Tax Guide for Fitness and Sporting Industry Employees

- Aug 27, 2025

- 14 min read

Welcome to your go-to guide for sorting out your taxes as an Australian fitness or sporting professional. Whether you're a personal trainer sweating it out on the gym floor, a sports coach on the sidelines, or a gym administrator keeping things running, your tax situation has its own unique hurdles. This guide is here to break it all down, from declaring different income streams to finding every industry-specific deduction you're entitled to.

A Tax Guide for Fitness and Sporting Industry Employees

Working in the fitness and sporting industry isn't just a job; it's a passion. It demands your energy, dedication, and often involves a unique professional setup. Just like you create tailored training plans for your clients, your finances need their own specialised game plan for tax time. Many fitness and sporting industry employees find themselves juggling multiple income sources—maybe a standard gym salary, plus earnings from private client sessions and online coaching. This mix can make tax time feel more like a marathon than a sprint.

Think of this guide as your financial playbook. We’ll walk you through all the essential tax obligations and opportunities that are specific to your line of work. It’s your roadmap to confidently manage your money and make sure your hard-earned cash works just as hard as you do.

Understanding Your Role in a Growing Industry

The Australian fitness sector is absolutely booming. Between 2018 and 2023, the industry expanded by 3.3%, and with employment numbers projected to continue growing, the opportunities are only getting bigger. This growth means more professionals like you are building careers in this dynamic space, and each one of you has distinct tax needs. You can discover more insights into the fitness sector's growth in Australia to see just how fast things are moving.

As you build your career, getting a handle on your tax obligations is non-negotiable. This really boils down to three key things:

Declaring All Income: You need to correctly report earnings from all your work, whether you're a classic employee, a contractor, or a bit of both.

Claiming Entitled Deductions: This is about identifying and claiming all the work-related expenses you're eligible for to legally reduce the amount of tax you have to pay.

Keeping Accurate Records: It's crucial to maintain proper documentation for your income and expenses. This is your proof if the Australian Taxation Office (ATO) ever comes knocking.

Getting these areas right isn't just about staying out of trouble with the tax office; it's about financial empowerment. When you have a clear picture of your tax situation, you can plan effectively, sidestep potential penalties, and legally get the biggest tax refund you're entitled to, year after year. Let’s dive in.

Decoding Your Income and Tax Obligations

In the fitness industry, your income streams can be as varied as your workout routines. One week you might be earning a steady salary from a gym, the next you're getting direct payments from personal training clients, and you could even be generating cash from online programs or social media sponsorships.

It’s crucial to understand that the Australian Taxation Office (ATO) looks at each of these income types differently. How you earn your money directly impacts your tax obligations.

Ignoring these differences is a recipe for a financial headache. For instance, the tax on your gym salary is usually handled by your employer through the Pay As You Go (PAYG) system. But for the money you earn directly from clients, you’re the one who needs to manage the tax and super.

Employee or Contractor? The Critical Difference

For anyone working in the fitness and sporting industry, one of the most important things to get right is whether you're an employee or an independent contractor. This status determines who is responsible for tax, super, and other essentials like insurance. Getting this wrong can lead to some serious financial penalties.

As an Employee (PAYG): This is the straightforward path. Your employer withholds tax from your paycheque and sends it to the ATO for you. They’re also legally required to pay your superannuation guarantee contributions.

As a Contractor (ABN): You're running your own show. You receive the full payment for your services, which means you're responsible for putting money aside for your own income tax and making your own super contributions.

The line between the two isn’t always crystal clear, especially with how flexible the industry has become. For a deeper dive, it’s worth understanding the key factors the ATO uses to define these roles. You can learn more about this by reviewing the differences between an employee and a contractor in our detailed guide.

Managing Multiple Income Streams

Many fitness pros work a hybrid model—maybe you're employed part-time at a gym while also running your own personal training business on the side. If this sounds like you, you must declare all your income from all sources on your annual tax return.

The ATO’s data-matching technology is more powerful than ever. It cross-references information from banks, employers, and other agencies, making undeclared income—including cash payments—very easy to detect.

To stay on the right side of the ATO, you need a system. Treat your contracting work like a proper small business. This means keeping meticulous records of every single payment you receive, whether it lands in your bank account, comes through a platform like Stripe, or is handed to you as cash.

By accurately tracking and reporting every dollar, you're building the foundation for a stress-free tax return and drastically minimising your risk of an audit.

Unlocking Your Work-Related Tax Deductions

Now, let’s get to the part that can make a real difference to your tax refund: work-related deductions. For anyone in the fitness and sporting industry, this is your chance to claim back the money you spent earning your income. The trick is to go beyond generic advice and focus on what’s specific to your role.

Every single claim you make needs to pass the Australian Taxation Office (ATO)'s three golden rules. You must be able to show that:

You paid for it yourself and weren't reimbursed.

The expense is directly tied to earning your income.

You have a record (like a receipt) to prove it.

Think of these as the non-negotiables for any deduction. If you can tick all three boxes, you're on the right track.

Common Deductions For Fitness Professionals

Let's dive into some of the most frequent expenses you can claim. The key is always connecting the purchase directly to what you do for a living.

Uniforms and Protective Clothing: This covers the cost of buying, renting, or mending compulsory uniforms that feature your employer's logo. It also includes specific safety gear, like specialised footwear, but not your everyday activewear.

Laundry Expenses: If you’re claiming a uniform, you can also claim the cost of washing it. The ATO allows a claim of $1 per load for a wash containing only work clothes, or 50 cents per load if you mix them with your personal items.

Self-Education and Certifications: Paying for courses, seminars, or new certifications that sharpen the skills needed for your current job are usually deductible. A great example is a coach completing a new sports science certificate to better train clients.

The crucial test for self-education is its link to your current job. If a course is designed to land you a completely different role or is only loosely related to your field, the ATO will likely knock back the claim.

Equipment and Tools of The Trade

As a hands-on professional, your gear is vital. You can claim the work-related portion of these costs.

For items costing $300 or less, you can claim an immediate deduction for the full work-related portion. For anything over $300, you’ll generally claim its decline in value (depreciation) over a few years. This could include:

Stopwatches, whistles, and coaching clipboards.

Kettlebells, resistance bands, or yoga mats you use to demonstrate exercises.

Laptops or tablets for managing client bookings and creating programs.

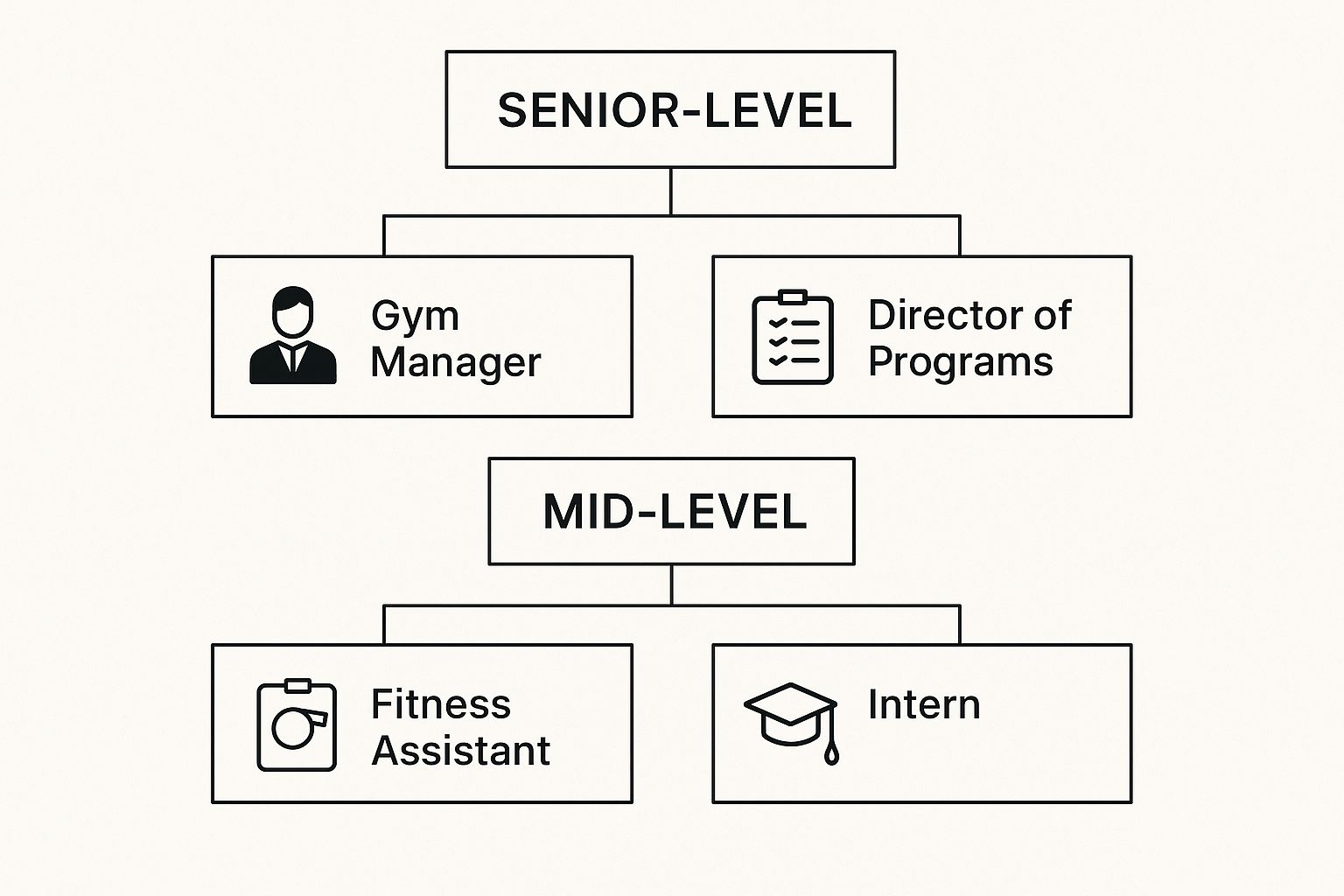

This image highlights how different roles across the industry have unique equipment needs and, therefore, different deduction opportunities.

As you can see, moving up the ladder often means more admin and business-related expenses become part of your job.

To make this even clearer, here's a quick checklist of common deductions for fitness professionals.

Common Tax Deductions for Fitness Professionals

Deduction Category | Specific Examples | Key ATO Requirement |

|---|---|---|

Clothing & Laundry | Compulsory branded uniforms, protective footwear (e.g., non-slip shoes), laundry costs for uniforms. | The clothing must be specific to your occupation or have a compulsory, registered logo. General activewear is not claimable. |

Equipment & Tools | Stopwatches, whistles, resistance bands, first aid kits, clipboards, client assessment tools (e.g., skinfold calipers). | For items over $300, you must claim depreciation. You must be able to prove the work-related usage percentage. |

Self-Education | First aid/CPR updates, fitness certifications, coaching accreditations, industry seminars. | The course must maintain or improve the skills needed for your current job, not get you a new one. |

Travel & Car | Driving between different gyms for work, visiting clients at their homes, travelling to a training course away from your usual workplace. | Travel between home and your primary workplace is not claimable. You must keep a logbook or use the cents per kilometre method. |

Home Office | A portion of your internet, phone, and electricity bills; stationery; depreciation on office furniture and computers. | You need a dedicated workspace and must keep records to calculate the work-related portion of your expenses. |

Other Expenses | Industry association fees (e.g., Fitness Australia), professional magazine subscriptions, public liability insurance. | The expense must be directly related to your employment, and you need receipts as proof. |

Remember to keep meticulous records for everything you plan to claim.

Other Important Claim Areas

Beyond the obvious, several other areas can yield valuable deductions.

Phone and Internet: You can claim the work-related percentage of your phone and internet bills. Just be realistic and keep records, like a logbook for a typical four-week period, to back up your claim.

Car Expenses: If you’re travelling between different work sites (like from one gym to another or to a client’s home), you may be able to claim car expenses using either the cents per kilometre method or a logbook.

Home Office Expenses: So many fitness pros handle their admin from home now. If you’re managing bookings, designing programs, or creating online content from a dedicated home office, you might be able to claim a portion of your running costs.

By carefully tracking these costs throughout the financial year, you can be confident you’re claiming everything you’re entitled to when tax time rolls around.

Mastering Your Record-Keeping Habits

Here’s a simple truth: a tax deduction is only as strong as the record that proves it exists. For fitness and sporting industry employees, the key to a stress-free tax return and a maximised refund is treating record-keeping just like a training schedule—it needs to be a consistent habit. The Australian Taxation Office (ATO) won't accept claims based on guesswork; they need proof.

Think of it as your 'financial fitness logbook'. Just as you track sets, reps, and a client's progress, you need to track your own work-related expenses. Getting into this rhythm means you won't be scrambling to find crumpled receipts at the end of the financial year.

This simple habit turns record-keeping from a painful chore into a powerful tool for managing your money. It gives you a clear, real-time picture of your spending and ensures you have everything ready when tax time rolls around.

Finding Your Perfect System

There's no single perfect way to keep records. The best method is the one you’ll actually use consistently. Your goal is to find a system that fits seamlessly into your busy lifestyle, whether you're rushing between clients or managing a full class schedule.

Here are a few popular and effective options:

Digital Apps: The ATO’s myDeductions app is a fantastic, free tool. It lets you snap photos of receipts, log car trips, and categorise expenses right from your phone. Come tax time, you can easily upload this information straight into your tax return or email it to your tax agent.

Simple Spreadsheets: Never underestimate the power of a basic spreadsheet. A simple file in Google Sheets or Microsoft Excel can be incredibly effective. Just create columns for the date, what you bought, how much it cost, and a quick note about how it relates to your work.

Cloud Accounting Software: If you're contracting with an ABN, software like Xero or MYOB offers more advanced features for invoicing, expense tracking, and getting a bigger picture of your business finances.

No matter which method you choose, consistency is everything. Set aside five minutes at the end of each day or once a week to update your records. This small time investment will save you from a massive headache later on.

What Counts as a Valid Record

The ATO has specific rules for what makes a record valid. A simple bank statement showing a purchase often isn't enough because it doesn't detail what you actually bought.

A valid receipt or tax invoice must show:

The name of the supplier

The amount of the expense

What the goods or services were

The date the expense was paid

The date the document was issued

Under ATO guidelines, you must keep these records for five years from the date you lodge your tax return. Storing digital copies is a safe, space-saving way to meet this requirement and avoid losing important paperwork.

Demystifying the Car Logbook

For many fitness pros who travel between different gyms, client homes, or training venues, car expenses can be a huge deduction. To claim the actual costs of using your car (not just a flat rate), you must keep a detailed logbook for a continuous 12-week period.

This logbook needs to track your odometer readings at the start and end of the 12 weeks, along with details of every single journey—both work and private. From this, you calculate your work-use percentage. You can then apply this percentage to all your car running costs for the year, including fuel, insurance, registration, and repairs. This method often results in a much larger claim than the simpler cents per kilometre method.

For a complete overview of what you'll need, our comprehensive tax return checklist can help you get all your documents in order.

Avoiding Common Tax Return Mistakes

Even the most organised professionals can trip up on their tax returns. For people in the fitness and sporting industry, a few common mistakes can mean a smaller refund or, worse, unwanted attention from the Australian Taxation Office (ATO). Knowing what to look out for is the best way to sidestep these issues.

One of the biggest mix-ups is clothing. It’s so easy to assume all your activewear is deductible, but the ATO has very strict rules. You can only claim compulsory, branded uniforms. That generic pair of leggings or those trainers you wear on the gym floor? Even if your boss requires them, they’re considered a private expense because you could just as easily wear them outside of work.

Miscalculating Work-Use Percentages

Another classic pitfall is overclaiming on things that have a mix of work and private use, like your mobile phone or home internet. The ATO expects you to have a solid, reasonable method for figuring out how much you used it for work.

Simply guessing a number, like claiming 50% without any records to back it up, is a huge red flag. The right way to do it is to keep a detailed logbook for a typical four-week period. This will give you a real, defensible percentage you can apply to your yearly bills.

The ATO's data-matching technology is smarter than ever. It cross-references information from all sorts of places, making it easy to spot unusual claims that just don't stack up against industry averages. Filing with accurate, provable figures is your best defence against an audit.

Forgetting to Declare All Income

In an industry where work can fluctuate, it’s absolutely critical to declare every dollar you earn. The job market for gyms and fitness centres has been on a rollercoaster, seeing an average dip of 8.9% between 2019 and 2024, with recovery now on the horizon.

During these shifts, picking up extra cash-in-hand gigs is pretty common. But you have to remember that all income, including cash payments, must be reported on your tax return. Not declaring it is a serious issue and can lead to hefty penalties.

Your Top Tax Questions Answered

Cutting through the confusion helps you lodge your tax return with confidence, knowing you’re making the right calls and staying on the right side of the Australian Taxation Office (ATO).

Can I Claim My Personal Gym Membership?

This is easily the most common question we get, and the answer is almost always no. It's a tough one to swallow, but even though you live and breathe fitness, the ATO sees your personal gym membership as a private expense. It's for maintaining your own health, not a cost you have to incur to earn your income.

But here’s where it gets interesting. The situation flips if you pay a fee to use a facility specifically to train your clients. For example, if you pay a casual rate at a gym just to run a session for a paying customer, that cost is directly tied to earning your income and is generally claimable. The key distinction is always personal use versus business use.

What Is the Difference Between a Uniform and Activewear?

The line between a work uniform and your everyday activewear can feel a bit blurry, but the ATO’s rules are actually quite specific on this.

You can only claim deductions for:

Compulsory Uniforms: This is clothing your employer requires you to wear, and it must have their logo permanently attached. Think embroidered polos or branded jackets.

Occupation-Specific Clothing: These are items unique to your job that you wouldn't reasonably wear outside of work, like specialised safety boots for certain trainers.

This means you can't claim a deduction for conventional activewear—things like generic leggings, shorts, or trainers—even if your employer has a "dress code" telling you to wear them. Because these items can easily be worn for personal activities, the ATO considers them a private expense.

A simple test is to ask yourself: "Could I wear this down to the shops without it being obvious that it's work gear?" If the answer is yes, it's probably not deductible.

Do I Really Need to Declare Cash Payments?

Yes. Absolutely. There's no grey area here—it's non-negotiable.

All income you earn is considered assessable income by the ATO, regardless of how it lands in your pocket. Whether it's cash, a bank transfer, or an online payment, you must declare every single dollar on your tax return.

Failing to declare cash income is a serious misstep and can lead to hefty penalties, interest charges, and in serious cases, even prosecution. The ATO uses sophisticated data-matching technology to spot differences between what you report and how you live, making it incredibly risky to leave any earnings out. Honest and accurate reporting is your only option.

As a Contractor Am I Responsible for My Own Super?

In most situations, yes, you are. If you’re working as a sole trader with an Australian Business Number (ABN), the responsibility for making superannuation contributions falls squarely on your shoulders. The clients or gyms you contract for generally aren't required to pay super for you.

This means it's crucial to get into the habit of setting aside a portion of your earnings for your super fund to build your retirement savings. The silver lining is that you can often claim a tax deduction for these personal super contributions.

To get a complete picture of your obligations, you can explore our detailed guide on how to file your taxes in Australia, which breaks down the key responsibilities for different working arrangements.

Need Tax Advice Tailored for Your Fitness Career?

As a fitness professional, you’re an expert at pushing physical limits and helping clients reach their goals. But what about your financial fitness? Handling your tax obligations is just as crucial as mastering strategies for sports injury prevention—both are key to building a long, successful, and stable career.

Think of us as your financial personal trainers. We'll help you understand every deduction you're entitled to and make sure you meet all your tax obligations without the stress. This way, your financial health will be just as strong as your professional passion. You focus on your clients, and we’ll handle the numbers.

• Need assistance? We offer free online consultations:

– LINE: barontax

– WhatsApp: 0490 925 969

– Email: info@baronaccounting.com

– Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator:

For more resources and expert tax insights, visit our homepage:

Comments