks. | The expense must be for renewing a licence, not getting it for the first time. Keep receipts for all fees paid. |

Uniforms & Clothing | Compulsory, logo-branded uniforms. Also includes specific protective gear like steel-capped boots, high-vis vests, safety glasses, and heavy-duty gloves. | The uniform must be mandatory for your work. For protective clothing, you must need it to avoid injury on the job. Keep all receipts for purchase, rental, repair, and cleaning. |

Tools & Equipment | Torches, batteries, body cameras, headsets, holsters, and belts. For those with a guard dog, this includes a portion of food, vet bills, and registration. | The equipment must be necessary for your duties. For a guard dog, you must prove it's a working animal and apportion costs between work and private use. Receipts are essential. |

Phone & Internet | The work-related portion of your mobile phone and home internet bills if you use them to contact supervisors, file reports, or check rosters. | You must keep a logbook or detailed records (like a diary) for a representative four-week period to determine your work-use percentage. Keep all bills. |

Car Expenses | Driving your personal vehicle between different work sites, travelling to training courses away from your usual workplace, or transporting bulky tools or equipment required for your job. | Travel between home and your regular workplace is generally not claimable. You must use either the cents per kilometre method (up to 5,000 km) or the logbook method (for claims over 5,000 km). A logbook must be kept for 12 continuous weeks. |

This table covers the essentials, but every situation is unique. The key is to always think back to the Three Golden Rules: Did you pay for it? Was it for your job? Can you prove it?

If you're a contractor operating your own security business, the range of deductions can be much wider. Our guide on tax deductions for small business dives deeper into business-specific expenses. No matter your structure, every claim needs careful documentation to keep you compliant and maximise your return.

Claiming Your Car and Travel Expenses

If you're a guard or security employee, chances are you spend a fair bit of time on the road. Whether you're doing mobile patrols between client sites or just heading out for special training, travel is part of the job. Getting your head around the Australian Taxation Office (ATO) rules for vehicle and travel costs is key to making sure you claim every dollar you're entitled to.

First things first, let's clear up the biggest point of confusion: the daily commute. The trip from your front door to your main workplace is considered private travel by the ATO, which means it’s not deductible. This is a hard rule, no matter how early your shift starts or how far you have to drive.

But once you’re officially on the clock, the story changes. Any travel you do between different work sites during your shift is fair game. For example, if you start your shift at the main office and then use your own car to visit three different client locations, all the driving between those client sites is claimable.

Cents Per Kilometre Method

This is the straightforward way to claim your car expenses, and it's a great fit if you drive less than 5,000 kilometres for work each financial year.

How it works: You claim a flat rate for every work-related kilometre you drive. For the 2024–25 financial year, that rate is 88cents per kilometre.

What you need: You don't have to keep a shoebox full of receipts for fuel or servicing. However, you do need to be able to show the ATO how you calculated your kilometres. A simple diary or log of your work trips will do the trick.

The cents per kilometre method is simple, but it's capped. You can only claim a maximum of 5,000 business kilometres per car each year using this approach. That works out to a maximum deduction of $4,400 (5,000 km x $0.88).

The Logbook Method

If you're clocking up more than 5,000 work kilometres a year, or if you just want to claim the actual running costs of your vehicle, the logbook method is for you. It definitely requires more paperwork, but for guards who are constantly on the move, it almost always leads to a much bigger tax deduction.

To use this method, you need to keep a detailed logbook for at least 12 consecutive weeks. This logbook helps you work out your 'business-use percentage' – basically, what portion of your car's use is for work. You can then claim that same percentage of all your car expenses for the year, including fuel, insurance, rego, and even the depreciation in its value.

For a deep dive into getting this right, check out our detailed guide on how to claim your car expenses. It walks you through setting up and keeping a logbook the ATO will love.

Other Travel-Related Costs

It’s not just about the car itself. Other travel costs can add up, too. If you have to pay for parking or tolls while travelling between different work sites, those expenses are fully deductible.

Just remember the golden rule: keep the receipts! You'll need them to prove these costs were a direct part of doing your job.

Understanding Your Superannuation Entitlements

Let's talk about 'super'. Think of superannuation as a nest egg you build throughout your working life, specifically for your retirement. For any guard or security employee, getting a firm grip on your super entitlements is non-negotiable. It's the foundation of your future financial security, and you need to know you're being paid correctly.

Under Australian law, your employer is legally required to pay a percentage of your regular earnings into a super fund for you. This system is called the Superannuation Guarantee (SG).

For the 2024–25 financial year, the SG rate is set at 11.5%. This isn't a static number; it's scheduled to gradually climb until it hits 12% in July 2025. These payments are mandatory for almost everyone, whether you're full-time, part-time, or a casual employee. Your employer must deposit these funds at least every quarter to stay on the right side of the Australian Taxation Office (ATO).

What About Super for Contractors?

This is where things can get a bit murky in the security industry. While a true independent contractor is usually responsible for sorting out their own super, the lines are often blurred.

The ATO doesn't just look at whether you have an ABN; they dig into the actual details of your work arrangement. If you're contracted mainly for your personal labour and skills, you might still be classified as an 'employee' for super purposes, even if you send invoices. This means the company that hired you could still be on the hook for paying your 12% SG.

It's a massive misconception that having an ABN automatically means you don't get super from the company you work for. The ATO cares about the nature of the work, not just the label on your invoice.

How to Check if You're Getting Paid Correctly

Keeping tabs on your super is a critical financial health check, and luckily, it's pretty straightforward. Here’s how you can do it:

Check Your Payslips: Every payslip should clearly state how much super has been contributed for that pay period.

Log into Your Super Fund: Your super fund's website or app is your best friend. Log in and look at your transaction history to confirm the payments are actually landing in your account.

Use ATO Online Services: By linking your myGov account to the ATO, you can get a bird's-eye view of all your super accounts and see the contributions reported by your employers.

Found a problem? If you spot that payments are missing or incorrect, your first step should be to chat with your employer. If that doesn't clear things up, you can report the issue directly to the ATO, and they'll investigate it for you.

Want to Boost Your Retirement Savings?

The SG is just the starting point. You can take control and grow your super much faster. Things like salary sacrificing (paying some of your pre-tax salary into super) or making personal deductible contributions can seriously accelerate your savings while potentially lowering your taxable income for the year.

Of course, to make smart decisions here, you first need to understand how your income is taxed. A great place to start is our complete guide to the Australian tax-free threshold.

How to Lodge Your Tax Return

Alright, you've sorted your income statements and wrangled all those deduction records. Now for the final step: lodging your tax return. For guards and security employees, getting this part right—meeting the deadlines and picking the best method—is key to a smooth, penalty-free tax time.

The standard deadline if you’re lodging your own tax return is 31 October every year. You’ll want to circle that date in your calendar because missing it can lead to some unwelcome penalties from the ATO. The good news? Using a registered tax agent usually buys you a significant extension.

Your Lodgement Options

You've got three main paths you can take to lodge your return. Each one has its pros and cons, really depending on how confident you feel and how complex your finances are.

Lodge with myTax: This is the ATO's own online portal, which you get to through myGov. It’s completely free and does a lot of the heavy lifting by pre-filling information like your salary and any bank interest. It’s a solid choice if your tax affairs are pretty straightforward.

Lodge with a Paper Form: This is the old-school way. While it’s still an option, it's easily the slowest and most likely to have errors. You'll need to fill out the forms by hand and mail them off to the ATO.

Lodge with a Registered Tax Agent: This is where you bring in a professional. Partnering with an accountant is hands-down the best way to make sure you’re compliant and getting the biggest refund possible. They know the ins and outs of deductions for security personnel and can help you navigate those tricky claims correctly.

Why Use a Tax Agent?

A tax agent does a lot more than just fill in boxes on a form. They bring industry-specific expertise to the table, making sure you don’t overlook claims for things like guard dog expenses or specialised equipment you had to buy.

This kind of professional oversight seriously lowers your risk of an ATO audit and, more often than not, leads to a much better outcome on your tax return.

For many in the security field, the fee for using a tax agent is a small price to pay for peace of mind and a potentially larger refund. Plus, the agent's fee is itself tax-deductible on your next return.

Before you jump in, get your documents together: your Tax File Number (TFN), income statements, and all the receipts for your work-related expenses. Having everything on hand makes the whole process faster, no matter which option you go with. For a complete walkthrough, our guide offers a detailed look into how to file taxes in Australia covering every step you need to take.

Frequently Asked Tax Questions

Working in security brings up some unique tax questions. Let's tackle the most common ones we hear from guards and security staff to clear up any confusion and keep you on the right side of the ATO.

Can I Claim My Initial Security Licence Fee?

This is a big one, and the short answer is no. The Australian Taxation Office (ATO) considers the cost of getting your initial security licence a capital expense. Think of it as the price of admission—it’s what allows you to start earning income in the first place, so it’s not deductible.

However, once you're in the game, the costs to stay there are deductible. Any money you spend on renewing that licence or keeping up certifications essential for your current job can be claimed. This includes things like renewing a firearms licence or a first aid certificate if your role requires them.

Is My Uniform Tax Deductible?

Yes, but there are some strict rules. You can claim the cost of buying, renting, repairing, and cleaning a compulsory uniform. The key is that it must clearly identify you as a security officer, usually with a company logo stitched on. This rule also covers mandatory protective gear like steel-capped boots or high-visibility vests.

You generally can't claim a deduction for conventional clothing, even if your boss tells you to wear it. For example, plain black trousers and a simple white shirt won't cut it because they aren't specific to your occupation.

What Records Do I Need to Keep?

The golden rule from the ATO is to keep all your work-related records for five years from the date you lodge your tax return. This isn’t just about receipts; it includes invoices, logbooks for travel, and any relevant bank statements that show your expenses.

Keeping good records is your best friend at tax time. It’s the proof you need to back up every claim you make, giving you peace of mind and protecting you if the ATO ever comes knocking for a review.

Tax Time Doesn't Have to Be a Headache. Let Us Help.

Let's be honest, figuring out taxes can be a real maze, especially with all the specific rules for guards and security staff. It’s easy to miss out on deductions you’re entitled to or, worse, make a mistake that flags the ATO. Why leave your hard-earned money on the table or risk the stress of an audit?

Our team of registered tax agents live and breathe this stuff. We specialise in helping security professionals just like you. We know exactly what you can claim—from your uniform costs to your security licence renewal—and we'll guide you through the entire process, step by step.

You focus on your important work, and we'll handle the numbers. You'll have peace of mind knowing your tax return is accurate, compliant, and maximised.

• Need assistance? We offer free online consultations:

– LINE: barontax – WhatsApp: 0490 925 969 – Email: info@baronaccounting.com – Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments