Australian Tax Guide for Police Officers

- Aug 18, 2025

- 13 min read

Let's be honest, tax time is probably the last thing you want to think about after a long shift. For police officers in Australia, lodging your tax return isn't always straightforward. The ATO language can feel like a whole different kind of code to crack.

This guide is here to cut through the noise. We'll give you clear, practical advice specifically for members of the force, so you can lodge with confidence and get the best possible refund.

Your Tactical Briefing for Tax Time

Being a cop means your work expenses are worlds away from the typical office job. Unpredictable call-outs, maintaining your own gear, and constant training—these all come with costs that are often overlooked but are legitimate tax deductions. Knowing exactly what you can claim is the key to making sure you're not leaving your hard-earned money on the table.

Think of this as your tactical briefing for this financial year. We're skipping the generic advice and getting straight into the details that matter to your profession.

What This Guide Covers for Police Officers

We're going to break down the key claim areas so you know exactly where to focus when preparing your tax return. Here’s what we’ll cover:

Vehicle and Travel Claims: The ins and outs of claiming travel between different stations, trips to court, and driving to training events.

Uniform and Gear Expenses: This is a big one. It's not just about laundering your uniform, but also those essential items you buy yourself, like specialised boots, holsters, or torches.

Home Office Costs: A lot of officers end up finishing reports or catching up on paperwork at home. We'll cover the basics here, and for a deeper dive, check out our detailed guide on work-from-home tax deductions.

Self-Education and Training: Did you pay for a course to upskill for your current role? We’ll look at what you can claim.

By the time you're done with this guide, you’ll have a solid checklist of deductions available to you. The goal is to help you lodge your tax return accurately and make sure you claim every single dollar you're entitled to.

Deconstructing Your Income and Allowances

Before we start hunting down deductions, we need to get the first part right: understanding exactly what the Australian Taxation Office (ATO) counts as your assessable income. For police officers, it’s never just about your base salary. It's a whole mix of different payments that all need to be declared.

Your income statement on myGov is your starting point, showing your gross pay. But the real key to getting your tax return right—and making sure you're set up to claim everything you can—is in the finer details of your payslip.

Breaking Down Your Gross Income

Your total earnings as an officer are made up of a few different pieces. The big one, of course, is your base salary, which is what you get for your standard hours. But as you know, police work is rarely that simple.

You’ve also got to account for all those overtime payments. Whether it's from staying back late, getting called in for a special operation, or heading to court on your day off, every bit of overtime is taxable income and has to be on your return.

Then there are the allowances. These are crucial. While they count as income, they often unlock the door for you to claim expenses you paid for out-of-pocket.

Common allowances you might see are:

Meal Allowances: Paid when you work overtime and can't take a proper meal break.

Travel Allowances: Covers your accommodation, food, and other costs when you have to work away from your home station.

Special Duty Allowances: For taking on specific, often higher-risk roles like tactical operations, undercover work, or serving in remote posts.

It's a classic mistake to think allowances are tax-free. They aren't. The ATO sees them as part of your income. The trick is that receiving an allowance is often the trigger that lets you claim a deduction for the expense it was meant to cover.

Understanding the Tax Implications

The way police officers are paid reflects the demanding nature of the job. According to Jobs and Skills Australia, the median full-time weekly income for officers is $2,422. That’s a fair bit higher than the median of $1,697 per week across all other jobs. You can dig into more detailed earnings data on their website.

That higher income bracket means managing your tax properly is even more important. Every single dollar of your assessable income adds to your total tax bill for the year. To get a handle on how this works with the tax-free portion of your income, check out our comprehensive guide on the Australian tax-free threshold. Getting all your income streams identified and declared correctly is the foundation of a solid, accurate tax return.

Digging into Your Key Work-Related Expenses

This is where your diligence really pays off. Knowing what you can claim as a work-related expense is the single most effective way to lower your taxable income and boost your refund. For police officers, the list of potential deductions is much longer than for most other jobs, all thanks to the unique demands you face every day.

We're going to move past the obvious stuff and get into the specific, often-overlooked claims that are available to you. Getting these categories right is vital, and so is knowing exactly what the Australian Taxation Office (ATO) needs as proof for every dollar you claim.

Uniforms and Protective Gear Deductions

One of the most clear-cut claims for police officers revolves around your uniform. This covers any piece of clothing that's part of your compulsory uniform or features your employer's logo permanently fixed to it.

The costs you can claim here are pretty straightforward:

Buying it: The initial cost of any uniform items you had to purchase yourself.

Fixing it: Any money spent on mending rips or replacing buttons to keep your uniform in good nick.

Washing it: The cost of laundering and ironing your uniform. The ATO makes this simple, allowing a claim of $1 per load for washes containing only your uniform, or you can calculate a reasonable cost for mixed loads.

But it doesn't stop at the standard-issue blues. You can also claim deductions for protective gear essential for your safety, as long as it wasn't supplied or paid for by your employer. Think about things like specialised heavy-duty boots, a custom firearm holster, durable gloves, or a high-vis winter jacket. These all fall under the umbrella of valid protective clothing claims.

Professional Fees and Self-Education

Staying on top of your game and connected within the force often comes with ongoing costs. The good news is these are almost always tax-deductible if they're directly tied to earning your income.

Common claims in this area include:

Union Fees: Your annual police union or association membership fees are 100% deductible.

Professional Registrations: Any costs for renewing essential licences, like a firearms licence required for your duties.

Work-Related Publications: Subscriptions to journals or magazines, such as the Police Journal, that have a direct link to your work.

Self-education is another massive area for potential claims. You can deduct the costs of a course if it has a clear connection to your current role as a police officer and helps you maintain or improve the specific skills you need. For example, a course in advanced forensic investigation techniques would almost certainly be deductible.

The ATO's Golden Rule: To claim a work-related expense, you must meet three criteria: you spent the money yourself and weren't reimbursed, the expense directly relates to earning your income, and you have a record (like a receipt) to prove it.

To help you keep track, here’s a quick checklist of common deductions for police officers. It’s a great starting point to make sure you’re not leaving any money on the table.

Common Tax Deductions Checklist for Police Officers

Deduction Category | Examples for Police Officers | Key Substantiation Rule |

|---|---|---|

Uniform & Protective Gear | Compulsory uniform items, boots, gloves, holsters, high-vis jackets | Receipts for purchase/repair. Logbook or diary notes for laundry costs. |

Professional Development | Union/association fees, firearms licence renewal, Police Journal subscription | Invoices or receipts showing the name of the supplier and the amount. |

Self-Education | Course fees, textbooks, stationery for courses improving current job skills | Enrolment records and receipts for all related costs. |

Home Office Expenses | Portion of electricity, gas, and internet for admin work done at home | Diary/logbook of hours worked from home and relevant utility bills. |

Tools & Equipment | High-powered torch, binoculars, briefcase, gun cleaning supplies | Receipts for items under $300. Items over $300 are depreciated. |

Car Expenses | Travel between stations, to court, or for training in your personal vehicle | Logbook for claiming more than 5,000 km, or cents per km method. |

Fitness Expenses | (Specialist roles only) Gym fees if maintaining an exceptionally high fitness level is an explicit job requirement | Requires a formal letter from employer and detailed fitness logs. |

Other Deductions | Work-related phone calls, donations to registered charities (over $2) | Phone bills with work calls highlighted, receipts for donations. |

This table covers the big ones, but your personal situation might include other valid claims. Always keep your receipts—it's the best habit you can get into at tax time.

Looking at Other Common Claims

Plenty of other expenses that police officers incur fall outside of these main buckets. You might have to use your personal phone for work calls or spend time at home catching up on reports. These smaller costs definitely add up.

Keep an eye out for these less obvious but perfectly valid deductions:

Home Office Expenses: If you regularly finish incident reports or handle other paperwork at home, you can likely claim a portion of your household running costs, like electricity and internet. The ATO’s revised fixed-rate method is designed to make this calculation easier.

Fitness Expenses: Now, this is a tricky one. For most officers, gym memberships are a private expense. However, a deduction may be allowed for those in highly specialised roles (like tactical response units) where you have to maintain a fitness level well above the norm as an essential and explicit part of your job. The ATO sets a very high bar here, so you'll need strong evidence to back it up.

Tools and Equipment: Think about the gear you buy to make your job easier. The cost of things like a high-powered torch, binoculars, or even a briefcase for carrying work documents can be claimed.

While these principles apply broadly, the rules change if you're operating with an ABN. For more on that, check out our guide covering common tax deductions for the self-employed. At the end of the day, careful and consistent record-keeping is what will allow you to confidently claim every dollar you're entitled to.

Claiming Your Vehicle and Travel Expenses Correctly

Vehicle and travel costs are a massive source of deductions for police officers, but you can bet the ATO keeps a close eye on these claims. Getting it right comes down to one critical point: knowing the difference between your daily commute (which you can't claim) and genuine work-related travel (which you can).

It’s a fine line, but understanding it can make a huge difference to your tax refund.

Your standard trip from home to your designated police station to start a shift, and the drive back home at the end, is considered a private commute. The ATO is very clear on this—you can’t claim it. This holds true even if you're carrying bulky equipment or taking work calls on the way.

So, What Is Work-Related Travel?

Once your shift officially starts, many of the kilometres you drive can become claimable. The rule of thumb is that the travel must be a direct part of performing your duties.

Here are a few real-world examples of travel you can claim:

Driving from your home station to another station for a briefing or to pick up gear.

Travelling from the station to court to give evidence, and then driving back.

Using your personal car to get to a work-related training course or conference that isn’t at your usual station.

Driving between two different jobs, if you happen to have a second job alongside your police work.

The core idea is simple: if you're already 'on the clock' and need to travel from one work location to another, you can generally claim the costs for that journey. Just keeping a simple diary of these trips is all you need to back it up.

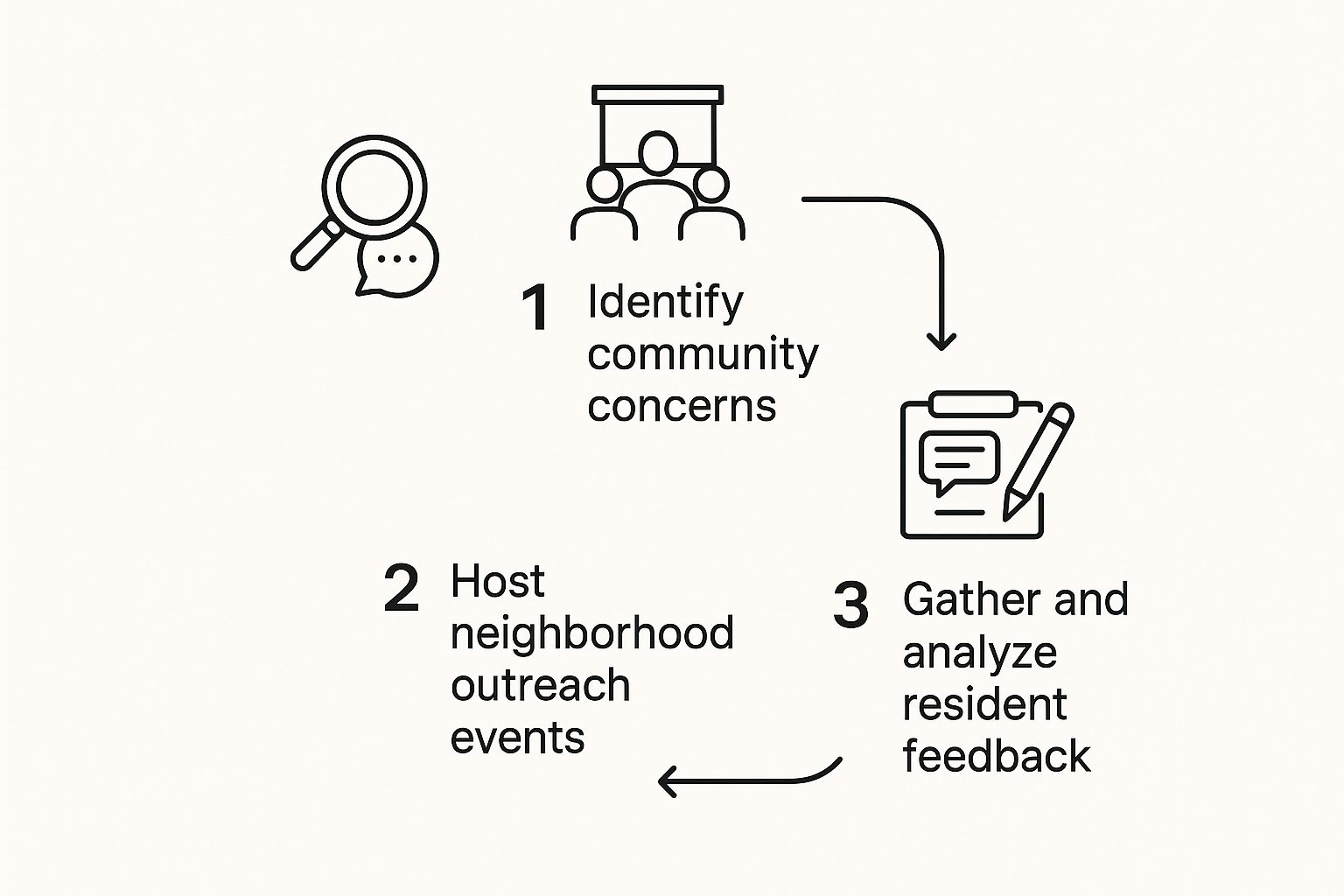

Engaging with the community is a core police duty, and sometimes this means travel is involved.

This highlights how duties often take you away from the station, reinforcing why it’s so important to track your work-related travel accurately.

Choosing the Right Method to Claim

When it comes to the claim itself, the ATO gives you two methods. Which one is best for you depends entirely on how many work-related k's you actually drive.

The Cents Per Kilometre Method

This is the straightforward option. For the 2024-2025 financial year, you can claim 88 cents per kilometre for up to a maximum of 5,000 work-related kilometres. You don't need a shoebox full of receipts, but you do need to show the ATO how you calculated your claim—a simple diary logging your work trips is perfect for this.

The Logbook Method

If you travel more than 5,000 work-related kilometres a year, this is your only option. It’s also the one that usually results in a much larger deduction.

It does require a bit more effort upfront. You'll need to keep a detailed logbook for a continuous 12-week period. This logbook establishes your car's "business-use percentage," which you can then apply to all of your vehicle's running costs. We’re talking fuel, insurance, rego, maintenance, and even the depreciation in its value.

For a deep dive into both methods, check out our guide on how to claim your car expenses as a tax deduction. Making the right choice here ensures you get the maximum refund you're legally entitled to.

Mastering Your Record Keeping for a Stress-Free Tax Time

Let's be blunt: strong claims are built on solid evidence. For police officers, work-related expenses are constant and incredibly varied. This makes meticulous record-keeping less of a 'good practice' and more of your best defence against having a claim denied by the Australian Taxation Office (ATO).

Poor records can mean missed deductions, or worse, trigger an audit.

The secret to a stress-free tax time isn't a mad scramble in June. It's about building simple habits throughout the year. A little effort now saves you countless hours later and gives you total confidence when you lodge your return. To make this happen, police officers should implement effective information management strategies for all their financial documents.

Embrace Digital Tools for Easy Tracking

Forget the shoebox overflowing with faded, crumpled receipts. In this day and age, technology is your best mate for staying organised. Get into the habit of using a dedicated app on your phone to instantly photograph and categorise receipts the moment you get them.

There are several great ATO-compliant apps that digitise your records, making them searchable and secure. This simple habit takes just a few seconds but creates a perfect, time-stamped record for every single claim—from a new pair of tactical boots to the fuel you put in for a work-related trip.

Don't forget, the ATO generally requires you to keep your tax records for five years from the date you lodge your return. Digital storage is easily the safest and most reliable way to make sure your documents are protected and accessible if you ever need them.

The Power of a Simple Spreadsheet

What about expenses that don’t come with a traditional receipt, like your uniform laundry costs or tracking car use with the cents per kilometre method? This is where a simple spreadsheet becomes invaluable. It doesn't need to be fancy; a few basic columns are all it takes to do the job perfectly.

Just create a sheet with these headers:

Date: When you incurred the expense.

Description: A quick note on what it was for (e.g., "Laundry - work uniforms only" or "Travel to court appearance").

Amount: The dollar value of the expense.

Category: What type of deduction it falls under (e.g., Uniform, Vehicle, Self-Education).

This system gives you a clear, running tally of your deductions and presents the ATO with a logical breakdown of how you calculated your claims.

And for your vehicle logbook, the details are non-negotiable if you're using the logbook method. You must record the date, odometer readings at the start and end of each trip, the total kilometres travelled, and the specific reason for the journey. A well-kept logbook is the key to maximising your vehicle claims legally and without any hassles.

Your Top Tax Questions Answered

Working in the force means your tax situation isn't always straightforward. We get a lot of specific questions from officers about what they can and can't claim, especially since general ATO advice doesn't always cover the unique parts of police work.

Here, we'll tackle the most common queries we see, giving you clear answers to help you lodge with confidence.

Can I Claim My Gym Membership?

This is easily the number one question we hear from police officers, and the short answer is almost always no.

The ATO sees general fitness as a personal expense, even for a physically demanding job like policing. While staying in shape is a core requirement of the role, the cost of a standard gym membership just isn't deductible for most officers.

There is, however, a very small window of exception. If you're part of a highly specialised unit—think tactical response groups—where you must maintain a fitness level far beyond that of a general duties officer, you might have a case. But you'd need rock-solid proof that this exceptional standard is an explicit condition of your employment. It’s a very high bar to clear.

Are My Firearms Licence and Training Costs Deductible?

Yes, they are. If holding a firearms licence is mandatory for your job, you can definitely claim the cost of getting or renewing it. It’s a direct cost of earning your income as a police officer.

On top of that, any expenses for mandatory firearms training or practice sessions are also deductible. This includes things like ammunition for work-related target practice and any fees for recertification courses. Just be sure to keep meticulous records and receipts for everything.

I Bought New Boots for My Uniform. Can I Claim Them?

Absolutely. This is a clear-cut deduction. If you’re required to wear specific footwear like protective or heavy-duty tactical boots as part of your uniform, and your employer doesn't pay for them, the full purchase price is claimable.

This type of footwear falls under the ATO's category of ‘protective clothing’. It's different from claiming conventional shoes, which the ATO would consider a private expense. A good pair of tactical boots is a critical tool of your trade, and thankfully, the ATO recognises this.

Many of the deduction rules for police officers are similar to those for other uniformed roles. Our tax guide for Australian Defence Force members, for example, goes over comparable rules for uniforms and equipment that might offer some extra insight.

Getting these specifics right is key to making sure you don't miss out on claims you're entitled to. Every single deduction adds up, ensuring your tax return is accurate and you get back every dollar you deserve.

Need an Expert to Look Over Your Police Tax Return?

Let's be honest, figuring out the specific tax rules for police officers can be a real headache. After a long shift, the last thing you want to do is sift through ATO guidelines, wondering if you’ve missed a key deduction.

You don't have to tackle it alone. Getting it right means you get the maximum refund you're entitled to for your service, and that's money you've earned. If you've got questions or just want a professional to take it off your hands, we're here to help. Our team knows the ins and outs of the unique claims available to law enforcement, so we can make sure your lodgement is spot on.

Don't risk leaving money on the table. A bit of professional advice can make all the difference to your outcome this financial year.

• Need assistance?

We offer free online consultations:

– LINE: barontax

– WhatsApp: 0490 925 969

– Email: info@baronaccounting.com – Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator:👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage:🌐 www.baronaccounting.com

Comments