Gaming Attendants in Australia: Your Ultimate Guide

- Aug 30, 2025

- 12 min read

Step onto the gaming floor of any buzzing Aussie pub, club, or casino, and you'll find the Gaming Attendant. They're the frontline professionals who make sure everything runs smoothly for anyone having a flutter on the electronic gaming machines.

This role is a unique blend of customer service, tech support, and strict rule-following, making them absolutely vital to the daily buzz of the venue.

What a Gaming Attendant Actually Does

Forget the idea of someone just standing around watching over the machines. A Gaming Attendant is more like an experience coordinator, a problem-solver, and a guardian of responsible gaming all rolled into one. No two days are ever really the same. One minute you're sorting out a technical glitch, the next you're handling a big payout, all while keeping a close eye on the legal side of things.

This isn't your standard customer service gig. It demands a very specific set of skills to manage the fast-paced environment. You're the face of the venue, creating a friendly vibe while making sure the gaming operations are all above board.

Core Responsibilities Unpacked

The job really boils down to three key areas. Get these right, and you're well on your way.

Here’s a snapshot of what a gaming attendant is juggling on any given day. It’s a role that requires a cool head, sharp eyes, and great people skills.

Responsibility Area | Key Tasks | Required Skills |

|---|---|---|

Patron Engagement and Support | Explaining games, processing payouts, answering questions, handling member loyalty programs. | Exceptional communication, patience, friendly demeanour, problem-solving. |

Machine and Financial Management | Minor machine maintenance (like clearing ticket jams), refilling ticket printers, managing cash floats, reconciling takings. | Attention to detail, trustworthiness, numeracy, basic technical aptitude. |

Compliance and Safety | Promoting responsible gambling, identifying patrons at risk, providing support info, ensuring venue follows gaming laws. | Vigilance, strong ethics, knowledge of regulations (RSA/RCG), assertiveness. |

Each of these pillars is crucial. You're not just serving customers; you're maintaining the integrity and safety of the entire gaming floor.

The Australian Bureau of Statistics officially recognises just how important this job is. They classify a Gaming Attendant (code 471431) as someone who helps patrons, looks after electronic gaming machines, and handles transactions. It's a Skill Level 4 occupation, which usually means you need an AQF Certificate II or III, or at least one year of solid experience, to do the job well. You can explore the official ABS occupation details to see the full breakdown.

A Glimpse into a Typical Day

Picture this: your shift kicks off with preparing the cash floats and doing a quick run-through to make sure every gaming machine is ready for action. Once the doors open and patrons start coming in, you switch into customer mode. You're constantly moving, keeping an eye on the floor, ready to jump in whenever someone needs help—whether it’s a machine that's jammed or a question about the venue’s loyalty program.

Throughout your shift, you're handling cash, processing jackpots, and always, always watching for any signs of problem gambling. It’s a role that demands you to be switched on at all times, mixing the people skills of a hospitality pro with the accuracy of a cashier and the watchfulness of a compliance officer. It’s definitely a challenge, but for anyone who enjoys a structured, fast-paced environment, it's incredibly rewarding.

Your Career Path and Industry Outlook

Starting as a gaming attendant isn't just a job—it's your entry ticket into a massive, fast-moving industry. Think of it as the foundation for a real career. You're on the ground floor, learning a powerful mix of customer service, cash handling, and the ins and outs of strict government regulations.

Many seasoned professionals in hospitality and entertainment got their start right where you are. The skills you pick up on the gaming floor are incredibly transferable. Juggling cash responsibly, keeping your cool while sorting out disputes, and sticking to compliance rules aren't just daily tasks; they're the building blocks that make you a prime candidate for the next step up.

Opportunities For Growth

For a dedicated gaming attendant, the most natural next step is often into a supervisory role. This means more responsibility, like leading a team, managing bigger financial totals, and tackling the trickier customer issues that get escalated.

From there, the path really opens up:

Gaming Supervisor: You'll be the one running the show for your shift, leading a team of attendants and making sure the entire floor operates like a well-oiled machine.

Venue Manager: This is a major leap. You’re now overseeing the entire gaming operation—from hiring and compliance to profitability and the overall customer vibe.

Compliance Specialist: If you have a sharp eye for detail and enjoy the rulebook side of things, a career in compliance is a great fit. You’ll be the expert making sure the venue follows every single state and federal gaming law to the letter.

A Stable And Growing Industry

The future looks bright for gaming attendants in Australia. The whole gaming and entertainment sector is expanding, and that means more jobs and more security. Industry stats are pointing to a 5% growth rate over the next five years, which is solid. This growth is all about venues wanting to provide better gaming services and keep their customers engaged.

In places like Brisbane, you'll even see school-based traineeships acting as a fantastic gateway for young people to get hands-on experience while they're still studying.

This steady growth means you’re entering a field with long-term potential. As you move forward, it's also crucial to understand your employment status, because it directly affects your rights and how you handle your taxes.

And to make sure you're putting your best foot forward, it pays to know the common job search mistakes to avoid. Your journey as a gaming attendant is just the beginning of what can be a very versatile and rewarding career.

Understanding Your Salary and Pay Rates

Most gaming attendant jobs fall under the Hospitality Industry (General) Award. Think of this as the rulebook that sets the minimum pay rates and conditions for everyone in the sector. It’s the safety net ensuring you get paid fairly for every hour, especially those less-than-social ones.

Cracking the Code on Pay Rates

A big chunk of your income will likely come from penalty rates. The gaming industry never sleeps—it’s a 24/7 operation—and your pay reflects that. Your willingness to work nights, weekends, and public holidays comes with a financial reward.

These penalty rates are there to compensate you for working outside the standard 9-to-5, and they can seriously boost your take-home pay. It pays (literally) to get familiar with the award specifics to make sure you’re being paid correctly for every single shift.

Key Takeaway: Don't underestimate the power of penalty rates. Working a Saturday night or a public holiday can often mean pay rates that are 25% to 100% higher than your base hourly wage. That makes a massive difference to your bottom line.

What Can You Expect to Earn?

While the exact figures will vary from place to place, we can look at some general benchmarks. An entry-level gaming attendant will usually start on an hourly rate that aligns with the Hospitality Award’s base levels. Stick with it, prove you're reliable, and after a year or two, your base rate will climb.

Entry-Level (0-1 year experience): Expect a base rate around the national minimum or award wage. Your real earnings boost will come from those penalty rates.

Experienced Attendant (2+ years experience): Once you’ve got skills and experience under your belt, you can command a higher base rate. Top performers in high-end venues can earn considerably more.

Supervisor/Manager: Stepping up into leadership comes with a salary package that reflects the extra responsibility for staff, compliance, and keeping the finances in check.

To make sure you're being compensated fairly, it’s smart to see what the going rates are for similar roles. You can start by conducting thorough market salary research to see how your pay stacks up against industry standards. This knowledge is your best asset when it comes to negotiating pay or planning your next career move.

Ultimately, your earnings are a direct reflection of your value to the venue. But just as important as understanding your payslip is staying organised for tax time. For a detailed guide on what you'll need, check out our comprehensive tax return checklist to make sure you have all your documents ready to go.

Maximising Your Tax Deductions

Getting your head around your payslip is one thing, but knowing how to keep more of your hard-earned cash is a completely different ball game. For gaming attendants, a solid grasp of work-related tax deductions can make a huge difference come tax time, ensuring you claim every single dollar you're entitled to.

The Australian Taxation Office (ATO) is pretty clear on what you can and can't claim. It all boils down to three golden rules: you must have paid for it yourself (and weren't reimbursed), the expense must be directly tied to earning your income, and you need a record to prove it. Simple.

Common Deductions for Gaming Attendants

Working as a gaming attendant comes with its own specific set of costs just to do your job. The good news is that many of these are legitimate tax deductions that can help lower your taxable income.

Let's break down some of the most common claims you can make:

Compulsory Uniforms: If your employer makes you wear a uniform with a logo or branding, you can claim the cost of buying, renting, and even repairing it.

Laundry and Cleaning: The costs of keeping that uniform clean are also on the table. The ATO even has set rates you can use if your claim is under $150, which means you don't need to keep every single receipt for laundry powder. Easy.

Licence and Certification Renewals: Keeping your qualifications up to date is crucial. You can claim the renewal fees for your Responsible Service of Alcohol (RSA) and Responsible Conduct of Gambling (RCG) licences. Just remember, you can't claim the initial cost of getting them for the first time.

Protective Items: If your job requires special safety gear, like non-slip shoes to prevent accidents on a polished floor, you can claim the cost of buying them.

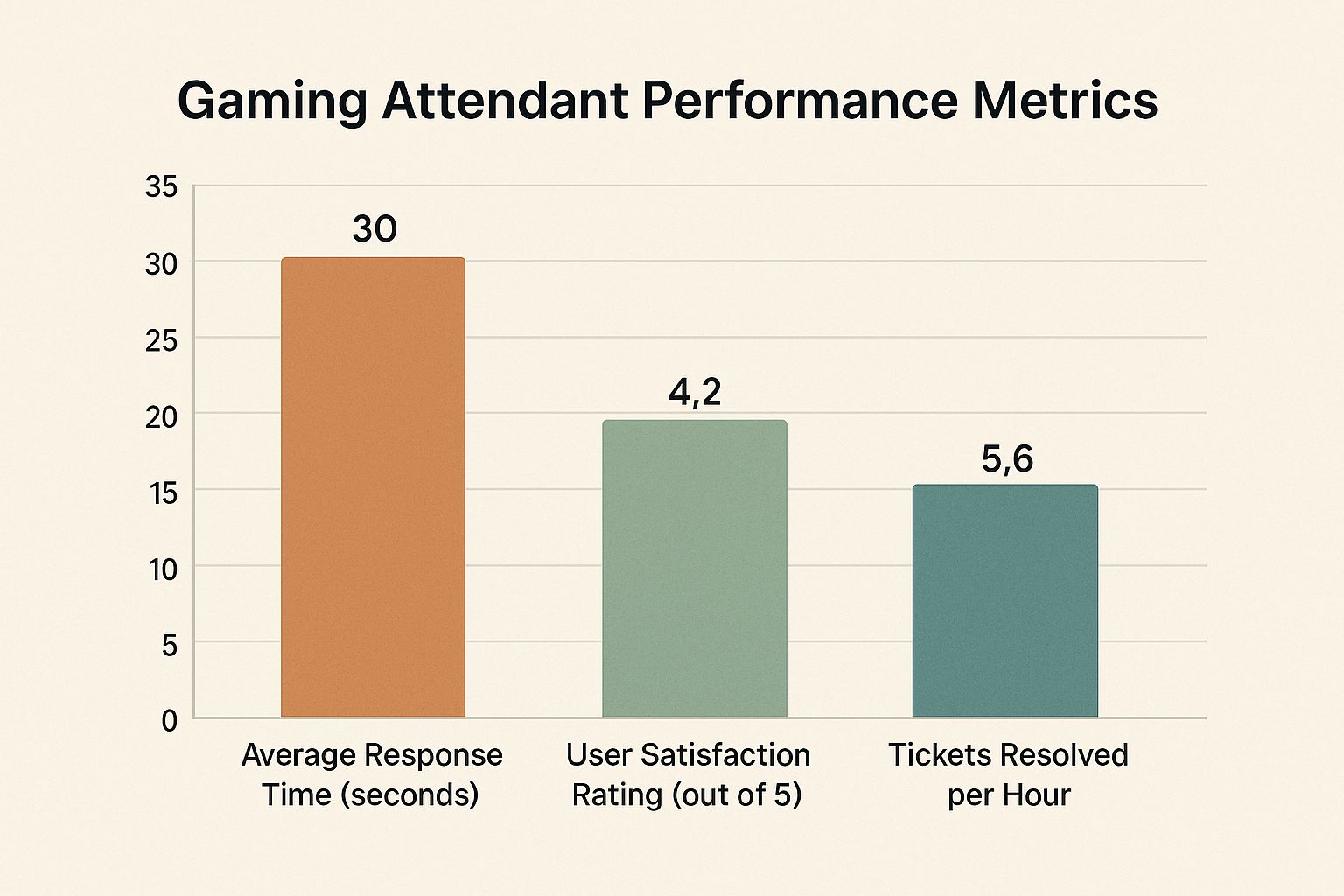

This kind of data shows just how much goes into the role behind the scenes—it’s not just about customer service, but also about efficiency and hitting professional standards.

Travel and Other Expenses

Claiming travel can feel a bit tricky, but there are definitely situations where gaming attendants can make a claim. Your daily trip from home to your main workplace? Unfortunately, that's not claimable.

However, if your boss asks you to travel from one venue directly to another during your shift, the cost of that trip is fair game. The best way to track this is by keeping a simple logbook. It’s your best evidence.

Since many gaming attendants get tips and work on an hourly basis, it’s worth staying on top of the rules specific to your situation.

Your Gaming Attendant Tax Deduction Checklist

To make things a little easier, here’s a quick checklist of potential deductions you can explore. Always double-check that your claims fit the ATO's three golden rules.

Expense Category | Examples | ATO Golden Rules (Must be work-related, you paid for it, you have a record) |

|---|---|---|

Uniforms & Laundry | Logo-branded shirts, pants, skirts; laundering or dry-cleaning costs. | Yes, if the uniform is compulsory and distinctive to your employer. |

Licences & Renewals | RSA, RCG, or any other required gaming licence renewal fees. | Yes, for renewals. The initial cost of obtaining the licence is not claimable. |

Protective Items | Non-slip shoes, safety glasses, or any other mandated safety equipment. | Yes, if required for your safety at work. |

Work-Related Travel | Driving between different venues during a single shift. | Yes, but not for travel between home and your regular workplace. Keep a logbook. |

Self-Education | Course fees for a formal qualification that directly improves your skills in your current role. | Yes, if it maintains or improves skills needed for your job. |

Tools & Equipment | Calculators, stationery, or other small items you buy for work (if under $300). | Yes, you can claim the full cost for items under $300. |

Union/Professional Fees | Annual membership fees for a union or professional association. | Yes, these are fully deductible. |

This checklist is a great starting point, but everyone's situation is a bit different. Always keep your receipts and records organised!

Trying to get all of this right can feel a bit overwhelming, but a little bit of organisation goes a long way. For a more detailed guide on getting the best result, have a look at our expert tips to maximize your tax return in Australia.

Smart Record Keeping for Tax Time

A great tax return doesn’t just happen in June; it’s the result of good habits built all year round. For gaming attendants, staying organised is the single best way to maximise your refund and dodge that last-minute panic. When your records are in order, you can confidently claim every single work-related deduction you're entitled to under ATO guidelines.

The trick is to make tracking your expenses a simple, everyday routine. Forget the old shoebox overflowing with faded receipts. These days, technology makes the whole process a lot easier and far more reliable.

Going Digital With Your Records

The simplest way to keep your financial records straight is to use digital tools. A fantastic place to start is the ATO’s myDeductions tool, which you can find right in the main ATO app. It lets you snap a quick photo of a receipt and log the expense right there on the spot.

Think of your phone as your pocket-sized tax assistant. The moment you pay for that RSA renewal or buy a new pair of non-slip work shoes, you can capture the receipt immediately. This one simple action means no more lost dockets and gives you the clear, ATO-compliant proof you need for every claim.

Of course, there are other options, like dedicated expense-tracking apps or even a basic spreadsheet you update each week. The key is to find a system that you'll actually use and stick with it. Consistency is way more important than complexity.

Essential Documents to Keep Safe

Beyond individual receipts, there are a handful of key documents you’ll need to have ready for your tax return. Keeping these organised will make lodging an absolute breeze.

Income Statement: This is the big one. It summarises everything you’ve earned and the tax your employer has already withheld. Your employer usually finalises it by mid-July, and it pops up in your myGov account.

Logbooks: If you’re claiming work-related car expenses for driving between venues, a logbook is non-negotiable. You’ll need to track your journey's purpose, date, and kilometres for a continuous 12-week period.

Bank Statements: These are great for cross-referencing your spending and catching any work-related purchases you might have forgotten to log. Highlighting the relevant transactions can be a lifesaver.

By putting aside just a few minutes each week to keep your records updated, you can turn tax time from a dreaded deadline into a simple box-ticking exercise. It’s a proactive habit that ensures you’re playing by the ATO’s rules and can file an accurate, stress-free return.

For anyone juggling multiple jobs or dealing with more complex finances, understanding the bigger picture of deductions is vital. While this guide is tailored for employees, the same record-keeping principles apply to sole traders. You can learn more by checking out our guide on tax deductions for small business, which really drills down into the importance of meticulous documentation. At the end of the day, good record-keeping is universal.

Common Questions for Gaming Attendants

Working on a gaming floor brings up a lot of questions, especially in a role as regulated as a gaming attendant. From the right qualifications to tricky tax rules, getting clear answers is the first step to a successful career. Let's tackle some of the most common queries we hear.

What Qualifications Do I Need?

You can't just walk onto a gaming floor and start working; you need specific certifications to legally do your job in Australia.

The two big ones are the Responsible Service of Alcohol (RSA) and the Responsible Conduct of Gambling (RCG) (or whatever your state calls it). Many employers also look favourably on a Certificate II or III in Hospitality, even if it’s not a day-one requirement. Here's a great tax tip: the initial cost to get these tickets isn't claimable, but the fees you pay to renew them down the track generally are.

Can I Claim My Uniform on My Tax Return?

This is a classic point of confusion, but the ATO is pretty black and white on this. You can't claim deductions for plain, conventional clothing—think standard black trousers or a simple white shirt—even if your boss insists you wear them.

However, if you're made to wear a compulsory uniform that’s unique to your employer, like a shirt or jacket with the venue's logo embroidered on it, you're in luck. The cost of buying and laundering these items is deductible. Just be sure to keep good records of what you spent.

Are Tips from Customers Taxable Income?

Yes, 100%. Any tips or gratuities you receive are considered income and must be declared on your tax return. It makes no difference whether a customer hands you cash or it's added electronically—it's your responsibility to report it.

It’s vital to keep a running tally of any cash tips you pocket during the financial year. This ensures you’re reporting everything correctly to the ATO and can help you avoid headaches later on.

Can I Claim Travel Between Different Venues?

Understanding travel deductions is a big one because it's so easy to get wrong. Your daily trip from home to your main workplace and back again is just your regular commute, and you can't claim it.

But, if your boss asks you to travel directly from one venue to another during your shift, you can usually claim the car expenses for that part of the journey. The rules are quite similar to other jobs that require moving between sites. If you want to dig deeper into vehicle claims, our Australian tax guide for bus drivers has some helpful examples that apply here too. The best way to track these work-related kilometres is by keeping a logbook.

• Need assistance? We offer free online consultations:

– LINE: barontax

– WhatsApp: 0490 925 99

– Email: info@baronaccounting.com

– Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator:👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage:🌐 www.baronaccounting.com

Comments