Tax Guide for Building and Construction Employees

- Aug 7, 2025

- 14 min read

For anyone working in the building and construction game in Australia, getting the most out of your tax return really comes down to knowing what you can claim. Think of your tax deductions like the specialised tools in your kit—using the right ones correctly helps you build a much stronger financial result. The key is knowing the rules set by the Australian Taxation Office (ATO).

Your Essential Guide to Construction Tax Deductions

Trying to figure out your tax obligations can feel like you've been handed a complex blueprint without any training. The good news is that when you boil it down, the main principles are actually pretty straightforward. For any expense to be claimable, it has to pass three golden rules:

You must have paid for it yourself and weren't paid back for it.

The expense has to be directly linked to how you earn your income.

You need to have a record to prove it (like a receipt or bank statement).

Getting these rules down pat is the first and most important step to lodging a tax return that gets you back every single dollar you're entitled to.

Understanding the Workforce (Building and Construction Employees)

The Australian construction industry is a massive part of our economy, employing around 1,342,500 people as of early 2024. That's a huge workforce, making up about 9.2% of all employed Aussies, and it covers everything from home builds to major infrastructure projects.

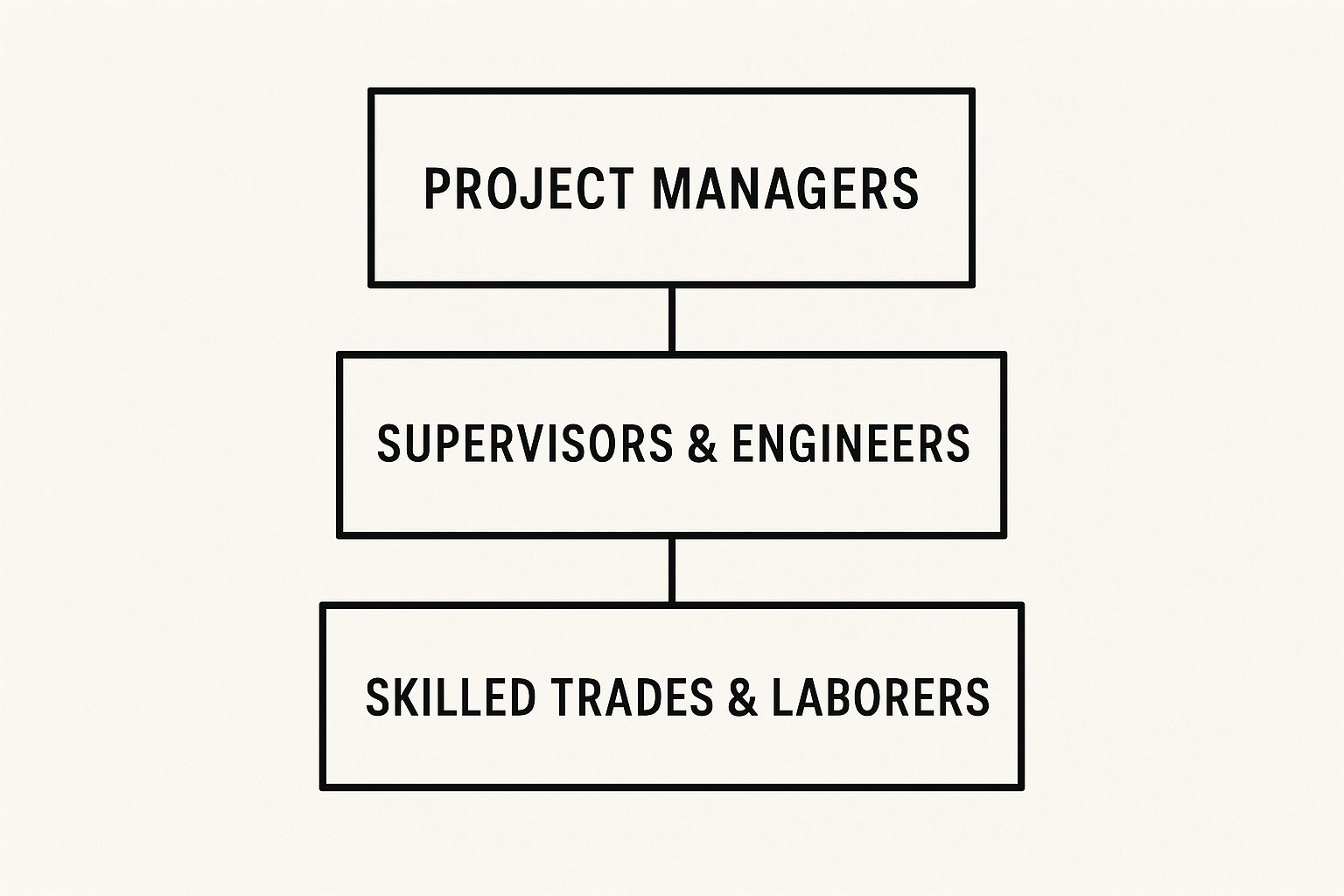

This image below breaks down the typical hierarchy you'd find on-site, showing how all the different roles fit together to get a project done.

As you can see, the structure flows from project management right down to the skilled tradies and labourers doing the hands-on work. Each of these levels has its own unique tasks and, as a result, different tax deductions you can potentially claim.

Laying the Foundation for Your Claims

For building and construction employees, claiming deductions isn't just about your tools and travel. It can cover everything from your protective gear and licence renewals to the work-related slice of your phone bill. The secret is to be organised and keep great records.

A common mistake we see is people thinking they can't claim expenses because they get an allowance from their employer. The truth is, you have to declare that allowance as income, but you can then claim deductions for what you actually spent.

To help you get started, here's a quick rundown of some of the most common deductions available to construction workers.

Quick Guide to Common Construction Employee Deductions

Deduction Category | Common Examples | Key Requirement |

|---|---|---|

Vehicle & Travel | Travel between different work sites, driving to pick up supplies. | Must use your own car; travel from home to your regular workplace is usually not claimable. |

Clothing & PPE | Steel-cap boots, hi-vis vests, safety glasses, sunscreens, work-specific uniforms with a logo. | Must be protective, compulsory, or have the company logo permanently on it. |

Tools & Equipment | Power tools, hand tools, and equipment you buy for work. | For items over $300, you claim the decline in value over time. |

Licences & Training | Renewing a forklift licence, white card, or other tickets; courses directly related to your job. | Must be to maintain or improve skills for your current job, not to get a new one. |

Other Expenses | Union fees, work-related mobile phone and internet use, stationery. | Must have records and be able to show how you calculated the work-related percentage. |

This table is just a starting point, but it shows how broad the categories can be.

Whether you're a new apprentice or a seasoned site supervisor, getting a handle on your entitlements is crucial. Our ultimate guide to tax deductions for tradespersons offers even more detail for tradies. This article will build on that foundation, zeroing in on the claims most relevant to you as a construction employee.

Claiming Vehicle and Travel Expenses Correctly

For many in the building and construction game, figuring out car and travel expense claims can feel like one of the trickiest parts of tax time. The rules can seem a bit tangled, but getting your head around them is the key to claiming everything you're entitled to without getting on the wrong side of the ATO.

The main thing to remember is this: you can only claim travel that's a direct part of your job. Your regular daily drive from home to work and back again? That’s just a private commute and, unfortunately, not claimable.

Let's imagine you're a chippy. Driving from your house straight to the main job site and home again is off-limits for claims. But what happens once your workday actually starts? That’s when the rules change.

What You Can Actually Claim

Let's tweak that scenario. Say you leave home and first drive to a hardware supplier to pick up timber for the day's job before then heading to the worksite. That initial trip—from your home to the supplier—is considered a work-related journey. Bingo, it’s tax-deductible.

Here are a few common examples of travel you can claim as a construction employee:

Driving between different job sites after you’ve already arrived at your first location for the day.

Trips to pick up work-related supplies or equipment, either on your way to a site or during the workday.

Travelling from your main workplace to an alternative one, like driving from the primary site to a secondary one for a specific task.

A common myth is that just because you haul bulky tools in your car, your home-to-work trip is automatically deductible. While this can be true, the ATO has very strict criteria. The tools must be genuinely heavy (over 20kg) and bulky, and, crucially, there must be no secure place to store them at the worksite. This lack of secure storage is what makes transporting them daily a necessity.

The Two Methods for Making Your Claim

When it comes to claiming your vehicle expenses, the ATO gives you two methods. The best one for you really boils down to how much work-related driving you do.

Cents per Kilometre Method: This is the straightforward option. For the 2024-25 financial year, you can claim 88 cents per kilometre for up to 5,000 work-related kilometres. You don't need receipts for every cost, but you must be able to show the ATO how you calculated your business kilometres (a simple diary of trips is perfect).

Logbook Method: This method usually gets you a bigger deduction, especially if you're on the road a lot. It means keeping a detailed logbook for 12 consecutive weeks to figure out your work-use percentage. You can then claim that percentage of all your car's running costs—fuel, insurance, rego, depreciation, the lot.

Choosing the right method can make a real difference to your final refund. To dive deeper into which one suits you, check out our full guide on how to claim your car expenses as a tax deduction. Whichever path you choose, remember that keeping good records is non-negotiable.

Deducting Tools, Equipment and Protective Clothing

If you work in the building and construction game, you know your tools and equipment are the lifeblood of your trade. The Australian Taxation Office (ATO) gets this too. They allow you to claim deductions for the cost of buying, leasing, insuring, and even repairing the gear you need to do your job.

Think of these deductions as the tax system’s way of helping you recoup some of the money you've personally invested in being safe and productive on site.

Now, how you claim these expenses all comes down to the price tag. Getting this right is crucial for keeping your claims above board and making sure you get back every dollar you're entitled to.

Claiming Tools and Equipment Based on Cost

To keep things straightforward, the ATO has clear rules based on how much you paid for an item. Here’s a quick breakdown of how to handle your claims depending on the cost.

Item Cost | Claim Method | Example |

|---|---|---|

$300 or less | Claim the full cost immediately | Buy a new socket set for $150 and claim the full $150 this financial year. |

More than $300 | Claim the decline in value (depreciation) over several years | Purchase a high-end laser level for $800 and claim a portion of its cost each year over its effective life. |

Let's dig a little deeper into what these claim methods really mean for your tax return.

The Immediate Deduction for Cheaper Items

For any tool or piece of equipment that costs $300 or less, the rule is refreshingly simple. You can claim an immediate, full deduction for the entire cost in the same financial year you bought it. This is perfect for all those smaller, everyday items you pick up throughout the year.

This rule also applies if you buy a set of items where each individual tool is under the $300 threshold, even if the total receipt is more. For instance, if you grab five different hand tools for $80 each in a single $400 purchase, you can still claim the full $400 straight away because no single item broke the limit.

Claiming More Expensive Gear Over Time

When you invest in a more substantial piece of kit costing more than $300, you can't claim the whole lot in one go. Instead, you claim its decline in value—also known as depreciation—over the tool's "effective life."

This just means you claim a portion of the original cost each year for several years. It's the ATO's way of spreading the tax benefit over the entire time the tool is expected to be useful to you.

Items that almost always fall into this depreciation category include:

High-powered cordless drills and combo kits

Laser levels and surveying equipment

Generators and larger site compressors

Power saws and concrete mixers

The ATO actually provides guidelines on the effective life of different assets, which tells you how many years you can spread the claim over. Getting your hands on quality gear often means looking for top suppliers for construction tools, and understanding depreciation helps you manage the cost of these bigger investments.

Don't Forget Your Protective Clothing

Safety on site is completely non-negotiable, and thankfully, the cost of your Personal Protective Equipment (PPE) is tax-deductible. This is easily one of the most common and important claims for anyone in the industry.

Deductible items you should be claiming include:

Steel-capped boots and other required work boots

High-visibility shirts, trousers, and vests

Safety glasses, goggles, and hard hats

Sunscreen and sunglasses, but only if your job requires you to work outdoors

Record Keeping Is Not Optional

Here’s the golden rule for every single deduction: you need proof. The ATO requires you to keep records like receipts, invoices, or bank statements for all your work-related purchases. It's as simple as that.

For those bigger items you're claiming through depreciation, you have to hold onto that proof of purchase for the entire period you're claiming its decline in value.

Keeping your records organised is half the battle. This is especially true for items you use for both work and personal reasons, like your mobile phone. Many tradies use their personal phone for work calls, coordinating with the team, or looking up plans. To figure out how to correctly calculate and claim these mixed-use costs, check out our handy guide to mobile phone tax deductions in Australia.

Understanding Allowances and Overtime Meal Claims

In the construction industry, getting allowances to cover specific costs of the job is pretty standard. But when tax time rolls around, these payments can cause a bit of a headache. One of the most common questions we get from tradies and other construction employees is how to deal with tool, travel, and site allowances.

The rule is actually quite simple, but it's crucial you get it right. You have to declare any allowance you receive from your employer on your tax return. Think of it as part of your income. Once you've declared it, you can then claim a deduction for the work-related expenses you actually paid for with that money.

A Closer Look at Overtime Meal Claims

One of the most specific—and valuable—deductions you can make is for overtime meals. The Australian Taxation Office (ATO) has some very particular rules here that can save you from keeping every single receipt, but you have to meet the criteria exactly.

Let's walk through a typical scenario. Say you're a concreter and a delayed pour means your shift suddenly runs long. You end up working a double, and your employer pays you an overtime meal allowance, just like your industrial award or enterprise agreement says they have to.

Because you received that specific allowance, you are entitled to claim a deduction for the cost of the meal you bought during that overtime shift.

The key takeaway here is the direct link between the allowance and the expense. The ATO allows this claim because your employer has formally recognised that you incurred an expense for food by working late, and they compensated you for it through a specific payment.

Claiming Overtime Meals Without Receipts

Here’s where it gets even better. The ATO sets a ‘reasonable amount’ for what you can claim for an overtime meal without needing to keep receipts. For the 2024-25 financial year, this amount is $37.80 per meal.

You can claim this amount as a deduction, as long as:

You actually spent the money on food and drink.

Your employer paid you a genuine overtime meal allowance under an industrial law, award, or agreement.

This allowance is recorded on your income statement or payslip.

This is a massive convenience, but it isn't a free pass. You can’t just claim the amount if you didn't buy a meal. It's designed to simplify the paperwork for a legitimate expense. If you spend more than the reasonable amount and want to claim the full cost, you will need to keep the receipt as proof of what you actually spent.

Claiming Self-Education and Licence Renewals

In the building and construction game, keeping your skills sharp and your tickets up-to-date isn't just a good idea—it's essential. The great news is the Australian Taxation Office (ATO) recognises this, allowing you to claim tax deductions for these costs, provided you follow one simple rule.

The golden rule is this: the training must have a direct connection to your current role. It either has to maintain or improve the specific skills you need for your job right now, or it must be likely to lead to a higher income in your current position.

What Can You Claim?

This opens the door to claiming a whole range of common industry costs. Think of everyday expenses like:

Renewing your general construction induction card (White Card).

Getting your Working at Heights or Confined Spaces ticket.

Completing a first aid or CPR course if your job requires it.

Specialised training on new equipment or construction methods relevant to what you do on-site.

But it’s just as important to know what you can't claim. Generally, you can't claim the initial cost of a qualification that gets you into the industry in the first place. For example, a pre-apprenticeship course to become a carpenter isn't deductible because it's about getting a new job, not improving skills in your current one.

Beyond the Course Fees

Don’t just stop at the course fees. Your claimable expenses can also include the other costs you rack up, like stationery, textbooks, and even your travel to and from the training location.

The Australian construction sector is a huge economic driver, and the hunger for skilled workers has pushed wages up, particularly in fields like heavy and civil engineering construction. When you invest in your skills, you're not just making yourself more valuable—the ATO often lets you deduct the costs, which helps you get ahead. You can read more about the nuts and bolts of the Australian construction industry and its impact.

For those in roles that require operating heavy machinery, getting or renewing specific licences is just part of the job. If you need to drive commercially, getting information on CDL permits is a must, and these costs can often be claimed as a licence renewal.

Mastering Your Record Keeping for an Audit-Proof Return

A tax deduction is only worth something if you can actually prove it. This simple truth is why solid record keeping is easily the most important skill for any building and construction employees who want an audit-proof tax return.

The days of chucking faded receipts into a shoebox are long gone. Modern methods are smarter, faster, and designed for a busy life on site.

Think of it this way: the Australian Taxation Office (ATO) isn't just looking at your claims in a vacuum. They use powerful data-matching software to stack your deductions up against others in similar jobs. If your claims look a bit too high for no good reason, it can easily trigger a review. Your records are your only real defence.

Going Digital with Your Proof

The simplest way to keep everything straight is to go digital, right away. Don’t let that receipt from the hardware store get lost in the ute.

Use Your Phone: The moment you get a receipt, snap a clear photo of it. The ATO is perfectly happy with digital copies as proof of purchase.

Embrace the Cloud: Use free services like Google Drive or Dropbox to set up folders for each financial year. You can send receipt photos straight from your phone, keeping everything organised and safe.

Annotate Bank Statements: If you do lose a receipt, a highlighted transaction on your bank statement can act as a backup. Just add a quick note in your digital files to explain the purchase (e.g., "Bunnings - New work boots").

Different Claims Need Different Proof

Not all records are created equal. The proof you need for a new power tool is a world away from what’s required for your vehicle expenses.

A car logbook, for instance, needs 12 continuous weeks of detailed tracking to lock in your work-use percentage. In contrast, a simple tool purchase just needs a single receipt or a bank statement entry. Nailing these differences is the key to staying compliant.

Properly documenting every single claim is the final piece of the puzzle to securing your deductions. For a full rundown of every document you'll need when it's time to lodge, our comprehensive tax return checklist is an absolute must-have. It gives you a clear, step-by-step guide to make sure you've got all your ducks in a row, making tax time a smooth and stress-free process.

Got Questions About Your Construction Tax? We’ve Got Answers.

Even after you've got your head around the main deduction categories, a few specific questions always seem to pop up for construction workers. It's totally normal. Let's tackle some of the most common queries we hear day in and day out, with clear, practical answers based on what the Australian Taxation Office (ATO) expects.

Can I Claim My Phone and Internet Bill as a Construction Worker?

Yes, you absolutely can claim the portion of your phone and internet bills that’s for work. It's one of the most common claims for tradies. But let's be realistic—it’s rare to use your personal phone 100% for work, so you can’t just claim the whole bill unless you can genuinely prove it.

The best way to figure out your claim is to keep a simple log for a typical four-week period. Just jot down your work-related calls, messages, and data usage. This could be anything from calling the site manager, texting suppliers, or jumping online to check building plans. This little bit of effort gives you solid proof to back up your claim.

Are Union Fees and Professional Dues Tax Deductible?

Definitely. This one’s a simple but surprisingly common one to miss. Any fees you pay for your trade union membership (like the CFMEU) or other professional associations directly tied to your construction job are 100% tax-deductible.

You can usually find the total amount you’ve paid for the year on your payment summary from the union itself. If you can't find that, don't stress—your bank statements are also perfect proof.

Forgetting to claim your union fees is like leaving free money on the table. It’s a straightforward deduction that really adds up, so make sure you double-check your records before lodging your return.

What Happens If I Buy Tools on a Payment Plan like Afterpay?

Great question, especially with how common "buy now, pay later" services are. Using a service like Afterpay or Zip Pay to buy work tools doesn’t change a thing about your tax claim. The ATO cares about the total cost of the tool, not how you paid for it.

The standard rules for claiming tools still apply:

For tools costing $300 or less: You can claim an immediate, full deduction for the entire purchase price in the same year you start using it. This is true even if you're still making repayments on your Afterpay plan.

For tools costing over $300: You’ll need to claim the cost through depreciation. This means you spread the deduction of the tool's full price over its effective life, as set by the ATO. Again, you depreciate the total cost, not the individual repayments.

Basically, you get the tax benefit based on the tool's full value from day one, which can help your cash flow long before you’ve finished paying it off.

Need an Expert to Look Over Your Tax Return?

Trying to figure out your tax return as a building or construction employee can feel like you've been handed a complex blueprint without the right training. Getting every travel claim, tool purchase, and site allowance right according to ATO rules is crucial. It’s the difference between maximising your refund and facing a potential audit.

Why leave your hard-earned money on the table or risk getting it wrong?

Our team lives and breathes tax for tradies. We know the specific deductions you’re entitled to and can spot things you might have missed. We'll help you build a much stronger, more accurate tax return, making sure every single eligible expense is accounted for.

Let us handle the tricky parts so you can get back to what you do best. You’ve worked hard for your income—we're here to help you keep more of it.

• Need assistance?

We offer free online consultations:

– Phone: 1300 087 213

– LINE: barontax

– WhatsApp: 0490 925 969

– Email: info@baronaccounting.com

– Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator:

For more resources and expert tax insights, visit our homepage:

Comments